Series A Funding

Table of Contents

Understanding Series A Funding Basics

At Zaidwood Capital, we recognize Series A Funding as a pivotal milestone in the startup journey, marking the transition from initial seed capital to substantial institutional backing. This early-stage venture capital round typically involves investments ranging from $2 million to $15 million, enabling companies to scale operations, refine products, and expand market reach. Unlike seed funding, which focuses on proving concepts, Series A emphasizes building a sustainable business model with demonstrated traction, such as consistent revenue growth and user acquisition metrics. For instance, a tech startup we advised progressed from a $500,000 seed round to securing $8 million in Series A, leveraging strong monthly recurring revenue to attract venture capital firms.

The Series A process generally spans 6 to 10 months, divided into preparation and execution phases. Preparation takes 3 to 6 months, involving internal readiness like financial modeling and team strengthening. Execution follows over 3 to 4 months, with key milestones including:

- Developing a compelling pitch deck that highlights market opportunity and competitive edge.

- Conducting targeted investor outreach to venture capital funds and angel networks.

- Negotiating the term sheet, which outlines investment terms and governance rights.

To contextualize Series A within broader startup investment rounds, consider the following comparison:

| Funding Stage | Typical Amount | Equity Dilution | Key Focus |

|---|---|---|---|

| Seed | $500K – $2M | 10-20% | Product validation and initial team building |

| Series A | $2M – $15M | 15-25% | Scaling operations and market expansion |

| Series B | $10M – $50M | 10-20% | Rapid growth and revenue optimization |

This progression underscores how each stage builds on the last, with equity dilution reflecting the value added at prior levels. Drawing from SEC guidelines on raising later-stage capital, Series A often involves equity financing that aligns investor interests with long-term success, minimizing risks through structured dilution.

We at Zaidwood Capital support entrepreneurs throughout this journey as a dedicated Investment Bank For Series A, connecting clients to our network of over 4,000 institutional investors. Our expertise in capital formation and due diligence streamlines access to growth capital, ensuring compliance and efficiency in competitive landscapes.

Upcoming sections explore Series A valuation methods, crafting a robust Series A term sheet, and essential requirements for attracting investors. Grasping these fundamentals equips founders to navigate this transformative phase confidently.

Series A Funding Fundamentals

Series A Funding represents a pivotal stage for startups transitioning from seed capital to institutional venture rounds. At this growth-stage investment level, companies must demonstrate robust fundamentals to attract discerning investors. We at Zaidwood Capital guide clients through this process, leveraging our network of over 4,000 institutional and private investors to facilitate connections and streamline capital formation.

Key Requirements for Series A Readiness

Securing Series A Funding hinges on several core prerequisites that signal scalability and viability. Startups typically need 12-18 months of proven traction, including consistent user growth or revenue streams, to validate product-market fit. A scalable business model, backed by intellectual property protection, further strengthens eligibility. According to SEC guidelines on capital raising readiness, maintaining accurate cap tables and financial statements is essential for transparency, while a clear plan for proceeds outlines how funds will fuel expansion.

