Series D

Table of Contents

Understanding Series D Funding

At Zaidwood Capital, we have witnessed firsthand how Series D represents a pivotal milestone for ambitious companies poised for explosive growth. This late-stage venture capital infusion empowers businesses to scale aggressively, often after exhausting earlier rounds, by providing the fuel needed to dominate new markets or gear up for transformative exits like initial public offerings.

Series D funding typically follows successful Series A, B, and C rounds, serving as growth equity rounds that bridge the gap to liquidity events. Companies pursue this stage to accelerate expansion, invest in innovative technologies, or consolidate market positions when organic growth alone falls short. According to foundational resources like the Series Funding Glossary, these rounds commonly raise between $50 million and over $200 million, with series d valuation benchmarks reflecting mature revenue streams and proven scalability. Since 2025, trends in the US have shifted toward emphasizing profitability metrics alongside rapid scaling, as investors prioritize sustainable paths amid economic uncertainties. Our team at Zaidwood, with over $24.4 billion in aggregate transaction volume, specializes in guiding clients through these complexities, from investor matchmaking to optimizing term sheets for maximum strategic advantage.

In the sections ahead, we delve into the fundamentals of Series D Funding, explore valuation intricacies, and outline practical steps for securing capital. Understanding these elements equips entrepreneurs and investors to navigate this critical phase effectively, leveraging expert advisory to turn potential into reality.

Core Principles of Series D Investments

Series D funding represents a critical juncture in the venture capital lifecycle, bridging mature companies toward liquidity events like IPOs or acquisitions. For startups that have achieved substantial revenue milestones, often exceeding $50 million in annual recurring revenue, this stage accelerates growth while mitigating risks. What is Series D Funding involves raising significant capital to fuel expansions that earlier rounds could only seed. At Zaidwood Capital, we advise clients on navigating these late-stage equity infusions, drawing from our experience in capital formation to highlight the strategic imperatives.

As companies progress through funding stages, each round builds on prior achievements, demanding greater proof of scalability and execution. Series A typically validates product-market fit with modest raises, while subsequent rounds emphasize operational scaling and market dominance. We recommend founders assess their readiness by aligning milestones with investor expectations, such as demonstrated cash flow management and team proficiency–key factors emphasized in funding workshops like those from Mercato partners. This evolution underscores the cyclical nature of venture ecosystems, where successful traction attracts more sophisticated capital.

Before delving into specifics, consider these high-level differences:

- Raise amounts escalate dramatically, from seed-level millions to hundreds for late stages.

- Investor profiles shift from high-risk angels to stability-focused private equity.

- Milestones evolve from ideation to profitability paths and exit preparations.

The following table illustrates these distinctions more clearly:

| Aspect | Series A | Series B | Series C | Series D |

|---|---|---|---|---|

| Typical Raise Amount | $2M-$15M | $10M-$50M | $20M-$100M | $50M-$200M+ |

| Key Milestones | Product-Market Fit | Scaling Operations | Market Expansion, Pre-IPO Preparation | Growth Acceleration, Exit Strategy Bridge |

| Investor Focus | Angels/Seed VCs | Early VCs | Growth VCs | PE Firms/Family Offices |

This comparison, informed by venture capital reports, reveals how series d funding demands a higher maturity threshold than earlier stages. Unlike Series A or B, where vision and initial traction suffice, Series D investors scrutinize sustainable models and risk mitigation, often weighting executive execution at 50% or more in evaluations. Post-table analysis shows why companies must demonstrate robust governance to secure these larger commitments, reducing dilution while positioning for global plays.

Expanding on this, investor criteria in Series D center on proven traction and strategic foresight. Funds seek businesses with scalable operations, clear paths to profitability, and defenses against market volatility–insights we reinforce through due diligence advisory. For instance, healthtech firms like those scaling telemedicine platforms often secure D-round capital by showcasing international expansion potential or acquisition synergies. Valuation benchmarks, typically 10-15x revenue multiples in series d valuation, reflect this maturity, rewarding consistent growth over speculative upside.

Comparison of Series A-D funding stages: amounts, investors, milestones

Understanding these principles equips companies to approach Series D with confidence, teasing deeper explorations into valuation nuances and market dynamics ahead.

In-Depth Mechanics of Series D Rounds

Series D funding represents a pivotal stage in advanced venture financing, where companies seek substantial capital to scale operations and solidify market positions. At Zaidwood Capital, we facilitate access to our network of over 4,000 institutional and private investors, enabling growth-stage firms to navigate these complex rounds effectively.

