Venture Capital Fundraising

Table of Contents

Understanding Venture Capital Fundraising

Venture capital fundraising plays a pivotal role in fueling US innovation, with investments exceeding $130 billion annually to propel high-growth startups from concept to market leaders. At Zaidwood Capital, we recognize that securing this funding can transform ambitious ideas into scalable enterprises, particularly for tech ventures aiming to disrupt industries.

Venture capital fundraising represents equity-based funding provided to high-growth startups in exchange for ownership stakes, enabling rapid expansion without immediate debt burdens. This form of startup equity financing contrasts with traditional loans by aligning investor interests with long-term success. Key stages include:

- Seed funding: Initial capital to validate ideas, typically from angel investors or early VCs.

- Series A funding: Follow-on investment to refine products and build teams, once initial traction is proven.

Later rounds focus on scaling operations. Common challenges encompass variable timelines–from six months for seed to over a year for series A, per pitch-to-check insights–and meeting investor expectations around team strength and market potential, as outlined in SBA funding guidelines.

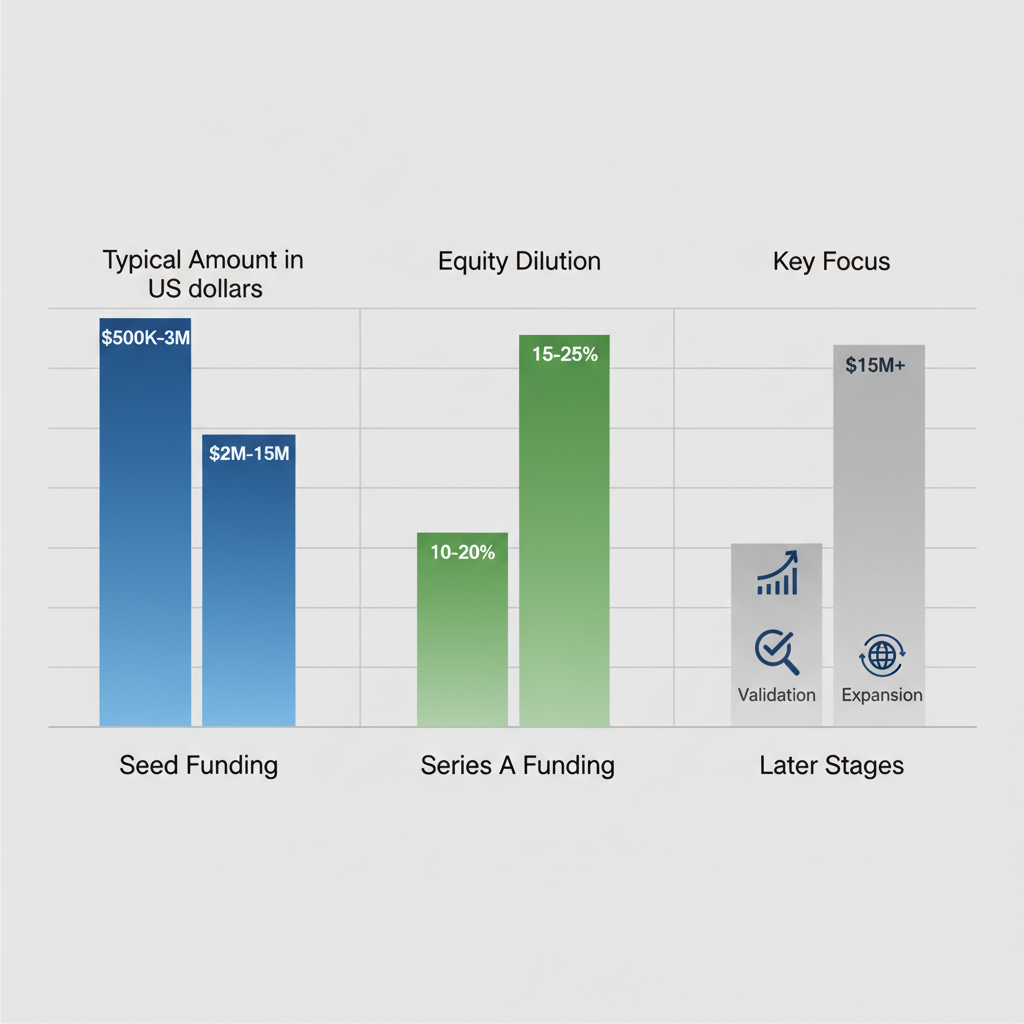

The table below differentiates these stages:

