Series F Funding

Table of Contents

Understanding Series F Funding Essentials

As startups mature, Series F funding emerges as a pivotal late-stage venture capital milestone, typically following Series E rounds. This advanced venture financing enables established companies to scale aggressively, solidify market dominance, and prepare for exits like IPOs or acquisitions. For a tech startup that has already achieved product-market fit and steady revenue growth, Series F Funding injects the capital needed to expand globally and enhance valuation ahead of public markets.

In this maturity-stage capital round, companies often raise between $50 million and $200 million to fuel initiatives such as international expansion, R&D acceleration, and operational scaling. Institutional investors, including private equity firms and hedge funds, dominate these pre-IPO funding opportunities, demanding rigorous due diligence and proven scalability. Preparation is key: robust financial modeling, strengthened governance, and compliance with regulatory standards–as outlined in SEC resources on raising later-stage capital–ensure smooth navigation. At Zaidwood Capital, we support clients through expert capital formation advisory and full-cycle due diligence, connecting them to our network of over 4,000 investors with access to $15 billion in deployable capital.

This section lays the groundwork for exploring Series F essentials. Subsequent discussions will delve into core fundamentals, strategic preparation, and advanced considerations to equip you for success in late stage venture capital.

Core Concepts of Series F Funding

Series F Funding represents a critical milestone for mature startups seeking to accelerate hyper-growth beyond initial market validation. This advanced stage of financing typically follows Series E and targets companies with proven revenue streams and expansive ambitions, such as acquisitions or global scaling. At Zaidwood Capital, we observe that understanding these core concepts empowers founders to navigate complex capital landscapes effectively. For a detailed overview, explore What is Series F Funding.

Late-stage venture capital at this level shifts focus from foundational product development to optimizing operations for sustained expansion. Unlike earlier rounds, Series F emphasizes risk mitigation through established business models, leading to higher valuation multiples that reflect market dominance. We draw from SEC guidelines on later-stage capital raising to underscore how these rounds build on prior investments, reducing uncertainty while amplifying growth potential. Typical raises range from $100 million to $300 million, enabling investments in infrastructure, talent acquisition, and international markets.

