Raising Venture Capital For Startups

Table of Contents

Navigating Venture Capital for Startups

Raising Venture Capital for Startups can transform innovative ideas into scalable businesses, providing the fuel needed for rapid growth. Unlike debt financing or bootstrapping, venture capital offers high-risk, high-reward equity funding tailored to groundbreaking companies. This approach enables founders to accelerate development without immediate repayment pressures, distinguishing it from traditional loans.

Startups pursue VC to access substantial resources for market expansion and product innovation. Preparation is key: validate your market, assemble a strong team, and refine your business model. Early-stage capital acquisition often begins with seed funding from angel investors or friends and family, evolving into formal VC rounds. As outlined in SEC resources, venture capital funds differ from angel investors by focusing on later stages like Series A, investing larger sums–often millions–in equity for active involvement and mentorship.

At Zaidwood Capital, we guide entrepreneurs through securing startup equity investment with our full-cycle advisory services, including crafting pitch decks and facilitating introductions to over 4,000 institutional investors. Our 24.4 billion USD in aggregate transaction volume and proprietary Velocity Matrix streamline Venture Capital Fundraising. Drawing from SEC Commissioner Uyeda’s remarks, we ensure compliance with investor protections in the US, fostering structured deals.

This guide explores the process, benefits, and pitfalls ahead, equipping you with fundamentals for success.

Fundamentals of Venture Capital and Early-Stage Funding

Venture capital represents a critical engine for startup growth, fueling innovation through targeted investments. At Zaidwood Capital, we guide founders through these processes, leveraging our expertise in equity advisory to structure deals that align with high-potential ventures. This section explores the fundamentals, equipping entrepreneurs with essential knowledge for How To Raise Venture Capital.

Defining Venture Capital and Its Role in Startups

Venture capital involves equity investments in startups with high-growth potential, often milestone-based to support scaling from early to mature stages. Unlike debt financing, which requires repayment with interest, VC exchanges capital for ownership stakes, aligning investor and founder interests in exponential returns. Raising Venture Capital for Startups typically occurs after initial validation, contrasting with bootstrapping or grants that avoid dilution. We observe in our deals that VC firms prioritize sectors like technology and biotech, providing not just funds but strategic guidance.

In the US market, VC investments surged in recent years, with over 62% of funds maintaining weekly contact with portfolio companies as per SEC insights. This active involvement helps navigate regulatory landscapes, including compliance with federal securities laws to avoid registration needs. Typical deals range from Series A onward, emphasizing rapid expansion.

Our equity advisory services at Zaidwood Capital streamline this process, drawing from 24.4 billion USD in aggregate transaction volume. We facilitate introductions to our network of over 4,000 investors, ensuring structured deals that mitigate risks and maximize value for US-based founders seeking scalable opportunities.

Exploring Seed Funding Basics

Seed funding serves as the initial equity round to validate product-market fit, enabling startups to develop prototypes and conduct market tests. This pre-seed capital source bridges the gap from idea to viable business, often structured as convertible notes or equity to minimize early dilution. What is seed funding for startups? It funds essential steps like team building and customer acquisition, distinct from later rounds focused on growth.

For 2025 in the US, typical amounts range from 500,000 to 2 million USD, influenced by factors like location and sector, according to industry trends. Sources include accelerators and crowdfunding platforms, but most rely on personal networks or specialized funds. Founders must prepare robust pitch decks and financial projections to attract these investments, while addressing accreditation–such as net worth exceeding 1 million USD or income over 200,000 USD individually, per SEC criteria.

Zaidwood Capital’s capital formation expertise aids in these preparations, helping craft compelling narratives and connect with suitable backers. With access to 15 billion USD in deployable capital, we observe that well-structured seed rounds in our deals enhance long-term viability, empowering US startups to progress toward venture capital readiness without overcommitting equity prematurely.

Understanding Angel Investors

Angel investors are high-net-worth individuals who provide early-stage capital from personal funds, often infusing mentorship alongside financial support. Who are angel investors and how do they fund startups? They typically invest 50,000 to 500,000 USD in exchange for equity, focusing on pre-seed or seed stages where traditional lenders hesitate. Differences from venture capital firms lie in scale and structure–angels offer flexible, smaller deals with hands-on advice, while VCs deploy larger pools through funds.

