Raise Capital

Table of Contents

Understanding Capital Raising for Business Growth

In today’s competitive landscape, businesses often need to raise capital to fuel expansion, innovate, and capture market opportunities. Raise Capital through strategic funding becomes essential for scaling operations, whether launching new products or entering global markets. At Zaidwood Capital LLC, we guide clients in navigating these complexities to secure funding effectively.

As a leading zaidwood capital advisory firm, we specialize in full-cycle mergers and acquisitions advisory, capital formation, debt advisory, and equity advisory services. Our team connects clients to a robust network of over 4,000 institutional and private investors, providing access to more than $15 billion in deployable capital. With an aggregate transaction volume exceeding $24.4 billion across 300+ deals, we streamline equity financing and venture capital funding processes, handling due diligence, strategic documentation, and investor introductions. Drawing from SEC guidelines like those in ‘Ready to Raise Capital,’ we emphasize regulatory preparation and best practices to align businesses with investor expectations, mitigating challenges such as mismatched terms or prolonged timelines.

This guide explores the fundamentals of capital raising, comparing equity versus debt options, and delving into venture funding mechanics. We cover practical applications, from crafting pitch decks and pro forma financials to advanced strategies for business financing strategies. Whether you’re a startup seeking growth equity or an established firm pursuing liquidity solutions, our insights equip you with the knowledge to make informed decisions and accelerate your path to success.

Fundamentals of Capital Raising Strategies

At Zaidwood Capital, we guide businesses through the complexities of capital raising, helping them secure the funding needed for sustainable growth. For companies looking to raise capital, understanding the foundational options is essential to making informed decisions that align with their strategic goals. Our expertise in capital formation ensures that US-based clients with revenues exceeding $1 million can access a network of over 4,000 institutional and private investors, representing more than $15 billion in deployable capital.

Equity financing involves selling ownership stakes in exchange for capital, providing businesses with funds without the burden of repayment. Equity financing typically appeals to startups and high-growth ventures seeking to scale operations rapidly. In contrast, debt financing requires borrowing money that must be repaid with interest, preserving full ownership but introducing fixed obligations. Common debt types include mezzanine financing, which blends debt and equity features for flexible terms, and venture debt, tailored for early-stage companies with venture backing. Hybrid structures combine elements of both, offering customized solutions for diverse needs.

We assist clients in evaluating these options based on their financial health, growth stage, and risk tolerance. For instance, companies with strong cash flows may prefer debt to avoid dilution, while those needing substantial upfront capital often turn to equity. The choice influences long-term control and profitability, requiring a balanced assessment of timelines–typically spanning 3 to 12 months–and preparation of key documents like pitch decks, pro formas, and business plans.

