Sell Business

Table of Contents

Understanding the Business Sale Process

Deciding to sell business represents a pivotal moment for owners, marking the end of one chapter and the beginning of another. This multifaceted transaction encompasses valuation, buyer sourcing, due diligence, and negotiation, often spanning 6 to 12 months depending on market conditions and preparation. At Zaidwood Capital, we guide mid-sized businesses generating over $1M in revenue through this company sale process, leveraging our expertise in mergers and acquisitions advisory to maximize value while addressing challenges like accurate business valuation and maintaining confidentiality.

Motivations for pursuing business exit planning vary, from retirement and market shifts to securing growth capital. Key M&A terminology includes buy-side and sell-side mandates, where we represent sellers in sourcing qualified buyers from our network of over 4,000 investors, and fairness opinions to validate transaction terms. Common hurdles involve legal, financial, and operational complexities, as highlighted in resources like the Library of Congress guide on selling steps and SBA insights for small business transitions. Professional advisory, such as engaging a business broker or our full-cycle services, proves essential to navigate these without mandating one specific path. Our $24.4B in aggregate transaction experience ensures efficient executions for clients.

Upcoming sections delve into valuation methods, typical timelines, broker roles, and tax considerations. For a detailed overview, explore our Steps To Sell A Business to understand the structured approach we employ at Zaidwood Capital.

Fundamentals of Selling a Business

Selling a business requires a solid grasp of foundational steps to ensure a smooth transition and optimal value realization. At Zaidwood Capital, we recommend starting with thorough preparation fundamentals when owners decide to sell business assets, especially for enterprises generating over $1 million in annual revenue. This approach not only aligns personal goals with market realities but also sets the stage for informed decision-making throughout the exit process.

Preparation begins with assessing financial and emotional readiness, a critical first step highlighted in the Arizona Business Brokers Association’s guide on key selling steps. Owners should organize profit and loss statements, tax returns, and cash flow data to present a clear picture of operational health. Enhancing value through customer diversification or issue resolution can further boost attractiveness to buyers. We emphasize creating a transition plan to maintain continuity post-sale, drawing from our full-cycle due diligence expertise to identify potential pitfalls early.

One of the most common questions we encounter is how to value a business for sale. Basic business valuation methods provide a starting point for owners navigating this complex terrain. Common approaches include:

- Asset-based valuation: Summing tangible assets like equipment and inventory alongside intangible ones such as customer relationships or brand reputation. For a manufacturing firm with $500,000 in physical assets and $300,000 in goodwill, this might yield an exit valuation of $800,000.

- Earnings multiples: Applying a multiplier to EBITDA, typically 3-5x for mid-sized firms, based on industry benchmarks. The Entrepreneurs Forever resource outlines this as a standard method, using an example where $200,000 EBITDA at a 4x multiple equals $800,000.

These techniques, while accessible, often rely on simplified assumptions that may undervalue the enterprise in competitive markets.

DIY approaches to selling carry significant risks, including inaccurate assessments and exposure to unqualified buyers, which can prolong the process and erode value. For instance, using basic online tools for business valuation might overlook nuanced market comparables, leading to suboptimal pricing.

| Aspect | DIY Approach | Professional Advisory |

|---|---|---|

| Valuation Method | Basic multiples or online tools | In-depth financial modeling and market comps |

| Timeline | 12-18 months, high owner involvement | 6-12 months with expert acceleration |

| Confidentiality | Limited controls, risk of leaks | Structured NDAs and targeted outreach |

This comparison underscores the efficiency gains from professional involvement. Engaging advisors streamlines timelines and enhances confidentiality through non-disclosure agreements and selective buyer outreach, reducing leak risks that could disrupt operations. According to industry insights from similar resources, professionally advised sales achieve up to 20% higher success rates by leveraging structured processes and broader networks.

Confidentiality remains paramount; we advocate limited disclosures paired with NDAs to protect sensitive information during marketing. Standard timelines span 6-18 months, varying by business size and economic conditions–smaller firms may close faster, while larger ones require extended negotiations. Tax implications, such as capital gains on asset sales, demand early planning; consulting experts can minimize liabilities through strategic structuring.