Investor Participation and Metrics

In series d funding, investor participation typically involves a mix of seasoned players focused on late-stage opportunities. Private equity firms lead with their emphasis on scaling mature businesses, while family offices seek diversification into high-potential assets, and sovereign wealth funds make strategic bets on transformative ventures. Key metrics evaluated include 30-50% year-over-year revenue growth, robust unit economics demonstrating profitability paths, and market share indicators that signal competitive dominance. VCs scrutinize customer acquisition costs against lifetime value to ensure sustainable expansion. Drawing from insights in the Breaking Into Venture Capital Guide, late-stage dynamics prioritize companies with proven traction, often requiring detailed due diligence on operational scalability.

| Investor Type | Tech | Healthtech | Fintech |

|---|---|---|---|

| Private Equity Firms | High (scale focus) | High (scale focus) | High (scale focus) |

| Family Offices | Medium (diversification) | Medium (diversification) | Medium (diversification) |

| Sovereign Wealth Funds | Low (strategic bets) | Low (strategic bets) | Low (strategic bets) |

Term Structures and Negotiation Essentials

Term structures in Series D rounds emphasize governance and exit mechanisms to protect stakeholder interests. Common elements include board seat allocations granting investors oversight, drag-along rights facilitating majority-driven exits, and anti-dilution provisions safeguarding against down rounds. Deal timelines average 4-6 months, encompassing due diligence, legal drafting, and closing. In tech sectors, terms often prioritize rapid scaling clauses, while healthtech deals incorporate regulatory milestones. Our advisory support at Zaidwood Capital aids in LP placements and full-cycle due diligence, mitigating risks highlighted in venture capital literature on negotiation pitfalls.

| Term | Standard | Negotiable |

|---|---|---|

| Board Seats | 1-2 for lead investors | Additional observer rights |

| Drag-Along Rights | 50% threshold | Higher thresholds for protection |

| Valuation Caps | Tied to revenue multiples | Adjustments for market volatility |

Market Trends Since 2025

Since 2025, Series D activity in the US has shifted toward sustainable growth, with longer runways emphasizing operational efficiency over aggressive expansion. Hybrid debt-equity structures have surged, comprising 25% of deals per recent analyses, allowing firms to balance leverage with equity dilution. In tech, D-stage investments prioritize AI integration, while healthtech focuses on biotech scalability amid regulatory easing. Fintech rounds increasingly incorporate ESG metrics, reflecting broader VC trends toward responsible capital deployment. This evolution, informed by post-2025 data from venture guides, underscores a 15% decline in pure equity volumes but a rise in strategic partnerships. At Zaidwood, we position clients to capitalize on these dynamics through targeted introductions, including deep tech investment opportunities that align with sustainable mandates.

Applying Series D Strategies Effectively

Valuation Factors and Benchmarks

Series D valuations hinge on several key drivers, including annual recurring revenue (ARR) growth rates, market comparables, and operational scalability. Companies typically achieve post-money valuations between $500 million and $2 billion in 2026, influenced by investor appetite for high-growth sectors. For instance, sustained ARR expansion above 50% year-over-year often commands premium multiples, as noted in the Series Funding Glossary from SaaSBoomi, which defines multiples as revenue-based metrics reflecting market maturity and exit potential.