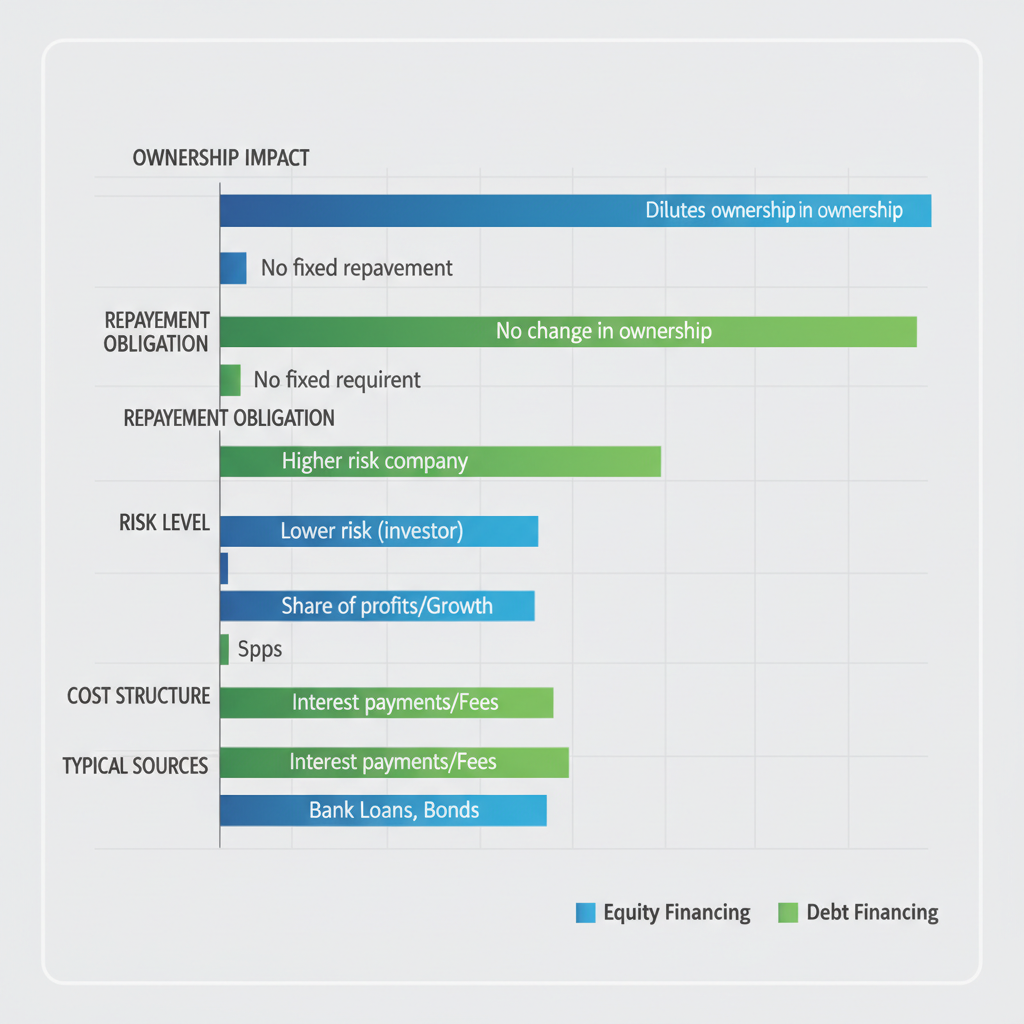

The following table provides an overview of key differences between equity and debt financing:

| Aspect | Equity Financing | Debt Financing |

|---|---|---|

| Ownership Impact | Dilutes ownership; investors gain shares | No dilution; retain full ownership |

| Repayment Obligation | No repayment; returns via dividends/profits | Fixed repayments with interest required |

| Risk Level | Higher for business (no fixed payments) | Lower for business if cash flows stable |

| Cost Structure | Costlier long-term due to sharing profits | Predictable costs via interest rates |

| Typical Sources | Venture capital, angels | Mezzanine, banks |

Drawing from SEC resources on offering pathways, this comparison underscores how equity suits innovative firms willing to share upside potential, while debt fits established operations prioritizing stability. Startups often favor equity for its non-restrictive nature, whereas mature companies with $1 million+ revenues leverage debt to maintain control and deduct interest expenses. Pros of equity include access to expertise from investors and no immediate repayment pressure; cons involve loss of decision-making autonomy. Debt pros encompass retained ownership and tax benefits; cons include repayment risks during downturns, as noted in Iowa State Extension fundamentals on business financing.

Expanding on these basics, our advisory services streamline due diligence processes, covering financial audits, legal reviews, and operational assessments to mitigate risks. We structure deals efficiently, from initial sourcing to closing, ensuring compliance with regulatory pathways like Rule 506 offerings that allow unlimited capital raises from accredited investors. For businesses exploring funding acquisition, we prepare comprehensive documentation and facilitate introductions, accelerating timelines and enhancing success rates.

Equity vs. debt financing comparison in capital strategies

In wrapping up the fundamentals, investment sourcing through tailored strategies positions companies for robust expansion. We at Zaidwood Capital emphasize How To Raise Capital For A Business, drawing on our $24.4 billion aggregate transaction volume to deliver precision advisory. This foundation sets the stage for advanced applications in mergers, acquisitions, and specialized funding, empowering clients to navigate capital markets with confidence.

Deep Dive into Equity and Venture Capital Options

Building on the fundamentals of capital raising, this section explores equity financing and venture capital funding options for US companies seeking growth. At Zaidwood Capital, we facilitate buy-side mandates and capital introductions to private equity and venture capital investors, helping clients raise capital efficiently. Our expertise ensures structured deals that align with business goals while minimizing risks like ownership dilution.

