Healthcare Mergers And Acquisitions

Table of Contents

Navigating Healthcare Mergers and Acquisitions

The landscape of Healthcare Mergers and Acquisitions continues to evolve rapidly, driven by strategic consolidations among hospitals, pharmaceutical companies, biotech firms, and healthcare providers. In recent months, deal volumes have surged, fueled by the pursuit of cost efficiencies and broader market consolidation amid rising operational pressures. This momentum reflects ongoing healthcare M&A trends, where organizations seek to enhance scale and capabilities in a competitive environment.

At Zaidwood Capital, we serve as a trusted Healthcare Investment Bank, delivering full-cycle M&A advisory and capital solutions with over $24.4 billion in aggregate transaction volume across more than 300 deals. Our team, led by Bryann Cabral, Rami Zeneldin, and Samuel Leung, executes buy-side and sell-side mandates, leveraging proprietary networks of over 4,000 institutional investors and access to more than $15 billion in deployable capital. We provide comprehensive due diligence and capital introductions to streamline transactions, helping clients navigate complexities like private equity healthcare acquisitions and PE-backed healthcare buyouts.

This guide explores the fundamentals of healthcare dealmaking, emerging trends, regulatory considerations, and practical strategies for success. Drawing from insights like the American Hospital Association’s emphasis on post-merger integration–such as aligning on a shared vision and developing detailed roadmaps–we highlight opportunities for seamless consolidations. For instance, recent hospital system mergers have demonstrated how unified operational planning can drive long-term value. As we delve deeper, readers will gain actionable insights to prepare for their next transaction.

Fundamentals of Healthcare M&A

Healthcare Mergers and Acquisitions represent a critical mechanism for growth and efficiency in the United States healthcare sector. These transactions involve the consolidation of hospitals, providers, biotech firms, and pharmaceutical companies to navigate complex regulatory landscapes and economic pressures. At Zaidwood Capital, we specialize in guiding clients through these processes, leveraging our expertise in mergers acquisitions advisory to ensure seamless executions from initial strategy to final closing.

In healthcare consolidation basics, mergers and acquisitions fall into two primary categories: horizontal integrations, where similar entities combine to achieve economies of scale, and vertical integrations, which link different stages of the supply chain, such as providers partnering with pharmaceutical suppliers. The historical evolution accelerated post-Affordable Care Act, with healthcare M&A trends shifting toward survival strategies amid reimbursement cuts and rising operational costs. Since 2010, deal volumes have surged, driven by the need for integrated care models and technological advancements like electronic health records. This period marked a transition from fragmented markets to consolidated networks, setting the stage for sustained industry transformation.

Key drivers fueling current activity include escalating cost pressures from labor shortages and supply chain disruptions, alongside rapid tech adoption in telemedicine and AI diagnostics. Antitrust considerations remain paramount in the US, enforced by the Federal Trade Commission to prevent monopolistic practices that could harm patient access. Subsector hotspots reveal varying dynamics, with hospitals facing heightened scrutiny yet pursuing partnerships for financial stability. Biotech and pharma sectors attract significant private equity healthcare acquisitions, as investors seek innovative pipelines amid patent cliffs. Projections for 2026 indicate continued momentum, particularly in provider consolidations addressing policy uncertainties.

