Help Selling My Business

Table of Contents

Navigating Help Selling Your Business

Selling a business marks a pivotal moment for owners, often fraught with uncertainties that demand expert guidance. Many entrepreneurs seek Sell My Business options without realizing the complexities involved, especially when generating at least $1,000,000 in revenue. We at Zaidwood Capital understand the need for reliable help selling my business, as solo efforts frequently lead to overlooked opportunities and prolonged timelines.

Common pain points in unassisted sales include undervaluation, where owners miss fair market pricing due to inadequate analysis; legal risks from incomplete documentation; and excessive time consumption in buyer sourcing. Professional M&A advisors like us mitigate these through strategic guidance, ensuring confidentiality and maximizing value. Our boutique services encompass buy-side and sell-side mandates, leveraging access to over 4,000 institutional investors. With $24.4B in aggregate transaction volume, we streamline transactions while adhering to rigorous due diligence. Unlike a traditional business broker, we focus on mergers and acquisitions advisory, helping with business valuation and preparation basics drawn from established guides like the Selling a Small Business Guide, which emphasizes timely valuation and transparent financials for credible negotiations.

This guide equips you with fundamentals of advisory support, detailed business valuation methods, preparation strategies for exit readiness, and advanced tactics for optimal outcomes. As your trusted partner, we commit to empowering assistance with business exit, fostering professional sale support tailored to your success.

Fundamentals of Business Sales and Advisory Support

When owners seek help selling my business, understanding the roles of professional advisors becomes essential for navigating complex transactions successfully. At Zaidwood Capital, we specialize in providing tailored M&A advisory support, leveraging our extensive network to connect clients with over 4,000 institutional and private investors. This boutique approach ensures full-cycle guidance from valuation to closing, drawing on our proven track record of more than 300 deals and $24.4 billion in aggregate transaction volume.

