Healthcare Investment Bank

Table of Contents

Understanding Healthcare Investment Banking

In the rapidly evolving landscape of the healthcare sector, a healthcare investment bank plays a pivotal role in navigating complex financial landscapes. This specialized field involves providing healthcare financial advisory to entities like biotech firms and hospitals, facilitating mergers and acquisitions, and enabling capital formation amid regulatory hurdles and surging innovation demands. Recent trends, including over 15% growth in healthcare transactions in 2025 as noted in Harvard Corporate Governance analyses, underscore the resurgence of competitive dealmaking, such as high-profile biotech battles, driven by post-2025 regulatory shifts toward more traditional antitrust approaches.

At Zaidwood Capital, we specialize in full-cycle M&A and capital advisory, delivering healthcare M&A advisory for buy-side and sell-side mandates, alongside healthcare capital raising through our network of over 4,000 institutional investors and access to more than $15 billion in deployable capital. Our team, led by experts Bryann Cabral, Rami Zeneldin, and Samuel Leung, has orchestrated over 300 deals with an aggregate transaction volume exceeding $24.4 billion, focusing on middle-market opportunities and biotech funding strategies without direct brokerage involvement. We streamline transactions via our Velocity Matrix, integrating proprietary data and strategic documentation to accelerate outcomes for clients seeking precision in volatile markets.

This guide explores the fundamentals of healthcare investment banking, delves into key services, and offers practical applications for investors and firms. From regulatory navigation to funding innovation, we provide foundational insights.

As you proceed, discover how Healthcare Investment Banking Services can inform your strategic decisions. This website is for informational purposes only and is not an offer, solicitation, or commitment to transact.

Core Principles of Healthcare Investment Banking

At Zaidwood Capital, we specialize in guiding healthcare organizations through the complexities of financial transactions. As a leading healthcare investment bank, our advisory approach focuses on the unique demands of the sector, where innovation meets stringent regulations. This section explores the foundational principles that drive successful outcomes in healthcare deals, emphasizing services tailored to biotech, pharma, and medical facilities.

Healthcare investment banking revolves around core services such as mergers and acquisitions, capital formation, and debt structuring. Healthcare M&A advisory involves facilitating Healthcare Mergers And Acquisitions for entities like pharmaceutical firms acquiring innovative startups, ensuring seamless integration amid evolving market dynamics. Capital raising processes help secure equity investments or grants, while debt options provide non-dilutive funding for expansion. Due diligence forms the backbone of these transactions, encompassing financial audits, operational reviews, and compliance checks to mitigate risks in regulated environments.

Regulatory frameworks, including FDA approvals and HIPAA compliance, profoundly impact healthcare deals, requiring specialized navigation to avoid delays. For instance, biotech acquisitions often hinge on intellectual property valuations under these rules. Equity financing suits high-growth ventures seeking scalability without repayment burdens, whereas debt appeals to asset-rich providers like hospitals needing equipment upgrades. According to resources on rural health funding, facilities in underserved areas face significant gaps, with low patient volumes complicating access to capital; blending federal loans from USDA programs and private sources addresses these challenges effectively.

In the healthcare sector, these services often overlap, as M&A deals frequently incorporate capital raising to fund post-merger growth, and debt advisory supports leveraged buyouts. This interconnectedness demands a holistic strategy to optimize funding structures.

| Service Type | M&A Advisory | Capital Raising | Debt Advisory |

|---|---|---|---|

| Primary Focus | Buy-side and sell-side deal facilitation | Equity and funding sourcing | Debt structuring for assets and cash flow |

| Typical Clients | Biotech and pharma companies | Startups and growth-stage firms | Hospitals and equipment-heavy entities |

Our integrated approach at Zaidwood Capital leverages these services in a full-cycle manner, connecting clients to over 4,000 institutional investors for efficient capital deployment. We draw on experiences like structuring innovation loans for biotechs, where non-dilutive options up to £5 million build resilient pathways, combining R&D tax relief with grants to foster commercialization without diluting ownership.

