How To Raise Venture Capital

Table of Contents

Navigating the Venture Capital Landscape

Entrepreneurs often search for ‘How to Raise Venture Capital’ to fuel their innovative ideas. At Zaidwood Capital, we guide startups through Venture Capital Fundraising, a process where investors provide equity financing in exchange for ownership stakes. This differs from loans, which require repayment with interest, or bootstrapping, which relies on personal funds without external dilution.

Venture capital targets high-growth companies in sectors like technology, biotech, or scalable models with proven traction, as noted in SEC resources on raising later-stage capital. These guidelines emphasize the need for compliance and readiness to attract investors. We at Zaidwood Capital connect clients to over 4,000 institutional and private investors with $15 billion in deployable capital, drawing from our $24.4 billion transaction volume and 300+ deals. Our capital advisory services streamline securing VC investment, offering expertise in startup funding strategies.

Yet challenges abound, including fierce competition and the demand for robust preparation, such as crafting a compelling venture capital pitch deck. Navigating VC funding stages requires strategic insight to avoid common pitfalls. To succeed, first grasp the core elements of venture capital, as explored in the sections ahead on understanding its benefits, the raising process, and best practices.

Fundamentals of Venture Capital Funding

Building on these basics, let’s explore what VCs truly value in potential investments. Understanding Raising Venture Capital For Startups requires grasping the core principles that drive decisions in this competitive landscape.

