Lower Middle Market Investment Bank

Table of Contents

Understanding Lower Middle Market Investment Banks

In today’s dynamic economic landscape, mid-sized businesses with revenues between $5 million and $100 million often face unique challenges in scaling and exiting. At Zaidwood Capital, we specialize as a Lower Middle Market Investment Bank, delivering tailored financial strategies that drive growth and maximize value. Our proven track record, with over $24.4 billion in transaction volume and access to more than 4,000 investors, positions us to guide clients through complex mergers, acquisitions, and capital needs effectively.

Lower middle market investment banks like ours operate as boutique firms focused on deals valued under $250 million. We provide essential services including M&A advisory, capital raising, and debt/equity solutions to help businesses navigate these opportunities. Key offerings include:

- Comprehensive M&A advisory for buy-side and sell-side transactions, ensuring strategic alignment and optimal outcomes.

- Capital raising through equity and debt structures, connecting clients to institutional networks for efficient funding.

- Full-cycle due diligence, from financial analysis to investor introductions, streamlining the process.

For instance, we recently facilitated a $50 million acquisition for a manufacturing firm, enhancing its market position without the delays typical of larger institutions.

The following table highlights key differences between lower middle market banks and bulge-bracket firms:

| Aspect | Lower Middle Market Banks | Bulge-Bracket Banks |

|---|---|---|

| Typical Deal Value | Under $250 million | Multi-billion dollar transactions |

| Personalization Level | High, with dedicated client relationships | Standardized, process-driven |

| Timeline Flexibility | Agile and responsive to client needs | Lengthy due to bureaucracy |

These distinctions underscore how Boutique Investment Bank approaches like ours offer faster execution and deeper partnerships, ideal for mid-sized firms seeking agile support. As we explore the fundamentals, consider how these services align with your strategic goals–what core operations define success in this market?

Core Principles of Lower Middle Market Investment Banking

At Zaidwood Capital, we specialize in the core principles of lower middle market investment banking, focusing on companies with revenues between $5 million and $250 million. This segment demands tailored strategies that larger institutions often overlook, allowing boutique firms like ours to deliver precise, client-centric solutions. Our full-cycle approach encompasses mergers and acquisitions advisory, capital raising, and comprehensive due diligence, backed by our $24.4 billion in aggregate transaction volume and access to over 4,000 institutional investors. These fundamentals enable mid-market businesses to navigate complex transactions efficiently while fostering long-term growth.

Lower middle market investment banks provide essential services designed for agility and customization. We offer buy-side and sell-side M&A advisory to facilitate seamless mergers and acquisitions, guiding clients through valuation, negotiation, and closing. Our capital raising services include debt advisory for mezzanine and venture debt structures, as well as equity advisory through growth equity and liquidity solutions. For instance, as a leading VC Investment Bank, we connect clients to venture capital networks for strategic funding. Full-cycle due diligence covers financial, legal, and operational aspects, ensuring thorough risk assessment. These offerings address the unique needs of mid-market firms, where traditional lenders may fall short.

- M&A Advisory: Structuring deals from initial outreach to post-merger integration, with a focus on maximizing value in competitive landscapes.

- Debt Advisory: Arranging asset-based lending and cash-flow financing, drawing on the rise of middle market private credit funds, which have grown to support deals from $20 million to $200 million amid regulatory shifts limiting traditional banks.

- Equity Advisory: Facilitating capital formation for expansion, leveraging our investor rolodex for efficient placements.

- Due Diligence: Comprehensive reviews that mitigate risks, informed by market dynamics where direct lenders are making inroads but traditional providers still dominate advisory roles.