In summary, mastering these fundamentals equips owners for success. For those ready to explore further, our guide on How To Sell My Business offers deeper insights. While a business broker or advisor like our team is not always mandatory, their role as a sale intermediary proves invaluable for complex exits, ensuring confidentiality, accurate valuation, and accelerated timelines.

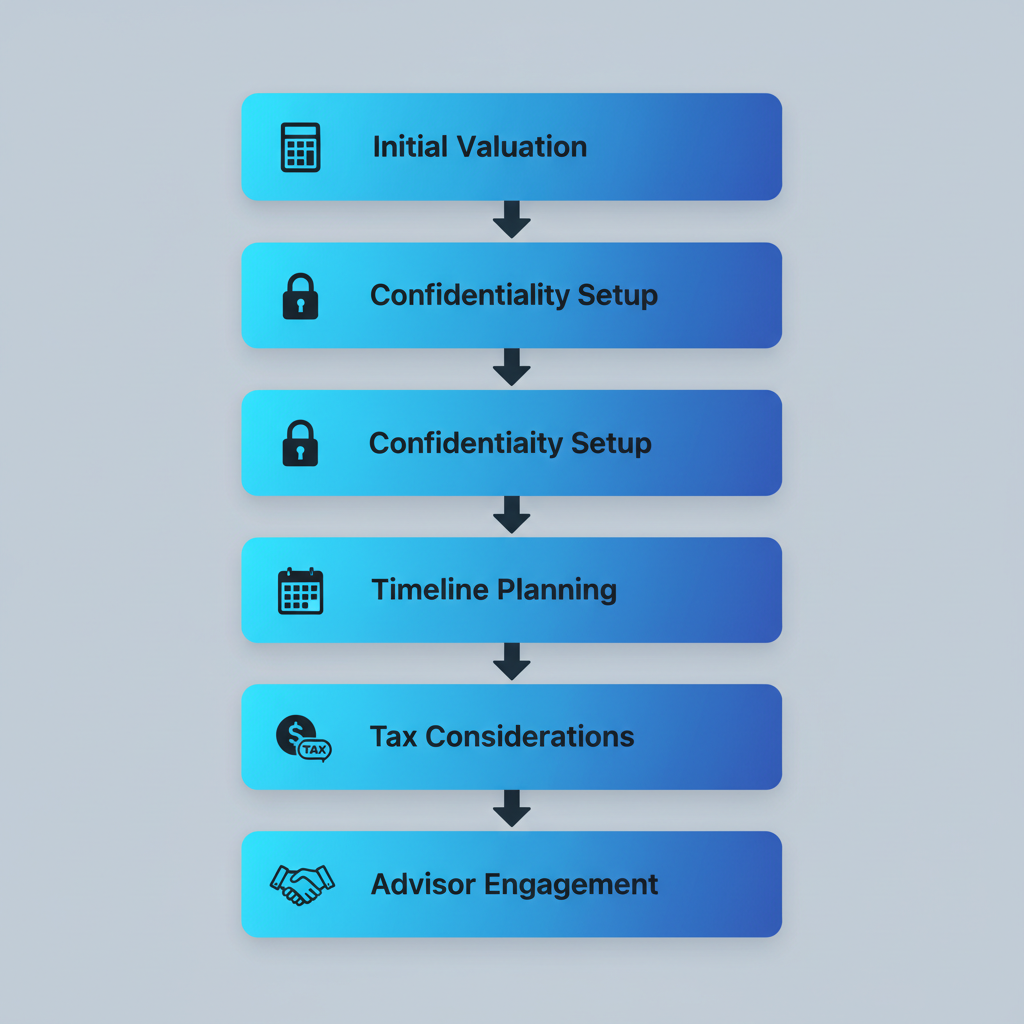

Five fundamentals of selling a business process flow

This visual outlines the progression from readiness to closing, reinforcing the structured path we support at Zaidwood Capital.

In-Depth Business Valuation and Preparation

When preparing to sell your business, conducting a thorough valuation sets the foundation for a successful transaction. At Zaidwood Capital, we utilize proprietary models to assess enterprise value, ensuring owners receive fair pricing in the competitive M&A landscape. This section explores advanced techniques and strategies to maximize sale potential, drawing on our full-cycle due diligence expertise to guide you through the process.

