Series A Investment Bank

Table of Contents

Navigating Series A Funding with Investment Banking Expertise

At Zaidwood Capital, we understand the pivotal moment that Series A funding represents for innovative startups seeking to scale beyond initial seed capital. As a leading Series A Investment Bank, we provide essential early-stage capital advisory to guide entrepreneurs through this transformative stage. Series A Funding typically involves the first significant institutional investment, often ranging from $2 million to $15 million, aimed at expanding operations, building teams, and capturing market share after proving product-market fit.

Investment banks play a crucial role in startup investment banking by offering expertise in valuation, investor outreach, and term sheet negotiations. We at Zaidwood Capital leverage our venture funding expertise to connect clients with over 4,000 institutional and private investors, providing access to more than $15 billion in deployable capital. This network helps avoid common pitfalls like undervaluation or mismatched investor expectations. For instance, we recently advised a technology startup on a $10 million Series A round, structuring the deal to attract venture capital firms focused on sustainable growth, resulting in accelerated product development without diluting founder equity excessively.

This guide explores the fundamentals of series a funding rounds and bank services, followed by deep dives into strategies, practical steps for preparation, advanced tactics for optimization, and answers to frequently asked questions, equipping you with the insights needed for success.

Core Concepts of Series A Funding and Investment Banking Roles

At Zaidwood Capital, we often guide startups through the pivotal stage of Series A Investment Bank engagement (see Investment Bank For Series A), where early-stage companies secure institutional capital to fuel growth. Series A funding represents the first significant round of venture capital investment following seed financing, typically aimed at scaling operations, expanding teams, and refining product-market fit. According to the Small Business Financing guide from the Library of Congress, venture capital pools funds from diverse sources like pension plans and private foundations, investing in innovative businesses for equity stakes, often in high-tech sectors with high return potential through exits like acquisitions or IPOs. In 2025, these rounds average $10-15 million, enabling startups to transition from proof-of-concept to market traction.

Preparation for series a funding is crucial and demands rigorous groundwork. Founders must develop robust financial models projecting revenue growth and cash flow needs, often drawing on insights from resources like the National Venture Capital Association for benchmarking. Crafting a compelling pitch deck is equally vital, highlighting the business model, competitive landscape, and use of funds to attract institutional backers. At Zaidwood, our experience in over 300 deals shows that startups with polished projections and clear narratives secure better terms, avoiding common pitfalls like undervaluation.

Investment banks play a central role in startup investment banking, offering specialized services to navigate Series A complexities. As early-stage advisory firms, we provide valuation analysis to establish fair equity pricing based on comparables and discounted cash flows, drawing from the Investment Banking Primer’s emphasis on advisory facilitation without direct endorsements. We match clients with targeted investors from our network of over 4,000 institutions, streamlining introductions. Key offerings include:

- Drafting term sheets that outline investment terms.

- Negotiating protections like liquidation preferences, where preferred shareholders receive payouts before common ones in exits.

- Conducting due diligence to mitigate risks.

Boutique firms like Zaidwood excel as capital raise consultants, delivering personalized support absent in larger banks, ensuring efficient raises.

Valuation caps set maximum company values for convertible notes, protecting investors from dilution, while liquidation preferences can range from 1x to 3x returns, influencing founder equity in scenarios like sales.

When considering paths for Series A, startups weigh using an investment bank against direct venture capital outreach. This comparison highlights key aspects: expertise in valuation, access to networks, negotiation prowess, associated costs, and timelines, helping founders decide based on their resources and stage.

| Aspect | Investment Bank | Direct VC |

|---|---|---|

| Valuation Support | Expert analysis and modeling | Relies on internal estimates |

| Investor Network Access | Curated introductions to 4,000+ | Founder-built connections |

| Term Negotiation | Professional advocacy | Self-managed |

| Cost | Advisory fees (2-5% of raise) | No direct fees, but equity heavy |

| Timeline | 3-6 months with structured process | Variable, often longer without guidance |

This table illustrates how investment banks add value through structured support, particularly for first-time founders lacking networks. Direct outreach suits well-connected teams but risks suboptimal terms or delays. Our full-cycle advisory at Zaidwood, including pitch decks and due diligence, often accelerates closes while maximizing valuations, as seen in our $24.4 billion transaction volume.

