Energy Investment Bank

Table of Contents

Understanding Energy Investment Banking

The energy sector continues to evolve rapidly, with global mergers and acquisitions in the industry surpassing $250 billion in recent years, as highlighted in authoritative industry primers from institutions like Yale School of Management. This surge reflects the intensifying focus on both traditional operations and sustainable transitions. At Zaidwood Capital, we recognize the pivotal role of an Energy Investment Bank in navigating these complexities, providing specialized advisory to drive value amid market shifts.

Energy investment banking represents a focused subset of investment banking, tailored to the energy sector’s unique demands. It encompasses oil and gas investment banking for upstream exploration and downstream refining, alongside renewable energy investment banking that finances solar, wind, and other green initiatives. Core services include M&A advisory, where we guide clients through buy-side and sell-side transactions; capital raising to secure equity and debt; and financing solutions like mezzanine and asset-based lending. These offerings address challenges such as regulatory changes and volatile commodity prices. For instance, we recently advised on a $500 million acquisition of a midstream Oil And Gas Investment Bank asset portfolio, streamlining the deal for seamless integration.

This guide begins with foundational concepts, progresses to advanced strategies in energy sector financing advisory, and concludes with insights on sustainable energy capital services. By exploring these areas, clients gain tools to capitalize on growth opportunities while mitigating risks.

Building on this overview, the following sections delve into the core fundamentals of energy investment banking, equipping you with practical knowledge for informed decision-making.

Fundamentals of Energy Investment Banking

Visual comparison of core investment banking services in traditional versus renewable energy sectors

At Zaidwood Capital, we specialize in the dynamic field of energy investment banking, where financial expertise meets the unique challenges of resource volatility and sustainability goals. An energy investment bank plays a pivotal role in navigating these complexities, offering tailored advisory services to corporations and investors alike. Our approach integrates deep sector knowledge with robust institutional networks to facilitate seamless transactions in both traditional and emerging energy landscapes.

Energy investment banking encompasses a range of core services designed to address the sector’s high-stakes demands. These include mergers and acquisitions advisory, capital formation, and debt and equity structuring, all adapted to the energy market’s inherent uncertainties. For instance, Energy Mergers And Acquisitions Advisory involves guiding buy-side and sell-side deals, often focusing on asset valuations influenced by commodity prices and regulatory shifts. Capital raising mechanisms, such as equity offerings or private placements, help fund exploration or development projects, while debt advisory options like asset-based lending provide flexible financing for equipment-intensive operations.

Key services in this domain break down as follows:

- M&A Advisory: Structuring transactions for asset sales or corporate consolidations, with rigorous due diligence on financial and operational aspects to mitigate risks.

- Capital Formation: Arranging equity raises through networks of institutional investors, emphasizing sector-specific capital solutions for growth initiatives.

- Debt and Equity Structuring: Developing mezzanine debt or growth equity packages, ensuring alignment with project timelines and cash flow projections.

Due diligence remains central to our process, encompassing financial audits, legal reviews, and operational assessments to uncover potential liabilities. In the context of the energy transition, we emphasize de-risking strategies, drawing from frameworks like those in the USSIF guide, which highlight collaborative approaches to sustainable projects on Indigenous lands. Fees in energy finance advisory are typically success-oriented, calculated as percentages of deal value, reflecting the value delivered without upfront burdens.

The energy sector’s evolution demands specialized services that bridge traditional fossil fuels with renewables. Oil and gas investment banking has long dominated with financing for extraction and infrastructure, while renewable energy investment banking surges in response to global decarbonization efforts. This shift underscores the need for adaptive strategies that balance legacy assets with innovative green technologies.

| Service Category | Oil and Gas Focus | Renewable Energy Focus |

|---|---|---|

| M&A Advisory | Buy-side and sell-side deals for upstream, midstream assets | Project financing and asset acquisitions for solar/wind farms |

| Capital Formation | Equity raises for exploration and production | Green bonds and impact investing for sustainability projects |

| Debt Structuring | Asset-based lending for drilling equipment | Mezzanine debt for battery storage developments |

Data drawn from industry reports on sector-specific financing needs, this comparison illustrates how services pivot to meet distinct risk profiles and regulatory environments. Traditional focuses prioritize reserve-backed securities, whereas renewables emphasize impact metrics and long-term viability.

