Series C

Table of Contents

Understanding Series C Funding

At Zaidwood Capital, we recognize Series C as a pivotal milestone in the startup journey. This later-stage venture funding round typically follows successful Series A and B stages, where companies have already validated their product-market fit and demonstrated consistent revenue growth. Series C Funding empowers established startups to scale aggressively, enter international markets, or gear up for acquisitions and initial public offerings. For entrepreneurs, achieving this stage signals strong traction and positions the business for exponential expansion.

Series C rounds usually raise between 50 and 100 million USD, with valuations often ranging from 500 million to 1 billion USD, reflecting the company’s proven market share and operational efficiency. Unlike earlier rounds focused on initial validation, Series C emphasizes hyper-scaling, such as building out sales teams or acquiring competitors. Key Series C investors include growth equity firms and institutional players seeking mature opportunities with reduced risk. For instance, a tech startup like Airbnb transitioned through Series C to fuel global bookings and infrastructure, showcasing how these growth capital rounds drive transformative growth.

We at Zaidwood Capital specialize in guiding clients through these complex late-stage rounds. Our capital formation expertise and access to over 4,000 institutional investors help secure optimal Series C valuation and connections to top Series C investors. As you explore the fundamentals ahead, discover how our strategic advisory streamlines your path to sustainable scaling without compromising control.

Fundamentals of Series C Funding

Series C funding represents a critical growth-stage capital milestone for startups that have validated their business models and achieved substantial revenue traction. Typically pursued by companies generating 10-50 million USD in annual recurring revenue (ARR), this round enables mature ventures to scale aggressively toward international markets or acquisitions. At Zaidwood Capital, we guide clients through these late-round venture financing stages, ensuring they meet investor expectations for robust performance. For a deeper dive into What is Series C Funding, explore how it fits into broader capital strategies.

Funding rounds evolve progressively, starting with seed and Series A focused on product-market fit, then Series B emphasizing operational scaling, and culminating in Series C for expansive growth. This progression demands increasing proof of viability, from initial prototypes to multimillion-dollar revenue streams. As startups advance, the stakes rise, with each stage building on prior successes to attract larger investments. Drawing from established guides on startup funding, this evolution underscores the need for strategic planning to transition smoothly between rounds.