In the US, angels often form syndicates to pool resources, investing 200,000 to 400,000 USD per deal as noted in SEC resources, and must qualify as accredited investors with thresholds like joint spousal income over 300,000 USD. This regulatory framework ensures compliance in private placements, broadening access to networks like industry associations.

Through our investor network access at Zaidwood Capital, we provide targeted introductions to these angels, enhancing deal flow for founders. Seed funding vs angel investment differences? Angels emphasize validation and guidance, as seen in our 300+ completed deals, allowing startups to build momentum before larger VC pursuits in the competitive US ecosystem.

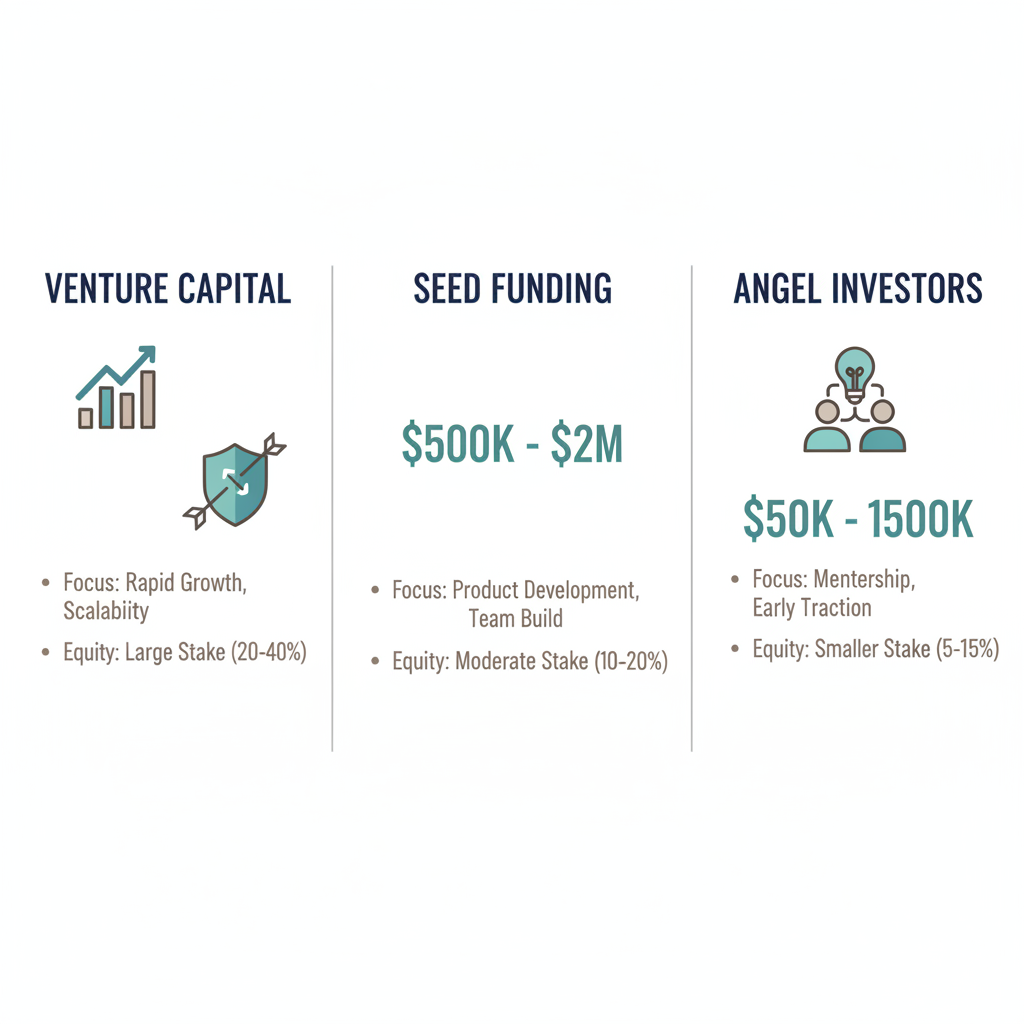

To synthesize these options, the following table outlines key distinctions:

