Sell My Business

Table of Contents

Navigating the Sale of Your Business

Deciding to sell my business marks a pivotal moment for any owner, blending emotional fulfillment with financial strategy. This choice demands careful consideration of your business exit strategy, especially amid challenges like accurate business valuation and finding qualified buyers. At Zaidwood Capital, we understand the complexities of the company sale process and guide owners through it with expertise.

As a boutique M&A advisory firm headquartered in Sheridan, Wyoming, we at Zaidwood Capital provide full-cycle services, including mergers and acquisitions advisory, capital formation, and comprehensive due diligence. Our track record speaks volumes: over $24.4 billion in aggregate transaction volume and more than 300 completed deals, led by principals Bryann Cabral, Rami Zeneldin, and Samuel Leung. We connect clients to a network of 4,000+ investors with access to $15 billion in deployable capital, streamlining transactions for optimal outcomes. For those seeking Help Selling My Business, our sell-side mandates ensure confidentiality and efficiency, much like the professional support emphasized by industry guides on preparing financial records and enhancing value.

This guide previews essential steps drawn from proven practices, such as early preparation to avoid pitfalls in valuation and buyer sourcing. Upcoming sections explore business valuation methods, operational readiness, typical timelines, and best practices with a trusted business broker. Whether assessing your business’s worth or crafting a transition plan, we equip you to navigate the sale successfully.

Assessing the Value of Your Business

Determining the value of your business is a foundational step when preparing to sell my business, enabling owners to set realistic expectations and negotiate effectively. At Zaidwood Capital, we emphasize accurate business valuation as key to maximizing proceeds in mergers and acquisitions. This assessment not only highlights strengths but also identifies areas for improvement before engaging buyers.

Methods for Business Valuation

Business valuation methods provide structured ways to estimate company worth, essential for small to mid-sized enterprises considering a sale. These approaches ensure owners understand their asset’s financial standing through proven techniques.