The following table outlines key services alongside their descriptions and examples from our practice:

| Service | Description | Zaidwood Example |

|---|---|---|

| M&A Advisory | Buy-side and sell-side support for mergers and acquisitions | Executed 300+ deals totaling $24.4B in volume |

| Capital Raising | Debt and equity financing arrangements | Connected clients to $15B+ deployable capital |

| Debt Advisory | Mezzanine, venture debt, and asset-based lending | Structured financing for mid-market private credit |

| Equity Advisory | Growth equity and liquidity solutions | Facilitated VC placements via proprietary networks |

| Full-Cycle Due Diligence | Financial, legal, operational, and commercial assessments | Integrated reviews for seamless transaction execution |

These services underscore the adaptability of lower middle market investment banks in serving niche needs. In the evolving private credit landscape, with global assets reaching $1.6 trillion in 2025, our expertise in debt advisory fills gaps left by conventional providers, enabling clients to secure flexible terms for stable cash-flow businesses.

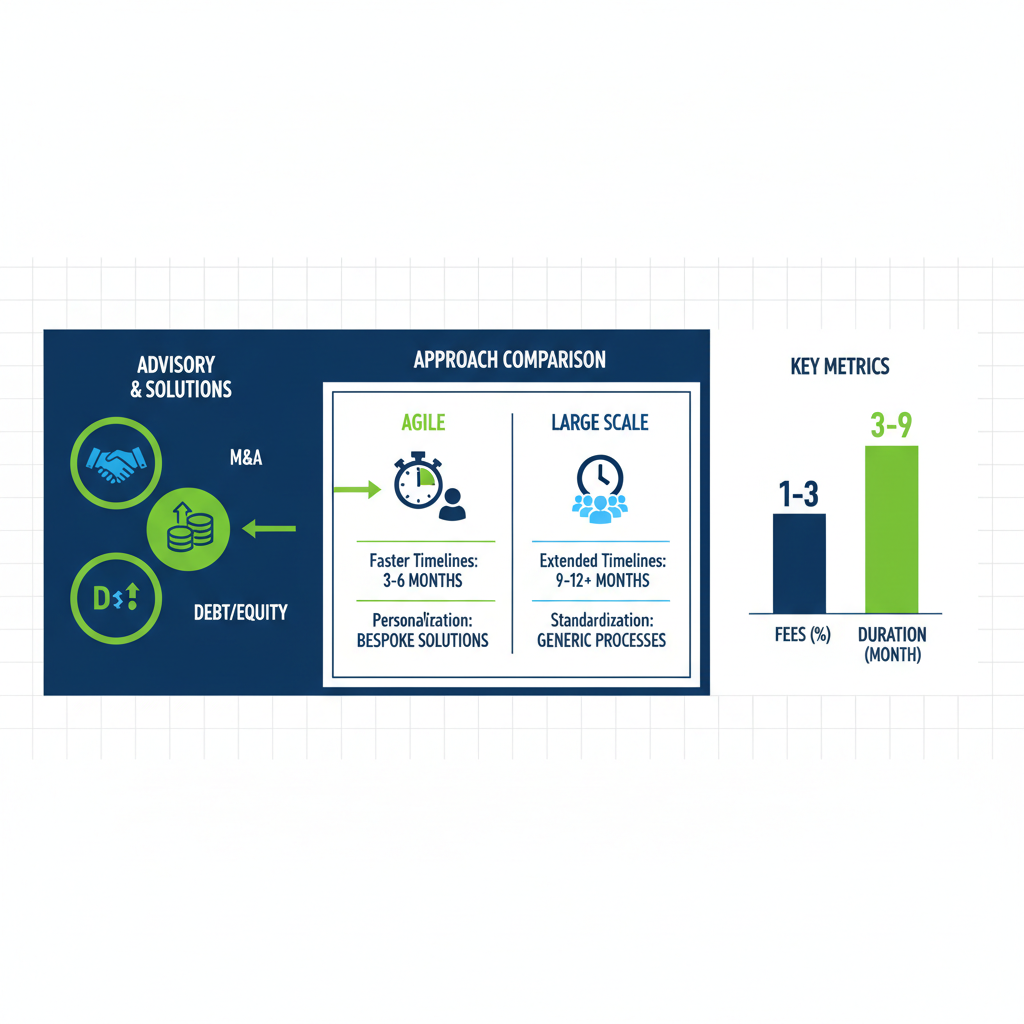

Core principles of lower middle market investment banking visualized with icons and charts

