Series B Funding

Table of Contents

Understanding Series B Funding Essentials

Scaling a startup beyond initial traction presents unique challenges, demanding significant capital to expand operations, enter new markets, and build robust teams. Series B funding emerges as a pivotal growth-stage financing milestone, enabling companies to transition from survival to sustainable expansion. At Zaidwood Capital, we observe that many tech entrepreneurs underestimate the preparation required for this Series B phase, where proven product-market fit and early revenue streams become essential prerequisites.

Series B funding typically follows a successful Series A, focusing on accelerating growth rather than ideation. Startups often raise between $10 million and $50 million, depending on industry and traction, to fuel sales, marketing, and product development. Key requirements include demonstrated revenue–frequently in the millions–strong user or customer growth, and a clear path to profitability. Primary series b investors comprise venture capital firms seeking scalable opportunities, drawn to series b valuation metrics like customer acquisition costs and lifetime value, which reflect maturity over seed-stage potential.

Series B Milestones Definition Box

- Proven revenue model with consistent growth

- Market fit validated through metrics (e.g., 2x-3x YoY increase)

- Team expansion readiness and operational scalability

- Valuation uplift based on traction, often 3-5x higher than Series A

In contrast to earlier venture capital rounds:

- Seed funding emphasizes idea validation ($500K-$2M, founder equity heavy)

- Series A targets product development ($2M-$15M, institutional VC entry)

- Series B prioritizes market dominance (higher stakes, performance-driven terms)

This guide explores Series B fundamentals, from readiness assessment to deal structuring, progressing to advanced negotiation tactics and post-funding strategies (Harvard Business School insights highlight aligning timelines with investor expectations for optimal outcomes).

Capital advisory firms like ours at Zaidwood Capital play a vital role, offering strategic introductions to aligned investors and expert structuring to maximize valuation and terms, smoothing the path to successful raises.

Core Fundamentals of Series B Funding

Series B funding represents a critical growth round financing stage where startups leverage proven traction to scale operations. At Zaidwood Capital, we guide clients through this transition, emphasizing strategic preparation for institutional venture participation. Understanding What is Series B Funding provides the foundation for navigating these rounds effectively.

Eligibility and Capital Amounts

To qualify for Series B, companies typically demonstrate post-Series A milestones, such as achieving at least $1 million in annual recurring revenue (ARR) and significant user growth metrics, like 3x year-over-year expansion. These benchmarks signal market validation and operational stability to potential backers. Average raises in Series B funding range from $20 million to $60 million, according to industry data, allowing firms to invest in team expansion, marketing, and infrastructure without diluting ownership excessively. We at Zaidwood Capital recommend thorough financial modeling to align these amounts with long-term scalability goals.

Key eligibility requirements include:

- Proven product-market fit with consistent revenue streams

- Strong unit economics and customer retention rates above 80%

- A capable leadership team ready for accelerated growth

These criteria ensure investors see a clear path to profitability.

Investor Overview

Series B investors primarily consist of growth-stage venture capital firms and institutional funds seeking higher returns through scalable opportunities. Unlike earlier stages, these backers prioritize data-driven traction over speculative potential. Prominent series b investors include specialized VCs like Sequoia Capital or Andreessen Horowitz, alongside corporate venture arms from tech giants. At Zaidwood Capital, our network connects clients to over 4,000 institutional players, facilitating introductions that streamline due diligence. These investors often provide not just capital but strategic advisory on market expansion and governance.

Valuation Basics

Valuation in Series B rounds builds on Series A foundations, shifting from user metrics to revenue multiples for a more mature assessment. Typical series b valuation benchmarks hover around 10-20 times ARR, reflecting projected scaling and market dominance, compared to Series A’s 5-10x focus on early validation. For 2026 projections, we anticipate upward pressure from AI and fintech sectors, potentially reaching $500 million pre-money valuations for high-growth SaaS firms, per SEC-informed trends on later-stage capital structures. This evolution underscores the need for robust due diligence to justify premiums.