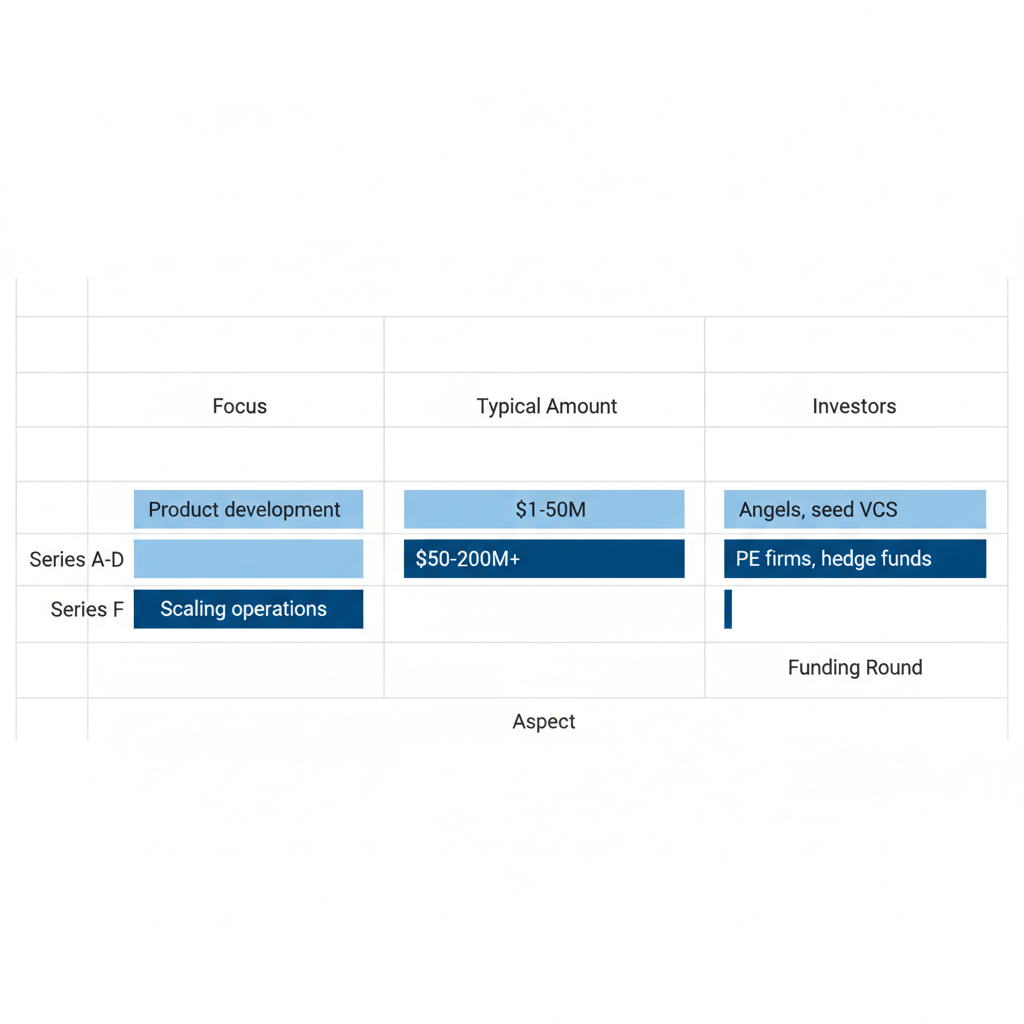

To illustrate the evolution, consider the key differences between Series F and earlier funding stages. The following table highlights critical aspects, informed by regulatory insights from the SEC on capital structures and maturity progression.

| Aspect | Series A-D (Early/Mid) | Series F (Late-Stage) |

|---|---|---|

| Focus | Product development and market entry | Scaling operations, international expansion, and pre-IPO readiness |

| Typical Amount | $1-50 million | $50-200 million+ |

| Investors | Angel investors, seed VCs | PE firms, hedge funds, sovereign wealth funds |

This comparison reveals how Series F funding matures the investment profile, transitioning from speculative bets to strategic infusions backed by robust financials. Startups entering this phase benefit from lower equity dilution due to elevated valuations, often assessed via revenue multiples of 10-20x, as validated by SEC resources on preparation for advanced capital raises.

In practice, these funds fuel pre-IPO funding strategies that prepare companies for public markets or major exits. For instance, a tech firm we advised used Series F proceeds to acquire complementary assets, boosting revenue by 150% within 18 months through streamlined global operations. Preparation involves rigorous financial audits, strategic planning, and governance enhancements to align with investor expectations in growth-stage equity rounds. This advanced capital infusion not only sustains momentum but also fortifies resilience against market volatility.

Such transformations highlight the pivotal role of expert guidance in late-stage venture capital. At Zaidwood Capital, our full-cycle capital advisory services assist clients in structuring these deals, conducting due diligence, and introducing them to our network of over 4,000 institutional investors. We emphasize tailored strategies that mitigate risks without promising outcomes, drawing on our $24.4 billion in aggregate transaction volume to facilitate seamless executions. This approach ensures founders position their ventures for optimal value creation in sophisticated funding environments.

Comparison of Series F funding aspects to earlier investment rounds

Building on these foundational mechanics, deeper analysis of investor dynamics and valuation tactics reveals opportunities for even greater strategic alignment, setting the stage for comprehensive deep dives into Series F intricacies.

In-Depth Analysis of Late-Stage Funding

Late-stage funding represents a critical phase in a company’s journey, where mature startups seek substantial capital to scale operations, prepare for exits, or navigate complex growth challenges. Within late stage venture capital, Series F funding rounds often attract sophisticated investors looking for high-conviction opportunities in established businesses. At Zaidwood Capital, we leverage our extensive network of over 4,000 institutional investors to connect clients with the right partners, drawing on our $24.4B aggregate transaction volume to facilitate seamless capital access. This analysis explores investor profiles, valuation strategies, and real-world examples to illuminate these dynamics.

