Oil And Gas Investment Bank

Table of Contents

Navigating Oil and Gas Investment Banking

In the dynamic energy sector, an oil and gas investment bank plays a pivotal role in orchestrating complex transactions amid fluctuating commodity prices and regulatory landscapes. We at Zaidwood Capital serve as a specialized Energy Investment Bank, offering tailored advisory for upstream exploration, midstream transportation, and downstream refining deals. With over 300 completed transactions and access to more than $15 billion in deployable capital, we connect private equity firms, family offices, and energy companies generating at least $1 million in revenue to our network of over 4,000 institutional investors.

Our core services encompass oil and gas M&A advisory, including buy-side and sell-side mandates, as well as oil and gas capital advisory for equity and debt structuring. We provide full-cycle due diligence–covering financial, legal, and operational aspects–to mitigate risks in volatile markets. For instance, in a hypothetical midstream pipeline acquisition, we would facilitate valuation, negotiate terms, and ensure compliance with antitrust guidelines from resources like the Federal Trade Commission’s Hart-Scott-Rodino Act, as outlined in comprehensive guides from the Library of Congress. Our debt advisory includes mezzanine and asset-based financing to support energy projects efficiently.

This guide explores the fundamentals of energy sector investment banking, from understanding key services and benefits to operational insights and best practices in petroleum financing advisory. Subsequent sections delve deeper into how boutique firms like ours streamline transactions for optimal outcomes in this high-stakes arena.

Understanding Oil and Gas Investment Banks

At Zaidwood Capital, we specialize in supporting clients navigating the complex landscape of the energy sector, particularly through our expertise in mergers and acquisitions and capital advisory services. As a premier Energy Mergers And Acquisitions Advisory firm, we deliver tailored solutions for US-based oil and gas companies seeking growth and stability in a dynamic market.

Core Services in M&A and Capital Advisory

We provide essential services as an oil and gas investment bank in the US, focusing on facilitating seamless transactions and funding opportunities for energy projects. Our core offerings include comprehensive M&A advisory, where we handle buy-side and sell-side mandates for upstream acquisitions, helping clients identify strategic targets or maximize asset value. For instance, in a recent midstream acquisition we advised, our team structured a deal that integrated sustainable practices, drawing from over 300 completed transactions in our portfolio.

In oil and gas capital advisory, we assist with equity and debt financing tailored to exploration and production initiatives. This encompasses arranging growth equity for expansion and liquidity solutions to optimize cash flows. Our network connects clients to more than 4,000 institutional investors, providing access to over $15 billion in deployable capital. Key services include:

- Buy-side M&A: Identifying and evaluating acquisition opportunities in oil and gas M&A, conducting preliminary valuations and negotiation support.

- Sell-side M&A: Preparing marketing materials, soliciting bids, and closing deals for upstream and midstream assets.

- Equity financing: Structuring placements with private equity firms and family offices for drilling programs.

- Debt advisory: Developing mezzanine and venture debt options for equipment-intensive projects.

These services ensure clients receive full-cycle support, aligning financial strategies with operational goals in the petroleum sector.

Oil and gas investment banks like ours differentiate buy-side and sell-side services to address unique needs in energy M&A specialists’ engagements. Buy-side focuses on acquiring assets to expand portfolios, while sell-side emphasizes divesting holdings for capital recycling. The following table outlines these variations:

| Service Type | Description | Key Activities | Energy Sector Relevance |

|---|---|---|---|

| Buy-side | Advising buyers in acquiring targets | Target identification, due diligence coordination, bid preparation | Enables upstream companies to consolidate reserves amid volatile commodity prices |

| Sell-side | Guiding sellers in divesting assets | Valuation, buyer outreach, transaction negotiation | Helps midstream firms monetize infrastructure in regulatory-heavy US markets |

This comparison highlights how we adapt our approach to client objectives, ensuring efficient execution in the oil and gas space. In practice, buy-side mandates often involve competitive bidding for proven reserves, while sell-side efforts prioritize confidentiality in downstream divestitures. Such tailored strategies have proven vital in our 24.4 billion USD aggregate transaction volume, underscoring their applicability to petroleum capital structuring challenges.

