Investment Banking Services

Table of Contents

Exploring Investment Banking Services

In today’s dynamic financial landscape, Investment Banking Services play a pivotal role in enabling businesses to navigate complex transactions for growth and restructuring. At Zaidwood Capital LLC, we specialize in Investment Banking as a boutique firm, offering tailored mergers and acquisitions advisory for both buy-side and sell-side mandates. Our expertise ensures clients achieve strategic objectives through meticulous due diligence and seamless execution.

We facilitate capital raising services via equity and debt instruments, connecting companies to over 4,000 institutional investors with access to more than $15 billion in deployable capital. Our track record boasts an aggregate transaction volume exceeding $24.4 billion across 300 completed deals. We prioritize transparency, responsiveness, and tailored execution for clients globally. As highlighted in FINRA Notice 25-06, modernizing regulations supports efficient capital formation while upholding investor protections, aligning with our compliance-focused approach. Similarly, SEC insights underscore how enhanced access to capital drives small business innovation and job creation, validating the need for expert financial transaction advisory.

This guide explores the understanding, benefits, processes, and best practices of these funding facilitation strategies. To grasp these services fully, let’s examine their core components next.

Core Components of Investment Banking

At Zaidwood Capital LLC, we specialize in What Is An Investment Bank, delivering tailored investment banking services that form the backbone of corporate financial strategies. These core components encompass mergers and acquisitions advisory, capital raising services, and debt and equity advisory, enabling businesses to achieve strategic growth and stability. Our expertise ensures clients receive guidance through complex transactions, leveraging our network to connect with institutional investors and deployable capital resources exceeding $15 billion.

Mergers and Acquisitions Advisory Essentials

Mergers and acquisitions advisory serves as a cornerstone of investment banking, providing strategic counsel to facilitate corporate transactions. This service involves guiding companies through the complexities of buying, selling, or merging entities to enhance market position and value creation.

Key elements include buy-side mandates, where we assist in identifying potential targets, conducting valuations, and negotiating terms to secure optimal acquisitions. Sell-side processes focus on preparing businesses for sale, including financial modeling and due diligence to attract buyers. Regulatory compliance, as outlined in FINRA’s key topics on mergers and acquisitions, underscores the importance of thorough reviews in areas like governance and customer account transfers to mitigate operational risks.

- Target Identification: We scout viable opportunities aligned with client objectives.

- Valuation and Negotiation: Rigorous assessments ensure fair pricing and successful deals.

- Due Diligence Integration: Full-cycle support verifies financial and operational integrity.

At Zaidwood Capital, we guide clients through these essentials with precision, drawing on our $24.4 billion in aggregate transaction volume to deliver seamless transaction advisory frameworks. Our team, led by experienced professionals, ensures compliance and efficiency in every mandate.

