How To Raise Capital For A Business

Table of Contents

Raising Capital for Your Business: An Overview

In today’s competitive landscape, understanding how to raise capital for a business remains crucial for mid-sized companies aiming for sustainable growth. Many entrepreneurs face hurdles in securing funds for expansion, navigating complex investor networks, and complying with regulations. At Zaidwood Capital, we specialize in guiding clients through these challenges with tailored business funding strategies.

Raising capital involves securing funds from investors or lenders to fuel operations and innovation. Common sources include equity investors like Raise Capital partners, debt financing options, seed funding for early-stage ventures, and angel investors for initial backing. We connect our clients to over 4,000 institutional investors with access to more than $15 billion in deployable capital, leveraging our $24.4 billion aggregate transaction volume and 300+ completed deals. Drawing from SEC resources on preparing to raise capital, we emphasize due diligence and documentation essentials, while FINRA’s recent notices highlight evolving regulatory frameworks that support efficient investor outreach methods without unnecessary burdens.

For instance, a mid-sized manufacturing firm we advised successfully obtained growth equity by streamlining their pitch to align with institutional criteria, demonstrating the value of expert advisory. As we explore funding options, benefits, processes, and best practices in subsequent sections, you’ll gain insights to evaluate paths forward, ensuring informed decisions for your business’s future.

Understanding Capital Raising Options

At Zaidwood Capital, we guide mid-sized businesses through the complexities of capital raising, helping them identify the most suitable funding strategies to fuel growth. Understanding these options is essential for entrepreneurs navigating expansion, as each method carries distinct advantages and considerations tailored to different business stages.

Types of Funding for Mid-Sized Businesses

When exploring How To Raise Capital For A Business, mid-sized companies often evaluate equity, debt, and hybrid financing to support scaling operations. Equity funding involves selling ownership stakes to investors, such as through private equity firms, which provide capital in exchange for shares and often strategic input. For growth-stage businesses, this can mean raising millions to fund acquisitions or market expansion, though it dilutes founder control.

Debt options, like mezzanine financing or venture debt, allow companies to borrow without surrendering equity. Mezzanine debt blends subordinated loans with equity-like features, offering flexibility for businesses with steady cash flows, typically at interest rates of 10-15%. Hybrid models combine elements of both, such as convertible notes that start as debt but convert to equity upon milestones.

Pros of equity include no repayment obligations and access to investor networks; cons involve ownership loss and higher scrutiny. Debt pros offer retained control and tax-deductible interest, but cons include repayment pressure during downturns. Preparation of robust financial documents, including pro forma statements, is crucial for all paths to demonstrate viability.

Key capital raising options: equity, debt financing, and hybrid models visualized.

Role of Advisory Firms in Fundraising

A capital advisory firm like ours plays a central role in streamlining the fundraising process for mid-sized businesses. We begin by assessing a client’s financial health and objectives, then structure tailored deals that attract the right investors. Our expertise in full-cycle due diligence ensures thorough preparation, from financial modeling to regulatory compliance, minimizing risks and enhancing credibility.

We facilitate connections to extensive networks, including over 4,000 institutional investors with access to more than $15 billion in deployable capital. For equity fundraising, we handle investor introductions, pitch deck development, and negotiation support, drawing on our $24.4 billion aggregate transaction volume to build trust. In debt scenarios, we arrange mezzanine or asset-based lending, verifying terms that align with cash-flow projections.

Step-by-step, our process includes initial strategy sessions, document preparation, and ongoing liaison during due diligence. This comprehensive approach not only accelerates capital access but also positions clients for long-term success, as seen in our 300+ completed deals. By leveraging professional guidance, businesses avoid common pitfalls and optimize outcomes in competitive markets.

Early-Stage Funding: Seed and Angels

Seed funding represents initial business financing to validate product ideas and achieve early milestones, typically ranging from $500,000 to $2 million for startups. This high-risk early capital supports prototype development, market testing, and team building, often sourced from founders, friends, or accelerators. According to SEC guidelines on private fund formation, proper structuring ensures compliance from the outset, focusing on clear investor expectations.