| Funding Stage | Typical Amount (US) | Equity Dilution | Key Focus |

|---|---|---|---|

| Seed Funding | $500K-$2M | 10-20% | Idea validation and MVP |

| Series A Funding | $2M-$15M | 15-25% | Product-market fit |

| Later Stages | $20M+ | 10-15% | Market expansion and growth |

These distinctions highlight evolving priorities, drawing from established financing practices.

This guide explores fundamentals, deep dives into processes, practical steps, advanced strategies, and FAQs to equip founders. We at Zaidwood Capital support through our Raising Venture Capital For Startups expertise, leveraging a network of over 4,000 investors and $24.4 billion in aggregate transaction volume for strategic guidance and capital introductions. Building core knowledge here sets the foundation for navigating VC capital raising effectively.

Venture Capital Fundraising Fundamentals

Venture capital fundraising represents a critical pathway for startups seeking high-growth opportunities through equity-based startup funding. At Zaidwood Capital, we guide entrepreneurs navigating this landscape, leveraging our extensive network to connect with institutional and private investors. This process involves exchanging ownership stakes for capital to fuel innovation and expansion, particularly in dynamic ecosystems like Silicon Valley. Understanding these fundamentals empowers founders to approach investor capital acquisition strategically, aligning their vision with potential backers’ expectations.

