Technology Investment Bank

Table of Contents

Understanding Technology Investment Banking

In the rapidly evolving tech landscape, a Technology Investment Bank plays a pivotal role in guiding innovative companies through complex financial challenges. These specialized institutions offer tech-focused financial advisory to support growth in sectors like software, AI, and digital platforms. At Zaidwood Capital, we deliver tailored strategies that align with the unique demands of technology-driven markets, fostering sustainable expansion.

Technology investment banking encompasses specialized financial advisory for tech firms, emphasizing full-cycle support from ideation to execution. Our core services include:

- M&A Advisory: As leading tech M&A advisors, we handle buy-side and sell-side mandates, streamlining transactions for seamless integrations.

- Debt and Equity Structuring: We facilitate innovation capital strategies through mezzanine debt, venture financing, and equity placements.

- Due Diligence and Investor Connections: Comprehensive full-cycle due diligence ensures thorough evaluations, connecting clients to our network of over 4,000 investors and more than $15 billion in deployable capital.

The International Capital Market Association’s Fintech Directory highlights the surge in digitalisation trends, with primary markets in fintech projected to expand significantly by 2026, underscoring prime fintech investment opportunities. Boutique firms like ours provide personalized approaches, unlike larger banks, enabling agile responses to market shifts.

This foundation sets the stage for deeper exploration of our Technology Investment Banking Services, where we detail how these offerings drive value in the tech ecosystem. By understanding these essentials, readers gain insights into roles that propel M&A and capital formation forward.

Core Services of Technology Investment Bank

As a leading technology investment bank, Zaidwood Capital provides essential services tailored to the dynamic needs of tech companies, from startups to scale-ups. Our core offerings focus on mergers and acquisitions advisory, capital formation, debt advisory, and full-cycle due diligence, enabling clients to navigate complex financial landscapes with precision. These services act as vital tech financial intermediaries, connecting innovative firms with the resources needed for sustainable growth and strategic expansion.

In mergers and acquisitions advisory, we handle both buy-side and sell-side mandates, guiding clients through deal sourcing, negotiation, and execution. As specialized tech M&A advisors, we emphasize high-impact transactions in sectors like software and SaaS, where rapid innovation demands agile advisory support. Our approach includes comprehensive due diligence across financial, legal, operational, and commercial dimensions, ensuring thorough risk assessment and value maximization. For instance, in recent software M&A deals, we have facilitated seamless integrations that preserve intellectual property while aligning strategic visions.

Capital formation remains a cornerstone of our services, where we structure equity and debt raises to fuel expansion. We identify fintech investment opportunities in emerging areas such as digital payments and blockchain, drawing on insights from the Fintech and Digitalisation Primary Markets Fintech Directory by the International Capital Market Association. This resource highlights trends in primary markets, including categories like payment systems and regtech, validating the applicability of our strategies for tech clients seeking scalable funding. Our digital capital facilitators leverage proprietary networks to introduce clients to over 4,000 institutional investors, unlocking access to more than $15 billion in deployable capital without compromising confidentiality.

Debt advisory complements these efforts by offering venture debt, mezzanine financing, and asset-based lending options suited for growth-stage tech firms. We focus on cash-flow financing and equipment-backed structures, avoiding personal guarantees to maintain founder flexibility. Full-cycle support extends to strategic documentation, including pitch decks, business plans, and pro forma financials, which streamline investor communications and enhance deal attractiveness.