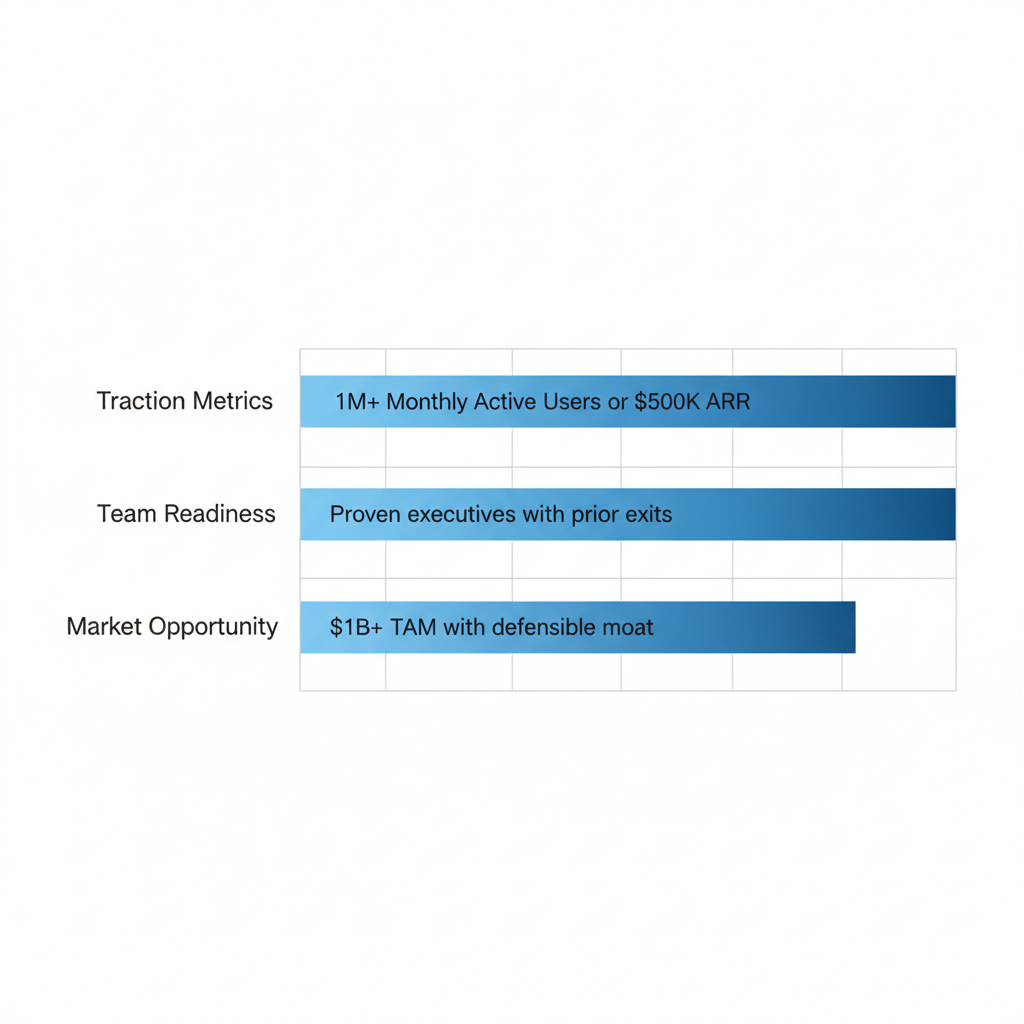

The following table outlines key requirements across essential categories, helping founders assess their preparedness:

| Requirement Category | Description | Typical Benchmarks |

|---|---|---|

| Traction Metrics | Evidence of product-market fit through user growth, revenue, or engagement. | 1M+ Monthly Active Users or $500K ARR |

| Team Readiness | Experienced founders and key hires in place. | Proven executives with prior exits |

| Market Opportunity | Addressable market size and competitive edge. | $1B+ TAM with defensible moat |

These benchmarks, drawn from industry standards for 2025 startups, underscore the need for data-driven validation. For instance, traction metrics not only quantify progress but also build investor confidence in sustainable growth trajectories. We assist clients in compiling these metrics during our full-cycle due diligence, ensuring alignment with SEC-recommended assessments.

One anonymized case involved a tech startup that, with our support, refined its 15-month revenue data to exceed $600K ARR, enabling a successful raise. Beyond metrics, team readiness involves assembling proven leaders, while market opportunity demands a total addressable market exceeding $1 billion with a unique competitive moat. These elements collectively position startups to meet institutional expectations without overpromising outcomes.

Series A funding fundamentals: essential benchmarks visualization

Interpreting these visualizations reveals how interconnected traction, team, and market factors are. Startups excelling in one area often bolster others, creating a compelling narrative for investors. This holistic approach, informed by resources like the SEC’s readiness checklists, empowers founders to self-evaluate and refine gaps before outreach.

Investor Profiles in Series A Rounds

Main investors in Series A Funding include venture capital firms, corporate venture arms, and family offices, each bringing distinct value. VCs prioritize high-growth potential, while corporates seek strategic synergies, and family offices offer flexible, patient capital.

