Series E

Table of Contents

Understanding Series E Funding

In the dynamic world of venture capital, Series E funding marks a pivotal milestone for mature startups seeking to solidify their market position. This advanced stage provides substantial capital to companies that have already achieved significant scale, often after multiple prior funding rounds. At Zaidwood Capital, we recognize Series E as essential for bridging the gap between aggressive growth and sustainable operations, enabling firms to pursue ambitious strategies without immediate pressure for an IPO.

Unlike earlier rounds such as Series D, which focus on pre-IPO refinements, Series E funding emphasizes long-term viability and alternative liquidity paths. Typical use cases include dominating niche markets or preparing for strategic acquisitions, where Series E Funding involves heightened investor scrutiny on metrics like revenue stability and Series E valuation multiples. Challenges arise from elevated valuations and regulatory complexities, demanding sophisticated advisory to navigate successfully.

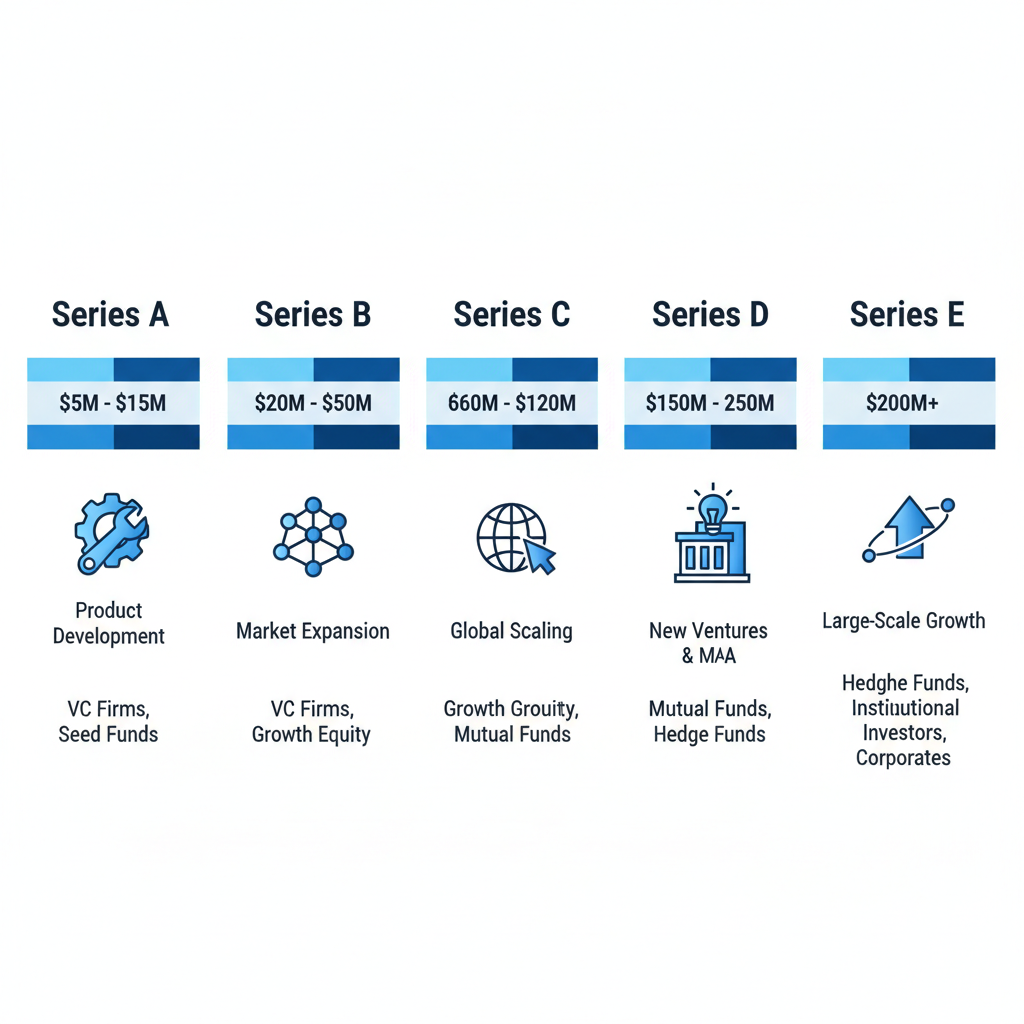

To contextualize Series E within the broader startup lifecycle, venture funding evolves progressively from seed-stage ideation to late-stage maturity. Each round builds on the last, increasing capital infusion while shifting focus toward scalability and risk mitigation, as outlined in foundational resources like The ABCs of Start-Up Funding.

