How To Finance Buying A Business

Table of Contents

Financing Options for Acquiring a Business

In today’s dynamic market, many entrepreneurs wonder how to finance buying a business, drawn to acquisitions over startups for their established revenue streams and reduced risk. Acquiring an existing operation, such as a mid-sized manufacturing firm, offers immediate cash flow and operational stability, making it an attractive funding strategies for business purchases.

Key financing pathways include Business Acquisition Financing through SBA loans, which provide government-backed options like the 7(a) program for long-term capital up to $5 million. These business acquisition loans often feature lower down payments of 10-30% of the purchase price and flexible terms, as outlined by the U.S. Small Business Administration. Seller financing allows buyers to negotiate direct payments with owners, easing upfront costs, while private equity infusions from institutional investors support larger deals.

At Zaidwood Capital, we guide corporate clients and fund managers through these acquisition capital solutions, leveraging our network of over 4,000 investors with more than $15 billion in deployable capital. Our expertise ensures thorough due diligence, though success depends on individual circumstances. This overview sets the foundation for exploring loan mechanics, benefits, processes, and best practices in the sections ahead.

Key Concepts in Business Acquisition Financing

Acquiring a business requires a solid grasp of financing options to ensure a sustainable transaction. This section explores essential mechanisms, the value of expert guidance, and foundational eligibility criteria, particularly for enterprises with revenues exceeding $1 million. By understanding these elements, buyers can navigate the complexities of funding structures effectively.

Core Financing Mechanisms

When exploring how to finance buying a business, entrepreneurs often start with core debt options like business acquisition loans, which provide capital to purchase an existing operation. These loans, frequently backed by the Small Business Administration (SBA), enable buyers to acquire assets, goodwill, and operations without liquidating personal savings entirely. The SBA’s 7(a) program, for instance, supports acquisitions up to $5 million, offering flexible terms for working capital and real estate improvements, as outlined in the SBA Business Guide to buying an existing business. For a practical walkthrough of loan options and application steps, see Get A Loan To Buy A Business.

Seller financing emerges as a vital bridge in many deals, where the outgoing owner extends credit for a portion of the purchase price, typically repaid over 3-7 years. This arrangement, sometimes called vendor-financed purchases, reduces upfront cash needs and aligns interests between buyer and seller. For larger transactions, private equity infusions play a role, injecting capital in exchange for ownership stakes to fuel growth. Acquisition debt funding complements these by covering the balance through bank loans or specialized lenders. Key terms include:

- Debt Financing: Borrowed funds repaid with interest, ideal for stable cash-flow businesses.

- Equity Financing: Investor capital for partial ownership, suited to high-growth targets.

These mechanisms form the backbone of successful acquisitions, balancing risk and opportunity.

Role of Advisory Expertise

Navigating the intricacies of business acquisition financing demands specialized knowledge, especially for structures like mezzanine debt that blend debt and equity features. At Zaidwood Capital, we guide clients through these complexities, leveraging our full-cycle due diligence to evaluate deal viability and optimize funding strategies. Our team assesses financial projections, operational synergies, and market positioning to ensure alignments with client goals, drawing on a network of over 4,000 investors for tailored capital introductions.

We emphasize comprehensive reviews to mitigate risks, such as scrutinizing business valuations and structuring hybrid financings that include seller notes alongside institutional debt. In a recent deal involving a mid-market manufacturing firm, our advisory streamlined mezzanine arrangements, securing favorable terms that accelerated closing. This expertise demystifies options like venture debt for tech acquisitions or asset-based lending for asset-heavy sectors. By integrating mergers and acquisitions advisory with debt and equity solutions, we streamline transactions, helping clients achieve precision in capital formation. Our approach underscores the importance of professional input to transform conceptual financing into executable plans, setting the stage for long-term value creation.

Down Payment and Eligibility Basics

Securing initial capital commitments involves understanding down payment norms, typically ranging from 10-30% of the purchase price, depending on lender requirements and deal size. For SBA 7(a) loans, buyers must demonstrate strong credit history, with scores above 680 often preferred, alongside a viable business plan and collateral. The SBA Business Guide stresses evaluating the target’s value through methods like capitalized earnings to justify the investment, while eligibility excludes certain industries and mandates U.S. operations with profit potential.

Preparation steps include obtaining pre-approvals and conducting valuations to align with lender expectations. The 7(a) program offers guarantees of up to 85% for loans under $150,000 and 75% above, with maturities up to 25 years for real estate-involved acquisitions, enhancing accessibility for qualified applicants. Key requirements encompass:

- Creditworthiness: Proven repayment ability and minimal debt history.

- Business Valuation: Independent appraisals confirming fair market worth.

- Equity Injection: Minimum down payment to signal buyer commitment.