Investor Profiles in Series F Rounds

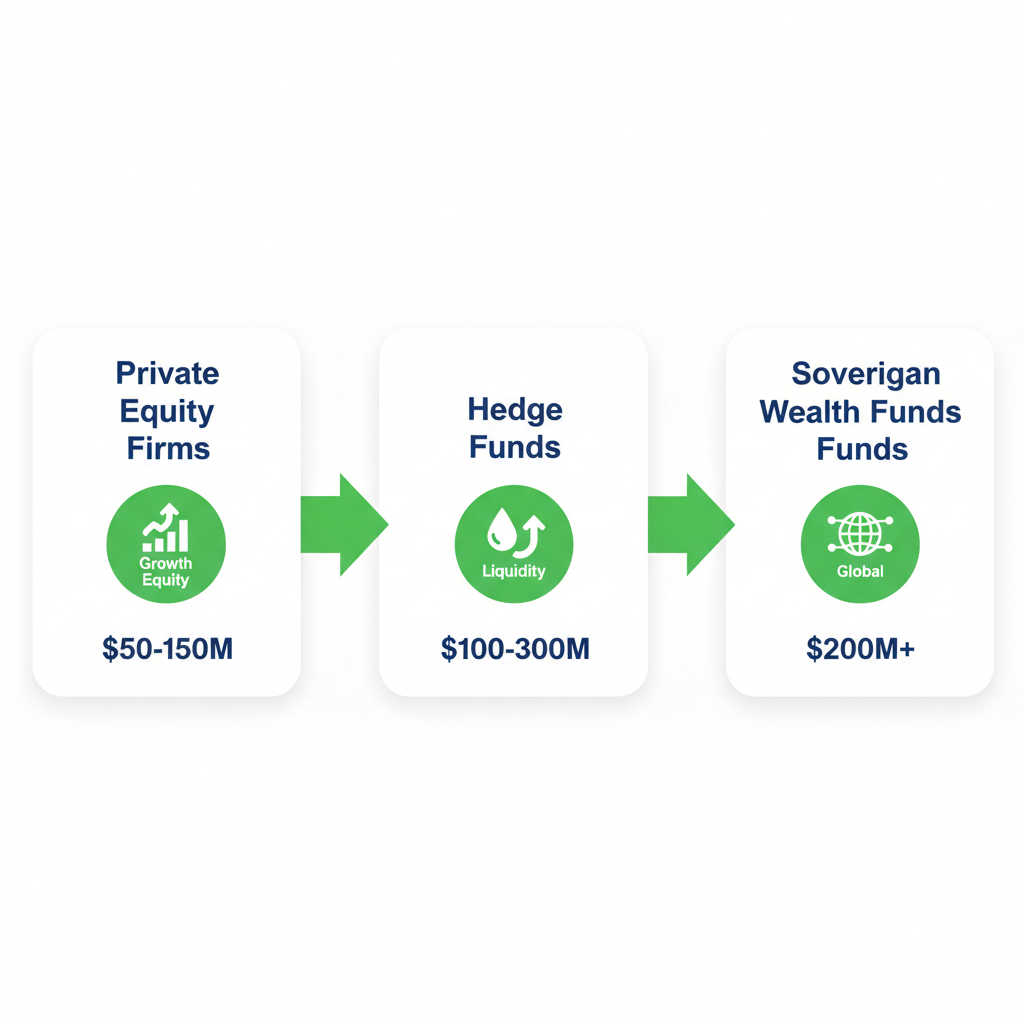

Series F Funding typically draws a diverse array of institutional players who bring not just capital but strategic expertise to mature companies. Private equity firms focus on growth equity and buyouts, aiming to optimize operations for maximum returns. Hedge funds prioritize pre-IPO liquidity, providing flexible capital to bridge valuation gaps before public markets. Sovereign wealth funds target strategic global expansion, injecting large sums to support international scaling. Endowments and family offices also participate, seeking stable, long-term yields from de-risked opportunities.

In our experience at Zaidwood Capital, these investors value companies with proven revenue streams and clear paths to liquidity events. We connect clients to this ecosystem, emphasizing alignments in growth trajectories and risk profiles. The diversity among these investors underscores the importance of tailored outreach; for instance, while hedge funds may demand aggressive timelines, sovereign funds often prioritize sustainable expansion.