Core healthcare investment banking services overview with M&A, capital, and debt advisory.

This foundation equips healthcare leaders to pursue growth confidently. As we transition to deeper strategies, understanding these principles reveals the pathways for executing complex transactions in an innovative landscape.

In-Depth Analysis of Healthcare M&A and Capital Strategies

At Zaidwood Capital, we specialize in guiding healthcare entities through complex mergers and acquisitions, leveraging our expertise in ma capital advisory to navigate evolving market dynamics. This section explores advanced tactics in buy-side and sell-side transactions, capital structuring for innovation, and rigorous due diligence processes, drawing from our involvement in over 300 deals totaling $24.4 billion in aggregate volume. Recent trends underscore the urgency of these strategies.

Navigating Buy-Side and Sell-Side M&A in Healthcare

Healthcare M&A activity surged in 2025, with U.S. deal volume projected at $2.3 trillion, a 49% increase from 2024, according to insights from the Harvard Law School Forum on Corporate Governance. In the pharma and biotech sectors, consolidation accelerated amid competitive pressures, as seen in the takeover battle between Pfizer and Novo Nordisk for Metsera. A specialized healthcare investment bank plays a pivotal role in facilitating these transactions, providing tailored healthcare M&A advisory to mitigate risks and maximize value.

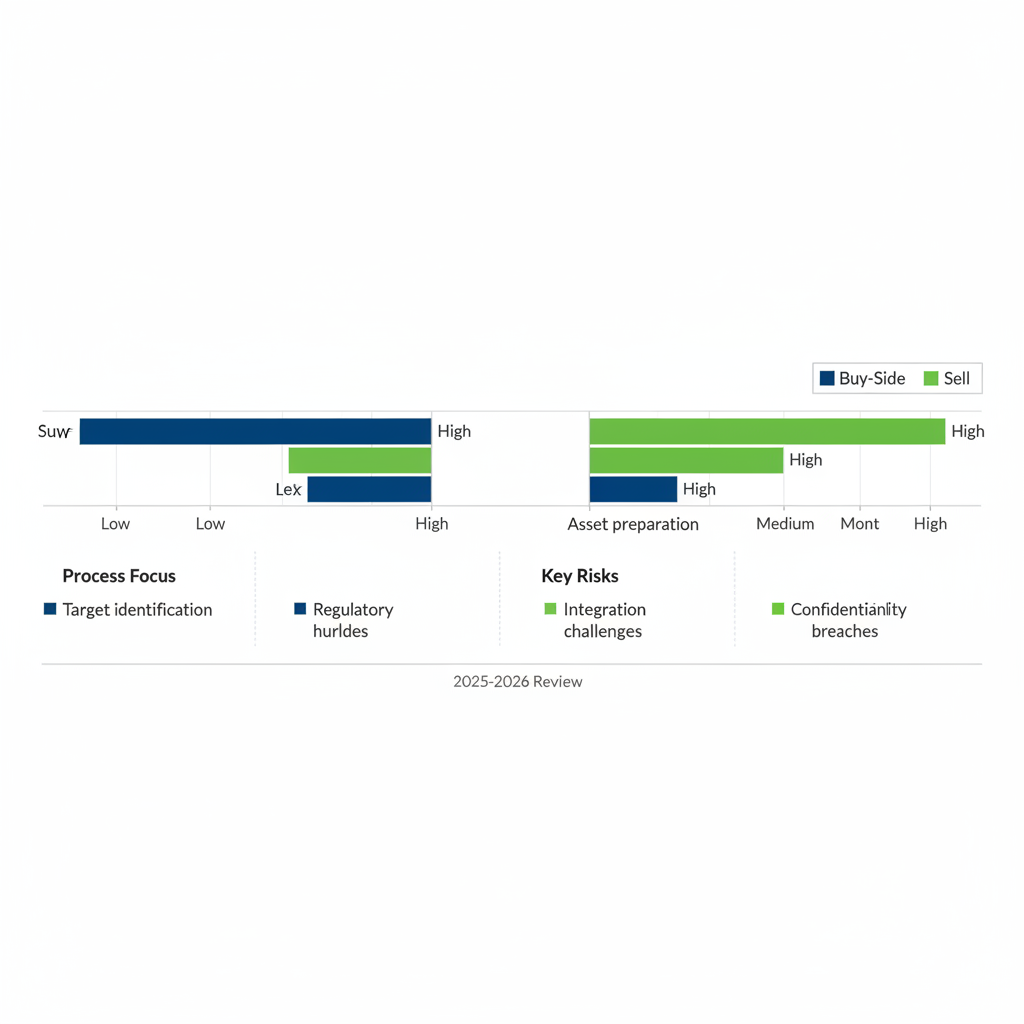

Healthcare M&A advisory involves distinct approaches for buy-side and sell-side engagements. On the buy-side, acquirers focus on identifying targets with strong pipelines in biotech innovation, conducting valuations to assess synergies, and integrating operations post-close. Sell-side processes emphasize preparing assets for market, crafting compelling narratives to attract buyers, and negotiating optimal terms. As experienced advisors, we facilitate buy-side mandates by sourcing undervalued pharma assets and support sell-side efforts through strategic positioning.

| Aspect | Buy-Side | Sell-Side |

|---|---|---|

| Process Focus | Target identification and valuation | Asset preparation and marketing |

| Key Risks | Overpayment and integration issues | Valuation gaps and negotiation delays |

This comparison highlights how buy-side strategies prioritize strategic fit and post-merger efficiency, while sell-side demands precise timing and regulatory navigation. In our practice, we draw on a network of over 4,000 institutional investors to streamline these processes, ensuring clients in pharma and biotech achieve resilient outcomes amid market volatility.