Selection criteria for these investors focus on alignment with the startup’s vision and sector expertise, as emphasized in SEC investor strategy advice. We connect clients to accredited investors and qualified purchasers through our capital introduction services, drawing from a vast pool to match long-term visions.

The table below contrasts investor types to inform strategic targeting:

| Investor Type | Investment Size | Focus Areas |

|---|---|---|

| VCs | $5M-$15M | Scalable tech, disruptive innovation |

| Family Offices | $2M-$10M | Niche sectors, long-term holds |

| Corporates | $3M-$20M | Strategic partnerships, ecosystem integration |

Post-investment, these profiles influence governance and growth paths. VCs often provide mentorship for rapid scaling, family offices emphasize stability, and corporates enable market access. Implications for strategy include diversifying outreach to mitigate risks, with our advisory enhancing these partnerships through precise introductions.

Preparation Steps for Series A Success

Preparation begins with robust financial modeling and pitch refinement to articulate value creation. Develop pro forma statements projecting runway and milestones, ensuring compliance with securities laws via expert advisors. We support this phase with strategic documentation, including pitch decks and business plans tailored for institutional audiences.

Key steps include validating assumptions with historical data, securing legal reviews for IP, and simulating investor Q&A. Hiring accountants and attorneys, as recommended by SEC resources, navigates complexities like ownership reporting. Our team streamlines these efforts, providing access to deal vaults and investor rolodexes for efficient execution.

Equity Basics in Series A

Startups typically dilute 15-25% equity in Series A rounds, impacting Series A valuation significantly. Valuations often range from $10M to $30M pre-money, based on traction and market potential. This exchange funds scaling while retaining founder control, though term sheets outline protections.

We advise on fair structuring to balance dilution with growth, avoiding overvaluation pitfalls. As Series A Investment Bank, our expertise ensures equitable outcomes, teasing deeper valuation strategies in subsequent sections.

Deep Dive into Series A Processes

Series A funding represents a critical juncture for startups transitioning from seed stage to scalable operations. At Zaidwood Capital, we guide clients through these complexities with our expertise in full-cycle due diligence and equity advisory, ensuring robust preparation for valuation, scrutiny, and deal closure. This deep dive explores the key processes that shape successful outcomes in this funding round.