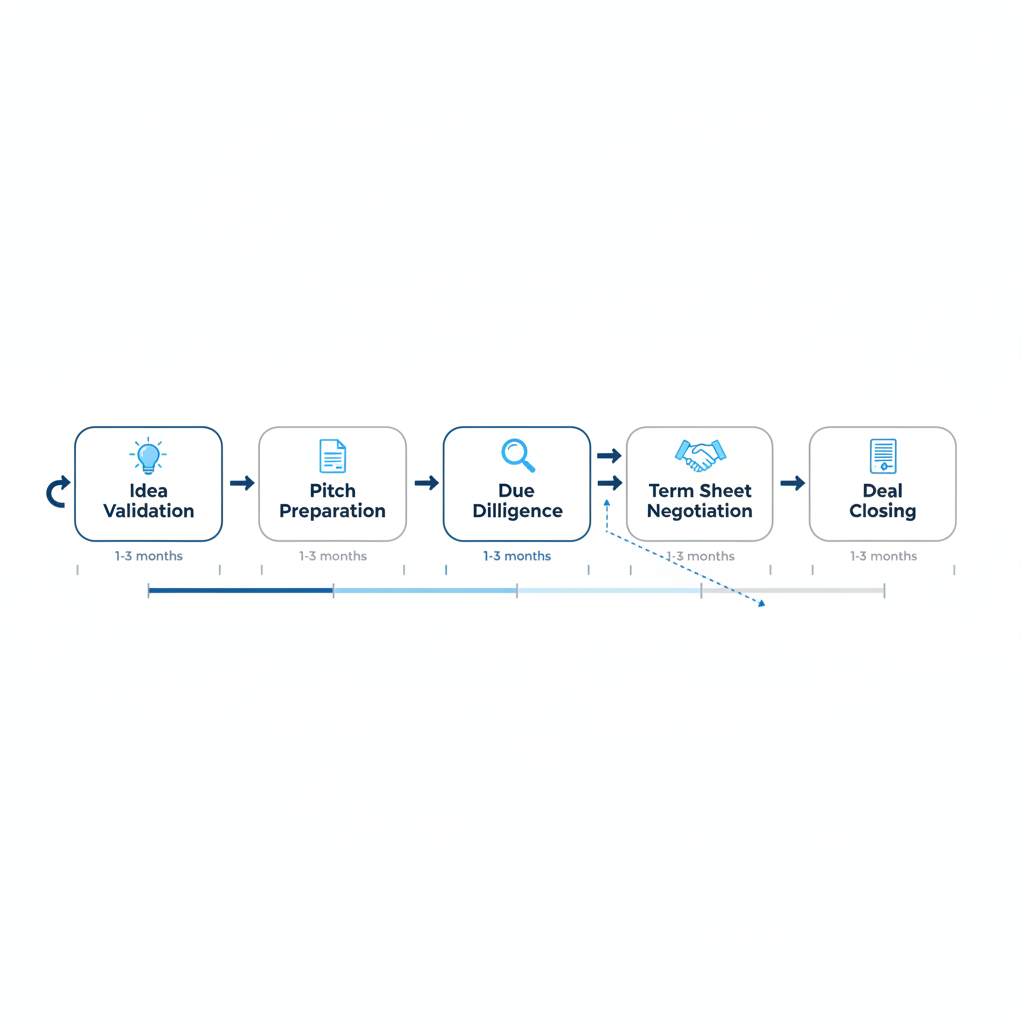

The venture capital process unfolds in structured stages, beginning with idea validation and culminating in deal closure. We recommend startups first assess market viability and refine their business model to demonstrate scalability. Preparation is key; crafting a compelling pitch deck and financial projections is essential for attracting interest.

- Idea Validation: Conduct market research and prototype testing to confirm product-market fit, often supported by initial bootstrapping or grants.

- Pitch Preparation: Develop a narrative highlighting traction, team strengths, and revenue potential. Resources like How To Raise Venture Capital outline best practices for this phase.

- Investor Outreach: Network through events, warm introductions, or platforms to secure meetings.

- Due Diligence: Undergo rigorous evaluation of operations, finances, and legal standing by prospects.

- Term Sheet and Closing: Negotiate terms on valuation, equity, and governance, then finalize the investment.

This sequence, informed by historical insights from Harvard Business Review on VC mechanics, typically spans 3-6 months. For early stages, seed funding provides initial capital–often $500,000 to $2 million–for proof-of-concept development, answering what seed funding entails in venture capital and how to raise it through angels or accelerators.

Venture capital fundraising fundamentals process visualization

Transitioning to growth phases, series A funding targets established startups with proven traction, usually $2-15 million to scale operations and enter markets. Key requirements include strong metrics like user growth and revenue, as outlined in SBA resources on funding options.

Selecting the right investor type is pivotal for alignment and success. Angel investors focus on early ideation with smaller checks, while VC firms emphasize scalable models, and family offices prioritize long-term value preservation.

| Investor Type | Focus | Typical Investment Size |

|---|---|---|

| Angel Investors | Early-stage ideas, mentorship | $25,000 – $500,000 |

| VC Firms | High-growth tech, expansion | $1M – $10M+ |

| Family Offices | Sustainable ventures, legacy | $500,000 – $5M |

Data from SBA reports indicate only about 20% of US startups secure VC, underscoring the need for targeted selection. We at Zaidwood Capital offer advisory tips, including due diligence support and introductions to our 4,000+ investor network, drawing on HBR’s emphasis on mutual fit to enhance outcomes.

Effective strategies involve building robust documentation and leveraging networks for warm leads. We stress transparency in projections to build trust, while integrating mezzanine or venture debt options for flexible capital. These approaches, combined with our full-cycle capital formation services, position startups for sustainable growth beyond initial rounds.

Deep Dive into Venture Capital Stages

Venture capital fundraising represents a critical pathway for startups seeking to transform innovative ideas into scalable businesses. At Zaidwood Capital, we observe that understanding the distinct stages of this process is essential for founders navigating early-stage capital rounds in the US. These phases involve not only securing funds but also building strategic partnerships that align with long-term growth objectives.

Seed Funding Essentials

Seed funding serves as the initial validation stage for startups, providing the resources needed to develop prototypes, assemble teams, and conduct market research. In the US context, typical amounts range from $500,000 to $2 million, sourced from angel investors, accelerators, or early venture funds. We note that this stage emphasizes proving concept viability, with investors focusing on the founding team’s expertise and initial traction metrics such as user engagement or pilot results.