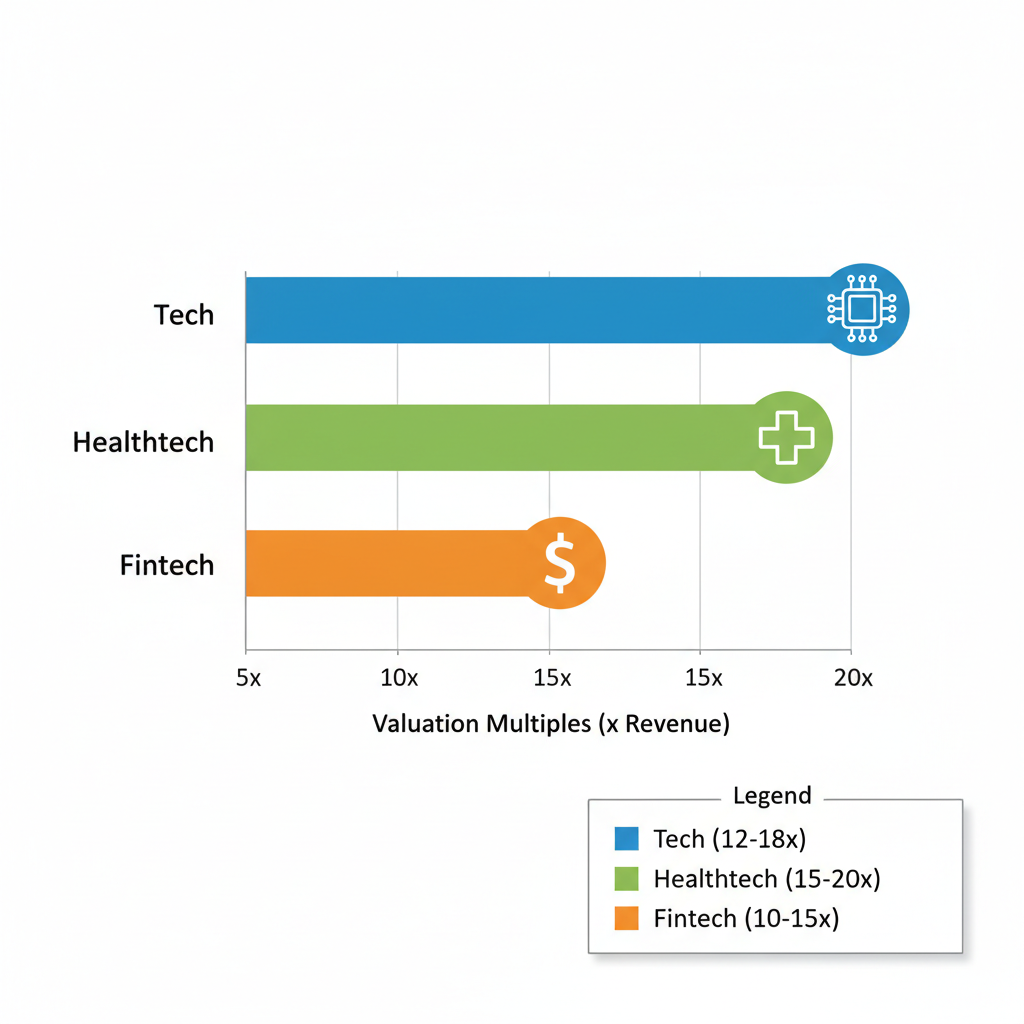

| Industry | Average Multiple | Key Driver |

|---|---|---|

| Tech | 12-18x Revenue | ARR Growth |

| Healthtech | 15-20x | Regulatory Approvals |

| Fintech | 10-15x | Compliance Metrics |

Series D valuation multiples by industry for 2026

Preparation and Advisory Support

Effective preparation for series d funding begins with optimizing capital structure through rigorous financial modeling and pitch deck refinement. We guide clients in building detailed pro forma financials that project sustainable growth, incorporating sensitivity analyses for various scenarios. Leveraging advisory support is crucial for term sheet negotiations and hybrid financing options, such as combining equity with debt advisory services.

| Step | Benefit | Common Pitfall |

|---|---|---|

| Financial Modeling | Enables accurate projections | Overly optimistic assumptions |

| Pitch Deck Refinement | Strengthens investor storytelling | Ignoring market feedback |

| Capital Structure Review | Optimizes dilution and terms | Neglecting tax implications |

Success Factors from Real Deals

Success in Series D rounds often stems from strong governance, investor alignment, and proactive due diligence management. In anonymized transactions we’ve supported, emphasizing transparent metrics and hybrid structures led to favorable terms, avoiding dilution pitfalls.

Advanced Considerations for Series D

At Zaidwood Capital, we guide clients through the intricacies of late-growth financing, where Series D rounds demand sophisticated strategies beyond initial capital raises. With access to over $15 billion in deployable capital and our extensive network of institutional investors, we help founders address advanced challenges like integrating mezzanine debt into series d funding structures.

| Aspect | Equity | Debt | Hybrid |

|---|---|---|---|

| Risk to Founder | High Dilution | Repayment Obligation | Balanced with Flexible Terms |

| Investor Appeal | Upside Potential | Fixed Returns | Growth + Income |

Success factors include robust fairness opinions and strategic LP placements, where our ma capital advisory services provide critical support.

Series D Funding FAQ

1. What are typical Series D funding amounts by industry? Series D funding rounds often range from $50 million to $200 million, varying by sector. Tech startups may raise $100 million or more for global expansion, while biotech firms target $150 million for clinical trials.

2. How does Series D differ from Series C? Unlike Series C, which focuses on scaling and market penetration, Series D emphasizes late-stage growth, acquisitions, or pre-IPO preparation. It involves higher stakes with institutional investors seeking proven traction and robust revenue streams.

3. What are series d valuation trends for 2026? Experts anticipate series d valuations in the US VC market to rise 15-20% by 2026, driven by AI and sustainability sectors. Valuations could average $1-2 billion, reflecting matured business models amid economic recovery.

4. What benefits does advisory provide in Series D? Our boutique ma advisory at Zaidwood Capital connects clients to over 4,000 investors, streamlining term negotiations and due diligence. We mitigate risks like overvaluation through tailored strategies.

5. What are common pitfalls in Series D funding? Founders often overlook diluted equity or misaligned investor expectations. We advise thorough network building to avoid mismatched terms, drawing from VC guides emphasizing risk tolerance and deal flow quality.

Navigating Series D for Growth Success

Series D funding represents a pivotal late-stage milestone, enabling established companies to accelerate global expansion, refine product offerings, and optimize operations for sustained growth. Typical series d valuation often exceeds $500 million, reflecting mature business models and proven revenue streams. At Zaidwood Capital, we guide clients through this complex landscape.