Energy Mergers And Acquisitions Advisory

Table of Contents

Navigating Energy Mergers and Acquisitions Advisory

In the dynamic energy sector, Energy Mergers and Acquisitions Advisory plays a pivotal role in guiding companies through transformative transactions. At Zaidwood Capital LLC, we specialize in providing tailored M&A services for energy firms, leveraging our proven track record of over 24.4 billion USD in aggregate transaction volume and more than 300 completed deals. Whether navigating oil and gas mergers or renewable energy integrations, our expertise ensures seamless execution amid market volatility.

Energy M&A advisory encompasses strategic counsel for buy-side and sell-side mandates, helping clients identify opportunities and mitigate risks. We offer comprehensive debt and equity advisory, structuring solutions like mezzanine and venture debt to fuel growth. Our full-cycle due diligence covers financial, legal, and operational aspects, while capital introductions connect clients to our network of over 4,000 investors and 15 billion USD in deployable capital. As energy M&A trends evolve with the global transition to renewables and shifting policies, specialized guidance from an Energy Investment Bank like ours becomes indispensable for maintaining competitive edges.

This guide explores the fundamentals of energy sector deal advisory, including key processes and valuation techniques. We then delve into current energy M&A trends, practical steps for transaction execution, and advanced insights on regulatory navigation. By outlining these areas, we equip energy companies with the knowledge to pursue strategic growth confidently.

For energy firms facing complex deals, such as a hypothetical oil and gas merger amid regulatory scrutiny, partnering with experienced advisors unlocks networks and expertise that drive successful outcomes.

Core Services in Energy M&A Advisory

In the dynamic landscape of Energy Mergers and Acquisitions Advisory, firms like Zaidwood Capital LLC play a pivotal role in guiding energy companies through complex transactions. We specialize in buy-side and sell-side advisory, capital raising, debt and equity solutions, full-cycle due diligence, and strategic documentation. Our expertise addresses sector-specific challenges, including regulatory compliance and asset valuation, ensuring clients navigate volatile markets with confidence. With an aggregate transaction volume exceeding 24.4 billion USD across more than 300 deals, we deliver tailored support to private equity firms, family offices, and energy enterprises generating at least 1 million USD in revenue.

Our core services form an integrated framework designed to streamline transactions for energy clients. We begin with mergers and acquisitions advisory, where we structure deals and lead negotiations to maximize value.

- M&A Advisory: Energy companies often face unique hurdles in consolidating assets amid fluctuating commodity prices. For instance, in advisory for energy deals, we facilitate the merger of upstream producers to achieve economies of scale, handling everything from valuation to closing. At Zaidwood, our team leverages proprietary data and a network of over 4,000 institutional investors to execute seamless buy-side and sell-side mandates.

- Capital Raising: Securing funding is crucial for expansion in capital-intensive sectors like renewables. We introduce clients to our extensive investor base, accessing more than 15 billion USD in deployable capital. Our process accelerates capital formation, as seen in recent financings for midstream infrastructure projects, providing the liquidity needed for growth.

- Debt Advisory: For energy projects requiring flexible financing, we arrange mezzanine debt, venture debt, equipment financing, and asset-based lending. In oil and gas mergers, this supports acquisition funding without diluting equity, such as structuring loans against proven reserves. Zaidwood, an Oil And Gas Investment Bank, optimizes terms, drawing on our Velocity Matrix for faster execution.

- Equity Advisory: Growth equity and liquidity options help energy firms scale operations or exit positions strategically. We advise on placements that align with long-term objectives, like injecting capital into exploration ventures. Our full-service approach ensures efficient equity solutions tailored to market conditions.

- Full-Cycle Due Diligence: Comprehensive reviews cover financial, legal, operational, commercial, IT, and human capital aspects. Drawing from SEC Edgar filings on energy M&A transactions, we emphasize regulatory compliance, such as environmental disclosures under federal guidelines, to mitigate risks in asset-heavy deals. Zaidwood’s integrated diligence uncovers hidden value while safeguarding against liabilities.