Role in Due Diligence and Debt Structuring

Our involvement in due diligence forms the backbone of secure oil and gas transactions, encompassing a step-by-step process to mitigate risks. We begin with financial reviews, analyzing balance sheets and cash flow projections using frameworks from resources like the Library of Congress guide on mergers and acquisitions, which emphasizes antitrust compliance under the Hart-Scott-Rodino Act. Next, legal assessments verify titles, contracts, and regulatory filings, followed by operational audits of drilling sites and production efficiency. Commercial evaluations gauge market positioning, while IT and human capital reviews ensure technological and workforce readiness. This full-cycle due diligence, informed by our proprietary data access, protects clients from hidden liabilities.

In debt structuring, we advise on instruments like asset-based lending and equipment financing, integrating sustainability elements such as methane abatement covenants. Drawing from the Columbia Energy Policy Center’s roadmap, we incorporate use-of-proceeds bonds linked to key performance indicators for emission reductions, aligning with IEA’s Net Zero Emissions scenario. For a recent exploration project, we structured venture debt that included methane monitoring provisions, facilitating 75% emission cuts by 2030 targets. Our expertise ensures debt solutions enhance liquidity without compromising project viability, supporting energy firms through full-cycle advisory.

Navigating Sector-Specific Challenges

We adeptly address regulatory hurdles and market volatilities in the US oil and gas landscape, where fluctuating prices and environmental mandates demand agile strategies. Drawing on FERC oversight and EIA data, our team navigates permitting delays and antitrust scrutiny in energy M&A. For sustainability, we integrate methane abatement into financing, countering emission regulations while attracting ESG-focused investors. In volatile crude markets, our petroleum capital structuring hedges risks through diversified debt options. By leveraging our Velocity Matrix for faster execution, we help clients maintain resilience, delivering value in an unpredictable sector.

Key Benefits of Engaging an Oil and Gas Investment Bank

Partnering with a specialized oil and gas investment bank offers energy firms a competitive edge in navigating complex markets. At Zaidwood Capital, we leverage our extensive network and full-cycle advisory to unlock value that in-house teams often cannot achieve alone. This approach not only secures funding but also optimizes transactions for long-term success, drawing on our $24.4B aggregate transaction volume to deliver tangible results.

Access to Capital and Investor Networks

We provide unparalleled access to capital through our connections with over 4,000 institutional and private investors, representing more than $15B in deployable funds. This network is vital in volatile markets where traditional financing can falter, as highlighted by Federal Reserve Bank of Dallas insights on conservative capex strategies amid fluctuating oil prices and supply dynamics.

Key benefits include:

- Broadened Funding Options: Tap into equity and debt sources beyond internal reach, enabling energy financing benefits for upstream and midstream projects.

- Investor Matching: Our deep tech deal access connects clients to targeted backers, streamlining oil and gas capital advisory processes.

- Rapid Introductions: Facilitate meetings with sovereign wealth funds and private equity firms, reducing fundraising timelines.

For instance, we recently assisted a mid-sized exploration firm in raising $200M for Permian Basin expansion, showcasing how our oil and gas investment bank infrastructure accelerates deal flow in uncertain economic conditions.

Expertise in Cost Management and Risk Mitigation

Our advisory services emphasize disciplined cost structures, utilizing success fees and retainers to align incentives without upfront burdens. We mitigate risks through comprehensive due diligence, addressing regulatory and sustainability challenges as outlined in the OECD’s framework on responsible business conduct for state-owned enterprises.

Benefits encompass:

- Tailored Cost Models: Flexible fee arrangements that scale with project milestones, optimizing expenses in capital-intensive sectors.

- Risk Assessment: Full-cycle evaluations covering financial, legal, and environmental factors to preempt volatility impacts.

- Sustainability Integration: Stakeholder engagement strategies that enhance resilience against ESG pressures and litigation risks.

In a recent transaction, we guided a client through due diligence on a $150M acquisition, identifying potential regulatory hurdles early and saving significant remediation costs. This expertise ensures smoother oil and gas M&A executions while fostering sustainable practices.