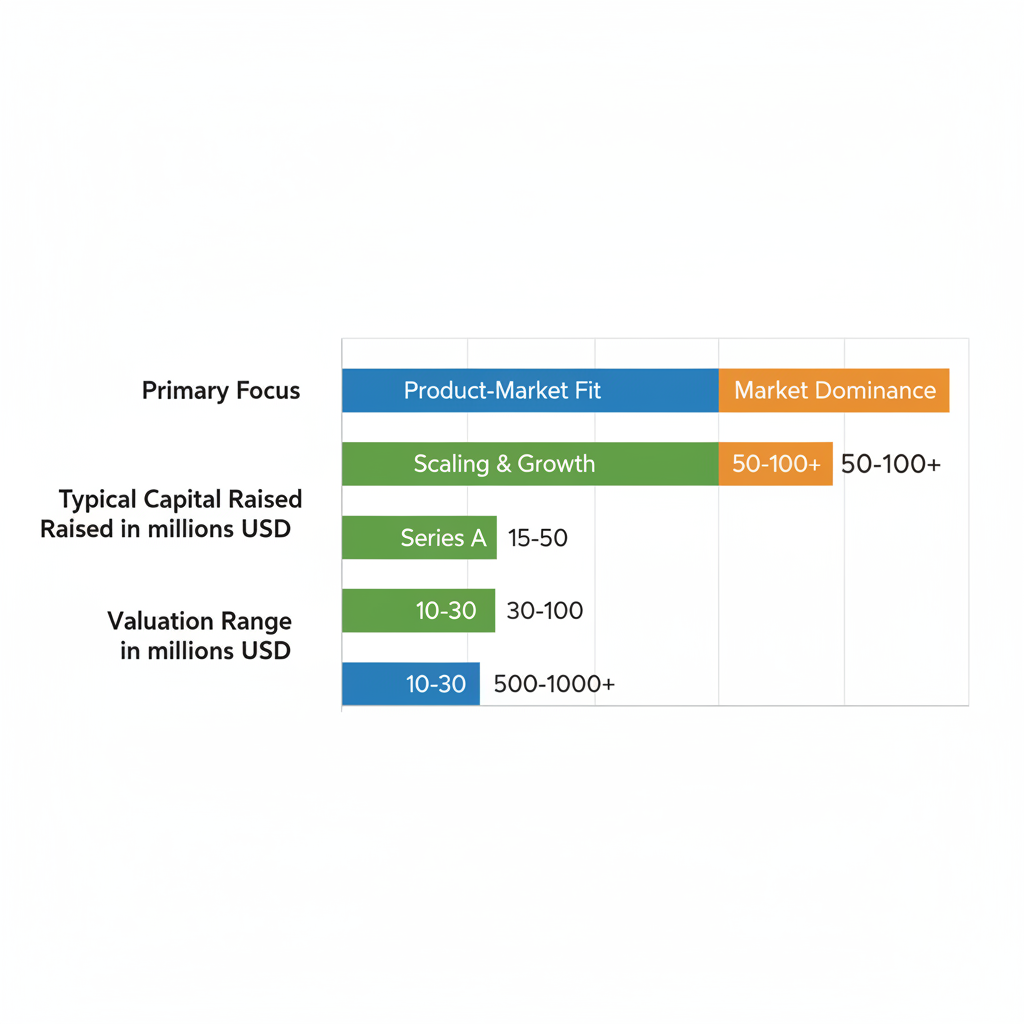

The following table compares key aspects of Series C with Series A and B to highlight progression in funding stages:

| Aspect | Series A | Series B | Series C |

|---|---|---|---|

| Primary Focus | Product development and market fit | Scaling operations and user growth | International growth and acquisition prep |

| Typical Capital Raised | 5-15 million USD | 15-50 million USD | 50-100 million USD |

| Valuation Range | 10-30 million USD | 30-100 million USD | 500 million – 1 billion USD+ |

These comparisons reveal how Series C shifts emphasis from validation in earlier rounds to massive scaling, often involving higher valuations and larger sums. For startups, reaching this stage implies a proven track record, but it also heightens scrutiny on sustainable growth. As noted in expert analyses of funding trajectories, companies like GreyOrange exemplify this by raising 140 million USD in Series C for global expansion, highlighting the transformative potential while stressing the importance of data-backed strategies to secure such opportunities.

Beyond capital amounts, Series C differs markedly from Series B by prioritizing market dominance over mere expansion. While Series B validates scalability with user growth, Series C demands Series C valuation benchmarks exceeding 500 million USD, often fueled by 3x+ year-over-year ARR increases. Key metrics investors evaluate include:

- ARR exceeding 10 million USD with consistent profitability paths.

- Customer acquisition costs dropping below lifetime value thresholds.

- Market share in core segments reaching 20-30% for US-based operations.

These indicators signal readiness for aggressive pursuits, aligning with informational queries on growth benchmarks.

Series C investors primarily comprise established venture capital firms and private equity players seeking high-return, lower-risk bets on proven entities. Unlike earlier rounds dominated by early-stage VCs, this phase attracts institutional heavyweights focused on IPO preparation or strategic buys. For instance, funds led by industry leaders provide not just capital but also networks for acquisitions, as seen in cases like LendInvest’s 39.5 million USD raise. We at Zaidwood Capital leverage our connections to over 4,000 institutional investors, facilitating introductions that streamline access to this deployable capital pool of 15 billion USD+.

Comparison of key funding aspects in Series A, B, and C rounds

In our experience advising US-market startups, preparing for Series C involves rigorous due diligence on financials and operations to appeal to these sophisticated backers. We recommend early engagement with advisory firms like ours to craft compelling narratives around growth potential, drawing from anonymized successes where clients secured oversubscribed rounds through targeted capital introductions. This foundational understanding sets the stage for navigating valuation complexities in subsequent deep dives, empowering executives to capitalize on these opportunities effectively.

Deep Dive into Series C Valuations and Metrics

At Zaidwood Capital, we specialize in guiding startups through late-stage funding rounds, including Series C, where valuations often reach sophisticated levels of scrutiny. Our full-cycle due diligence and capital advisory services help optimize these assessments, ensuring clients position themselves strongly with institutional investors. This deep dive explores valuation benchmarks, trends, and key metrics that define success in these rounds, drawing on our experience with over $24.4 billion in aggregate transaction volume.

Valuation Benchmarks and Trends

Series C valuations in the US typically range from $500 million to $1 billion, with projections for 2026 pushing averages above $700 million as market confidence rebounds. These figures reflect a startup’s maturity, where investors seek evidence of scalable revenue and market dominance. Influencing factors include robust intellectual property, experienced management teams, and proven traction in large addressable markets. For instance, tech startups benefiting from AI integrations often command premiums, while broader economic stability drives overall upward trends.

