Who Can Help Me Sell My Company

Table of Contents

Understanding Options for Selling Your Company

Selling a company is a pivotal decision that demands careful navigation to achieve maximum value while mitigating risks. Many business owners wonder, Who Can Help Me Sell My Company, especially when facing complexities like valuation inaccuracies and limited buyer networks. At Zaidwood Capital, we understand these challenges and provide professional sale assistance for businesses, ensuring a strategic approach tailored to middle-market companies with at least $1,000,000 in revenue. If you are considering whether to Sell My Business, our team can help.

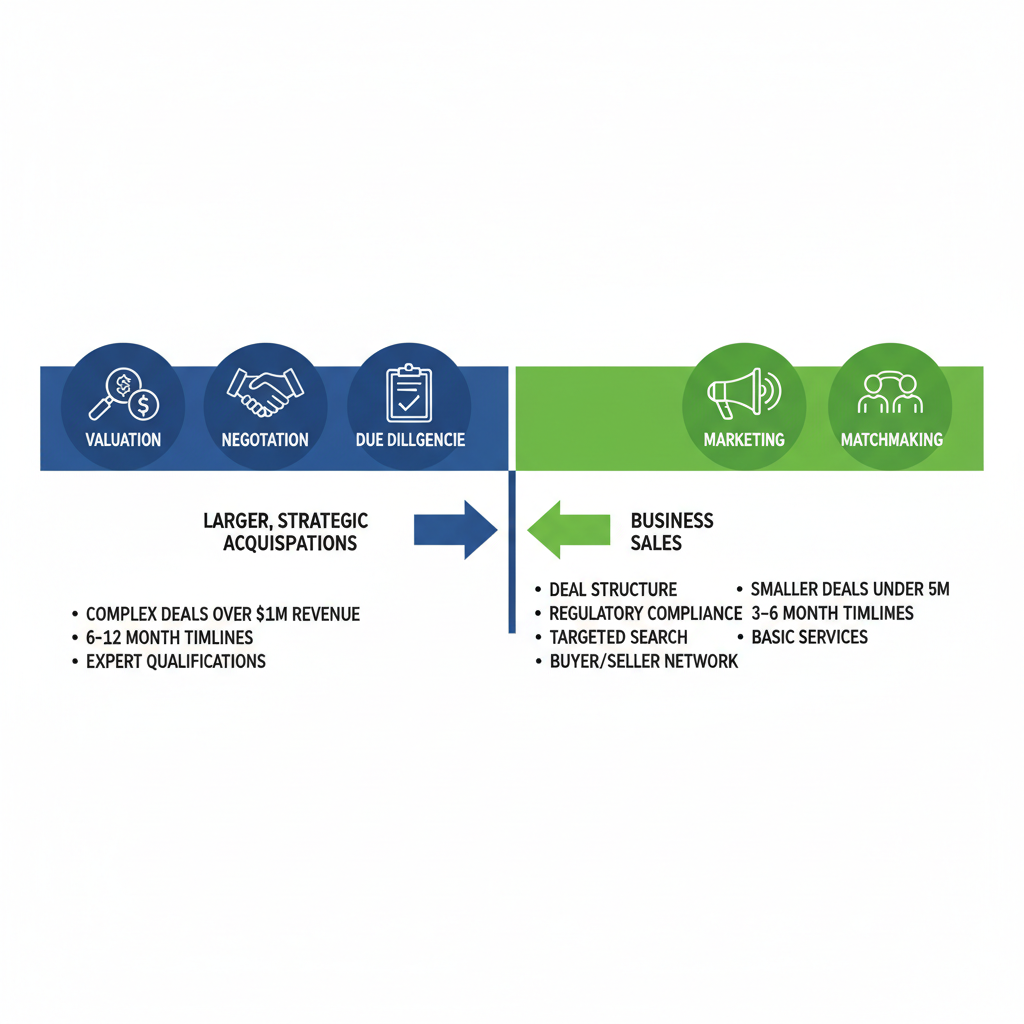

Professional guidance is essential in these transactions. An M&A advisor specializes in complex deals for larger enterprises, offering full-cycle services from valuation to closing, including due diligence and capital introductions. In contrast, a business broker typically handles smaller transactions with a focus on local matchmaking. Self-selling often leads to pitfalls like undervaluation or protracted negotiations, underscoring the need for company exit specialists. We at Zaidwood Capital differentiate through our expertise in sell-side mandates, leveraging access to over 4,000 investors and more than $15 billion in deployable capital. Our team has driven $24.4 billion in aggregate transaction volume across 300+ deals, delivering streamlined outcomes.