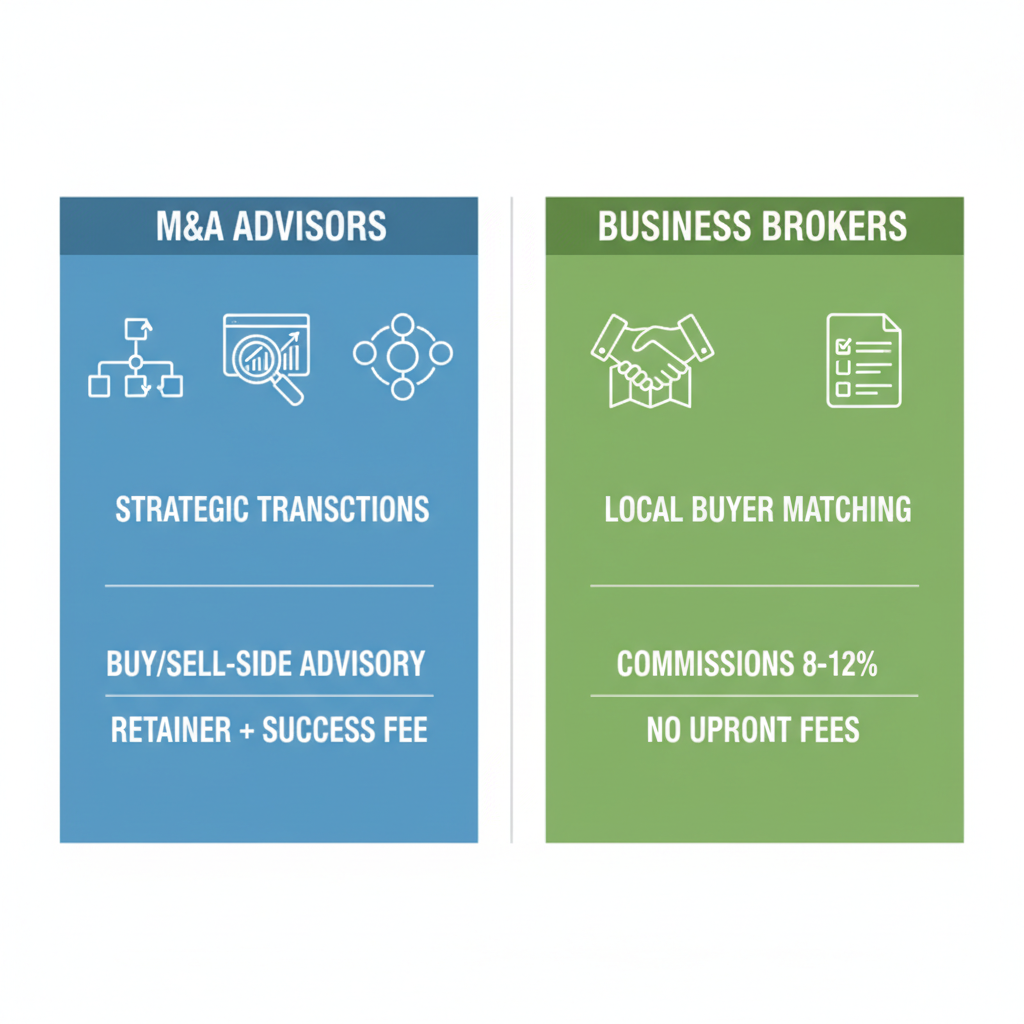

M&A advisors play a pivotal role in strategic transactions, particularly for mid-market companies with revenues exceeding $1 million. Their responsibilities encompass comprehensive deal structuring, including buy-side and sell-side advisory, precise business valuation, and full-cycle due diligence across financial, legal, operational, and commercial aspects. Advisors also facilitate debt and equity structuring, providing access to investor networks for capital introductions that streamline the sale process. This expertise is crucial for achieving accurate enterprise worth assessment and mitigating risks associated with undervaluation or overlooked liabilities.

In contrast, a business broker focuses on facilitating sales for smaller enterprises, typically those valued under $5 million. These sale facilitation experts handle listing preparation, targeted buyer outreach within local markets, and basic negotiation support to match sellers with appropriate purchasers. While brokers emphasize marketing the business effectively, their scope often excludes advanced financial modeling or institutional capital raising, making them suitable for straightforward transactions.

Both M&A advisors and business brokers complement each other in the sales ecosystem, offering distinct yet overlapping support depending on the business’s scale and complexity. Advisors provide depth in strategic planning and high-level financing, while brokers excel in efficient, localized matchmaking. Together, they address different facets of the sale, enabling owners to select the right professional based on their specific needs.

| Aspect | M&A Advisors | Business Brokers |

|---|---|---|

| Primary Focus | Strategic transactions for mid-market companies ($1M+ revenue), including full-cycle due diligence and capital introductions | Facilitating sales of smaller businesses, often under $5M, with emphasis on local buyer matching |

| Services Included | Buy/sell-side advisory, valuation, debt/equity structuring, investor network access | Listing preparation, buyer outreach, basic negotiation support |

| Fee Structure | Retainer plus success fee (Lehman or double Lehman formula) | Commission on sale price (8-12%), no upfront fees |

This comparison highlights how M&A advisors are ideal for larger, more intricate deals requiring sophisticated structuring, whereas business brokers suit simpler, smaller-scale sales with quicker timelines. Owners of growing enterprises benefit from advisory depth to maximize value, while micro-business sellers gain from broker efficiency in finding regional buyers.

Evaluating these differences underscores the importance of aligning professional support with business size and goals. For instance, mid-market firms often require the investor connections and due diligence rigor that advisors provide, potentially yielding higher returns through optimized terms. In smaller deals, brokers’ commission-based model minimizes upfront costs, though it may limit access to premium financing options. This framework helps owners decide proactively, ensuring the chosen expert enhances the transaction’s success without unnecessary expenses.

Comparison of M&A advisors versus business brokers services and fees

Engaging experts is necessary for valuation accuracy and risk mitigation, as self-managing sales can lead to errors in assessing true business worth or exposing vulnerabilities during negotiations. To find reputable professionals, verify credentials through resources like the FINRA Investor Protection guide, which emphasizes checking registration status to ensure legitimacy without implying broker-dealer services. Look for track records of completed deals and client testimonials, prioritizing those with experience in your industry.

Costs vary by engagement: advisors typically charge retainers plus success fees based on formulas like the Lehman scale, reflecting their comprehensive involvement, while brokers operate on pure commissions. At Zaidwood Capital, our full-cycle M&A and capital advisory services focus on Who Can Help Me Sell My Company, guiding clients through strategic transactions with precision and efficiency.

This website is for informational purposes only and is not an offer, solicitation, recommendation, or commitment to transact. Not investment advice–consult your legal, tax, and financial advisors before making decisions. Investments involve risk; investments may be illiquid and investors may lose all or part of their investment. Past performance does not guarantee future results.