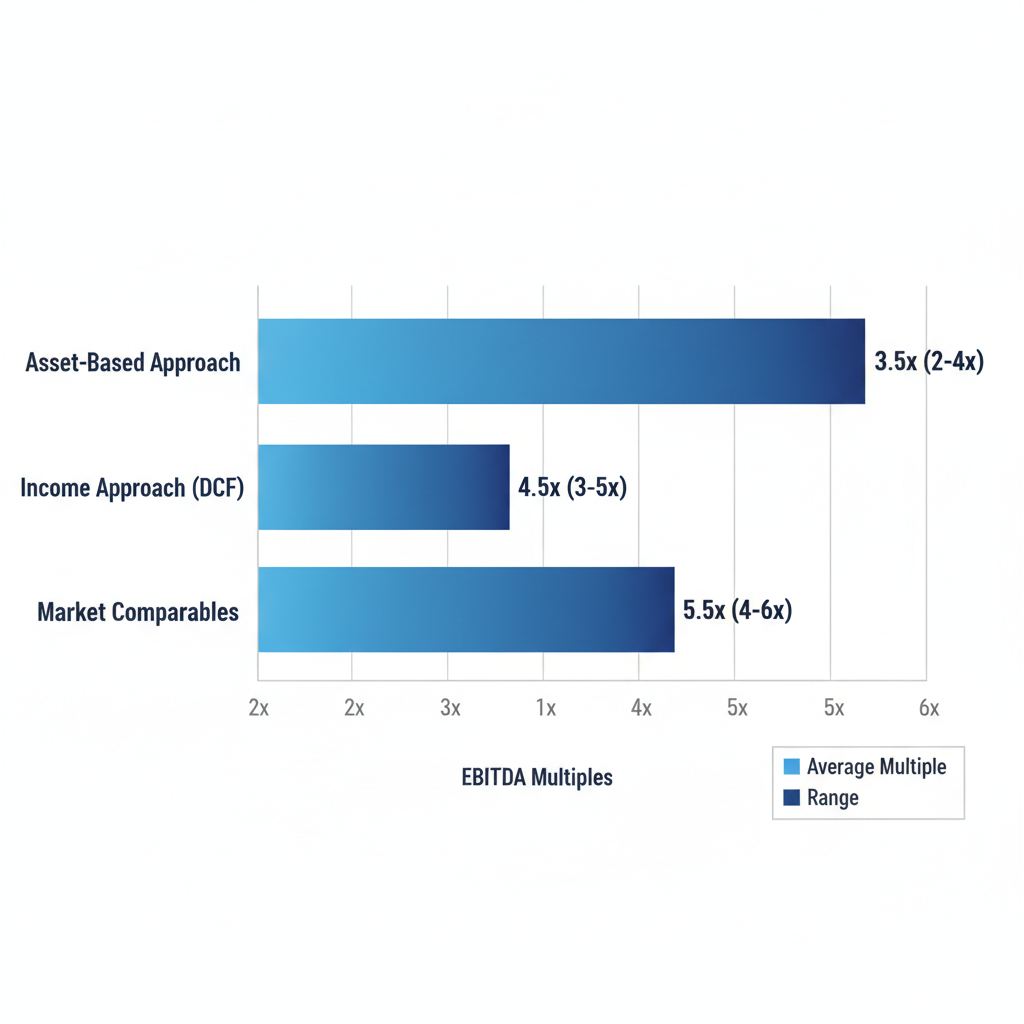

The asset-based approach calculates value by subtracting liabilities from assets, ideal for businesses with significant tangible holdings like equipment or inventory. For example, a manufacturing firm with $500,000 in assets and $200,000 in debts might value at $300,000. The income approach, often using discounted cash flow (DCF), projects future earnings and discounts them to present value; a service company with steady $150,000 annual cash flow could reach $600,000 at a 5% discount rate. The market approach applies comparables, such as EBITDA multiples of 3-5x for small businesses, where a tech firm with $100,000 EBITDA might sell for $400,000 based on similar deals. Emerging AI tools enhance these by automating data analysis, improving accuracy by up to 20% according to recent studies, though traditional methods remain core.

These techniques prepare owners for due diligence, aligning valuations with market realities to attract serious buyers and streamline transactions.

Key business valuation methods with typical EBITDA multiples illustrated

Understanding these methods empowers informed decision-making. For instance, in one of our 300+ deals, a mid-sized retailer used a hybrid income-market approach to justify a 4x multiple, facilitating a smooth exit.

Factors Influencing Business Worth

Several interconnected factors shape business worth, from internal metrics to external dynamics, guiding owners toward higher valuations. Recognizing these allows strategic enhancements before listing for sale.

Financial performance drives value, with strong revenue growth and EBITDA margins applying higher multiples; a business showing 15% annual growth might command 5x EBITDA versus 3x for stagnant peers. Market conditions, like industry demand, influence comparables–a booming sector could elevate values by 20%. Operational strengths, including intellectual property and customer retention, add premiums; for example, a software company with patented tech might boost worth by $200,000. Per surveys, 98% of small owners undervalue due to overlooked intangibles like team quality. At Zaidwood, we assess these holistically during full-cycle due diligence to uncover hidden value.

- Financial Health: Optimize EBITDA through cost controls.

- Market Positioning: Leverage trends for growth projections.

- Operational Efficiency: Build scalable processes.

Strengthening these factors not only raises enterprise value calculation but positions the business favorably in competitive sales, reducing negotiation risks.

Obtaining a Professional Valuation Report

Engaging experts for a formal business valuation report delivers objective insights, crucial for credible sale preparations. This process ensures compliance and buyer confidence in complex transactions.

The journey begins with selecting certified appraisers or advisory firms experienced in M&A. Owners gather financials, operational data, and market info for analysis; experts then apply methods like DCF or multiples, often costing $5,000-$20,000 based on scope–simpler small business reviews at the lower end, comprehensive ones higher. Benefits include defensible pricing and tax planning support; our anonymized case saw a client gain 15% more proceeds via precise reporting. Zaidwood provides full-cycle due diligence, integrating financial, legal, and commercial reviews without promising outcomes, connecting to our network for robust evaluations. For those wondering Who Can Help Me Sell My Company, professional guidance unlocks strategic advantages.

This report serves as a roadmap, tying valuation to broader sale strategies and highlighting how accurate assessments, supported by firms like ours, accelerate successful exits.

Key Benefits of Selling Your Business

Selling your business can unlock significant value and open new chapters for entrepreneurs ready to transition. At Zaidwood Capital, we help clients navigate the process of deciding to sell my business, ensuring they capture the full potential of their venture while aligning with long-term goals. This approach not only provides financial rewards but also strategic flexibility, supported by our expertise in mergers acquisitions advisory.

Financial and Strategic Advantages

The decision to sell often begins with the allure of immediate financial liquidity, transforming years of hard work into substantial proceeds for personal or professional reinvestment. Owners gain access to capital that enables diversification, such as funding retirement or launching a new enterprise, while avoiding ongoing operational risks.