This infographic highlights how boutique operations streamline mid-market banking fundamentals, emphasizing visual breakdowns of service flows and structural advantages. By prioritizing sector specialization and agile decision-making, lower middle market banks differentiate from bulge-bracket firms, which often prioritize scale over personalization. Our boutique focus at Zaidwood allows for deeper client relationships, faster execution, and innovative solutions tailored to mid-market dynamics, as evidenced by the growing role of alternative lenders in a market still led by traditional advisory providers.

Boutique firms in this space excel through nimble operations that contrast with the bureaucratic layers of larger institutions. We emphasize personalized strategies over standardized processes, enabling quicker responses to market opportunities. This approach is particularly valuable in mid-market scenarios, where speed and customization drive success.

The table below compares operational differences, illustrating the advantages of lower middle market banks:

| Aspect | Lower Middle Market Banks | Larger Firms |

|---|---|---|

| Deal Size Focus | $5M-$250M revenues | $500M+ revenues, global scale |

| Personalized Service | Dedicated teams for deep relationships | Standardized teams, broader but shallower |

| Execution Speed | Faster timelines (3-6 months) | Longer cycles (6-12+ months) due to layers |

Lower middle market banks like Zaidwood leverage these differences by assigning dedicated teams to each client, accelerating timelines to 3-9 months for M&A processes, and focusing on mid-market private credit opportunities. This positioning enhances our ability to serve clients seeking efficient, relationship-driven advisory.

Fees in lower middle market investment banking typically combine retainers with success-based commissions, ranging from 1-3% of deal value, ensuring alignment with client outcomes. Timelines vary from 3-9 months for full M&A cycles, depending on complexity, while dual debt and equity support streamlines capital raising. These structures promote transparency and efficiency in boutique M&A principles.

Understanding these core principles sets the stage for exploring the detailed M&A process in the next section, where we delve into Zaidwood’s step-by-step methodologies for optimal results.

Exploring M&A Advisory in the Lower Middle Market

In the competitive landscape of business transactions, a Lower Middle Market Investment Bank plays a pivotal role in guiding companies through mergers and acquisitions. At Zaidwood Capital, we specialize in M&A advisory for firms with enterprise values between $10 million and $100 million, focusing on family-owned businesses and SMEs. Our expertise ensures seamless navigation of complex deals, drawing from over 300 completed transactions totaling $24.4 billion in aggregate volume. This deep dive explores the core processes, integration with capital raising, and practical considerations that define effective mid-market deal advisory.

