Tech Mergers And Acquisitions

Table of Contents

Navigating the World of Tech Mergers and Acquisitions

In the rapidly evolving technology landscape, tech mergers and acquisitions represent strategic consolidations that propel innovation and growth. These deals, involving software, hardware, AI, and cybersecurity firms, enable companies to expand markets, acquire top talent, and unlock technological synergies. Recent research from MIT Sloan underscores technology’s pivotal role, showing that consolidations driven by market exploitation can enhance technology deployment and boost post-merger value by up to 20%. However, challenges like valuation discrepancies and integration risks often complicate these technology deal-making endeavors.

At Zaidwood Capital, we serve as a premier Technology Investment Bank specializing in full-cycle M&A advisory. With over 24.4 billion USD in aggregate transaction volume and more than 300 completed deals, our team guides clients through buy-side and sell-side mandates. We mitigate risks by providing comprehensive due diligence and strategic counsel, while our access to over 4,000 institutional investors and 15 billion USD in deployable capital accelerates processes and enhances outcomes. Our expertise ensures smoother integrations, particularly in scenarios like acqui-hiring where employee ownership fosters retention and alignment.

This guide equips you with essential insights into digital consolidation strategies. We explore key steps from initial valuation to closing, associated costs and regulatory hurdles, rigorous due diligence practices, and emerging trends such as AI-driven M&A and cybersecurity acquisitions. Understanding these fundamentals lays the groundwork for successful navigation of the M&A process.

Core Principles of Tech Mergers and Acquisitions

In the dynamic landscape of tech mergers and acquisitions, understanding the core principles is essential for navigating complex transactions effectively. At Zaidwood Capital, we emphasize a structured approach that encompasses key steps, cost considerations, and strategic benefits, leveraging our full-cycle M&A and capital advisory expertise to guide clients through innovation-focused consolidations. Engaging Technology Investment Banking Services early can streamline tech deal execution and mitigate risks from the outset.

The process typically unfolds in four main steps. First, target identification involves scouting potential partners or assets that align with strategic goals, such as entering new markets or acquiring cutting-edge IP. We recommend leveraging extensive networks to pinpoint opportunities, drawing from our portfolio experience where anonymized mid-market tech firms expanded via targeted acquisitions. Second, valuation and negotiation assess the target’s worth using discounted cash flow models and comparable transactions, negotiating terms to balance risk and reward. Third, due diligence examines financials, operations, and legal aspects to uncover hidden liabilities, often revealing integration hurdles in tech stacks. Finally, closing and integration finalize the deal and merge operations, ensuring seamless synergy realization. This framework, honed through our 24.4 billion USD in aggregate transaction volume, prepares clients for successful outcomes.

Illustrated steps of tech mergers and acquisitions process

These steps form the backbone of any transaction, but understanding the broader fundamentals aids preparation by highlighting potential synergies and pitfalls upfront. For instance, in a recent anonymized deal, thorough target identification uncovered complementary AI capabilities, accelerating post-merger growth.

Advisory costs for tech M&A vary based on deal size and complexity. Typically, fees range from 1-3% of the transaction value, or fixed amounts between 50,000 and 500,000 USD for mid-market tech deals. These investments yield substantial benefits, including access to our network of over 4,000 institutional investors, expert negotiation to optimize terms, and robust risk mitigation through full-cycle due diligence. Advisors like Zaidwood Capital provide precision in structuring, reducing execution time via our Velocity Matrix approach and ensuring compliance throughout.

Regulatory considerations add another layer, particularly antitrust reviews under the Clayton Act. The Federal Trade Commission (FTC) and Department of Justice enforce these via the Hart-Scott-Rodino Act, requiring premerger notifications for deals exceeding 119.5 million USD to assess competitive impacts. This scrutiny is crucial in tech, where consolidation can raise monopoly concerns, and we guide clients to navigate filings confidentially.

Looking ahead, AI-driven M&A trends for 2026 will transform deal sourcing with predictive analytics, enabling faster identification of high-potential targets in sectors like cybersecurity acquisitions. These innovations promise enhanced efficiency in evaluating synergies for emerging tech landscapes.

