Investment Bank For Series A

Table of Contents

Navigating Series A Funding with Investment Bank Expertise

Securing Series A Funding represents a pivotal milestone for startups transitioning from seed stage to scalable operations. As an investment bank for Series A rounds, we at Zaidwood Capital recognize the excitement and hurdles involved, such as crafting compelling pitches for institutional investors. According to the SBA, many early-stage companies require $2-15 million to fuel growth, yet only a fraction succeed without expert guidance.

This first significant institutional investment post-seed demands navigating complex challenges like valuation negotiations and rigorous due diligence. Investment banks play a crucial role by facilitating introductions to venture capital networks and providing strategic advisory to optimize terms. Our series A fundraising advisors and venture capital placement agents streamline these processes, acting as early-stage investor connectors to bridge startups with qualified backers. For instance, tech firms scaling post-MVP often rely on such Series A capital raising specialists to validate their business models under SEC-compliant private fundraising structures.

In this comprehensive guide, we cover the fundamentals of Series A processes, deep dives into our advisory services, practical steps for engagement, advanced considerations for deal structuring, and answers to common FAQs. These insights empower entrepreneurs to make informed decisions.

At Zaidwood Capital, our team has orchestrated over 300 early-stage deals with $24.4 billion in aggregate transaction volume. We connect clients to more than 4,000 investors and $15 billion in deployable capital, ensuring tailored support for sustainable growth. Before exploring deeper, understanding these basics sets a strong foundation.