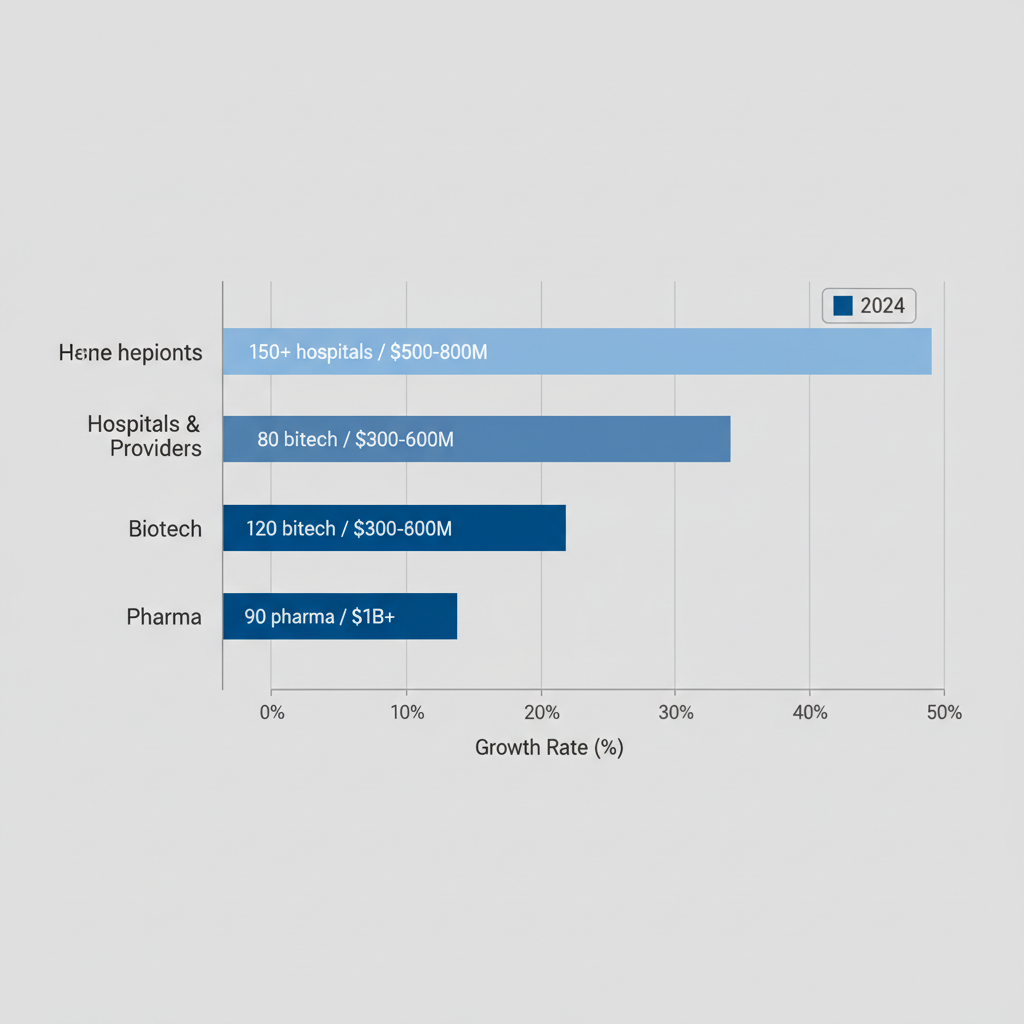

| Subsector | Deal Volume (2024) | Deal Volume (2025 Q1-Q2) | Avg. Deal Value (USD M) | Growth Rate (%) |

|---|---|---|---|---|

| Hospitals & Providers | 150+ | 200+ | $500-800 | 30 |

| Biotech | 80 | 120 | $300-600 | 25 |

| Pharma | 60 | 90 | $1B+ | 40 |

This comparison underscores pharma’s robust growth, propelled by blockbuster drug developments, while hospitals demonstrate steady volume increases amid divestitures of underperforming assets. For 2026, these trends suggest intensified private equity involvement in medical deals, focusing on strategic alignments over sheer scale. Such evolutions enable organizations to enhance capabilities in outpatient services and value-based care, ultimately improving patient outcomes and operational resilience.

Building on this data, healthcare leaders must evaluate how subsector-specific growth influences long-term viability. For instance, biotech’s rising deal values correlate with investor appetite for cutting-edge therapies, whereas provider mergers often prioritize geographic expansion to bolster negotiating power with payers. These insights inform proactive strategies, allowing firms to anticipate regulatory hurdles and capitalize on emerging opportunities like collaborative models in managed care.