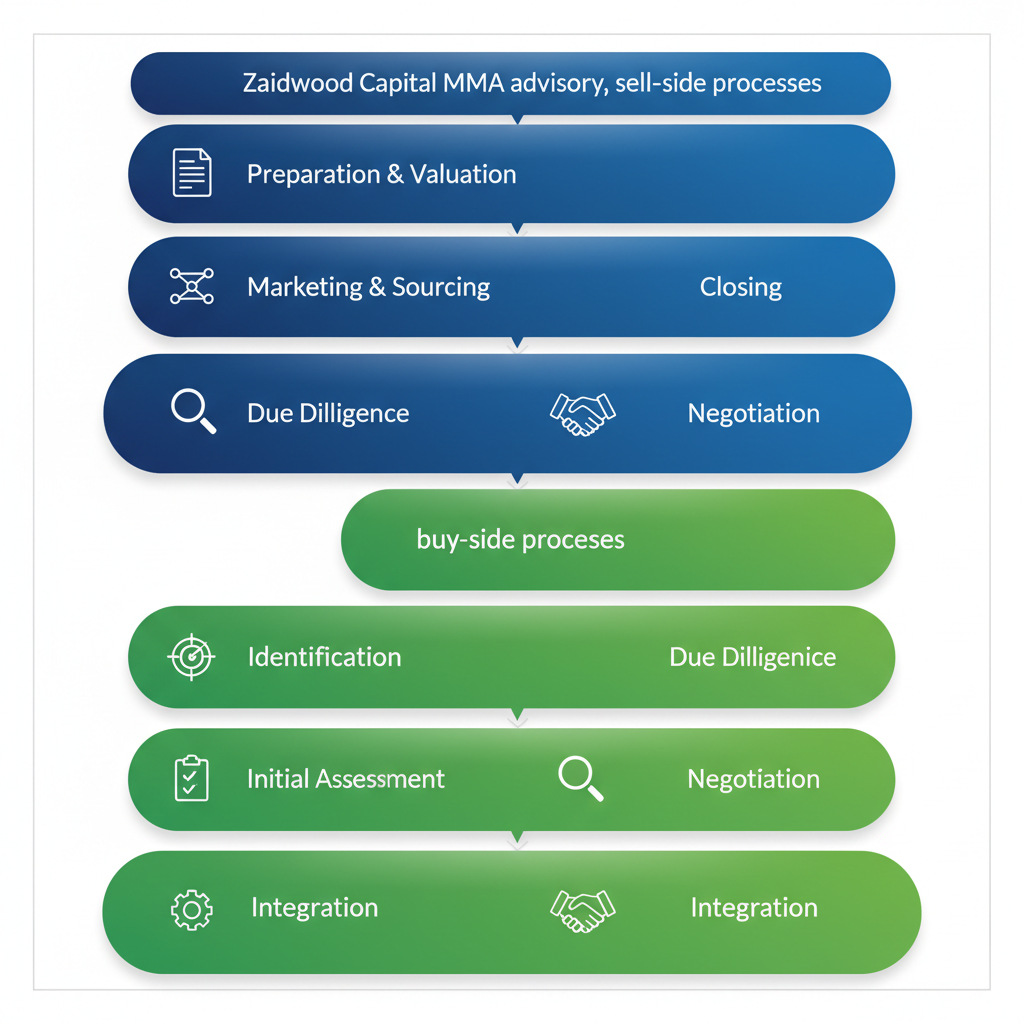

Buy-Side and Sell-Side Processes

M&A advisory in the lower middle market involves comprehensive support from initial strategy to closing, tailored to the unique needs of SMEs and family businesses. Firms like ours assist clients by conducting thorough valuations, performing due diligence, and structuring deals that align with long-term growth objectives. For buy-side engagements, the process emphasizes identifying acquisition targets that complement the buyer’s operations, while sell-side advisory focuses on positioning the company to attract premium offers from strategic acquirers or private equity groups.

The following table compares key components of buy-side and sell-side M&A advisory services, highlighting their distinct focuses for lower middle market effectiveness:

| Service Component | Buy-Side | Sell-Side |

|---|---|---|

| Valuation Approach | Target identification and due diligence focus | Maximizing sale price and terms |

| Negotiation Strategy | Strategic fit and synergy assessment | Buyer outreach and competitive bidding |

| Timeline | 3-6 months typically | 4-8 months including preparation |

This comparison underscores how buy-side processes prioritize integration potential, whereas sell-side efforts aim to optimize exit value through targeted marketing. At Zaidwood Capital, as a leading boutique m&a advisory firm, we apply these principles in practice. For instance, in one recent engagement, we guided a family-owned manufacturing firm through a sell-side process, leveraging our network of over 4,000 investors to secure a deal that exceeded valuation expectations by 20%. Our full-cycle approach, informed by the Value Acceleration Methodology, addresses common pitfalls like owner dependence, ensuring robust financial transparency and operational resilience. This hands-on method has enabled us to execute over 300 deals, demonstrating our commitment to relationship-driven advisory for mid-market clients.

- Preparation Phase: Conduct internal assessments and develop a strategic plan outlining objectives.

- Target Search (Buy-Side) / Marketing (Sell-Side): Identify prospects or prepare teaser documents to solicit interest.