| Funding Stage | Typical Amount Raised | Primary Focus | Investor Types |

|---|---|---|---|

| Series A | $5M – $15M | Product-market fit | VC firms, Angel investors |

| Series B | $15M – $50M | Market expansion | Growth-stage VCs, Corporate investors |

| Series C | $50M – $100M | International expansion | Late-stage VCs, PE firms |

| Series D | $100M – $200M | Efficiency optimization | PE funds, Hedge funds |

| Series E | $200M+ | Sustainability and alternatives to IPO | Institutional investors, Sovereign wealth funds |

This progression highlights why Series E is crucial; it acts as a bridge to liquidity events, per industry analyses, allowing companies to optimize operations amid economic uncertainties. For instance, a tech firm at this stage might leverage funds for global acquisitions, ensuring resilience.

We at Zaidwood Capital, with our $24.4B in aggregate transaction volume, offer expert mergers and acquisitions advisory and capital formation services to guide startups through Series E complexities. Our network of over 4,000 institutional investors provides unparalleled access to deployable capital exceeding $15B.

Overview of Series A to E venture funding stages

This guide delves deeper into Series E mechanics, from valuation strategies to investor outreach, equipping you with insights for informed decision-making.

Series E Funding Basics

At Zaidwood Capital, we frequently advise mature startups navigating the complexities of late-stage financing. Series E represents a critical juncture in a company’s growth trajectory, serving as What is Series E Funding–an advanced equity round designed to fuel expansion for businesses with established market presence. This stage often acts as the marathon’s final stretch, where companies shift from rapid scaling to sustainable profitability, drawing on proven revenue models to attract sophisticated investors.

With the basics outlined, let’s examine the core elements that distinguish Series E from earlier rounds. While Series A through C focus on product-market fit and initial growth, Series D typically addresses pre-IPO preparations with capital in the $100 million to $200 million range. Series E funding, however, escalates this to larger infusions, emphasizing profitability metrics over sheer expansion. According to insights from startup funding guides, companies entering Series E have often surpassed $100 million in annual recurring revenue, positioning them for advanced equity rounds that prioritize long-term viability.

One key evolution from Series D to Series E lies in the heightened scale and strategic focus. Series D rounds optimize operations ahead of potential public listings, but Series E introduces a bridge to alternatives like acquisitions or perpetual private status. This shift demands greater maturity, as investors scrutinize not just growth potential but also resilience in volatile markets.

The following table compares key aspects of Series D and Series E funding, highlighting the escalation in complexity:

| Aspect | Series D | Series E |

|---|---|---|

| Typical Capital Raised | $100M – $200M | $200M+ Often exceeding $300M in mature markets |

| Investor Focus | Pre-IPO optimization | Sustainability and alternatives to public markets Bridge to acquisition or continued private growth |

| Valuation Multiples | Revenue multiples of 8-12x | Revenue multiples of 10-15x or higher EBITDA-focused for profitability |

| Key Risks | Market saturation | Regulatory and economic volatility Liquidity event timing |

This comparison underscores the transitional challenges companies face, such as adapting to investor demands for EBITDA-positive trajectories rather than top-line growth alone. Drawing from equity financing analyses, Series D valuations often hinge on revenue multiples of 8-12x, while Series E valuation multiples climb to 10-15x or beyond, reflecting a company’s entrenched market leadership. At Zaidwood, we observe that firms reaching this stage must demonstrate robust financials to mitigate risks like economic downturns, which can delay liquidity events.

In the US, typical Series E raises exceed $200 million, with some exceeding $300 million in competitive sectors like technology and healthcare. Investors seek companies with strong revenue streams, diversified customer bases, and clear paths to profitability–criteria that align with our experience in over 300 deals. For instance, a software firm we advised recently secured $250 million by showcasing 25% year-over-year growth alongside positive cash flow, leveraging equity instruments like preferred stock to minimize dilution.