Resources like Small Business Development Centers (SBDCs), partnered with the U.S. Small Business Administration, offer valuable general counseling on business planning and operations, complementing but differing from our specialized M&A focus. Understanding these options is the first step; subsequent sections explore detailed roles and strategies to prepare your business for a successful exit.

The Basics of M&A Advisors and Business Brokers

When considering how to sell your company, understanding the roles of key professionals is essential. M&A advisors and business brokers serve as vital transaction intermediaries, guiding owners through the sale process. At Zaidwood Capital, we specialize in full-cycle M&A advisory, leveraging our extensive experience to support middle-market businesses. These experts ensure transactions align with strategic goals, from initial valuation to closing.

M&A advisors focus on complex deals for companies with revenues exceeding $1 million. They structure intricate transactions, including mergers and acquisitions, by performing detailed valuations, leading negotiations, and overseeing due diligence. As noted in industry standards from the IPAG M&A advisors’ job description, these professionals conduct financial and market analysis to assess risks and develop strategies that drive growth. Our team at Zaidwood handles sell-side mandates, capital raising, and strategic documentation, connecting clients to over 4,000 institutional investors with access to more than $15 billion in deployable capital. This comprehensive approach minimizes risks and maximizes value in larger, multifaceted sales.

In contrast, business brokers act as sale facilitation experts for smaller transactions, typically under $5 million. They emphasize marketing the business effectively and providing basic matchmaking between buyers and sellers. While they facilitate listings and initial introductions, their scope often stops short of in-depth financial structuring. For owners of modest enterprises, a business broker streamlines the process by preparing marketing materials and handling basic negotiations, making it accessible for straightforward exits.

| Aspect | M&A Advisor | Business Broker |

|---|---|---|

| Deal Size Focus | Businesses over $1M revenue | Sales under $5M |

| Services Provided | Valuation, negotiation, due diligence, capital raising | Marketing, matchmaking, basic facilitation |

| Qualifications Needed | Advanced degrees, certifications, extensive networks | Licensing, sales experience |

| Typical Timeline | 6-12 months | 3-9 months |

| Cost Structure | Retainer plus success fee | Commission-based (typically 8-12%) |

This comparison highlights how M&A advisors excel in sophisticated, high-value deals requiring strategic depth, while business brokers suit simpler, quicker sales. At Zaidwood, we tailor our advisory to middle-market complexities, ensuring efficient outcomes without unnecessary delays.

Qualifications for these roles vary by transaction type. M&A advisors often hold MBAs or master’s degrees in finance, with certifications like CFA enhancing credibility. The IPAG description emphasizes proficiency in financial modeling and international communication for global deals. Our Zaidwood leaders, including Bryann Cabral, Rami Zeneldin, and Samuel Leung, bring over 300 completed transactions and $24.4 billion in aggregate volume, underscoring our expertise. Business brokers typically need real estate or business licensing and proven sales acumen. Preparation involves financial audits and documentation to attract serious buyers, setting the stage for success.

Building on these professional options, if you’re wondering Help Selling My Business, engaging the right advisor early can transform the journey. We at Zaidwood provide tailored support for your unique needs, from valuation to investor introductions.

Comparison of M&A advisors and business brokers for business sales

This foundational knowledge empowers informed decisions, whether pursuing a boutique M&A advisor for comprehensive guidance or a business broker for streamlined facilitation.

In-Depth Exploration of Sell-Side Transactions

When considering the question of who can help me sell my company, turning to experienced sell-side experts becomes essential for navigating the complexities of mergers and acquisitions. At Zaidwood Capital, we provide comprehensive support throughout the sell-side process, drawing on our $24.4 billion in aggregate transaction experience and network of over 4,000 institutional investors. This deeper exploration outlines the key stages and services involved, from initial preparation to final closing, ensuring clients achieve optimal outcomes in a structured manner.

Key Services in Sell-Side Advisory

As a leading boutique ma advisory firm, we specialize in core services that guide clients through sell-side transactions with precision and efficiency. Our M&A advisory encompasses equity advisory, debt structuring, and strategic consulting, all tailored to mid-market companies seeking to maximize value. Preparation begins with robust valuation assessments, where we develop confidential teasers and financial pro formas to highlight the business’s strengths.