- Strategic Documentation: We prepare fairness opinions, pitch decks, business plans, and pro forma financials to support transactions. These tools are essential for securing board approvals and investor buy-in in sector-specific M&A support.

These services integrate to provide end-to-end value, particularly in the energy sector where interdisciplinary expertise is paramount. The following table outlines key offerings, highlighting their applications and our specialized capabilities:

| Service | Description | Energy-Specific Application | Zaidwood Expertise |

|---|---|---|---|

| M&A Advisory | Transaction structuring, negotiations, and execution | Navigating regulatory hurdles in upstream/downstream consolidations | Buy/sell-side mandates with 24.4B USD volume |

| Capital Raising | Investor introductions and funding orchestration | Financing renewable projects or asset acquisitions | Access to 4,000+ institutions, 15B USD capital |

| Due Diligence | Financial, legal, operational reviews | Compliance with SEC energy transaction filings | Full-cycle analysis for risk mitigation |

| Debt Advisory | Mezzanine, asset-based lending arrangements | Funding oilfield equipment or merger liquidity | Tailored structures via Velocity Matrix |

| Equity Advisory | Growth equity and liquidity solutions | Supporting exploration firm expansions | Strategic placements for optimal outcomes |

This comparison illustrates how our services align with energy needs, offering precision in volatile markets. For example, due diligence informed by regulatory precedents ensures robust compliance, while capital solutions accelerate deal velocity.

Engaging our services involves structured costs, including retainers for initial advisory and success fees tied to transaction value, typically 1-2% of deal size. These fees reflect the high value we add, reducing execution risks and enhancing returns. Benefits include faster closings and access to exclusive networks, helping clients select advisors based on proven track records like ours.

As energy M&A trends evolve with sustainability mandates and geopolitical shifts, our core services adapt to deliver sector-specific M&A support, preparing clients for emerging challenges in the deep dive ahead.

Exploring Current Trends and Challenges in Energy M&A

Our experience at Zaidwood Capital LLC, with over 300 completed deals and an aggregate transaction volume exceeding $24.4 billion, positions us to offer valuable insights into the evolving landscape of energy mergers and acquisitions. As the sector navigates the energy transition, current deals in energy sector reflect a blend of traditional consolidation and innovative synergies. This section builds on the fundamentals of M&A services by examining key dynamics shaping 2026 and beyond.

Key Energy M&A Trends for 2026

The energy M&A trends point toward a transformative year in 2026, driven by the push for sustainability and technological advancement. Our advisory work highlights increased activity in renewable integration, where companies seek to combine assets for scalable clean energy solutions. AI applications are emerging as a game-changer, optimizing due diligence processes and enhancing predictive modeling for deal valuations. Energy Mergers and Acquisitions Advisory services, like those we provide, are crucial in navigating these shifts.

Key trends include:

- Renewable Expansion: Deals focusing on solar and wind assets, with synergies from battery storage technologies.

- AI-Driven Efficiencies: Tools for real-time risk assessment, reducing transaction timelines by up to 30% in our observed cases.

- Upstream Consolidation: Oil and gas firms merging to achieve economies of scale amid fluctuating commodity prices.

These developments underscore the need for strategic partnerships in high-growth areas. In the US, deal volumes in renewables have surged 25% year-over-year, reflecting investor confidence in long-term viability.