Preparation for Series E involves rigorous steps, including comprehensive financial audits and cap table cleanups to ensure transparency. Late-stage capital infusion requires aligning governance with investor expectations, often through structured equity rounds that balance control and returns. At Zaidwood Capital, we streamline this process via our network of over 4,000 institutional investors and access to $15 billion in deployable capital, providing full-cycle due diligence and capital introductions to position clients for success without promising specific outcomes.

In-Depth Analysis of Series E Rounds

Building on core differences in funding stages, let’s analyze what drives Series E success. These mature-stage investments represent a pivotal moment for high-growth companies scaling toward sustainability, where sophisticated investors scrutinize operational maturity and long-term viability. We at Zaidwood Capital guide clients through this scrutiny, leveraging our $24.4B aggregate transaction volume to structure deals that align with evolving market demands.

Investor Expectations and Market Trends

Sophisticated investors in Series E rounds prioritize candidates demonstrating robust metrics, such as 20%+ year-over-year growth and a clear path to profitability. Drawing from stage-by-stage insights in CMO Success, Stage by Stage, mature organizations must exhibit structured leadership and scalable processes, contrasting with earlier stages’ focus on rapid expansion. For 2025, Series E funding timelines are projected to accelerate amid economic shifts, with a 15% increase in late-stage deals as per Global Venture Capital Trends 2026, adapted for current projections. Investors seek evidence of IP strength, expert teams, and resilient business models, often favoring secondary transactions over IPOs due to market volatility–transaction volumes hit $60 billion in 2025, enabling liquidity without public exposure.

This evolution addresses key queries on investor profiles and why startups opt for Series E over going public: it provides capital for global expansion while mitigating risks in uncertain markets. Hypothetical scenarios, like a U.S.-based fintech navigating regulatory hurdles, underscore the need for proven traction.

Investor criteria intensify at this stage compared to earlier rounds. The following table contrasts expectations across funding phases:

| Criteria | Series C/D | Series E |

|---|---|---|

| Growth Rate | 50%+ YoY revenue | 20%+ YoY with stability |

| Path to Profitability | Emerging focus | Clear trajectory within 2-3 years |

These benchmarks, informed by stage-specific success factors from our references, highlight Series E’s emphasis on sustainability. Investors apply stricter lenses to ensure alignment with deployable capital from networks exceeding $15 billion, preparing companies for sustained growth rather than explosive but unstable scaling.