The following table outlines key drivers versus challenges in tech M&A, illustrating the balanced fundamentals that shape successful strategies:

| Aspect | Drivers | Challenges |

|---|---|---|

| Market Expansion | Access to new customer bases and geographies through synergies. | Valuation Discrepancies: Overinflated tech valuations leading to post-deal disputes. |

| Talent Acquisition (Acqui-hire) | Bringing in specialized tech talent and intellectual property. | Integration Risks: Cultural clashes and system incompatibilities in tech stacks. |

| Technological Synergies | Combining AI, cloud, or cybersecurity capabilities for innovation. | Regulatory Scrutiny: Antitrust concerns in consolidating dominant tech players. |

This comparison underscores how drivers like talent acquisition fuel growth, yet challenges such as integration risks demand proactive planning. At Zaidwood Capital, our advisors address these through tailored due diligence and negotiation strategies, as demonstrated in over 300 completed deals where we mitigated regulatory hurdles and aligned cultures for seamless integration. While these principles provide a solid framework, deeper exploration of regulations and trends reveals the nuances essential for tech-specific success.

Exploring Regulatory and Trend Dynamics in Tech Mergers and Acquisitions

Navigating the landscape of tech mergers and acquisitions requires a keen understanding of regulatory frameworks and evolving market trends. As an experienced M&A capital advisory firm, we have guided numerous clients through these complexities, drawing on insights from completed deals to highlight the intricacies involved.

Regulatory Hurdles in Technology Deals

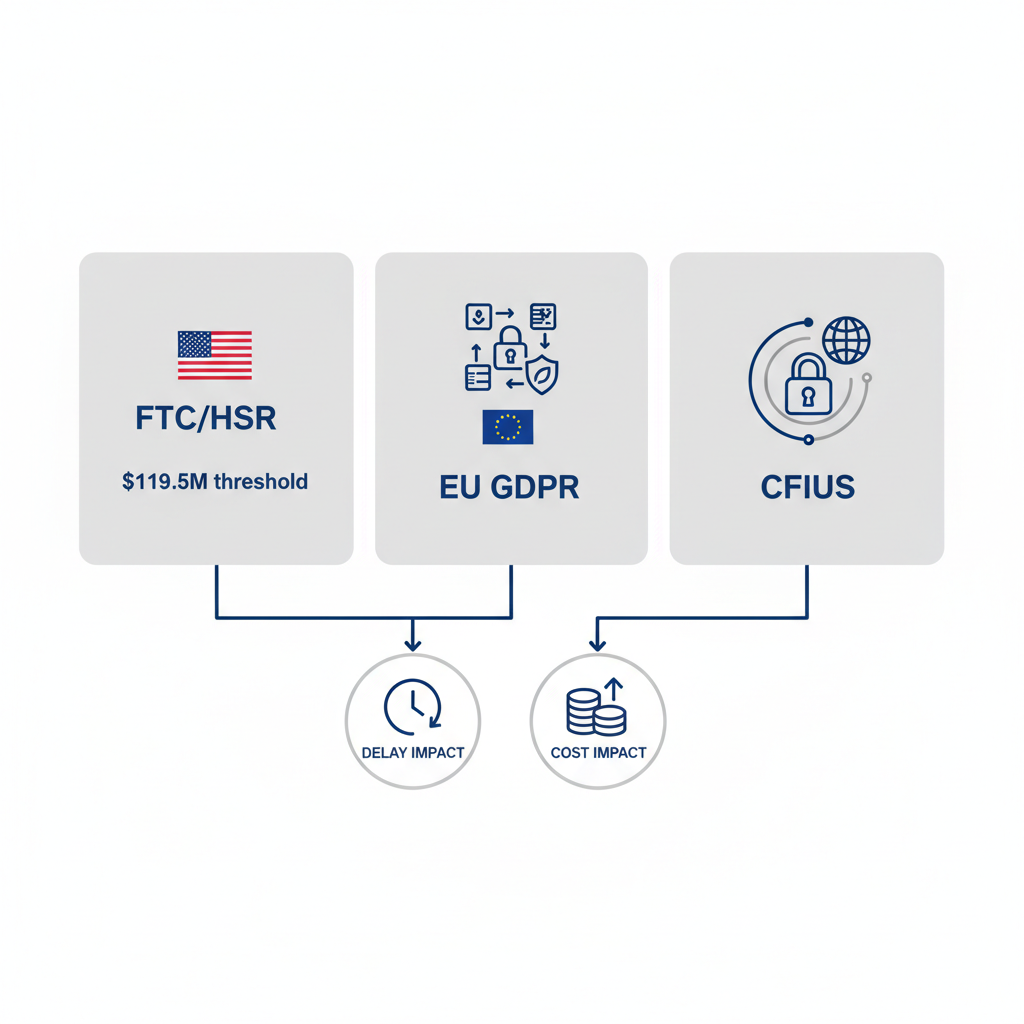

In the realm of tech mergers and acquisitions, regulatory barriers in digital deals pose significant challenges that can alter deal trajectories. These hurdles stem from antitrust scrutiny, data privacy mandates, and international oversight, all designed to prevent monopolies and safeguard sensitive information. For instance, the Hart-Scott-Rodino Act mandates pre-merger notifications for transactions exceeding $119.5 million, triggering reviews by the Federal Trade Commission to assess competitive impacts. Similarly, the European Union’s GDPR imposes rigorous data protection assessments, especially for cross-border deals involving user data. Non-compliance can result in fines up to 4% of global revenue, underscoring the high stakes for technology firms.