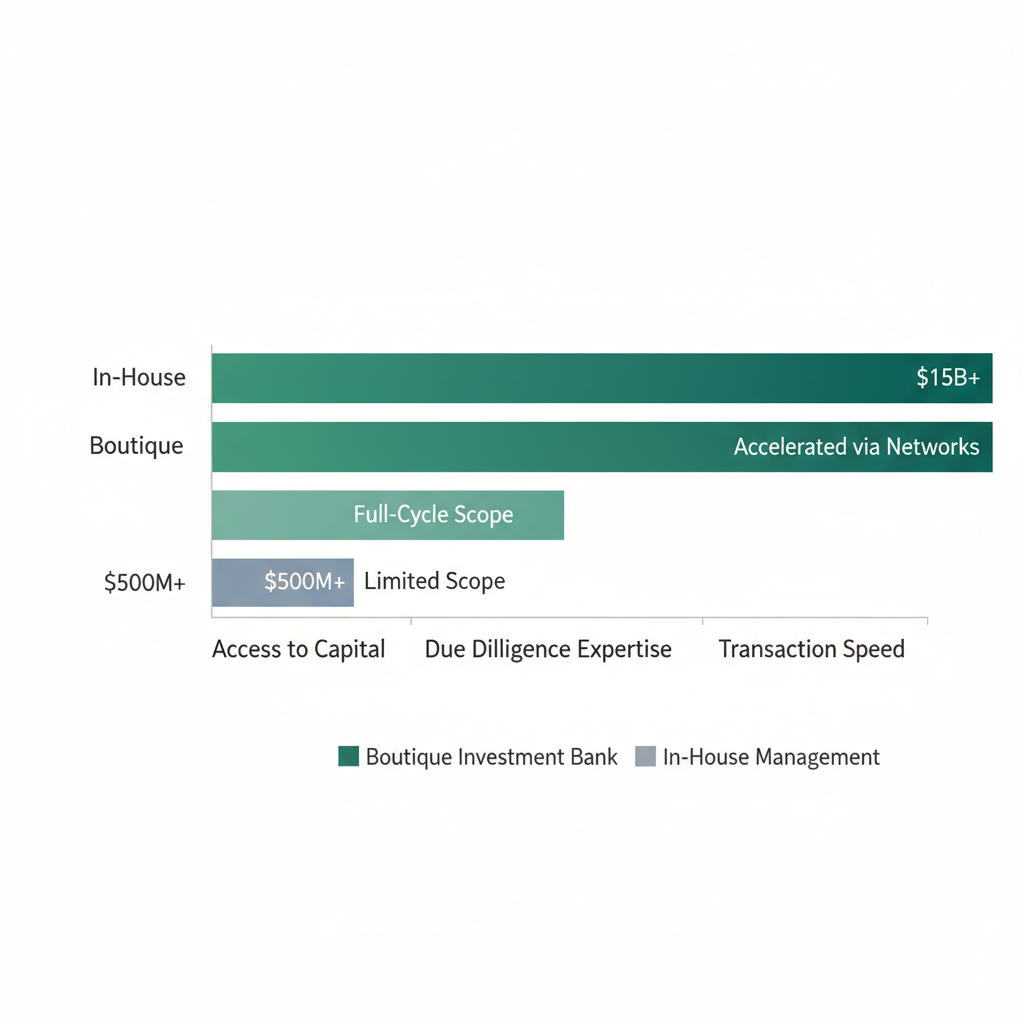

When evaluating advisory options, consider the differences between relying solely on internal teams and engaging a boutique firm like ours. In-house management often limits scope due to resource constraints, whereas specialized banks offer expansive capabilities.

| Benefit Category | In-House Management | Boutique Investment Bank (e.g., Zaidwood) |

|---|---|---|

| Access to Capital | Limited to existing contacts | $15B+ deployable capital via 4,000+ investors |

| Due Diligence Expertise | Internal resources only | Full-cycle covering financial to human capital |

| Transaction Speed | Slower due to lack of networks | Accelerated via Velocity Matrix and strategic docs |

This comparison, informed by Zaidwood’s $24.4B transaction volume, illustrates how boutique advisory surpasses in-house efforts by providing global reach and proprietary tools. For energy firms, this translates to faster capital deployment and reduced exposure, particularly amid OECD-noted sustainability demands that internal teams may overlook. Ultimately, our model empowers clients to navigate sector complexities with greater efficiency and foresight.

Strategic Advantages for Energy Projects

Engaging us yields long-term gains, including accelerated project execution and superior market positioning through sector deal optimization. Our Velocity Matrix and strategic documentation expedite timelines, allowing firms to capitalize on opportunities like rising capex trends noted in Dallas Fed reports.

Advantages include:

- Enhanced Execution: Pre-vetted networks cut negotiation periods, enabling quicker asset deployments.

- Market Positioning: Personalized advisory refines pitches for better valuation in competitive bids.

- Scalable Growth: Support for expansions via integrated M&A and financing, building resilient portfolios.

A case in point is our facilitation of a $500M joint venture for an offshore development, where our sustainability-focused risk mitigation aligned stakeholders and boosted project viability. These elements preview how our operational mechanics drive sustained value in dynamic energy landscapes.