We calculate Series C valuations using established methods such as comparable transactions, analyzing recent deals in similar sectors, and discounted cash flow (DCF) models that project future earnings against present risks. Pre-money valuation, as defined in standard funding glossaries, serves as the baseline before new capital infusion, allowing for precise equity dilution forecasts. These approaches ensure a data-driven foundation, aligning with the rigorous expectations of late-stage venture capital.

The following table outlines factors influencing Series C valuations across industries:

| Factor | Tech Startups | Fintech Startups | General Impact |

|---|---|---|---|

| Revenue Growth Rate | 3-5x YoY for high multiples (10-20x ARR) | 2-4x YoY with regulatory focus (8-15x ARR) | Drives premium on scalable models |

| Market Size | Global TAM >$1B USD essential | US fintech TAM with compliance | Expands addressable market valuation |

This comparison highlights how sector-specific dynamics amplify valuation potential. In tech, explosive growth rates justify higher multiples, while fintech emphasizes regulatory navigation for sustainable expansion. Citing controller insights from funding guides, these trends underscore the need for operational efficiency to support rising multiples in the US market, where tech surges have increased average deals by 20% year-over-year. At Zaidwood Capital, our strategic documentation and fairness opinions refine these calculations, enhancing outcomes for clients navigating comparable transactions.

Factors influencing Series C valuations in tech and fintech sectors

Building on these benchmarks, US trends reveal a focus on resilient models amid economic shifts. Late-stage assessments increasingly prioritize IP strength and team expertise, with Zaidwood’s network of over 4,000 investors providing access to tailored deep tech deal opportunities. This positions startups for valuations that reflect true potential, transitioning seamlessly into metric-driven evaluations.

Key Investor Metrics for Evaluation

Series C investors prioritize metrics that signal sustainable profitability and market leadership, shifting from early-stage potential to tangible performance. At this stage, companies must demonstrate revenue multiples exceeding 10x annual recurring revenue (ARR) alongside consistent growth trajectories. We advise clients on these indicators through our equity advisory services, leveraging cohort analysis and real-time financial visibility to meet investor thresholds.

Key metrics include ARR growth, often targeting 3-5x year-over-year for tech firms, alongside churn rates below 5% to affirm customer retention. Positive EBITDA margins further validate operational maturity, appealing to private equity and banks entering the cap table. Drawing from controller perspectives on successful rounds, these benchmarks reduce perceived risk, with stats showing funded companies achieving 15-20% higher post-round valuations when metrics align.

The table below details essential metrics for Series C evaluation:

| Metric | Threshold | Why It Matters |

|---|---|---|

| ARR Growth | 3-5x YoY | Indicates scalable revenue, justifying high multiples and attracting growth equity |

| Churn Rate | <5% annually | Reflects customer loyalty, critical for long-term valuation stability |

| EBITDA Margin | Positive (5-10%+) | Proves profitability, essential for traditional investors and IPO preparation |

| Revenue Multiple | 10-20x ARR | Benchmarks against peers, influencing pre-money valuation in comparable deals |

Interpreting this table, strong ARR growth and low churn directly correlate with premium funding terms, as seen in recent US fintech deals where compliance-enhanced models secured 12x multiples. EBITDA positivity, per funding round analyses, mitigates dilution risks during equity raises. Zaidwood Capital integrates these into our full-cycle due diligence, including pro forma financials and pitch decks, to streamline transactions for clients.

In practice, Series C investors evaluate these alongside broader criteria like market size and team dynamics. For example, a SaaS platform with 4x ARR growth and 3% churn might command a $800 million valuation, bolstered by our capital introductions to sovereign wealth funds and endowments. This metric-focused approach not only secures funding but prepares for exits, where operational rigor–such as faster data reporting–plays a pivotal role. Our Velocity Matrix accelerates this process, connecting startups to $15 billion in deployable capital while avoiding common pitfalls like over-optimistic projections. Ultimately, mastering these evaluations empowers informed strategies, aligning with Zaidwood’s commitment to precision in mergers and acquisitions advisory.

Practical Strategies for Series C Funding

At Zaidwood Capital, we guide startups through the complexities of later-stage funding with our extensive experience in over 300 completed deals. Series C funding represents a pivotal moment where companies demonstrate scalability and path to profitability, often attracting a mix of venture capital, private equity, and corporate investors. Drawing from our transaction advisory expertise, this section outlines practical steps to prepare your pitch, engage Series C investors, and negotiate favorable terms. Our focus remains on US fintech examples to illustrate effective funding preparation tactics.

