Sell Side Advisory Services

Table of Contents

Understanding Sell Side Advisory Services in M&A

In today’s competitive mergers and acquisitions landscape, Sell Side Advisory Services play a crucial role for companies looking to divest assets or entire businesses. These services provide expert guidance to sellers, ensuring they navigate the complexities of transactions with confidence. For middle-market firms in the US, engaging professional seller-side M&A guidance can significantly enhance outcomes in divestiture advisory support.

Sell Side Advisory Services encompass comprehensive professional assistance for sellers throughout the M&A process. This includes strategic positioning to maximize enterprise value, meticulous confidentiality protocols to protect sensitive information, and streamlined negotiations that often lead to faster deal closings. According to industry insights from the Seller’s Guide to M&A, companies utilizing such advisory support experience an average value uplift of 20-30% in successful divestitures, mitigating risks associated with incomplete disclosures or mismatched buyer expectations. Key elements like sell-side due diligence preparation and oversight of the sell-side M&A process are vital for complex transactions, where boutique firms offer personalized execution tailored to unique client needs.

At Zaidwood Capital, our Sell Side Advisory expertise shines in middle-market deals, leveraging our institutional network of over 4,000 investors and $24.4B in aggregate transaction volume to facilitate efficient capital deployment.

This foundational overview sets the stage for exploring the core fundamentals of the sell-side process in greater detail.

Fundamentals of Sell Side Advisory

Sell Side Advisory Services form the cornerstone of mergers and acquisitions for middle-market sellers in the US, guiding them through the complexities of divestitures to achieve optimal outcomes. These services focus on preparing businesses for sale, maximizing value, and ensuring smooth transactions. At Zaidwood Capital, we emphasize strategic preparation to align with market demands and buyer expectations.

Sell-side due diligence represents a critical pre-sale readiness assessment, where sellers proactively identify potential risks, strengths, and opportunities within their operations. This process involves thorough internal audits and third-party reviews to uncover hidden value, such as untapped revenue streams or operational efficiencies that can enhance the business’s appeal. By addressing issues early, sellers avoid deal breakers that could derail negotiations or reduce offers. For instance, examining financial records, legal compliance, and customer contracts helps present a robust profile to prospective buyers. Benefits include risk mitigation, which can increase sale prices by 10-20% according to industry benchmarks, and faster deal closures by minimizing post-offer surprises.

In the realm of M&A, understanding the differences between sell-side and buy-side advisory sharpens a seller’s strategy. Sell-side efforts prioritize marketing the asset to generate competitive bids, while buy-side focuses on acquisition targets that fit the buyer’s growth objectives. This distinction ensures sellers leverage the right expertise for their divestiture goals.

| Aspect | Sell-Side Advisory | Buy-Side Advisory |

|---|---|---|

| Primary Focus | Maximizing seller value through preparation and marketing | Identifying and negotiating optimal acquisitions for buyers |

| Key Activities | Due diligence, valuation, auction process | Target sourcing, synergy analysis, integration planning |

| Client Benefit | Confidential divestiture with multiple bidder access | Strategic acquisitions to fuel growth |

Understanding both sides of advisory enhances a seller’s strategy by fostering a holistic view of the transaction landscape, allowing for better positioning and negotiation. At Zaidwood, our full-cycle capabilities span sell-side and buy-side mandates, providing comprehensive support that integrates strategy and execution for middle-market clients without relying on external comparisons.

The sell-side M&A process unfolds in structured phases to streamline divestiture preparation workflow. First, conduct a comprehensive valuation to establish a realistic price range based on market comparables and discounted cash flow analysis. Second, prepare the confidential information memorandum (CIM) detailing the business’s operations, financials, and growth potential. Third, develop a teaser document for initial outreach to qualified buyers while maintaining anonymity. Fourth, manage the auction process by soliciting indications of interest, refining bids, and facilitating due diligence for shortlisted parties. Finally, negotiate terms and close the deal, ensuring all contingencies are met. This methodical approach, informed by cultural and strategic insights from sources like the 2022 Bain & Company survey, underscores the value of early cultural fit assessments to align with buyer expectations and drive long-term success.

We at Zaidwood conduct full-cycle due diligence encompassing financial, legal, and operational aspects, leveraging our expertise as a Sell Side Investment Bank to deliver precision in every transaction stage.