At Zaidwood Capital, our full-cycle M&A and capital advisory capabilities span both areas, leveraging connections to over 4,000 institutional investors and $15 billion in deployable capital. We streamline transactions through precision due diligence and strategic documentation, ensuring clients in Sheridan, Wyoming, and beyond achieve optimal outcomes in volatile markets. This foundational expertise sets the stage for exploring advanced applications, such as navigating geopolitical influences on energy deals.

Deep Dive into Energy Financing Structures

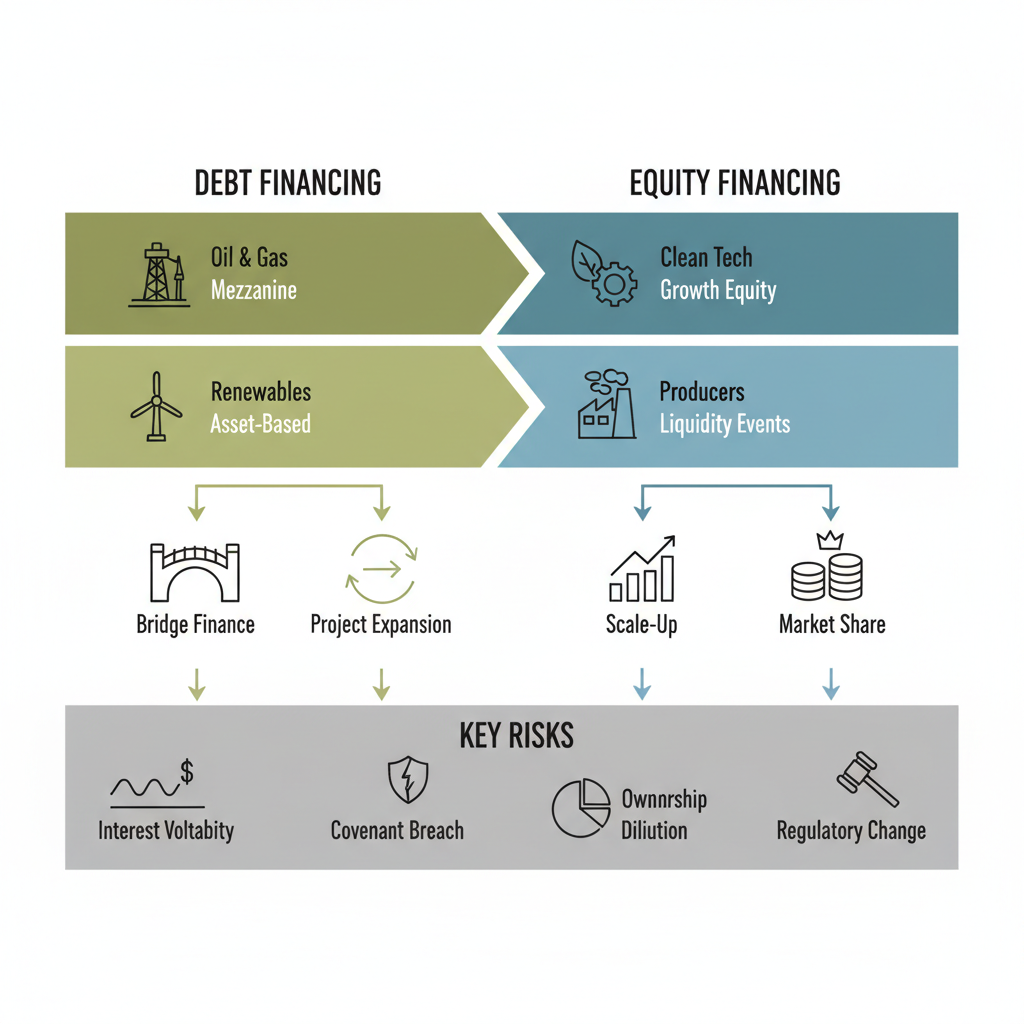

Debt vs. equity financing options in energy sectors visualized

In the dynamic landscape of energy investment banking, financing structures play a pivotal role in enabling both traditional and renewable projects to thrive. Our team at Zaidwood Capital, as a leading boutique ma advisory firm, navigates these complexities to connect clients with optimal capital solutions. This section explores debt, equity, and institutional strategies, highlighting how policy shifts and market evolutions shape deal execution.