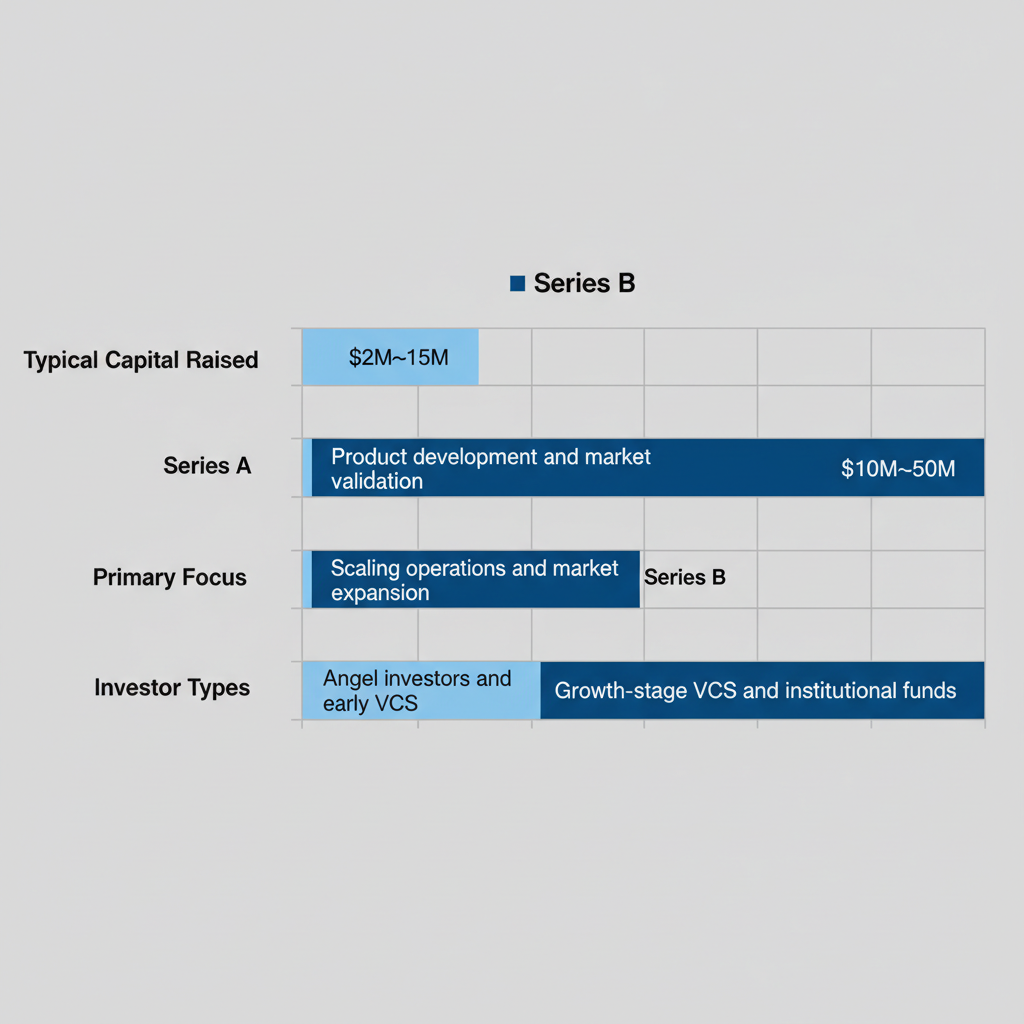

The following table illustrates the progression from Series A to Series B, highlighting key differences in financing dynamics:

| Aspect | Series A | Series B |

|---|---|---|

| Typical Capital Raised | $2M – $15M | $10M – $50M |

| Primary Focus | Product development and market validation | Scaling operations and market expansion |

| Investor Types | Angel investors, early VCs | Growth-stage VCs, institutional funds |

| Valuation Metrics | 5-10x ARR or user growth | 10-20x ARR with scaling projections |

This comparison, drawn from SEC guidelines on later-stage capital, emphasizes post-Series A traction as a vital bridge to growth. Series B enables broader market penetration but demands rigorous compliance with investor protections, such as detailed capital structures. Facilities leveraging these insights can better position for sustainable expansion, avoiding common pitfalls like overvaluation. At Zaidwood Capital, we stress interpreting these metrics to align funding with strategic milestones, ensuring long-term value creation.

Interpreting the table, the shift toward institutional involvement in Series B amplifies scrutiny on operational efficiency and exit potential. For instance, tech startups like those in our portfolio have used these rounds to double headcount while maintaining 20% month-over-month growth, validating the focus on scaling. This data reinforces the importance of advisory support in negotiating terms that protect founder equity amid rising valuations.