International considerations add layers of complexity, such as the Committee on Foreign Investment in the United States (CFIUS) reviews, which evaluate national security risks from foreign buyers acquiring U.S. tech assets. Stanford Law School’s Tech Mergers and Acquisitions course illustrates this through case studies like blocked deals in semiconductors, where regulatory intervention halted integrations due to potential data vulnerabilities. These requirements demand thorough due diligence from the outset, often extending timelines and inflating costs. We have navigated similar regulations in our advisory roles, ensuring clients anticipate these obstacles to maintain momentum.

Regulations matter profoundly in tech because they directly influence deal viability and valuation in a sector driven by innovation and data. The following table outlines key regulatory frameworks and their implications for tech M&A:

| Regulation | Key Requirements | Impact on Tech Deals |

|---|---|---|

| FTC/Hart-Scott-Rodino | Mandatory filings for deals over $119.5M USD. | Delays in Approval: Can extend timelines by 6-12 months. |

| EU GDPR/Merger Control | Data protection assessments for cross-border tech acquisitions. | Compliance Costs: Additional legal fees up to 10% of deal value. |

| CFIUS (US Foreign Investment) | National security reviews for foreign tech buyers. | Deal Blocks: Potential vetoes on sensitive tech like AI or cybersecurity. |

This comparison reveals how regulatory scrutiny can derail even well-structured transactions, from prolonged approvals to outright prohibitions. To mitigate these risks, engaging expert advisors early is essential. Through proactive compliance strategies and scenario planning, we help clients streamline filings, conduct mock reviews, and build contingency plans that minimize disruptions and protect deal value. Such approaches have proven instrumental in our portfolio of successful tech integrations.

Key regulations and impacts in tech mergers and acquisitions

Emerging Trends Shaping Tech M&A

Looking ahead to 2026 and beyond, emerging trends are reshaping tech mergers and acquisitions, with AI-driven M&A at the forefront. Artificial intelligence is accelerating due diligence processes, enabling faster analysis of vast datasets and predictive modeling of synergies. According to MIT Sloan research, AI tools can improve due diligence speed by up to 40%, reducing manual efforts and enhancing accuracy in valuation assessments. This shift towards AI-enhanced acquisition strategies allows buyers to identify undervalued assets in real-time, particularly in software and cloud sectors. We have observed this in recent deals where AI integration post-merger streamlined operations, boosting efficiency without extensive overhauls.

Cybersecurity acquisitions represent another pivotal trend, driven by escalating global threats and regulatory pressures. Valuations in this space are surging, with premiums reaching 20-30% for firms offering robust defense platforms, as acquirers seek to fortify their ecosystems against breaches. The MIT Sloan study further notes that companies with unique technology portfolios, including advanced cybersecurity solutions, are prime targets for competitors aiming to neutralize threats through acquisition. Key due diligence steps for these buyouts include auditing threat detection protocols, reviewing incident response histories, and assessing intellectual property robustness. In our advisory experience, focusing on these elements has facilitated seamless post-merger integrations, where cybersecurity enhancements become a competitive differentiator.

AI’s influence extends to merger strategies, from automated contract reviews to simulation of integration outcomes, minimizing cultural clashes and operational silos. For cybersecurity-focused deals, trends indicate a rise in strategic partnerships before full acquisitions, allowing testing of compatibility amid evolving regulations. These patterns underscore the need for agile advisory support to capitalize on opportunities while navigating risks. Overall, these trends signal a more data-centric future for M&A, where technology not only drives value but also defines success.

To illustrate the transformative potential, consider the differences between AI-driven and traditional approaches:

| Metric | Traditional M&A | AI-Driven M&A |

|---|---|---|

| Speed | 6-12 months for due diligence | 3-6 months with AI automation |

| Cost | High manual labor (20-30% of budget) | Reduced by 15-25% through efficiency |

| Accuracy | Prone to human error (10-15% variance) | Improved precision (5% variance) |

This table highlights AI’s advantages in streamlining processes, though traditional methods remain vital for nuanced negotiations. In practice, hybrid models combining both yield optimal results, as we’ve implemented in client engagements to balance innovation with reliability. As regulations evolve, these trends will continue to inform proactive strategies in tech M&A.