Core Principles of Series A Capital Raising

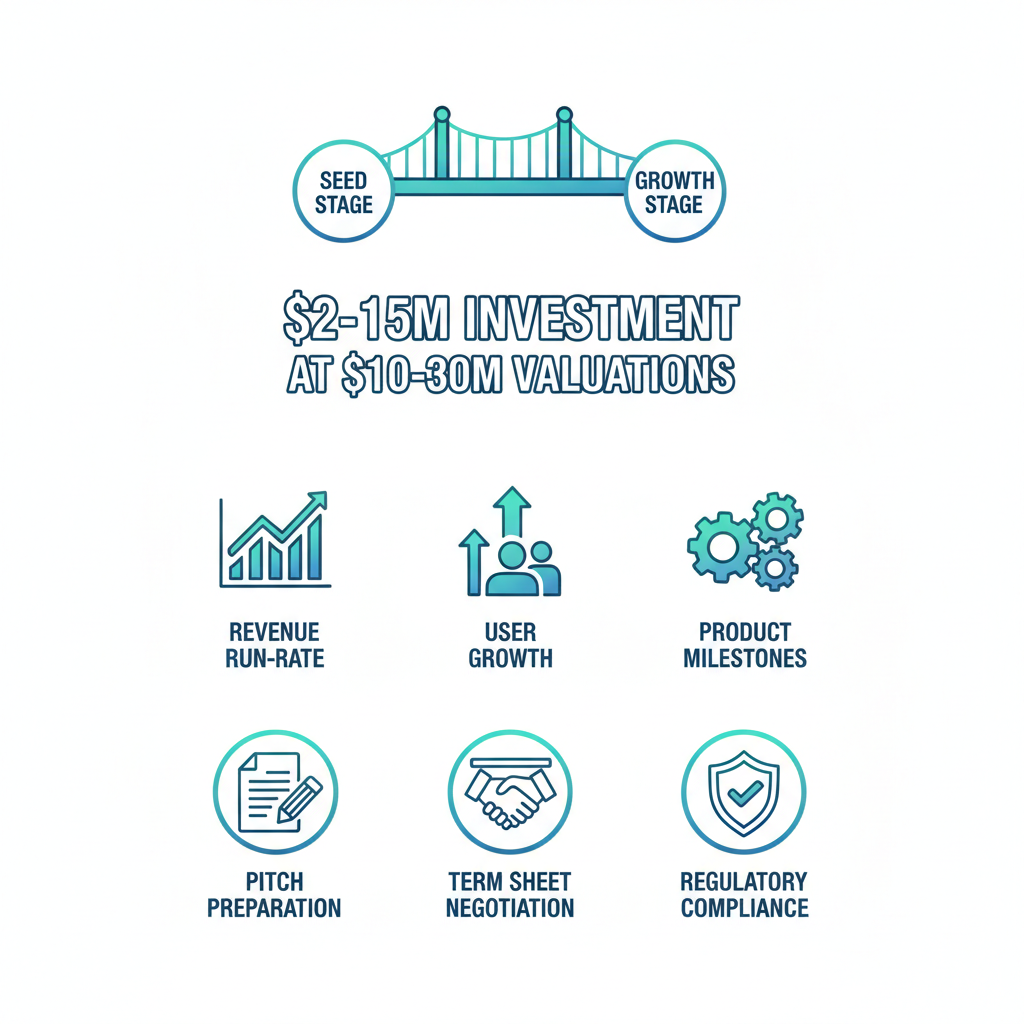

Series A funding represents a critical bridge between seed-stage experimentation and scalable growth for startups. Typically ranging from $2 million to $15 million at valuations of $10 million to $30 million, this round attracts institutional investors seeking proven potential. Investment structures often include preferred equity, convertible notes, or SAFE agreements, balancing founder control with investor protections. At Zaidwood Capital, we observe that successful Series A rounds hinge on demonstrating product-market fit and a clear path to revenue generation, drawing from our experience in facilitating over 300 deals totaling $24.4 billion in aggregate volume.

Key milestones for Series A readiness focus on traction and scalability. Startups must showcase metrics that signal sustainability, such as:

- A monthly recurring revenue run-rate exceeding $100,000, indicating predictable cash flows.

- User growth rates of at least 20% month-over-month, validating market demand.

- A minimum viable product with engaged early adopters, often evidenced by retention rates above 40%.

These benchmarks, informed by SEC guidance on early-stage investors, align with venture capital preferences where VC funds invested around $215 billion in 2024, prioritizing data-backed narratives over speculative ideas.

Handling Series A independently presents common pitfalls, including fragmented investor outreach and undervaluation due to inexperience. Founders often struggle with cold emailing, leading to low response rates and prolonged timelines that dilute focus on core operations.

| Aspect | With Investment Bank | Self-Funded Approach |

|---|---|---|

| Investor Access | Structured introductions to 4,000+ networks | Cold outreach and limited connections |

| Time to Close | Accelerated by 30-50% via expertise | Prolonged, often 9-18 months |

| Valuation Support | Professional modeling and negotiation | Self-negotiation, risk of undervaluation |

Investment banks mitigate these risks by leveraging established relationships and streamlined processes. In our full-cycle capital advisory, we reduce timeline uncertainties and enhance valuation outcomes, as seen in anonymized deals where structured introductions closed rounds 40% faster than solo efforts.

The advisory role of an Series A Investment Bank is pivotal in pitch preparation and term sheet negotiations. Boutique firms offer agility, providing tailored guidance as series A fundraising advisors to refine business models and craft compelling narratives. We integrate early-stage funding consultants to support due diligence, ensuring compliance and investor confidence. As venture capital placement agents, banks connect founders to targeted investors, acting as Series A investor matchmakers to align interests efficiently.

Regulatory basics under Rule 506(b) of Regulation D allow exemptions for private placements to accredited investors, emphasizing clear disclosures to avoid general solicitation. FINRA Notice 17-14 highlights compliance in capital formation, urging broker-dealers to prioritize transparency in private offerings. Startups must file Form D post-sale and adhere to anti-fraud provisions, with SEC resources stressing eligibility verification for angels and VCs. Our equity advisory services include navigating these requirements, supporting seamless transitions to growth phases.

Core principles of Series A capital raising illustrated

This foundation sets the stage for deeper exploration of tailored strategies in subsequent sections.

Exploring Investment Bank Services for Series A

Investment banks play a pivotal role in guiding startups through Series A funding rounds, where securing growth capital becomes essential. An investment bank for Series A offers specialized services that bridge the gap between innovative companies and venture capital sources. We at Zaidwood Capital focus on these tailored solutions, leveraging our extensive network to streamline the process for early-stage ventures seeking to scale.