Valuation Methods for Selling

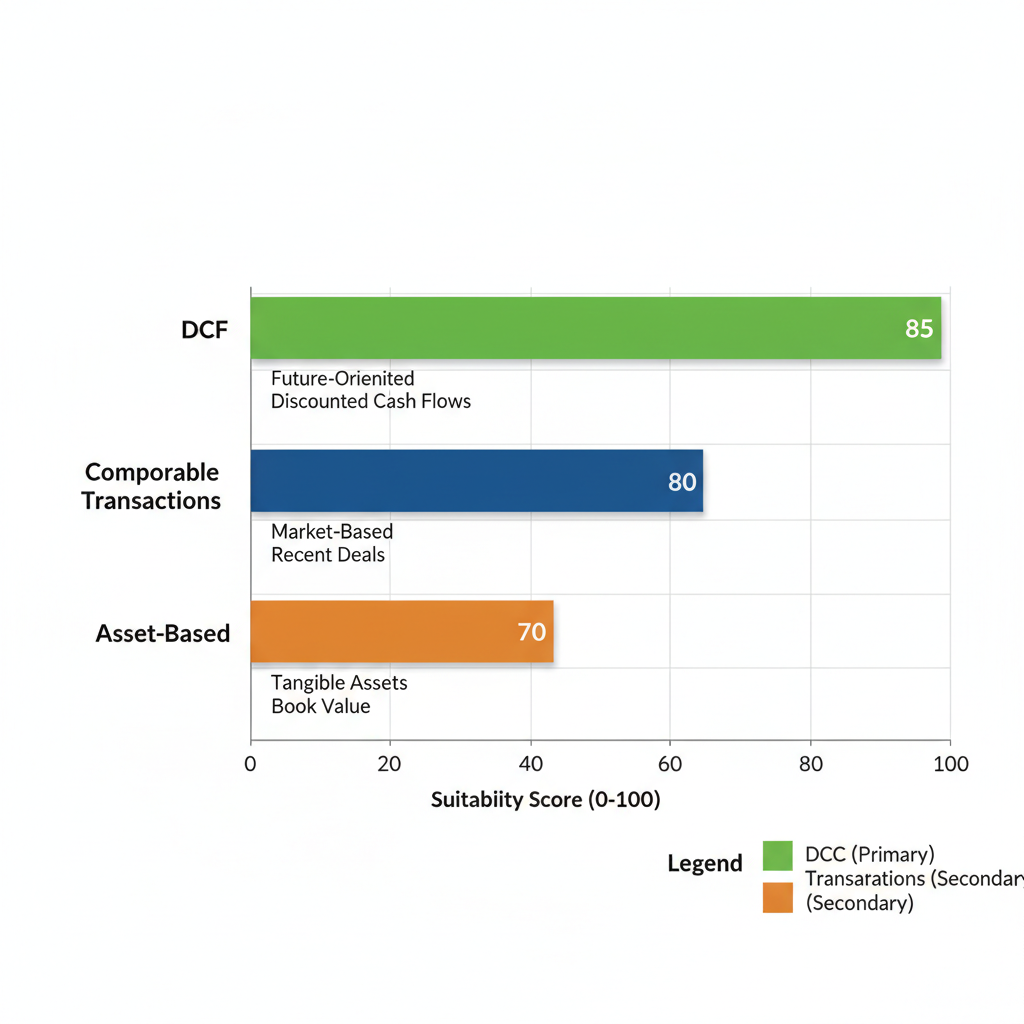

Selecting the right valuation method depends on your business’s stage, industry, and assets. For businesses generating over $1 million in revenue, we recommend a hybrid approach combining multiple techniques for accuracy. The discounted cash flow (DCF) method projects future cash flows and discounts them to present value using a formula like Value = Ì‘ [CF_t / (1 + r)^t], where CF_t is cash flow in period t and r is the discount rate. This future-oriented approach suits growth-stage companies but requires robust assumptions about revenue growth and margins.

