Get A Loan To Buy A Business

Table of Contents

Exploring Financing Options for Business Acquisition

Acquiring an existing business presents a compelling opportunity for entrepreneurs seeking growth without starting from scratch. Many aspiring owners turn to financing solutions to make this vision a reality, especially when considering how to get a loan to buy a business. This approach allows buyers to leverage established revenue streams and customer bases, accelerating their path to profitability.

Business acquisition financing encompasses the various funding mechanisms designed to facilitate the purchase of an ongoing enterprise. Loans play a crucial role in bridging cash flow gaps during transitions and enabling the use of assets as collateral for leverage. However, challenges such as stringent eligibility criteria, including credit scores above 680 and viable business plans, often arise. The Small Business Administration (SBA) supports this landscape by backing over 50,000 loans annually, enhancing access for small business acquisitions and promoting economic vitality.

Among the primary Business Acquisition Financing options, the SBA 7(a) loan stands out for its flexibility, offering up to $5 million with favorable terms for buyers meeting general qualifications like demonstrated repayment ability. Seller financing complements this by allowing owners to finance a portion of the sale directly, easing negotiations and reducing upfront capital needs. These acquisition loan options address common queries on qualification and suitability for purchasing established operations.

At Zaidwood Capital, we guide clients through these complexities with our expertise in debt advisory and capital formation. Our tailored strategies ensure structured deals align with your goals, paving the way for in-depth explorations of fundamentals, eligibility details, and practical implementation in the sections ahead.

Business Acquisition Financing Fundamentals: This refers to debt and equity arrangements specifically tailored for purchasing an existing company, focusing on asset valuation, cash flow analysis, and risk mitigation to secure sustainable funding.

Fundamentals of Business Acquisition Loans

Acquiring a business often requires strategic financing, and understanding how to get a loan to buy a business forms the foundation of acquisition funding basics. These loans provide the capital needed to purchase an existing enterprise, allowing entrepreneurs to leverage established operations rather than starting from scratch. At Zaidwood Capital, we guide clients through purchase loan essentials, ensuring alignment with their financial profiles and long-term objectives.

Qualification for business acquisition loans hinges on several key factors. Lenders typically require a strong credit score of at least 680, demonstrated business experience of two or more years, and a viable business plan that projects profitability. According to SBA guidelines, eligibility also includes the borrower’s ability to repay the loan, often assessed through cash flow projections and personal financial statements. We recommend evaluating these criteria early to identify potential gaps and strengthen applications.

Down payment requirements for business purchases generally range from 10 to 20 percent of the total acquisition price, depending on the lender and deal structure. This equity injection demonstrates the buyer’s commitment and reduces lender risk. For those with limited assets, collateral options extend beyond traditional pledges; alternatives include personal guarantees, seller notes, or SBA-backed assurances that mitigate exposure. These flexible arrangements make acquisition financing accessible even for buyers without substantial holdings.