Such fundamentals equip sellers with the knowledge to navigate M&A confidently, setting the stage for deeper exploration into advanced strategies.

Comparison of sell-side and buy-side M&A advisory fundamentals

This visual reinforces the advisory distinctions, highlighting how sell-side preparation directly influences transaction efficiency and value realization in the competitive US middle-market arena.

Deep Dive into Sell Side Advisory Processes

At Zaidwood Capital, our Sell Side Advisory Services guide clients through the complexities of divestitures, ensuring maximum value and efficient execution. The sell-side M&A process begins with meticulous planning to position the business attractively for potential buyers. We leverage our expertise in M&A capital advisory to tailor strategies that align with market dynamics and seller objectives, drawing on our network of over 4,000 institutional investors to bridge capital gaps highlighted in middle-market analyses.

Valuation and Auction Strategies in Sell Side M&A

Valuation forms the cornerstone of the sell-side M&A process, providing a benchmark for pricing and negotiations. Common techniques include discounted cash flow (DCF) analysis, which projects future cash flows discounted to present value, and comparable company analysis, which evaluates multiples from similar transactions. These methods, as outlined in standard seller guides, help establish a realistic enterprise value while accounting for synergies potential buyers might realize. At Zaidwood, our team applies these with proprietary adjustments to reflect unique assets and growth trajectories, ensuring sellers understand the rationale behind pricing recommendations.

Auctions play a pivotal role in the sell-side M&A process by soliciting competitive bids, enhancing leverage, and often driving up transaction values through structured competition. This step follows initial valuation, where we craft teaser documents and investment memorandums to attract interest without compromising confidentiality. Seller auction dynamics vary based on the target buyer universe, influencing the pace and outcome of bids.

The following table outlines key auction formats, drawing from established benchmarks in M&A advisory:

| Auction Type | Description | Pros | Cons |

|---|---|---|---|

| Broad Auction | Targets wide buyer pool | Maximizes competition and value | Longer process, less confidentiality |

| Targeted Auction | Focuses on select strategic buyers | Faster, higher strategic fit | Potentially lower bids |

| Negotiated Sale | Direct to one buyer | Quick and confidential | Limited leverage for price |

For middle-market deals, where capital access challenges often limit options, a targeted auction frequently proves optimal. It balances speed and fit, leveraging networks like ours at Zaidwood to connect sellers with strategic investors efficiently. This approach mitigates the inefficiencies noted in analyses of midsize firms, such as prolonged processes in broad auctions, while capitalizing on our $24.4 billion aggregate transaction volume for credible positioning.

Timeline and Preparation for Sell Side Transactions

The typical sell-side M&A process spans 3 to 9 months, depending on deal complexity, market conditions, and preparation quality. We structure it into distinct phases: preparation, investor selection, due diligence, and contracting, as informed by comprehensive seller guides. This phased approach, or transaction phase management, allows for controlled progression and risk mitigation, addressing common queries on duration and key milestones.

Preparation occupies the initial 1-2 months, focusing on financial readiness. Sellers must compile clean financial statements, normalized earnings, and pro forma projections to present a compelling narrative. At Zaidwood, our full-cycle due diligence support begins here, identifying potential red flags early to avoid surprises. This includes auditing historicals for accuracy and preparing a virtual data room for secure document sharing, which streamlines subsequent phases.

Investor selection follows, lasting 1-3 months, where we tap our extensive network to pre-qualify buyers and solicit non-binding indications of interest. Management presentations and site visits build momentum, with negotiations refining terms. Challenges like market timing, such as economic downturns delaying commitments, require agile adjustments; our proprietary tools accelerate this by automating outreach and tracking, reducing typical timelines for middle-market transactions.

Due diligence, spanning 1-2 months, intensifies scrutiny on financials, operations, and legal aspects. Sell-side due diligence preparation is crucial, enabling proactive issue resolution to maintain buyer confidence. Common pitfalls include incomplete disclosures leading to renegotiations or deal fatigue; Zaidwood counters these with integrated support, coordinating Q&A to protect value.

Finally, the contracting phase concludes in 1-2 months, formalizing binding offers, purchase agreements, and closing conditions. Throughout, we emphasize confidentiality and value maximization, drawing on HBR insights into middle-market capital gaps to position clients advantageously. Our streamlined execution has facilitated over 300 deals, ensuring sellers navigate these phases with precision and confidence.