Key documents for seed rounds include a concise pitch deck outlining the business model, market opportunity, and use of funds, alongside basic financial projections. Founders often prepare simple cap tables to illustrate equity distribution. Equity dilution at this juncture usually falls between 10% and 20%, allowing startups to retain majority control while incentivizing early backers. The timeline for closing a seed round typically spans 3 to 6 months, involving iterative pitching and negotiations.

To highlight differences within early funding, the following table compares seed funding with pre-seed stages, drawing from standard practices outlined in SEC resources on capital raising pathways.

| Metric | Pre-Seed | Seed Funding |

|---|---|---|

| Timeline | 1-3 months | 3-6 months |

| Equity | 5-15% dilution | 10-20% dilution |

| Docs | Basic term sheet, idea deck | Pitch deck, financials, cap table |

This comparison underscores how seed funding builds on pre-seed foundations by requiring more robust documentation and greater investor commitment. For instance, in an anonymized case of a tech startup we advised, refining the pitch deck based on NVCA model standards accelerated their seed close by two months, emphasizing the value of standardized templates without implying legal guarantees.

As startups progress, visual representations of these stages can clarify evolving priorities. The bar chart below illustrates funding amounts, equity dilution, and focus areas across venture capital investments.

Comparison of venture capital stages: funding, dilution, and focus

Transitioning from seed requires demonstrating key milestones, which naturally leads into preparation for subsequent growth funding phases.

Series A Funding Dynamics

Series A funding marks the scaling phase where startups transition from validation to expansion, often raising $2 million to $15 million to refine products, enter new markets, and build operational infrastructure. In 2026 trends within the US, we anticipate increased emphasis on data-driven scalability and sustainable unit economics, influenced by economic shifts toward resilient growth models as per SEC guidance on later-stage capital.

Preparation involves crafting a compelling pitch that highlights post-seed achievements, such as revenue milestones or customer acquisition costs. Strategies include leveraging warm introductions to VCs and tailoring financial models to project 3-5 years of growth. Essential documents evolve to include detailed term sheets, investor rights agreements, and pro forma financials, aligned with NVCA model legal documents for efficiency and compliance.

Equity dilution in series A rounds commonly ranges from 15% to 25%, reflecting the higher stakes and valuation increases from seed. Venture capitalists prioritize traction like recurring revenue exceeding $1 million annually, a cohesive team with complementary skills, and a market size surpassing $1 billion in total addressable opportunity. The process extends 4 to 9 months, incorporating rigorous due diligence on financials and operations.

At Zaidwood Capital, our M&A capital advisory services enhance this by providing full-cycle due diligence support and introductions to institutional networks, streamlining execution without promising specific outcomes.

The table below outlines VC expectations for series A, adapted from industry standards in NVCA resources.

| Requirement | VC Expectations |

|---|---|

| Traction | >100% YoY revenue growth, 10k+ users |

| Team | Proven executives, domain expertise |

| Market | TAM >$1B, defensible moat |

In one anonymized example, a SaaS company we supported strengthened their series A pitch by incorporating NVCA-inspired voting agreements, which built investor confidence through transparent terms.

Transitioning Between Stages

Moving from seed to series A demands hitting milestones like product-market fit and initial revenue streams, often challenging founders with valuation negotiations and governance shifts. Common hurdles include insufficient traction data or misaligned cap tables, which can delay rounds by months. We recommend using bullet-point timelines for planning:

- Month 1-2: Audit seed metrics and update pitch materials.

- Month 3-4: Secure lead investor commitments via targeted outreach.

- Month 5-6: Finalize due diligence and close with board seat allocations.

These steps bridge theory to application, setting the stage for practical execution in later fundraising efforts.

Practical Steps for Venture Capital Fundraising

Venture capital fundraising represents a critical phase for startups seeking to scale their operations and achieve market traction. At Zaidwood Capital, we assist founders in navigating this process efficiently, from initial preparations to deal closure. By focusing on structured execution tactics, entrepreneurs can enhance their chances of securing the necessary capital. This section outlines practical steps tailored for seed funding and series A funding stages, drawing on proven investor engagement methods to build momentum.