| Funding Type | Typical Amount (USD) | Equity Stake | Key Focus |

|---|---|---|---|

| Venture Capital | 1M+ | 10-30% | Scaling and market expansion |

| Seed Funding | 500K-2M | 5-20% | Product development and validation |

| Angel Investors | 50K-500K | 5-15% | Mentorship and early traction |

Venture capital suits ambitious scaling, while seed funding and angel investments lay foundational groundwork, each with tailored equity expectations. At Zaidwood, we tailor advisory to these nuances, observing that hybrid approaches often yield optimal outcomes in our transaction history.

Comparison of venture capital, seed funding, and angel investment types

This comparison underscores how early-stage choices influence long-term trajectories, with Zaidwood’s full-cycle services ensuring founders navigate them strategically toward sustainable growth.

Key Benefits of Securing Venture Capital

Securing venture capital represents a pivotal step for startups seeking to transform innovative ideas into market-leading enterprises. At Zaidwood Capital, we’ve facilitated over 300 deals with an aggregate volume of 24.4 billion USD, witnessing firsthand how equity-driven expansion propels businesses forward. This funding not only provides essential capital but also unlocks strategic resources that bootstrapped companies often lack. As a leading ma capital advisory firm, we guide clients through capital formation, ensuring they leverage VC to achieve sustainable growth in the competitive US landscape.

Accelerated Growth and Scalability

Venture capital enables startups to achieve rapid expansion by injecting substantial funds, typically ranging from 1 million to 10 million USD or more, into core operations. This influx supports hiring talent, developing products, and entering new markets, fostering investor-backed acceleration that outpaces organic growth. Unlike seed funding, which covers initial stages, VC propels scaling by funding infrastructure and marketing at a velocity that aligns with ambitious trajectories.

- Market Expansion: Funds allow geographic reach and product diversification.

- Operational Efficiency: Investments in technology streamline processes.

- Revenue Multiplication: Capital fuels customer acquisition strategies.

Through our capital raising expertise, we’ve seen portfolio companies double revenues within 18 months. Our proprietary Velocity Matrix optimizes fundraising, connecting founders to deployable capital efficiently. For instance, a tech startup we advised scaled from prototype to 50,000 users in under a year post-VC infusion, highlighting Raising Venture Capital for Startups as a catalyst for exponential progress.

Access to Expertise and Networks

One of the most undervalued benefits of VC is the access to seasoned investor mentorship and expansive networks. Venture capitalists bring decades of experience in strategy, operations, and governance, offering guidance that refines business models and mitigates risks. This contrasts with angel investors, who provide early capital but often lack the institutional depth of VC firms.

- Strategic Mentorship: Advisors help navigate pivots and scaling challenges.

- Operational Insights: Expertise in supply chain and talent management.

- Network Introductions: Connections to partners, suppliers, and clients.

Leveraging our network of over 4,000 institutional and private investors, we facilitate introductions that yield partnerships and talent acquisition. Drawing from SEC guidelines on accredited investors, this access enhances deal credibility, as qualified backers signal market validation. We’ve observed a SaaS company in our portfolio secure key hires through VC-referred executives, boosting innovation and market penetration.

Funding Timelines and Market Positioning

Venture capital funding typically unfolds over 6 to 12 months, from pitch to close, though thorough preparation can shorten this to under six months. This timeline allows startups to refine pitches and build traction, positioning them favorably against competitors. SBA programs underscore how such capital access, akin to VC, drives US manufacturing and tech growth by enabling competitive edges in innovation and speed.

- Preparation Phases: Due diligence and term sheet negotiations.

- Credibility Boost: VC backing attracts top talent and alliances.

- US Market Advantage: Positions firms ahead of bootstrapped rivals.