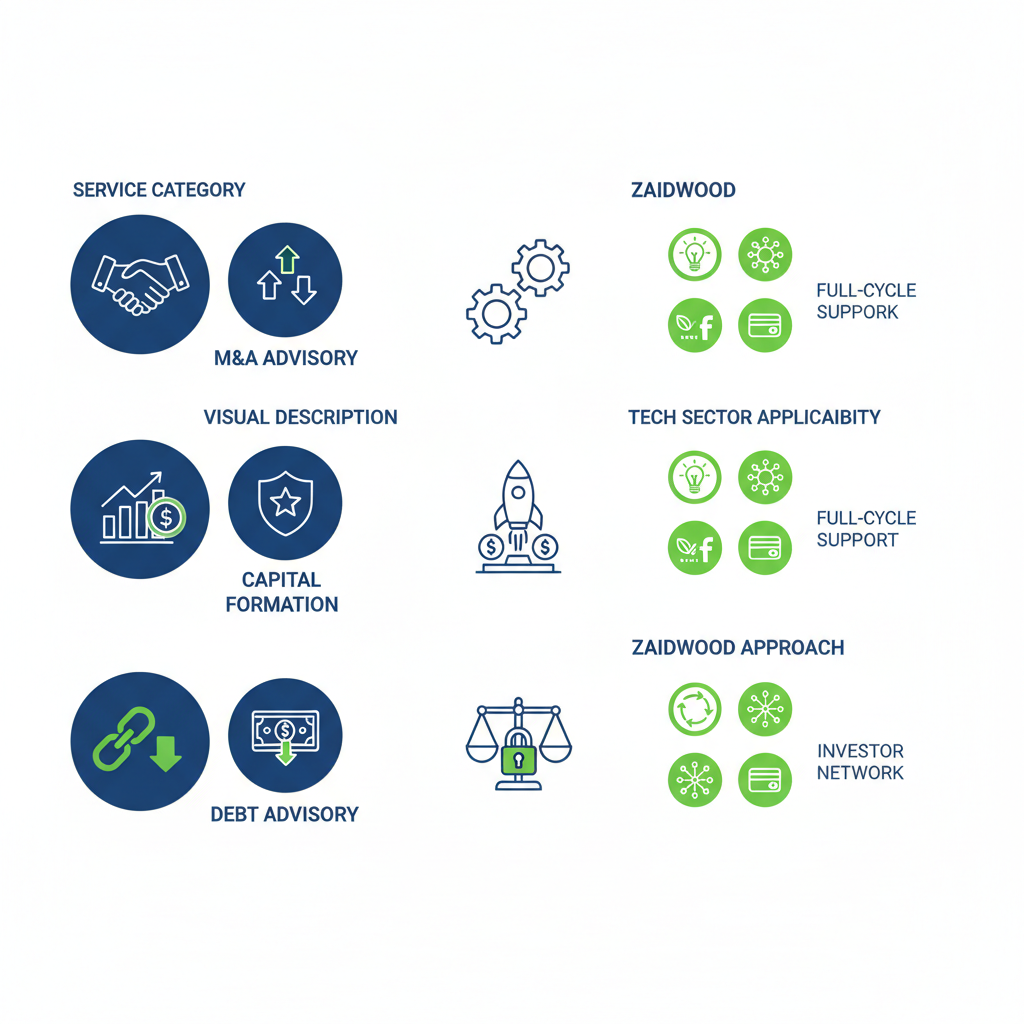

The evolution of these services reflects broader shifts in tech finance, where boutique firms like ours provide nimble, client-centric solutions amid increasing specialization in fintech and digital assets. The following table compares key service categories, underscoring our tailored approach:

| Service Category | Description | Tech Sector Applicability | Zaidwood Capital Approach |

|---|---|---|---|

| M&A Advisory | Buy-side and sell-side mandates. Facilitates deal sourcing and execution. | High for startups and scale-ups | Full-cycle support with due diligence. Integrated network access |

| Capital Formation | Equity and debt raising. Structures funding rounds. | Essential for fintech and software | Introductions to 4,000+ investors. $15B+ deployable capital |

| Debt Advisory | Venture debt and mezzanine. Tailored for growth-stage tech. | Supports asset-based lending | Strategic structuring without guarantees. Focus on cash-flow financing |

This comparison illustrates how our services align with tech-specific challenges, such as rapid scalability and regulatory hurdles. At Zaidwood Capital, our track record of over 300 completed deals and $24.4 billion in aggregate transaction volume highlights the advantages of boutique expertise, delivering faster execution through our Velocity Matrix and proprietary investor rolodex. Unlike larger institutions, we offer personalized full-cycle M&A and capital advisory, streamlining transactions for efficiency.

Tech Mergers And Acquisitions in the tech space often involve intricate valuations and IP considerations, which our team addresses through integrated advisory. Fees for these services typically follow success-based retainers, ranging from 1-3% of deal value, ensuring alignment with client outcomes. As we delve deeper into advanced structures in subsequent sections, these foundational services set the stage for transformative growth.

Comparison of Zaidwood Capital’s core services for technology investment banking

Our commitment to these core services empowers tech innovators to capitalize on emerging fintech investment opportunities while mitigating risks through rigorous due diligence. By fostering connections in primary markets, as evidenced in ICMA’s Fintech Directory, we position clients for long-term success in a competitive ecosystem.