Preparing Your Pitch and Documents

Effective venture capital fundraising begins with robust preparatory materials that clearly articulate your startup’s value proposition. We recommend starting with a compelling pitch deck that outlines the problem your business solves, the innovative solution offered, market opportunity, and early traction metrics. For seed funding, emphasize product-market fit and initial user growth; in series A funding, highlight scalable revenue models and expansion plans. According to insights from the NYU Entrepreneurial Institute’s fundraising guides, founders should aim for 10-15 slides, focusing on team commitment and potential for high returns to secure follow-up meetings.

Next, develop a comprehensive business plan that details operational strategies, competitive analysis, and go-to-market approaches. Include pro forma financials projecting three to five years of revenue, expenses, and cash flow, customized for the funding stage. For seed funding rounds, prioritize customer acquisition costs and lifetime value metrics, as these demonstrate viability to early-stage investors like angel groups and micro-VCs. In series A funding, incorporate detailed unit economics and burn rate projections to show sustainable scaling.

To organize these essentials, consider the following comparison:

| Document | Purpose | Seed vs Series A |

|---|---|---|

| Pitch Deck | Concise overview to spark investor interest and secure meetings | Seed: Focus on idea validation; Series A: Emphasize growth metrics |

| Financials | Demonstrate financial health and projections | Seed: Basic forecasts; Series A: Detailed KPIs and scalability |

| Term Sheet | Outline proposed investment terms and conditions | Seed: Simple equity terms; Series A: Includes preferences and governance |

This table highlights how documents evolve with funding stages, ensuring alignment with investor expectations. We assist in crafting these using our strategic documentation services, providing templates that streamline preparation and reduce common pitfalls.

Engaging Investors and Networks

Once documents are ready, shift to investor engagement methods that leverage personal connections and targeted outreach. Build your network six to twelve months in advance by attending industry events and seeking warm introductions through advisors or alumni groups. At Zaidwood Capital, our capital introductions connect clients to over 4,000 institutional investors, facilitating access to deployable capital for efficient fundraising execution.

Negotiation plays a pivotal role; Harvard Business Review notes that successful deals often involve flexible term structures, with median series A valuations around $10-15 million based on traction data. Prioritize investors active in your sector, avoiding first-time funds for better guidance. Use advisory support to refine pitches, emphasizing metrics like monthly recurring revenue for series A funding.

Evaluate outreach strategies with this overview:

| Strategy | Pros | Cons |

|---|---|---|

| Warm Intros | Higher response rates; builds trust quickly | Requires strong existing network |

| Cold Outreach | Broad reach to new prospects | Low conversion; time-intensive follow-ups |

| Events | Face-to-face networking; sector insights | Travel costs; unpredictable connections |

Warm introductions often yield the best results, as they align with the selective nature of venture capital fundraising. We provide advisory support to optimize these tactics, helping founders secure meetings that advance their rounds.

Handling Due Diligence and Closing

Due diligence verifies claims through financial audits, legal reviews, and operational assessments, typically lasting 60-90 days. Prepare by organizing data rooms with clean cap tables, IP documentation, and customer contracts. For seed funding, focus on foundational validations; series A funding demands deeper commercial and IT scrutiny.

Closing involves signing definitive agreements and wiring funds, often with legal counsel to navigate representations and warranties. Zaidwood Capital’s full-cycle due diligence and boutique M&A advisory services streamline this, coordinating with investors to expedite verification and mitigate risks. While timelines vary, thorough preparation can shorten the process, enabling faster capital deployment without promising specific outcomes.

This structured approach empowers founders to execute venture capital fundraising confidently, transitioning to more advanced scenarios as needs evolve.

Advanced Strategies in Venture Capital Fundraising

At Zaidwood Capital, we specialize in guiding founders through the complexities of venture capital fundraising, where sophisticated tactics can significantly enhance outcomes for emerging companies. As businesses evolve from initial stages to more mature funding rounds, advanced approaches become essential to optimize capital structure and investor alignment. Our expertise in equity and debt advisory helps navigate these challenges, particularly in seed and series A contexts, ensuring compliance and value creation.