Hands-On Strategies for Tech Mergers and Acquisitions

In the fast-paced world of tech mergers and acquisitions, practical preparation and risk assessment form the backbone of successful deals. We at Zaidwood Capital emphasize actionable strategies that leverage our full-cycle M&A advisory to guide clients through these complexities, ensuring smoother transactions and better outcomes.

Preparing for Due Diligence in Tech Deals

Preparing for due diligence in tech mergers and acquisitions requires a structured approach to organize financials, intellectual property, and operations, minimizing surprises during buyer scrutiny. We advise starting with a comprehensive internal audit to identify gaps early. Begin by compiling financial statements, including revenue projections and historical performance metrics, to demonstrate fiscal health. Secure IP documentation, such as patents and trademarks, verifying ownership and any ongoing litigation that could impact value.

Next, conduct operational reviews to assess tech stack compatibility and talent retention plans. This involves mapping current systems against potential integration needs and outlining key employee retention strategies to retain institutional knowledge post-acquisition. Practical deal preparation also includes reviewing contracts and regulatory filings for compliance, drawing from FTC guidance on merger reviews to anticipate antitrust scrutiny under the Clayton Act and Hart-Scott-Rodino premerger notifications.

Here is a checklist contrasting standard tech due diligence with cybersecurity-focused additions, highlighting areas where preparation yields significant benefits like faster deal closure and reduced valuation discounts.

| Category | General Tech Items | Cybersecurity Additions |

|---|---|---|

| Financial Review | Revenue projections, IP valuation | Risk premiums for cyber exposures |

| Operational Audit | Tech stack compatibility, talent retention plans | Vulnerability scans, recent breaches |

| Legal Compliance | Contract reviews, regulatory filings | SOC 2, GDPR adherence |

Thorough preparation using these checklists not only streamlines the due diligence process but also positions companies favorably. Advisors like us help by coordinating third-party audits and automating documentation, reducing timelines by up to 30% and ensuring all elements align with buyer expectations.

Assessing Risks in Cybersecurity Acquisitions

Assessing risks in cybersecurity acquisitions demands a focused evaluation of threats, compliance, and valuation to safeguard investments in this high-stakes sector. We recommend beginning with a review of incident history, including past breaches and response efficacy, to gauge the target’s resilience. Evaluate existing controls, such as firewalls and encryption protocols, through third-party audits to confirm robustness against evolving threats.

Key due diligence steps for cybersecurity buyouts include modeling potential breach impacts on operations and finances, factoring in regulatory fines under frameworks like GDPR. Compliance checks are critical; verify adherence to standards such as SOC 2 and ISO 27001 to mitigate legal exposures. In valuation, consider recurring revenue stability from subscription models, while adjusting for cyber risks that could erode 10-20% of enterprise value if unaddressed.

AI plays a pivotal role in accelerating due diligence via automation tools, enabling rapid threat simulations and data pattern analysis. The following table compares manual versus AI-driven risk assessment tools, illustrating efficiency gains and improved accuracy in cybersecurity evaluations.

| Tool Type | Efficiency | Accuracy | Cost Implications |

|---|---|---|---|

| Manual Review | Time-intensive (weeks to months) | Prone to human error, ~80% coverage | High labor costs, variable expertise |

| AI-Driven | Automated scans (days) | Enhanced detection, 95%+ precision | Initial setup, scalable savings |

Manual methods often overlook subtle vulnerabilities, while AI-driven M&A tools provide comprehensive insights, reducing oversight risks. We integrate these technologies in our full-cycle M&A advisory to offer clients precise risk evaluations, ultimately enhancing deal certainty in cybersecurity acquisitions.

Advanced Considerations for Tech Mergers and Acquisitions

In the realm of tech mergers and acquisitions, post-merger integration stands as a pivotal phase that can determine long-term success. Our team at Zaidwood Capital has observed that effective integration not only consolidates operations but also unlocks synergies that drive innovation and revenue growth. For instance, in sophisticated tech integrations, aligning cultures and technologies requires meticulous planning to mitigate disruptions and capitalize on combined strengths.

When focusing on AI-driven M&A, the benefits post-merger are particularly compelling. Operational efficiencies emerge through seamless data flows and automated processes, reducing costs by up to 30% in some cases we’ve advised on. Prime strategic acquisition targets include machine learning firms specializing in predictive analytics, such as those developing natural language processing tools for enterprise applications. These startups offer scalable algorithms that enhance decision-making, making them attractive for larger tech entities seeking to bolster their AI capabilities. Addressing relevant queries like which AI startups are prime targets, we highlight those with proprietary datasets and robust IP portfolios, often valued between $50 million and $500 million in emerging sectors.