Series A vs. Series B funding comparison chart

Building on these fundamentals, the chart visually captures how Series B elevates priorities from ideation to execution. Successful transitions, such as Airbnb’s $112 million Series B in 2010, exemplify how targeted capital fuels global reach. We at Zaidwood Capital advise clients to prepare comprehensive pitch decks highlighting these evolutions, setting the stage for deeper dives into due diligence and negotiation tactics in subsequent sections.

In-Depth Exploration of Series B Dynamics

Series B funding represents a pivotal stage where startups transition from early validation to scalable growth, often securing tens of millions to achieve market dominance. At Zaidwood Capital, we guide clients through these complexities, leveraging our expertise in capital formation to optimize outcomes. This exploration covers valuation mechanics, investor expectations, advisory roles, and emerging trends, equipping founders with strategies to navigate this critical phase effectively.

Valuation Mechanics and Influencing Factors

Valuation at the Series B stage hinges on proven traction, demanding a nuanced approach beyond initial seed metrics. Key factors include revenue growth rates exceeding 100% year-over-year, expansive market size potential, and competitive moats like proprietary technology. In the US, where tech hubs drive innovation, series b valuation often reflects these elements through rigorous methodologies.

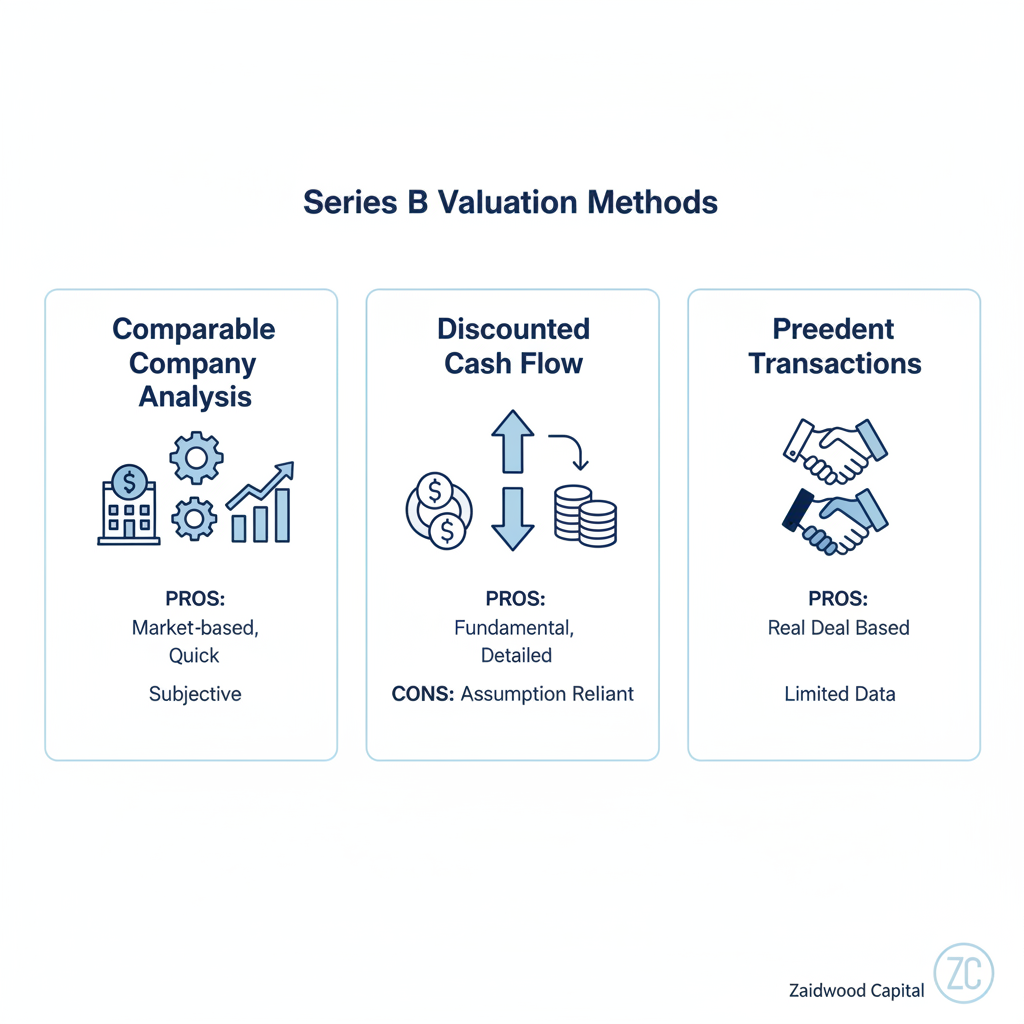

Methods for calculating series b valuations draw from established financial models. Comparable company analysis benchmarks against similar firms’ recent rounds, providing a market-driven snapshot. Discounted cash flow models project future revenues, discounting them to present value for a fundamental assessment. Precedent transactions review past deals in the sector for contextual pricing. Our team at Zaidwood applies these tools to tailor valuations that attract premium investors.

For instance, a SaaS startup with $10 million in annual recurring revenue might command a 10x multiple using comparables, aligning with US trends from Harvard Business School case studies on tech funding. These approaches differ markedly from Series A, where valuations emphasize team and product potential over scaled metrics, often at lower multiples around 5-7x.

The following table outlines common valuation methods for Series B rounds, aiding startups in preparation:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Comparable Company Analysis | Benchmark against similar firms | Market-based, quick | Subjective selection |

| Discounted Cash Flow (DCF) | Project future cash flows | Fundamental, detailed | Relies on assumptions |

| Precedent Transactions | Review past sector deals | Transaction-specific | Limited data availability |

Selecting the right method depends on data availability and sector norms; for tech firms, blending comparables with DCF yields robust results. Advisory application ensures these valuations withstand investor scrutiny, as seen in HBS strategies emphasizing accurate projections.

Series B valuation methods: comparable analysis, DCF, and precedent transactions overview