In advanced valuation techniques, founders often employ discounted cash flow (DCF) models and comparables analysis to establish defensible equity valuations. For series A funding, where growth metrics take precedence over early prototypes, we recommend integrating market benchmarks to justify higher multiples. During equity advisory discussions, leveraging capital advisory services proves invaluable, as our team provides tailored fairness opinions to bridge valuation gaps between founders and investors. This approach not only secures better terms but also mitigates dilution risks in multi-round planning.

Structuring hybrid rounds combines equity with debt elements, ideal for seed funding where cash flow predictability is limited. Managing multiple investors requires clear data rooms and proprietary tools to streamline due diligence, while post-funding governance–drawing on NVCA model legal documents–ensures robust board structures and investor rights. The SEC’s guidance on later-stage capital adaptations highlights the need for exemptions like Rule 506(b) to facilitate these complex deals without regulatory hurdles.

The following table outlines key strategies and their implications:

| Strategy | Application (Seed/Series A) | Risks/Benefits |

|---|---|---|

| Hybrid Funding | Seed (debt-equity mix) | Benefits: Flexible terms, lower immediate dilution; Risks: Higher interest costs, repayment pressure |

| Valuation Caps | Series A (term sheet protection) | Benefits: Investor upside limits, founder value preservation; Risks: Negotiation friction, cap misalignment |

| Syndicate Deals | Both (lead investor coordination) | Benefits: Broader capital access, shared due diligence; Risks: Alignment issues, slower decision-making |

Hybrid funding, for instance, allows startups to layer convertible notes atop equity, preserving optionality in uncertain markets. However, as seen in hypothetical scenarios where rapid scaling demands arise, mismanaged caps can erode founder equity unexpectedly. For series A processes, which typically span 4-6 months per SEC insights on later-stage transitions, sophisticated KPIs like customer acquisition cost and lifetime value become critical differentiators from seed funding’s focus on product-market fit. We advise founders to prioritize these metrics early to accelerate timelines and attract syndicate leads.

In applications, advanced equity deals demand vigilant LP placements, where our network connects clients to institutional backers. Bullet-pointed tips include: preparing milestone-based tranches for accountability; conducting scenario modeling to anticipate governance shifts; and engaging legal counsel for NVCA-compliant documentation to avert disputes. By addressing these elements, founders can transform potential pitfalls into strategic advantages, paving the way for sustained growth and future rounds.

Frequently Asked Questions on Venture Capital Fundraising

How long does the venture capital fundraising process typically take? The timeline varies by stage, generally spanning 3-12 months. Early networking, as emphasized in pitch preparation guides, can extend to six months prior for building investor relationships.

What key documents are required for VC fundraising? Essential items include a pitch deck outlining your vision, a capitalization table, and detailed financial projections to demonstrate viability.

What equity stake do VCs usually seek? Investors typically request 10-30% equity, balancing control with growth potential.

What criteria do VCs prioritize in startups? They focus on scalable business models, strong founding teams, and proven traction like customer metrics.

How can advisors assist in venture capital fundraising? We provide pitch refinement, investor introductions, and strategic prep to enhance success rates.

What are typical seed funding amounts in the US? Seed rounds range from $500,000 to $5 million, targeting initial product development.

What are the main differences between seed funding and series A funding? Seed funding supports early validation with smaller amounts and less maturity, while series A funding, averaging $10-15 million, requires demonstrated progress and scaling plans.

Key Takeaways for Venture Capital Fundraising Success

Venture capital fundraising represents a pivotal path for high-growth startups seeking to scale effectively. Our key insights underscore the importance of meticulous preparation, leveraging robust networks, and navigating due diligence with precision to achieve successful VC journeys.

- Master the Stages: Begin with seed funding to validate your concept, then advance to series A funding for market expansion, each demanding tailored pitches and milestones.

- Strategic Preparation: Craft compelling business plans and financial projections, drawing from SBA guidance on funding options to build investor confidence.

- Hybrid Financing: Explore equity alongside debt advisory services for balanced capital structures that mitigate equity dilution.

- Network and Expertise: Connect with institutional investors through trusted advisors to streamline funding milestone summaries and accelerate outcomes.

At Zaidwood Capital, we empower founders with our full-cycle capital raising support. Contact us to explore how our network of over 4,000 investors can guide your next steps–without any commitments.