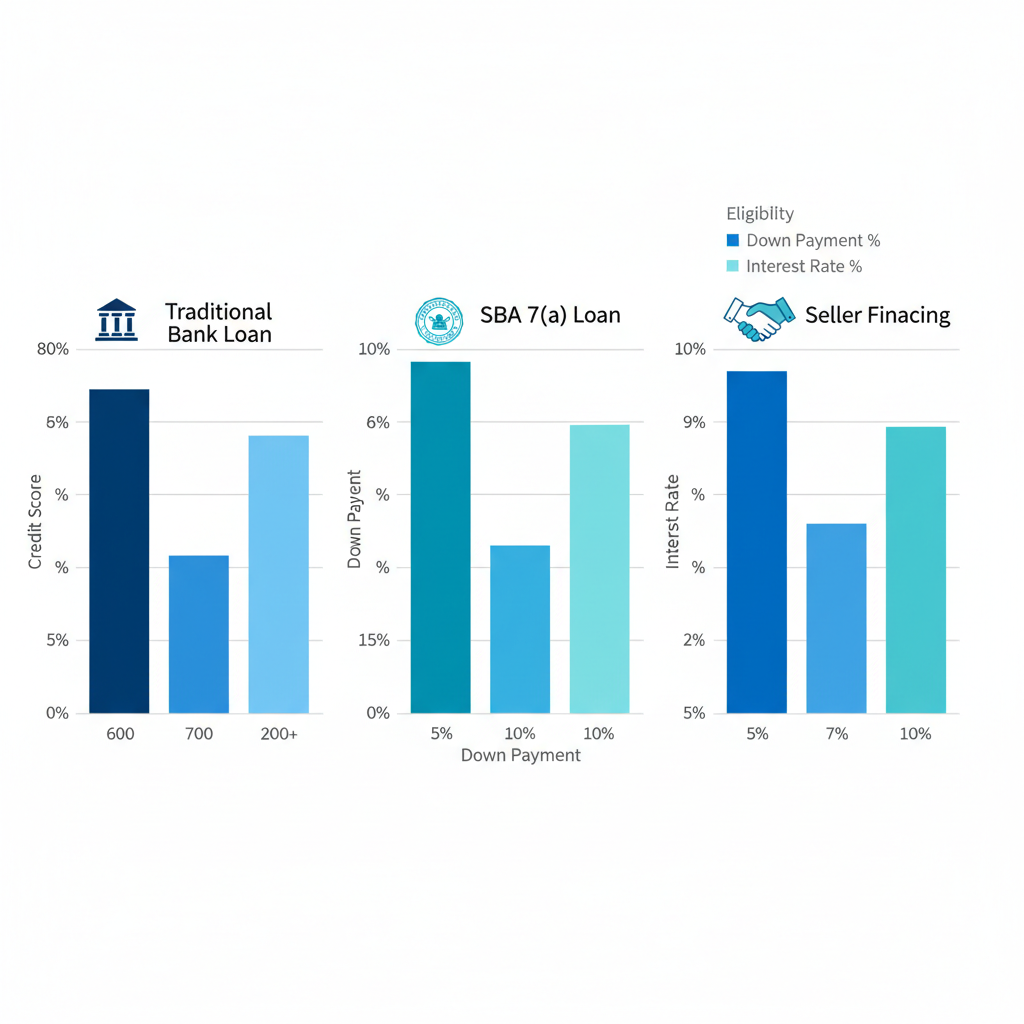

Selecting the right loan type involves weighing eligibility, costs, and fit for your acquisition goals. The following table outlines key features of common options, drawing from industry standards and SBA data for 2025 projections.

| Loan Type | Eligibility Basics | Down Payment | Interest Rates (2025 Est.) | Best For |

|---|---|---|---|---|

| Traditional Bank Loan | Strong credit (680+), 2+ years experience | 10-20% | 5-8% | Established businesses with assets |

| SBA 7(a) Loan | Credit 680+, viable business plan | 10% | Variable 8-10% | Small business acquisitions, limited collateral |

| Seller Financing | Negotiable with seller, good faith | 0-20% | 6-9% | Relationship-based deals, startups |

Data sourced from SBA guidelines and industry averages for 2025 projections.

The SBA 7(a) loan stands out for small buyers due to its government guarantee, which covers up to 85 percent of the loan amount and eases collateral demands. This structure supports acquisitions up to $5 million, ideal for entrepreneurs with solid plans but modest assets. In contrast, traditional bank loans favor those with robust balance sheets, while seller financing offers flexibility through negotiated terms.

Interest rates for business acquisition loans in 2025 are projected to range from 5 to 10 percent, often variable and tied to the prime rate plus a margin. Factors like loan term, borrower credit, and economic conditions influence these rates; shorter terms may secure lower figures, but longer amortizations increase total interest paid.

Interest Rate Variables: Rates fluctuate with market benchmarks–monitor the Federal Reserve’s actions and consult lenders for personalized quotes. Overlooking these dynamics can lead to over-leveraging, a common risk we help clients navigate.

At Zaidwood Capital, our debt advisory services integrate these fundamentals, connecting clients to tailored financing solutions from our network of over 4,000 investors. We streamline the process, from eligibility assessment to closing, ensuring efficient execution without compromising terms.

Overview of key business acquisition loan options

This overview equips you with the essentials, but deeper insights into structures like the How To Finance Buying A Business reveal nuanced strategies for success.

Deep Dive into SBA 7(a) Loans for Acquisitions

SBA 7(a) loans represent a cornerstone of government-backed acquisition funding, providing small businesses with flexible financing options for purchasing existing companies. As part of the broader 7(a) program details, these loans support change of ownership transactions, enabling buyers to acquire profitable operations without relying solely on personal capital. At Zaidwood Capital, we guide clients through this process, leveraging our expertise in mergers and acquisitions to ensure seamless integration of SBA financing into deal structures.