Practical Aspects of Sell Side Advisory

Sell Side Advisory Services play a crucial role in guiding middle-market companies through the complexities of divestitures and transactions in the US. At Zaidwood Capital, we specialize in providing tailored support to sellers, ensuring efficient execution that aligns with their strategic goals. This section explores the practical elements of these services, from mandate handling to cost considerations, drawing on real-world challenges faced by midsize firms as highlighted in Harvard Business Review analyses of capital access gaps.

Boutique Firm Execution in Sell Side Mandates

Boutique firms like Zaidwood Capital excel in managing sell-side mandates by leveraging focused expertise and extensive networks to streamline the sell-side M&A process. We begin with an initial engagement phase where we assess the seller’s objectives, financials, and market positioning. This preparation typically spans 1-2 months, involving the development of a confidential information memorandum (CIM) and teaser documents to attract potential buyers without compromising sensitive data.

Once prepared, the marketing phase follows, lasting 2-4 months, during which we discreetly approach our network of over 4,000 institutional and private investors. Our proprietary Velocity Matrix accelerates this practical divestiture execution by integrating digital tools and targeted outreach, reducing timelines compared to traditional approaches. For instance, while larger banks may take longer due to bureaucratic layers, our agile structure, backed by $24.4 billion in aggregate transaction volume, enables faster due diligence and negotiation cycles.

Throughout the process, we coordinate buyer interactions, manage data rooms, and facilitate negotiations to drive toward closing. Timelines can vary by deal complexity:

- Preparation: 1-2 months for valuation and materials.

- Marketing and LOI: 2-3 months to secure offers.

- Due diligence and close: 1-2 months post-LOI.

This structured approach addresses common middle-market inefficiencies, such as limited access to capital providers, ensuring sellers achieve optimal outcomes. Our hands-on involvement minimizes disruptions, allowing owners to focus on operations while we bridge the gap to qualified buyers.

In US middle-market contexts, where companies often lack the resources of larger enterprises, boutique execution proves invaluable. By citing examples from capital bridging studies, we underscore how targeted networks like ours overcome funding deployment hurdles, leading to more efficient transactions.