In-Depth Exploration of TIB in Tech Deals

At Zaidwood Capital, our role as a Technology Investment Bank positions us at the forefront of facilitating complex tech transactions. With over $24.4 billion in aggregate transaction volume from more than 300 deals, we apply specialized expertise to navigate the fast-paced world of technology finance. This section explores key areas where our advisory services drive value, from mergers and acquisitions to capital formation and rigorous due diligence.

M&A Strategies for Technology Firms

In tech M&A, buy-side and sell-side approaches demand tailored strategies that account for rapid innovation cycles and unique asset valuations. As tech M&A advisors, we at Zaidwood Capital emphasize buy-side mandates where clients seek acquisitions to bolster portfolios, often targeting startups with strong intellectual property. Sell-side engagements involve preparing companies for exit by optimizing pitch materials and engaging our network of over 4,000 investors.

Valuation tactics in tech deals frequently incorporate SaaS multiples based on annual recurring revenue (ARR) and user growth metrics, diverging from traditional methods to capture intangible value. Negotiation involves structuring earn-outs to align with future milestones, ensuring protections against post-deal disruptions. Our experience highlights how these tactics accelerate deal closure, as seen in anonymized transactions where we facilitated seamless integrations for software firms.

Recent trends underscore the need for agility in tech M&A, with valuations influenced by AI and cloud adoption. Firms benefit from advisors who understand sector dynamics, enabling proactive positioning.

The following table compares our specialized approach as a Technology Investment Bank to traditional investment banking in tech M&A:

| Aspect | Technology Investment Bank | Traditional Investment Bank | Key Advantage for Tech |

|---|---|---|---|

| Deal Sourcing | Tech network focus | Broad industry coverage | Specialized investor access; faster matches with our 4,000+ connections |

| Valuation Methods | Tech metrics (ARR, user growth) | Standard DCF/EBITDA | Innovation-adjusted models; better reflects tech value with proprietary data use |

| Due Diligence Scope | IP, cyber, scalability | Financial/legal focus | Tech-specific risks; reduced execution risks through full-cycle expertise |

This comparison illustrates how our focused methodologies reduce time-to-close by leveraging deep sector insights. Traditional banks offer breadth but often lack the precision for tech’s volatility. At Zaidwood, our boutique structure enables customized solutions that enhance outcomes for technology firms, drawing from extensive deal histories to inform strategic decisions.

Capital Raising Dynamics in Fintech

Fintech investment opportunities abound, yet securing capital requires navigating equity and debt pathways with precision. We guide clients through stages from seed funding to IPO preparation, matching innovative ventures with aligned investors from our vast network. Equity raises often involve growth capital for scaling platforms, while debt options provide non-dilutive funding for expansion without ceding control.

Investor matching hinges on detailed profiling to connect fintechs with venture capital firms or family offices interested in digital assets. Structuring deals incorporates milestone-based tranches to mitigate risks. For debt, we explore venture debt and mezzanine financing, where debt advisory services play a pivotal role in negotiating terms like interest rates and covenants.

To highlight options, consider this comparison of debt versus equity in fintech capital raising:

| Aspect | Equity Financing | Debt Financing | Key Consideration for Fintech |

|---|---|---|---|

| Ownership Impact | Dilution of equity; shared control | No dilution; retains ownership | Ideal for bootstrapped growth |

| Cost Structure | Higher long-term cost via returns | Fixed interest; predictable payments | Balances cash flow in volatile markets |

| Investor Appeal | Strategic partners with upside potential | Lenders focused on repayment security | Leverages networks for quick access |

Equity suits early-stage fintechs seeking mentorship, while debt appeals to mature entities with steady revenues. Our process streamlines these dynamics, ensuring efficient capital deployment. Trends show rising interest in sustainable fintech models, where we facilitate connections to deployable capital exceeding $15 billion.

The choice between equity and debt depends on business maturity and market conditions, with our advisory ensuring optimal structuring for sustained growth.