Valuation Methods and Factors

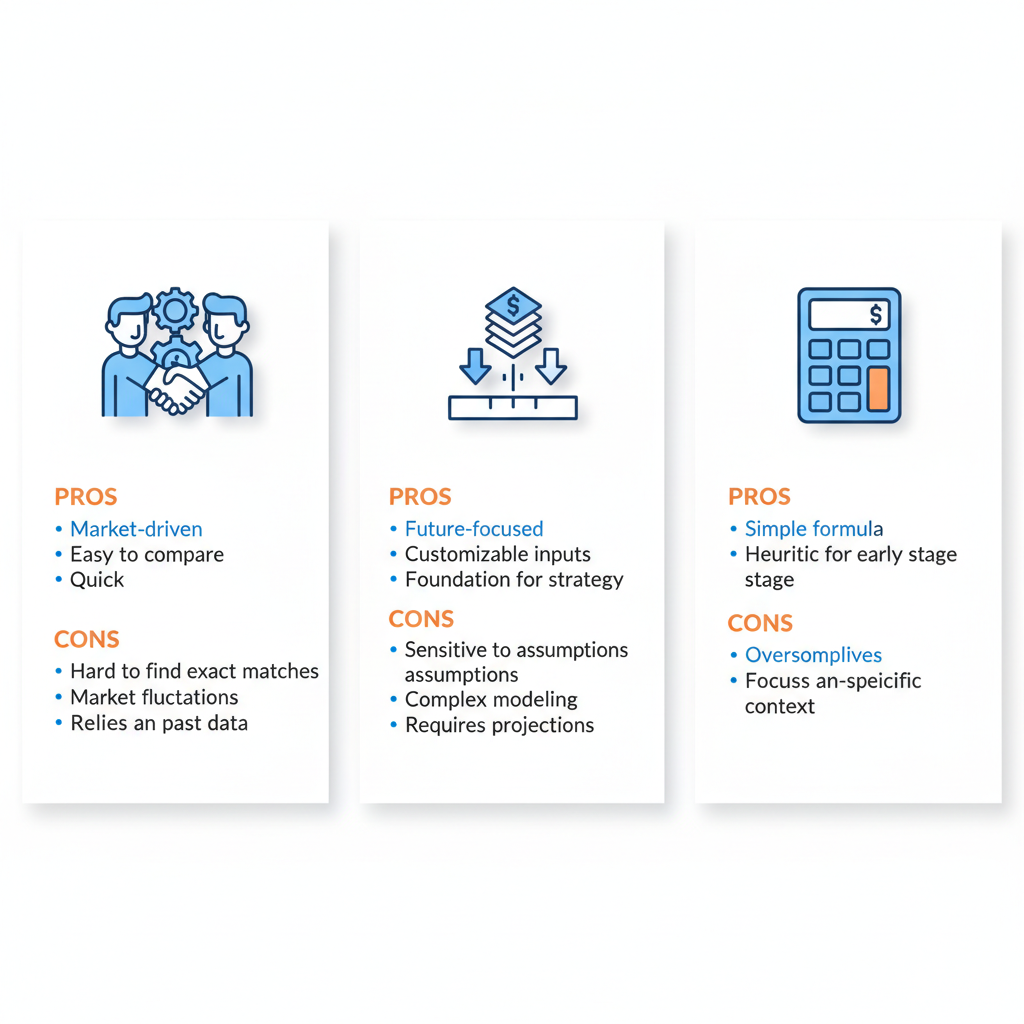

Determining Series A valuation requires a blend of quantitative and qualitative approaches to reflect a startup’s potential enterprise value. Common methodologies include comparable company analysis, discounted cash flow (DCF), and venture math, each offering unique lenses on funding round pricing.

Comparable company analysis benchmarks the startup against similar ventures using metrics like revenue multiples or user growth rates. This method draws on market data to establish a baseline, often adjusting for sector-specific premiums. For instance, in the AI sector, we observe heightened valuations in 2025-2026 due to rapid innovation cycles, with average US Series A deals reaching $20-30 million as per SEC insights on later-stage capital trends.

Discounted cash flow projects future revenues and discounts them to present value, emphasizing long-term viability. Venture math, meanwhile, back-calculates valuation based on exit scenarios and required ownership stakes for investors, simplifying early-stage projections.

Influencing factors extend beyond methods: strong intellectual property, proven team track records, and market traction significantly elevate valuations. Our proprietary tools at Zaidwood model these elements, incorporating 2025 trends like AI-driven efficiencies to avoid over-optimistic projections–a common pitfall that can derail rounds.

The following table compares these valuation methods, highlighting their applicability to Series A scenarios:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Comparable Company Analysis | Values based on similar startups’ metrics. | Quick benchmarks | Subjective multiples, less precise. |

| Discounted Cash Flow | Projects future cash flows discounted to present. | Forward-looking | Assumes accurate projections, high uncertainty for early-stage. |

Based on NVCA model documents, these approaches standardize practices while allowing customization. Comparable analysis suits fast-paced markets, whereas DCF provides depth for revenue-generating startups, though it demands reliable forecasts. Founders should prepare data rooms with traction metrics to support these evaluations, aligning with investor expectations for defensible pricing.

In practice, a SaaS startup might leverage comparables to justify a $25 million pre-money valuation, factoring in 40% YoY growth amid AI trends. At Zaidwood, we integrate such analyses into our advisory to optimize outcomes.

Series A valuation methods: Comparables, DCF, and Venture Math overview

Investor Due Diligence Essentials

Investor due diligence in Series A rounds scrutinizes a startup’s viability across multiple dimensions, demanding thorough preparation from founders. Our full-cycle due diligence services at Zaidwood uncover potential risks early, streamlining this phase.