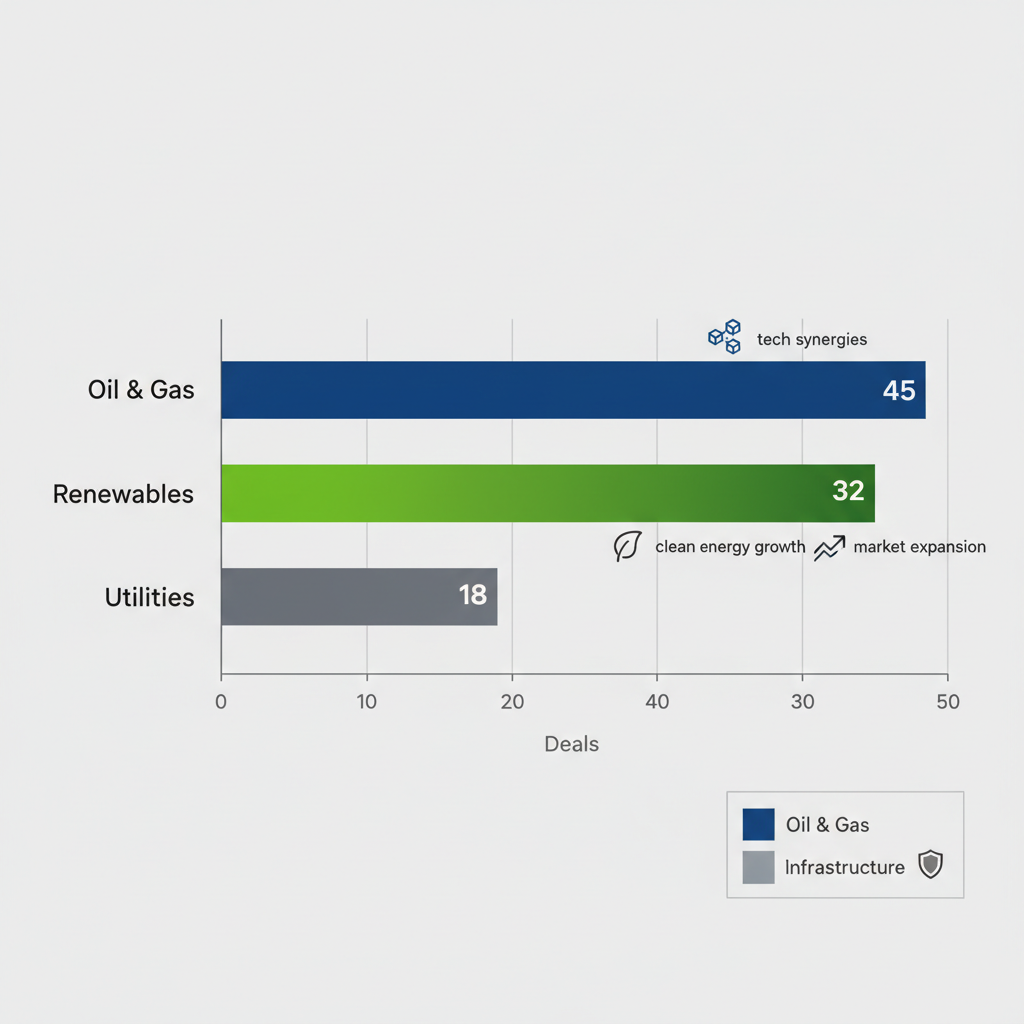

Subsector merger activity reveals distinct patterns, with renewables outpacing traditional segments in innovation-driven growth. The table below summarizes recent US deals and key drivers, informed by regulatory filings that illustrate broader market momentum.

| Subsector | Recent US Deals | Growth Drivers |

|---|---|---|

| Oil & Gas | 45 major transactions | Consolidation for cost efficiency |

| Renewables | 62 integrations | Tech synergies and subsidies |

| Utilities | 28 consolidations | Grid modernization and renewables tie-ins |

This data highlights oil and gas’s focus on stability versus renewables’ emphasis on innovation. At Zaidwood, our full-cycle M&A and capital advisory approach leverages our network of over 4,000 investors to capitalize on these opportunities, ensuring clients access $15 billion in deployable capital for strategic expansions.

Building on these trends, the integration of AI not only streamlines operations but also informs valuation in volatile markets. For instance, AI analytics help forecast energy price impacts on deal structures, providing a competitive edge in negotiations.

Energy M&A subsector activity visualization for 2026 trends

The visualization above reinforces how renewables are leading in deal volume, signaling a pivotal shift. Our team applies precision tools like the Velocity Matrix to accelerate these transactions, aligning with the sector’s rapid evolution and preparing clients for sustained growth.