Buy-side vs sell-side M&A comparison in healthcare sector

Structuring Capital for Biotech Innovation

Funding biotech advancements requires nuanced capital structures, especially as tariffs on medical supplies and pharmaceuticals introduce cost uncertainties, per HFMA analysis. Hospitals and innovators face potential 25% tariffs on imports, prompting a shift toward domestic financing solutions. Here, healthcare capital raising becomes essential, with a healthcare investment bank advising on blended options to fuel innovation capital pathways.

We explore equity, debt, and hybrids for biotech firms seeking to scale drug development or acquire technologies. Equity infusions provide flexible growth capital without repayment pressures, ideal for early-stage ventures. Debt options, including mezzanine and venture debt, offer lower dilution but demand steady cash flows. Hybrids combine elements for balanced risk, such as convertible notes that evolve with milestones. In pharma deal structuring, we prioritize options aligning with regulatory timelines and market demands.

| Option | Pros | Cons | Healthcare Fit |

|---|---|---|---|

| Equity | No repayment; aligns incentives | Ownership dilution; higher cost | Early biotech R&D with high risk |

| Debt | Retain control; tax benefits | Repayment obligations; collateral | Mature pharma with stable revenue |

Hypothetical case: A biotech firm raising $50 million via hybrid debt-equity blended our advisory to secure non-dilutive funds, enabling faster clinical trials amid regulatory shifts.

Due Diligence Essentials in Healthcare Deals

Thorough due diligence underpins successful healthcare transactions, encompassing financial, legal, operational, and IT reviews. We conduct full-cycle assessments to uncover risks in pharma and biotech deals.

Key steps include:

- Financial diligence: Scrutinize revenue forecasts, IP valuations, and reimbursement models, ensuring alignment with 2025 M&A trends like mega-deals.

- Legal diligence: Examine regulatory compliance, FDA approvals, and litigation histories to address tariff-related supply vulnerabilities.

- Operational diligence: Evaluate supply chains and R&D pipelines for integration feasibility.

- IT and human capital review: Assess data security and talent retention amid innovation demands.

Strategic documentation, such as pitch decks and pro forma financials, supports these efforts. Our process minimizes surprises, fostering confident executions in dynamic healthcare landscapes.