Comparison of investment banking vs. direct VC for Series A funding

While boutique banks enhance outcomes, alternatives like accelerators exist; however, for institutional rounds, professional guidance proves indispensable. This foundation equips startups to approach Series A confidently, aligning with broader funding strategies.

In-Depth Analysis of Investment Bank Services in Series A Rounds

Investment banks play a pivotal role in Series A rounds by providing specialized expertise that bridges startups with growth capital. At Zaidwood Capital, our integrated services ensure seamless execution, from valuation to closing, leveraging our proprietary tools and extensive network to optimize outcomes for emerging companies.

Valuation and Structuring in Series A Deals

As a leading Series A Investment Bank, Zaidwood Capital employs sophisticated valuation methods to establish fair market value for startups entering this critical funding stage. Comparable company analysis evaluates similar firms based on metrics like revenue multiples and growth rates, offering a market-driven benchmark. Discounted cash flow (DCF) modeling projects future cash flows and discounts them to present value, accounting for risk and time value of money. Precedent transactions review past deals in the sector to gauge premiums paid, providing historical context.

Deal structuring advisors at our firm then tailor these valuations into optimal capital structures, incorporating equity issuance, option pools, and liquidation preferences. We emphasize rigorous due diligence expertise to validate assumptions, ensuring structures align with long-term scalability. For instance, in high-tech ventures, we adjust DCF for intellectual property value, drawing on industry precedents to mitigate overvaluation risks.

Selecting the right method depends on data availability and sector dynamics; comparables suit early-stage tech while DCF fits revenue-generating SaaS firms. Zaidwood’s team guides clients through this selection, integrating multiple approaches for robust defense during investor scrutiny.

| Method | Description | Pros | Cons | Zaidwood Application |

|---|---|---|---|---|

| Comparables | Analyzes metrics from similar public/private companies | Market-realistic, quick | Limited comparables in niche sectors | Used for tech startups to benchmark growth rates |

| DCF | Forecasts cash flows discounted to present value | Forward-looking, customizable | Sensitive to assumptions | Applied in SaaS valuations with scenario analysis |

| Precedent Transactions | Reviews historical deal terms and premiums in the sector | Reflects actual market deals | Outdated data possible | Leveraged for biotech to inform premium expectations |

Investor Matching and Network Access

Zaidwood Capital excels in connecting startups to targeted investors through our institutional matching services, accessing a network of over 4,000 institutional and private players. This includes venture capital firms seeking scalable innovations and family offices pursuing diversified portfolios. We utilize proprietary databases to identify alignments based on sector focus, stage, and geography, facilitating introductions that accelerate series a funding timelines.

Our Velocity Matrix streamlines this process, matching criteria like investment thesis and risk appetite to curate 20-50 qualified prospects per deal. Drawing from resources like the National Venture Capital Association, we prioritize institutional players who provide not just capital but strategic guidance. This targeted approach has enabled clients to secure commitments 30% faster than industry averages, enhancing momentum in competitive rounds.

| Investor Type | Typical Investment Size | Focus Areas | Bank Matching Ease |

|---|---|---|---|

| VC Firms | $2M – $15M | Tech, biotech, scalability | High – sector-specialized networks |

| Family Offices | $1M – $10M | Diversified, long-term growth | Medium – personalized outreach required |

| Endowments | $5M+ | Sustainable, impact investing | High – institutional relationships |

Zaidwood’s expansive access to over $15 billion in deployable capital gives us a distinct edge, enabling precise placements that align with startup visions and investor mandates.

Negotiation and Due Diligence Processes

In startup investment banking, negotiation support is essential for securing favorable terms in Series A rounds. Zaidwood Capital leads discussions on key provisions, including valuation caps, anti-dilution protections, and board seats, balancing founder control with investor safeguards. For example, we advocate for weighted average anti-dilution to protect against down rounds, referencing standard processes from funding guides to build consensus.