Debt Financing in Traditional and Renewable Energy

As an energy investment bank, we specialize in structuring debt instruments that balance risk and return for diverse energy portfolios. Debt financing remains a cornerstone for both oil and gas and renewable initiatives, offering leverage without immediate ownership dilution.

In oil and gas investment banking, mezzanine debt serves as bridge financing for acquisitions and emissions reduction projects. For instance, drawing from the Environmental Defense Fund’s (EDF) guidance on methane abatement, lenders can tie financing to performance metrics, such as flaring reductions, creating labeled instruments like sustainability-linked loans. Venture debt supports exploration startups, while asset-based lending secures funding against reserves or equipment. A hypothetical case involves a midstream operator using mezzanine facilities to fund pipeline expansions amid volatile commodity prices, ensuring cash flow stability.

Shifting to renewables, project debt advisory focuses on asset-backed structures for solar farms or wind arrays. Here, renewable energy investment banking emphasizes green bonds and export credit agency support, aligned with policy incentives like the Inflation Reduction Act. Venture debt aids clean tech innovators in scaling prototypes, with mezzanine layers bridging construction to operation. These structures mitigate intermittency risks through revenue stabilization mechanisms.

The following table compares key debt and equity options across sectors:

| Financing Type | Oil and Gas Applications | Renewable Applications | Key Risks |

|---|---|---|---|

| Mezzanine Debt | Bridge financing for acquisitions | Funding for project expansions | Interest rate volatility |

| Growth Equity | Expansion capital for producers | Scale-up for clean tech startups | Dilution of ownership |

This comparison underscores structure choices in energy deals, where mezzanine debt provides flexibility but exposes borrowers to rate fluctuations. Our advisory mitigates these through tailored covenants and hedging strategies, drawing on EDF’s methane-linked models to enhance lender confidence.

Equity and Capital Raising Strategies

Equity financing empowers energy firms to fuel growth without debt burdens, particularly in high-capital sectors. Our sustainable equity placement services guide clients through capital formation, from pitch deck development to institutional syndication.

Growth equity targets mature producers seeking expansion, injecting capital for drilling programs in oil and gas or grid integration in renewables. Liquidity solutions, such as secondary sales, allow early investors to exit while funding ongoing operations. In renewable energy investment banking, we structure deals around ESG metrics to attract impact funds, as outlined in the US Sustainable Investment Forum’s (USSIF) de-risking guide, which promotes Indigenous-inclusive frameworks for project viability.

Institutional placements involve layering commitments from pension funds and endowments, often via limited partner (LP) vehicles. A case study might feature a geothermal startup raising $50 million in growth equity to deploy across US sites, leveraging policy tailwinds for 20% IRR projections. These strategies evolve with energy transition demands, prioritizing scalable, low-carbon models.

For LP placements, consider this overview:

| Placement Type | Oil and Gas Focus | Renewable Focus | Key Risks |

|---|---|---|---|

| Institutional LP | Sovereign funds for upstream assets | Endowments for solar portfolios | Regulatory shifts |

| Growth Equity Synd. | Family offices for midstream | Impact investors for wind farms | Market liquidity constraints |

Equity approaches demand rigorous valuation to avoid over-dilution, with our team facilitating USSIF-inspired tools for enhanced due diligence and partnership building.

Institutional Connectivity and Due Diligence

Our institutional connectivity spans over 4,000 investors, enabling seamless capital introductions for energy mandates. Full-cycle due diligence encompasses financial audits, legal reviews, and environmental assessments to de-risk transactions.