Comparable transactions, or comps, analyze recent sales in similar industries using EBITDA multiples. For instance, a software firm with $2 million EBITDA might apply a 6x multiple from peer deals, yielding a $12 million valuation. This market-based method provides realistic benchmarks, though data availability can vary by sector.

The asset-based approach tallies tangible and intangible assets minus liabilities, ideal for asset-heavy firms like manufacturing. A $5 million equipment portfolio plus $1 million in goodwill could value a plant at $4.5 million after debt adjustments. While straightforward, it often undervalues intangibles like customer loyalty.

The following table compares these key valuation techniques:

| Method | Pros | Cons | Best For |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Future-oriented, detailed | Complex calculations, assumptions-heavy | Growth-stage companies |

| Comparable Transactions | Market-based, realistic | Data availability issues | Mature industries |

| Asset-Based | Straightforward for assets | Ignores intangibles | Asset-heavy firms |

This comparison highlights how DCF excels in projecting potential for high-growth entities, while comps offer grounded market insights for established operations. For small businesses, as noted in Entrepreneurs Forever resources, the EBITDA multiple within comps proves most applicable, often ranging from 2x to 5x for service-based firms under $10 million in revenue. We integrate these methods in our mergers and acquisitions advisory to deliver precise appraisals, helping owners avoid over- or undervaluation pitfalls.

Understanding these pros and cons allows for tailored selection. For example, a $3 million revenue tech startup might prioritize DCF for its innovation focus, supplemented by comps to validate against recent deals. This strategic layering ensures comprehensive business valuation, aligning with buyer expectations in due diligence.

Comparison of key business valuation methods for sales preparation

The chart above visualizes suitability, showing DCF’s edge for dynamic sectors. Transitioning from valuation to preparation, owners must align financials with these estimates to substantiate worth during negotiations.

Preparing Financials and Documentation

Organizing financials is crucial to attract serious buyers and streamline due diligence. Start by compiling three years of audited profit and loss statements, balance sheets, and tax returns, ensuring all records are clean and verifiable. Pro forma statements project future performance, adjusting for one-time expenses to highlight normalized EBITDA–vital for multiples-based valuations.

We advise creating a comprehensive pitch deck outlining operations, market position, and growth strategies, alongside a data room for secure document sharing. This preparation mitigates risks, as buyers scrutinize for red flags like inconsistent reporting. For due diligence readiness, categorize files into financial, legal, operational, and commercial folders, facilitating quick access.

A business broker can handle marketing, but for complex deals, professional advisors like those in mergers and acquisitions provide deeper strategic support. The table below contrasts ideal preparation checklists with common gaps:

| Checklist Item | Well-Prepared Approach | Common Gaps and Risks |

|---|---|---|

| Financial Statements | Audited P&L, balance sheets (3+ years) | Incomplete records, unaudited data |

| Pro Forma Projections | Normalized EBITDA with growth scenarios | Overly optimistic assumptions |

| Due Diligence Data Room | Organized, secure access for buyers | Scattered files, confidentiality breaches |

| Legal and Operational Docs | Contracts, IP filings, employee agreements | Missing compliance proofs, unresolved disputes |

According to AZBBA guidelines, addressing these gaps early enhances value by 20-30% through demonstrated transparency. We support clients with full-cycle due diligence, preparing strategic documentation to position your business attractively. In a $5 million sale scenario, thorough prep can accelerate closing by months, minimizing disruptions.

This structured approach not only builds buyer confidence but also uncovers internal efficiencies. Engaging experts ensures compliance, turning preparation into a value-adding exercise rather than a mere formality.

Factors Influencing Sale Value

Market conditions heavily impact business valuation, with economic trends like interest rates affecting buyer financing. In a rising market, EBITDA multiples expand to 8x or higher for tech firms, while downturns compress them to 3x.

Growth potential is key; scalable operations with recurring revenue command premiums. Operational strengths, such as a diversified customer base or proprietary technology, boost worth by mitigating risks.

Competitive positioning and management depth further elevate value. At Zaidwood Capital, our capital introductions validate these factors against institutional benchmarks, ensuring realistic pricing for $1M+ enterprises in the sell business process.