Angel investors, high-net-worth individuals, provide personal investor backing in exchange for equity, with investments usually between $25,000 and $500,000. They seek startups with strong teams, scalable models, and traction, often participating in US networks like the Angel Capital Association for deal flow. To find them, entrepreneurs should network at industry events, refine pitches emphasizing market potential, and offer detailed business plans.

Pros of seed funding include rapid capital without immediate repayments and mentorship opportunities; cons encompass high dilution and pressure to hit growth targets quickly. Angel pros feature flexible terms and strategic advice from experienced backers, while cons involve lengthy negotiations and potential loss of autonomy. What do angel investors look for? Primarily, a compelling vision, defensible IP, and realistic projections. Understanding these foundational steps equips businesses to progress toward larger rounds, underscoring the value of expert advisory in capital formation.

Benefits of Professional Capital Advisory

Engaging professional capital advisory services like those offered by Zaidwood Capital can significantly enhance a business’s ability to secure funding efficiently and effectively. Our expertise in equity and debt fundraising mitigates common pitfalls, from mismatched investor expectations to cumbersome documentation processes. By leveraging our full-cycle M&A and capital advisory capabilities, clients gain access to strategic insights that streamline transactions and optimize outcomes. This section outlines key advantages, demonstrating how our network and guidance propel fundraising success.

Access to Extensive Investor Networks

One of the primary benefits of partnering with a capital advisory firm is gaining entry to a vast ecosystem of potential funders, which directly addresses queries like ‘Who provides seed funding to early-stage companies?’ and ‘What are the typical amounts for seed funding rounds?’ Our network connects clients to over 4,000 institutional and private investors, including private equity firms, family offices, and sovereign wealth funds, representing more than $15 billion in deployable capital. This funding network leverage opens doors to diverse opportunities, such as seed funding rounds that typically range from $500,000 to $2 million for early-stage ventures, enabling quick access to resources without the delays of independent outreach.

- Targeted Introductions: We facilitate warm connections to high-net-worth individuals and institutions, prioritizing alignment based on your business model and growth stage.

- Diverse Capital Sources: From angel investors providing personal funding advantages like flexible terms for strong teams, to institutional smart money flows as noted by FINRA, which dominate trading volumes and influence market dynamics.

- Scalable Opportunities: In understanding How To Raise Capital For A Business, our rolodex has supported over 300 deals, including an anonymized tech startup that secured $1.5 million in seed funding within three months through targeted family office introductions. See Investment Bank To Raise Capital.

Streamlined Due Diligence and Documentation

Professional advisors excel in managing the intricate due diligence phase, which often stalls independent fundraising efforts. We handle full-cycle due diligence, covering financial, legal, operational, and commercial aspects, to prepare your business for investor scrutiny. This includes crafting pro forma financials, balance sheets, and cash flow projections, drawing on SEC guidelines for beginner financial statements to ensure transparency and accuracy. By organizing these documents upfront, we accelerate the review process, reducing timelines from months to weeks.

- Comprehensive Financial Preparation: Our team develops pitch decks and business plans with detailed income statements and equity analyses, highlighting assets minus liabilities for a clear net worth picture.

- Legal and Compliance Support: We coordinate reviews of footnotes, management discussions, and ratios like operating margins to validate projections and mitigate risks.

- Efficiency Gains: Advisory due diligence saved a manufacturing client six weeks in their $10 million debt raise by pre-empting queries on cash flow activities, allowing faster closure on asset-based lending.

Enhanced Fundraising Success Through Expertise

Our strategic guidance optimizes every aspect of the capital-raising journey, addressing questions such as ‘How much do angel investors typically invest?’ and ‘What is the difference between angel investors and venture capital?’ Angel investors often commit $25,000 to $100,000 per deal, favoring individual involvement with early-stage companies, while venture capital involves larger funds from pooled institutional sources for scalable growth. We refine pitches, structure deals, and navigate private equity steps like valuation and term sheets, drawing on 24.4 billion USD in aggregate transaction volume across 300+ completed engagements.