Key components include financial audits to verify revenue streams and burn rates, legal reviews for incorporation and IP ownership, and operational assessments of team scalability. Drawing from NVCA checklists, investors probe cap tables for clean structures and compliance with SEC regulations on later-stage raises.

Founders must anticipate these by organizing audited financials, patent filings, and customer contracts. We emphasize IP audits, especially in tech sectors where 2025 trends amplify value.

To illustrate preparation contrasts, the table below outlines founder actions versus investor inquiries:

| Area | Founder Preparation | Investor Expectations |

|---|---|---|

| Financials | Audited statements, pro forma models | Revenue validation, burn rate analysis |

| Legal | Cap table cleanup, IP assignments | Compliance checks, litigation history |

| Operations | Scalability plans, key hires roadmap | Market fit evidence, go-to-market risks |

This framework, informed by NVCA standards, reveals gaps proactively. Effective prep mitigates red flags, positioning startups favorably as we facilitate targeted investor introductions from our network of over 4,000 institutions.

Negotiation Dynamics in Series A

Negotiations in Series A funding evolve from initial term sheet issuance to final closing, blending strategy with compromise to secure optimal terms. As a leading M&A capital advisory firm, we advise on these dynamics, leveraging our $24.4 billion in transaction experience.

The process begins with a letter of intent (LOI) outlining high-level terms, progressing to the term sheet that details valuation, investment amount, and governance rights. Pre-money valuation represents the startup’s worth before infusion, while post-money adds the new capital–critical for dilution calculations. For example, a $20 million pre-money valuation with $5 million raised yields a $25 million post-money figure, granting investors 20% ownership.

Common strategies include pushing for pro-rata rights to maintain stakes in future rounds and negotiating anti-dilution protections against down rounds. Liquidation preferences ensure investors recover funds first in exits, often at 1x non-participating levels per NVCA models.

From term sheet to due diligence confirmation, talks intensify on board seats and veto powers. We at Zaidwood employ scenario modeling to counter aggressive terms, advising on milestones for tranched funding–a 2025 norm for risk mitigation.

Closing involves executing definitive agreements, with our strategic documentation ensuring regulatory alignment. Pitfalls like undervaluing IP can erode leverage; thus, preparation via our equity advisory equips founders to navigate these, fostering equitable deals that fuel growth.

Practical Aspects of Series A Funding

Securing Series A funding marks a pivotal milestone for startups scaling beyond initial seed stages. At Zaidwood Capital, we guide entrepreneurs through these practical elements, leveraging our expertise in strategic documentation and capital introductions to streamline the process. This section outlines key steps from preparation to closing, highlighting how informed actions lead to efficient outcomes.

Preparing Pitch Materials

Crafting compelling pitch materials is essential for attracting Series A investors who seek evidence of scalability and market fit. We recommend starting with a concise pitch deck, typically 10-15 slides, that captures the core narrative. Essential slides include the problem statement, outlining the market pain point; the solution, demonstrating your unique value proposition; market opportunity, quantifying total addressable market size; and traction, showcasing user growth, revenue metrics, or key partnerships. Follow with team bios emphasizing relevant experience, competitive landscape analysis, go-to-market strategy, and a clear ask for funding amount tied to milestones.

Business plans expand on this foundation, providing a detailed roadmap. Include executive summary, company description, market analysis with SWOT, organizational structure, product roadmap, marketing and sales strategies, operational plans, and risk assessment. Pro forma financials form the backbone, projecting income statements, balance sheets, and cash flows for 3-5 years, assuming realistic growth rates and expense scaling.

The following table contrasts pitch decks and business plans to clarify their distinct roles:

| Element | Pitch Deck Focus | Business Plan Depth |

|---|---|---|

| Problem/Solution | High-level overview, visual storytelling | Detailed analysis, customer interviews |

| Market Analysis | TAM/SAM/SOM estimates, key trends | In-depth segmentation, competitive matrix |

| Financial Projections | High-level asks and runway | Full pro formas, sensitivity analysis |

| Team and Operations | Key bios, high-level strategy | Org charts, detailed operational timelines |

This comparison underscores why pitch decks prioritize persuasion for initial investor meetings, while business plans offer substantive depth for due diligence. Why it matters: Investors use these materials to assess viability quickly, with SEC guidelines from ‘Ready to Raise Capital’ stressing clear cap tables and financial transparency to build trust. Tips: Tailor decks to investor preferences using tools like Canva for visuals; validate pro formas with historical data; iterate based on feedback to refine messaging. By aligning these elements, founders position their ventures for stronger Series A funding pursuits.