Bar chart of in-house vs. boutique advisory benefits in oil and gas sector

This visual underscores the quantitative edges of boutique partnerships, reinforcing our commitment to delivering measurable strategic benefits for clients pursuing robust energy initiatives.

How Oil and Gas Investment Banks Operate

At Zaidwood Capital, our operations in the energy sector leverage the Velocity Matrix to streamline complex transactions, ensuring efficiency for clients navigating the dynamic US oil and gas landscape. This framework integrates M&A advisory, capital formation, and financing solutions, drawing on our experience with over 300 deals and access to more than $15 billion in deployable capital. By focusing on regulatory compliance and risk mitigation, we facilitate seamless energy transaction workflows that align with client objectives while addressing sector-specific challenges like environmental impacts highlighted by organizations such as BankTrack.

Transaction Structuring and Execution

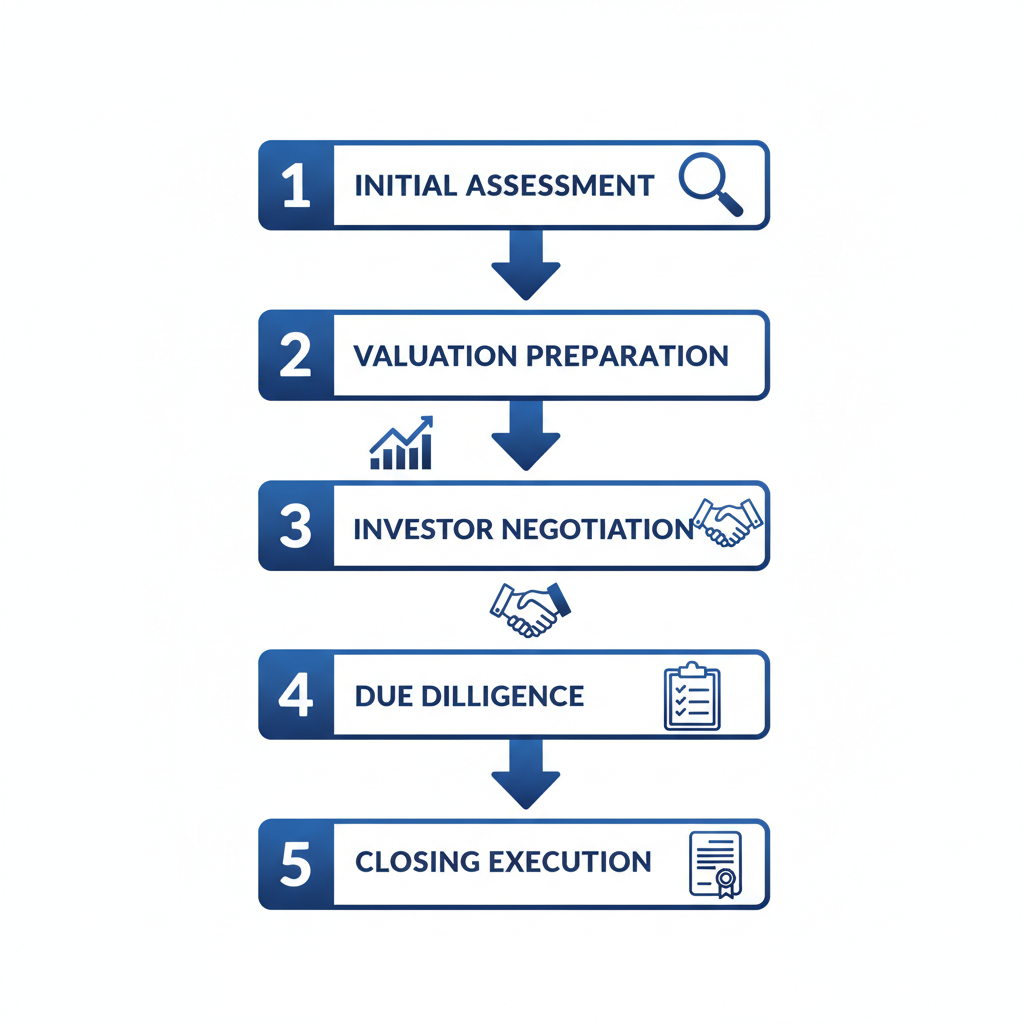

Our process for oil and gas M&A begins with a thorough valuation assessment, where we analyze assets, reserves, and market conditions to establish a fair enterprise value. Step 1: Initial Engagement and Valuation – We conduct detailed financial modeling to identify synergies and risks, often incorporating sustainable metrics to appeal to modern investors. This step typically spans 4-6 weeks and sets the foundation for negotiations.