This variety enhances opportunities for startups, allowing them to match specific needs with investor mandates. The following table outlines key investor types in late-stage venture capital, highlighting their focus areas and typical check sizes.

| Investor Type | Focus Areas | Typical Investment Size |

|---|---|---|

| Private Equity Firms | Growth equity and buyouts | $50-150M |

| Hedge Funds | Pre-IPO liquidity | $100-300M |

| Sovereign Wealth Funds | Strategic global expansion | $200M+ |

As illustrated, private equity firms offer mid-range commitments suited for operational enhancements, while sovereign wealth funds deploy outsized capital for transformative initiatives. Based on insights from the Harvard Venture Capital Outlook for 2026, this diversity is expected to intensify with recovering liquidity, favoring quality deals in AI and tech sectors. For startups, selecting the right investor type is pivotal; mismatched partnerships can dilute control or misalign incentives. At Zaidwood, we guide clients through these selections, ensuring introductions that align with strategic goals and accelerate funding timelines.

Understanding investor motivations enables founders to craft compelling narratives that resonate across profiles. This targeted approach not only secures capital but also embeds advisory support for navigating late-stage complexities.

Visual guide to key investors in late-stage funding rounds

The infographic above visually captures this investor landscape, reinforcing how varied funding sources contribute to robust late-stage ecosystems. Transitioning from profiles to valuation, these elements inform how companies position themselves for optimal terms.

Valuation Strategies for Mature Startups

Valuing mature startups in late stage venture capital requires sophisticated metrics that reflect operational maturity and exit potential. Common methods include EBITDA multiples, which benchmark against peers in similar sectors, and discounted cash flow (DCF) models that project future revenues discounted to present value. For pre-IPO funding scenarios, comparable company analysis (CCA) aligns private valuations with public market peers, adjusting for liquidity premiums.

Consider a tech firm with $50M annual EBITDA; applying a 15x multiple yields a $750M valuation, but DCF might adjust this based on 20% growth projections over five years, factoring in a 10% discount rate. In practice, late-stage valuations emphasize revenue predictability and market dominance, often incorporating strategic premiums for M&A appeal.

We at Zaidwood Capital apply these strategies in our M&A capital advisory services, optimizing pitches to highlight defensible moats and scalable models. For biotech examples, valuations might blend revenue multiples with pipeline milestones, ensuring alignment with investor risk appetites. Educational application reveals that hybrid approaches–combining multiples with scenario-based DCF–provide balanced insights, mitigating biases in volatile markets.

These methods support not just funding but also IPO or acquisition preparations, where accurate valuations underpin successful negotiations.

Examples of Late-Stage Investments

In 2025, anonymized case studies from the tech and biotech sectors exemplify late-stage dynamics. A SaaS platform raised $250M in Series F from a consortium of private equity firms and hedge funds, using the capital for European expansion and AI integrations. This deal, valued at $2.5B via 12x revenue multiples, highlighted pre-IPO funding’s role in liquidity provisioning amid market recovery.

Another biotech entity secured $400M from sovereign wealth funds, focusing on clinical trial acceleration. Valued through DCF at $3.8B, it underscored institutional growth capital’s emphasis on global reach. Per the Harvard Corporate Governance Venture Capital Outlook for 2026, such raises signal a flight to quality, with AI-adjacent firms commanding premiums and secondary markets providing exit ramps.

These illustrations demonstrate how late stage venture capital fuels growth through targeted infusions, with advisory expertise streamlining due diligence and terms. At Zaidwood, we facilitate similar outcomes by connecting clients to aligned investors, emphasizing pitch optimization for efficient closes.

Preparing for a Series F Funding Round

At Zaidwood Capital, we guide clients through the complexities of late-stage funding rounds, ensuring they are positioned for success in securing growth capital. Preparing for such a milestone demands meticulous attention to financial health, strategic partnerships, and proactive risk management. This section outlines key steps, highlighting how our integrated services streamline the process.