- Pitch Optimization: Tailored narratives emphasize unique selling points, such as strong management teams that angel investors prioritize, leading to higher engagement rates.

- Deal Structuring Advantages: For equity raises, we balance pros like rapid seed funding access against cons such as equity dilution, ensuring terms protect founder interests.

- Proven Outcomes: Strategic capital benefits shone in a recent healthcare deal where our expertise in mezzanine debt structuring secured favorable rates, distinguishing personal angel support from VC’s rigorous milestones.

How Capital Raising Works in Practice

At Zaidwood Capital, we guide mid-sized businesses through the practical steps of capital raising, leveraging our expertise in m&a advisory services to connect clients with funding opportunities. From initial outreach to final execution, our process ensures regulatory compliance and efficient deal flow, drawing on SEC building blocks for small businesses to structure investor engagement tactics effectively.

Connecting with Institutional Investors

Connecting with institutional investors begins with strategic outreach, a key part of how to raise capital for a business. We start by leveraging our advisory networks to introduce clients to over 4,000 institutional and private entities, including private equity firms, family offices, and venture capital funds. Step 1: Identify target investors aligned with your sector and growth stage through our proprietary investor rolodex. Step 2: Craft tailored pitch overviews highlighting unique value propositions, incorporating SEC-compliant disclosures to build trust. Step 3: Schedule introductory calls or virtual meetings, utilizing investor engagement tactics like data room access for preliminary due diligence.

For early-stage ventures, we facilitate connections with angel investors, emphasizing personalized pitching best practices such as concise narratives on market potential and exit strategies. This approach has enabled our clients to secure initial commitments efficiently. As we refine these connections, the next phase involves thorough preparation to meet lender and investor expectations.

Preparing for Debt and Equity Financing

Preparing for debt and equity financing requires meticulous attention to financing preparation phases, ensuring all documentation withstands scrutiny. We assist clients in compiling essential financial models, including pro forma statements and cash flow projections, tailored to debt options like mezzanine or asset-based lending. Step 1: Assemble historical financials, audited if possible, alongside collateral assessments for debt applications, adhering to SEC guidelines for transparent reporting. Step 2: Develop comprehensive business plans and pitch decks for equity pursuits, focusing on growth equity and liquidity solutions. Step 3: Conduct internal due diligence simulations to preempt investor queries, covering operational, legal, and commercial aspects.

In equity scenarios, we integrate seed funding elements early, such as valuation benchmarks and cap table management, to attract growth-oriented backers. Our full-cycle due diligence services streamline this process, reducing timelines and enhancing credibility. These preparations set the foundation for seamless negotiations and funding approvals.