This visual underscores how growth valuation models evolve, informing our clients’ positioning for higher multiples.

Investor Due Diligence and Expectations

Series B investors prioritize startups demonstrating scalable operations and defensible growth paths. Their due diligence extends beyond financials to assess team dynamics, market positioning, and risk mitigation. In the US, venture capital firms conduct exhaustive reviews, often spanning 60-90 days.

Key scrutiny areas include audited financial statements, customer acquisition costs under 30% of lifetime value, and operational scalability metrics. Series b investors expect clear paths to profitability within 18-24 months, backed by robust unit economics. Preparation involves compiling comprehensive data rooms with legal compliance docs and IP audits.

From HBS insights, effective due diligence uncovers hidden risks, such as churn rates above 5%. We advise clients to simulate these processes, ensuring alignment with VC due diligence processes and fostering trust. For example, a fintech client recently passed rigorous checks by highlighting 200% YoY user growth.

Role of Advisory in Series B Preparation

Advisory firms play a crucial role in structuring compelling narratives for Series B success. They refine pitch decks to emphasize traction and ROI potential, while negotiating term sheets to protect founder equity. As a leading M&A capital advisory firm, our network connects clients to over 4,000 institutional investors.

Preparation strategies include mock due diligence sessions and investor matching based on sector expertise. Advisors facilitate introductions to series b investors focused on US markets, streamlining the process. Ethical practices ensure transparent communications, avoiding overpromising on projections.

In one case, our guidance helped a healthtech startup secure $40 million by optimizing their valuation narrative around sustainability metrics, drawing from HBS preparation tips on investor alignment.

Trends Shaping Series B in 2026

By 2026, Series B landscapes will intensify around AI integration and sustainability, driving premium valuations for aligned startups. Investors will favor those embedding ethical AI for efficiency gains, with multiples rising 15-20% for compliant firms. US trends, per HBS analyses, highlight a shift toward ESG-focused capital.

Emerging patterns include hybrid funding models blending equity with debt for flexibility. Sustainability emphasis will prioritize carbon-neutral operations, influencing due diligence checklists. Tech sectors like cleantech may see average rounds at $50 million, up from current norms.

The table below compares 2024 baselines to 2026 projections, informed by HBS trend data:

| Aspect | 2024 Baseline | 2026 Projection |

|---|---|---|

| Average Multiple | 8x revenue | 10x revenue |

| Key Focus | Scalability | AI & Sustainability |

| Round Size (US Tech) | $30-40M | $40-60M |

These shifts underscore the need for forward-looking strategies. At Zaidwood, our full-cycle advisory prepares clients for these dynamics, ensuring resilient growth trajectories amid evolving investor preferences.