Financial and Documentation Readiness

Achieving capital round readiness starts with robust financial and documentation preparation, particularly for Series F Funding. Companies must develop comprehensive pro forma financials that project revenue, expenses, and cash flows over the next three to five years. These models should incorporate conservative assumptions aligned with market conditions and operational scalability.

We assist with crafting detailed business plans that articulate growth strategies, market positioning, and exit pathways. Essential documentation includes audited financial statements, cap tables, and intellectual property inventories. For due diligence, prepare materials covering financial, legal, and operational aspects, drawing from SEC guidelines on capital raising disclosures to ensure transparency in reporting obligations under Regulation D or S-1 filings.

A checklist for this phase includes:

- Compile historical financials and reconcile discrepancies.

- Build scalable financial models with sensitivity analyses.

- Draft pitch decks emphasizing traction metrics and valuation rationale.

- Conduct internal governance audits to address board composition and compliance.

These funding preparation protocols not only build investor confidence but also facilitate smoother transitions toward pre-IPO alignment. By leveraging our expertise in strategic documentation, clients avoid common oversights that could delay funding.

As companies weigh preparation options, choosing between in-house efforts and professional support can significantly impact efficiency. The following table compares key elements of self-managed preparation versus partnering with a capital advisory firm like ours:

| Preparation Element | In-House Approach | With Advisory Firm |

|---|---|---|

| Due Diligence | Internal team handles, potential gaps | Full-cycle support, comprehensive coverage |

| Investor Access | Limited network | 4,000+ institutional connections |

| Documentation | Basic pitches | Pro forma financials, strategic plans |

Engaging advisory support provides access to extensive networks and specialized tools, reducing preparation time while enhancing compliance with SEC requirements for later-stage capital raises. This approach allows teams to focus on core operations, ultimately leading to more compelling presentations that resonate with sophisticated investors. Our full-cycle due diligence services ensure all aspects–from financial audits to operational reviews–are thoroughly addressed, minimizing surprises during investor scrutiny.

Engaging Advisors and Investors

In late stage venture capital, selecting the right advisory partners is crucial for effective investor outreach. We recommend evaluating firms based on their track record in structuring debt and equity deals, as well as their ability to provide capital introductions to institutional players.

Strategies for engagement include:

- Identifying advisors with deep networks in private equity and venture capital.

- Collaborating on tailored outreach campaigns targeting family offices, sovereign wealth funds, and endowments.

- Utilizing debt advisory services to explore hybrid financing options that complement equity raises.

At Zaidwood Capital, we connect clients to over 4,000 institutional investors, facilitating introductions that align with specific funding needs. This network, combined with our expertise in equity advisory, helps navigate the nuances of late-stage negotiations. For Series F rounds, prioritize advisors who offer end-to-end support, from pitch refinement to term sheet negotiations, ensuring alignment with long-term objectives like pre-IPO positioning.

Effective investor engagement involves personalized communications that highlight unique value propositions and risk-adjusted returns. By partnering early, companies can leverage advisory insights to refine their narrative, increasing the likelihood of securing commitments from high-caliber backers.

Risk Mitigation in Preparation

Late-stage preparations carry inherent risks, especially in pre-IPO funding scenarios where scrutiny intensifies. Common pitfalls include incomplete due diligence, misaligned valuations, and regulatory non-compliance. To mitigate these, implement rigorous internal reviews and seek external validations.

Key tactics encompass:

- Stress-testing financial models against economic downturns.

- Securing legal counsel for contract reviews and IP protections.

- Preparing contingency plans for investor queries on governance and ESG factors.

Drawing from SEC resources, ensure disclosures address material risks in offering documents to avoid enforcement actions. At Zaidwood Capital, we help clients anticipate these challenges through proactive audits and scenario planning, focusing on operational resilience without guaranteeing outcomes.

By addressing these risks upfront, companies enhance their appeal to investors and pave the way for successful funding. This preparation not only safeguards the capital raise but also sets a strong foundation for future liquidity events.

Overall, thorough preparation transforms potential hurdles into opportunities, with advisory partnerships amplifying effectiveness in the competitive landscape of advanced venture financing.