Preparing Your Pitch and Documentation

See our zaidwood capital transactions for representative deal examples.

Crafting a compelling pitch for Series C requires a deep understanding of investor expectations, emphasizing market opportunity, proven traction, and robust financial projections. Start by developing a pitch deck that highlights your company’s growth metrics, such as revenue multiples and user acquisition rates, tailored to late-stage audiences. We recommend including visuals on market expansion potential and competitive positioning to showcase scalability. For fintech startups, like those in digital lending or insurtech, underscore regulatory compliance and customer retention data to build credibility.

Next, focus on financial modeling with detailed pro forma statements that project cash flows, EBITDA margins, and break-even timelines. These documents must align with historical performance, using cohort analysis for deeper insights into user lifetime value. At this stage, operational efficiency becomes key; integrate metrics on treasury management and cost controls to signal readiness for rapid scaling.

Effective documentation also involves preparing comprehensive business plans that outline strategic milestones, such as international expansion or product diversification. Best practices include engaging advisors early to refine these materials, ensuring they withstand rigorous due diligence. For instance, pro forma financials should incorporate scenario analyses for various market conditions, while pitch decks benefit from iterative feedback loops.

The following table compares pitch strategies for Series C investors, helping tailor your approach based on investor type:

| Strategy | VC Firms | Private Equity | Corporate Investors |

|---|---|---|---|

| Pitch Focus | Growth metrics and scalability | Path to profitability and exits | Strategic synergies and market entry |

| Documentation Emphasis | Pro forma financials | Due diligence reports | Partnership agreements |

This comparison draws from controller insights on late-stage funding, where VC firms prioritize high-growth narratives, private equity seeks exit viability, and corporate players value collaborative opportunities. After presenting these tailored pitches, anticipate varied investor responses: VCs may probe deeper into unit economics, while private equity demands detailed audits. In the Bolttech Series C case, strategic documentation facilitated a $147 million raise at a $2.1 billion valuation, welcoming partners like Sumitomo Corporation through clear partnership outlines. Referencing such examples, we advise iterating based on initial feedback to strengthen your positioning.

Approaching Investors and Negotiating Terms

Identifying and approaching Series C investors begins with leveraging professional networks, including platforms like ours at Zaidwood Capital, which connect clients to over 4,000 institutional players. For US fintech startups targeting 2026 rounds, prioritize growth-oriented funds in hubs like New York and San Francisco. We suggest a targeted outreach strategy: research investor portfolios for alignment, such as those with insurtech or payment tech exposure, then initiate warm introductions via mutual connections.

- Source Investors: Use databases and advisory firms to shortlist 20-30 prospects, focusing on those with dry powder for late-stage deals. Attend industry events or webinars, like those on scaling to IPO, to build rapport.

- Initial Pitching: Schedule virtual or in-person meetings with a customized deck teaser. Highlight traction, such as Bolttech’s platform enhancements post-funding, to demonstrate global potential. Follow up promptly with full documentation, emphasizing pro forma projections.

- Due Diligence Preparation: Anticipate requests for operational data, compliance records, and customer metrics. Best practices include organizing a virtual data room with audited financials and IP details to expedite reviews.

Negotiation tactics center on valuation and terms, where Series C valuation often hinges on 3-5x return multiples for investors. Key areas include liquidation preferences, anti-dilution protections, and board seats. We approach these discussions collaboratively, starting with a term sheet that balances founder control with investor safeguards. In fintech contexts, negotiate flexible covenants around regulatory changes to mitigate risks.

To illustrate negotiation dynamics, consider this comparison of common terms:

| Term | Typical VC Preference | Private Equity Stance | Negotiation Tip |

|---|---|---|---|

| Liquidation Preference | 1x non-participating | 2x participating | Cap at 1.5x for alignment |

| Valuation Adjustment | Price-based anti-dilution | Full ratchet | Use weighted average |

| Governance | Observer rights | Full board seat | Limit to advisory role |

Drawing from controller guides, these terms reflect shifts toward profitability proof, as seen in Bolttech’s strategic JV with Sumitomo for Asian expansion. Post-term sheet, conduct legal reviews to avoid pitfalls. Investor engagement methods succeed when transparent; we have facilitated such closes by streamlining documentation, ensuring swift paths to funding. Always consult advisors for tailored advice, as outcomes vary by market conditions.