Practical Strategies for Series B Success

Securing Series B funding requires more than innovative ideas; it demands structured execution and strategic partnerships. At Zaidwood Capital, we guide startups through these stages, emphasizing practical steps to attract boutique M&A advisory expertise that aligns with growth objectives. Now that you’ve explored the dynamics of later-stage financing, let’s implement actionable tactics tailored for US-based ventures.

Building a Compelling Pitch and Timeline

Crafting a strong pitch begins with a clear framework that highlights traction and scalability. Start by assembling financial projections, including revenue forecasts and burn rate analysis, backed by key metrics like customer acquisition costs and lifetime value. Incorporate pitch optimization techniques, such as storytelling that ties your product to market needs, while showcasing milestones achieved since seed rounds.

We recommend a 6-9 month timeline for Series B execution to maintain momentum without rushing decisions. Here’s a numbered checklist:

- Month 1-2: Refine pitch deck and identify target series b investors.

- Month 3-4: Conduct initial outreach and secure introductory meetings.

- Month 5-6: Present detailed demos and negotiate preliminary terms.

- Month 7-9: Finalize due diligence and close the round.

This structured approach ensures alignment with investor expectations. For best practices, stress data-driven narratives to build credibility.

Negotiating Term Sheets and Structures

Navigating term sheets is critical for protecting founder equity and control in Series B rounds. Focus on key elements like series b valuation, which typically ranges from $50M to $200M pre-money, influencing dilution levels. Review liquidation preferences, often set at 1x to 2x invested capital, to understand payout priorities during exits or acquisitions.

Drawing from SEC guidelines on raising later-stage capital, prioritize negotiations around governance rights, including board composition. We advise startups to consult experienced advisors early to interpret these structures and avoid unfavorable concessions. For instance, push for pro-rata rights to maintain future investment options without excessive investor veto powers.

The following table outlines essential term sheet components:

| Component | Standard Range | Impact on Startup |

|---|---|---|

| Valuation (Pre-Money) | $50M – $200M | Determines dilution and ownership control |

| Liquidation Preference | 1x – 2x | Affects payout priority in exits |

| Board Seats | 1-2 new seats | Influences governance and decision-making |

This overview, aligned with regulatory standards, underscores the need for thorough review. Following negotiations, leverage advisory insights to refine structures for long-term viability. Always engage legal counsel to ensure compliance.

At Zaidwood, our full-cycle advisory services help demystify these processes, providing clarity on implications without promising specific outcomes.

Leveraging Advisory Networks for Connections

Effective investor outreach tactics rely on robust networks to reach the right series b investors. We provide access to over 4,000 institutional and private investors, including venture capital firms focused on tech startups, facilitating targeted introductions that accelerate deal flow.

Begin by mapping your ideal investor profile–those with sector expertise and follow-on capacity. Our team structures capital raises to match these profiles, using proprietary databases for precise matching. For US startups, this network includes family offices and endowments ready to deploy significant capital.

Implement a multi-channel approach: Combine virtual roadshows with personalized emails and warm referrals. Track engagement metrics to prioritize high-potential leads. By partnering with a boutique M&A advisory like ours, clients gain streamlined connections, enhancing pitch reception and term negotiations. This method not only broadens reach but also builds strategic alliances for sustained growth.

Common Pitfalls and Mitigation Tactics

Series B processes carry risks that can derail progress if unaddressed. Common pitfalls include overvaluation, leading to down rounds later, and inadequate due diligence, exposing hidden liabilities. Neglecting governance terms may erode founder control, while rushed timelines can signal desperation to investors.

To mitigate, conduct comprehensive self-audits before outreach, verifying financials and IP protections. Engage advisors for objective valuations, avoiding hype-driven projections. The SEC emphasizes regulatory compliance in capital raising, so align structures accordingly.

Consider this comparison of scenarios:

| Aspect | Success Scenario | Failure Scenario |

|---|---|---|

| Valuation Approach | Data-backed, conservative estimates | Inflated figures without traction proof |

| Due Diligence | Proactive, full-cycle review | Reactive, incomplete disclosures |

| Network Use | Targeted introductions via advisors | Cold outreach without warm leads |

Success stems from preparation, while failures often arise from oversight. Bullet-point tactics include:

- Validate assumptions with third-party audits.