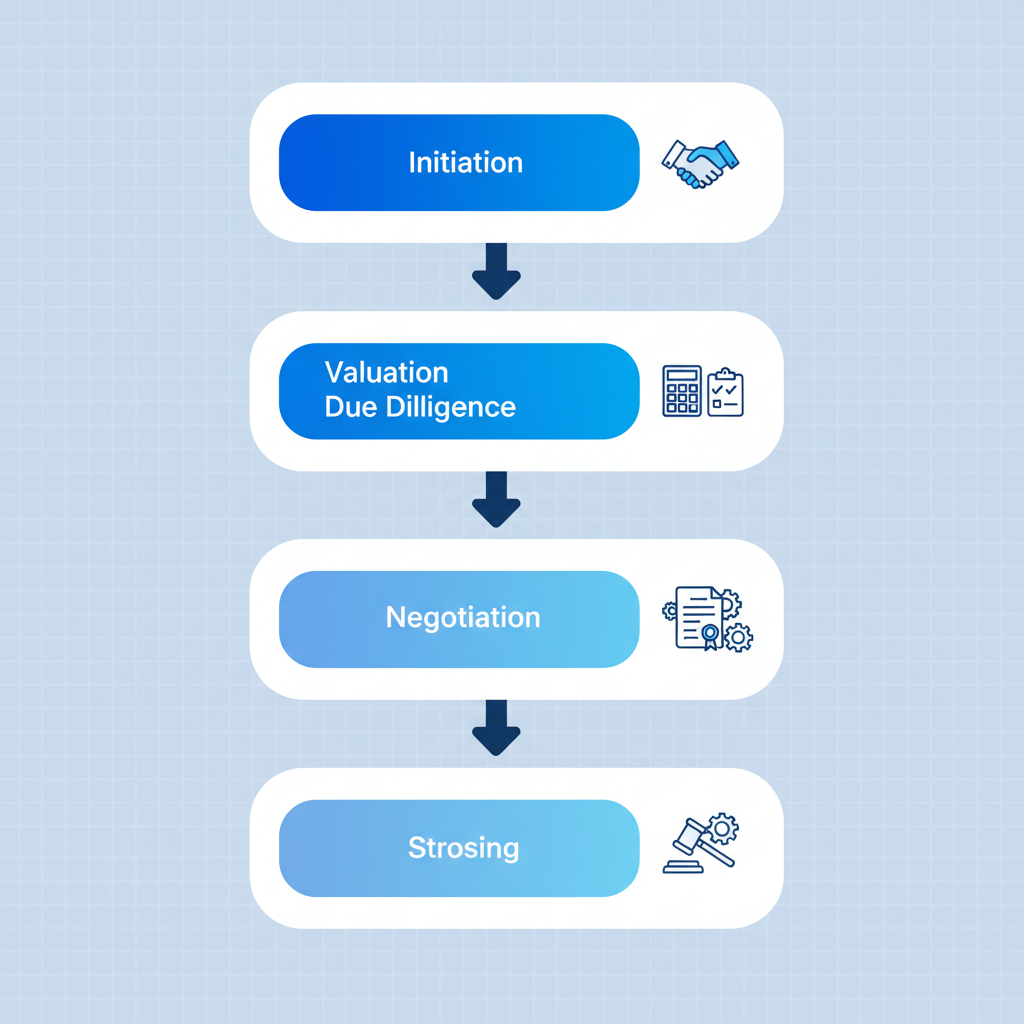

Visual overview of essential investment banking services

This infographic highlights how M&A advisory integrates with broader services, providing a clear visual map for understanding interconnected strategies. Building on these visuals, we transition to funding mechanisms that complement transactional support.

Capital Formation and Raising Strategies

Capital raising services are vital for businesses seeking to fund expansion, innovation, or restructuring through structured financing solutions. These strategies bridge companies with investors, optimizing equity and debt instruments for sustainable growth.

Core aspects involve equity placements, where we facilitate connections to venture capital or private equity for ownership-based funding, and debt structuring options like mezzanine financing that blend debt and equity features. Venture debt provides non-dilutive capital for high-growth firms, supported by advisory on terms and covenants. Due diligence plays a pivotal role, ensuring investor confidence through comprehensive financial and market analysis.

- Equity Placements: Matching clients with aligned investors for growth capital.

- Debt Structuring: Tailoring mezzanine and venture debt to balance risk and reward.

- Investor Matching: Leveraging our network of over 4,000 institutions for efficient placements.

We at Zaidwood Capital apply these strategies to empower clients, integrating capital raising services with our full-cycle advisory to accelerate funding timelines and enhance execution velocity.

Debt and Equity Advisory Overviews

Debt and equity advisory offers specialized guidance on financing structures, helping firms navigate options for optimal capital deployment. This dual approach addresses immediate liquidity needs while supporting long-term objectives in a boutique setting.

Debt advisory encompasses processes like asset-based lending, utilizing collateral for secured loans, and cash-flow financing based on revenue projections for operational funding. Equity solutions focus on growth capital infusions, providing flexibility without excessive leverage. Transaction advisory frameworks ensure these mechanisms align with overall corporate goals, with due diligence validating asset quality and repayment capacity.

- Asset-Based Lending: Securing funds against tangible assets for stability.

- Cash-Flow Financing: Enabling scalability through predictable revenue streams.