Healthcare M&A activity comparison by subsector 2024-2025

At Zaidwood Capital, we provide full-cycle due diligence services encompassing financial audits, operational reviews, and compliance assessments tailored to healthcare complexities. Our team conducts baseline valuation methods, including discounted cash flow analyses and comparable transactions, to establish fair market values amid volatile subsector dynamics. Through our Healthcare Investment Banking Services, clients access our network of over 4,000 institutional investors, facilitating efficient capital deployment. We streamline transactions by integrating proprietary tools for risk mitigation, ensuring robust structures that withstand antitrust reviews and support sustainable growth in this evolving landscape.

Deep Dive into Healthcare M&A Dynamics

Healthcare mergers and acquisitions represent a pivotal arena for growth and innovation in the medical sector, where regulatory frameworks and investment strategies profoundly influence transaction success. At Zaidwood Capital, we specialize in guiding clients through these complexities, leveraging our expertise in debt advisory and equity advisory to optimize outcomes.

Regulatory Impacts on Healthcare Deals

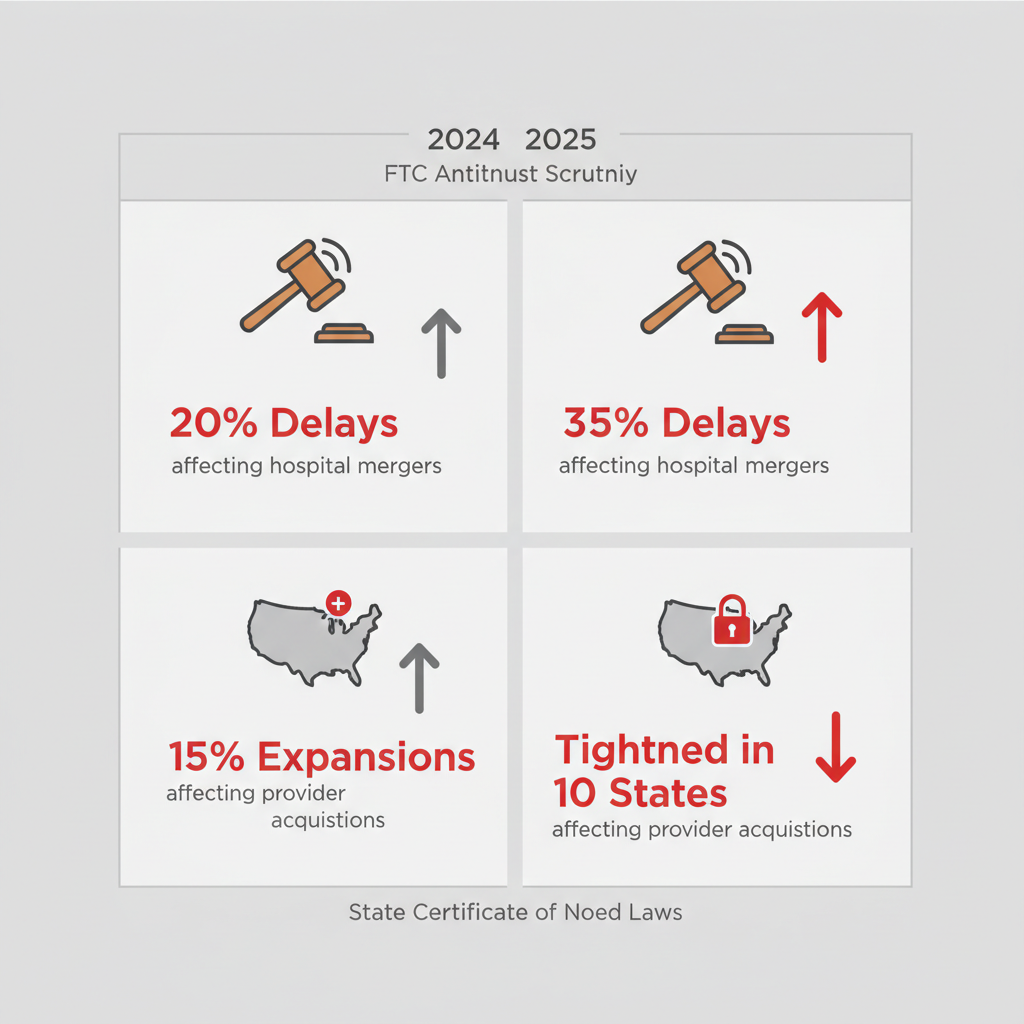

Regulatory hurdles in medical deals have intensified, particularly through Federal Trade Commission (FTC) oversight and state-level interventions, reshaping Healthcare Mergers and Acquisitions landscapes across the United States. The FTC’s heightened antitrust scrutiny aims to prevent monopolistic consolidations, leading to prolonged review periods that can extend deal timelines by months. For instance, recent guidelines emphasize evaluating competitive impacts on patient access and pricing, drawing from comprehensive due diligence protocols that assess market concentration and potential cost increases.

State Certificate of Need (CON) laws further complicate expansions, requiring approvals for facility developments or service additions to ensure public necessity. In Q2 2025, updates from various states, including California’s push for transaction reporting via SB 25 and Massachusetts’s H.5159 strengthening private equity oversight, have tightened these requirements. As noted in state regulatory analyses, these changes restrict expansions in over 15% of proposed cases, compelling parties to restructure deals or abandon pursuits.

| Regulatory Factor | Pre-Change Impact (2024) | Post-Change Impact (2025) | Example Deal Type Affected |

|---|---|---|---|

| FTC Antitrust Scrutiny | Delayed 20% of deals | Increased to 35% delays | Hospital mergers |

| State Certificate of Need Laws | Restricted 15% expansions | Tightened in 10 states | Provider acquisitions |