Core Elements VCs Evaluate

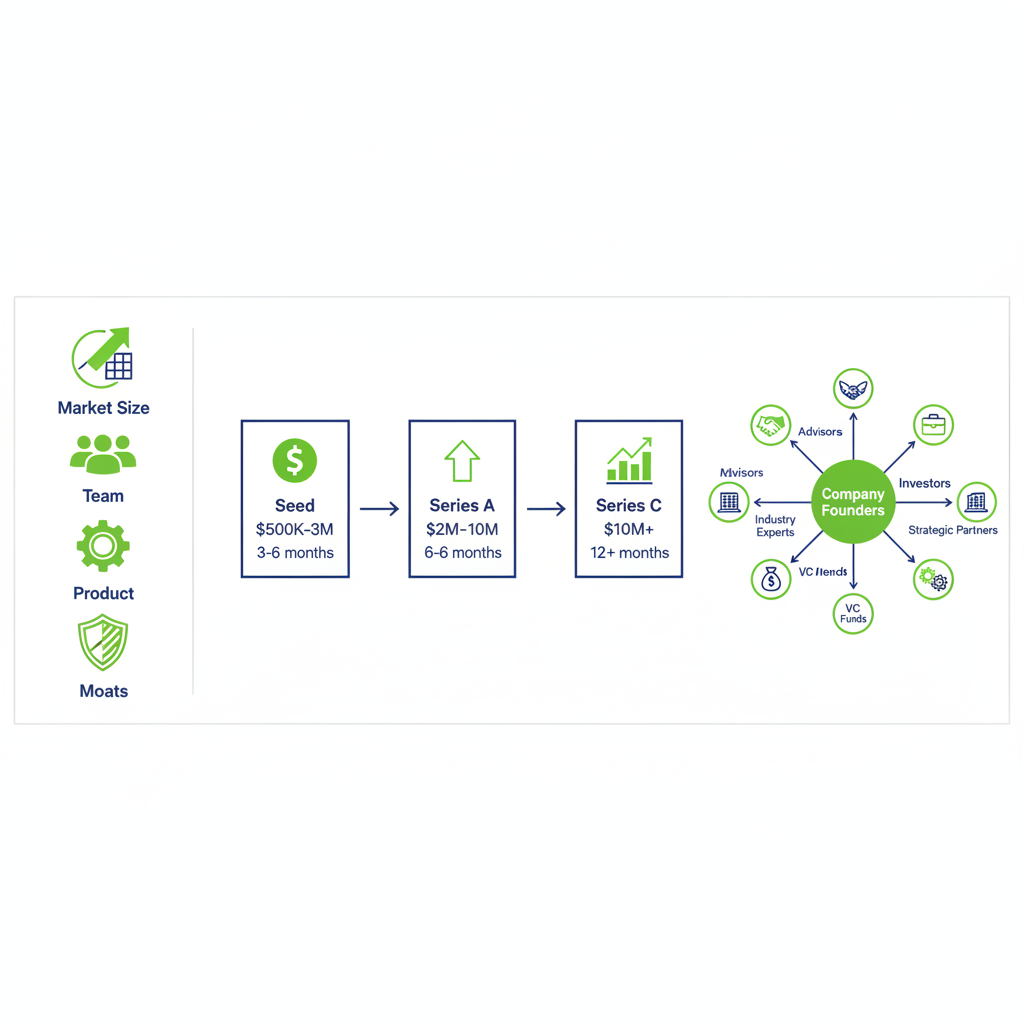

Venture capitalists prioritize several key factors when assessing startups, including market size, team strength, and product viability. A scalable business model with a total addressable market exceeding $1 billion signals high growth potential, while a founding team with complementary skills and prior successes builds investor confidence. Defensible moats, such as proprietary technology or network effects, protect against competition. According to Harvard Business School Online insights on pitching business ideas, effective presentations highlight these elements to demonstrate traction and vision.

We at Zaidwood Capital have guided numerous entrepreneurs through evaluations, leveraging our $24.4 billion in aggregate transaction volume to refine pitches that resonate with institutional investors. For instance, we’ve advised tech startups on articulating their unique value propositions without revealing sensitive details.

To prepare, founders should validate their ideas through customer interviews and prototype testing, ensuring alignment with VC investment criteria like those emphasized in HBS resources.

Navigating VC Funding Stages

The VC funding stages progress from seed to Series A, B, and beyond, each with distinct focuses and requirements. Seed funding, typically $500,000 to $2 million, supports initial product development and market validation over 3-6 months. Series A, often $10 million or more, emphasizes scaling proven models with demonstrated revenue traction. Later rounds like Series B and C build on milestones, raising larger amounts for expansion.

In our experience at Zaidwood, early-stage preparation involves crafting compelling narratives around traction metrics, such as user growth or prototypes, drawing from SEC guidelines on readiness using the CAPITAL framework for cap tables and investor strategies.

Key tips include maintaining detailed financials and allocating time for outreach; bullet-point breakdowns help clarify:

- Seed: Prototype + initial users (3-6 months)

- Series A: Revenue proof + team expansion (6-9 months)

- Series B/C: Market dominance + scalability (9-12 months)

This structure aids in mastering VC funding stages and funding round essentials.

Venture capital funding stages, evaluation elements, and advisory expertise overview

The infographic above illustrates these interconnected aspects, providing a visual roadmap for entrepreneurs. By aligning with these stages, founders can better anticipate investor expectations and timelines.

Role of Advisory Expertise

Advisory firms like Zaidwood Capital play a pivotal role in bridging startups with investors through strategic guidance and network access. We assist in due diligence preparation, strategy refinement, and connecting clients to over 4,000 institutional investors, ensuring pitches address what VCs seek.

Drawing from our full-cycle M&A and capital advisory expertise, we’ve facilitated deals across sectors by anonymizing startup profiles to match investor appetites, supported by our $24.4 billion transaction volume that underscores reliable execution.

Founders benefit from tips like engaging advisors early for pitch deck reviews and regulatory compliance, as per SEC recommendations on securing experienced counsel. This preparation enhances success in raising venture capital effectively, leading to strategic advantages in subsequent sections.

Advantages of Securing Venture Capital

With these basics in mind, the benefits become clear. Securing venture capital offers transformative advantages for startups and growing companies, extending far beyond mere financial support. Our experience at Zaidwood Capital shows how these investments fuel innovation and sustainable expansion in competitive markets.

Access to Capital and Networks

In exploring how to raise venture capital, entrepreneurs discover that the primary advantage lies in gaining substantial funding without incurring debt. This capital enables rapid scaling, covering operational costs, product development, and market entry strategies. Venture capital firms provide equity-based financing tied to milestones, sharing risks while aligning interests for mutual success. Key VC partnership perks include access to expansive networks that open doors to industry mentors, potential partners, and essential resources.

At Zaidwood Capital, our capital advisory services connect clients to over 4,000 institutional and private investors, facilitating introductions that streamline the funding process. Drawing from our involvement in more than 300 deals, we leverage this network to match opportunities with deployable capital exceeding $15 billion.

For instance, early-stage companies often use these connections to secure follow-on investments, accelerating growth trajectories and enhancing competitive positioning in dynamic sectors.