Shifting to cybersecurity acquisitions, the landscape intensifies with rising threats. Top targets for 2026 M&A include companies excelling in zero-trust architectures and endpoint detection, projected to see deal volumes surge by 25% due to regulatory pressures. Our experience underscores how acquiring such firms fortifies defenses against evolving cyber risks, with integrations yielding immediate improvements in threat intelligence sharing.

Post-merger integration demands careful navigation of challenges and opportunities, especially when comparing AI-driven M&A to cybersecurity acquisitions. The importance of this phase cannot be overstated, as it directly impacts value realization and stakeholder confidence. Drawing from methodologies in advanced courses like Stanford’s Tech Mergers and Acquisitions, case studies reveal that swift alignments prevent value erosion while fostering collaborative environments.

| Element | AI-Driven M&A | Cybersecurity Acquisitions |

|---|---|---|

| Integration Speed | Faster via API synergies. | Methodical due due to protocol audits. |

| Talent Retention | Key for AI expertise preservation. | Critical for security clearance holders. |

| Synergy Realization | Enhanced predictive capabilities. | Improved threat response networks. |

| Compliance Hurdles | Data privacy alignments. | Regulatory certification merges. |

| Risk Mitigation | Algorithmic vulnerability scans. | Unified incident response frameworks. |

| Value Creation | Reduced breach vulnerabilities. | Streamlined compliance reporting. |

This comparison illustrates distinct dynamics: AI integrations accelerate innovation, while cybersecurity focuses on resilience. Following such integrations, our advisory role proves invaluable in smoothing processes through full-cycle due diligence and strategic guidance, ensuring compliance and synergy capture.

Advanced advisory tools further elevate these transactions. Fairness opinions provide independent valuations to affirm deal equity, essential for complex tech assets where intangibles dominate. In one hypothetical scenario, our team delivered a fairness opinion for a $200 million AI acquisition, validating synergies against market benchmarks. Transaction advisory encompasses structuring mezzanine debt and equity placements, leveraging our network of over 4,000 investors. Strategic documentation, such as pitch decks and pro forma financials, equips clients for negotiations, highlighting growth trajectories and risk mitigations. For boutique capital advisory services, these elements form the backbone of successful executions in high-stakes environments.

By addressing these advanced considerations, we prepare clients for the nuances of tech mergers and acquisitions, raising queries on optimal targets and integration paths that inform deeper strategic dialogues.

Common Questions About Tech Mergers and Acquisitions

In the realm of tech mergers and acquisitions, we often field questions on key processes and trends. Here are answers to common deal FAQs.

What are the main steps in a tech merger or acquisition? The process typically includes strategy development, target identification, due diligence, valuation, negotiation, and closing. Regulatory approvals follow, ensuring compliance with antitrust laws. This structured approach minimizes risks and aligns objectives.

What cost ranges can tech deals involve? Deals vary widely, from $10 million for startups to billions for major firms. Factors like revenue multiples and synergies drive valuations, with AI-driven M&A often commanding premiums up to 20-30% higher.

How do regulations impact tech M&A? U.S. antitrust reviews by the FTC assess market concentration, while international deals face CFIUS scrutiny for national security. Compliance is essential to avoid delays or blocks.

What due diligence tips apply to acquisition queries? Focus on financial audits, IP verification, and cultural fit. Review tech portfolios thoroughly, as unique assets enhance attractiveness per MIT Sloan research.

How does AI influence technology merger strategies? AI-driven M&A accelerates innovation through data synergies, with consolidation motives improving tech deployment, according to MIT Sloan studies on effective integrations.

What about cybersecurity acquisitions in 2026? Targets like vulnerability management firms will rise, valued for defensive tech. Acquirers prioritize those reducing threats, boosting post-merger resilience via M&A advisory services.

Key Takeaways from Tech Mergers and Acquisitions Insights

Tech mergers and acquisitions demand a structured approach, from initial valuation and due diligence to navigating regulatory hurdles like those detailed in the FTC’s Guide to Antitrust Laws on mergers. Compliance with the Clayton Act and Hart-Scott-Rodino premerger notifications remains essential to avoid anticompetitive pitfalls.

Trends such as AI-driven M&A and cybersecurity acquisitions are accelerating innovation but intensify scrutiny on data security and market dominance. These dynamics underscore the critical role of rigorous due diligence in mitigating risks.

We at Zaidwood Capital leverage our extensive network of over 4,000 investors to streamline transactions and deliver value. Our full-cycle advisory empowers clients to execute successfully. We hope these core M&A lessons provide clarity; explore professional guidance tailored to your needs without commitment.