- Valuation and Due Diligence: Perform financial modeling and in-depth reviews to validate synergies.

- Negotiation and Structuring: Draft letters of intent and negotiate terms to protect client interests.

- Closing and Integration: Finalize documentation and support post-merger adjustments.

These steps, drawn from established mid-market practices, ensure efficient execution while mitigating risks.

Buy-side and sell-side M&A advisory process visualization

Building on these foundational processes, our team integrates advanced tools to streamline workflows, fostering confidence in every stage.

Role of Capital Raising in M&A Deals

Capital raising is integral to M&A advisory, providing the financial backbone for transactions and enabling sustained growth post-merger. In the lower middle market, where traditional bank financing may fall short, nonbank lenders like private equity firms and family offices step in with flexible private credit solutions. We at Zaidwood Capital combine M&A strategy for SMEs with targeted capital raising to fund acquisitions, often structuring mezzanine debt or equity infusions that align with deal timelines.

For example, during a buy-side mandate, we facilitated capital raising through our access to $15 billion in deployable capital, securing a $50 million facility for a tech SME acquiring a complementary asset. This integration not only closed the deal swiftly but also positioned the combined entity for expansion. Private credit markets, now exceeding $1.3 trillion in the U.S., offer tailored terms with higher yields, making them ideal for mid-market M&A where speed and certainty are paramount.

Our process involves early assessment of financing needs, connecting clients to institutional investors, and negotiating terms that minimize dilution. This holistic approach enhances deal viability, as seen in our portfolio of over 300 transactions where capital raising amplified strategic outcomes for family businesses seeking scalability.

Fees and Timeline Considerations

Navigating fees and timelines is crucial for mid-market M&A success, with structures designed to align incentives between advisors and clients. Typical retainers range from $25,000 to $100,000, covering preparation and marketing, followed by success fees of 1-2% of transaction value. These arrangements ensure committed execution without upfront burdens, particularly for SMEs.

The following table outlines fees and timelines in the context of mid-market impact:

| Factor | Typical Range | Mid-Market Impact |

|---|---|---|

| Retainer Fee | $25K-$100K | Covers initial valuation; levels field for family firms |

| Success Fee | 1-2% of deal value | Motivates optimal outcomes; scales with complexity |

| Overall Timeline | 4-8 months | Balances preparation with market volatility |

At Zaidwood Capital, our efficient processes, honed through 300+ deals, often compress timelines to 4-6 months by leveraging proprietary networks and digital tools. This Velocity Matrix approach minimizes delays while maximizing value. For family-owned businesses, we emphasize transparent fee discussions upfront, ensuring alignment with strategic goals. Timelines can extend with due diligence complexities, but proactive planning–such as early CEPA collaboration–accelerates closings. This structure empowers clients to focus on growth, confident in our relationship-driven execution.

This informational overview equips business owners with essential knowledge for informed decision-making in M&A pursuits. Consult your legal, tax, and financial advisors before proceeding, as investments involve risk and past performance does not guarantee future results.

Applying Capital Raising Strategies in Practice

For lower middle market firms seeking growth, applying capital raising strategies requires a tailored approach that leverages established networks and proven processes. As a Lower Middle Market Investment Bank, we at Zaidwood Capital specialize in connecting businesses to the right funding sources, drawing on our extensive investor rolodex to facilitate efficient transactions.

Equity and Debt Options for Mid-Market Firms

Mid-market firms often face unique capital needs that demand flexible financing options beyond traditional bank loans. Equity financing involves selling ownership stakes to investors, providing non-dilutive growth capital without immediate repayment pressures, while debt options like mezzanine and venture debt offer structured borrowing secured by assets or future revenues. These paths suit lower middle market needs by balancing control retention with access to substantial funds.