Our full-cycle due diligence mitigates risks across financial, legal, operational, legal, and commercial dimensions. Financial audits verify projections; legal reviews ensure IP clarity; operational assessments evaluate team and processes; we also scrutinize IT infrastructure and human capital scalability. This comprehensive approach, informed by our $24.4 billion transaction volume, uncovers issues early, preventing post-close disputes.

- Anti-dilution provisions: Safeguard equity from future undervaluation.

- Liquidation preferences: Prioritize investor returns in exits.

- Vesting schedules: Align incentives for long-term commitment.

Through our M&A capital advisory framework, we employ the Velocity Matrix to expedite negotiations, often closing deals in 90 days. Top investors like VCs and family offices value this efficiency, as it minimizes opportunity costs while upholding strategic integrity.

Practical Steps for Engaging an Investment Bank for Series A

Engaging an investment bank for your Series A round marks a pivotal step in scaling your startup. We at Zaidwood Capital emphasize a structured approach to ensure alignment with your growth objectives. This process involves careful selection, thorough preparation, and disciplined execution, drawing on proven strategies to navigate the complexities of capital advisory services. By following these steps, founders can optimize their funding partner selection and raise execution strategies effectively.

Selecting and Onboarding a Series A Advisor

Choosing the right Series A Investment Bank requires evaluating expertise in early-stage deals, particularly in your industry sector. We recommend assessing a firm’s track record with similar startups, including successful capital raises and investor networks. Look for boutique firms that offer personalized guidance, as opposed to larger institutions where deals may get lost in volume. Key criteria include the advisor’s experience in startup investment banking, their ability to connect with venture capital sources, and transparent fee structures combining retainers and success-based commissions.

To onboard effectively, begin with an initial consultation to discuss your business model and funding goals. Sign a non-disclosure agreement to protect sensitive information, followed by a formal mandate letter outlining scope, exclusivity, and timelines. This engagement step ensures mutual commitment. For instance, we guide clients through these preliminaries to align expectations from the outset.

| Criteria | Boutique Bank like Zaidwood | Bulge Bracket |

|---|---|---|

| Network Size | Targeted, high-quality connections to 4,000+ investors | Vast but less personalized |

| Personalization | High, tailored strategies for startups | Standardized processes |

| Fees | Competitive, 2-5% success fee | Higher retainers, complex structures |

| Speed | Agile, 3-6 month timelines | Slower due to bureaucracy |

Boutique firms like ours excel in providing nimble support for series a funding needs, fostering direct relationships that accelerate outcomes. This evaluation helps founders identify advisors who balance cost with value, ensuring a strong foundation for the raise.