Advanced Considerations in Pre-IPO Transitions

As companies mature in late stage venture capital, transitioning from Series F Funding to pre-IPO funding requires nuanced strategies to bridge the gap to public markets. This phase demands careful structuring to maintain momentum while addressing valuation pressures and liquidity needs. At Zaidwood Capital, our expertise in equity advisory positions us to guide clients through these complexities, ensuring alignment with long-term goals.

Pre-IPO funding serves as essential IPO bridge financing, providing the capital infusion needed for final preparations like regulatory compliance and market positioning. Common structures include mezzanine debt, which blends equity-like features with debt security, and secondary offerings that allow early investors to liquidate shares without full dilution. These late-maturity equity instruments help companies refine operations and scale ahead of listing. In our experience, blending these options minimizes ownership erosion while accelerating readiness. For instance, tech firms often layer secondary sales atop bridge loans to optimize cash flow without over-leveraging.

The valuation impact of pre-IPO funding can significantly alter ownership dynamics. High pre-IPO valuations, as projected in the Harvard Corporate Governance Venture Capital Outlook for 2026, may lead to dilution if not managed, but they also attract quality investors amid returning liquidity. Transition steps post-Series F Funding typically involve assessing capital gaps, engaging boutique M&A advisory for fairness opinions, and structuring rounds to align with market timing. Our full-cycle support includes documentation preparation and investor introductions from our network of over 4,000 institutions.

Tech examples abound, such as AI-driven startups leveraging secondary markets for $210 billion in 2025 liquidity, per Harvard trends, to fund IPO backlogs. These scenarios highlight strategic advisory’s role in navigating convergence of public and private valuations.

The following table outlines key differences in funding structures from Series F to pre-IPO, illustrating the pathway evolution:

| Stage | Primary Structure | Key Risks |

|---|---|---|

| Series F | Equity-heavy venture rounds | Dilution from high valuations |

| Pre-IPO | Bridge loans, secondary sales | Market timing and liquidity issues |

This comparison underscores how pre-IPO structures shift toward flexibility, reducing equity dilution risks prevalent in Series F rounds. Strategic choices here, informed by 2026 projections of accelerated M&A and IPO momentum, enable companies to capitalize on quality-driven opportunities while mitigating timing vulnerabilities. Our advisory ensures clients execute these transitions with precision and foresight.

Frequently Asked Questions on Series F Funding

Series F Funding represents an advanced stage in venture capital, often bridging companies toward IPOs. Here, we address common queries on late stage venture capital and pre-IPO funding to guide founders effectively.

What distinguishes Series F investors from earlier rounds?

Series F investors, typically large institutions, focus on scaling mature companies with proven models, unlike seed investors who back ideas. They prioritize robust governance and exit strategies for stability.

How does Series F support hyper-growth?

This round fuels international expansion, acquisitions, and tech enhancements. We recommend aligning funding with clear milestones to maximize capital advisory services outcomes.

What risks come with late stage venture capital?

Key risks include valuation dilution, regulatory hurdles, and market volatility, as noted in SEC resources on later-stage capital. Diligent preparation mitigates these through structured due diligence.

Why pursue pre-IPO funding, and how does it affect valuation?

Pre-IPO funding refines operations for public markets, boosting valuation via proven traction. It enables liquidity for early investors while signaling maturity to underwriters.

How is Series F typically structured?

Structures often involve convertible notes or preferred equity with anti-dilution protections. Tailoring terms to investor expectations ensures smooth transitions toward public offerings.

Navigating Your Series F Funding Pathway

In summary, your Series F Funding journey represents a pivotal phase in late stage venture capital and pre-IPO funding, demanding meticulous preparation, targeted investor outreach, and seamless transitions to liquidity events. We have outlined strategies to position your company for success, from valuation optimization to governance strengthening.

At Zaidwood Capital, our expertise in capital advisory leverages a network of over 4,000 institutional investors and $15 billion in deployable capital, ensuring efficient navigation through complex funding landscapes. Our full-cycle services streamline transactions for late-stage success.

We invite you to reflect on these insights and plan strategically. As Harvard’s 2026 venture outlook suggests, renewed liquidity and selective investing trends underscore the value of disciplined preparation for emerging opportunities.