- Growth Equity Solutions: Injecting capital for expansion while preserving control.

Our boutique advantages at Zaidwood Capital shine in customizing these funding advisory mechanisms, offering personalized structuring that draws on proprietary insights and our extensive investor rolodex for superior outcomes.

Having outlined these components, let’s explore the tangible advantages they offer businesses next.

Advantages of Professional Investment Banking Services

Engaging professional zaidwood capital advisory services provides significant value for businesses navigating complex financial landscapes. Investment Banking Services offer expertise that drives efficiency and strategic growth, particularly in high-stakes areas like mergers and acquisitions advisory and capital raising services. Our clients benefit from tailored strategies that align with their unique goals, reducing operational burdens while maximizing outcomes.

Strategic Benefits in M&A Transactions

Mergers and acquisitions advisory delivers strategic advantages by leveraging specialized knowledge to streamline complex deals. This includes precise valuation assessments and negotiation support that enhance transaction success rates.

At Zaidwood Capital, our team applies full-cycle M&A and capital advisory expertise across buy-side and sell-side mandates. With over 300 completed deals and an aggregate transaction volume exceeding $24.4 billion, we provide our clients with enhanced valuation accuracy through proprietary data access. This enables stronger negotiation leverage, often resulting in faster closings and more favorable terms. For instance, in sell-side engagements, our network facilitates targeted buyer outreach, minimizing time to market while preserving deal integrity.

The broader impact of these strategic benefits lies in sustainable growth acceleration. Businesses gain deal optimization benefits that not only secure immediate value but also position them for long-term market leadership. By addressing relevant questions like the advantages of hiring an M&A advisor for sell-side deals, firms can confidently pursue expansion without internal resource strain.

Capital Raising Efficiency Gains

Capital raising services improve funding processes by expanding access to diverse investor pools and refining deal structures. This leads to quicker capital deployment and more competitive terms, essential for scaling operations.

Our approach at Zaidwood Capital connects clients to a network of more than 4,000 institutional and private investors, unlocking access to over $15 billion in deployable capital. We specialize in equity advisory for growth equity and liquidity solutions, as well as debt advisory including mezzanine and venture debt structures. This integrated service has enabled efficient funding acceleration advantages for companies generating at least $1 million in revenue, often achieving optimized terms that reduce costs and accelerate timelines compared to traditional channels.

On a wider scale, these efficiency gains empower businesses to focus on core competencies rather than fundraising logistics. Boutique investment banking services like ours offer personalized attention that large institutions often overlook, directly addressing why clients choose us for equity raising. Ultimately, this translates to enhanced financial flexibility and reduced equity dilution.

Risk Mitigation Through Due Diligence

Integrated due diligence in investment banking services identifies potential pitfalls early, safeguarding transactions from unforeseen liabilities. This proactive process covers financial, legal, operational, and commercial aspects to ensure robust deal foundations.

Zaidwood Capital’s full-cycle due diligence capabilities provide comprehensive risk assessment tailored to each engagement. Drawing from our extensive experience in over 300 deals, we conduct thorough reviews that uncover hidden issues, such as compliance gaps or valuation discrepancies. For example, in M&A transactions, our team employs structured methodologies to mitigate risks, ensuring seamless execution while maintaining regulatory adherence.

To bolster these efforts, we align with best practices from resources like FINRA’s MAP Tools for Mergers & Acquisitions, which offer guidance on due diligence protocols and compliance in M&A activities. This authoritative framework helps our clients navigate regulatory complexities effectively.

The overarching effect is fortified transaction security and preserved value. By emphasizing risk mitigation, businesses avoid costly post-deal surprises, fostering trust among stakeholders. These benefits underscore the precision catalyst of professional advisory in today’s dynamic markets.

These benefits are realized through structured processes, which we’ll examine next.

The Investment Banking Process Unveiled

At Zaidwood Capital LLC, our zaidwood capital financial advisory delivers comprehensive Investment Banking Services designed to guide clients through complex transaction lifecycles. We facilitate mergers and acquisitions advisory, capital raising services, and debt advisory with precision, ensuring regulatory compliance as outlined in FINRA Notice 25-06 for modernizing capital formation processes. This full-cycle approach streamlines transactions from initiation to closing, leveraging our network of over 4,000 institutional investors to optimize outcomes.