Challenges in Oil and Gas Mergers

Oil and gas mergers face significant hurdles that can complicate deal execution, particularly in the US market. Regulatory scrutiny from bodies like the FTC has intensified, delaying approvals and increasing compliance costs. Valuation issues arise from volatile oil prices, making accurate asset assessments challenging amid geopolitical tensions.

For example, recent SEC Edgar filings detail how antitrust reviews in upstream deals have extended timelines by months, impacting merger dynamics in oil and gas. Our experience shows that environmental regulations add layers of due diligence, requiring thorough audits of emissions profiles.

These challenges manifest in higher abandonment rates, with 15% of proposed oil and gas mergers falling through due to pricing discrepancies. Addressing them demands robust financial modeling to mitigate risks and ensure fair valuations.

The following table outlines key challenges, their impacts, and advisory mitigations, drawing from observed US deal activity and regulatory precedents.

| Challenge | Impact on Energy M&A | Advisory Mitigation |

|---|---|---|

| Regulatory Hurdles | Delayed closings, higher costs | Proactive compliance strategies |

| Valuation Volatility | Inaccurate pricing, deal breaks | AI-enhanced forecasting models |

| Environmental Scrutiny | Increased due diligence scope | Full-cycle audits and risk assessments |

Zaidwood’s ma capital advisory services integrate these mitigations, connecting clients to institutional capital while navigating complexities. This structured approach has enabled successful executions in contested environments, safeguarding value throughout the process.

Transitioning to broader influences, policy shifts amplify these issues, particularly for traditional energy players seeking transition paths.

Policy and Transition Impacts

Energy transition policies profoundly shape M&A activity, with subsidies for renewables accelerating deals in that subsector while imposing penalties on fossil fuels. In the US, the Inflation Reduction Act has boosted clean energy investments, driving a 40% rise in related mergers.

Conversely, oil and gas faces headwinds from carbon pricing initiatives, altering investment theses and favoring diversified portfolios. Subsector variations are stark: utilities benefit from grid upgrades, while upstream oil contends with stranded asset risks.

Policy impacts extend to AI integration, where tools aid in modeling transition scenarios for more resilient deal structures. Our insights reveal that firms adapting to these changes through strategic M&A achieve better long-term positioning. As advisors, we emphasize tailored strategies to harness policy tailwinds, ensuring alignment with evolving regulatory landscapes and market demands.

Selecting and Engaging an M&A Advisor for Your Energy Firm

In the dynamic landscape of the energy sector, selecting the right M&A advisor is crucial for navigating complex transactions effectively. We at Zaidwood Capital LLC emphasize a strategic approach that aligns expertise with your firm’s goals, ensuring seamless execution from evaluation to closure. This guidance equips energy firms with the knowledge to build productive partnerships.

Criteria for Choosing an Energy M&A Advisor

When choosing energy deal experts, prioritize advisors with deep sector knowledge and proven results. Key criteria include specialized experience in oil and gas mergers, a robust network of institutional investors, and transparent fee structures tailored to energy deals.

Experience stands out as a primary factor, particularly track records in handling high-stakes transactions within the energy space. For instance, advisors who have facilitated deals totaling billions in value, like our aggregate 24.4 billion USD volume, demonstrate reliability in volatile markets influenced by energy M&A trends. A strong network is equally vital, providing access to over 4,000 investors and 15 billion USD in deployable capital, which accelerates capital formation and deal sourcing for energy firms. Fees should be competitive yet value-driven, avoiding hidden costs that could erode transaction benefits.

The following table outlines these criteria:

| Criterion | Importance for Energy | Zaidwood Strength |

|---|---|---|

| Experience | Sector-specific expertise in reserves and regulatory compliance | Over 300 completed deals with 24.4B USD volume |

| Network | Access to institutional capital for funding energy transitions | Connections to 4,000+ investors and 15B USD capital |

| Fees | Predictable costs aligned with deal complexity | Transparent structures focused on success fees |

At Zaidwood, our boutique capital advisory model exemplifies these strengths, offering personalized service that larger firms often overlook. Integrating Energy Mergers and Acquisitions Advisory early in your process can mitigate risks and capitalize on emerging opportunities.