These metrics, informed by 2024-2025 transaction data, underscore how pre-change leniency allowed smoother progress, while post-change enforcements demand meticulous compliance planning. We advise clients to incorporate early regulatory assessments in their strategies, aligning with capital protection guidelines that prioritize risk mitigation through robust valuation perspectives.

Such dynamics not only delay closings but also elevate compliance costs, often by 20-30% due to added legal reviews. For example, a hypothetical hospital merger in a CON-strict state might require revised structures to secure approvals, highlighting the need for adaptive transaction planning.

Side-by-side regulatory impacts on healthcare M&A deals 2024 vs 2025

Private Equity’s Role in Driving Acquisitions

Private equity healthcare acquisitions have surged, driven by firms seeking resilient returns in a sector projected to grow amid demographic shifts and technological advancements. Investment strategies increasingly target subsectors like outpatient services and digital health, with 2025 marking a pivot toward AI-enhanced providers for scalable efficiencies. According to investment trends, private equity allocations to healthcare reached record levels, focusing on platforms with strong operational KPIs and liquidity management.

The appeal lies in undervalued assets post-regulatory flux, enabling buyouts that consolidate fragmented markets. Subsector preferences lean toward behavioral health and home care, where venture capital in health buyouts supports innovative models. Due diligence in these deals emphasizes compliance and cybersecurity, as outlined in valuation frameworks that stress long-term value creation.

In 2025, changes include heightened focus on sustainable growth, with firms adapting to reimbursement shifts by integrating automation for error reduction. A hypothetical acquisition of a regional provider network illustrates this: private equity injects capital for expansion, but must navigate ownership transparency rules in states like Minnesota.

We at Zaidwood Capital enhance these processes through our boutique M&A advisory and fairness opinions, connecting clients to our network of over 4,000 investors for seamless equity advisory in private equity healthcare acquisitions.

Emerging Trends and Challenges

Healthcare M&A trends in 2025 spotlight AI integration, revolutionizing due diligence with predictive analytics for risk assessment and clinical outcomes. Consolidation opportunities abound in telemedicine and biotech, yet challenges like data privacy and interoperability persist, demanding adaptable models.

Forward-looking insights reveal AI-driven tools, such as diagnostic platforms, attracting investments while regulatory evolution poses hurdles. We support clients with strategic financial consulting to capitalize on these shifts, ensuring compliance and innovation alignment.

