How To Sell My Business

Table of Contents

Navigating the Sale of Your Business

Deciding how to sell my business marks a pivotal moment for many owners, often blending excitement with apprehension about leaving a legacy behind. At Zaidwood Capital, we understand these emotions and guide you through the selling your company process with expertise and care. Whether timing the market or addressing emotional attachments, preparation is key to a successful exit strategy planning.

The overall selling process involves several critical stages. According to the Library of Congress guide on selling a small business, it begins with thorough preparation, including financial audits and legal reviews. Next comes valuation, where exploring business valuation methods like discounted cash flow or comparable sales helps determine fair worth–answering how do I value my business before selling. Then, marketing the business through professionals, negotiation, and finally closing with due diligence. The Small Business Administration emphasizes that proper preparation boosts success rates, with studies showing prepared sellers close deals 30% faster. Expect a timeline of 6-12 months, though complexities like tax implications can extend this.

Key takeaways include:

- Engage experts early to navigate challenges.

- Focus on accurate valuation for optimal pricing.

- Plan for post-sale transitions to ease emotional hurdles.

We at Zaidwood Capital leverage our network of over 4,000 investors to streamline Sell Business transactions. In one case, our advisory turned a family-owned firm’s sale into a seamless handover, preserving value and relationships–without promising outcomes, but with proven support for your journey.

Understanding Your Business’s Value

At Zaidwood Capital, we recognize that understanding your business’s value is a foundational step in the process of Steps To Sell A Business. If you’re pondering ‘How to Sell My Business,’ starting with a thorough valuation ensures you approach the market with realistic expectations and maximize your outcomes. This section explores essential business valuation methods, key influencing factors, and practical preparation strategies to help you achieve a fair assessment.