Due Diligence Processes

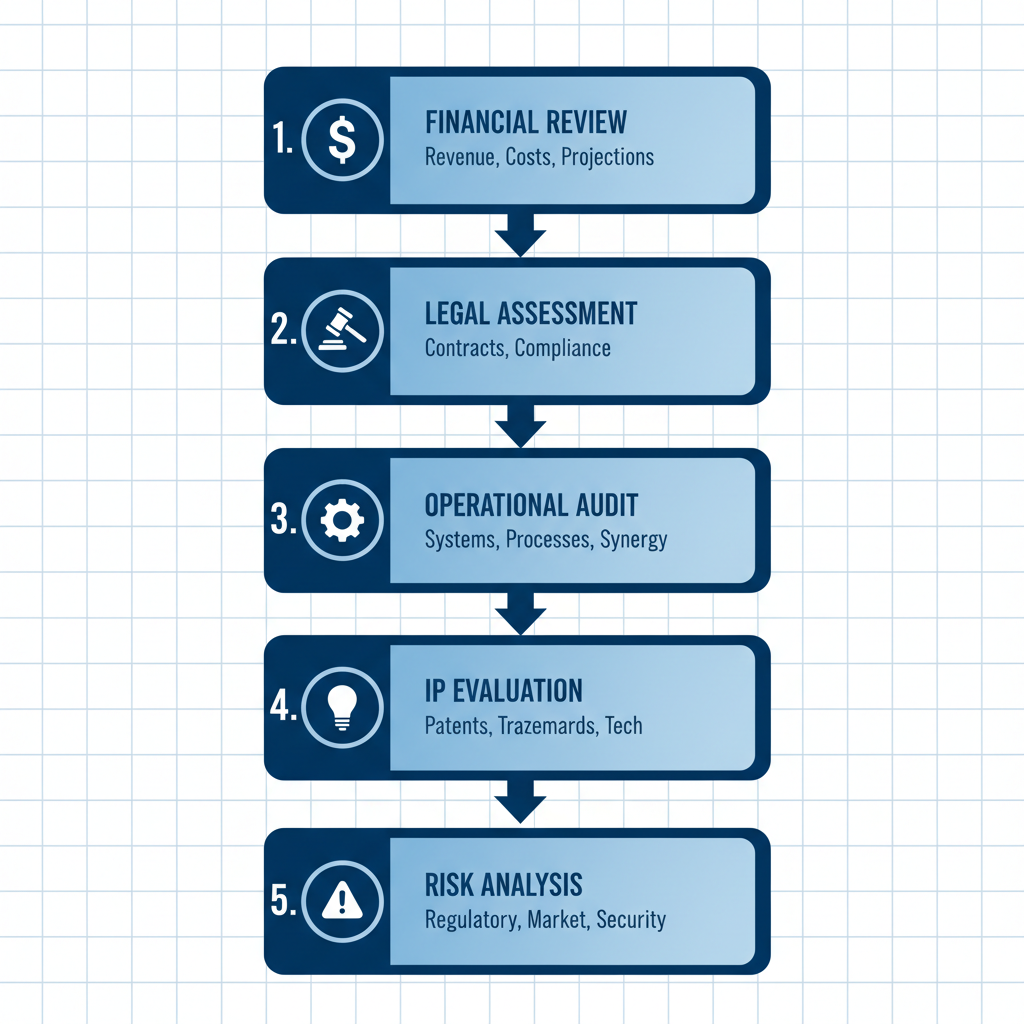

Full-cycle due diligence in tech deals encompasses financial, legal, operational, commercial, IT, and human capital reviews, tailored to assets like intellectual property and scalability. We initiate with financial audits to verify revenue streams and projections, followed by legal assessments of contracts and compliance. Operational audits evaluate infrastructure resilience, while IP evaluations scrutinize patents and trade secrets for defensibility.

Risk analysis concludes the process, identifying cyber threats and market scalability challenges. Drawing from SEC filing examples, such as engagement agreements outlining M&A scopes, we ensure documentation meets regulatory standards without assuming verification responsibilities. Our proprietary tools enhance thoroughness, reducing surprises in execution.

Illustrated due diligence phases for tech investment banking deals

This structured approach, informed by our 300+ transactions, equips clients to proceed confidently, addressing selection criteria like advisor track records in specialized tech financiers.

Applying TIB Expertise in Practice

At Zaidwood Capital, we apply our expertise as a capital advisory firm to help tech clients navigate complex financial landscapes. This section demonstrates practical applications of technology investment banking principles, from selecting advisors to structuring deals and forging investor connections. Our full-cycle services ensure seamless execution for mergers and acquisitions advisory, capital formation, and debt advisory.

