Boutique Investment Bank

Table of Contents

Exploring Boutique Investment Banks

In the dynamic world of finance, a Boutique Investment Bank stands out by offering specialized financial advisory services tailored to specific client needs. At Zaidwood Capital, we focus on delivering expertise in mergers and acquisitions, capital formation, and debt and equity solutions for middle-market companies and fund managers. Unlike larger bulge bracket firms with their broad scale, boutique banks like ours provide personalized attention and niche capital advisory services to private equity firms, family offices, and businesses generating over $1 million in revenue.

Our core offerings include M&A advisory for buy-side and sell-side mandates, full-cycle due diligence, and access to a network of more than 4,000 investors. We structure debt advisory solutions such as mezzanine and venture debt, alongside equity advisory for growth and liquidity. Drawing from recruitment insights in the Yale School of Management guide, this specialized talent pool enables us to offer focused advisory that contrasts with the generalist approach of bigger institutions. For instance, our team has facilitated over 300 deals with an aggregate transaction volume of $24.4 billion, including a recent middle-market acquisition that streamlined a family’s asset portfolio.

This guide explores the understanding, benefits, processes, and best practices of partnering with a Lower Middle Market Investment Bank, empowering you with insights for informed financial decisions.

Core Services of Boutique Investment Banks

At Zaidwood Capital, we specialize in delivering targeted financial solutions as a boutique investment bank, focusing on middle-market clients who seek personalized guidance without the layers of large institutions. Our core services encompass mergers and acquisitions advisory, capital formation, debt advisory, equity support, and comprehensive due diligence. These offerings enable corporate clients and fund managers to navigate complex transactions efficiently, leveraging our deep industry expertise and extensive network.