We at Zaidwood Capital assist in these preparations, ensuring clients meet thresholds through rigorous due diligence. Mastering these basics empowers buyers to position deals favorably, paving the way for strategic advantages in ownership transitions.

Advantages of Different Financing Strategies

When considering how to finance buying a business, understanding the advantages of various approaches is essential for making informed choices. From traditional loans to seller financing and equity options, each strategy offers unique benefits tailored to different acquisition scenarios. As a leading M&A capital advisory firm, we at Zaidwood Capital help clients navigate these options, leveraging our network of over 4,000 investors to optimize funding structures and ensure seamless transactions.

Benefits of Traditional Loans

Traditional loans, particularly business acquisition loans, provide stable and reliable funding for purchasing established businesses. Government-backed options like SBA 7(a) loans stand out due to their lower interest rates, often ranging from 7% to 10%, and extended repayment terms up to 10 years, as outlined in the SBA’s Fund Your Business Guide. These loans require a down payment of 10-20%, but the backing reduces lender risk, making approval more accessible for qualified buyers with solid credit and business plans.

Pros include predictable payments and retention of full ownership without diluting equity. For instance, successful acquisitions of manufacturing firms have utilized these loans to fund expansions without immediate cash flow strain. However, cons involve rigorous documentation and collateral requirements, which can delay closing. We advise on hybrid structures combining these loans with our debt advisory services to mitigate drawbacks and align with long-term goals.

Seller Financing Advantages

Seller financing offers compelling upsides for buyers seeking flexible acquisition funding pros, especially in relationship-driven deals. By involving the vendor directly, this approach typically lowers upfront costs to 5-15% down, with negotiable interest rates around 6-8% and custom terms that can span several years. This reduces the buyer’s initial capital burden and allows payments tied to the business’s performance, building trust between parties.

Key benefits encompass tax advantages for sellers, who can defer capital gains, often leading to more favorable terms for buyers. It accelerates deal timelines by bypassing lengthy bank approvals and fosters ongoing support from the seller during transitions. Drawbacks include potential higher overall costs if rates exceed market levels or dependency on the seller’s financial health. At Zaidwood, our full-cycle M&A and capital advisory expertise helps structure these arrangements to maximize purchase financing upsides while minimizing risks.

Equity and Private Options

Equity and private equity financing unlock significant growth potential for larger business purchases, particularly for high-potential firms. Private equity investors provide capital in exchange for stakes, often requiring 20-30% down but offering strategic input that enhances post-acquisition scaling. This approach suits ambitious deals where buyers aim to accelerate expansion, drawing on networks for additional resources and expertise.

Advantages include access to mentorship and operational improvements that boost value, as seen in ventures where equity infusions led to rapid market penetration. Unlike debt, it avoids interest payments, sharing risks and rewards. However, cons involve equity dilution and loss of some control, plus intense due diligence. We at Zaidwood facilitate these through our equity advisory services, connecting clients to deployable capital exceeding $15 billion and tailoring hybrids for optimal outcomes.

This comparison highlights how SBA loans excel in stability for steady operations, seller financing in affordability for personal transitions, and private equity in transformative growth. Readers evaluating options should consider their business’s scale and risk tolerance; for example, a mid-sized acquisition might blend seller notes with equity for balanced leverage. Our team previews application processes to streamline these decisions, ensuring alignment with your strategic objectives.

| Financing Type | Upfront Capital Needed | Interest/Equity Cost | Flexibility | Best For |

|---|---|---|---|---|

| SBA 7(a) Loans | 10-20% down | Variable rates (7-10%) | Up to 10-year terms | Established businesses |

| Seller Financing | 5-15% down | Negotiable rates (6-8%) | Custom terms | Relationship-driven deals |

| Private Equity | 20-30% down | Equity stake | Strategic input | High-growth firms |

The Process of Securing Business Purchase Financing

Navigating how to finance buying a business requires a structured approach, blending traditional lending options with creative financing strategies. At Zaidwood Capital, we guide clients through these steps, leveraging our access to over $15 billion in deployable capital to streamline securing acquisition capital. This process not only ensures compliance but also positions buyers for long-term success in deal funding procedures.

Loan Application Steps

Applying for business acquisition loans through SBA 7(a) programs or traditional banks involves a methodical process. First, assess eligibility: your business must be for-profit, U.S.-based, and meet SBA size standards, with strong creditworthiness to demonstrate repayment ability. We recommend gathering essential documents, including business financial statements, tax returns for the past three years, a detailed business plan outlining the acquisition, and personal financials for owners with 20% or more stake.