Step 2: Negotiation and Deal Structuring – Here, we draft term sheets and handle bidding processes, ensuring confidentiality and compliance with SEC regulations. For capital deals, we prepare pitch decks that highlight project viability, followed by investor matchmaking from our network of over 4,000 institutions.

Step 3: Closing – Legal documentation and regulatory approvals culminate in fund transfers, with post-closing integration support. In oil and gas M&A, this execution minimizes downtime, as seen in our facilitation of upstream asset sales exceeding $500 million. An oil and gas investment bank in the US, like ours, excels in these energy transaction workflows by prioritizing speed and precision.

Five-stage vertical flow for oil and gas investment bank M&A operations

This structured approach not only accelerates deal timelines but also mitigates financing risks associated with fossil fuel projects, as noted in BankTrack’s analysis of banking practices. Clients benefit from our proprietary tools that enhance transparency throughout.

Debt Advisory and Financing Processes

Debt advisory forms a cornerstone of our sector financing mechanics, particularly for oil and gas projects requiring flexible capital. Step 1: Needs Assessment – We evaluate client balance sheets and project cash flows to recommend options like mezzanine debt or asset-based lending, considering factors such as collateral value and interest coverage ratios.

Step 2: Structuring and Syndication – Drawing from the Columbia Energy Policy Center’s roadmap on methane abatement debt financing, we integrate sustainability-linked covenants, such as those for emissions reduction, into loan agreements. This involves creating use-of-proceeds bonds or KPI-linked instruments to attract lenders focused on environmental accountability.

Step 3: Execution and Monitoring – We syndicate facilities among banks and monitor compliance, ensuring draws align with project milestones. Our debt advisory services specialize in mezzanine and asset-based arrangements, providing clients with tailored oil and gas capital advisory that balances cost and flexibility while addressing risks like those in volatile commodity markets.

This methodical process supports energy firms in securing non-dilutive funding, often reducing effective interest rates by 1-2% through strategic structuring.

Integration of Due Diligence in Operations

Due diligence permeates every phase of our operations, ensuring robust risk assessment from inception to close. In the initial valuation stage, financial and operational reviews verify reserve estimates and compliance with environmental regulations, flagging issues early to refine deal terms.

During negotiation, legal and commercial due diligence uncovers liabilities, such as title disputes or permitting delays common in oil and gas assets. We employ full-cycle due diligence, encompassing IT and human capital audits, to provide comprehensive insights.

At closing, final verifications confirm representations and warranties. Our Velocity Matrix integrates these checks seamlessly, reducing execution time by up to 30% across 300+ transactions. This holistic approach not only safeguards investments but also fosters trust in our advisory role, aligning with global standards for responsible banking as advocated by initiatives like the Equator Principles.

Best Practices for Oil and Gas Investment Banking

Engaging with an oil and gas investment bank requires a strategic approach to ensure alignment with your debt and mergers and acquisitions needs. We at Zaidwood Capital emphasize evaluating firms based on their expertise in energy sector investment strategies. This section outlines key practices, from selection to future trends, to optimize your advisory engagements.

Selecting the Right Advisory Firm

Choosing the right oil and gas investment bank in the US involves assessing several critical criteria to support debt advisory and oil and gas M&A activities. We recommend prioritizing firms with a proven track record in the energy sector, including successful completions of upstream and midstream transactions. A robust network of institutional investors is essential, as it facilitates access to capital for financing rounds.

To guide your decision-making, consider the following checklist:

- Sector Focus: Select advisors specialized in oil and gas, with deep knowledge of regional dynamics like Permian Basin operations.

- Network Size: Opt for firms connected to over 4,000 investors, enabling efficient LP placement and capital introductions.

- Track Record: Review aggregate transaction volumes exceeding $20 billion to gauge reliability in complex deals.

Energy advisory best practices also include verifying the firm’s boutique expertise, which offers personalized service without the bureaucracy of larger banks. Insights from BankTrack highlight the importance of selecting advisors committed to sustainable financing policies, ensuring long-term viability. By focusing on these elements, clients can secure partners that streamline transactions and mitigate risks effectively. (152 words)

Valuation and Regulatory Considerations

Effective valuation in oil and gas M&A demands tailored methods that account for volatile commodity prices and asset specifics. We advocate using a combination of discounted cash flow (DCF) analysis and comparable transactions to derive accurate enterprise values. Regulatory considerations, such as environmental compliance under EPA guidelines, must integrate into these processes to avoid deal disruptions.