Applying Healthcare Investment Strategies in Practice

We guide middle-market firms through the practical application of healthcare investment strategies, drawing on our expertise in full-cycle M&A and capital advisory. This section outlines actionable steps for partner selection, fee evaluation, and due diligence execution, tailored to the complexities of healthcare deals. By focusing on boutique advisory approaches, we emphasize targeted support that aligns with the sector’s unique regulatory and financial demands.

Selecting a Partner for Healthcare Advisory

Choosing the right partner is crucial for successful healthcare capital raising and M&A activities. We recommend evaluating firms based on their experience in healthcare M&A advisory, network strength, and alignment with middle-market needs. Key criteria include proven track records in biotech and medtech transactions, as well as the ability to navigate debt financing options like innovation loans.

| Criteria | Boutique Firms | Large Banks |

|---|---|---|

| Network Access | Targeted institutional connections | Broad but less specialized |

| Fee Structure | Performance-based, flexible | Higher retainers, standardized |

Boutique firms often provide specialized access to investors focused on healthcare, enabling more tailored introductions. In contrast, large banks offer volume-driven global reach, which may dilute sector-specific insights. At Zaidwood Capital, our unique selling points include connections to over 4,000 institutional investors and access to more than $15 billion in deployable capital, ensuring efficient matchmaking for healthcare mandates.

To select a boutique ma advisory partner, follow these steps (60% of process): 1) Assess sector experience through case studies of completed deals; 2) Review network depth via investor references; 3) Evaluate cultural fit for collaborative execution. For examples (20%), consider biotechs leveraging non-dilutive loans like Innovate UK programs to bridge R&D gaps, as highlighted in BioIndustry.org insights on resilient funding pathways. Tips (20%): Prioritize firms offering full-cycle due diligence to mitigate risks early; audit for healthcare investment bank expertise in middle-market debt structures.

Fee Structures and Selection Processes

Understanding fee structures is essential for budgeting healthcare investment banking advisory services. We advise middle-market clients to scrutinize models that balance upfront costs with performance incentives, ensuring alignment with deal outcomes. Typical fees in healthcare deals range from retainers for initial advisory to success-based commissions upon closing.

Evaluation processes begin with requests for proposals, followed by due diligence on firm capabilities. We structure our engagements to minimize financial burdens while maximizing value in healthcare M&A advisory.

| Type | Range | Healthcare Application |

|---|---|---|

| Retainer | $50,000 – $250,000 | Covers initial strategy and due diligence in biotech deals |

| Success Fee | 1% – 3% of transaction value | Applied to M&A closings or capital raised in medtech funding |

| Equity Stake | 0.5% – 2% | Used in venture debt for high-growth pharma ventures |

These structures allow flexibility, with performance-based elements rewarding efficient execution. For instance, in healthcare capital raising, success fees motivate advisors to secure optimal terms. Following selection, we integrate our velocity matrix to streamline processes, reducing time to close by leveraging proprietary data access.

Steps for fee evaluation (60%): 1) Compare total cost projections against deal size; 2) Negotiate milestones for phased payments; 3) Verify transparency in expense reporting. Examples (20%) include blended models for debt advisory, combining retainers with low-interest loan facilitation. Tips (20%): Seek capped fees for middle-market transactions; align with firms experienced in regulatory-compliant healthcare deals to avoid hidden costs.

Implementing Due Diligence and Documentation

Effective implementation ensures smooth transaction execution in healthcare settings. We focus on practical steps for due diligence, emphasizing financial, legal, and operational reviews tailored to healthcare capital raising challenges.

- Assemble a cross-functional team for comprehensive audits;

- Prepare pro forma financials projecting post-deal performance;

- Document compliance with sector regulations like HIPAA.

Examples (20%) draw from biotech scenarios, where resilient pathways via innovation loans support commercialization, per BioIndustry.org guidance on blended funding. Tips (20%): Engage early for risk identification; use strategic documentation to facilitate investor confidence. These basics pave the way for advanced trends in precision financing.