Eligibility and Borrowing Limits for SBA 7(a) Loans

To qualify for an SBA 7(a) loan in business acquisitions, businesses must meet stringent criteria designed to promote viable enterprises. Primary eligibility includes operating within the United States, possessing a sound business plan that demonstrates repayment ability, and maintaining a credit score of at least 680. According to SBA guidelines, the applicant’s net worth must not exceed $15 million, with average net income over the past two years under $5 million, ensuring support for truly small businesses. Additionally, the target business must be for-profit and not engaged in passive investments like real estate speculation or speculation in stock markets, focusing instead on operational acquisitions.

For borrowing limits, the maximum loan amount stands at $5 million, with the SBA providing guarantees up to 85% for loans under $150,000 and 75% for larger amounts, as outlined in program terms. This structure reduces lender risk, making SBA 7(a) loans particularly attractive for acquisitions where collateral may be limited to the purchased business assets. Viability assessments emphasize cash flow projections post-acquisition, requiring detailed financial modeling to confirm the deal’s sustainability. For instance, a manufacturing firm acquiring a complementary supplier might leverage strong historical revenues to secure funding, provided equity injection meets the typical 10-20% requirement.

These parameters highlight the SBA 7(a) loan’s role in facilitating accessible capital for strategic purchases, balancing risk with opportunity for growth-oriented buyers.

| Aspect | SBA 7(a) | Conventional Bank | Seller Financing |

|---|---|---|---|

| Max Loan Amount | $5 million | Varies by bank | Negotiable |

| Guarantee % | Up to 85% | None | Seller’s word |

| Use for Acquisition | Yes, full purchase | Yes, with strong collateral | Partial often |

SBA 7(a) loans offer substantial government backing, which lowers interest costs and eases approval for buyers with solid plans but moderate credit. In contrast, conventional bank loans demand more personal guarantees and assets, while seller financing provides flexibility but depends on the vendor’s willingness. Choose SBA 7(a) when seeking structured, long-term funding for complete acquisitions; opt for seller financing as a complement for quicker closes or gap coverage.

SBA Guarantee Definition: The SBA’s guarantee portion–up to 85% for smaller loans–reimburses lenders for a share of losses if the borrower defaults, encouraging financing for riskier small business deals without full recourse.