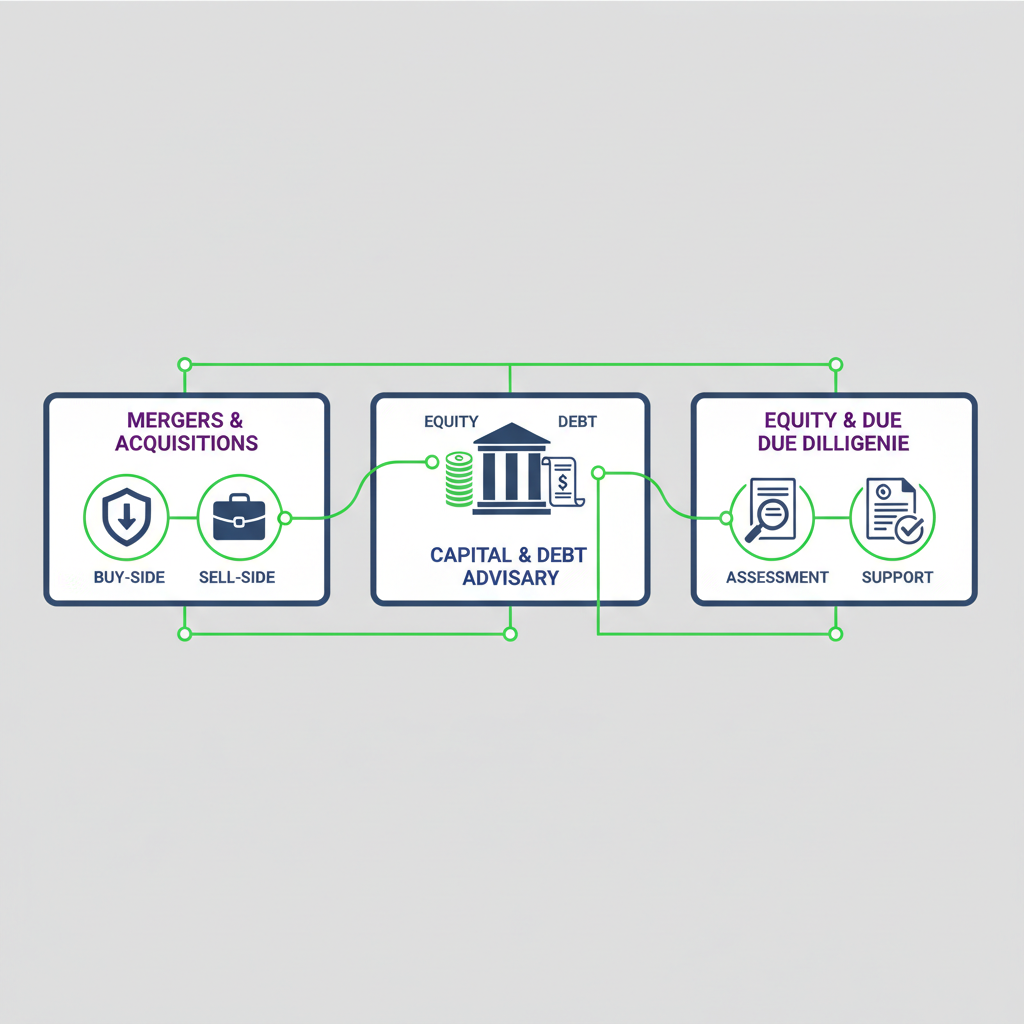

Core services overview for boutique investment banks like Zaidwood Capital

This visual representation highlights how our integrated approach streamlines strategic financial decisions, setting the stage for detailed exploration of each service area.

Mergers and Acquisitions Advisory Essentials

We provide essential M&A advisory services tailored for middle-market companies, covering both buy-side and sell-side mandates. On the buy-side, our team assists with deal sourcing by identifying potential acquisition targets that align with strategic growth objectives, conducting initial valuations, and facilitating negotiations to secure favorable terms. For sell-side engagements, we position clients effectively in the market, preparing confidential information memorandums and coordinating outreach to qualified buyers.

This specialized M&A services approach draws from our experience in over 300 completed deals, emphasizing negotiation support to mitigate risks and maximize value. As outlined in industry overviews like those from Wake Forest University, boutique firms excel in these focused advisory roles, offering hands-on involvement that larger banks often cannot match due to their scale. Our process ensures middle-market clients receive agile, client-centric guidance throughout the transaction lifecycle, from initial strategy to closing.

Capital Formation and Debt Advisory Options

Capital formation remains a cornerstone of our offerings, where we guide clients through equity and debt raising strategies to fuel expansion. We connect businesses to our network of more than 4,000 institutional and private investors, providing access to over $15 billion in deployable capital. This includes structuring venture debt and asset-based lending arrangements that offer flexible funding without immediate equity dilution.

In debt advisory, we specialize in mezzanine financing and equipment financing solutions, helping clients optimize their capital structure for sustainable growth. Targeted debt structuring allows for customized terms that support operational needs, such as cash-flow financing for scaling enterprises. Insights from SEC discussions on small business capital formation underscore the importance of such networks in enhancing access to diverse funding sources, which we leverage to deliver efficient placements and advisory support.

Equity and Due Diligence Support

Our equity advisory services focus on securing growth capital and liquidity solutions, particularly for fund managers and corporate entities navigating expansion phases. As a VC Investment Bank, we facilitate introductions to venture capital firms and private equity investors, structuring deals that align with long-term value creation. This involves crafting compelling pitch materials and negotiating terms to attract committed funding.

Complementing this, our full-cycle due diligence processes cover financial, legal, operational, and commercial assessments to ensure transaction integrity. We conduct thorough reviews of financial statements, operational workflows, and market positioning, identifying potential risks early. With an aggregate transaction volume exceeding $24.4 billion, our team emphasizes rigorous evaluations that protect client interests, providing the depth required for informed decision-making in high-stakes environments.

Advantages of Partnering with Boutique Firms

In the competitive landscape of financial services, partnering with a M&A capital advisory firm like Zaidwood Capital offers distinct advantages. As a Boutique Investment Bank, we specialize in delivering tailored solutions that prioritize strategic depth and client-centric execution over the broad scale of larger institutions. Our approach in M&A advisory and debt advisory ensures that middle-market companies receive focused support for complex transactions, from initial structuring to final closure.

Personalized Expertise and Agility

Boutique firms excel in providing agile financial advisory that adapts quickly to client needs, often surpassing the response times of larger banks bogged down by bureaucracy. We leverage our compact teams to offer tailored advice, enabling faster deal structuring and execution. For instance, in hypothetical M&A scenarios, our experts can pivot strategies within days, incorporating real-time market insights without layers of internal approvals.

Key benefits include:

- Customized Deal Structuring: We craft bespoke solutions for buy-side and sell-side mandates, drawing on full-cycle due diligence to mitigate risks early.

- Rapid Response Times: Insights from the Columbia Mergers and Acquisitions course highlight how boutiques achieve up to 30% faster due diligence through focused expertise, reducing overall transaction timelines.

- Strategic Depth: Our advisors integrate valuation methods and takeover defenses seamlessly, ensuring clients navigate challenges like asset valuation cited by 80% of executives in the program’s surveys.