Engaging Advisory Support

Engaging experienced advisors accelerates Series A funding by bridging gaps in investor networks and deal expertise. Firms like ours at Zaidwood Capital provide boutique M&A advisory services that include crafting investor-ready documentation, targeted outreach to our network of over 4,000 institutional and private investors, and hands-on support in term sheet review and closing coordination.

Our process begins with assessing your capital needs and refining pitch materials to highlight traction and valuation drivers. We then facilitate introductions to aligned limited partners (LPs), leveraging the Velocity Matrix for efficient matching based on sector, stage, and geography–such as advisory services in Wyoming for regional funds. During negotiations, we analyze investment agreement drafts, flag risks in venture term negotiations, and coordinate due diligence to ensure smooth progression.

Why it matters: Advisory support mitigates common pitfalls like mismatched investor expectations, as noted in SEC resources emphasizing strategic investor selection for long-term alignment. With our full-cycle due diligence and capital formation capabilities, we reduce time to close, drawing on 24.4 billion USD in aggregate transaction volume. Tips: Vet advisors for track records in Series A deals; schedule initial consultations to outline scopes; integrate their insights early to avoid revisions. This partnership empowers founders to navigate complexities confidently, enhancing funding success rates.

Negotiation and Closing Steps

Negotiating and closing a Series A round demands precision to balance founder control with investor protections. Begin with term sheet review: Scrutinize key provisions like valuation, which sets the pre-money benchmark for equity dilution. Counteroffers should address favorable terms while maintaining momentum.

- Receive and analyze the initial term sheet, focusing on economic and control elements.

- Engage legal counsel for redline suggestions, incorporating NVCA model documents for standard clauses.

- Conduct due diligence, providing requested documents like cap tables and IP assignments.

- Finalize legal documentation, including stock purchase agreements and investor rights.

- Coordinate closing: Handle wire transfers, update cap tables, and issue shares.

The following table compares founder-friendly versus investor-heavy term sheet provisions, informed by NVCA standards:

| Term | Founder-Friendly | Investor-Heavy |

|---|---|---|

| Liquidation Preference | 1x non-participating | 2x participating (Prioritizes returns) |

| Anti-Dilution | Narrow-based weighted average | Full ratchet (Stronger protection) |

| Board Control | Majority founder seats | Investor majority (Governance leverage) |

These contrasts reveal negotiation leverage points; for instance, non-participating preferences allow founders greater upside in exits. Why it matters: Balanced terms prevent future disputes, with SEC guidelines underscoring transparency in ownership reporting. Common pitfalls include overlooking anti-dilution impacts on Series A valuation during down rounds. Tips: Prioritize economics first, then governance; use templates from NVCA to benchmark; involve advisors for impartial reviews. Upon agreement, execute closing logistics efficiently to activate funds, ensuring compliance and momentum for growth.

Advanced Series A Strategies

At Zaidwood Capital, we specialize in guiding startups through the complexities of Series A Funding, drawing on our extensive experience in full-cycle M&A and capital advisory. With over $24.4 billion in aggregate transaction volume, we have honed sophisticated tactics that elevate round optimization tactics for high-growth ventures. These strategies focus on maximizing valuation while mitigating risks in a competitive landscape.

Investor syndication stands out as a cornerstone for scaling Series A rounds beyond traditional single-lead structures. By pooling commitments from multiple venture firms, syndicates distribute risk and amplify capital inflows, often enabling rounds to exceed $20 million. Drawing from NVCA Model Legal Documents, which outline standardized syndication mechanics like tranched financings tied to milestones, we advise founders to leverage these for phased disbursements that align investor confidence with performance targets. In one anonymized deal we facilitated, syndication unlocked $25 million by connecting a tech startup to diverse funds, enhancing credibility and negotiation leverage. This approach not only broadens capital access but also fosters strategic partnerships that propel post-investment growth.