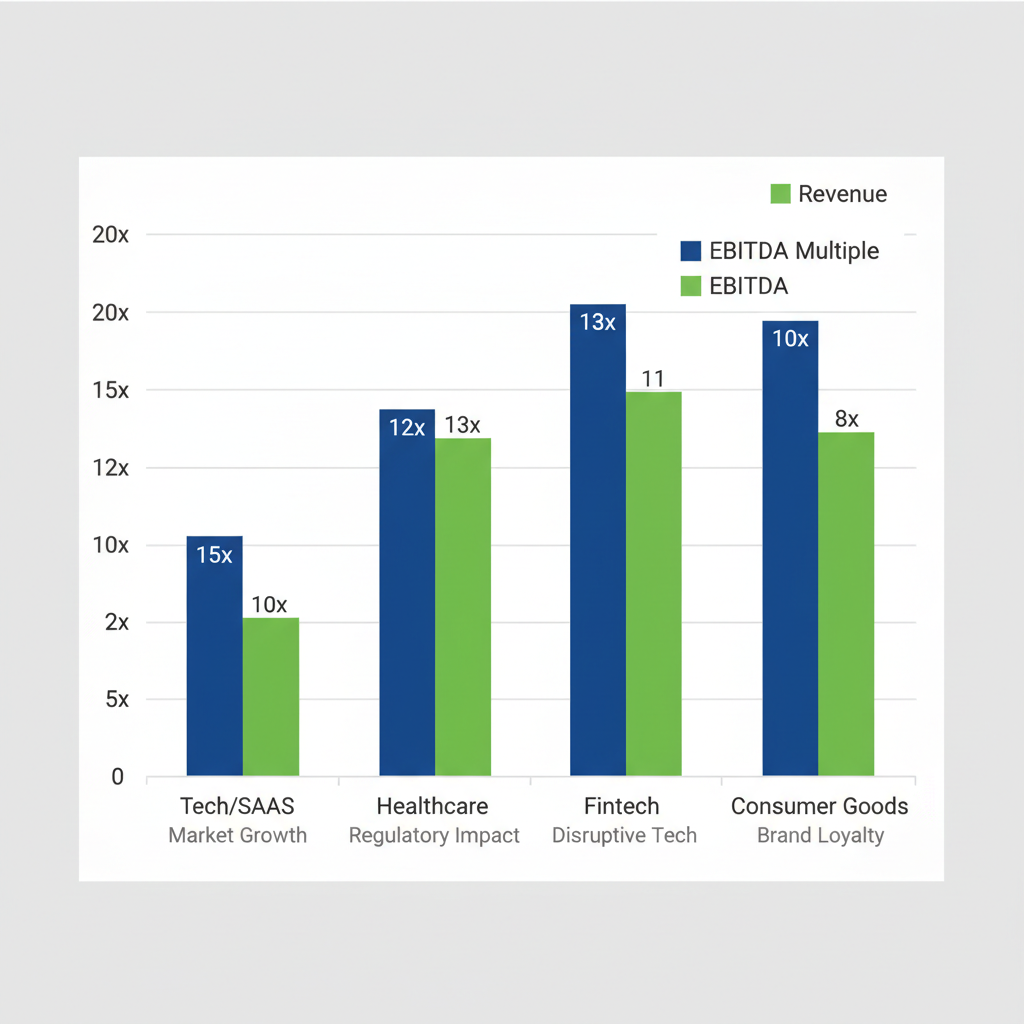

Series E valuation multiples by industry sectors visualization

Such comparisons reveal how expectations mature, setting the stage for valuation intricacies in late-stage funding.

Valuation Dynamics in Late-Stage Funding

Valuation in Series E rounds hinges on revenue and EBITDA multiples, typically ranging from 10-15x revenue in the U.S., influenced by economic conditions and competitive positioning. High-growth equity valuations reflect factors like recurring revenue streams and market dominance, with 2025 trends showing upward adjustments due to stabilizing interest rates and AI-driven efficiencies. For instance, Series E valuation multiples vary by sector, rewarding strong user metrics in fintech or regulatory milestones in healthcare.

We at Zaidwood assist in benchmarking these dynamics, drawing on full-cycle due diligence to validate IP and team expertise for optimal positioning. Startups raising $100-500 million in Series E funding must demonstrate scalable operations, as multiples compress under volatility but expand with proven paths to liquidity.

Common multiples illustrate this variability, determined by industry benchmarks and macroeconomic cues:

| Industry | Revenue Multiple | EBITDA Multiple | Key Influencing Factors |

|---|---|---|---|

| Tech/SaaS | 12-18x | 8-12x | Recurring revenue growth |

| Healthcare | 10-15x | 7-10x | Regulatory approvals |

| Fintech | 15-20x | 9-13x | User acquisition metrics |

| Consumer Goods | 8-12x | 6-9x | Market share stability |

Based on 2026 trends adapted to 2025 from our references, these figures apply to startups by highlighting sector-specific levers–Tech/SaaS firms, for example, command premiums through predictable cash flows, aiding negotiations in competitive landscapes.

Role of Debt in Series E Structures

Hybrid financing blends equity with debt options like mezzanine in Series E, optimizing capital stacks for balanced risk. This approach suits companies avoiding dilution while funding acquisitions or expansions, especially in a 2025 environment favoring flexible structures over pure equity.

We at Zaidwood emphasize debt advisory services to navigate these hybrids, structuring venture debt alongside equity based on our extensive investor network. For a hypothetical SaaS provider, integrating mezzanine debt could lower overall costs, ensuring agility without over-leveraging amid economic flux.