Exploring Equity Financing Mechanisms

Equity financing involves selling ownership stakes in exchange for capital, a key mechanism for startups and growth-stage companies. We structure these deals by assessing company valuation, which determines how much equity is surrendered for investment. Common methods include comparable company analysis and discounted cash flow models to arrive at a fair pre-money valuation. Term sheets outline critical terms such as valuation caps, liquidation preferences, and anti-dilution provisions, which protect investors while defining founder rights.

Our team at Zaidwood leverages deep structuring expertise to negotiate favorable terms. For instance, in a recent anonymized case, we advised a tech firm on a $5 million equity investment round, securing a 20% dilution cap through refined term sheets. This process typically spans 6-18 months, requiring robust pitch decks, financial projections, and legal due diligence documents like cap tables and shareholder agreements.

Equity financing offers advantages over debt in providing non-repayable funds, but it demands careful consideration of trade-offs. The following table compares equity and debt across key aspects:

| Aspect | Equity Pros | Equity Cons | Debt Pros | Debt Cons | Suitability |

|---|---|---|---|---|---|

| Capital Access | No repayment obligation; attracts risk-tolerant investors | Ownership dilution; loss of control | Retain full ownership; predictable terms | Repayment pressure; interest costs | Equity for early-stage; debt for mature firms |

| Cost Structure | No fixed returns; aligns incentives | Potential for higher long-term cost via equity value | Lower overall cost if repaid timely | Default risk and covenants | Equity when cash flow is uncertain |

| Flexibility | Funds growth without assets as collateral | Investor veto rights on decisions | Faster execution; less scrutiny | Collateral requirements | Equity for innovation-driven businesses |

| Scalability | Scales with company growth | Ongoing reporting to shareholders | Build credit history | Limits aggressive expansion | Debt for asset-rich companies |

| Risk Profile | Shares risk with investors | Exit pressures from VCs | Fixed obligations | Bankruptcy risk on default | Equity for high-growth potential |

Venture Capital Funding Stages and Strategies

Venture capital funding progresses through distinct stages, each with specific requirements and milestones. Seed funding validates ideas, often requiring a compelling prototype and market research. Series A focuses on achieving product-market fit, demanding proven traction like user growth metrics and revenue streams. Advisory firms like ours accelerate access by refining pitch decks, connecting to networks of over 4,000 investors, and preparing due diligence packages including financials, IP audits, and operational plans.

Success factors include strong founder teams, scalable business models, and strategic networks–areas where we excel in buy-side introductions. Ownership dilution averages 15-25% per round, necessitating early planning to retain control. Timelines vary from 6-12 months for seed to 12-18 for Series A, influenced by market conditions and preparation quality.

In 2025, venture capital funding requirements emphasize AI integration and sustainability, per SEC data on early-stage investments showing $150 billion in US volumes last year. We address challenges like competitive pitches through tailored strategies, as seen in our support for a biotech client securing $8 million in seed funding via accelerated investor outreach.

Key milestones include:

- Seed Stage: Develop MVP, secure initial users, validate assumptions.

- Series A: Scale operations, hit revenue targets, expand team.

The following table compares venture capital rounds based on typical amounts and investor focus, drawing from SEC early-stage investor insights:

| Stage | Typical Amount | Milestones | Investor Focus |

|---|---|---|---|

| Seed | $500K-$2M | Idea validation | Angels, accelerators |

| Series A | $2M-$15M | Product-market fit | VC firms |

Leveraging our Velocity Matrix, we streamline these processes, integrating digital marketing with capital markets to shorten timelines. For companies navigating VC rounds, our capital introductions bridge gaps in accessibility, ensuring alignment with investor mandates. This integrated approach addresses common challenges like due diligence delays, positioning clients for successful closes.

Venture capital funding stages comparison chart

As an Investment Bank To Raise Capital, we guide clients through these complexities, from equity term negotiations to VC stage advancements, fostering sustainable growth.