Core Valuation Methods Explained

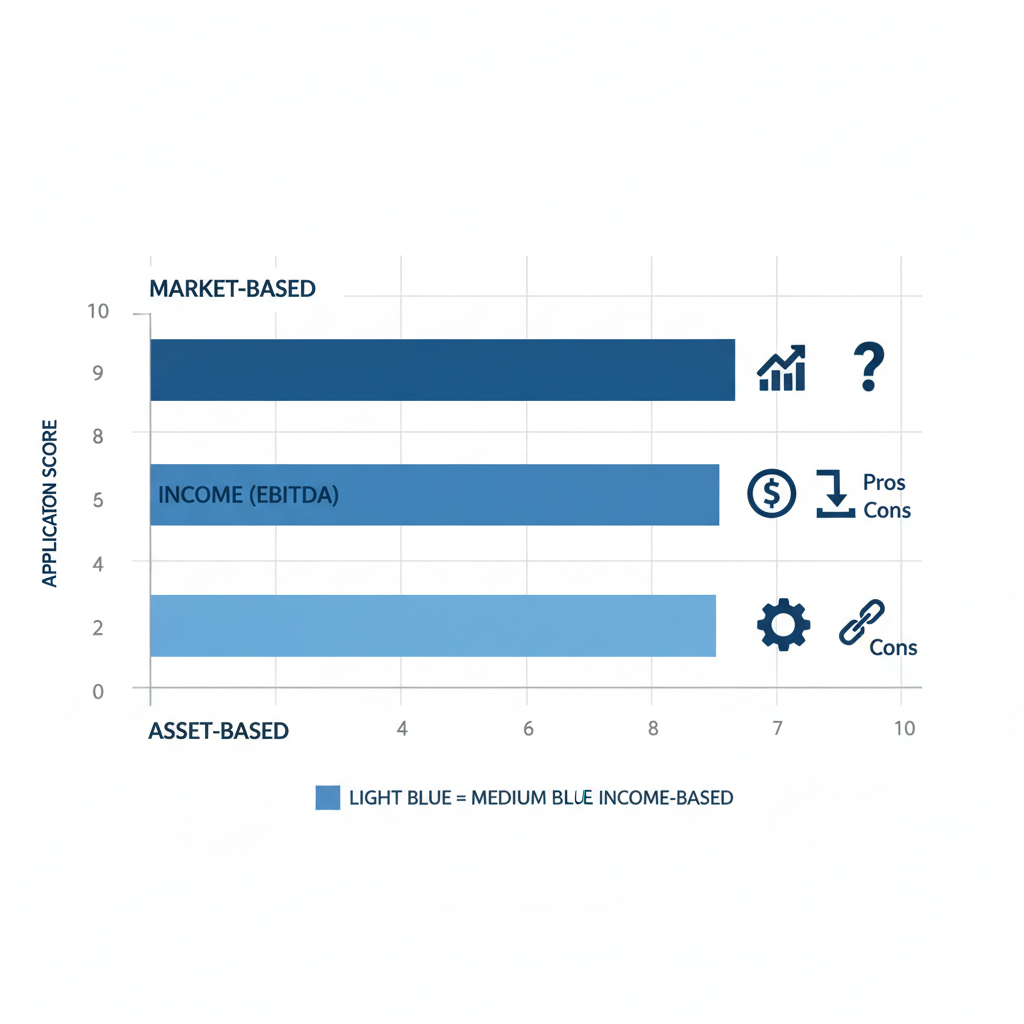

Business valuation methods provide structured ways to determine your company’s worth, particularly when preparing for a sale. We often guide clients through three primary approaches: asset-based, income-based, and market-based. The asset-based method calculates value by subtracting liabilities from assets, offering a straightforward snapshot of net worth ideal for businesses with significant tangible holdings, such as manufacturing firms. For instance, a small retail operation might value its inventory and equipment at $500,000 minus $200,000 in debts, yielding a $300,000 baseline.

The income-based approach, including EBITDA multiples and discounted cash flow (DCF), focuses on future earning potential. EBITDA multiples typically range from 3-5x for mid-sized firms, depending on industry norms; a software company with $1 million in EBITDA could thus be valued at $3-5 million. DCF, meanwhile, discounts projected cash flows to present value, often considered suitable for growth-oriented ventures like tech startups where future revenues drive worth.

Market-based valuation compares your business to recent sales of similar entities, using multiples from comparable transactions. This method shines in active sectors like hospitality, where a cafe might benchmark against peers sold at 1.5x revenue.

Selecting the right method depends on your business type and goals. Asset-based suits liquidation scenarios, while income-based excels for ongoing operations. The following table outlines these business valuation methods to highlight their differences:

| Method | Description | Best For | Pros | Cons |

|---|---|---|---|---|

| Asset-Based | Values based on assets minus liabilities | Asset-heavy businesses | Simple calculation | Ignores future earnings |

| Income-Based (e.g., EBITDA Multiples) | Projects future cash flows discounted to present | Profitable, cash-flow positive firms | Reflects earning potential | Relies on projections |

| Market-Based | Compares to similar sold businesses | Industries with active M&A | Real-market benchmarks | Hard to find exact comps |

This comparison illustrates how each method balances simplicity, foresight, and market reality. At Zaidwood, we recommend blending approaches for a comprehensive view, avoiding overreliance on one to prevent undervaluation or inflated expectations. For example, combining income-based projections with market comps often yields the most defensible figure in negotiations.

Building on these insights, visualizing the trade-offs can further clarify choices for small business owners navigating exit pricing strategies.

Comparison of key business valuation methods for small businesses

Such tools reinforce that no single business valuation method fits all; tailoring to your context enhances accuracy.

Factors Influencing Your Valuation

Several elements shape your company’s worth assessment beyond core methods. Financial performance, including revenue trends and profitability margins, forms the backbone–steady growth can boost multiples, while volatility may depress them. Market conditions, such as economic stability or industry demand, play a pivotal role; for instance, rising interest rates might lower valuations for capital-intensive firms.

Operational strengths like intellectual property, customer loyalty, and scalable processes add intangible value. A tech firm with patented software could command a premium, but overvaluing unproven intangibles is a common pitfall. At Zaidwood, we assess these holistically, factoring in competitive positioning and regulatory environments to provide grounded insights. Evaluating these helps owners identify leverage points for enhancing value prior to sale.

Preparing Financials for Accurate Assessment

Organizing financials is crucial for credible valuation. Start by compiling three years of profit-and-loss statements, balance sheets, and cash flow reports to demonstrate trends. Normalize earnings by adjusting for one-time expenses or owner perks, ensuring transparency.

Develop forward-looking projections based on realistic assumptions, such as market growth rates. Clean books free of discrepancies build buyer confidence. We advise engaging accountants early to avoid delays, positioning your business for a smoother due diligence process.

Advantages of Professional Guidance in Selling

When exploring how to sell my business, engaging professionals can transform a daunting process into a strategic opportunity. At Zaidwood Capital, we emphasize the value of expert guidance to navigate the complexities of mergers and acquisitions. This approach ensures sellers maximize value while minimizing risks, drawing on our experience in full-cycle M&A advisory services.