Deep Dive into Valuation and Advisory Services

When owners seek help selling my business, understanding its true value is the cornerstone of a successful transaction. In the realm of mergers and acquisitions advisory, accurate business valuation ensures fair pricing and attracts qualified buyers. At Zaidwood Capital, we specialize in providing comprehensive mergers and acquisitions advisory services, including full-cycle due diligence that leverages our proprietary data to refine valuations and strategize sales effectively. This deep dive explores key methods and factors to empower mid-market businesses generating at least $1 million in revenue.

Understanding Business Valuation Methods

Business valuation forms the foundation of any sale process, determining the fair market value through established enterprise appraisal techniques. For mid-market businesses, common approaches include asset-based, income-based, and market-based methods, each suited to different operational profiles. The asset-based method calculates value by subtracting liabilities from asset totals, offering a straightforward balance sheet snapshot. Income-based approaches, such as discounted cash flow (DCF), project future earnings and discount them to present value, capturing growth trajectories. Market-based valuation relies on multiples from comparable sales, reflecting real-world transaction data.

As detailed in the Selling a Small Business Guide, there is no single formula for valuation; instead, these methodologies provide flexible tools tailored to the business’s context. Selecting the right method–or a combination–during sale preparation is crucial, especially for owners preparing documentation to support negotiations and transparency.

The following table compares these key methods for small to mid-sized businesses:

| Method | Description | Pros | Cons | Best For |

|---|---|---|---|---|

| Asset-Based | Values assets minus liabilities | Simple for asset-heavy firms | Ignores future earnings | Manufacturing or real estate |

| Income-Based (DCF) | Discounted future cash flows | Accounts for growth potential | Relies on projections | Tech or service firms |

| Market-Based | Comparable sales multiples | Market-driven realism | Limited comparables | Similar industry peers |

We often recommend hybrid approaches, integrating multiple methods for a robust assessment, particularly when providing fairness opinions in our advisory services. For instance, a manufacturing firm with $2 million in annual revenue might blend asset-based with market multiples to highlight both tangible holdings and peer benchmarks, enhancing buyer confidence.

These techniques underscore the value of professional input; unlike a business broker focused solely on facilitation, our team conducts in-depth analyses to optimize outcomes. By applying these methods, we help clients achieve valuations that reflect their enterprise’s full potential, bridging theoretical calculations with practical sale intermediary support.

Comparison of common business valuation methods for mergers and acquisitions

This visual representation aids in grasping how each approach contributes to a holistic business valuation strategy, informing decisions in competitive markets.

Factors Influencing Your Business Value

Several internal and external elements shape a business’s valuation, directly impacting sale proceeds. Internally, financial performance stands out: consistent revenue growth, healthy profit margins, and strong cash flow are paramount. For a service-oriented firm with $1.5 million in revenue, optimized working capital can elevate value by 20-30%, as buyers prioritize sustainable earnings. Operational efficiency, including streamlined processes and a skilled workforce, further bolsters appeal, while robust documentation–financial statements, contracts, and IP portfolios–mitigates risks during due diligence.

Externally, market conditions play a pivotal role; economic stability, industry trends, and competitive landscapes influence multiples. In a booming sector like technology, valuations may rise due to high demand, whereas regulatory changes or recessions can depress them. The Selling a Small Business Guide emphasizes preparing comprehensive records to address these dynamics, noting that transparency with potential buyers fosters trust and higher offers.

To address these factors pre-sale, we advise strategic optimizations. Internally, conduct a financial audit to clean up balance sheets and implement cost controls, potentially increasing value through enhanced EBITDA. For external influences, time the sale during favorable market cycles–ideally when industry peers are transacting actively. Owners should seek professional business valuation early, around 12-18 months before listing, to identify gaps and execute improvements.

At Zaidwood Capital, our full-cycle due diligence integrates these assessments, providing tailored strategies like operational enhancements and market positioning. For example, we recently assisted a mid-market client in refining their operations, which not only addressed internal weaknesses but also capitalized on external opportunities, resulting in a 15% valuation uplift. This advisory tie-in ensures clients maximize value, aligning with our commitment to streamlining transactions for optimal results.

External factors can be mitigated through diversification or strategic partnerships, while internal strategies focus on scalability. Ultimately, engaging experts early transforms potential vulnerabilities into strengths, paving the way for a confident sale process.