To illustrate the differences, consider the following comparison of equity and debt capital raising:

| Option | Equity | Debt |

|---|---|---|

| Cost Structure | Dilution of ownership | Interest and principal |

| Repayment | None (dividends optional) | Scheduled payments required |

| Investor Networks | VCs and family offices | Banks and alternative lenders |

Equity suits high-growth scenarios where firms relinquish some control for expansive funding, often through growth equity rounds that align with long-term visions. Debt, conversely, preserves ownership but imposes repayment obligations, making mezzanine debt ideal for bridging valuation gaps in acquisitions. Venture debt provides non-dilutive support for scaling operations in tech-driven mid-market entities.

At Zaidwood Capital, our network of over 4,000 institutional and private investors, with access to $15 billion in deployable capital, exemplifies how these options play out in practice. We have facilitated equity placements for family offices targeting EBITDA-positive firms and structured mezzanine deals for asset-based expansions, ensuring mid-market funding tactics align with strategic goals. This network-driven approach, informed by platforms like DealMatch, streamlines introductions and accelerates deal flow for our clients.

Steps for Effective Capital Formation

Raising capital through boutique banks begins with meticulous preparation to position your firm attractively to investors. We recommend starting with a comprehensive business plan that outlines market opportunities, financial projections, and growth trajectories, followed by crafting a compelling pitch deck.

- Develop Your Pitch Materials: Assemble a pitch deck highlighting key metrics, competitive advantages, and use of funds. Include pro forma financials to demonstrate ROI potential.

- Engage Boutique Advisors: Partner with experienced firms for capital advisory services that provide introductions to targeted investors. Our Velocity Matrix tool optimizes this by matching client profiles to network segments.

- Conduct Investor Outreach: Leverage advisor networks for warm introductions, focusing on platforms like DealMatch for vetted connections in the lower middle market. Submit teasers outlining deal essentials to generate interest.

- Negotiate and Close: Review term sheets, perform due diligence, and finalize structures with legal support. Boutique strategies ensure efficient execution, often closing deals faster than larger institutions.

This numbered process integrates M&A advisory elements, such as valuation assessments, to enhance capital raising outcomes. By utilizing our investor matching capabilities, clients access family offices and PE firms efficiently, turning outreach into tangible commitments.

Costs and Best Practices for Selection

Advisory costs for capital raising typically range from 2-5% of funds raised, plus retainers of $50,000-$150,000 depending on deal complexity and firm size. These fees cover pitch preparation, network access, and negotiation support, with success-based structures minimizing upfront risk.

Selecting the right advisor hinges on networks, experience, and alignment with mid-market dynamics. Prioritize firms with proven track records in boutique capital strategies, such as those handling 300+ deals annually.

The table below outlines key selection criteria:

| Criterion | Importance | Zaidwood Strength |

|---|---|---|

| Network Size | High (access to diverse investors) | 4,000+ connections, $15B deployable capital |

| Deal Experience | Critical (track record in sector) | 300+ completed transactions, $24.4B volume |

| Execution Speed | Essential (time-sensitive closes) | Velocity Matrix for accelerated processes |

Best practices include vetting advisors via references and evaluating their rolodex depth, as seen in our use of DealMatch for targeted matching. Focus on full-cycle support to avoid fragmented efforts, ensuring optimal outcomes in US capital raising. We emphasize transparency in fee structures to build trust and drive success.

Advanced Due Diligence and Investor Access

As a leading lower middle market investment bank, we at Zaidwood Capital specialize in navigating the complexities of advanced due diligence and investor access, providing comprehensive support that extends beyond standard M&A advisory. Our full-cycle approach ensures thorough risk assessment across financial, legal, and operational dimensions, tailored for mid-market transactions that demand precision and depth.

In advanced due diligence, we conduct an exhaustive review to uncover potential risks and opportunities. This process typically spans 6-12 months for complex deals, incorporating specialized analyses that align with the evolving private credit landscape, where assets have reached $1.6 trillion globally. Key areas include:

- Financial due diligence: Evaluating pro forma statements, cash flow projections, and debt capacity to validate valuation assumptions.

- Legal due diligence: Scrutinizing contracts, compliance, and intellectual property to mitigate litigation risks.