Next, select a participating lender, as the SBA does not issue loans directly but provides guarantees up to 85% for loans under $150,000 and 75% for larger amounts, reducing lender risk. Submit the application via the lender, who evaluates your package. Approval timelines typically range from 45 to 90 days, factoring in due diligence on the target business. Expect fees such as a guarantee fee of 2-3.75% of the guaranteed portion, depending on loan size and maturity. Once approved, funds can finance up to $5 million for acquisitions, including working capital or equipment needs. Integrating full-cycle due diligence early enhances approval odds and mitigates risks.

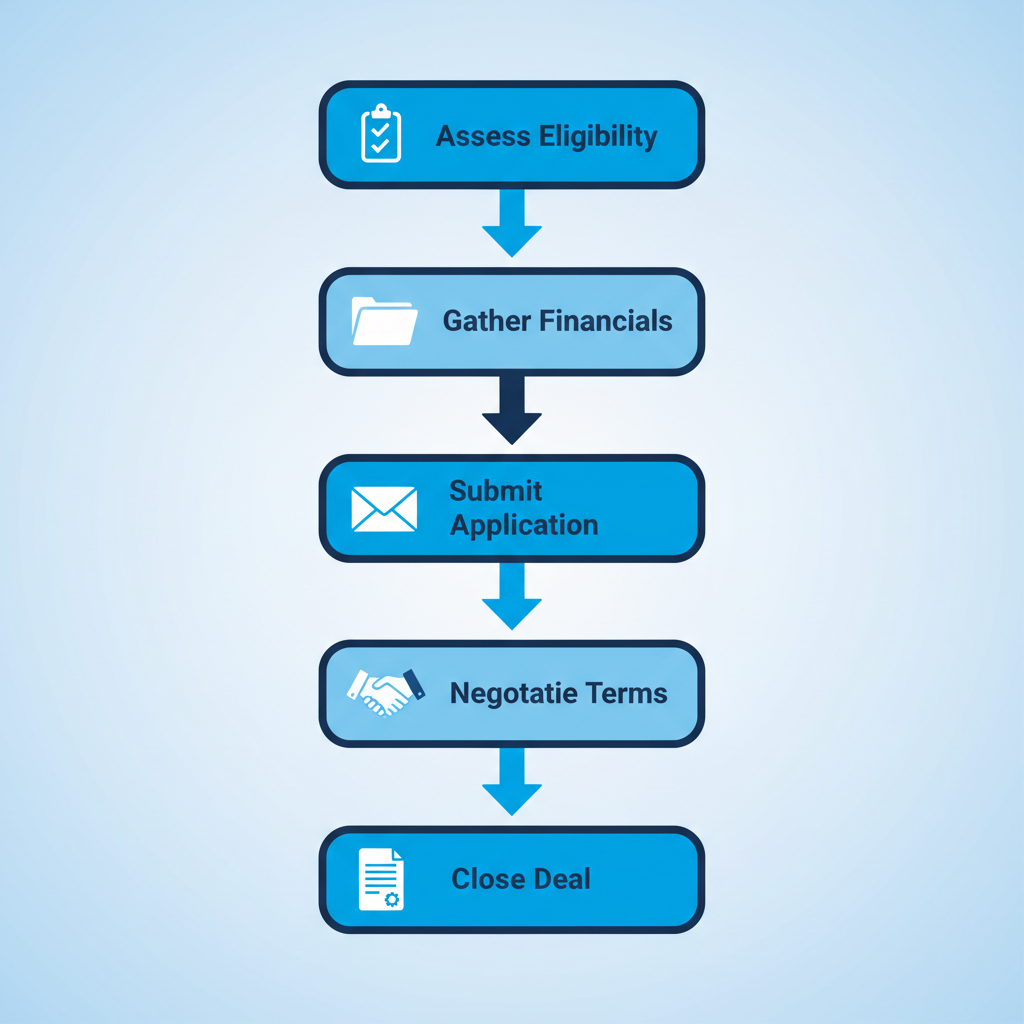

Step-by-step guide to securing business purchase financing through SBA 7(a) loans

This visual roadmap underscores the importance of preparation in the loan journey, setting a foundation for subsequent negotiations.

Negotiating Seller Terms

Structuring seller financing demands strategic negotiation to align interests and minimize risks. Begin by reviewing the seller’s motivations, such as tax benefits or faster deal closure, to identify leverage points. Propose terms like a 5-10 year amortization with interest rates of 6-9%, often tied to prime plus a margin, ensuring they reflect market conditions without overburdening cash flow.

Address balloon payments judiciously, capping them at 20-30% of the principal to avoid future refinancing pressures. Include protective clauses, such as covenants for business performance and collateral on assets, while offering the seller a security interest in the business. We advise conducting thorough due diligence on the target’s financials to validate valuation and negotiate earn-outs based on post-acquisition milestones. This approach fosters trust, with our team facilitating discussions to secure favorable seller financing arrangements that support seamless transitions.