We at Zaidwood Capital specialize in preparing businesses for sale over 3-6 months, which typically results in higher valuation multiples through meticulous financial optimization and market positioning. Drawing on our capital formation services, we connect sellers to over $15 billion in deployable capital from our network of 4,000+ institutional investors. This facilitates seamless reinvestment, whether into passive income streams or growth-oriented ventures. According to the Library of Congress guide on small business transitions, effective liquidity management post-sale enhances tax efficiency and long-term wealth preservation.

In practice, this means owners can pivot strategically without the burdens of daily management, as seen in our work with a mid-sized manufacturing firm that reinvested proceeds into sustainable tech startups, yielding diversified returns within two years.

Maintaining Confidentiality in the Sale

A key concern for many is executing a confidential business exit to safeguard ongoing operations and maintain competitive edges during negotiations. Discreet sales prevent talent flight, customer attrition, or opportunistic rivals, preserving the enterprise’s value until closing.

Zaidwood employs targeted strategies like non-disclosure agreements (NDAs) and selective marketing to vetted buyers, ensuring minimal market disruption. Our investor rolodex enables precise introductions to qualified parties, often shortening the typical 6-12 month sale timeline while upholding privacy. We avoid broad listings, instead leveraging professional networks akin to those of a business broker but with our full-cycle due diligence to mitigate leaks and risks. The Library of Congress emphasizes researching intermediaries thoroughly, a step we integrate to align with your confidentiality needs.

This approach protected a technology client we advised, allowing them to complete a strategic company divestiture to a strategic buyer without internal awareness, ultimately securing a premium price and smooth handover to our trusted network.

Long-Term Transition Support

Beyond the transaction, selling provides ongoing benefits through expert guidance on reinvestment and legacy preservation, ensuring your vision endures post-exit. This support turns a one-time event into a foundation for future success.

At Zaidwood, our strategic consulting extends into post-sale advisory, helping clients allocate proceeds via equity and debt solutions while addressing family or employee transitions. We offer fairness opinions and capital introductions to optimize outcomes, drawing on 24.4 billion USD in aggregate transaction volume for proven strategies. Referencing Library of Congress resources on succession planning, we focus on tax implications and operational handovers to minimize disruptions.

For instance, we assisted a family-owned enterprise in structuring an employee share plan after sale, preserving the founders’ legacy while empowering the next generation–demonstrating how our services foster enduring value.

The Process of Selling Your Business

Selling your business requires a structured approach to maximize value and ensure a smooth transition. At Zaidwood Capital, we guide clients through the entire journey to sell my business effectively, typically spanning 6 to 12 months. This process involves meticulous preparation, strategic engagement, and precise execution, drawing on our expertise in mergers and acquisitions advisory.

Visual guide to the essential steps in selling your business efficiently.

Preparation Steps Before Listing

The preparation phase, lasting 3 to 6 months, focuses on organizing key documents and enhancing business appeal. Begin with a comprehensive sale preparation checklist: compile financial statements, tax returns, and balance sheets for transparency. Conduct intellectual property audits and operational reviews to identify and resolve issues, as recommended by SBA guidelines for due diligence readiness.

We at Zaidwood integrate our strategic documentation services to create polished pitch decks and pro forma financials, streamlining this step for clients. Our boutique ma capital advisory approach ensures all materials align with investor expectations, accelerating the path to listing and boosting perceived value through professional presentation.

Common pitfalls include incomplete financial records, which can deter buyers or lower offers. Overlooking legal compliance, such as unresolved contracts, may lead to delays. Addressing these early prevents costly surprises during buyer scrutiny.

Engaging Professionals and Finding Buyers

Once prepared, engage advisors and implement buyer sourcing strategies through established networks. Hire a qualified business broker to market the opportunity discreetly and screen potential acquirers. Leverage industry connections and platforms to identify serious buyers, emphasizing confidentiality via non-disclosure agreements, as outlined in AZBBA best practices.

Zaidwood’s capital introductions connect clients to over 4,000 institutional investors, facilitating targeted outreach. Our full-cycle mergers and acquisitions advisory handles broker coordination and investor matchmaking, reducing time to find aligned buyers while maintaining process integrity.

Pitfalls arise from inadequate vetting, risking unqualified prospects who waste resources. Relying solely on personal networks may limit reach, missing optimal matches. Professional guidance mitigates these by ensuring broad, vetted exposure without compromising security.