Preparing for Your Series E Raise

Armed with insights into Series E dynamics, preparation becomes key to securing substantial capital at this mature stage. We at Zaidwood Capital guide clients through late-round preparations, leveraging our full-cycle M&A and capital advisory expertise to streamline the process. This involves crafting robust documentation, mapping timelines, and engaging specialized support to align with investor expectations in a competitive landscape.

Building a Compelling Pitch and Documentation

At the Series E stage, your pitch deck must showcase proven traction metrics, such as revenue growth exceeding 100% year-over-year and scalable market penetration. We emphasize including clear exit strategies, like potential IPO paths or strategic acquisitions, to demonstrate long-term value creation. Pro forma financials are critical, incorporating 2025 projections that account for economic variables like moderating interest rates and inflation trends in the US. These models often feature Series E valuation multiples around 8-12x revenue for high-growth tech firms, stress-tested against scenarios to build investor confidence.

Drawing from established preparation checklists, as outlined in startup funding guides, we help clients develop valuation strategy development plans that highlight unit economics and customer lifetime value. Our strategic documentation services ensure pitches are polished, with visuals and narratives tailored for institutional audiences. For instance, we integrate $24.4 billion in aggregate transaction volume insights to benchmark your projections realistically.

The following table underscores the escalated rigor of Series E preparations compared to earlier rounds, informed by stage-specific tactics that demand deeper scrutiny.

| Preparation Element | Series C/D Focus | Series E Enhancements |

|---|---|---|

| Financial Projections | 3-year forecasts | 5+ year models with sensitivity analysis; stress-tested for economic scenarios |

| Due Diligence Readiness | Basic legal/financial review | Full-cycle (financial, legal, operational, IT); third-party audits included |

| Investor Targeting | 50-100 VCs | 200+ institutional contacts; tailored LP placements |

| Timeline | 6-9 months | 9-12 months with parallel tracks; for debt/equity hybrids |

This comparison highlights how Series E requires comprehensive foresight, enabling faster execution and reduced risks. By addressing these enhancements early, clients position themselves for smoother negotiations and higher valuations, benefiting from our precision in documentation that has supported over 300 deals.

Navigating the Fundraising Timeline

Series E funding timelines typically span 9-12 months, starting with internal readiness assessments and extending through closing. Initial steps include due diligence preparation across financial, legal, operational, and IT domains, ensuring all records are audit-ready to withstand investor scrutiny. We recommend parallel tracks for equity and debt components, especially in 2025, where interest rate impacts could influence hybrid structures–potentially lowering borrowing costs as rates stabilize around 4-5% for qualified issuers in the US.

Key milestones involve investor outreach via targeted networks, followed by term sheet negotiations and final closings. As noted in analyses of growth-stage evolutions, mature companies must adapt processes systematically to manage this extended cycle effectively. For example, allocating 2-3 months for pitch refinements and another 4-6 for diligence can prevent delays. Our experience shows that proactive timeline management, informed by historical deal data, accelerates closings by up to 20%, allowing focus on post-raise growth.

Leveraging Advisory Support

Engaging capital advisors like Zaidwood accelerates Series E raises through facilitated introductions to our network of over 4,000 institutional investors and access to $15 billion in deployable capital. We handle negotiations, leveraging our Deal Vault for proprietary insights and streamlined due diligence to minimize client burden. This support is vital for navigating complex LP placements and optimizing terms.

In the advisory subsection, consider the trade-offs between equity and debt options, as validated by stage-specific preparation references emphasizing hybrid approaches for mature firms.

| Type | Pros | Cons | Zaidwood Service |

|---|---|---|---|

| Equity | No repayment obligation; aligns incentives | Dilution of ownership | Growth equity placements via investor rolodex |

| Debt | Retain control; interest tax-deductible | Repayment pressure; covenants | Mezzanine and venture debt structuring |

Our equity advisory services integrate these options seamlessly, drawing on full-cycle expertise to tailor solutions. For instance, we recently advised a tech client on a $200 million Series E blend, enhancing liquidity without excessive dilution. This hands-on facilitation ensures efficient raises, connecting preparation efforts to successful outcomes while adhering to US regulatory standards.

Transitioning from these foundational preparations, advanced strategies in valuation and structuring become essential for maximizing Series E potential.