Engaging Equity Partners

Leveraging private equity requires a targeted pitch process to attract aligned investors. Start by refining your investment thesis, highlighting the acquisition’s growth potential and synergies, supported by pro forma financials and market analysis. Prepare a compelling pitch deck that details use of funds, projected returns, and exit strategies, aiming for 20-30% IRR to appeal to family offices or venture firms.

Next, tap into advisory networks for introductions; our boutique M&A advisory services connect clients to over 4,000 institutional investors, expediting outreach. Schedule virtual or in-person meetings, following up with teasers and NDAs. Due diligence from equity partners will scrutinize operations and compliance, so maintain transparency. Close by negotiating term sheets on equity stakes, typically 20-40%, and governance rights. This collaborative method, informed by our capital formation expertise, accelerates funding while aligning partners for sustained value creation.

Effective Strategies for Financing Your Business Acquisition

At Zaidwood Capital, with our $24.4 billion in aggregate transaction volume, we guide clients through smart acquisition funding by blending proven financing methods. Learning how to finance buying a business requires balancing cost, flexibility, and risk. We emphasize optimized purchase strategies that align with your goals, leveraging our expertise in full-cycle M&A and capital advisory to streamline transactions.

Hybrid Financing Approaches

Combining financing sources creates flexible structures for business acquisitions. One effective approach pairs seller financing with business acquisition loans, such as SBA 7(a) programs. Seller financing allows the current owner to provide a portion of the purchase price, often at favorable terms, while SBA loans cover the balance with government-backed guarantees. This hybrid reduces upfront capital needs and spreads risk.

For instance, if acquiring a $2 million business, secure 60% via an SBA loan at prime-plus rates around 7-10%, and 40% through seller notes over five years. Prepare pro forma financials to demonstrate repayment ability, incorporating tax effects like interest deductibility to optimize cash flow. We recommend this for deals under $5 million, as it minimizes equity dilution. Always consult advisors to structure terms that protect both parties, ensuring smooth transitions without overleveraging.

Leveraging Advisory Networks

Accessing capital quickly hinges on strong connections. At Zaidwood, our network of over 4,000 institutional and private investors unlocks $15 billion in deployable capital, accelerating funding for acquisitions. We facilitate introductions to private equity firms, family offices, and venture capital sources tailored to your deal size and industry.

Start by engaging financial advisory M&A services like ours to map investor fits. For example, in a recent mandate, we connected a client to growth equity providers within weeks, securing mezzanine debt at competitive rates. Prepare a compelling pitch deck highlighting synergies and projected returns. This velocity matrix approach–integrating digital marketing with capital markets–shortens timelines from months to days. Target firms generating at least $1 million in revenue for eligibility, focusing on sectors like technology or manufacturing. Our first-plural collaboration ensures personalized strategies, empowering you to close deals efficiently.

Risk Mitigation Tips

Effective risk management safeguards your investment during acquisition financing. Conduct thorough due diligence to uncover hidden liabilities, using checklists for financial, legal, and operational reviews. For SBA-backed business acquisition loans, verify eligibility: operate for profit in the US, meet size standards, and demonstrate creditworthiness per SBA guidelines.

Key tips include:

- Review historical financials and pro formas for revenue stability, avoiding industries excluded like speculation.

- Negotiate seller financing terms with covenants limiting representations, such as earn-outs tied to performance.

- Benchmark interest rates–SBA 7(a) caps at prime plus 2.75% for loans over $50,000–and secure fixed rates to hedge volatility.

- Address tax effects early, like structuring for 1031 exchanges if applicable, and include escape clauses for material adverse changes.

Common pitfalls: Overlooking repayment capacity or ignoring upfront fees (up to 3.75% for SBA). We advise full-cycle due diligence to mitigate these, ensuring resilient deals without guarantees of outcomes.

Next Steps in Business Acquisition Financing

As you consider how to finance buying a business, key options like business acquisition loans and seller financing stand out for their flexibility and accessibility. These approaches often require a down payment of 10-20% of the purchase price, enabling you to leverage existing assets while minimizing upfront capital. Private equity can play a pivotal role by providing structured funding for larger deals, ensuring alignment with growth strategies. In our acquisition funding recap, seller financing may influence business acquisition taxes through deferred payments and potential deductions, but always consult tax professionals for specifics.

At Zaidwood Capital, we offer comprehensive debt advisory services to guide you through tailored financing solutions. Our network of over 4,000 investors and full-cycle due diligence processes help streamline transactions, connecting you to $15 billion in deployable capital. We invite you to explore our services for personalized advisory that aligns with your goals, without any commitments. Contact us for details.

Looking ahead, current market opportunities favor strategic acquisitions. For further funding tips, refer to the SBA Business Guide on funding your business. With informed steps, you position yourself for successful growth.