Practical Strategies for Healthcare Mergers

At Zaidwood Capital, we specialize in guiding healthcare organizations through the complexities of mergers and acquisitions. Our expertise in full-cycle M&A advisory ensures seamless transactions, drawing on our access to over $15 billion in deployable capital to structure deals effectively.

Preparing Your Company for a Merger

Preparing for Healthcare Mergers and Acquisitions demands a structured approach to operational and financial readiness. We recommend starting with a comprehensive merger readiness checklist that evaluates your current state across key areas. This includes conducting thorough financial audits to verify balance sheets, cash flow projections, and revenue streams, ensuring transparency for potential buyers or partners.

Next, align your internal teams on strategic objectives. Foster cross-departmental collaboration to address buyout preparation in health, such as standardizing clinical protocols and optimizing supply chains. Develop contingency plans for talent retention, including incentives to maintain physician and staff engagement during transitions.

- Perform financial audits: Review historical performance and forecast future revenues under various merger scenarios.

- Assess operational efficiencies: Identify redundancies in IT systems and administrative processes to streamline post-merger integration.

- Engage stakeholders early: Communicate vision and values to build buy-in and reduce resistance.

Our services, including pitch decks and pro forma financials, help craft compelling narratives that highlight synergies. For instance, in a recent advisory mandate, we assisted a mid-sized provider in aligning operations, resulting in a smoother evaluation phase. These steps mitigate risks and position your organization for value maximization, typically taking 6-12 months depending on scale.

Due Diligence Essentials

Due diligence in healthcare transactions requires a meticulous full-cycle process tailored to regulatory and clinical nuances. We conduct comprehensive reviews across financial, legal, operational, commercial, IT, and human capital domains to uncover potential liabilities early.

Begin with financial scrutiny, examining not just standard metrics but also reimbursement compliance and payer contracts. Legal reviews must prioritize HIPAA adherence and licensing validations. Operationally, evaluate clinical workflows and staff credentials to ensure seamless integration.

| Due Diligence Area | Standard Checklist Items | Healthcare-Specific Additions | Risk Mitigation Focus |

|---|---|---|---|

| Financial | Balance sheets, revenue projections | Reimbursement compliance, payer contracts | HIPAA violations |

| Operational | Supply chain review | Clinical protocols, staff credentials | Integration disruptions |

This comparison underscores the need for specialized focus in healthcare, where overlooking payer dynamics or credentialing can lead to costly delays. Following the table, we emphasize interpretation: Standard items provide a baseline, but healthcare additions address sector-unique risks like regulatory non-compliance, which can erode deal value by up to 20% if unaddressed.

Drawing from the American Hospital Association’s insights on post-merger integration, successful due diligence incorporates four key pillars: beginning with the end in mind for unified vision, conducting a full inventory of integration elements, setting realistic timelines (often 1-2 years), and developing a prioritized roadmap. Our full-cycle due diligence services enhance these by providing expert analysis, as seen in supporting clinical program alignments for clients. This phased approach–preliminary screening, deep dives, and validation–empowers informed decisions without overextending resources.

Navigating Consolidation Opportunities

Healthcare M&A trends point to accelerating consolidation driven by rising costs and technological shifts. Private equity healthcare acquisitions offer substantial opportunities, particularly for scaling operations and enhancing efficiencies through strategic integrations.

We guide clients in leveraging these trends by identifying PE partners aligned with long-term growth. Focus on market gaps, such as ambulatory care expansions, where our capital formation advisory connects to institutional networks for funding. Consider valuation drivers like EBITDA multiples, often 8-12x in this space, and post-merger synergies in supply chain and IT.

- Analyze market dynamics: Target regions with high consolidation activity.

- Structure deals for value: Use mezzanine debt to bridge funding gaps.

- Plan integrations proactively: Apply AHA’s roadmap to prioritize high-impact areas.