Pitch Development and Investor Matching

Series A fundraising advisors help startups refine their pitch materials to resonate with potential investors. This begins with crafting compelling pitch decks that incorporate pro forma financials, market analysis, and growth projections. We emphasize clear storytelling to highlight a company’s unique value proposition, ensuring the narrative aligns with investor expectations for scalability and returns.

Venture capital placement agents within our team facilitate direct connections to suitable limited partners and funds. By leveraging proprietary tools like our Velocity Matrix, we match startups with venture capitalists who align with their sector and stage. This network-driven approach, accessing over 4,000 institutional investors and $15 billion in deployable capital, accelerates introductions and boosts deal momentum.

Startups often require customized pitches to stand out in competitive landscapes. Boutique firms excel here due to their agile focus on early-stage needs, unlike larger institutions that handle broader mandates.

| Service Area | Boutique Bank | Full-Service Bank |

|---|---|---|

| Personalization | Tailored for startups, agile execution | Standardized processes, less flexibility |

| Network Size | Targeted VC access (4,000+) | Broad but less specialized connections |

| Cost Efficiency | Lower retainers for Series A | Higher fees due to overhead |

Boutique banks provide deeper personalization, enabling faster iterations on pitches and more precise investor targeting. Our Velocity Matrix, for instance, analyzes deal parameters to prioritize high-fit matches, reducing time to funding while minimizing misaligned outreach. This targeted strategy often yields higher engagement rates compared to generalized networks of full-service providers.

Due Diligence and Term Sheet Guidance

Full-cycle due diligence support is crucial for Series A startups facing investor scrutiny. We guide clients through financial, legal, and operational reviews, preparing robust documentation to address potential red flags early. Drawing from SEC guidelines on private fund formation, we ensure compliance with Regulation D exemptions, such as Rule 506(b) for accredited investor offerings, which helps validate fund structures and investor commitments.

The process unfolds in structured phases:

- Financial Audit: Verify revenue models, burn rates, and pro forma projections using audited statements to demonstrate fiscal health.

- Legal Review: Examine intellectual property, contracts, and cap tables to mitigate risks, often involving SEC-compliant disclosures.

- Operational Assessment: Evaluate team capabilities and market positioning, incorporating insights from early-stage investor dynamics like those outlined in SEC resources on angel and VC involvement.

- Commercial Validation: Analyze competitive landscapes and go-to-market strategies to build investor confidence.

As startup funding intermediaries, we also assist in negotiating term sheets, focusing on valuation, liquidation preferences, and governance rights. Venture capital placement agents play a key role here, providing market benchmarks from our $24.4 billion transaction history. This comprehensive preparation not only withstands due diligence but positions clients favorably for closing, with FINRA Rule 5110 underscoring fair underwriting practices that we adhere to for transparent dealings.

Series A deal facilitators like us integrate equity advisory to optimize structures, ensuring terms align with long-term growth. By anticipating investor queries–such as those on withdrawal rights or performance fees from private fund setups–we empower startups to negotiate from strength, ultimately securing favorable outcomes in a landscape where VC investments reached $215 billion in 2024.

Fee Structures in Series A Advisory

Understanding fee structures is vital for startups engaging an investment bank for Series A. Boutique advisors typically charge retainers of $50,000 to $150,000, covering initial pitch development and due diligence preparation. Success fees range from 3% to 5% of funds raised, incentivizing efficient capital deployment while aligning interests.

Equity components are rare in pure advisory but may appear in integrated services, often under 1% for high-value introductions. These fees reflect the value of accessing specialized networks and expertise, far outweighing costs through accelerated funding timelines. As a boutique ma advisory firm, we structure fees transparently, compliant with FINRA standards on corporate financing to ensure fairness and regulatory adherence.

| Fee Type | Typical Range | Value Added |

|---|---|---|

| Retainer | $50K-$150K | Covers pitch refinement and initial outreach |

| Success Fee | 3%-5% of raise | Motivates closing deals, tied to performance |

| Equity (if any) | <1% stake | Enhances long-term alignment in select cases |

These structures provide substantial ROI, as our capital introductions to $15 billion networks often secure raises exceeding advisory costs by multiples. For instance, the retainer funds comprehensive due diligence that prevents costly delays, while success fees ensure focused execution. Boutique models like ours deliver this efficiency without the overhead of full-service banks, making Series A advisory accessible and impactful for emerging companies.