The following table illustrates the stark differences in investor network access levels between self-managed efforts and partnering with an advisory firm like ours:

| Aspect | Self-Managed | Advisory Firm (e.g., Zaidwood) |

|---|---|---|

| Network Size | Limited to personal contacts | 4,000+ institutional investors (Global reach) |

| Capital Access | Variable, smaller pools | $15B+ deployable capital (Structured introductions) |

Based on our reported network and SEC insights on capital raising, advisory partnerships provide structured pathways to institutional backers, far surpassing individual outreach limitations. This access transforms syndication from a logistical challenge into a strategic advantage, setting the stage for robust negotiations.

Advanced negotiations in Series A Funding demand mastery of levers like earn-outs and milestone-based payouts to bridge valuation gaps. We emphasize dissecting the Series A term sheet for hybrid debt-equity structures, where convertible notes evolve into preferred stock with protective provisions. Incorporating ESG factors, a rising trend for 2025-2026, can justify premium Series A valuations by demonstrating sustainable scalability. NVCA resources highlight variations in investors’ rights agreements that safeguard against dilution, empowering founders to counter aggressive liquidation preferences. Through our mergers acquisitions advisory expertise, we prepare clients with fairness opinions that validate terms, ensuring equitable outcomes without overpromising results.

Post-funding governance requires proactive board dynamics and transparent reporting to sustain momentum. We guide the establishment of balanced boards post-Series A, integrating investor oversight with founder autonomy via NVCA-inspired voting agreements. Regular KPI disclosures and milestone audits prevent misalignments, while governance post-investment frameworks address compliance in hybrid financings. In evolving markets, these practices mitigate pitfalls like over-dilution, positioning companies for seamless Series B transitions. Our strategic consulting ensures tailored reporting that builds enduring trust with stakeholders.

Series A Funding FAQ

Q: What is the average US Series A valuation in 2025?

A: Typically ranging from $20-30 million, valuations reflect market conditions, traction, and sector. Per SEC guidelines, accurate assessments ensure fair equity distribution (20 words).

Q: What are key pitfalls in a Series A term sheet?

A: Overly aggressive investor preferences, like broad liquidation rights, can erode founder control. Consult the SEC Glossary for terms; we advise balanced structuring to protect interests (22 words).

Q: How does advisory support negotiations?

A: Our team assists with term clarifications, investor introductions, and equity structuring. For comprehensive capital needs, explore our debt advisory services alongside equity rounds (21 words).

Q: What are current equity dilution trends?

A: Startups often dilute 15-25% in Series A, varying by valuation and round size. Anti-dilution provisions, as defined in SEC resources, safeguard against future down rounds (20 words).

Q: What are post-money valuation implications?

A: It determines ownership post-investment, influencing control and exits. Higher post-money reduces dilution but signals stronger terms; strategic planning aligns with long-term goals (19 words).

Q: What factors determine investor interest?

A: Strong team, product-market fit, scalable revenue, and defensible moats drive decisions. We leverage our network to connect with aligned VCs for optimal outcomes (18 words).

Navigating Series A Success

Successfully securing Series A Funding requires meticulous preparation, accurate Series A valuation, strategic negotiation of the Series A term sheet, and a smooth closing. Throughout this guide, we’ve covered these stages, from building a compelling pitch to navigating equity structures and due diligence. As outlined by the SEC, compliant capital raising ensures transparency and investor confidence in later-stage rounds.

At Zaidwood Capital, we leverage our network of over 4,000 institutional investors and $24.4B in transaction experience to guide founders through these complexities. Our full-cycle advisory streamlines your path to growth.

Ready to scale? Contact us for a consultation on your funding wrap-up and beyond. This website is for informational purposes only and is not an offer, solicitation, or commitment to transact.