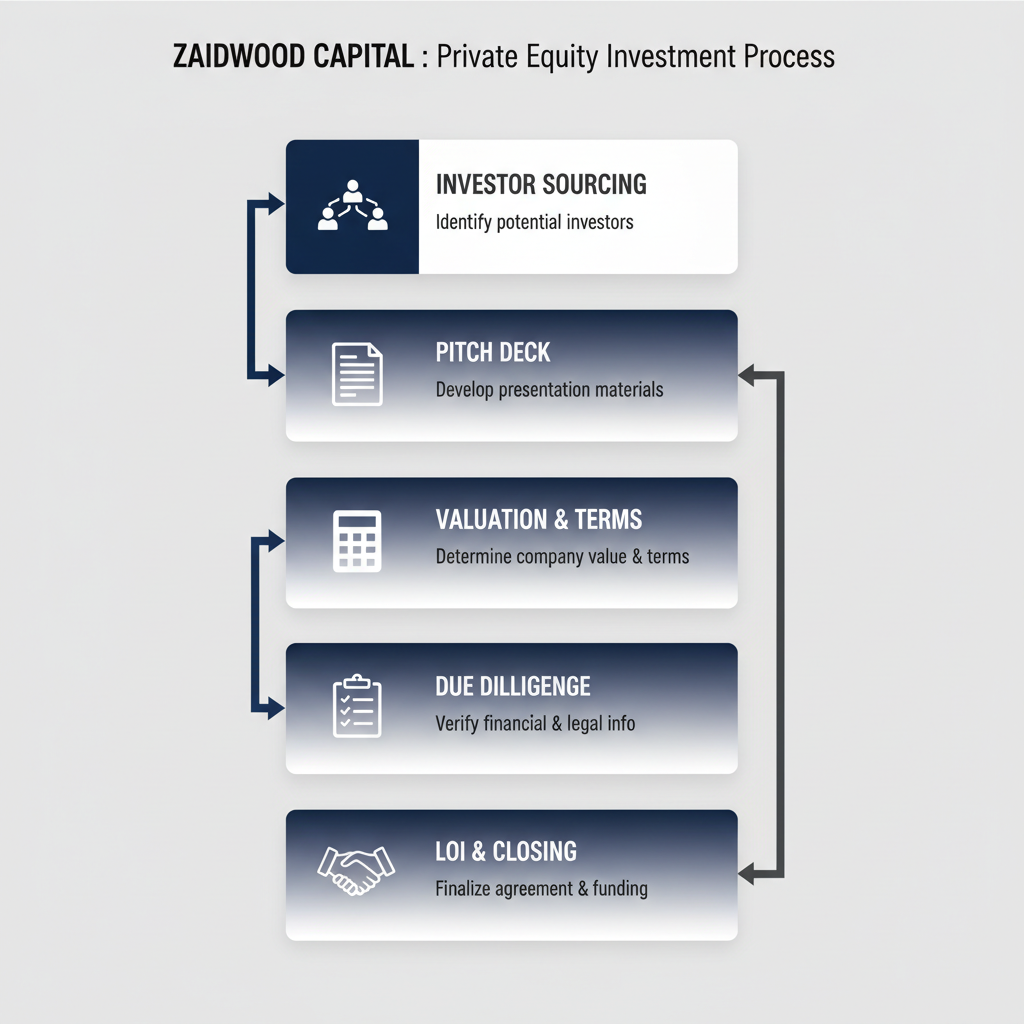

Step-by-step private equity capital raising process visualization

The Private Equity Investment Process

The private equity investment process follows a clear deal execution workflow, from sourcing to closing, where we provide end-to-end support. Step 1: Investor sourcing through our extensive network, targeting firms with aligned mandates and deploying targeted outreach. Step 2: Pitch deck creation and initial meetings, presenting detailed narratives on strategy and returns, compliant with SEC capital raising building blocks. Step 3: Valuation and term sheet negotiation, where we model scenarios to secure favorable economics, including equity stakes and governance rights.

Step 4: In-depth due diligence, coordinating financial, legal, and operational reviews with our full-cycle expertise to address risks proactively. Step 5: LOI issuance and closing, finalizing documentation and fund transfers while ensuring all regulatory hurdles are cleared. For institutional funding, we handle LP placements to endowments and sovereign wealth funds, mirroring these steps for broader capital access. Throughout, our guidance empowers clients to navigate complexities, paving the way for best practices in ongoing capital management.

Note: This content is for informational purposes only and does not constitute an offer, solicitation, or investment advice. Consult legal, tax, and financial advisors before proceeding. Investments involve risk and may result in loss.

Best Practices for Successful Capital Raising

At Zaidwood Capital, we guide mid-sized businesses through the complexities of capital raising by leveraging our expertise in advisory and investor relations. Drawing from our full-cycle M&A and capital formation services, we emphasize strategies that streamline fundraising while aligning with regulatory frameworks. This approach helps clients access efficient funding sources, including hybrid models that blend debt and equity to meet specific growth needs.