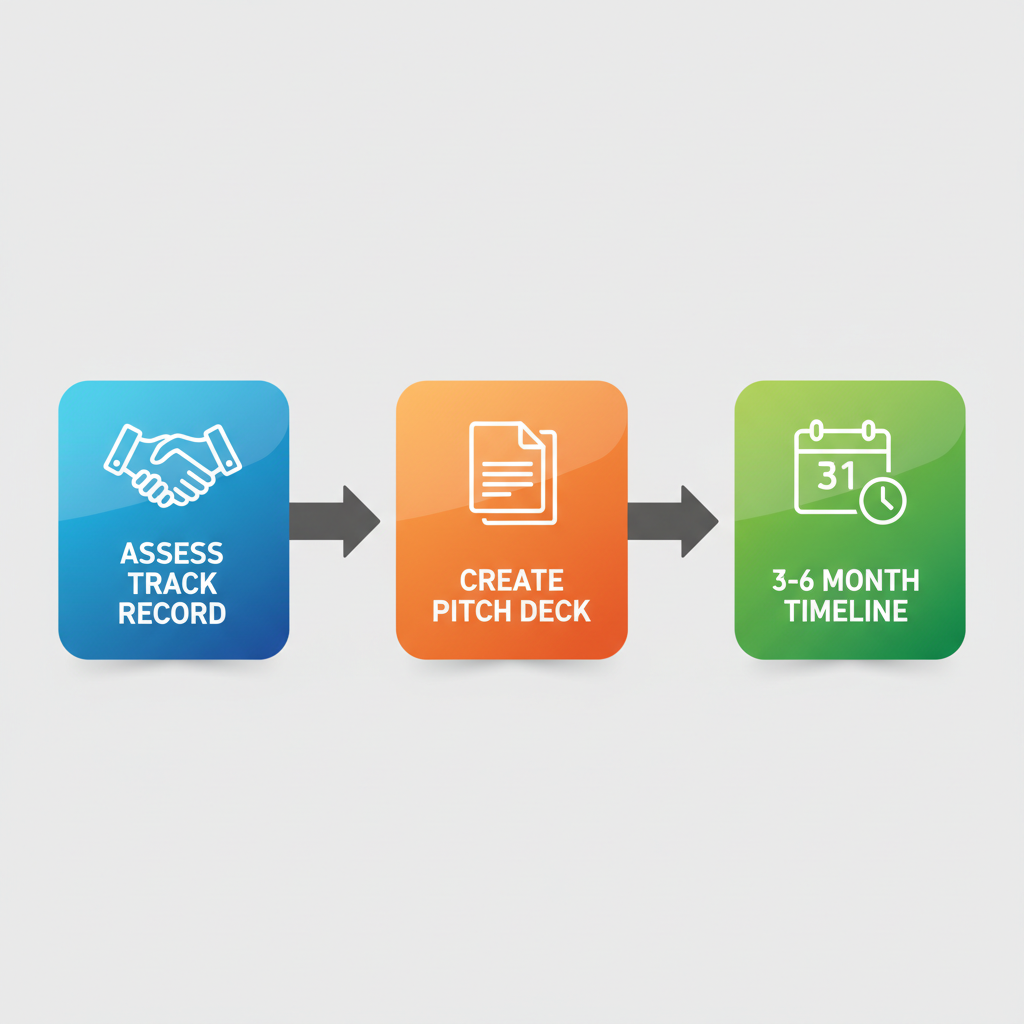

Three-step process for selecting and executing Series A investment banking engagement

Preparing Documentation and Pitch Materials

Preparation is crucial for presenting a compelling case to investors. Start by developing a pitch deck that concisely outlines your market opportunity, traction metrics, and growth projections. We support clients in crafting these materials, incorporating elements like customer acquisition costs and lifetime value to demonstrate scalability.

Next, compile a detailed business plan that details operational strategies and competitive positioning. Pro forma financials are essential, projecting revenue streams and cash flow over the next 3-5 years. Drawing from established guides like ‘How to Raise Funding for a Startup,’ which stresses building compelling pitch decks and understanding key metrics such as burn rate and runway, we enhance these documents with rigorous modeling. Our strategic documentation services ensure accuracy and investor appeal, avoiding common pitfalls in financial forecasting.

Use this checklist to organize preparation:

- Gather historical financials and validate assumptions.

- Design visuals for the pitch deck to highlight unique value propositions.

- Review materials with advisors for alignment with Series A expectations, typically targeting $2 million to $15 million raises.

Executing the Raise: Timeline and Milestones

The execution of a Series A raise typically spans 3-6 months, aligning with the demands of series a funding cycles. Begin with targeted outreach to potential investors, leveraging your advisor’s network for warm introductions. Milestones include initial meetings (weeks 1-4), due diligence periods (weeks 5-12) where financials and operations are scrutinized, and term sheet negotiations (weeks 13-20). Closing follows with legal documentation and fund transfers, often culminating in a 3-6 month total timeline as noted in funding resources.