Strategic Support and Validation

Venture capital brings invaluable strategic support, starting with the validation that a reputable firm’s endorsement provides. This credibility attracts top talent, customers, and additional partners, signaling market confidence in the business model. Backers offer advisory input on operations, governance, and pivots, accelerating development through expert guidance. A strong venture capital pitch deck becomes crucial here, articulating the vision and metrics to secure commitment.

Through zaidwood capital advisory, we enhance this validation by preparing comprehensive due diligence and strategic documentation, ensuring clients present compelling cases to investors. Our full-cycle services, informed by SEC guidelines on later-stage capital raising, help navigate compliance while building investor trust.

Real-world implications include boosted enterprise value, as seen in anonymized cases from our portfolio where advisory support led to faster deal closures and improved negotiation leverage.

Long-Term Growth Potential

The long-term growth potential from venture capital stands out through opportunities for expansion and innovation funding. Investors commit to multi-stage support, providing resources for geographic scaling, R&D investments, and technology upgrades. This phased approach, often aligned with VC funding stages, fosters resilience and adaptability in evolving markets. Investment growth benefits emerge as companies achieve key milestones, unlocking higher valuations and exit pathways.

Zaidwood Capital’s expertise in capital formation complements these advantages, offering equity advisory and institutional introductions that sustain momentum across funding rounds. Referencing SEC resources, our services emphasize compliant scaling strategies that mitigate risks during growth phases.

In practice, this translates to enhanced innovation capacity; for example, our clients have utilized such funding to enter new markets, driving revenue increases and positioning for successful acquisitions or IPOs. To leverage these benefits, the next section outlines process steps for effective implementation.

The Venture Capital Raising Process

Raising venture capital involves a structured journey that transforms innovative ideas into scalable businesses. At Zaidwood Capital, we guide entrepreneurs through this process, leveraging our expertise in capital formation to streamline each stage. The timeline typically spans 4 to 9 months, demanding meticulous preparation and execution. These steps ensure founders are equipped to secure funding effectively.

Venture capital raising process: preparation, outreach, and closing stages

This visual outlines the core phases, highlighting how early efforts in preparation set the foundation for successful outcomes downstream. We recommend focusing on clarity and data-driven narratives to resonate with investors.

Preparation and Pitch Development

How to Raise Venture Capital begins with validating your business idea through rigorous market research. We advise entrepreneurs to assemble a strong team with complementary skills and develop a minimum viable product (MVP) to demonstrate feasibility. This groundwork establishes credibility before approaching investors.

Crafting a compelling venture capital pitch deck is crucial next. Aim for 10-15 slides covering the problem, solution, market size, business model, traction metrics, competitive landscape, financial projections, and team bios. As outlined in Harvard Business School Online resources, effective pitching emphasizes storytelling with real-world insights to engage audiences. Tailor the deck to VC interests, such as scalability in tech sectors, using visuals and concise data.

At Zaidwood Capital, our strategic documentation services include refining pitch decks to highlight unique value propositions. We integrate best practices like focusing on customer pain points and evidence of demand, ensuring the presentation stands out. Avoid overloading with details; instead, use the deck to spark interest for deeper discussions. This phase typically takes 2-3 months, building a solid fundraising roadmap.

Investor Outreach and Due Diligence

Once prepared, initiate investor outreach through professional networks and warm introductions. Attend industry events, leverage LinkedIn, and engage accelerators to build VC deal flow. We facilitate connections to our network of over 4,000 institutional investors, accelerating access to deployable capital.

Secure initial meetings to present your pitch, followed by the due diligence phase. Investors scrutinize financials, legal structures, operations, and market viability. Drawing from SEC guidelines on raising later-stage capital, this evaluation ensures compliance with regulatory standards, including disclosures on risks and ownership.

Our zaidwood capital m&a services provide full-cycle due diligence support, covering financial, legal, and operational reviews to prepare clients thoroughly. This advisory assistance mitigates red flags and strengthens your position. Expect this stage to last 2-4 months, with transparency being key to advancing.

Negotiation and Closing

Negotiations follow positive due diligence, centering on term sheets that outline valuation, equity stake, liquidation preferences, and governance rights. We recommend prioritizing founder-friendly terms while aligning on milestones. Legal reviews verify compliance, incorporating SEC-mandated disclosures to protect all parties.