Marketing follows, involving targeted investor outreach to our extensive network, ensuring broad yet discreet exposure. We then handle negotiations, drafting letters of intent (LOIs) and term sheets to secure favorable terms. Finally, closing integrates full-cycle due diligence and documentation, supported by success-based fees typically ranging from 1 to 5 percent of the transaction value. Our team’s credentials, led by professionals like Bryann Cabral, Rami Zeneldin, and Samuel Leung, underscore our ability to deliver these services effectively.

| Service Category | M&A Advisor | Business Broker |

|---|---|---|

| Valuation Expertise | Comprehensive financial modeling, DCF analysis, comparable transactions | Basic multiples-based valuation |

| Buyer Sourcing | Access to 4,000+ institutional investors | Local and regional networks |

| Negotiation Support | Strategic deal structuring and fairness opinions | Standard LOI guidance |

| Due Diligence | Full-cycle (financial, legal, operational) | Limited coordination |

| Marketing | Confidential teasers and data room management | Public listings and broker networks |

| Timeline | 6-12 months for complex deals | 3-6 months for smaller deals |

Role of Due Diligence in Company Sales

Due diligence forms the backbone of any successful sell-side transaction, serving as a critical preparation phase to withstand buyer scrutiny and mitigate risks. This full-cycle process systematically reviews financial, legal, operational, commercial, IT, and human capital aspects, ensuring all representations are accurate and defensible. According to the Ohio State University Extension factsheet on business transitions, external sales can require one to three years, emphasizing the need for early and meticulous diligence to avoid delays or deal failures.

We at Zaidwood Capital integrate due diligence from the outset, beginning with internal audits of financial records and pro formas, drawing on SBA guidance for comprehensive business planning that includes market analysis and projections. This preparation identifies potential red flags, such as incomplete documentation or compliance issues, allowing time for remediation. As the process advances, we coordinate with legal and financial experts to compile a virtual data room, facilitating secure buyer access while protecting sensitive information.

In negotiation and closing stages, due diligence evolves into collaborative verification, where buyers conduct their reviews under non-disclosure agreements. Our role involves providing fairness opinions and strategic support to address queries efficiently, reducing timeline risks influenced by market conditions. For instance, OhioLine data notes that only 33 percent of small businesses have transition plans, often leading to closures; our proactive approach counters this by aligning diligence with the overall sell-side strategy.

The benefits of thorough due diligence are profound: it maximizes transaction value by building buyer confidence, minimizes post-closing disputes, and streamlines the path to completion. Clients engaging our full-cycle services gain peace of mind, knowing their company is positioned for a seamless handover. By addressing relevant questions like the role of an M&A advisor in preparation, we empower owners to approach sales with clarity and strategic foresight.