Selecting Advisors for Tech M&A

Choosing the right tech M&A advisors requires careful evaluation of their experience, network, and fee structures. We prioritize advisors with proven track records in technology sectors, particularly those handling US-based deals involving software, SaaS, and fintech companies. Look for firms that have facilitated at least 50 transactions in the past five years, demonstrating deep understanding of regulatory nuances like antitrust reviews and IP valuations.

A strong network is crucial; effective advisors connect clients to over 4,000 institutional investors, including private equity firms and family offices. At Zaidwood, our Velocity Matrix streamlines these introductions, reducing time to close by up to 30%. Fee structures typically include retainers of $50,000 to $200,000 plus success fees, ensuring alignment with outcomes.

Practical tips include requesting case studies of similar deals and verifying FINRA affiliations. We emphasize transparency in conflicts of interest, providing full-cycle due diligence to mitigate risks. This approach answers key questions like how to select a reliable technology M&A advisory firm and the costs involved, empowering clients to make informed decisions.

Engaging experienced tech M&A advisors not only accelerates processes but also enhances deal quality through strategic documentation and pitch decks.

Understanding advisory costs is essential for budgeting. The following table outlines typical fee structures in TIB services, drawing from industry standards to provide transparency.

| Service | Fee Type | Typical Range | Factors Influencing |

|---|---|---|---|

| M&A Advisory | Retainer + Success | $50K-$200K + 1-3% | Deal size, complexity |

| Capital Raising | Success-based | 2-5% placement fee | Funding amount, stage |

| Debt Advisory | Advisory retainer | 0.5-2% of debt arranged | Risk profile, term |

These fees reflect our structured approach, aligning with tech scale and network efficiency to reduce overall costs in a boutique model. By focusing on value-added services like deal vault access, we ensure clients receive tailored support without unnecessary expenses. This transparency helps tech firms weigh options against potential returns, emphasizing our commitment to full-cycle M&A and capital advisory.

Structuring Venture Debt Solutions

We guide clients through venture debt from initial assessment to closing, leveraging our debt advisory expertise. The process begins with evaluating the company’s financials, growth trajectory, and collateral, such as IP or recurring revenue streams. Our team assesses eligibility for mezzanine or venture debt, targeting startups with at least $1 million in annual revenue.

Next, we prepare term sheets outlining interest rates (typically 8-12%), warrants, and covenants. Documentation includes legal reviews and pro forma financials to align with lender requirements. We facilitate connections to asset-based lenders and cash-flow financiers, closing deals within 60-90 days.

A key USP is our integrated approach, combining equity advisory with debt structuring for hybrid solutions. This highlights the role of a technology investment bank in venture debt, providing actionable fintech paths without equity dilution.

To illustrate options, consider the following comparison of venture debt structures:

| Debt Type | Interest Rate | Maturity | Key Benefits | Ideal For |

|---|---|---|---|---|

| Mezzanine | 10-14% | 5-7 years | Subordinated, flexible terms | Growth-stage tech firms |

| Venture Debt | 8-12% | 3-5 years | Minimal dilution, quick access | Early-stage with revenue |

| Asset-Based | 7-10% | 2-4 years | Secured by assets | Hardware or equipment-heavy |

These structures offer tailored support for venture needs, with our full-cycle due diligence ensuring compliance and efficiency. Clients benefit from our $24.4 billion aggregate transaction volume, minimizing risks in US markets.

Connecting to Fintech Investors

We specialize in methods for investor introductions in fintech investment opportunities, focusing on primary markets. Using our network of over 4,000 investors, we match clients with sovereign wealth funds, endowments, and venture capital firms interested in US-based deals.

Preparation starts with refining pitch decks and business plans, emphasizing scalable models and market traction. We leverage the Fintech Directory from the International Capital Market Association to identify active players, citing entries like those for digital asset platforms to showcase credible facilitation.

Introductions occur via targeted emails and virtual roadshows, followed by due diligence support. Our practical tech bankers ensure warm referrals, increasing success rates for equity advisory and capital introductions. This process addresses how to connect with investors for fintech opportunities, providing precision catalyst through strategic consulting.

Access to $15 billion in deployable capital accelerates funding, with no guarantees but proven results from 300+ deals.