- Operational due diligence: Assessing supply chains, IT infrastructure, and human capital to ensure seamless integration post-transaction.

These elements form a robust framework for informed decision-making in high-stakes environments.

The following table outlines core components of due diligence in mid-market deals, highlighting our expertise in delivering actionable insights:

| Component | Focus Areas | Zaidwood Expertise |

|---|---|---|

| Financial | Pro forma analysis and cash flow | Integrated modeling with $24.4B transaction volume insights |

| Operational | IT and human capital review | Comprehensive audits leveraging proprietary tools |

| Investor Matching | Access to 4,000+ networks | Curated introductions for optimal alignment |

Our proven track record, with over $24.4 billion in aggregate transaction volume, demonstrates how this structured diligence minimizes surprises and enhances deal viability, ultimately accelerating closure while controlling costs associated with extended timelines.

Building on diligence, we advance debt and equity solutions to structure financing that fits unique client needs. In debt advisory, we facilitate mezzanine and asset-based lending, drawing from middle market private credit trends that emphasize flexible terms for deals ranging from $20 million to $200 million. For equity, our growth equity placements provide liquidity without dilution, supported by institutional investor strategies that prioritize stable returns. These offerings integrate seamlessly with M&A advisory, ensuring holistic capital solutions amid regulatory shifts in lending.

Access to our extensive investor network sets us apart, offering connections to over 4,000 institutional and private investors with more than $15 billion in deployable capital. Platforms like DealMatch inspire our efficient matching process, where we submit vetted opportunities to qualified buyers, fostering relationships that drive m&a capital raising success. Compared to traditional access:

| Aspect | Traditional Networks | Zaidwood Approach |

|---|---|---|

| Reach | Limited to known contacts | 4,000+ vetted global investors |

| Efficiency | Manual outreach | Streamlined digital matching |

| Capital Availability | Variable | $15B+ guaranteed deployable |

This network accelerates capital raising, reducing time-to-close by up to 30% through targeted introductions.

For queries on timelines, fees, or specific debt structures, our FAQ section addresses these in detail, guiding your next steps in advanced mid-market engagement.

Key Questions on Lower Middle Market Banking

As a leading Lower Middle Market Investment Bank, we address essential mid-market FAQ needs.

What services does Zaidwood Capital provide? We offer full-cycle M&A advisory, capital raising, debt advisory, equity advisory, and due diligence for companies with revenues over $1 million, leveraging our network of 4,000+ investors.

How do we differ from large firms? Unlike bulge-bracket banks, our boutique approach delivers personalized M&A advisory and capital raising with faster execution via our Velocity Matrix, avoiding the bureaucracy of giants like Goldman Sachs.

What are typical M&A fees? Fees range from 1-3% of transaction value, structured as retainers plus success-based commissions, ensuring alignment without excessive upfront costs, per market standards.

How long does the M&A process take? Timelines average 6-12 months, from valuation to closing, accelerated by our proprietary data access, though direct lenders note variability based on deal complexity.

How do we assist with debt and equity? For debt, we structure mezzanine and venture options through debt advisory services, tapping $1.3 trillion private credit market for flexible terms. Equity aid includes growth capital introductions.

What are capital raising steps? We prepare pitch decks, identify targets, negotiate terms, and close, drawing on $15 billion deployable capital for efficient outcomes.

Leveraging Lower Middle Market Expertise for Growth

Partnering with a Lower Middle Market Investment Bank unlocks agile, personalized M&A advisory and capital raising strategies tailored for mid-market growth. In the evolving lower middle market, where buyer interest remains robust despite volatility, boutiques like ours excel through deep expertise and collaborative approaches that enhance value acceleration.

At Zaidwood Capital, our full-cycle due diligence, access to 4,000+ investors, and $24.4B transaction volume demonstrate proven efficacy in navigating complex deals. We prioritize operational resilience and scalability to meet strategic acquirers’ demands.

Explore our tailored solutions to drive your next growth phase with confidence.