Applying Investment Bank Advisory in Series A Processes

We understand the challenges US startups face when navigating Series A funding, where the right guidance can make all the difference. This section provides actionable insights into selecting advisors, following a structured timeline, and drawing lessons from real deals to help you secure capital efficiently.

Selecting and Engaging Your Series A Advisor

Choosing the right investment bank for Series A requires careful evaluation to ensure alignment with your startup’s goals in the US market. As series A fundraising advisors, we emphasize factors like proven track record in early-stage deals, extensive investor networks, and fee structures that align with success-based outcomes rather than upfront costs. Startups should prioritize advisors who offer compliance with regulatory standards, as outlined in FINRA Notice 17-14, which highlights rules for broker-dealer activities in capital raising to protect all parties involved.

Key criteria for selection include:

- Track Record: Look for firms with a history of closing Series A rounds, ideally in your industry sector.

- Network Size: Advisors with broad connections to venture capital firms and institutional investors accelerate introductions.

- Fee Alignment: Success fees tied to funding milestones ensure shared incentives without straining limited resources.

| Criteria | Boutique Advisors | Placement Agents Only |

|---|---|---|

| Network Depth | 4,000+ institutional connections | Limited to specific VC contacts |

| Full-Service Scope | M&A + capital + due diligence | Introductions and placement only |

| US Market Expertise | Tailored for early-stage firms | General fundraising support |

Boutique advisors provide comprehensive support, integrating capital advisory services like ours at Zaidwood Capital, which connect startups to over 4,000 investors and $15 billion in deployable capital. This full-cycle approach, informed by SBA funding guides, ensures thorough preparation and regulatory adherence from the outset. In contrast, placement agents focus narrowly on connections, potentially leaving gaps in strategy and diligence. We fit seamlessly by offering tailored US expertise, helping startups avoid common pitfalls and position for stronger terms. Engaging early, around 12-18 months pre-funding, allows time for alignment and planning.