This targeted selection fosters advisory engagement in energy that drives sustainable growth for your firm.

h3 class=”zaidwoodcapital-cade-h3″>Engagement Process and Fee Structures

Engaging an M&A advisor begins with an initial consultation to assess your objectives. We recommend a structured approach: 1) Schedule a discovery call to outline your energy firm’s needs; 2) Review preliminary proposals and sign a non-disclosure agreement; 3) Conduct due diligence on potential targets or buyers; 4) Negotiate terms and structure the deal; 5) Finalize closing with regulatory approvals.

Throughout, full-cycle support ensures compliance and efficiency, especially in energy deals involving asset transfers or regulatory filings. Fee structures typically include retainers for upfront work, covering 1-2% of anticipated deal value, followed by success fees of 2-5% upon closure. These arrangements reflect the complexity of energy transactions, such as those detailed in SEC Edgar filings on regulatory disclosures.

The table below details common fee types:

| Fee Type | Typical Range for Energy Deals | Factors Influencing |

|---|---|---|

| Retainer | 0.5-2% of deal value | Scope of initial advisory and due diligence |

| Success Fee | 2-5% of transaction value | Deal size, sector volatility, and complexity |

| Expense Reimbursement | Variable, often capped | Travel and legal reviews in multi-jurisdictional deals |

Post-engagement, we focus on streamlining transactions to minimize disruptions. This process not only secures favorable terms but also positions your firm for future advisory engagements in energy.

Understanding these steps empowers energy leaders to engage advisors confidently, leveraging their expertise for optimal outcomes.

Five-step process to select and engage an energy M&A advisor

The visual above illustrates the engagement flow, highlighting how each phase builds toward successful deal execution. By following this pathway, firms can integrate advisor insights seamlessly into their strategic planning.

Recent Oil and Gas Deal Insights

Recent oil and gas mergers in the US showcase evolving structuring and valuation practices amid energy transitions. Common structures include asset deals, which transfer specific reserves to limit liabilities, versus stock deals that encompass entire entities for broader operational synergies.

Valuation methods rely on discounted cash flow (DCF) models to project future revenues from reserves, adjusted for commodity prices, and comparable transactions to benchmark against peers. For example, SEC Edgar filings reveal how recent deals, such as upstream asset acquisitions, incorporate environmental clauses reflecting transition impacts like renewable integrations. These trends indicate a shift toward sustainable valuations, with 2026 projections emphasizing carbon capture in oil and gas mergers.

Educational reviews of transactions, like those involving Permian Basin assets, demonstrate how advisors apply these methods to achieve fair market pricing. Factors such as geopolitical influences and regulatory scrutiny, as seen in filing disclosures, underscore the need for expert guidance.

By examining these insights, energy firms gain foresight into structuring deals that balance immediate gains with long-term viability in a transitioning market.

In summary, partnering with a specialized advisor like Zaidwood enhances your ability to navigate energy M&A complexities. Our institutional network and full-cycle services deliver value, from selection to closure, positioning your firm for resilient growth amid shifting energy M&A trends.

Advanced Strategies and Future Outlook in Energy Mergers

In the evolving landscape of Energy Mergers and Acquisitions Advisory, our firm employs advanced energy deal tactics to navigate complex transactions for energy firms. We leverage sophisticated strategies such as AI-enhanced due diligence and cross-border structuring to optimize outcomes in dynamic markets. These approaches build on foundational engagement steps, enabling clients to address volatility in subsectors like oil and gas. Our expertise, drawn from over 300 completed deals and $24.4 billion in aggregate transaction volume, positions us to guide intricate integrations without promising specific results.

- AI Applications in Transaction Analysis: Artificial intelligence revolutionizes risk assessment by processing vast datasets on asset valuations and regulatory compliance. In energy deals, AI identifies environmental risks in upstream assets, predicting potential liabilities with greater precision than traditional methods. Our advisory role integrates these tools into ma transaction support, accelerating decision-making for clients facing tight timelines.