In our transaction experience, we’ve streamlined processes using equity advisory services to accelerate closings. The Velocity Matrix integrates due diligence for faster execution, as seen in a biotech client who raised 8 million USD in nine months, gaining a first-mover advantage in therapeutics and outpacing regional peers.

The Venture Capital Raising Process

Raising venture capital represents a critical milestone for US startups seeking to scale operations and innovate. Our advisors at Zaidwood Capital guide founders through this complex fundraising roadmap, leveraging our extensive network to connect with institutional and private investors. By streamlining deal execution phases, we help mitigate common pitfalls and accelerate timelines, drawing from over 300 completed transactions.

Preparing Your Startup for Funding

The foundation of raising venture capital for startups begins with thorough preparation, focusing on seed funding stages. Start by developing a comprehensive business plan that outlines your market opportunity, competitive landscape, and growth strategy. Next, craft a compelling pitch deck highlighting your unique value proposition, team expertise, and traction metrics. Finally, prepare pro forma financials projecting revenue, expenses, and scalability over three to five years.

At Zaidwood Capital, our full cycle ma advisory services include strategic documentation to refine these materials, ensuring they meet investor expectations. We assist in creating investor-ready financial models that demonstrate realistic paths to profitability.

Key tips include consulting SBA resources for capital access tools, which apply broadly to US startups beyond rural areas, such as microloans and innovation grants. Validate assumptions early to avoid overoptimism, and seek feedback from mentors to strengthen your narrative.

Navigating the Pitch and Negotiation Stages

Sourcing investors involves tapping networks of angel investors and venture funds, often starting with warm introductions. According to SEC guidance, understand investor types like angels, who invest personal funds in early rounds averaging $200,000 to $400,000, and VC funds focused on Series A and beyond. Pitch meetings feature 10-15 minute presentations followed by Q&A, iterating based on feedback to refine your approach.

Our full-cycle expertise at Zaidwood Capital facilitates investor outreach through our connections to over 4,000 global investors, optimizing due diligence by preparing for financial and legal reviews. We support term sheet negotiations on valuation, equity stakes, and protective provisions, aiming for balanced agreements.

Maintain momentum with follow-ups, and document all interactions to track progress. Emphasize compliance with federal securities laws during engagement to prevent regulatory hurdles.