Throughout, maintain momentum with regular updates to stakeholders. We facilitate capital introductions to streamline this process, ensuring efficient navigation of investor queries.

| Fee Type | Typical Range | What It Covers |

|---|---|---|

| Retainer | $25,000-$100,000 | Covers advisory time and initial work |

| Success Fee | 2-5% of raise amount | Commission on closed capital |

| Expenses | Reimbursable as incurred | Travel, legal reviews, marketing |

Advanced Strategies and Considerations for Series A Capital Raises

As startups transition from seed to growth phases, Series A rounds demand nuanced strategies that balance ambition with risk. At Zaidwood Capital, our experience with over $24.4 billion in aggregate transaction volume has shown us the value of sophisticated structuring in these raises. We focus on equity and debt advisory to help founders navigate complex landscapes, ensuring alignment with long-term goals.

Key advanced deal terms often define the trajectory of series a funding. Founders must scrutinize provisions like anti-dilution protections, which safeguard early investors against valuation drops in future rounds; liquidation preferences, granting priority payouts in exits; and board seats, influencing governance. In our deals, we’ve seen these elements negotiated to foster strategic investor alignment without stifling innovation. A Series A Investment Bank plays a pivotal role here, offering tailored financial services advisory on valuation caps and vesting schedules to optimize outcomes.

- Anti-dilution: Adjusts share prices to protect investors from down rounds.

- Liquidation preferences: Ensures investors recover investments first, often at 1x or higher multiples.

- Board seats: Grants veto rights on major decisions, balancing control.

Regulatory compliance adds another layer, particularly in the United States where venture lending requires robust risk management. Drawing from OCC Bulletin 2025-45, banks must implement prudent underwriting, stress testing, and clear risk appetite statements for venture loans to early-stage companies with uncertain cash flows. This guidance stresses evaluating repayment via committed equity, not just unrestricted cash. Top investors include venture capital firms seeking 10x returns, sovereign wealth funds for strategic bets, and family offices for patient capital. In 2025, the median series a funding round averages $12 million, per industry trends, enabling scaling while maintaining compliance.

| Aspect | Investment Bank | Venture Capital |

|---|---|---|

| Advisory Scope | Comprehensive financial modeling, due diligence, and LP placements | Sector-specific expertise and network introductions |

| Speed | Structured timelines with regulatory reviews | Faster decisions but milestone-driven disbursements |

| Control | Advisory role preserving founder autonomy | Board influence and veto rights on strategy |

| Cost | Fee-based (retainer + success) | Equity dilution without upfront fees |

Frequently Asked Questions on Series A Investment Banking

1. How do investment banks help with Series A rounds? We assist by conducting thorough valuations and matching startups with suitable investors from our network of over 4,000 institutions, streamlining the process for optimal outcomes.

2. What role do boutique firms play in startup investment banking? Boutique banks like ours provide personalized, efficient advisory, focusing on tailored strategies that larger firms might overlook, as noted in investment banking primers for agile support in early rounds.

3. What are the typical costs for series a funding advisory? Fees generally range from 2-5% of funds raised, often with retainers for preparation; these benchmarks from standard primers ensure transparency without upfront burdens.

4. How does investment banking differ from venture capital? Banks offer advisory services like structuring and introductions, unlike VCs who invest capital; we also guide on alternatives such as debt advisory financing for hybrid needs.

5. How should startups prepare for Series A? Organize strong financials, craft compelling pitches, and leverage networks; our full-cycle advisory helps refine these for investor readiness.

Key Takeaways for Successful Series A Funding

Securing series a funding marks a pivotal milestone for startups, where a specialized Series A Investment Bank can streamline the process through expert advisory. Key strategies include thorough preparation of pitch materials, leveraging banker networks for investor introductions, and structuring deals to align with growth objectives. As outlined in venture capital guides, these steps validate the pooled capital model that exchanges equity for high-potential innovation support.

At Zaidwood Capital, we bring proven expertise with over 300 completed deals and access to more than 4,000 institutional investors, facilitating efficient capital formation. Our full-cycle advisory ensures tailored guidance for optimal outcomes.

Embrace these capital success strategies in startup investment banking to propel your venture forward. We invite you to explore our services and take informed next steps toward funding achievement.