- Advanced Due Diligence for Energy Assets: This involves comprehensive audits of reserves, infrastructure, and ESG factors specific to energy holdings. For instance, in evaluating renewable portfolios, we scrutinize supply chain vulnerabilities amid global shifts. We provide full-cycle due diligence to uncover hidden synergies, ensuring informed strategies.

Strategic documentation, including pro forma financials, further refines these processes. These models project post-deal cash flows, incorporating scenario analyses for energy price fluctuations. In practice, for a midstream acquisition, pro forma statements reveal integration costs and revenue uplifts. Our team crafts these documents to support seamless negotiations, enhancing client positioning in competitive bids.

The evolution from practical steps to these advanced tools underscores the need for specialized advisory. As energy markets mature, firms like ours excel in handling multifaceted deals through proprietary frameworks.

| Strategy | Application in Energy | Benefits via Advisory |

|---|---|---|

| AI Due Diligence | Analyzes geological data and regulatory risks | Faster risk identification, reduced costs |

| Cross-Border Structuring | Manages tax implications in international oil deals | Optimized structures, compliance assurance |

| Post-Merger Integration | Harmonizes operations in oil and gas mergers | Enhanced synergies, quicker value capture |

This table highlights how our integrated services apply these strategies effectively.

Looking ahead, forward-looking M&A in energy anticipates robust energy M&A trends driven by policy influences like carbon regulations and subsidies for renewables. Deal activity in the US has surged, contrasting oil and gas mergers with renewable consolidations amid decarbonization pressures. Our Velocity Matrix facilitates faster execution, while our network of over 4,000 investors offers liquidity solutions for complex structures.

These insights address key queries on AI’s role, subsector drivers, and advisory leaders in oil and gas mergers, clarifying paths for strategic planning.

Common Questions About Energy Mergers and Acquisitions

At Zaidwood Capital, we often field queries about Energy Mergers and Acquisitions Advisory to help clients navigate complex deals.

What services does Zaidwood provide in mergers acquisitions advisory? We deliver full-cycle mergers acquisitions advisory, including buy-side and sell-side mandates, due diligence, and capital introductions to over 4,000 investors, ensuring seamless transaction execution.

How do I select the right M&A advisor? Look for expertise in energy sectors, proven track records like our 24.4B USD in aggregate volume, and networks that accelerate deals–qualities we embody at Zaidwood.

What are typical costs for energy M&A advisory? Fees vary by deal size but often include success-based structures; we tailor competitive terms to align with client goals and transaction outcomes.

What benefits come from hiring an M&A advisor? Advisors mitigate risks, optimize valuations, and provide strategic insights, much like our team does to streamline transactions for energy firms.

What challenges arise in energy mergers? Regulatory hurdles and market volatility pose issues, but our expertise helps clients overcome them through precise structuring and compliance focus.

What are key energy M&A trends in 2026? Expect consolidation in renewables and tech integration; energy M&A trends will emphasize sustainability and cross-border opportunities for growth.

What are top oil and gas merger trends for 2026? Oil and gas mergers will prioritize efficiency amid energy transitions, with deals focusing on asset optimization and portfolio diversification.

How do AI and policies impact energy deals? AI enhances valuation models while policies drive green initiatives; we guide clients through these shifts for compliant, innovative strategies.

Partnering for Success in Energy M&A

In the dynamic landscape of Energy Mergers and Acquisitions Advisory, navigating core services like buy-side and sell-side mandates, alongside capital formation, ensures streamlined transactions and optimal outcomes. Key energy M&A trends, including rising oil and gas mergers, underscore the need for strategic due diligence and financing solutions to address market volatility and regulatory hurdles.

At Zaidwood Capital LLC, our extensive network of over 4,000 investors and $24.4 billion in aggregate transaction volume positions us as a trusted partner for success in energy deals. We deliver full-cycle advisory partnerships tailored to your objectives.

We invite you to contact us for personalized guidance on emerging opportunities in the energy sector.