This personalized touch not only enhances efficiency but also builds trust, allowing us to address unique client objectives with precision.

Access to Exclusive Networks

One of the standout advantages of boutique partnerships lies in our extensive connections to institutional and private investors, which directly boost deal success rates. We provide clients with access to over 4,000 investors and more than $15 billion in deployable capital, facilitating smoother capital formation and equity placements.

Notable advantages encompass:

- Investor Introductions: Through our network-driven debt solutions, we connect clients to family offices, sovereign wealth funds, and venture capital firms for targeted funding opportunities.

- Proven Transaction Volume: With an aggregate of $24.4 billion across more than 300 completed deals, our track record demonstrates reliable access to capital sources that larger firms may overlook in niche markets.

- Enhanced Deal Momentum: Drawing from Columbia course case studies, such networks accelerate technology adoption via M&A, as 70% of participants anticipate using these strategies for growth.

These exclusive networks empower clients to secure commitments efficiently, turning potential deals into realized value.

Cost-Effective and Focused Solutions

Boutique investment banks deliver cost efficiencies by concentrating on middle-market needs, avoiding the overhead that inflates fees at bulge-bracket institutions. Our streamlined operations ensure targeted services in debt advisory and equity advisory, where every resource aligns with client goals.

Core efficiencies feature:

- Competitive Fee Structures: We offer lower retainers and success fees tailored to transaction size, often 20-30% below industry averages for similar middle-market deals.

- Focused Expertise: Without diverting to unrelated services, we prioritize full-cycle due diligence and strategic documentation, minimizing unnecessary costs.

- Value-Driven Outcomes: As emphasized in academic frameworks like those from Columbia’s M&A program, this focus on efficiency metrics allows boutiques to optimize deal math and closing processes, delivering higher net returns for clients.

By emphasizing these focused solutions, we help companies achieve their objectives without excessive expenditures, paving the way for streamlined processes in subsequent transaction phases.

The Process at Boutique Investment Banks

At a Boutique Investment Bank like Zaidwood Capital, we specialize in delivering tailored boutique M&A advisory services that streamline complex transactions for middle-market clients. Our client-centric approach ensures every step in the M&A advisory and debt advisory processes aligns with your strategic goals, from initial discussions to post-deal support. By leveraging our extensive network and proprietary tools like the Velocity Matrix, we facilitate efficient transaction execution processes without compromising on thoroughness.

Initial Consultation and Deal Assessment

We begin the engagement with a structured intake to understand your objectives in mergers and acquisitions or capital formation. This phase sets the foundation for successful structured financing steps.

- Client Intake Meeting: We conduct an in-depth discussion to assess your business needs, market position, and transaction type, whether buy-side M&A advisory or sell-side mandates.

- Needs Assessment and Valuation: Our team evaluates financials, growth potential, and risks, preparing initial valuations and identifying key value drivers using pro forma financials.

- Pitch Deck Development: We craft customized pitch materials, incorporating market data and strategic narratives to highlight opportunities in debt advisory or equity raises.

- Strategy Formulation: Based on insights, we outline a tailored deal strategy, aligning with your timeline and goals while addressing potential challenges.

This assessment phase typically concludes with a formal engagement agreement, ensuring alignment before advancing. Drawing from events like the ACG Boston gatherings, we emphasize early networking to gauge market appetite.