Best approaches include conducting thorough due diligence on reserves and production forecasts, drawing from Dallas Fed economic insights that underscore capex discipline amid price fluctuations. For regulatory navigation, prioritize stakeholder engagement as outlined in OECD frameworks, which promote responsible business conduct in state-owned enterprises and private deals alike.

Incorporate this checklist for robust practices:

- Valuation Techniques: Apply DCF for future-oriented projections and comparables for market benchmarks.

- Regulatory Compliance: Embed ESG factors early, consulting legal experts for FERC approvals.

- Risk Mitigation: Use scenario modeling to address oil price sensitivity and policy shifts.

A Zaidwood case study illustrates this: We assisted a midstream client in navigating Clean Air Act regulations during a $500 million acquisition, integrating sustainability audits that enhanced deal value by 15%. This holistic method ensures valuations reflect both financial and compliance realities. (168 words)

The following table compares key valuation approaches used in energy transactions, highlighting their applicability to different asset types:

| Method | Description | Pros | Cons | Best For |

|---|---|---|---|---|

| DCF Analysis | Discounted cash flow based on reserves and production | Accounts for future revenues | Sensitive to oil price fluctuations | Upstream assets |

| Comparable Transactions | Based on recent deals | Market-reflective | Limited comparables in niche sectors | Midstream infrastructure |

These methods provide a balanced framework for assessing oil and gas assets, with DCF offering long-term projections informed by Dallas Fed forecasts on capex trends. Comparables ensure alignment with current market dynamics, though availability varies by subsector. At Zaidwood, we apply these in full-cycle due diligence, leveraging our $24.4 billion transaction experience to customize valuations that support strategic decision-making and regulatory adherence, ultimately driving successful outcomes for clients. (102 words)

Trends and Future Outlook

Looking ahead to 2025-2026, oil and gas capital advisory will be shaped by conservative capex growth and a surge in sustainable financing, per Dallas Fed analyses predicting modest production increases amid global energy transitions. We foresee heightened M&A activity in consolidation plays, with private equity driving upstream deals valued at $100 billion annually.

Oil and gas M&A trends point to increased focus on midstream infrastructure to support LNG exports, while capital markets emphasize ESG-linked bonds. Regulatory pressures from OECD stakeholder guidelines will accelerate due diligence on sustainability, influencing deal timelines.

For strategic planning, adopt this checklist:

- M&A Opportunities: Target cross-border synergies in low-carbon technologies.

- Capital Trends: Prepare for green debt structures amid rising interest rates.

- Outlook Preparation: Model scenarios for OPEC+ policies and EV demand shifts.

In our ma capital advisory practice, we position clients to capitalize on these dynamics through targeted LP placements. Sector investment strategies will evolve with carbon capture integrations, offering resilient portfolios through 2026. We recommend proactive engagement to navigate these shifts effectively. (148 words)

Leveraging Oil and Gas Investment Banking for Success

In the volatile energy sector, partnering with a specialized oil and gas investment bank in the US unlocks strategic advantages for capital-intensive projects. These firms excel in navigating oil and gas M&A transactions, offering precise valuations and seamless integrations that mitigate risks and maximize value. Similarly, oil and gas capital advisory services facilitate efficient funding structures, from equity placements to debt arrangements, ensuring sustained growth amid fluctuating commodity prices. Energy banking strategies like these empower companies to capitalize on market opportunities while addressing regulatory and environmental challenges.

At Zaidwood Capital, our boutique ma advisory stands out through access to over $15 billion in deployable capital and a track record of more than 300 completed deals, totaling $24.4 billion in aggregate volume. We deliver full-cycle support, including due diligence and strategic documentation, tailored to petroleum advisory insights that tackle sector-specific hurdles such as exploration uncertainties and supply chain disruptions. This expertise positions boutique firms as vital partners for informed decision-making in complex energy landscapes.

We at Zaidwood invite you to explore how our services can align with your objectives–reach out for a confidential discussion to advance your initiatives. For deeper M&A knowledge, consult resources like the Library of Congress guide on mergers, acquisitions, and joint ventures, which offers valuable industry databases and regulatory insights for ongoing education.