Application Process and M&A Integration

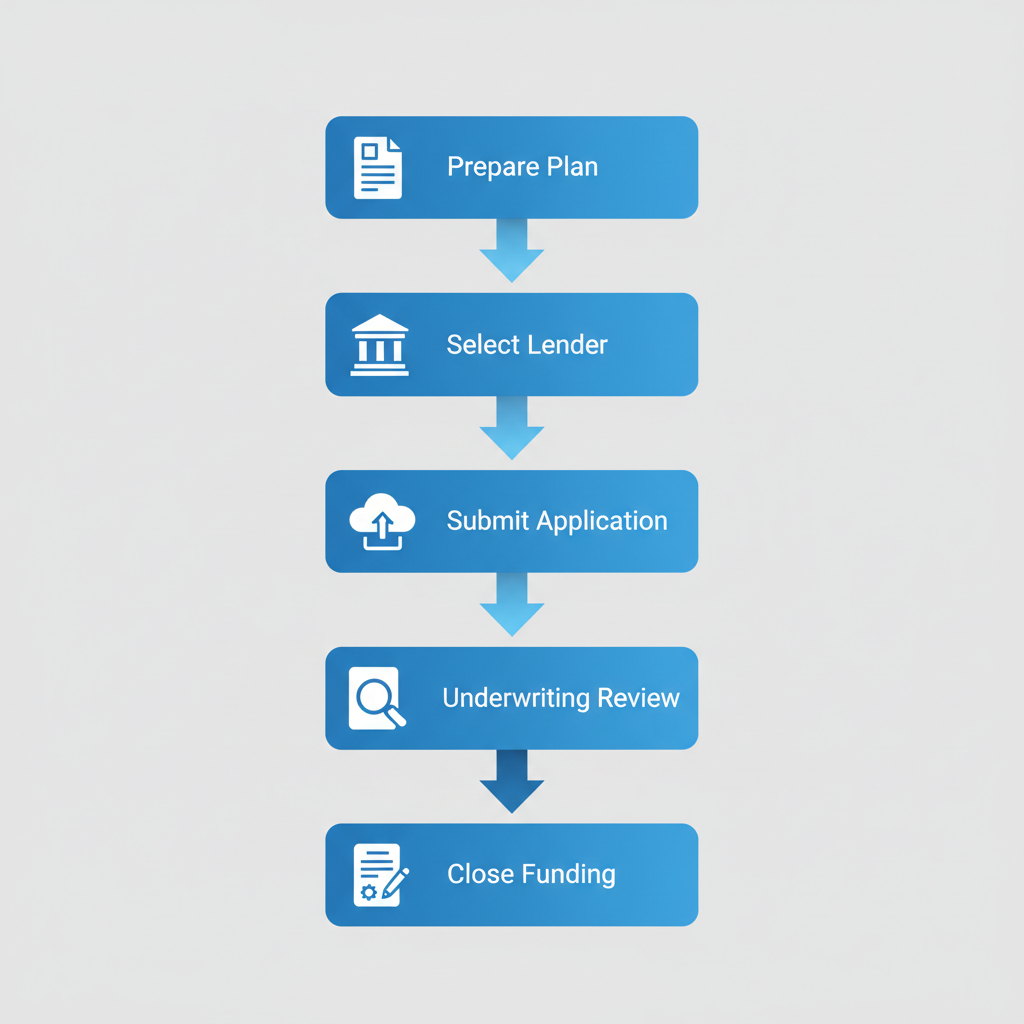

Securing an SBA 7(a) loan for mergers and acquisitions involves a structured, multi-step process that integrates financial due diligence with deal advisory. We at Zaidwood Capital emphasize early preparation to align loan terms with acquisition goals, streamlining what can otherwise be a lengthy endeavor. The process typically spans 45-90 days, depending on complexity, and requires collaboration with SBA-approved lenders.

Key steps include: 1) Developing a comprehensive business plan outlining the acquisition rationale, post-deal synergies, and five-year projections; 2) Gathering financial documents such as tax returns, balance sheets, and cash flow statements for both buyer and target; 3) Submitting the application through an SBA lender, often via the Preferred Lender Program for faster processing; 4) Undergoing SBA review for eligibility and guarantee approval; and 5) Closing the loan with legal documentation tying funds directly to the purchase price.

Interest rates for 2025, tied to the prime rate, range from prime plus 2.25% to 4.75% for loans over $50,000, with maturities up to 10 years for working capital needs in acquisitions. Restrictions prohibit using funds for speculative purposes, ensuring alignment with operational M&A objectives like change of ownership. Our debt advisory services play a pivotal role here, assisting clients in preparing robust applications, negotiating terms, and conducting full-cycle due diligence to mitigate risks.

| Step | Description | Timeline | M&A Integration |

|---|---|---|---|

| 1. Preparation | Business plan and financials assembly | 2-4 weeks | Due diligence on target |

| 2. Lender Submission | Application to SBA-approved bank | 1 week | Valuation alignment |

| 3. SBA Review | Eligibility and guarantee assessment | 2-5 weeks | Synergy modeling |

| 4. Underwriting | Credit and collateral evaluation | 2-4 weeks | Term sheet negotiation |

| 5. Closing | Fund disbursement and deal execution | 1-2 weeks | Post-acquisition planning |

This phased approach ensures compliance while accelerating M&A timelines. For example, in a recent advisory engagement, we facilitated an SBA 7(a) loan for a tech firm acquiring a regional distributor, reducing closing time by 30% through pre-vetted documentation.

Five-step SBA 7(a) loan application process for business acquisitions

Building on these steps, integrating seller financing can bridge gaps in SBA coverage, such as covering a portion of the purchase price at favorable terms. We advise clients on hybrid structures, where SBA funds handle the bulk of the acquisition, and seller notes provide earn-outs tied to performance milestones. This combination enhances deal viability, particularly for businesses with seasonal cash flows. Ultimately, our full-cycle M&A and capital advisory services position clients to navigate SBA intricacies effectively, from initial eligibility checks to final integration, fostering sustainable growth through strategic acquisitions.

Practical Strategies for Seller Financing

Seller financing, also known as owner-carry deals or vendor loan arrangements, occurs when the seller provides a loan for a portion of the purchase price in business acquisitions. This approach allows buyers to get a loan to buy a business without relying solely on traditional lenders, offering flexibility in structuring deals. At Zaidwood Capital, we often incorporate seller financing into our capital advisory firm strategies to optimize client outcomes in mergers and acquisitions. By blending seller notes with other funding sources, we help clients navigate complex transactions efficiently.