Advanced Topics in Series C Funding

As startups mature into Series C funding stages, the complexity of capital raising intensifies, demanding sophisticated strategies to optimize outcomes. At Zaidwood Capital, we guide clients through these advanced dynamics, leveraging our full-cycle advisory to navigate deal intricacies and maximize value. Series C rounds typically involve investments exceeding $50 million, focusing on scaling operations amid heightened scrutiny from institutional backers.

In structuring Series C deals, founders must weigh equity financing, debt instruments, and hybrid models to balance growth needs with ownership preservation. Equity financing dilutes founder stakes but provides unrestricted capital for expansion, often at valuations driven by revenue multiples of 8-12x. Debt financing, conversely, imposes repayment obligations yet minimizes immediate dilution, appealing for bootstrapped growth phases. Convertible notes and similar hybrids offer flexibility, bridging equity upside with debt-like terms. These complex funding mechanisms influence Series C valuation profoundly, as misaligned structures can erode enterprise worth by 15-20% due to unfavorable terms, per industry benchmarks.

Advanced considerations in Series C structures include aligning investor alignment with long-term milestones, such as market penetration or product diversification. We advise evaluating tax implications and regulatory compliance early to avoid costly revisions.

| Structure | Equity Financing | Debt Financing | Hybrid Options |

|---|---|---|---|

| Risk Profile | Dilution but no repayment | Repayment obligation, lower dilution | Convertible notes with flexibility |

| Investor Returns | Equity upside potential | Interest + principal | Equity conversion + interest |

This comparison underscores equity’s appeal for high-growth trajectories versus debt’s predictability, while hybrids mitigate risks through phased conversions. Drawing from established glossaries on series funding, these structures address dilution pressures inherent in later-stage rounds. At Zaidwood, our debt financing advisory expertise ensures tailored implementations, connecting clients to deployable capital pools exceeding $15 billion.

Shifting to international dimensions, Series C investors increasingly span global portfolios, introducing cross-border challenges like currency fluctuations and jurisdictional variances. US-based startups pursuing funding in emerging sectors must navigate differing valuation norms–European rounds often emphasize sustainability metrics, potentially lowering multiples by 10-15% compared to Silicon Valley benchmarks. Global investor dynamics complicate due diligence, with sovereign funds demanding robust ESG compliance. We facilitate these placements through our network of over 4,000 institutions, optimizing Series C valuation amid geopolitical shifts.

Post-funding integration demands rigorous governance overhauls to sustain momentum. Implementing board expansions with independent directors enhances oversight, particularly in deep tech where IP protection is paramount. Trends show Series C-backed firms in AI and biotech achieving 25% faster scaling via integrated strategies. At Zaidwood, we support seamless transitions, ensuring alignment with strategic documentation for enduring success.

Frequently Asked Questions on Series C

Addressing growth round queries, these FAQs clarify Series C essentials.

What is the typical valuation for a Series C funding round?

Series C valuations often exceed $100 million, reflecting proven profitability and scalability, as seen in GreyOrange’s $140 million raise. We assess these metrics to support expansion strategies.

Who are the top Series C investors in the US?

Leading Series C investors include institutional players like hedge funds and private equity firms seeking mature startups. Our network connects clients to over 4,000 such investors for optimal partnerships.

How does Series C differ from Series B funding?

Unlike Series B’s focus on scaling operations with $10-20 million raises, Series C targets international growth and acquisitions at higher valuations, preparing for IPO, per industry examples like LendInvest’s $39.5 million round.

How can startups prepare for Series C valuation assessment?

Demonstrate strong revenue growth and market dominance; consult experts for tailored preparation. At Zaidwood Capital, our equity advisory services guide through this stage effectively.

Navigating Series C with Expertise

Securing Series C funding represents a pivotal scaling capital essential for established startups eyeing international expansion or IPO preparation. Typically raising 50-100 million USD at a Series C valuation exceeding 500 million, companies attract Series C investors focused on proven market traction and robust growth metrics. Best practices include refining financial models and demonstrating scalable operations to captivate venture capital and private equity players.

At Zaidwood Capital, we leverage our network of over 4,000 institutional investors and 24.4 billion USD in aggregate transactions to guide clients through this stage with precision. Our expertise in capital formation ensures tailored strategies that align with your expansion goals.

Contact us today to explore how our advisory services can propel your Series C success.