Advanced Topics in Healthcare Investment Trends

At Zaidwood Capital, we observe significant sector shifts in healthcare investment as organizations adapt to technological advancements and regulatory changes. The healthcare landscape is evolving rapidly, with increased focus on biotech innovations and digital health solutions driving capital demands. These shifts underscore the need for sophisticated strategies in equity, debt, and mergers and acquisitions to support growth amid economic uncertainties.

Emerging trends in healthcare capital formation highlight the dynamic interplay between funding mechanisms and market forces. According to the Harvard Law School Forum on Corporate Governance, global M&A deal volume surged by over 25% in 2025, reaching projections of $2.3 trillion in the U.S., with healthcare witnessing competitive activity such as the Pfizer-Novo Nordisk battle for Metsera. This resurgence signals bolder transactions in the sector.

| Trend | Equity Raising | Debt Financing | M&A Activity |

|---|---|---|---|

| Growth Drivers | VC interest in AI health tech | Mezzanine for expansions | Regulatory easing |

| Challenges | Valuation pressures | Interest rate sensitivity | Integration complexities |

We at Zaidwood leverage our financial services advisory expertise to navigate these trends, connecting clients to over 4,000 institutional investors for seamless execution. In sector trend forecasting, AI-driven integrations are propelling equity investments, while advanced funding innovations like mezzanine debt facilitate biotech expansions.

Challenges in healthcare capital raising for biotech firms remain pronounced. Valuation pressures in equity markets stem from high expectations for AI health tech returns, often leading to cautious investor sentiment. Debt financing faces interest rate sensitivity, complicating expansions in a volatile environment. For M&A, integration complexities arise from regulatory scrutiny and operational merges, as seen in 2025’s major deals. Our full-cycle due diligence, covering IT and human capital, helps mitigate these risks through rigorous analysis.

Successful healthcare capital raising examples from 2025 illustrate effective strategies. Biotech firms secured substantial equity rounds via targeted VC pitches emphasizing AI applications, often exceeding $500 million. In debt advisory, mezzanine structures supported facility upgrades without diluting ownership. Healthcare M&A advisory facilitated cross-border acquisitions, streamlining transactions for enhanced market access. These cases highlight the value of institutional networks in achieving optimal outcomes.

Frequently Asked Questions on Healthcare Investment

What services does a healthcare investment bank typically offer?

We at Zaidwood provide full-cycle M&A advisory, capital formation, and debt advisory services tailored for healthcare clients. These encompass buy-side and sell-side mandates, equity placements, and strategic financing to support growth and mergers in the sector.

How do I select the top healthcare M&A advisory firms in the US?

Look for firms with proven transaction volume, like our 24.4B USD aggregate, and expertise in healthcare deals. Prioritize those offering integrated due diligence and access to institutional investors for efficient execution.

How to raise capital for healthcare companies through investment banks?

Engage a healthcare investment bank for healthcare capital raising strategies, blending loans, grants, and private funding. For rural facilities, leverage USDA programs and CDFIs to build a robust capital stack, ensuring project viability.

What are the costs for healthcare M&A advisory in middle-market deals?

Fees typically range from 1-3% of deal value, influenced by tariffs on supplies that may raise operational costs. We structure advisory to align with client budgets, focusing on value-driven outcomes without upfront guarantees.

What trends shape healthcare capital raising?

Rising demand for telehealth funding and domestic manufacturing incentives amid tariff pressures. Advisory query responses emphasize diversified sources for resilient funding FAQ insights in evolving markets.

Key Takeaways in Healthcare Investment Banking

In navigating the dynamic landscape of a healthcare investment bank, we at Zaidwood Capital emphasize comprehensive healthcare M&A advisory and healthcare capital raising services. Key trends include rising demand for strategic healthcare finance amid regulatory shifts and technological advancements, enabling seamless sector advisory essentials.

Selecting the right advisory partner proves crucial for success in healthcare transactions, where rigorous due diligence uncovers risks and opportunities. Our full-cycle approach ensures informed decisions and value maximization.

Explore tailored advisory options with us to advance your healthcare initiatives thoughtfully.