Practical Steps for Engaging Professionals

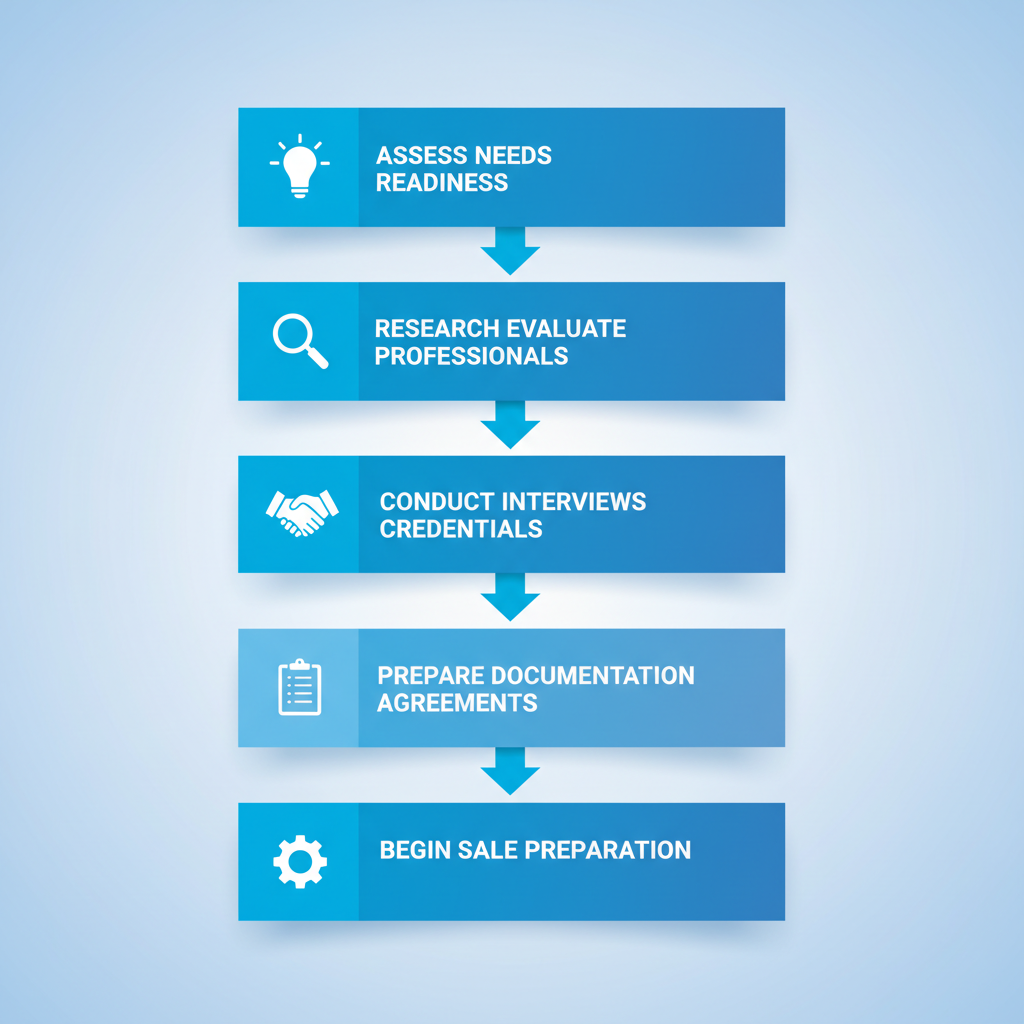

When considering who can help me sell my company, business owners often seek experienced professionals to navigate the complexities of mergers and acquisitions. At Zaidwood Capital, we guide clients through a structured professional engagement process, ensuring alignment with their goals for mid-market transactions. This involves evaluating potential advisors, selecting the right fit, and preparing your business meticulously. By following these steps, you can mitigate risks and maximize value in the sale process.

Evaluating and Selecting Advisors

Assessing qualifications begins with reviewing the track record of potential M&A advisors or business brokers. Look for firms with proven deal experience, such as aggregate transaction volumes exceeding $24 billion and hundreds of completed deals. A strong network is crucial–prioritize those connected to over 4,000 institutional investors for broader buyer access. Always request client references to gauge satisfaction and outcomes.

Costs vary by service provider. M&A advisors typically charge retainers plus success fees of 1-5%, reflecting their comprehensive involvement in due diligence and capital raising. Business brokers often operate on fixed fees or commissions, suitable for smaller transactions. To verify credentials, we recommend using the FINRA Check Registration tool, which helps confirm regulatory compliance and protect against unqualified practitioners.

Conduct selection interviews with multiple candidates. Prepare questions on their approach to your industry and timelines, typically 1-3 months for initial engagement. Sign non-disclosure agreements (NDAs) early to discuss sensitive details securely. Avoid common pitfalls like rushing without thorough due diligence, as this can lead to mismatched partnerships.

| Criteria | M&A Advisor | Business Broker |

|---|---|---|

| Network Size | 4,000+ institutional investors | Regional buyers |

| Deal Experience | $24.4B volume, 300+ deals | Smaller transactions |

| Services Scope | Full-cycle due diligence, capital raising | Marketing and basic negotiation |

| Cost Structure | 1-5% success fee | Fixed or commission-based |

| Ideal Company Size | $1M+ revenue mid-market | Under $5M sales |

This framework helps prioritize based on your business needs–for instance, mid-market firms benefit from M&A advisors’ extensive networks, while smaller operations may suit brokers’ cost efficiency. Zaidwood Capital excels in network and experience, offering zaidwood capital services tailored to sell-side mandates. Applying these insights ensures a strategic selection that aligns with your objectives.

Step-by-step process for hiring M&A advisors and brokers

Preparing Your Business for Sale

With advisory support from sale preparation partners, readying your business starts with financials. Clean and audit statements to present accurate revenue, EBITDA, and projections–aim for at least three years of audited data. Address any discrepancies early to build buyer confidence. We assist in normalizing earnings, excluding one-time expenses to reflect sustainable performance.

Operational readiness involves IP audits to secure patents and trademarks, ensuring transferability. Evaluate management transitions, documenting key roles and succession plans to demonstrate continuity. Streamline processes, such as inventory management and customer contracts, to highlight scalability.

| Document Type | Key Components | Purpose |

|---|---|---|

| Financial Statements | Audited P&L, balance sheets, cash flow | Validate valuation and profitability |

| IP Inventory | Patents, trademarks, licenses | Protect assets and enable smooth transfer |

| Customer Contracts | Major agreements, renewal terms | Showcase revenue stability |

| Management Org Chart | Roles, bios, transition plans | Assure operational continuity |

| Pro Forma Projections | 3-5 year forecasts | Illustrate growth potential |

Advanced Considerations in Company Sales

After mastering the practical preparation steps, savvy owners turn to advanced elements that can significantly influence the outcome of a company sale. At Zaidwood Capital, we guide clients through sophisticated deal structuring, regulatory navigation, and strategic documentation to maximize value and minimize risks in sell-side transactions. Our expertise in full-cycle mergers and acquisitions ensures seamless execution for mid-market firms seeking optimal exits.