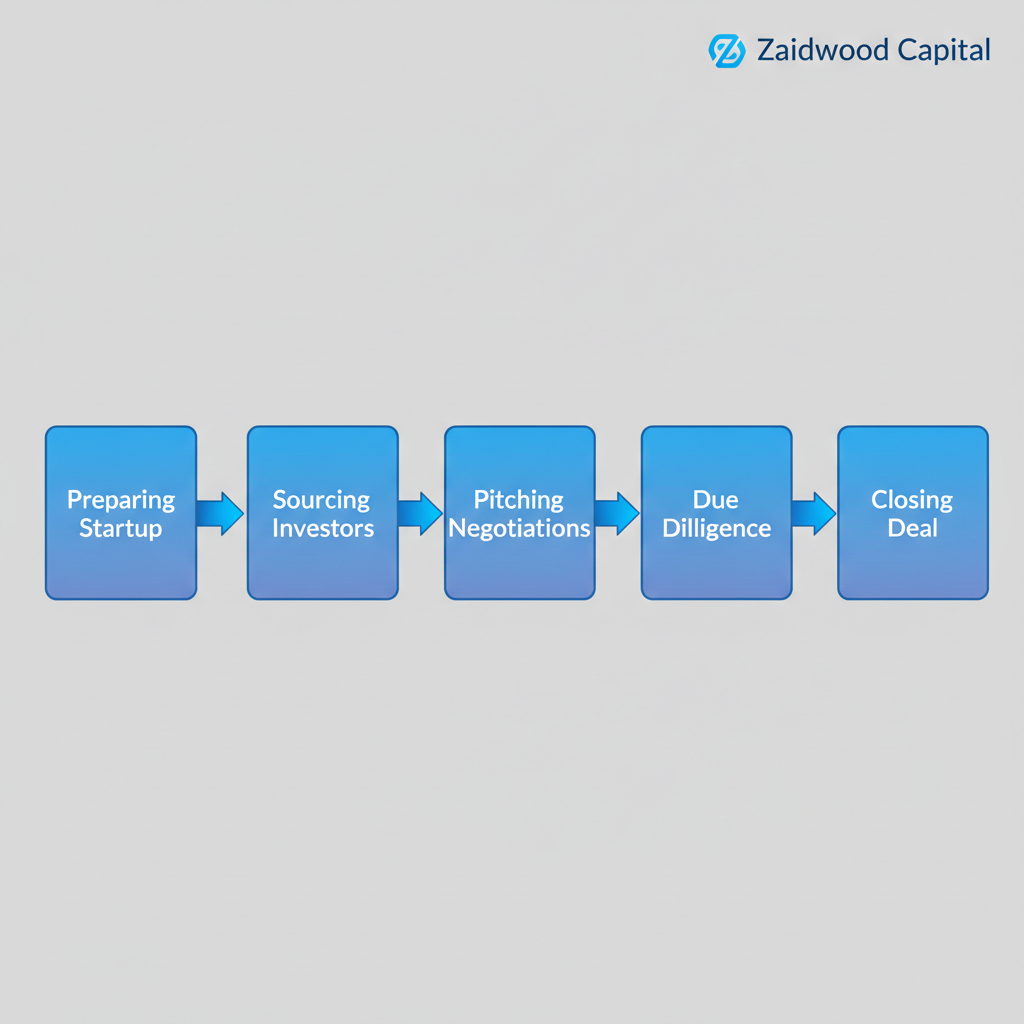

The venture capital process unfolds over 6-18 months, as illustrated in the timeline below:

| Phase | Duration | Key Activities |

|---|---|---|

| Preparation | 1-3 months | Business planning, pitch deck creation, financial modeling |

| Pitching | 2-6 months | Investor sourcing, meetings, feedback loops |

| Due Diligence | 1-3 months | Financial audits, legal reviews, reference checks |

| Closing | 1 month | Term sheet finalization, legal documentation, fund transfer |

This structured overview highlights the iterative nature of each phase, allowing founders to allocate resources effectively. Transitions between stages often require adjustments based on investor input, ensuring alignment with strategic goals.

Venture capital raising process stages overview

Closing the Deal and Post-Funding Management

Closing involves finalizing legal documents, such as stock purchase agreements, and securing board approvals. Our due diligence capabilities verify all representations, minimizing closing conditions and expediting fund disbursement.

Post-funding, establish governance structures like reporting cadences to investors. Zaidwood Capital provides ongoing advisory to track milestones and prepare for subsequent rounds, leveraging our $24.4B transaction volume for proven strategies.

Monitor key performance indicators quarterly, and communicate transparently to build trust. Avoid overexpansion by pacing growth with capital inflows, consulting legal experts for compliance.

Effective Strategies for Successful Fundraising

Raising capital is a critical milestone for startups, and mastering the process requires strategic planning and expert guidance. At Zaidwood Capital, based on our experience with over 300 deals, we help founders navigate venture capital fundraising by avoiding pitfalls, targeting the right investors, and refining pitches for maximum impact. This section outlines actionable strategies to enhance your success in securing funding.

Avoiding Common Pitfalls in VC Raises

When raising venture capital for startups, founders often encounter avoidable errors that can derail their efforts. Common pitfalls include setting unrealistic valuations without sufficient market validation, presenting weak traction metrics that fail to demonstrate growth potential, and neglecting thorough due diligence preparation. These mistakes can lead to rejected pitches or unfavorable terms, prolonging the fundraising timeline and eroding investor confidence.

To illustrate, consider overvaluing a pre-revenue startup at $50 million based on optimism alone; investors may view this as disconnected from reality, resulting in lowball counteroffers or disinterest. Similarly, lacking clear financial projections can signal poor planning. Drawing from SBA best practices in accessing capital, such as aligning funding needs with proven programs like 7(a) loans for working capital, startups can build credible cases.

As a leading boutique ma advisory firm, we mitigate these risks through our full-cycle due diligence services, ensuring robust documentation and realistic assessments to position your raise for success.