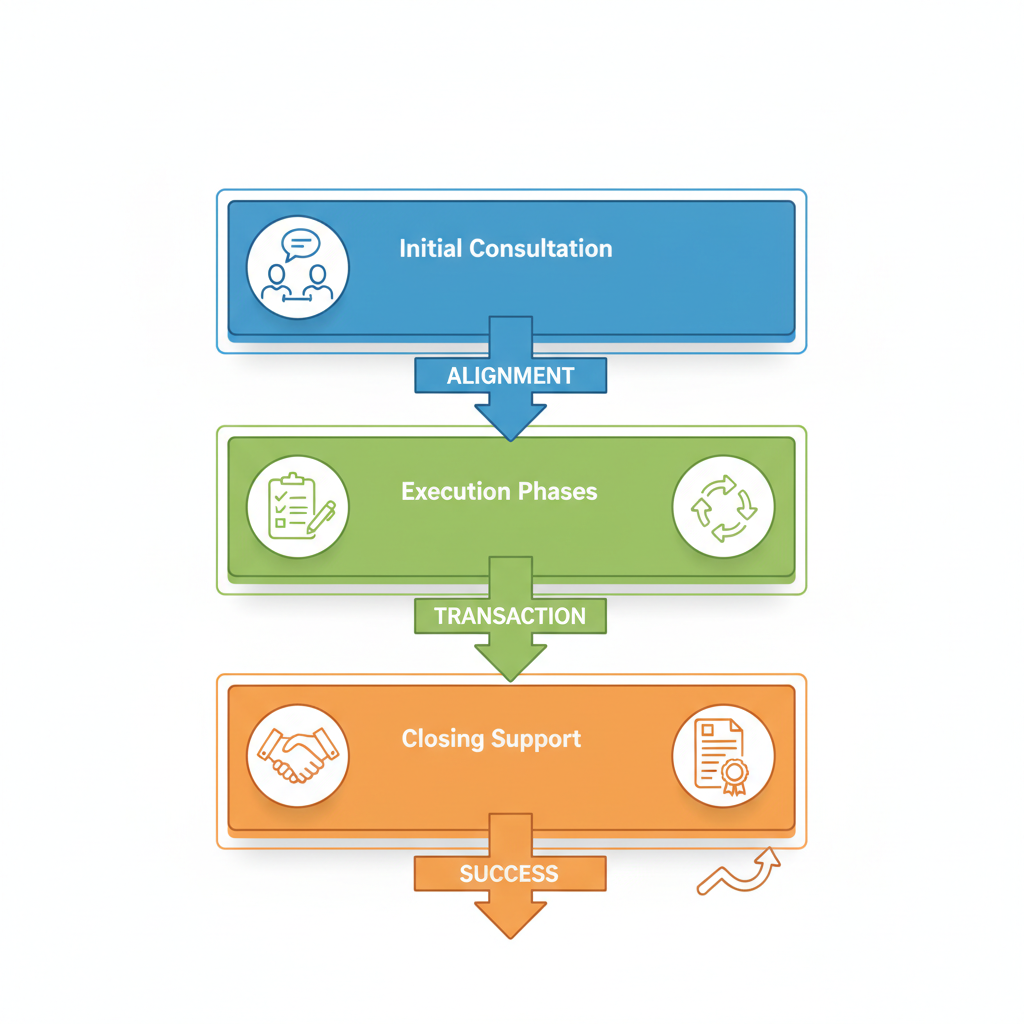

Illustrated process of engagement stages at boutique investment banks

The diagram above visualizes how these initial steps integrate into the broader workflow, providing a clear roadmap for clients navigating boutique advisory engagements.

Execution and Due Diligence Phases

Once the strategy is set, we move into execution, focusing on rigorous due diligence and investor outreach to drive the transaction forward.

- Due Diligence Execution: We perform full-cycle due diligence across financial, operational, legal, and commercial scopes, reviewing documents like contracts and IP portfolios to mitigate risks.

- Investor Introductions: Leveraging our network of over 4,000 institutional investors, we facilitate targeted introductions, informed by real-world networking forums such as ACG events that connect M&A professionals.

- Negotiation and Structuring: We lead discussions with counterparties, structuring deals for optimal terms in mezzanine debt or growth equity, utilizing our Velocity Matrix for integrated execution.

- Documentation Preparation: Throughout, we develop key documents including letters of intent and preliminary agreements, ensuring compliance and clarity.

In debt advisory contexts, this phase supports capital formation by matching clients with lenders for asset-based or cash-flow financing, enhancing efficiency in US markets.

These steps underscore our commitment to precision, bridging assessment insights with actionable progress while adapting to evolving deal dynamics.

Closing and Post-Transaction Support

The final phase focuses on seamless closing and sustained value creation post-transaction.

- Final Negotiations and Documentation: We finalize terms, coordinating with legal teams to execute definitive agreements and handle any last-minute adjustments.

- Fairness Opinions: For qualifying transactions, we provide independent fairness opinions to validate deal pricing and structure, bolstering stakeholder confidence.

- Closing Coordination: We oversee the transfer of funds, assets, and ownership, ensuring all regulatory filings are completed accurately.

- Post-Transaction Advisory: Following closing, we offer ongoing support, including integration planning and performance monitoring to maximize synergies.

This comprehensive approach in closing M&A advisory engagements helps clients realize long-term objectives. By selecting a boutique firm attuned to your needs, the overall process yields more predictable outcomes, paving the way for future opportunities in capital markets.