Negotiating Terms and Advantages of Seller Financing

Seller financing provides significant advantages over traditional loans, particularly for small business buys. Unlike rigid bank financing, it offers flexible terms tailored to the buyer’s cash flow and the seller’s goals, such as interest rates ranging from 6-10% and repayment periods up to 10 years. Sellers may also transfer valuable operational expertise during the transition, reducing the learning curve for new owners. This method lowers barriers to entry, making it ideal for entrepreneurs seeking to acquire established operations without exhaustive credit checks.

One key benefit is the potential to combine seller financing with other options, like an SBA 7(a) loan, to cover the full purchase price. According to SBA guidelines, seller notes can serve as subordinated debt, allowing the primary loan to take precedence while the seller’s portion fills gaps. This hybrid structure enhances affordability and aligns incentives, as the seller remains invested in the business’s success.

Negotiating effective terms requires preparation and clear communication. We recommend the following steps:

- Assess the business’s financials to determine a realistic down payment and propose terms based on projected cash flows.

- Discuss interest rates and amortization schedules early, aiming for rates competitive with market standards to appeal to the seller.

- Include balloon payments for later years if needed, but ensure they match the buyer’s growth trajectory.

- Build rapport by highlighting how the deal benefits the seller, such as steady income streams post-sale.

These tactics not only secure favorable conditions but also foster trust, leading to smoother closings. For instance, in a recent deal, we negotiated a 15% down payment with a five-year term, combining it seamlessly with an SBA 7(a) loan for a mid-sized manufacturing firm acquisition.

| Feature | Seller Financing | SBA 7(a) Loan |

|---|---|---|

| Down Payment | Flexible (0-20%) | 10% minimum |

| Approval Speed | Fast, seller-dependent | Lender process (weeks) |

| Risk Sharing | Seller motivated for success | Government guarantee |

Seller financing excels in speed and customization, often closing in days rather than weeks, which is crucial for time-sensitive opportunities. Industry data shows 20-30% of small deals incorporate this method, underscoring its practicality. However, pairing it with an SBA 7(a) loan provides added security through government backing, balancing risks while maximizing leverage.

Risks, Legal Documents, and Prevalence in US Acquisitions

While seller financing facilitates business purchases, it carries inherent risks that demand careful management. Buyers face potential default consequences, such as the seller reclaiming the business if payments falter, which can disrupt operations and credit. Sellers risk non-payment without full collateral enforcement, especially in economic downturns. We mitigate these through thorough due diligence, ensuring terms protect all parties and align with the buyer’s repayment capacity.

Legal documentation is essential to safeguard interests in these arrangements. Key paperwork includes promissory notes outlining repayment details and security agreements pledging assets as collateral. Additional filings, like UCC-1 statements, secure the seller’s lien position. For combinations with SBA 7(a) loans, subordination agreements are required to comply with lender priorities, as per SBA funding program guidelines.

Promissory Note Definition: A legal document where the buyer promises to repay the seller a specified amount under agreed terms, including principal, interest, and maturity date.

To streamline the process, we advise using checklists for required documents:

- Purchase agreement incorporating financing terms.

- Promissory note with amortization schedule.

- Security agreement and UCC filings.

- Subordination agreement if blending with bank loans.

- Personal guarantees, if applicable.

Seller financing is prevalent in US acquisitions, particularly for small businesses under $5 million, where 20-30% of deals feature it according to industry benchmarks. This commonality stems from its adaptability in owner-financed transitions, especially in sectors like retail and services. In acquisitions in the US, it complements traditional options, enabling more entrepreneurs to enter ownership.

| Document Type | Seller Financing | SBA 7(a) Loan |

|---|---|---|

| Promissory Note | Required | Not primary (uses loan agreement) |

| Security Agreement | Essential for collateral | Required for assets |

| Subordination | Needed for hybrids | Lender dictates |

| UCC Filings | Seller-specific | Comprehensive review |

Understanding these elements allows buyers to navigate risks effectively. At Zaidwood Capital, our expertise in hybrid structures ensures compliant, efficient executions, transitioning seamlessly to more advanced financing strategies for larger deals.