Practical Steps for Securing Funding

Raising capital requires meticulous preparation and strategic execution, especially when navigating the complexities of equity financing in the US. At Zaidwood Capital, we assist clients in developing robust strategies to raise capital efficiently, leveraging our expertise in full-cycle M&A and capital advisory. Our capital formation advisory services streamline the process, from crafting compelling narratives to facilitating investor connections.

Preparing Your Capital Raising Pitch

Creating a strong pitch is the foundation of successful funding preparation. We guide clients through developing pitch decks, business plans, and pro forma financials tailored to attract investors. Start by outlining your business model, market opportunity, and growth projections in a concise deck–aim for 10-15 slides that highlight traction and scalability.

- Structure the Pitch Deck: Begin with an executive summary, followed by problem-solution slides, market analysis, and competitive landscape. Include team bios and financial forecasts to demonstrate viability.

- Develop Financial Pro Formas: Project revenue, expenses, and cash flows for 3-5 years, using conservative assumptions grounded in market data. We help refine these models to align with investor expectations for venture capital funding.

- Craft the Business Plan: Detail operational strategies, risk factors, and exit scenarios. Incorporate SEC guidelines from the Ready to Raise Capital resource, ensuring compliance with basic offering requirements.

A checklist for pitch readiness includes verifying data accuracy, aligning visuals with brand identity, and rehearsing delivery for clarity. Common pitfalls involve overloading slides with jargon or neglecting financial realism–avoid these by iterating with feedback.

The following table outlines essential documents for different financing types, based on standard practices and SEC recommendations:

| Document | Equity Financing | Debt Financing | Venture Capital |

|---|---|---|---|

| Pitch Deck | Required | Optional | Required |

| Financial Pro Formas | Essential | Essential | Essential |

| Business Plan | Required | Required | Required |

| Historical Financial Statements | Essential | Essential | Essential |

| Legal Incorporation Documents | Required | Required | Required |

Prioritizing documents depends on your financing path; for equity financing, emphasize pitch decks and pro formas to showcase growth potential, while debt financing prioritizes repayment capacity through financials. This preparation positions you strongly for investor scrutiny.

We assist in customizing these elements, ensuring pitches resonate in competitive US markets.

Navigating Due Diligence and Investor Meetings

Once your pitch is ready, due diligence forms the critical bridge to closing deals. This full-cycle process involves rigorous financial, legal, and operational reviews by potential investors. We support clients by coordinating data rooms and addressing queries promptly to maintain momentum.

Key steps in due diligence include:

- Financial Checks: Provide audited statements and pro formas for analysis of revenue sustainability and burn rates. Differences between equity and debt, as noted in financing comparisons, mean equity investors scrutinize scalability, while debt lenders focus on collateral and cash flows.

- Legal and Compliance Review: Share incorporation papers, IP assignments, and contracts. SEC guidelines stress early preparation to avoid delays in raising capital.

- Operational Assessment: Detail supply chains and customer metrics to affirm scalability.

Investor outreach begins with leveraging networks for warm introductions–our access to over 4,000 institutional contacts accelerates this. Target family offices or venture capital firms aligned with your sector.

In meetings, employ strategies like storytelling to connect emotionally, backed by data. Prepare for Q&A on risks and use visuals to illustrate traction. Timelines vary: typically 3-6 months for equity financing in the US, per industry benchmarks, though venture capital funding can extend to 9 months for complex startups. Factor in follow-ups within 48 hours to nurture relationships.

Best practices mitigate pitfalls such as inconsistent messaging or undervaluing equity stakes. Maintain transparency to build trust, and use tools like CRM software for tracking. For hybrid approaches like mezzanine financing, blend equity and debt elements judiciously.

We facilitate these stages, from introductions to negotiation support, ensuring efficient navigation. Complex scenarios, such as cross-border deals, benefit from advanced structuring–exploring those next enhances long-term success.

Advanced Capital Structures and Advisory Insights

As firms seek to raise capital through sophisticated means, advanced capital structures offer flexible pathways for growth-oriented companies. We at Zaidwood Capital specialize in guiding clients through these complex arrangements, leveraging our expertise in equity financing and hybrid investments. Our zaidwood capital m&a services provide tailored solutions for businesses targeting venture capital funding in high-value US transactions.