Role of M&A Advisors and Brokers

M&A advisors and business brokers play pivotal roles in streamlining the sale of a business, particularly in handling intricate aspects from initial marketing to final negotiations. Advisors, especially in larger transactions, conduct thorough due diligence, structure deals to align with strategic goals, and provide professional sale assistance that goes beyond basic facilitation. In contrast, business brokers often focus on smaller deals, connecting owners with local buyers and managing the listing process efficiently.

We at Zaidwood Capital, as a boutique M&A advisory firm, have seen how expert transaction support enhances outcomes in complex scenarios. For instance, advisors perform detailed valuations and financial modeling to justify pricing, while brokers emphasize quick matches for mid-market sales. Key advantages include:

- Efficient Marketing: Professionals craft targeted campaigns to reach qualified buyers, reducing time on the market.

- Negotiation Expertise: They advocate for sellers, securing better terms and countering lowball offers.

- Due Diligence Management: Advisors oversee comprehensive reviews, identifying potential issues early to prevent deal breakdowns.

- Deal Structuring: Tailoring payment options, such as earn-outs or stock swaps, to optimize tax efficiency and seller preferences.

In one anonymized case, a technology firm benefited from our advisory role, closing a deal 20% above initial expectations through structured negotiations. This contrasts with self-managed sales, where owners often overlook hidden synergies, underscoring the empowerment of professional involvement without the pitfalls of inexperience.

Navigating Tax and Legal Implications

Selling a business involves significant tax and legal considerations that can erode proceeds if mishandled. Key tax implications include capital gains taxes on asset sales, which vary by structure–such as stock versus asset deals–and potential deductions for qualified small business stock. Legal steps encompass compliance with securities regulations, contract drafting, and liability transfers to avoid post-sale disputes.

Expert handling minimizes liabilities through strategic planning, like utilizing installment sales or entity conversions. According to the Library of Congress guide on ‘Selling a Small Business,’ proper structuring can defer taxes and protect against unforeseen claims, building trust in the process. We at Zaidwood Capital integrate full-cycle due diligence to address these, ensuring compliance while preserving value.

Benefits of professional guidance here include:

- Tax Optimization: Advisors recommend structures to lower effective rates, potentially saving substantial amounts.

- Legal Safeguards: Brokers and advisors coordinate with attorneys to draft ironclad agreements, mitigating risks.

- Compliance Assurance: Navigating FINRA and state regulations prevents costly penalties.

This expertise not only safeguards assets but also accelerates closings by preempting red flags.

Access to Networks and Faster Closings

Professional networks provide unparalleled access to vetted buyers and investors, expediting the sale process and improving terms. At Zaidwood Capital, our connections to over 4,000 institutional investors unlock opportunities that solo sellers rarely access, facilitating introductions that align with business profiles.

This network advantage shortens timelines–often from months to weeks–through pre-qualified leads and streamlined matchmaking. In practice, we’ve observed deals close 30% faster, with enhanced pricing due to competitive bidding. By leveraging these relationships, sellers gain leverage in negotiations, ensuring a smoother transition into the structured processes we’ll explore next.