Negotiation and Closing the Deal

Negotiation follows buyer identification, involving due diligence phases on financial, legal, and operational aspects. Review offers, negotiate terms like price and transition support, then finalize with binding agreements. Closing logistics include title transfers and fund disbursals, supported by SBA advice on professional legal and accounting input.

We provide full-cycle due diligence at Zaidwood, covering financial modeling and compliance checks to fortify negotiations. Our equity advisory expertise structures deals for optimal outcomes, guiding clients from term sheets to seamless closings with investor network support.

Potential pitfalls encompass rushed due diligence, uncovering hidden liabilities post-agreement. Emotional attachments can hinder objective bargaining, leading to suboptimal terms. Thorough preparation and advisor involvement safeguard against these, ensuring a secure, value-driven close.

Best Practices for a Successful Business Sale

When preparing to sell my business, following proven best practices can significantly enhance outcomes and minimize risks. We recommend focusing on advisor selection, fee management, and informed questioning to align with strategic goals. These steps ensure a smooth transaction process, leveraging expert guidance from firms like Zaidwood Capital and our ma capital advisory services.

Selecting the Right Business Broker

Choosing the right business broker is crucial for a successful sale. Key criteria include the advisor’s track record in completed deals, particularly in your industry, and their network size, which should connect you to qualified buyers efficiently. For instance, seek firms with access to over 4,000 institutional and private investors to broaden exposure.

In M&A advisor selection, evaluate boutique expertise that offers personalized service over volume-driven approaches. Experienced brokers facilitate due diligence and documentation, reducing errors that could derail negotiations. We emphasize advisors who integrate full-cycle support, from valuation to closing, to optimize terms.

At Zaidwood Capital, our boutique model provides tailored strategies, drawing on $24.4 billion in aggregate transaction volume to guide clients through complex sales. This ensures alignment with your objectives while accelerating the process via our proprietary Velocity Matrix.

Managing Fees and Commissions

Understanding business broker fees is essential to protect your proceeds. Typical structures include commissions of 5-10% of the sale price, often scaled via the Lehman formula, which decreases percentages on higher deal values. Flat fees for specific services, like valuations, can supplement these arrangements.

Effective commission negotiation tactics involve benchmarking against industry standards and tying payments to milestones, such as signing or closing. Consider small business multiples from valuation methods, like 1-20x EBITDA, to set realistic expectations and justify fee alignments. Transparency in fee breakdowns prevents surprises and fosters trust.

Zaidwood Capital’s transparent advisory model prioritizes value over hidden costs, ensuring fees reflect our full-cycle M&A and capital advisory services. We streamline transactions to deliver efficient results, minimizing unnecessary expenses for clients seeking optimal sale outcomes.

Questions to Ask Potential Advisors

To vet potential advisors effectively, prepare targeted inquiries that reveal their capabilities. Ask about their deal history: ‘How many similar transactions have you completed in the past year?’ This highlights reliability and relevance to your business broker needs.

Further probe strategies: ‘What is your approach to maintaining confidentiality during the sale?’ and ‘What timelines do you anticipate for due diligence and closing?’ These questions address critical phases, ensuring proactive management. Inquire about networks: ‘How do you connect sellers to buyers, and what success rates do you achieve?’

Zaidwood Capital stands out with our $24.4 billion transaction volume and access to substantial deployable capital. We invite questions on our track record, reinforcing our commitment to precision and client success in every engagement.

Achieving a Successful Business Exit

As you consider how to sell my business, achieving a successful exit requires a strategic approach grounded in thorough preparation and expert guidance. Key to this process is establishing a solid foundation through accurate business valuation, which determines fair market value based on financial performance, market conditions, and comparable sales. Effective preparation, including organizing financial records and legal documents, typically spans 6-12 months and enhances confidentiality while maximizing liquidity benefits. Selecting the right business broker is crucial; look for experienced professionals with strong networks to identify qualified buyers efficiently.

At Zaidwood Capital, we specialize in guiding business owners through these complexities with our comprehensive mergers and acquisitions advisory services. Our team leverages an aggregate transaction volume of $24.4 billion and connections to over 4,000 institutional investors to facilitate seamless transitions, including capital introductions that align with your goals. Through our capital formation advisory, we empower clients to navigate sell-side mandates without the pressures of direct execution.

Looking ahead, an exit strategy summary integrates these elements for optimal results. We encourage consulting professionals early to ensure a smooth handover. For additional insights on post-sale planning, the U.S. Small Business Administration offers valuable transition guides emphasizing due diligence and ongoing support. We at Zaidwood invite you to explore our advisory wrap-up expertise and book a call to discuss your path forward.