Step-by-Step M&A Advisory Workflow

We provide structured mergers and acquisitions advisory to support seamless business transactions. Our process begins with initiation, where we assess client objectives and identify potential targets or buyers, typically spanning 2-4 weeks.

- Target Sourcing: We leverage proprietary databases and industry connections to curate a tailored list of acquisition candidates or divestiture opportunities.

- Valuation and Preliminary Analysis: Conducting detailed financial modeling, we deliver valuation reports to establish fair market value, integrating due diligence previews for risk assessment.

- LOI Negotiation: Drafting and negotiating letters of intent, we align terms on price, structure, and contingencies, drawing on FINRA Notice 25-06 insights for regulatory alignment in due diligence integration.

- Comprehensive Due Diligence: Coordinating full-cycle reviews–financial, legal, operational–we uncover synergies and mitigate risks over 6-8 weeks.

- Closing: Finalizing documentation and obtaining fairness opinions, we oversee regulatory filings to complete the transaction efficiently.

This workflow ensures clients navigate M&A complexities with confidence, achieving strategic growth while adhering to compliance standards. Integration of equity advisory parallels enhances overall transaction execution.

Step-by-step visualization of the investment banking process from initiation to closing

The diagram above illustrates how these stages connect, providing a visual roadmap that underscores our commitment to efficient deal flow. By embedding strategic documentation from the outset, we minimize delays and maximize value realization.

Capital Formation Execution Phases

Our capital raising services empower businesses to secure funding through a methodical pipeline. We emphasize preparation and investor engagement, compliant with FINRA Notice 16-37 guidelines for capital acquisition brokers.

- Preparation and Pitch Deck Creation: We craft compelling pitch decks and business plans, incorporating pro forma financials tailored to client narratives, taking 3-5 weeks.

- Investor Outreach: Utilizing our 4,000+ global investor network, we identify and qualify prospects, initiating targeted communications to build interest.

- Roadshow and Presentations: Organizing virtual or in-person meetings, we present opportunities to institutional investors, addressing queries and refining pitches.

- Term Sheet Negotiation: Securing indicative terms, we negotiate investment structures, ensuring alignment with client goals over 4-6 weeks.

- Closing and Documentation: Finalizing agreements with legal support, we facilitate fund transfers and provide post-closing advisory.

These phases deliver access to over $15 billion in deployable capital, streamlining capital formation for sustained growth. Our full-cycle support includes capital introductions, fostering long-term investor relationships.

Debt Advisory and Structuring Details

In debt advisory, we guide clients through financing pipeline stages, focusing on mezzanine debt, venture debt, and asset-based options. This complements our equity advisory for balanced capital structures.

- Assessment and Needs Analysis: Evaluating client cash flows and collateral, we recommend suitable debt instruments within 2-3 weeks.

- Structuring Solutions: Designing mezzanine or asset-based facilities, we model terms like interest rates and covenants to optimize costs.

- Lender Identification: Tapping our network, we approach banks and alternative lenders for competitive proposals.

- Negotiation and Due Diligence: Refining terms and coordinating reviews, we ensure compliance and risk mitigation over 5-7 weeks.

- Placement and Closing: Executing placements with documentation, we secure funding and monitor initial compliance.

Transaction execution steps in debt advisory provide flexible financing, such as equipment or cash-flow loans, enhancing liquidity without equity dilution. This integrated approach aligns with our Velocity Matrix for accelerated results.

Mastering these processes requires adherence to proven strategies, detailed next.

Effective Strategies in Investment Banking

At Zaidwood Capital LLC, we specialize in Investment Banking Services that drive optimal results for our clients. Our approach integrates proven methodologies to enhance mergers and acquisitions advisory, capital raising services, and due diligence processes. By focusing on these areas, businesses can navigate complex financial landscapes with greater confidence and efficiency.