Hybrid financing options blend debt and equity characteristics, allowing companies to access advanced funding without immediate full dilution. These structures, such as mezzanine debt and convertible notes, comply with SEC exemptions like Rule 506(b) private placements, enabling unlimited capital raises from accredited investors while avoiding full registration. They suit firms navigating regulatory pathways outlined in SEC resources for small businesses.

The following table compares key hybrid financing options:

| Structure | Key Features | Best For | Risks |

|---|---|---|---|

| Mezzanine Debt | Equity-like debt with warrants | Growth-stage firms | Equity dilution upon conversion |

| Convertible Notes | Debt converting to equity at discount | Early-stage companies | Valuation caps limiting upside |

| SAFE Agreements | Future equity upon triggering event | Pre-seed startups | Illiquidity and trigger uncertainty |

| Preferred Equity | Convertible preferred shares | Scaling enterprises | Dividend preferences burdening cash flow |

Hybrid structures provide strategic leverage, particularly when paired with our advisory insights. For instance, mezzanine debt offers subordinated financing that cushions senior lenders, ideal for expansion without ceding control outright. Clients benefit from our full-cycle due diligence, which extends to IT systems and human capital assessments, ensuring robust evaluations before committing to these hybrids. This comprehensive approach mitigates risks like integration challenges in technology-driven deals.

In advanced due diligence, we delve beyond financials to scrutinize operational synergies, including cybersecurity protocols and talent retention strategies. For $1M+ revenue firms, our network of over 4,000 institutional investors unlocks access to $15B in deployable capital, facilitating seamless LP placements and fairness opinions. This $24.4B transaction expertise underscores our role in multi-round strategies.

Distinguishing seed from Series A venture capital funding is crucial: seed rounds focus on product validation with smaller checks, while Series A emphasizes scalable growth with structured equity financing. Top firms in our network prioritize early-stage innovators, offering not just capital but strategic consulting to optimize term sheets. We address common queries like selecting hybrids for US markets by evaluating regulatory fit and investor alignment, preparing clients for sustained success.

Common Questions on Raising Capital

Raising capital is a pivotal step for growth-oriented businesses navigating US regulatory landscapes. Our funding FAQs address common investment queries to guide your equity financing journey effectively.

What are the pros and cons of equity financing?

Equity financing provides capital without repayment obligations but dilutes ownership. Pros include access to expertise from investors; cons involve sharing control and potential future exit pressures.

How does equity financing affect company ownership?

Equity issuance grants investors shares, reducing founders’ stake proportionally. We advise structuring deals to retain key decision-making rights while securing necessary funds.

What tips secure debt financing effectively?

Prioritize strong collateral, detailed cash flow projections, and compliance with SEC guidelines. Venture debt suits early stages, minimizing equity dilution.

Why hire advisory for venture capital funding?

Professional guidance matches firms with aligned VCs, streamlines due diligence, and ensures regulatory adherence. Our zaidwood capital transaction advisory accelerates successful raises.

What timelines and documents are needed for due diligence?

Expect 3-6 months; prepare financials, IP details, and contracts per SEC early-stage investor standards. Thorough preparation builds investor confidence.

These insights highlight strategic planning’s role. Consult us for tailored support in your capital raise.

Key Takeaways for Effective Capital Raising

Raising capital effectively requires strategic choices between equity financing and debt options, as outlined in our comprehensive guide. This funding summary recaps the trade-offs: debt preserves ownership but demands repayment with interest, while equity financing, including venture capital funding, provides capital without loans yet dilutes control. We’ve highlighted practical steps from bootstrapping to advanced mezzanine structures, emphasizing our advisory role in due diligence and investor introductions.

- Assess Business Stage: Align financing with growth needs, favoring debt for established firms and equity for startups.

- Levage Networks: Connect to institutional investors for optimal terms and faster execution.

- Prioritize Due Diligence: Ensure thorough preparation to mitigate risks and enhance deal success.

At Zaidwood Capital, we empower US businesses generating $1M+ in revenue to navigate these strategies through our $24.4B transaction volume expertise. Explore our services to streamline your capital raising journey–results vary based on individual circumstances.