Effective Pitching to Angels and Seed Providers

Crafting a compelling pitch is essential when approaching angel investors and seed funding opportunities. We advise starting with a clear value proposition that highlights your business’s unique market position and scalable potential. In our experience, successful pitches integrate realistic financial projections to demonstrate return on investment, addressing key questions like how to raise capital for a business effectively.

To optimize your presentations, consider these practices:

- Tailor your deck to the audience, focusing on traction metrics for angels who prioritize early-stage innovation.

- Practice concise delivery, limiting the pitch to 10-15 minutes followed by targeted Q&A to build rapport.

- Follow up promptly with personalized summaries, reinforcing your vision and addressing any concerns raised.

- Leverage networks in the US for introductions, as angel investors often respond to warm referrals over cold outreach.

For instance, a tech startup we advised secured seed funding by emphasizing user growth data in their pitch, leading to a swift commitment from a regional angel group. These steps foster trust and increase close rates in competitive early funding rounds.

Selecting the Right Investors and Structures

Choosing the appropriate investors requires careful alignment of your business objectives with their expertise and terms. We recommend evaluating investor types based on stage, such as venture firms for growth equity or family offices for strategic partnerships. Optimized funding approaches often involve mixing debt and equity to balance control and cost.

Key criteria for investor matching techniques include:

- Assessing alignment on vision and timeline, ensuring shared goals to avoid future conflicts.

- Reviewing proposed structures, like convertible notes for seed rounds versus straight equity for larger raises.

- Prioritizing those with relevant industry networks to unlock additional value beyond capital.

- Consulting on tax implications and exit strategies early to structure deals that support long-term scalability.

In one anonymized case, a manufacturing client benefited from our debt advisory services to secure mezzanine debt alongside equity, optimizing their capital stack without excessive dilution. This methodical selection enhances deal terms and positions businesses for sustained expansion.

Navigating Due Diligence and Common Pitfalls

Due diligence can make or break a capital raise, so proactive preparation is crucial for smooth execution. We stress maintaining transparent, organized records to facilitate investor reviews, drawing on compliance insights from sources like FINRA Notice 25-06, which highlights ways to reduce regulatory burdens in capital formation while upholding protections.

Effective due diligence strategies encompass:

- Organizing financials, contracts, and IP documentation in a virtual data room for easy access.

- Anticipating queries on market risks and mitigation plans to demonstrate thoroughness.

- Engaging legal counsel early to address potential red flags, such as incomplete governance policies.

- Conducting mock diligence sessions to identify and resolve issues before formal reviews.

Common pitfalls, like delayed responses or inconsistent data, often stem from poor preparation; avoiding them through checklists aligned with FINRA’s focus on efficient processes can prevent costly setbacks. For example, a client we supported expedited their raise by pre-empting compliance checks, closing funding two weeks ahead of schedule and enabling accelerated operations.

Key Takeaways for Capital Raising Success

In this comprehensive funding recap, we’ve explored how to raise capital for a business through strategic planning and informed and scalable execution. From initial seed funding to engaging angel investors, debt financing, and equity rounds, diverse options exist to fuel growth. Effective capital raising hinges on leveraging robust networks for investor connections, conducting thorough due diligence to mitigate risks, and crafting compelling pitches that emphasize transparency and value. At Zaidwood Capital, as a leading transaction advisory firm, we facilitate introductions to our extensive network of over 4,000 institutional and private investors, supporting clients without any promises of outcomes.

Key takeaways for success include:

- Prioritize clear business documentation and financial projections to build investor confidence.

- Maintain ongoing compliance with regulatory standards, as outlined in SEC resources for starting private funds, to ensure smooth capital pursuits.

- Focus on authentic storytelling in pitches to differentiate your venture.

Looking ahead in this advisory wrap-up, we encourage businesses to prepare robust materials and initiate targeted outreach. Explore our tailored capital formation services to synthesize these success strategies and advance your funding goals with professional guidance.