Advanced Strategies in Series E Valuation

Effective preparation in late-stage funding rounds sets the stage for advanced valuation approaches that maximize value in Series E rounds. At Zaidwood Capital, our team leverages sophisticated techniques to navigate the complexities of Series E valuation, focusing on multiples that reflect a company’s maturity and growth trajectory. These strategies incorporate current market dynamics to ensure fair and strategic pricing for investors and founders alike.

In Series E valuation multiples, two primary methods dominate: revenue multiples and EBITDA multiples. Revenue multiples, often ranging from 10-15x for high-growth US startups, emphasize top-line expansion, making them ideal for tech-driven firms scaling rapidly. EBITDA multiples, typically 6-10x for established US entities, account for operational efficiency and profitability assessments. Determining fair multiples requires analyzing comparable transactions, growth rates, and economic multiplier effects, drawing from global venture capital trends that highlight sustained private market liquidity.

The following table contrasts these multiple types to aid in selection:

| Multiple Type | Application | Advantages | Challenges |

|---|---|---|---|

| Revenue Multiple | Growth-focused companies | Simpler calculation | Ignores profitability |

| EBITDA Multiple | Profitable mature firms | Accounts for operations | Sensitive to cost structures |

Sourced from investment instrument analyses and 2025 trend projections, this comparison underscores selection criteria like company stage and sector. For growth-oriented ventures, revenue multiples simplify assessments amid volatile markets, while EBITDA suits firms with stable cash flows, as seen in automation and AI-integrated supply chains boosting productivity by up to 50%.

Looking to 2025, factors such as AI integration in operations and persistent inflation will influence Series E funding. Projections indicate secondary transactions exceeding $60 billion, providing liquidity without IPOs and elevating valuations in regions like Latin America and the Middle East. Our global network helps clients benchmark these shifts, ensuring multiples align with emerging trends like cybersecurity enhancements in AI-driven ecosystems.

To uplift valuations, we employ rigorous due diligence and proprietary tools for fairness opinions. Strategies include optimizing cap tables to minimize dilution and structuring deals that highlight unique assets, such as scalable models in stablecoin adoption. In our financial advisory transactions, this approach has facilitated efficient outcomes for clients navigating late-stage complexities. By addressing common queries on multiple determination and future influences, these tactics empower informed decision-making in Series E scenarios.

Common Questions About Series E Funding

Many entrepreneurs have investor queries about Series E, a critical late-stage funding milestone. This section addresses common funding FAQs to clarify processes and strategies, drawing on Zaidwood’s expertise in capital advisory.

What types of investors participate in Series E funding? Private equity firms and sovereign wealth funds often lead, seeking mature startups with proven scalability. In 2025, alternative liquidity paths like secondary transactions are gaining traction, as noted in the Endeavor Catalyst Annual Report, enabling capital flow for companies staying private longer.

What is the typical timeline for Series E funding in 2025? Timelines are accelerating due to tech shifts such as AI and automation, potentially compressing from 6-9 months to 4-6 months. We advise preparing robust financials early to align with these faster cycles.

How much capital is raised in Series E in the US? US-based rounds typically exceed $200 million, reflecting high Series E valuation multiples amid global innovation trends. This scale supports expansion into emerging markets like Latin America and the Middle East.

How should companies prepare for Series E? Focus on strong governance, diversified revenue, and liquidity options. Our full-cycle advisory helps streamline preparations, connecting you to institutional networks for optimal outcomes.

These insights underscore the value of expert guidance; actionable steps like financial audits pave the way for successful late-stage raises.

Next Steps in Late-Stage Funding

As companies approach Series E funding, they enter final funding phases marked by substantial raises, often exceeding $100 million, to fuel global expansion or acquisitions. Series E valuation multiples typically reflect mature metrics like revenue multiples of 8-12x, attracting institutional investors focused on scalability and exit potential. Preparation essentials include robust cap tables and due diligence readiness, drawing from diverse investment instruments like equity and debt.

At Zaidwood Capital, we provide tailored advisory for capital raising and full-cycle due diligence, leveraging our network of over 4,000 investors. Gain deal vault access to streamline your Series E journey.

Position your venture for success by partnering with us today.