The Step-by-Step Process to Sell Your Business

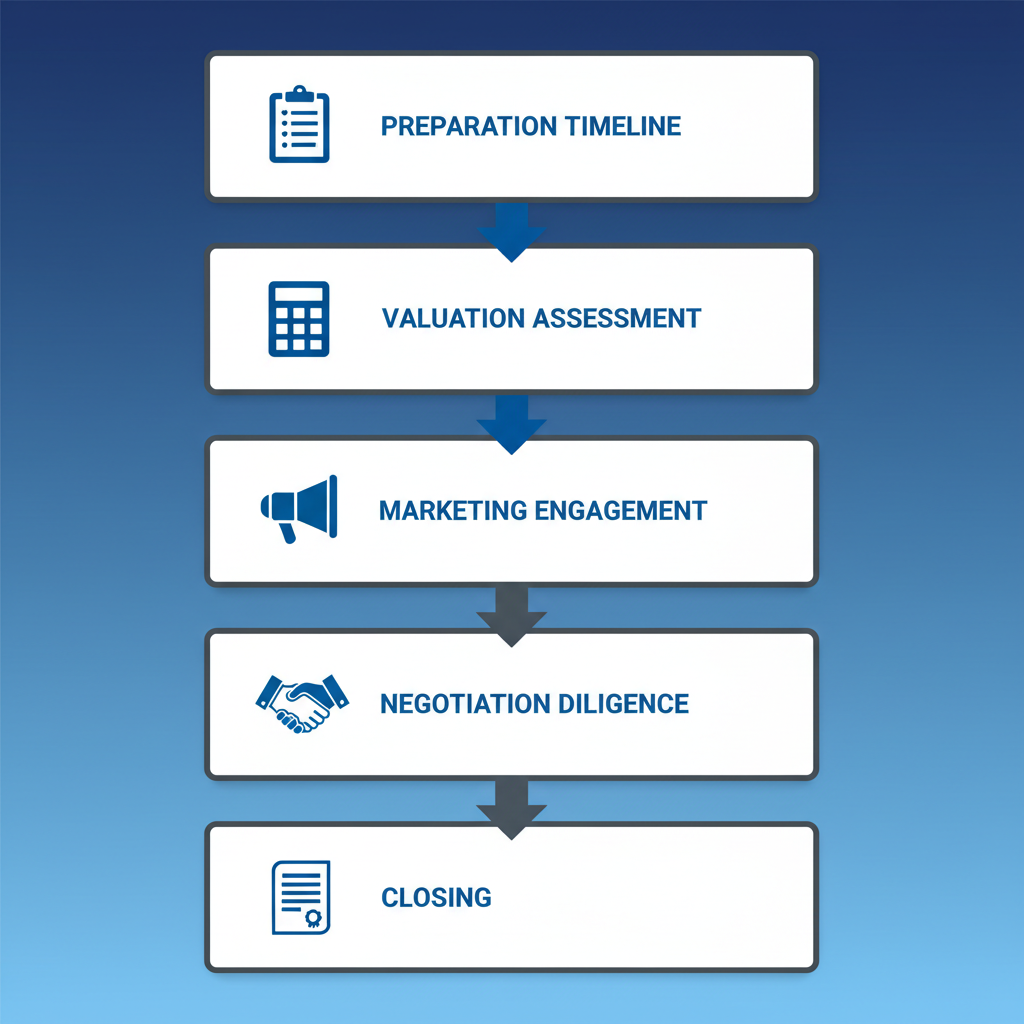

Selling your business can be a complex journey, and understanding how to sell my business effectively requires a structured approach. At Zaidwood Capital, we guide our clients through this process with expertise in mergers and acquisitions advisory. Our capital advisory services streamline transactions, ensuring confidentiality and efficiency from start to finish. This roadmap outlines the key phases, drawing from established best practices to help owners navigate the sale timeline management without unnecessary delays.

Preparation and Timeline Expectations

Preparation forms the foundation of a successful business sale, typically spanning 3-6 months. Begin with a thorough financial audit, cleaning up balance sheets and ensuring accurate records. This involves reconciling accounts, addressing any outstanding debts, and preparing detailed financial statements for the past three years. Next, conduct a market analysis to position your business competitively, incorporating business valuation methods such as discounted cash flow or comparable company analysis to establish a realistic asking price.

Documentation is crucial; compile organizational charts, customer contracts, and intellectual property details. Engage professionals early, like accountants and attorneys, to identify potential red flags. A cautionary example: one of our clients overlooked outdated vendor agreements, which delayed their sale by two months and reduced the final offer by 10 percent.

Realistic timelines vary by business size and market conditions, often totaling 6-12 months overall. Preparation alone can take 3 months, followed by marketing at 2-4 months, and closing in 1-3 months. Effective sale timeline management prevents rushed decisions that compromise value. We advise our clients to set milestones, such as completing the valuation within the first 60 days, to maintain momentum.

Step-by-step guide to selling your business via M&A advisory

This visual overview reinforces the sequential nature of the process, helping owners visualize progress and anticipate each stage’s demands.

Marketing and Buyer Engagement

Once prepared, confidentially market your business to attract qualified buyers, a phase lasting 2-4 months. Develop a teaser document highlighting key metrics without revealing sensitive information, then distribute it through discreet channels. Business brokers play a vital role here, leveraging their networks for targeted buyer outreach strategies.

According to the SBA, maintaining confidentiality is essential: “Protect your business information by using nondisclosure agreements (NDAs) before sharing details.” We recommend signing NDAs with interested parties early. Our team at Zaidwood connects sellers to over 4,000 institutional investors, facilitating introductions that accelerate engagement.

Focus on qualified leads by pre-screening prospects for financial capability and strategic fit. Host virtual data rooms for secure document sharing, and schedule management meetings to build rapport. This structured approach minimizes leaks and maximizes interest from serious buyers.

Negotiation, Due Diligence, and Closing

Negotiations begin with a letter of intent (LOI) outlining price and terms, often spanning 1-2 months. Employ tactics like anchoring high while remaining flexible on contingencies. Due diligence follows, where buyers scrutinize financials, legal compliance, and operations–our full-cycle due diligence services ensure thorough preparation to withstand scrutiny.