- Build buffer time into timelines for iterations.

- Foster transparent communication to build trust.

Emphasizing due diligence ensures resilient strategies. This informational guidance equips you for informed decisions; consult professionals for tailored advice. Investments involve risk–past performance does not guarantee future results.

Advanced Considerations in Series B Financing

Series B funding represents a pivotal stage where startups scale operations and refine market positioning. For companies transitioning from early validation to aggressive growth, this round often involves valuations exceeding $30 million, demanding nuanced strategies to balance dilution and control. Our experience at Zaidwood Capital highlights how advanced capital hybrids can optimize these structures without compromising long-term vision.

In exploring hybrids, founders must weigh equity versus debt options to suit their trajectory. Pure equity infusions provide flexibility but at the cost of ownership stakes, while mezzanine debt offers convertible terms that bridge to future rounds. Venture debt, meanwhile, supports non-dilutive expansion through interest payments tied to revenue milestones. These instruments influence series b valuation by layering repayment obligations against growth projections, often requiring pro forma models to forecast impacts.

The following table compares key hybrid approaches:

| Option | Key Features | Suitability |

|---|---|---|

| Pure Equity | Dilutive, no repayment | High-growth startups |

| Mezzanine Debt | Convertible, interest-bearing | Bootstrapped expansions |

| Venture Debt | Non-dilutive loan, warrants | Revenue-generating scale-ups |

Drawing from Harvard Business School insights on tech funding, these options apply particularly to software firms seeking to extend runway pre-IPO. Post-selection, advisory structuring ensures alignment with investor expectations, mitigating risks in documentation and terms.

Governance evolves significantly post-Series B, with series b investors demanding board seats and veto rights on major decisions. Institutional governance shifts introduce rigorous reporting and compliance, fostering accountability while potentially slowing agility. We guide clients through these transitions, integrating our Velocity Matrix to streamline LP placements and maintain founder influence. Effective advisory here involves negotiating protective provisions that safeguard strategic autonomy amid heightened scrutiny.

Looking ahead, Series B implications ripple into subsequent rounds and exit paths. Optimized hybrids preserve equity for later liquidity events, but misaligned governance can deter acquirers or inflate cap tables. Trends in tech show a rise in ESG-linked terms, influencing valuations by up to 20% per HBS analyses. Our capital advisory services facilitate introductions to over 4,000 institutional networks, enhancing pitch efficacy without outcome assurances. For seasoned teams, prioritizing documentation and network leverage positions firms for sustained momentum, answering queries on pitching success through tailored, data-driven narratives.

Frequently Asked Questions on Series B

For quick insights into Series B funding, we address common funding round queries below.

What are typical amounts raised in Series B?

Companies often secure $10 million to $50 million in Series B, scaling operations post-Series A success. This stage funds market expansion and team growth, varying by industry and location.

What requirements must startups meet for Series B?

Proven traction, revenue milestones, and a scalable model are essential, per SEC guidelines on later-stage capital. Strong product-market fit and clear growth metrics attract committed investors.

Who are the primary Series B investors?

Venture capital firms and growth equity funds dominate as Series B investors, focusing on tech and high-potential sectors. We connect clients to institutional networks for targeted introductions.

How is Series B valuation determined?

Valuations range from $30 million to $100 million, influenced by revenue multiples and market comparables. Unlike earlier rounds, Series B valuation emphasizes sustainable growth projections and competitive edges.

Why seek advisory support for Series B?

Expert guidance streamlines compliance and pitch refinement, drawing on SEC structures for efficient raises. Our full-cycle advisory ensures optimal investor alignment and transaction velocity.

Navigating Series B for Sustainable Growth

Series B funding marks a pivotal stage where startups scale operations with investments typically ranging from $10 million to $50 million, focusing on proven business models. In this growth financing summary, key elements include assessing series b valuation based on metrics like revenue growth and market traction, while engaging series b investors who prioritize scalability and team strength.

At Zaidwood, we emphasize the value of advisory partnerships in navigating due diligence and forging scaling partnerships. Our expertise in connections and strategic execution, informed by insights from Harvard Business School strategies, ensures thorough preparation without overpromising outcomes.

As you apply these learnings, explore debt advisory services to support sustainable expansion.