Finalizing involves drafting definitive agreements, conducting final audits, and wiring funds. At Zaidwood Capital, our capital advisory team assists with documentation, ensuring smooth execution. This closing phase wraps up the VC deal flow, often within 1-2 months.

Throughout, maintain momentum on your fundraising roadmap. We emphasize realistic timelines and iterative improvements to navigate challenges effectively.

Effective Strategies for Venture Capital Success

Mastering the process of securing investment requires these best practices to stand out in a competitive landscape. At Zaidwood Capital, we guide clients through refined approaches that boost their chances of success.

Crafting Compelling Pitch Decks

How to Raise Venture Capital starts with a pitch deck that captivates investors from the first slide. Focus on core elements like problem-solution fit, market analysis, and financial projections, limiting the deck to 10-20 slides for clarity and impact. According to Harvard Business School Online resources, effective pitches emphasize storytelling to connect emotionally with audiences, using real-world examples to illustrate scalability and traction.

Design plays a crucial role in pitch optimization techniques. Prioritize high-quality visuals over dense text–charts, infographics, and minimal bullet points keep attention sharp. Tools like clean templates from Canva or PowerPoint ensure professional aesthetics without overwhelming complexity.

For presentation, practice delivery to convey confidence and expertise. Anticipate questions on market risks or revenue models, rehearsing concise responses. In our deals, we’ve seen founders who iterate based on early feedback transform average decks into funding magnets. Key takeaways include aligning visuals with your narrative and timing rehearsals to under 15 minutes for maximum engagement.

Avoiding Common Pitfalls

Fundraising error avoidance is essential across VC funding stages, from seed to Series A and beyond. Common mistakes include overvaluing the company early, which deters investors seeking realistic equity stakes. Founders often present weak traction data, such as unverified user metrics, leading to skepticism.

In preparation, neglecting legal readiness can stall progress–SEC guidelines stress updating cap tables and financials to avoid compliance errors during negotiations. Outreach pitfalls involve generic emails; instead, personalize with mutual connections. During talks, pushing too aggressively on terms without flexibility risks deal collapse.

Prevention strategies include seeking iterative feedback on pitches and modeling scenarios for runway calculations. Dedicate resources to advisor input early, ensuring alignment with investor expectations. We’ve observed clients who address these issues methodically advance faster, turning potential setbacks into strengths. Use checklists for due diligence to maintain momentum throughout the process.

Leveraging Advisory Networks

Partnering with experienced advisors optimizes the raise by providing intros, refining documents like pro formas, and navigating complexities. Best practices involve selecting partners with deep industry knowledge who offer more than capital–think strategic guidance and network access.

At Zaidwood Capital, we leverage our extensive rolodex for targeted investor matches, connecting clients to institutions aligned with their goals. For instance, in zaidwood capital transactions, advisors have facilitated smooth progressions through funding rounds by preparing tailored materials and anticipating regulatory hurdles.

Engage advisors early to map investor strategies and time commitments effectively. Communicate your long-term vision clearly, incorporating their insights on exit paths. This collaboration enhances credibility and efficiency. Key benefits include accelerated timelines and higher success rates, as seen in our anonymized cases where advisory input unlocked otherwise elusive opportunities.

Achieving Venture Capital Funding Goals

In our comprehensive guide on How to Raise Venture Capital, we’ve explored the essential steps for entrepreneurs to secure funding successfully. From understanding VC criteria and navigating VC funding stages to crafting a compelling venture capital pitch deck, the journey requires meticulous preparation. Key benefits include access to expansive networks, expert validation, and accelerated growth, while the process spans ideation, pitching, due diligence, and closing. Best practices emphasize clear financials, targeted investor outreach, and avoiding common pitfalls like incomplete documentation or unrealistic projections.

We at Zaidwood Capital reinforce this path with our expertise in advisory services, full-cycle due diligence, and strategic introductions to over 4,000 institutional investors. Whether pursuing equity rounds or complementary debt advisory financing, our team helps structure deals that align with your vision and runway needs, drawing on $24.4B in aggregate transaction volume for proven results.

Assess your readiness using the SEC’s CAPITAL framework–covering cap tables, funding amounts, proceeds plans, investor strategies, time commitments, advisors, and long-term vision–to ensure compliance and appeal. Contact us for tailored guidance; persistence, strong discipline, and strategic partnerships pave funding achievement paths through successful VC strategies.