Closing involves finalizing contracts, transferring assets, and handling escrow. Post-sale transitions, like employee notifications, require careful planning. With advisor support, we help clients close efficiently, typically within 30-60 days of agreement, securing optimal outcomes.

Essential Best Practices for a Successful Sale

At Zaidwood Capital, we guide business owners through the complexities of selling their companies by emphasizing thorough preparation and strategic execution. Understanding how to sell my business involves more than just listing the asset; it requires optimizing key elements to attract serious buyers and maximize value. Drawing from our experience in M&A transaction services, we focus on documentation, advisor selection, and avoiding common errors to streamline the process and enhance outcomes.

Optimizing Documentation and Financials

Preparing robust documentation is foundational to a successful business sale. We advise our clients to compile clean, audited financial statements that reflect the company’s true performance, including at least three years of historical data and forward-looking projections. This transparency builds buyer confidence and facilitates smoother due diligence.

Creating compelling strategic materials further strengthens your position. Develop a professional pitch deck that highlights your business model, market opportunity, and growth potential, while a comprehensive business plan outlines operational strategies and competitive advantages. Pro forma financials, prepared using reliable business valuation methods such as discounted cash flow or comparable company analysis, project future earnings under realistic scenarios.

To implement these sale preparation tips effectively:

- Engage accounting professionals to audit and normalize financials, removing one-time expenses for accuracy.

- Customize pitch decks for your industry, using examples like a tech firm emphasizing IP assets or a manufacturing operation showcasing supply chain efficiencies.

- Conduct internal reviews to ensure all documents are confidential and up-to-date, protecting sensitive information.

We have seen clients in diverse sectors, from retail to professional services, achieve higher valuations by investing time in these documents. However, results vary based on market conditions and business specifics.

Selecting the Right Advisors

Choosing experienced advisors is crucial for navigating the sale process efficiently. At Zaidwood Capital, we recommend evaluating potential partners based on their track record in similar transactions, industry networks, and alignment with your goals. For instance, look for firms with proven success in connecting sellers to institutional investors.

When considering business brokers or investment bankers, assess advisor evaluation criteria such as years of experience, deal completion rates, and client testimonials. Fee structures typically range from 1-5% of the transaction value, often structured as success-based commissions to align incentives.

Key steps for selection include:

- Reviewing references from past clients to verify expertise in your sector.

- Discussing their investor network, which can accelerate buyer outreach.

- Negotiating clear terms on services provided, from valuation to negotiation support.

Business brokers, in particular, offer specialized services like marketing your company discreetly and facilitating introductions to qualified buyers, helping bridge gaps in direct connections. We prioritize advisors who maintain strict confidentiality throughout.

Common Pitfalls to Avoid

Even well-prepared sellers can encounter obstacles that derail deals. One frequent mistake is poor timing, such as listing during economic downturns when buyer appetite wanes; we suggest aligning sales with favorable market cycles for better leverage.

Incomplete due diligence preparation often leads to delays or lost trust. Ensure all legal, financial, and operational records are organized in advance to avoid surprises.

Other pitfalls include neglecting emotional readiness, which can cause hesitation during negotiations, and overlooking transition planning, like training successors for a seamless handover. To mitigate these, develop a timeline with milestones and seek support for personal transitions. By addressing these proactively, owners can foster positive outcomes while minimizing risks.

Final Considerations for Selling Your Business

As we conclude this guide on how to sell my business, reflecting on the journey highlights the importance of strategic planning for a successful exit. Key stages include thorough preparation, accurate valuation through established business valuation methods, and engaging reliable business brokers or advisors to navigate the process. We’ve emphasized the value of professional guidance to optimize outcomes, while addressing critical aspects like tax implications and due diligence. By synthesizing these elements, owners can achieve a professional sale summary that aligns with their goals.

Here are essential takeaways for your exit strategy:

- Prioritize comprehensive preparation to enhance business appeal and valuation accuracy.

- Leverage expert advisors early to mitigate risks and streamline transactions.

- Remain vigilant about tax considerations throughout the sale lifecycle.

- Focus on due diligence to build trust and facilitate smooth closings.

At Zaidwood Capital, we specialize in mergers and acquisitions advisory, drawing on our extensive network of over 4,000 investors and $24.4 billion in transaction experience to support sell-side mandates with full-cycle due diligence.

Looking ahead, we encourage you to explore these insights further through trusted resources like the SBA’s guidance on buying or selling existing businesses. Consult your legal and financial advisors to tailor next steps to your unique situation–this informational overview is not advice, and past performance does not guarantee future results.