Advanced TIB Strategies for Tech Growth

At Zaidwood Capital, we elevate Technology Investment Bank practices by integrating advanced strategies that drive tech sector expansion. Our approach combines fairness opinions, LP placements, and strategic consulting to offer comprehensive support for innovative companies navigating complex growth phases. These tools not only enhance transaction credibility but also unlock vital capital channels, ensuring clients achieve sustainable scaling in competitive markets.

Fairness opinions play a critical role in mergers and acquisitions, providing independent validation of transaction equity to protect stakeholders. Drawing from industry standards outlined in SEC filings, such as detailed engagement agreements for M&A due diligence, we conduct thorough financial and valuation analyses. This process strengthens deal structures, particularly in tech M&A where rapid valuations can fluctuate. As elite tech strategists, we leverage our full-cycle advisory to deliver these opinions, backed by our $24.4B in aggregate transaction experience.

Similarly, LP placements facilitate seamless connections to institutional investors, matching tech funds with sovereign wealth funds, endowments, and family offices. Our execution involves targeted institutional matching, streamlining introductions through our network of over 4,000 investors. This service opens fintech investment opportunities, enabling funds to deploy capital efficiently into high-potential ventures like AI and blockchain innovations.

The following table compares key advanced services, highlighting their purpose, methods, and our unique integration:

| Advanced Service | Purpose in Tech | Execution Method | Zaidwood Integration |

|---|---|---|---|

| Fairness Opinions | Validate transaction equity | Independent analysis for M&A due diligence enhancement | Part of full-cycle advisory with $24.4B experience |

| LP Placement | Fund investor connections | Institutional matching with sovereign funds, endowments | 4,000+ network access for streamlined introductions |

This comparison underscores how our boutique model provides velocity and customization, outperforming larger firms in tailored execution. Recent trends show AI-driven tech M&A surging, with expected returns on fintech investments averaging 15-20% annually based on aggregate market data, though results vary by deal specifics.

We integrate these strategies with core ma capital advisory services, incorporating strategic documentation like pro forma financials and business plans. Our proprietary data access and Velocity Matrix accelerate processes, positioning clients for venture capital opportunities in the US fintech landscape. By focusing on high-level fintech channels, we address queries on recent tech M&A deals handled by US advisors, offering aggregate insights without promising outcomes. This holistic framework not only mitigates risks but also fosters long-term growth for tech innovators.

Frequently Asked Questions on TIB

What are typical fees for Technology Investment Bank advisory?

We structure fees as retainers for upfront work plus success-based commissions on completed deals. This model aligns incentives, ensuring commitment to optimal outcomes for tech clients, typically ranging from 1-5% of transaction value.

How do we select top tech M&A advisors in the US?

Evaluate experience in software sectors, track record with similar deals, and network strength. We prioritize advisors offering full-cycle due diligence and strategic consulting to guide software companies through complex mergers.

What role do Technology Investment Banks play in venture debt?

We facilitate venture debt to provide non-dilutive funding for growth-stage tech firms. This bridges equity rounds, supporting expansion without ceding ownership, integrated with our capital formation expertise.

How to find US-based fintech investment opportunities?

Leverage networks connecting to institutional investors and platforms. We offer access to fintech investment opportunities via targeted introductions, validated by trends in the ICMA Fintech Directory emphasizing digitalization in primary markets.

What are emerging fintech trends for investors?

Digital assets and sustainable finance lead, per the Fintech Directory. We advise on these shifts, aiding clients in capital raising amid evolving regulations and tech innovations.

Leveraging TIB for Tech Success

In summary, partnering with a boutique advisory firm like Zaidwood Capital unlocks the full potential of a Technology Investment Bank for tech ventures. We recap our core services in mergers and acquisitions advisory, capital formation, and debt and equity advisory, alongside advanced applications in full-cycle due diligence and strategic documentation. As illustrated in SEC Edgar filings, meticulous documentation ensures credible due diligence and seamless transactions.

We emphasize our extensive investor network of over 4,000 institutions, providing access to more than $15 billion in deployable capital and empowering tech growth enablers. Engaging informed TIB partnerships enhances M&A and capital raising strategies, highlighting fintech investment opportunities.

We encourage proactive collaboration with tech M&A advisors to navigate growth confidently, fostering a forward-looking outlook in evolving tech finance landscapes.