Fee Structures and Costs in Middle-Market Deals

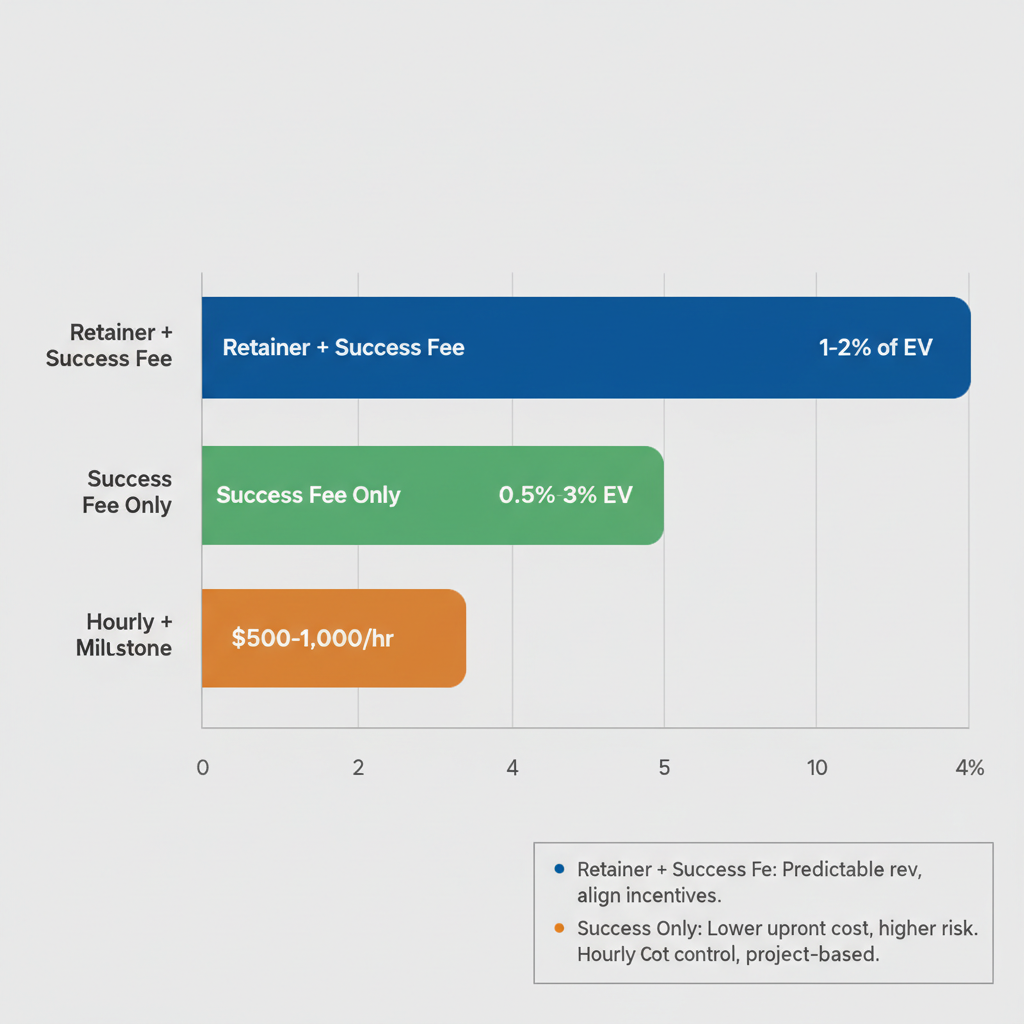

Understanding fee structures is essential for sellers evaluating middle-market fee analysis in sell-side advisory engagements. These models balance upfront commitments with performance-based incentives, ensuring advisors remain motivated to deliver strong results. Typical costs reflect the value provided in navigating complex US deals, where inefficiencies can inflate expenses without professional guidance.

Common fee models include retainers combined with success fees, pure success-based payments, or hourly billing with milestones. Retainers cover initial work like preparation and marketing, while success fees tie compensation to deal closure, often as a percentage of enterprise value (EV). Sellers should weigh these against the expertise gained, as poor execution, such as inadequate buyer outreach, can lead to suboptimal sale prices.

The following table compares key sell-side advisory fee models:

| Fee Model | Description | Typical Range (Middle-Market) | Pros for Sellers |

|---|---|---|---|

| Retainer + Success Fee | Upfront fee plus percentage of deal value | 1-2% of EV | Aligns incentives with outcome |

| Success Fee Only | No upfront, paid on close | 0.5-3% of EV | Lower barrier to entry |

| Hourly + Milestone | Billed by time with bonuses | $500-1,000/hr | Flexible for smaller deals |

As illustrated, retainer-plus-success structures dominate middle-market deals for their alignment of interests, though success-only options appeal to risk-averse sellers. At Zaidwood, we structure fees to emphasize value creation, using general ranges that incentivize swift, high-quality execution without compromising our commitment to client success. This approach mitigates the high costs often borne by midsize firms, such as elevated interest rates or broker fees noted in capital access studies.

Beyond advisory fees, sell-side due diligence costs typically range from $50,000 to $200,000 in US transactions, covering financial, legal, and operational reviews to prepare for buyer scrutiny. These expenses are front-loaded but essential for identifying risks early, potentially increasing sale multiples by 10-20%. Sellers benefit from boutique firms’ efficiency here, as our integrated full-cycle due diligence reduces external consultant needs and leverages our capital formation advisory network for streamlined validations.

Comparison of sell-side advisory fee structures for M&A deals

This visual underscores the variability in models, helping sellers select options that fit their deal size and risk tolerance. Ultimately, investing in robust sell-side support yields long-term value by maximizing proceeds and minimizing transaction friction in competitive markets.

Advanced Strategies in Sell Side Advisory

Advanced elements within Sell Side Advisory Services demand a nuanced understanding of complex transactions, particularly in the middle market where strategic depth can significantly influence outcomes. At Zaidwood Capital, our advanced strategies encompass sophisticated seller preparation, including the development of compelling pitch decks and comprehensive fairness opinions that articulate value propositions clearly to prospective buyers. These strategic documents not only streamline the sell-side M&A process but also facilitate smoother post-close integration by addressing potential synergies early. For instance, we emphasize cultural alignment during preparation, drawing from insights that highlight how strategy and culture often determine long-term success beyond financial metrics. This holistic approach ensures sellers are positioned for optimal execution without compromising operational continuity.