Practical Steps to Prepare and Execute Your Sale

Preparing to sell your business requires a structured approach that builds confidence and maximizes value. We at Zaidwood Capital emphasize starting with internal readiness to ensure a smooth transition when seeking help selling my business. This preparation not only streamlines the process but also positions your company attractively to potential buyers. By addressing key areas early, you mitigate risks and accelerate the overall timeline through our M&A capital advisory services, which leverage the Velocity Matrix for efficient outcomes.

Key Preparation Actions Before Engaging Help

Before bringing in external advisors, focus on essential internal preparations to demonstrate your business’s health and organization. These pre-sale readiness measures form the foundation for a successful transaction.

- Conduct Financial Statement Reviews: Begin by auditing your financials for accuracy. Gather the last three years of profit and loss statements, balance sheets, and cash flow reports. Address any discrepancies, such as unreconciled accounts or outdated valuations, to present a clear financial picture. For instance, if your revenue streams include seasonal fluctuations, document them thoroughly to avoid surprises during due diligence.

- Perform Operational Audits: Evaluate your day-to-day operations, including supply chain dependencies and key customer contracts. Identify any vulnerabilities, like over-reliance on a single client, and develop contingency plans. This step ensures operational continuity post-sale, which buyers value highly.

- Organize Strategic Documentation: Compile critical documents such as intellectual property records, employee agreements, and compliance certifications. Create a secure data room for these materials to facilitate quick access once advisors are engaged. We recommend using digital tools for version control to maintain professionalism.

These actions typically take 1-3 months and equip you with pre-sale readiness measures that enhance credibility. By completing them independently, you reduce advisory costs and demonstrate proactive management. For example, a client in the manufacturing sector recently organized their documentation ahead of time, which sped up our initial assessment by weeks. Tips include prioritizing high-impact areas like financials first and consulting internal accountants for quick wins. This groundwork aligns with regulatory standards outlined in FINRA Notice 25-06, promoting transparent practices from the outset.

Engaging Professionals and Managing Costs

Once prepared, engaging professionals is crucial for navigating the complexities of a business sale. We guide clients through selecting advisors via requests for proposals (RFPs) and clear contracts, ensuring alignment with your goals. Understanding professional fee structures upfront helps manage expectations and budgets effectively.

Advisor fees vary by service and firm size. Retainers often range from $25,000 to $100,000 to cover initial strategy and due diligence. Success fees, typically 1-5% of the transaction value, incentivize strong outcomes. For business valuation services, expect costs between $5,000 and $50,000, depending on complexity; these are rarely free as they involve detailed analysis. A business broker might charge 8-12% commission on the sale price, focusing on smaller deals, while full-service firms like ours provide comprehensive support, including capital introductions to our network of over 4,000 investors.

Costs tie directly into the sale phases, influencing how quickly you progress. Transparent fee disclosures, as highlighted in FINRA Notice 25-06, ensure compliance and build trust during advisor selection. Below is a comparison of the key phases, illustrating how costs integrate with activities and timelines.

| Phase | Key Activities | Advisor Role | Timeline Estimate |

|---|---|---|---|

| Preparation | Financial audits, document organization, valuation prelims | Initial assessment and strategy development | 1-3 months |

| Engagement | Advisor selection, NDA signing, due diligence start | Full-cycle support including introductions | 3-6 months |

| Execution | Negotiations, closing, post-sale transition | Deal structuring and fairness opinions | 2-4 months |

Engaging experts like our team accelerates these timelines significantly. For instance, our Velocity Matrix streamlines due diligence, often reducing the engagement phase by 20-30% through proprietary tools and our $24.4 billion aggregate transaction experience. Post-engagement, we handle negotiations and provide fairness opinions to ensure equitable deals. A manufacturing client benefited from our introductions, closing in under six months total. Tips for cost management include negotiating capped retainers and prioritizing firms with success-based incentives. Always review contracts for regulatory compliance per FINRA guidelines to avoid hidden fees. This structured approach not only controls expenses but also enhances deal quality, preparing you for advanced optimization tactics.

Advanced Considerations in M&A Transactions

As business owners navigate the complexities of selling their company, advanced strategies become essential for maximizing outcomes. Beyond basic preparations, value maximization tactics focus on sophisticated optimizations that can significantly elevate your business valuation. For those seeking help selling my business, integrating expert guidance early ensures these enhancements align with market dynamics and buyer expectations. Our team emphasizes earnings normalization–adjusting financials to reflect sustainable performance–and crafting robust growth projections that demonstrate future potential. These approaches not only highlight operational strengths but also mitigate risks associated with undervaluation during negotiations.