Advanced Deal Structures

In complex transactions, innovative financing options elevate the appeal of a deal. We specialize in structures like mezzanine debt, which blends debt and equity to fuel pre-sale growth, and equity advisory services that provide liquidity through partial sales or recapitalizations. Asset-based lending leverages company assets for secured funding, while full-cycle due diligence builds buyer confidence through thorough reviews. These approaches suit mid-market companies aiming for strategic growth or accelerated timelines.

| Structure | Description | Suitability |

|---|---|---|

| Mezzanine Debt | Hybrid debt-equity for growth pre-sale | Limited to smaller scales |

| Equity Advisory | Liquidity solutions via partial sales | Basic matchmaking |

| Asset-Based Lending | Secured financing using assets | Standard equipment focus |

| Full-Cycle Due Diligence | Comprehensive reviews for buyer confidence | Coordination only |

Zaidwood Capital excels in tailoring these for mid-market deals, drawing on our access to over 4,000 institutional investors. For instance, mezzanine debt suits firms with steady cash flows but limited collateral, while equity advisory fits owners desiring partial liquidity without full divestiture. This matrix helps owners align structures with their goals, often shortening the IPAC timeline from 9 to 18 months through our Velocity Matrix integration. As complex transaction specialists, we outperform basic business brokers by offering ma capital advisory that incorporates digital marketing for faster exits.

These options not only enhance deal viability but also position your company attractively in competitive US markets. Our team, led by seasoned professionals, negotiates terms that reflect true enterprise value, ensuring regulatory compliance from the outset.

Regulatory and Tax Considerations

Regulatory filings demand precision in advanced sales, particularly for cross-border or industry-specific deals. We handle SEC notifications, antitrust reviews under Hart-Scott-Rodino, and state-level approvals to avoid delays. Tax implications, such as capital gains structuring or 338(h)(10) elections, require expert foresight to optimize after-tax proceeds. For mid-market owners pondering ‘Who Can Help Me Sell My Company,’ partnering with an M&A advisor like Zaidwood mitigates these hurdles, preserving value amid evolving compliance landscapes. Our proprietary investor rolodex facilitates introductions that align with regulatory safe harbors, streamlining approvals.

Strategic Documentation

Robust documentation underpins successful advanced deals. We craft pitch decks that highlight synergies and pro forma financials, drawing on SBA guidelines for credible projections that integrate market analysis and growth strategies. These tools, including business plans and fairness opinions, demonstrate viability to buyers. Our deal vault secures sensitive data, enabling efficient virtual data rooms. As advanced sale intermediaries, we ensure documents reflect strategic intent, from liquidity solutions to venture debt terms, empowering informed negotiations.

Frequently Asked Questions About Selling Your Company

Selling your company often raises questions like “Who Can Help Me Sell My Company?” These professional help FAQs provide clear answers on engaging M&A advisors and business brokers for a smooth process.

Do I need an M&A advisor for my sale? Yes, especially for complex transactions. An M&A advisor navigates valuation, negotiations, and due diligence, ensuring optimal outcomes amid market dynamics.

What are typical costs for a business broker or M&A advisor? Fees vary by deal size, often 1-5% of sale price plus retainers. Industry data from sources like OhioLine highlights success-based structures to align incentives.

How do I choose a qualified M&A advisor? Evaluate experience, track record, and industry focus. Seek firms with strong networks and proven deal execution to match your business needs.

What is the typical timeline for selling a company? External sales generally take 1-3 years, per transition planning insights. Factors include preparation, buyer sourcing, and closing variables.

What role does Zaidwood Capital play in mergers and acquisitions advisory? We offer full-cycle mergers and acquisitions advisory services, connecting you to our network of over 4,000 investors for efficient sell-side mandates.

Next Steps in Your Company Sale Journey

As outlined in our ‘Who Can Help Me Sell My Company’ guide, this sale support summary highlights the choice between an M&A advisor and a business broker based on your business size and goals. Proper preparation and qualification remain essential for a smooth exit strategy wrap-up, ensuring maximum value in transactions.

At Zaidwood Capital, we leverage our extensive network of over 4,000 institutional investors and $24.4B in aggregate transaction volume to deliver full-cycle M&A advisory. Our team provides tailored guidance, from due diligence to capital introductions, streamlining your journey.

We encourage consulting SBA Resource Partners like Small Business Development Centers for initial planning support. Book a call with us today to explore your options without commitment.