Advanced Insights in Healthcare M&A

As healthcare evolves rapidly, advanced elements are reshaping the landscape of Healthcare Mergers and Acquisitions. We at Zaidwood Capital observe that artificial intelligence is poised to drive significant synergies in 2026. AI-enhanced health deals will streamline diagnostics and personalize patient care, attracting investors seeking innovative efficiencies. For instance, predictive analytics could reduce operational costs by up to 30 percent in integrated systems, according to industry projections. These healthcare M&A trends signal a shift toward tech-integrated platforms, where AI optimizes supply chains and enhances telemedicine capabilities. Sovereign funds, with their long-term horizons, are increasingly eyeing these opportunities to diversify into resilient healthcare assets amid global uncertainties.

Private equity healthcare acquisitions remain focal points for high-value targets in digital health and biotech. In 2026, we anticipate top targets including AI-driven genomics firms and virtual care providers, fueled by demands for scalable solutions post-pandemic. Capital flows are surging, with private equity deploying substantial resources to capitalize on consolidation. Advanced due diligence becomes critical here, scrutinizing tech integrations for regulatory compliance and data security. Our analysis draws from quarterly reports like the M&A Quarterly Activity Report Q1 2025, which, despite a Q1 dip to five deals totaling under $1.4 billion due to economic volatility, underscores potential recovery through strategic partnerships.

| Metric | Healthcare (USD B) | Tech/Other Sectors (USD B) | Key Driver |

|---|---|---|---|

| Total Deployment | 150+ | 200 | Consolidation needs |

| Avg. per Deal | 500 | 300 | Innovation focus |

Healthcare’s higher average deal sizes reflect urgent consolidation amid financial distress, as seen in Q1 trends where four of five transactions involved unstable entities. In contrast, tech sectors prioritize volume through nimble innovations. This disparity highlights healthcare’s unique drivers, such as policy shifts and demographic pressures, positioning it for robust 2026 rebounds.

We provide M&A capital advisory tailored to these complexities, offering advanced structuring for intricate transactions. Our institutional LP placement services connect clients to over 4,000 investors with $15 billion in deployable capital, facilitating seamless equity raises for AI synergies or sovereign fund alignments. Through full-cycle due diligence, we mitigate risks in tech-heavy deals, ensuring precision in fairness opinions and strategic documentation. This approach empowers healthcare entities to navigate volatility, leveraging our $24.4 billion aggregate transaction volume for informed, forward-looking strategies.

Frequently Asked Questions on Healthcare M&A

How is private equity driving healthcare M&A activity in 2025-2026?

Private equity healthcare acquisitions are accelerating due to attractive valuations and growth opportunities in telehealth and outpatient services. We see funds targeting scalable platforms to capitalize on demographic shifts and tech integration.

What are the key healthcare M&A trends over the past 3 months?

Recent healthcare M&A trends highlight increased hospital consolidations amid rising costs and regulatory pressures. Deals emphasize operational efficiencies and geographic expansion to enhance market positions.

How do regulations impact healthcare mergers?

Stringent antitrust reviews and HIPAA compliance slow but refine transactions, ensuring patient data security. Thorough due diligence mitigates risks in this regulated environment.

What preparation is essential for healthcare M&A?

Conduct full-cycle due diligence on financials, operations, and compliance early. Our mergers acquisitions advisory services help streamline this process for smoother executions.

Key Takeaways for Healthcare M&A Success

In the evolving arena of Healthcare Mergers and Acquisitions, staying ahead requires synthesizing key healthcare M&A trends and the pivotal roles of private equity healthcare acquisitions in fostering growth. Observed patterns, such as heightened investment in medical consolidations, underscore the need for robust market analysis and adaptive strategies drawn from industry benchmarks.

Effective strategic health dealmaking demands meticulous preparation and comprehensive due diligence to navigate regulatory complexities and valuation challenges. By prioritizing these elements, stakeholders can mitigate risks and capitalize on synergies, ensuring resilient outcomes in a competitive landscape.

At Zaidwood Capital, our $24.4 billion aggregate transaction volume and access to over 4,000 investors empower us to guide clients through these intricacies. We invite you to connect as you plan your next move in healthcare M&A.