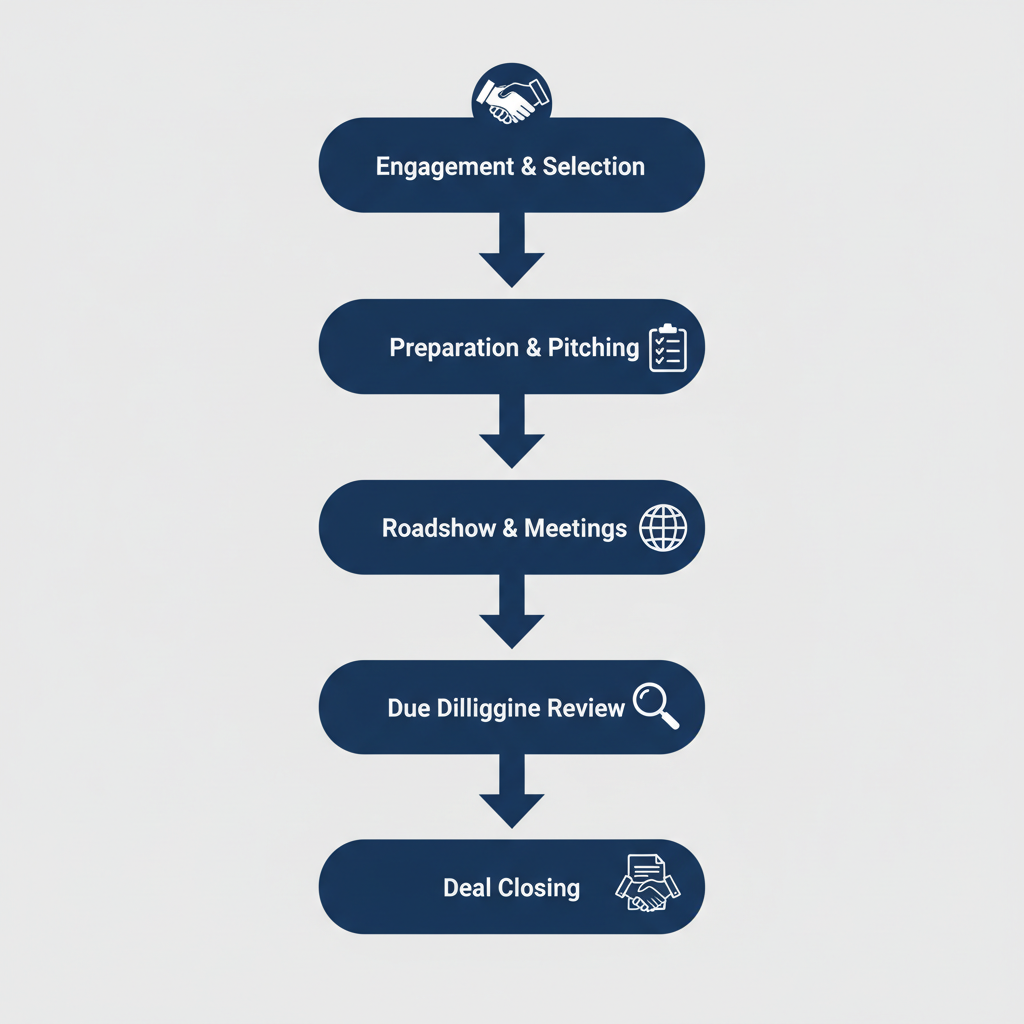

Step-by-Step Funding Timeline with Bank Support

A structured timeline streamlines Series A processes, typically spanning 6-9 months from engagement to close, as recommended by SBA resources on venture capital stages. Venture capital placement agents and banks play pivotal roles in compressing this period through targeted support. We break it down into key phases, where our involvement accelerates outcomes.

- Engagement Phase (1-2 Months): Initial assessment of your business model, financials, and pitch materials. Advisors refine strategy, ensuring compliance with FINRA guidelines for capital formation.

- Pitch and Roadshow Phase (3-6 Months): Investor outreach begins, with banks facilitating meetings and providing data room setup. This is where networks shine, introducing you to qualified leads.

- Due Diligence Phase (1-2 Months): Respond to investor queries with guided support on legal, financial, and operational reviews, mitigating risks highlighted in SBA due diligence best practices.

- Closing Phase (1 Month): Negotiate terms, finalize documentation, and execute the round, with advisors ensuring smooth wire transfers and post-close integration.

| Phase | Bank Role | Duration |

|---|---|---|

| Engagement | Strategy refinement and compliance check | 1-2 months |

| Pitch and Roadshow | Investor introductions and pitch optimization | 3-6 months |

| Due Diligence | Document support and risk mitigation | 1-2 months |

| Closing | Term negotiation and execution assistance | 1 month |

This framework, drawn from our experience and SBA timelines, reduces overall duration by up to 20% through proactive bank involvement. For instance, our investor outreach specialists handle introductions efficiently, allowing founders to focus on operations. Following this path addresses when to hire an investment bank for Series A–ideally at the seed-to-Series A transition–to build momentum and secure favorable valuations.

Understanding this timeline underscores the value of integrated support in navigating complexities. Banks not only connect but also advise on term sheets, ensuring startups in the US emerge stronger. As we transition to more advanced considerations, these steps form a solid foundation.

Step-by-step Series A funding process with Zaidwood Capital bank advisory support.

Real-World Case Insights from Deal Execution

In our deals, we’ve seen how funding strategy partners transform Series A outcomes for US tech startups. One anonymized example involves a SaaS company raising $10 million; our introductions to aligned venture funds, backed by full due diligence, closed the round in seven months, exceeding expectations without diluting control excessively.

Another case featured a biotech firm leveraging our investor outreach specialists to secure $8 million from family offices and VCs. Integrated services streamlined documentation, adhering to FINRA standards, and highlighted benefits like accelerated timelines and better terms–key advantages of comprehensive advisory over siloed placement.

These insights demonstrate how series A fundraising advisors enhance success rates, fostering long-term growth while addressing common hurdles like investor skepticism.

Advanced Strategies in Series A with Boutique Expertise

As Series A rounds grow more intricate, startups require nuanced tactics beyond standard equity raises. We at Zaidwood Capital specialize in elevating these efforts through sophisticated advisory, blending hybrid structures, global outreach, and seamless post-raise planning. This approach addresses the complexities faced by US-based tech firms seeking scalable growth, drawing on regulatory insights to ensure compliance and efficiency.