To illustrate key value maximization tactics, consider the following strategies, each tailored to different timelines and impacts:

- Earnings Normalization: Recast financial statements to eliminate one-time expenses and owner perks, presenting a clearer picture of recurring profitability.

- Process Streamlining: Identify inefficiencies in operations and supply chains to boost margins, appealing to buyers focused on scalability.

- Documentation Enhancement: Develop comprehensive pitch materials and financial models that underscore strategic positioning and synergies.

The following table compares prominent strategies to enhance business valuation, balancing quick wins against long-term optimizations:

| Strategy | Description | Impact on Valuation | Implementation Time |

|---|---|---|---|

| Financial Cleanup | Normalize earnings, reduce expenses | 10-20% uplift | 1-2 months |

| Operational Efficiency | Streamline processes, key contracts | 15-25% potential | 3-6 months |

| Strategic Documentation | Pitch decks, pro formas via advisors | Direct appeal to buyers | Ongoing |

These strategies provide a framework for pre-sale preparations, with financial cleanup offering rapid gains ideal for time-sensitive deals, while operational efficiency delivers deeper, sustainable value. Implementation time varies based on company size, but starting early amplifies results. At Zaidwood Capital, we integrate these tactics into our advisory process to help clients achieve optimal valuations without overextending resources.

Evaluating intermediaries is crucial in advanced M&A contexts. For smaller transactions, a business broker may suffice to facilitate introductions and basic negotiations, particularly when speed is prioritized over complexity. However, for intricate deals involving multiple stakeholders or international elements, intermediary evaluation reveals the superiority of specialized advisors who manage full-cycle due diligence, including financial audits, legal reviews, and compliance checks. We advise verifying professionals through resources like FINRA’s investor protection tools to ensure registration and ethical standards, building trust in high-stakes phases where overlooked discrepancies can derail transactions. Timing risks, such as market volatility or regulatory delays, underscore the need for agile advisory support to navigate uncertainties effectively.

Our boutique M&A advisory services at Zaidwood Capital elevate these considerations through unparalleled access to over $15 billion in deployable capital from a network of more than 4,000 institutional investors. We provide full-cycle due diligence, capital formation advisory, and exclusive deal vault access, enabling sophisticated clients to structure liquidity solutions and strategic documentation with precision. With an aggregate transaction volume exceeding $24.4 billion across 300+ deals, our team–led by experts in mergers and acquisitions–delivers streamlined transactions that mitigate risks while capitalizing on opportunities. This integrated approach ensures seamless execution, from equity advisory to fairness opinions, positioning your business for superior outcomes in competitive markets.

Frequently Asked Questions on Selling Your Business

Seeking Help Selling My Business? At Zaidwood Capital, we provide expert guidance through our M&A advisory services to simplify the process.

How Can I Find Professional Help to Sell My Business?

Engage reputable M&A advisors like us for comprehensive support. We offer full-cycle due diligence and capital introductions to connect you with qualified buyers efficiently, ensuring a smooth transaction.

What Does a Business Broker Do When Selling a Company?

A business broker markets your business, negotiates terms, and facilitates buyer interactions. While we focus on advisory, our team handles similar roles through strategic positioning and investor matching.

How Much Does a Business Broker Charge?

Fees typically range from 5-12% of the sale price, plus retainers. Zaidwood Capital structures our advisory fees transparently, aligning with transaction success and value delivered.

When Should I Get a Professional Business Valuation?

Obtain a business valuation early, before listing, to set realistic expectations. As noted in the Selling a Small Business Guide, it’s essential for fair market assessment and negotiation preparation.

Why Is Preparation Essential for Selling?

Thorough preparation involves financial audits and documentation. We assist with due diligence to present your business attractively, maximizing value and attracting serious investors.

Partnering with Zaidwood for Your Business Sale

Selling your business demands meticulous preparation, precise business valuation, and collaboration with professionals such as a business broker to navigate complexities effectively. At Zaidwood Capital, we emphasize help selling my business through expert exit strategies that maximize value and streamline processes for successful outcomes.

Our full-cycle M&A and capital formation advisory services draw on $24.4 billion in aggregate transaction volume and connections to over 4,000 institutional investors with more than $15 billion in deployable capital, ensuring access to optimal financing and buyers.

We uphold compliant practices aligned with FINRA Notice 25-06 to support efficient capital formation. Contact us today for a personalized consultation to optimize your sale and achieve a seamless exit.