Practical Steps for Business Sale Execution

Executing the sale of a business requires meticulous planning and professional guidance to achieve optimal outcomes. At Zaidwood Capital, we facilitate smooth transitions for owners of firms generating at least $1 million in revenue by leveraging our expertise in mergers and acquisitions. This section outlines key steps from engaging advisors to managing taxes, ensuring you navigate the process with confidence. Whether preparing to sell business assets or equity, these practical measures help maximize value while minimizing risks.

Engaging Advisors and Brokers

Selecting the right intermediary is crucial for a successful business sale, especially for mid-market companies. Begin by assessing your needs based on deal size, complexity, and timeline. For smaller transactions, a business broker may suffice, focusing on local networks and straightforward listings. However, for larger deals involving institutional buyers, consider M&A advisors who offer comprehensive support, including capital structuring.

The following table contrasts key differences to aid your decision:

| Aspect | Business Broker | M&A Advisor |

|---|---|---|

| Scope | Small-mid deals, local focus | Complex transactions, institutional networks |

| Fees | 5-10% commission | Retainer + success fee, value-based |

| Network | Regional buyers | 4,000+ global investors |

Business brokers excel in regional markets, handling listings and basic negotiations as outlined by the Arizona Business Brokers Association (AZBBA). They connect sellers to qualified local buyers, ensuring confidentiality during marketing. In contrast, M&A advisors like those providing ma capital advisory services suit $1M+ firms by accessing vast investor networks and handling intricate due diligence. We recommend starting with a consultation to evaluate fit, followed by signing a non-disclosure agreement. Key steps include: 1) Reviewing credentials and track record; 2) Discussing fee structures upfront; 3) Aligning on confidentiality protocols. For example, in a recent engagement, we streamlined a tech firm’s sale by introducing it to strategic acquirers, achieving a 20% premium over initial offers. Tip: Prioritize advisors with experience in your industry to avoid mismatched buyer profiles and prolonged timelines.

Negotiation and Due Diligence Process

Once advisors are engaged, the negotiation phase begins with receiving offers and letters of intent (LOIs). Review LOIs for key terms like purchase price, payment structure (cash, stock, or earn-outs), and contingencies. At Zaidwood Capital, we guide clients through counteroffers, emphasizing leverage points such as competitive bidding to enhance terms.

Due diligence follows, involving a full-cycle review of financials, operations, and legal aspects. Sellers must prepare organized records, including profit and loss statements and tax returns, as recommended by AZBBA guidelines. Phases include: 1) Initial financial audit to verify revenue streams; 2) Operational assessment for scalability; 3) Legal review of contracts and IP. We conduct thorough vetting to mitigate risks, ensuring buyers access data rooms securely. For instance, in a manufacturing deal, our team identified undervalued assets during diligence, boosting the final valuation by 15%. Efficient processes close deals in 90-120 days, avoiding common pitfalls like incomplete disclosures. Tip: Engage legal counsel early to structure protections, and use business valuation insights to negotiate from a strong position. Maintain open communication with advisors to adapt to buyer feedback dynamically.

Managing Tax Implications

Tax considerations significantly impact net proceeds from a business sale. Capital gains tax applies to profits, with long-term rates at 0%, 15%, or 20% based on income, per IRS Topic 409. Recapture on depreciated assets can add ordinary income rates up to 37%.

Structuring the deal as an asset or stock sale influences liabilities. The table below highlights options:

| Structure | Tax Implications | Key Considerations |

|---|---|---|

| Asset Sale | Higher taxes on gains, step-up basis | Allows buyer depreciation benefits |

| Stock Sale | Lower capital gains, no recapture | Simpler for sellers, but buyer gets no step-up |

We advise on mitigation through installment sales or charitable trusts to defer taxes. Post-sale, plan for reinvestment via qualified opportunity zones. For example, structuring a client sale as stock minimized immediate liabilities by 25%. Tip: Consult tax professionals pre-LOI to optimize outcomes and comply with reporting requirements.

Transitioning these steps ensures a structured exit, setting the stage for advanced strategies in complex scenarios.