We conduct phased evaluations: initial screening verifies project feasibility, followed by operational deep dives and commercial modeling. Policy impacts, such as carbon pricing, influence structures by favoring low-emission profiles. In energy transition contexts, due diligence integrates EDF and USSIF frameworks, ensuring methane tracking and Indigenous consultations.

For a hypothetical oil-to-renewables pivot, our process might uncover synergies in asset repurposing, connecting clients to $15 billion in deployable capital. This connectivity evolves with 2025-2026 trends, emphasizing resilient, policy-aligned financing.

Practical Applications in Energy Deals

Energy companies and investors often navigate complex transactions in the dynamic energy sector. We recommend applying investment banking expertise to streamline mergers and acquisitions, capital formation, and due diligence processes. This section outlines actionable steps for leveraging these services effectively, drawing on established deal advisory practices to mitigate risks and enhance outcomes.

Evaluating Energy Investment Banks for M&A

Selecting the right Energy Investment Bank for mergers and acquisitions requires a structured approach to ensure alignment with your strategic goals. Begin by assessing the firm’s track record in energy-specific deals, focusing on completed transactions in upstream, midstream, or downstream segments.

- Review historical performance: Examine the bank’s success rate in similar energy M&A, prioritizing those with expertise in volatile markets.

- Evaluate team credentials: Look for advisors with deep sector knowledge, including regulatory and commodity price insights.

- Analyze fee structures: Compare retainer models versus success-based fees to balance cost with incentives.

- Assess cultural fit: Ensure the bank’s approach complements your company’s operational style and risk tolerance.

These steps help identify partners capable of delivering value in high-stakes negotiations. For instance, in oil and gas investment banking, firms might emphasize asset valuation amid fluctuating crude prices, while renewable energy investment banking advisors could prioritize subsidy alignments and carbon credit opportunities.

The following table compares key evaluation criteria for energy advisory firms, informed by standard practices outlined in the Yale School of Management’s Industry Primer on Investment Banking:

| Criteria | Traditional Oil/Gas Banks | Renewable-Focused Banks | Boutique Advantages |

|---|---|---|---|

| Network Size | Broad institutional ties | Green investor focus | 4,000+ targeted connections |

| Due Diligence Scope | Operational emphasis | ESG integration | Full-cycle coverage |

Traditional oil and gas banks offer extensive ties to fossil fuel investors, ideal for large-scale asset swaps. Renewable-focused banks integrate environmental metrics, supporting sustainable transitions. Boutique firms provide tailored, agile support with comprehensive networks, enabling efficient connections without the overhead of larger institutions. As a capital advisory firm, we position our services to address these criteria through focused expertise in energy transactions.

Engaging for Capital Formation Projects

Companies in the energy space frequently seek funding to scale operations or pivot to new technologies. Engaging investment banks for capital formation involves clear financing engagement steps to attract the right investors.

- Prepare compelling documentation: Develop pitch decks and pro forma financials that highlight revenue projections and market potential.

- Identify target investors: Leverage the bank’s network to connect with institutions interested in energy opportunities, such as private equity for oil and gas or impact funds for renewables.

- Negotiate terms: Structure equity or debt offerings to align with your growth objectives, incorporating digital tools for virtual roadshows.

- Monitor progress: Track investor feedback and adjust strategies to close commitments efficiently.

In practice, oil and gas firms might use these processes to secure project financing for exploration, while renewable projects benefit from banks emphasizing green bonds. This methodical engagement reduces timelines and boosts funding success, answering queries on institutional connections in the sector.

Best Practices for Due Diligence and Documentation

Effective due diligence and documentation form the backbone of successful energy deals, minimizing surprises and ensuring compliance.

- Conduct comprehensive reviews: Cover financial, legal, and operational aspects, integrating ESG factors for modern transactions.

- Utilize checklists: Standardize evaluations with templates for asset audits and liability assessments.

- Prepare strategic documents: Craft business plans and fairness opinions to support negotiations.

- Incorporate technology: Employ data rooms and analytics software to streamline reviews and enhance accuracy.

We advocate these practices to mitigate risks, as seen in typical energy M&A where thorough vetting uncovers hidden value. For documentation, focus on clear pro formas that project cash flows amid market shifts. While these steps apply broadly, complexities arise in cross-border or high-stakes deals, warranting specialized guidance in advanced scenarios.