Selecting the Right Boutique Investment Bank

When navigating complex financial landscapes, selecting the appropriate Boutique Investment Bank or engaging a specialized M&A advisory boutique firm partner is crucial for achieving optimal outcomes in mergers and acquisitions, capital raising, and related advisory services. We recommend a structured approach that evaluates key attributes to ensure alignment with your strategic objectives. This process not only mitigates risks but also maximizes value creation through tailored expertise and robust support.

Evaluating Experience and Track Record

Assessing a boutique investment bank’s experience begins with scrutinizing its historical performance, much like the rigorous evaluation processes in investment banking recruitment highlighted in industry guides. We advise reviewing aggregate transaction volume as a primary indicator; for instance, firms handling over $24.4 billion in deals demonstrate substantial capability in executing high-stakes engagements. Look for sector-specific expertise, where specialized knowledge in areas like technology or healthcare can drive superior results.

To guide your due diligence, consider these best practices:

- Examine completed deals: Prioritize banks with 300+ transactions, ensuring a proven track record in both buy-side and sell-side mandates.

- Analyze success metrics: Focus on valuation accuracy and deal closure rates, drawing from M&A course insights that emphasize strategic documentation and case study outcomes.

- Verify team credentials: Seek professionals with diverse backgrounds, akin to MBA-level hires valued for transferable skills in financial modeling and relationship-building.

By applying these selection criteria for advisory firms, you can identify partners equipped to handle your unique challenges effectively.

Assessing Network and Service Scope

A strong network forms the backbone of effective boutique advisory, particularly for capital formation and investor introductions. We emphasize evaluating access to institutional investors, such as private equity firms and family offices, which can unlock deployable capital exceeding $15 billion. Additionally, assess the breadth of services, including full-cycle due diligence encompassing financial, legal, and operational reviews, as outlined in comprehensive M&A frameworks.

Key criteria for thorough assessment include:

- Investor connectivity: Confirm connections to over 4,000 global entities for seamless capital introductions and LP placements.

- Service customization: Ensure offerings cover M&A advisory alongside debt advisory elements like mezzanine and venture debt structuring.

- Fee structures: Review competitive models that balance upfront costs with success-based incentives, avoiding rigid arrangements that limit flexibility.

These best practices in debt partnering and network evaluation empower informed decisions, fostering partnerships that accelerate transaction timelines.

Alignment with Business Goals

True partnership requires deep alignment between the bank’s strengths and your business aspirations, especially in M&A advisory and equity needs. We suggest mapping firm capabilities against your goals, such as streamlining transactions through integrated digital tools and proprietary data access. This ensures the advisor not only advises but actively contributes to strategic growth.

Practical tips for alignment:

- Match sector focus: Select firms with demonstrated prowess in your industry, leveraging insights from deal sourcing to takeover defense.

- Evaluate full-service integration: Opt for providers offering equity advisory for growth capital alongside fairness opinions and pitch deck development.

- Conduct compatibility checks: Engage in preliminary discussions to gauge cultural fit and response to your specific pain points, much like networking in recruitment processes.

Through this methodical approach, we help clients forge relationships that deliver precision in execution and sustained value, reinforcing the overall efficacy of boutique engagements.

Unlocking Value with Boutique Expertise

As we’ve outlined throughout this guide, partnering with a Boutique Investment Bank unlocks significant value for businesses navigating complex financial landscapes. These specialized firms excel in M&A advisory and debt advisory, offering tailored solutions that larger institutions often overlook. By leveraging their agility and deep industry networks, companies can achieve more efficient capital formation and transaction outcomes.

Core services such as mergers acquisitions advisory, full-cycle due diligence, and equity structuring form the backbone of boutique expertise. Their advantages shine through in strategic boutique advisory, where personalized attention accelerates processes and minimizes risks. For instance, value-driven debt expertise helps secure mezzanine financing or venture debt options suited to unique growth needs. We’ve also explored selection best practices, emphasizing alignment with firm track records and cultural fit to ensure seamless collaboration.

The efficiency of boutique processes, from initial consultations to deal closure, streamlines operations and enhances strategic outcomes. As highlighted in the SEC’s ongoing work to enhance small business capital formation, policy support underscores the vital role of these firms in fostering accessible financing pathways.

At Zaidwood Capital, our proven capabilities across $24.4 billion in aggregate transactions demonstrate the potential impact of boutique partnerships. We encourage exploring these options thoughtfully, consulting advisors to align with your specific objectives and mitigate inherent risks in financial endeavors.