Advanced Financing Structures and Advisory Support

When pursuing complex business acquisitions, buyers often explore advanced financing structures to optimize capital deployment and minimize risk. These sophisticated options build on basic loans by layering multiple sources, allowing for tailored solutions that align with deal specifics. For those looking to get a loan to buy a business, hybrid models combining government-backed programs with private arrangements provide a strong foundation for mid-market transactions.

Hybrid financing typically integrates an SBA 7(a) loan as the primary component with seller financing as secondary support. This approach leverages the SBA’s change-of-ownership provisions, which enable up to $5 million in funding for acquisitions, with flexible repayment terms up to 10 years for real estate-inclusive deals. Seller financing contributes additional capital, often covering 10-20% of the purchase price through deferred payments or notes, reducing the buyer’s upfront cash needs while aligning incentives between parties. Our team at Zaidwood Capital structures these hybrids to ensure compliance and efficiency, drawing on our extensive experience in facilitating seamless transitions.

| Structure | Key Features | Suitability | Zaidwood Role |

|---|---|---|---|

| SBA + Seller | Low down, flexible terms | Small-mid deals | Structuring support |

| Mezzanine Debt | Subordinated, equity-like | Growth acquisitions | Debt advisory |

Hybrid models like SBA + seller financing excel in smaller to mid-sized deals by combining low-down-payment government guarantees with vendor-backed terms, fostering quicker closings. In contrast, mezzanine debt serves larger growth-oriented acquisitions, providing subordinated capital that bridges senior debt and equity gaps through equity-like features such as warrants or conversion rights. These options enhance overall deal viability by distributing risk across funding layers.

For even more ambitious ventures, mezzanine and venture debt introduce advanced acquisition funding mechanisms suited to high-growth scenarios. Mezzanine debt, often unsecured and subordinate to senior loans, offers higher yields to lenders while providing buyers with flexible, non-dilutive capital up to 30% of total financing. Venture debt complements this for tech or scaling firms, extending runway without immediate equity surrender. These instruments demand rigorous valuation and cash flow projections, which our advisors meticulously prepare.

Our M&A advisory services encompass full-cycle due diligence, including financial, legal, and operational reviews, alongside fairness opinions to validate transaction equity. We facilitate capital introductions through our network of over 4,000 investors and access to $15B in deployable capital, ensuring optimal funding matches. Additionally, we craft strategic documentation such as pitch decks and pro forma financials to support execution, guiding clients through every phase of advanced deals with precision and expertise.

Frequently Asked Questions on Business Loans

What are the basic qualifications to get a loan to buy a business?

To meet acquisition eligibility for getting a loan to buy a business, lenders typically require a strong credit score above 680, a detailed business plan outlining operations and projections, and relevant industry experience. Per SBA guidelines, personal guarantees may also be needed to demonstrate commitment.

What are the best loan types for business acquisitions?

The SBA 7(a) loan stands out for its flexibility and government backing, covering up to 90% of financing needs. Seller financing complements this by allowing the seller to fund a portion, easing approval for buyers with solid plans but limited capital.

What down payment is typically required?

Most lenders expect a down payment of 10-20% of the purchase price to show skin in the game, reducing their risk while aligning buyer interests with long-term success.

What options exist for limited collateral?

With limited collateral, personal guarantees or seller financing can bridge gaps. SBA loans often rely on business cash flow rather than assets, making them accessible for established acquisitions.

What interest rates should I expect on these loans?

Rates generally range from 5-10%, with SBA 7(a) loans tied to prime plus 2.25-4.75% per SBA guidelines. We at Zaidwood Capital, a boutique M&A firm, recommend consulting us for personalized rate strategies and financing FAQs to guide your decision.

Navigating Your Business Acquisition Financing Journey

Embarking on your acquisition path forward requires understanding key financing options like getting a loan to buy a business. Fundamentals include eligibility criteria such as strong credit and business plans, with competitive rates around 7-10% for an SBA 7(a) loan. Seller financing offers flexible terms from motivated owners, while hybrid structures combine these for optimized funding. Thorough due diligence ensures informed decisions, mitigating risks in this complex process.

At Zaidwood Capital, our expertise in full-cycle M&A advisory and access to over 4,000 investors streamline your financing summary. We guide clients through mezzanine debt and capital formation for seamless executions.

We stand ready to empower your journey–contact us to explore tailored solutions today.