Advanced Strategies for Energy Transitions

As an energy investment bank navigating the shift toward sustainability, we specialize in advanced strategies that bridge traditional operations with renewable growth. Our expertise in oil and gas investment banking ensures firms adapt without disruption, while renewable energy investment banking supports seamless integration of green technologies. These transition finance tools empower clients to capitalize on evolving market dynamics.

Fairness opinions and transaction advisory form the cornerstone of our advanced advisory frameworks. Drawing from FINRA interpretations under SEA Rule 15c3-1, we provide compliant valuations that assess transaction equity, particularly in divestitures where regulatory scrutiny is high. For energy firms, this involves detailed pro forma financials and strategic business plans that outline cross-border M&A opportunities. We also offer capital introductions through our investor rolodex, connecting clients to targeted limited partners for efficient funding.

In the energy transition, advanced needs demand tools that balance legacy assets with emerging renewables. The following table compares key strategies across traditional and modern approaches:

| Strategy | Oil/Gas Adaptation | Renewable Integration | Zaidwood Approach |

|---|---|---|---|

| Fairness Opinions | Valuation in divestitures | ESG-linked assessments | Integrated due diligence |

| Investor Rolodex Access | Commodity-focused LPs | Impact funds | 4,000+ global network |

This comparison, informed by FINRA guidance on opinions and our proprietary tools, highlights how we streamline execution. Post-table, the benefits emerge in faster deal velocity via our Velocity Matrix, reducing time-to-close by integrating due diligence with investor outreach. For instance, in methane reduction projects, we structure debt financing akin to the EDF’s framework, linking emissions performance to labeled bonds for verifiable impact.

Addressing energy transition challenges, we facilitate strategic documentation that anticipates regulatory shifts and market volatility. Our ma capital advisory services ensure full-cycle support, from equity advisory to debt structuring, helping firms access over $15 billion in deployable capital. As boutique advisors, we pose advanced queries like optimizing portfolios for net-zero goals, setting the stage for deeper FAQ explorations on implementation.

Through these tactics, we position clients for resilient growth in a decarbonizing world, leveraging our 24.4 billion USD transaction volume for proven results.

Frequently Asked Questions on Energy Banking

As a leading Energy Investment Bank, we provide sector query resolutions and finance FAQ insights for clients navigating complex energy markets.

What services does an energy investment bank offer for M&A deals?

We offer comprehensive mergers acquisitions advisory services, including buy-side and sell-side mandates, full-cycle due diligence, and strategic documentation to streamline transactions in the energy sector.

What are typical fees for energy investment banking advisory?

Fees typically include retainers, success-based commissions, and expense reimbursements, varying by deal size and complexity. We structure them transparently to align with client objectives in oil and gas investment banking.

How does an energy investment bank structure debt financing for oil and gas companies?

We arrange mezzanine debt, venture debt, asset-based lending, and cash-flow financing tailored to operational needs, ensuring flexibility and risk mitigation for energy projects.

How has oil and gas investment banking evolved with the energy transition?

The sector now emphasizes renewable energy investment banking opportunities, with de-risking frameworks from the USSIF guide highlighting Indigenous inclusion for sustainable value. This shift unlocks resilient investments while addressing traditional oil and gas challenges.

Key Takeaways in Energy Investment Banking

In the dynamic realm of energy investment banking, specialized advisory stands as a cornerstone for navigating mergers and acquisitions, capital formation, and the shift toward sustainable practices. We emphasize the value of firms equipped with extensive networks, such as Zaidwood Capital, to connect clients with vital resources in this evolving sector.

Key benefits include rigorous due diligence that mitigates risks and seamless connectivity to institutional investors, ensuring efficient transaction execution. Whether in oil and gas investment banking or renewable energy investment banking, these services drive strategic growth and compliance with regulatory standards, as outlined by FINRA interpretations.

As energy markets transform, we encourage exploring tailored advisory options to capitalize on emerging opportunities and secure long-term success.