Conducting effective sell-side due diligence requires a multi-faceted strategy that goes beyond basic financial reviews to include IT infrastructure evaluations, human capital assessments, and cultural compatibility checks. Sellers benefit from layered scrutiny that uncovers hidden risks and opportunities, such as talent retention plans that align with buyer expectations. Advanced preparation in these areas mitigates surprises during negotiations and enhances deal certainty. As outlined in discussions on M&A strategy, prioritizing cultural due diligence, identifying potential deal breakers early, can prevent post-transaction disruptions, allowing for a more seamless transition.

The importance of advanced preparation cannot be overstated, as it directly impacts valuation and buyer confidence in the sell-side due diligence phase. Thorough vetting across financial, legal, operational, and commercial domains equips sellers with robust defenses against scrutiny while highlighting strengths.

| Due Diligence Area | Focus | Seller Benefit | Zaidwood Capability |

|---|---|---|---|

| Financial | Pro formas and audits | Accurate valuation | Full-cycle financial review |

| Legal/Operational | Contracts and processes | Risk mitigation | Integrated assessments |

| Commercial/IT | Market and tech eval | Strategic positioning | Proprietary data tools |

This coverage comparison illustrates how targeted diligence fortifies the seller’s position. Our $24.4B in aggregate transaction volume underscores Zaidwood’s expertise in delivering these integrated evaluations, enabling clients to navigate complexities with precision and achieve favorable terms.

Zaidwood Capital’s unique advantages further distinguish our full-cycle M&A advisory full-cycle M&A advisory in advanced sell-side engagements. With access to over 4,000 institutional and private investors, we facilitate targeted introductions that accelerate the process and broaden buyer pools for middle-market divestitures. Our proprietary data tools and extensive deal experience, spanning more than 300 completed transactions, provide sellers with forward-looking insights on market dynamics and integration roadmaps. By incorporating cultural and strategic elements from the outset, as emphasized in M&A best practices, we help clients realize enhanced value through disciplined execution. This comprehensive framework supports high-level divestiture tactics without promising specific results, focusing instead on informed decision-making and strategic alignment.

FAQ on Sell Side Advisory Services

At Zaidwood Capital, we address common seller queries about Sell Side Advisory Services through these divestiture FAQs. Our expertise ensures sellers navigate transactions efficiently, maximizing value while minimizing risks.

What are the benefits of engaging sell-side advisory services?

Sell-side advisory provides strategic guidance, from valuation to buyer outreach, enhancing deal outcomes. We at Zaidwood leverage our network of over 4,000 investors to secure optimal terms, reducing closure time and boosting transaction value for clients.

How does a boutique firm handle boutique sell-side mandates?

Boutique firms like ours offer personalized attention, focusing on tailored strategies. We conduct thorough preparation, including teasers and investment memorandums, drawing on our $24.4B aggregate transaction volume for precise execution.

What is the typical timeline for the sell-side M&A process?

The sell-side M&A process typically spans 6-12 months, covering preparation, investor selection, due diligence, and contracting. We establish a one-year contract to guide clients through phases, with extensions if needed for successful closure.

What fees are involved in sell-side advisory?

Fees often follow a success-fee structure, tied to transaction closure, plus initial consulting hours. At Zaidwood, our model includes up to 300 hours across phases, ensuring alignment with client goals without upfront burdens.

What are the benefits of sell-side due diligence?

Sell-side due diligence identifies issues early, strengthening buyer confidence and deal pricing. It involves coordinating data rooms and transaction structuring, as we do, to mitigate risks and facilitate smoother negotiations.

Key Takeaways on Sell Side Advisory Services

Sell Side Advisory Services represent the seller advisory essentials for middle-market companies seeking optimal outcomes in divestitures. Key benefits include value maximization through thorough mergers and acquisitions advisory and enhanced efficiency via sell-side due diligence and the sell-side M&A process. These M&A summary insights underscore how professional guidance streamlines transactions and connects sellers to qualified buyers.

At Zaidwood Capital, we deliver full-cycle advisory support, leveraging our extensive network of over 4,000 investors to facilitate seamless capital access and strategic exits. Our expertise ensures tailored solutions that align with your divestiture goals.

Looking ahead, evolving M&A trends emphasize bridging capital gaps for midsize firms, as highlighted in Harvard Business Review insights on middle-market inefficiencies. Innovation in digital tools promises greater accessibility and fairness in future transactions.