Optimizing M&A Deal Structures

We recommend initiating early due diligence to identify potential synergies and risks, allowing for more informed negotiations from the outset. Flexible structuring options, such as earn-outs, enable value maximization by tying portions of the purchase price to post-merger performance milestones. Strong documentation, aligned with regulatory best practices from FINRA’s guidelines on mergers and acquisitions, ensures compliance and mitigates legal exposures.

- Incorporate earn-outs: These contingent payments adjust for uncertainties, reducing upfront costs while aligning seller incentives with long-term success.

- Layer protective clauses: Include representations, warranties, and indemnification provisions to safeguard against undisclosed liabilities.

- Leverage advisory optimization tactics: Use scenario modeling to test deal variations, optimizing tax efficiency and cash flow impacts.

In practice, we applied these strategies in a mid-market buy-side mandate, structuring a deal with phased payments that minimized risk exposure by 25%. This approach, supported by our zaidwood capital m&a services, facilitated smoother integration and preserved client capital for growth initiatives.

Best Approaches to Capital Raising

Targeted investor pitches are essential, tailoring presentations to the profiles of institutional players like private equity firms and family offices. Diversifying funding sources, including equity offerings and emerging trends like venture debt, broadens access to capital. We draw from SEC insights on small business capital formation, noting how amendments to Regulation D and crowdfunding rules have expanded options for startups, with small businesses driving 60-84% of net new jobs.

- Segment investor outreach: Prioritize those with aligned sector expertise to improve response rates and terms.

- Blend equity and debt instruments: Combine growth equity with mezzanine financing to balance dilution and leverage.

- Utilize the Velocity Matrix: Our proprietary tool accelerates execution through integrated digital marketing and capital markets strategies.

For one client seeking $50 million in funding, we orchestrated a multi-tranche raise, connecting them to our network of over 4,000 investors. This diversified approach secured favorable debt terms, enhancing liquidity without excessive equity surrender, and underscored the efficacy of strategic capital raising services.

Enhancing Due Diligence Practices

Conduct multi-faceted reviews encompassing financial audits, legal compliance checks, and operational assessments to uncover hidden risks. In investment banking transactions, this thorough process validates asset values and forecasts, preventing costly oversights. We emphasize iterative reviews, incorporating third-party validations for objectivity.

- Financial scrutiny: Analyze historical statements and pro forma projections to verify revenue sustainability.

- Legal and regulatory mapping: Assess contracts, IP rights, and adherence to frameworks like FINRA’s business transfer protocols.

- Operational deep dives: Evaluate supply chains and IT infrastructure for scalability and vulnerabilities.

Applying these due diligence enhancement methods, we supported a sell-side engagement where comprehensive reviews identified $10 million in potential liabilities early, enabling renegotiations that boosted deal value by 15%. Our full-cycle due diligence services ensure clients proceed with transparency and resilience.

Implementing these practices positions businesses for success, as we’ll summarize ahead.

Navigating Your Path in Investment Banking

As we conclude this guide on Investment Banking Services, Zaidwood Capital LLC stands ready to support your strategic objectives through expert mergers and acquisitions advisory and capital raising services. Our full-cycle approach covers everything from initial consultations to seamless execution, leveraging institutional networks to connect businesses with over 4,000 investors and access to more than $15 billion in deployable capital. This comprehensive financial navigation ensures compliance and efficiency, drawing on resources like the FINRA MAP Tools for Mergers & Acquisitions to guide regulatory submissions effectively.

Key takeaways include prioritizing due diligence in transactions, adhering to best practices outlined in FINRA Notice 16-37 for capital acquisition brokers, and fostering transparent investor relations. These elements minimize risks while maximizing value in corporate restructuring and funding pursuits. Our team’s experience with $24.4 billion in aggregate transactions underscores the advantages of tailored advisory for sustainable growth.

Looking forward, we invite you to explore strategic transaction support tailored to your needs, including debt advisory services for mezzanine and venture debt solutions. By partnering with professionals, businesses can navigate complex markets with confidence. Consider reaching out to align your vision with proven pathways for expansion–your next milestone awaits.