- Conduct market research to ground valuations.

- Track key metrics like user acquisition and revenue growth.

- Engage early for compliance checks.

Finding and Pitching the Right Investors

Selecting the appropriate investors is foundational to a successful raise. Focus on those aligned with your stage and sector, such as venture firms specializing in early-stage tech or healthcare. In the United States, top networks include groups like the Angel Capital Association for broad connections. Crafting a compelling pitch involves concise decks–aim for 10-15 slides–that emphasize storytelling over data dumps, highlighting problem-solution fit and scalable vision.

For example, tailor your narrative to show how your innovation addresses market gaps, backed by traction data. Use tools like warm introductions to access investor databases. Effective pitching also means practicing delivery to convey passion and expertise, addressing potential concerns proactively.

The following table outlines common mistakes in this phase, their consequences, and best practices aligned with our expertise:

| Mistake | Consequence | Best Practice |

|---|---|---|

| Generic pitches to mismatched investors | Wasted time and no responses | Research sector focus and stage preferences using our investor rolodex for targeted outreach |

| Overly long or jargon-heavy decks | Investor disengagement | Refine to 10-15 slides with clear storytelling, leveraging our pitch deck services |

| Ignoring term sheet nuances | Unfavorable deals | Seek fairness opinions early; we provide strategic documentation for balanced negotiations |

| Neglecting follow-up | Missed opportunities | Build relationships systematically, supported by our capital introductions |

| Weak financial modeling | Perceived lack of preparation | Develop pro forma financials through our consulting to demonstrate viability |

Interpreting this table, avoiding these errors streamlines the process, as seen in SEC remarks on simplifying exempt offerings to reduce compliance burdens for startups. Our network of over 4,000 investors facilitates precise matches, enhancing pitch effectiveness.

Advanced Tips for Seed and Angel Alignment

For early-stage funding, aligning with seed funding and angel investors demands tailored approaches. Prioritize networks in the United States, such as those affiliated with accelerators or regional syndicates, to find mentors who offer strategic value beyond capital. Preparation includes honing pitch refinement techniques, like focusing on unit economics and exit potential during negotiations.

Examples include joining platforms like AngelList for visibility or attending demo days to showcase prototypes. When negotiating terms, emphasize convertible notes or SAFE agreements to minimize dilution, informed by regulatory insights on accredited investor qualifications.

We support this through equity advisory and capital formation services, connecting you to deployable capital while ensuring term sheets protect founder interests. A simple checklist for seed pitches: Verify investor thesis match; simulate Q&A sessions; prepare cap table impacts.

- Network via events and referrals.

- Stress unique defensibility.

- Consult on valuation caps pre-term sheet.

This alignment fosters long-term partnerships, setting the stage for scaled growth.

Optimizing Your Path to Venture Capital Success

Raising Venture Capital for Startups demands thorough preparation to streamline timelines and avoid common pitfalls like mismatched investor expectations or incomplete documentation. By aligning your business model with potential backers early, you enhance the efficiency of the funding process, turning potential obstacles into opportunities for strategic growth. We’ve seen how proactive steps, such as refining pitch decks and financial projections, can significantly shorten the path to securing capital, answering key concerns about preparation and typical errors in the journey.

At Zaidwood Capital, our boutique advisory expertise, backed by 24.4 billion USD in aggregate transactions, empowers startups through full-cycle equity advisory and capital formation services. We leverage our network of over 4,000 institutional investors to facilitate connections that drive success, complementing equity raises with options like debt advisory services for balanced financing strategies. Our strategic documentation and due diligence support ensures your venture stands out in competitive landscapes.

We invite you to explore seed funding and angel investors as vital gateways to larger venture capital rounds. Post-funding, focus on sustainable growth funding and scaling operations wisely. For ongoing access, consider U.S. Small Business Administration resources, including 7(a) loans and microloans, which extend applicability to rural and nationwide ecosystems–broadening opportunities where we can partner to achieve your strategic equity partnerships and unlock your startup’s full potential.