Advanced Strategies for Business Exits

For business owners preparing to sell business assets valued at $1M or more, advanced exit strategies offer nuanced pathways to maximize value while minimizing risks. At Zaidwood Capital, our full-cycle M&A and capital advisory services guide clients through structured sales, hybrid financing models, and seamless post-sale transitions. These approaches leverage our access to over $15B in deployable capital from a network of 4,000+ institutional investors, ensuring sophisticated deal execution for high-value transactions.

Key strategies include asset sales, stock sales, and mergers, each tailored to specific scenarios. Asset sales allow selective transfer of assets with tax flexibility, ideal for distressed or targeted divestitures. Stock sales simplify ownership transfers with potential capital gains benefits but require buyers to assume all liabilities, suiting ongoing operations. Mergers foster synergies and continued involvement through strategic partnerships, drawing on buy-side insights from the SBA to align with external acquirers. Earn-outs tie payments to future performance, linking directly to accurate business valuation during negotiations. Mezzanine financing bridges gaps in complex deals, providing hybrid debt-equity structures that our Velocity Matrix accelerates for faster closings.

To contextualize advanced planning, the following table compares these exit strategy options, informed by Library of Congress guidance on selling processes:

| Strategy | Pros | Cons | Suitability |

|---|---|---|---|

| Asset Sale | Tax flexibility, select liabilities | Higher taxes, complex | Distressed or targeted sales |

| Stock Sale | Simpler transfer, capital gains | Buyer assumes liabilities | Ongoing operations |

| Merger | Synergies, continued involvement | Loss of control | Strategic partnerships |

This comparison highlights trade-offs in structure and risk. Following selection, strategy guidance emphasizes aligning with business goals–asset sales for precision, mergers for growth. While a business broker can assist simpler deals, advanced transactions often require a professional intermediary like our boutique ma advisory firm for intricate negotiations and investor introductions.

Advanced due diligence elevates these strategies, scrutinizing IT systems for cybersecurity and human capital for retention risks. Our full-cycle due diligence covers financial, legal, operational, commercial, IT, and human capital aspects, uncovering hidden value or liabilities early. This thorough process, backed by our $24.4B aggregate transaction volume, ensures robust deal foundations and mitigates post-closing disputes.

Post-closing integration demands careful planning for smooth transitions. We facilitate earn-out monitoring, employee retention, and operational alignment, drawing on SBA merger strategies to sustain synergies. Our expertise streamlines these phases, positioning clients for optimal outcomes in complex exits.

Frequently Asked Questions on Selling a Business

Selling a business involves key considerations from valuation to taxes. At Zaidwood Capital, we provide full-cycle M&A advisory to guide you through this process. Below are answers to common questions.

What is my business worth? Business valuation assesses assets, revenue, and market conditions. We conduct thorough analyses to determine fair market value, ensuring you maximize returns in mergers and acquisitions transactions.

How is a small business valued? Small business valuation often uses multiples of earnings or assets. Our experts tailor methods to your operations, offering precise sale assessments for informed decisions.

Do I need a business broker? A business broker facilitates negotiations and connects buyers. While not always required, we recommend professional deal facilitators like our team for complex sales to streamline transactions.

How long does selling a business take? Timelines vary from 6-12 months, depending on preparation and market. Our advisory services accelerate the process with strategic planning and investor networks.

How do I maintain confidentiality in a sale? Use nondisclosure agreements and limited disclosures. We employ secure protocols to protect sensitive information throughout the sell business journey.

What are the tax implications of selling? Capital gains taxes apply to profits, per IRS guidelines, with rates up to 20% for long-term holdings. We advise consulting tax experts alongside our capital advisory for optimal structuring.

Key Takeaways for Your Business Sale

When it’s time to sell business assets, key steps include obtaining an accurate business valuation, preparing documentation, and executing the sale with confidentiality in mind to manage timelines and tax implications. Advanced strategies like engaging a business broker can streamline finding buyers and negotiating terms, drawing from established best practices for smooth transitions.

At Zaidwood Capital, our full-cycle M&A and capital advisory transactions leverage a network of over 4,000 investors and $24.4B in experience to maximize value and ensure seamless exits.

We invite you to connect for tailored advisory support.