Hybrid financing emerges as a powerful tool for optimizing capital structures in Series A. By layering venture debt atop initial equity infusions, companies can extend runway without excessive dilution. As series A fundraising advisors, we guide clients through these arrangements, leveraging SEC guidelines on private funds to structure exempt offerings under Regulation D Rule 506(b). For instance, a SaaS startup might secure $5 million in equity followed by $2 million in convertible debt, mitigating valuation pressures amid market volatility. This strategy not only preserves founder equity but also aligns with FINRA structuring rules for balanced risk distribution, enabling faster scaling while maintaining investor confidence.

Expanding beyond domestic markets demands strategic international investor outreach. US startups often benefit from global capital bridge-builders who tap networks in Europe and Asia for diversified funding. Venture capital placement agents play a role here, but their scope can limit depth in integrated planning. For advanced needs in complex raises, boutique firms provide comprehensive support, from due diligence to documentation, addressing challenges like currency risks and cross-border regulations.

| Strategy | Placement Agents | Boutique Investment Bank |

|---|---|---|

| Investor Targeting | Basic connections | Global network access ($15B+ deployable capital) |

| Integrated Due Diligence | Limited review | Full-cycle support (financial, legal, operational) |

| Strategic Documentation | Basic materials | Pitch decks + pro formas with proprietary tools |

Placement agents offer targeted introductions, yet boutique investment banks like ours deliver end-to-end value, streamlining transactions through our Velocity Matrix for accelerated execution. At Zaidwood, we integrate these elements with access to over 4,000 institutional investors, ensuring tailored solutions that outperform fragmented approaches and foster long-term growth.

Post-raise integration solidifies Series A success, focusing on M&A preparation and valuation refinement. We assist with mergers acquisitions advisory to position companies for strategic exits or synergies, utilizing our proprietary Deal Vault for secure data management. Advanced valuations present hurdles, such as projecting post-funding metrics under evolving market conditions, but our expertise navigates these per FINRA Rule 5110 guidelines. By preparing robust pro formas and conducting full-cycle due diligence, we equip clients for subsequent rounds or acquisitions, transforming capital into sustained competitive advantage.

Common Questions on Series A Investment Banking

What role does an investment bank for Series A play in fundraising?

At Zaidwood Capital, we structure deals and make key introductions to investors, helping startups navigate complex terms and secure optimal funding. This guidance ensures alignment with growth objectives.

How do boutique firms assist with Series A rounds?

Boutique investment banks offer agile support and extensive networks, providing personalized strategies as early funding guides for emerging companies. Their focused expertise accelerates the process.

What are the costs of hiring series A fundraising advisors?

Fees typically include retainers starting at $50,000 plus success-based commissions around 2-5% of funds raised, per SBA funding guidelines. These structures balance commitment and results.

How to choose specialists for Series A advisory?

Select firms with proven startup track records, like those experienced in venture capital. Look for teams offering comprehensive services beyond equity, including debt advisory services for hybrid needs.

When is the best time to hire for Series A?

Engage advisors post-seed funding after demonstrating traction, such as revenue milestones. This timing, aligned with SBA recommendations, maximizes investor appeal and valuation.

What differentiates series A fundraising advisors from venture capital placement agents?

Advisors provide full strategic support, while VC connectors focus on introductions. Both aid early-stage funding, but advisors offer broader deal structuring for American startups.

Leveraging Expertise for Series A Success

As startups prepare for Series A, recognizing readiness signals ensures alignment with an investment bank for Series A that matches their vision. Our guidance on selecting series A fundraising advisors and venture capital placement agents emphasizes tailored support from boutique firms like Zaidwood Capital. These capital growth partners provide compliant practices, as outlined in FINRA Notice 17-14, prioritizing ethical placement while accessing extensive networks.

The benefits of full-cycle advisory include seamless network connections to over 4,000 investors and strategic documentation for efficient fundraising. We deliver precision in mergers and acquisitions, streamlining transactions for sustainable growth.

Explore our advisory services today to propel your Series A success forward.