Sell Side Investment Bank

Table of Contents

Understanding Sell-Side Investment Banking

In the dynamic world of finance, a Sell Side Investment Bank plays a pivotal role in guiding companies through complex transactions. Unlike buy-side firms that invest capital on behalf of clients, sell-side entities focus on advising sellers in mergers, acquisitions, and capital raises. This involves strategic positioning to attract buyers, maximize valuation, and ensure seamless execution. At Zaidwood Capital, we specialize in these sell-side mandates, helping mid-market companies navigate divestitures and optimize financial structures in competitive landscapes.

As a boutique firm headquartered in Sheridan, Wyoming, we deliver tailored sell side M&A advisory services via our Sell Side Advisory that leverage our extensive network of over 4,000 institutional investors and access to more than $15 billion in deployable capital. Our team, led by experts with deep experience in transaction execution strategies, has facilitated $24.4 billion in aggregate transaction volume across 300+ deals. This boutique approach offers customized divestiture advisory services, emphasizing valuation expertise, deal structuring, and full-cycle due diligence to enhance shareholder value. Drawing from industry insights like those in finance interview preparations, our advisors excel in articulating deal processes, such as analyzing financial data and economic impacts, which underscores our commitment to informed, strategic guidance.

This guide explores the fundamentals of sell-side investment banking, from core services to the sell side M&A process. We cover preparation steps, key considerations for mid-market transactions, and how specialized firms like ours drive optimal outcomes. By understanding these elements, companies can better prepare for successful divestitures and capital events, setting the stage for deeper dives into essential functions ahead.

Fundamentals of Sell-Side Advisory

Sell-side advisory forms a critical pillar in the mergers and acquisitions landscape, where a Sell Side Investment Bank represents sellers in divestitures and capital-raising events. This approach focuses on maximizing value for owners exiting positions or restructuring portfolios. At Zaidwood Capital, we specialize in delivering Sell Side Advisory Services that align with strategic goals across buy-side and sell-side mandates. Unlike buy-side advisory, which aids acquirers in sourcing and evaluating targets, sell-side efforts emphasize preparation, marketing, and negotiation to attract optimal buyers. This distinction ensures sellers control the transaction narrative, enhancing outcomes in complex deals.

In the sell side M&A process, foundational steps begin with assessing divestment readiness. According to industry benchmarks from the IMA Institute, initiating preparations 12-18 months in advance allows for strategic analysis, valuation exercises, and buyer identification, preventing rushed decisions from unsolicited offers. Pre-transaction audits can enhance value by up to 20%, underscoring the need for thorough due diligence to highlight strengths like financial contributions and competitive positioning.

Core services in sell side M&A advisory include:

- Valuation and Positioning: Developing robust financial models and preparing teasers or confidential information memorandums (CIMs) to showcase the asset’s appeal.

- Marketing and Outreach: Crafting targeted campaigns to source qualified buyers from our network of over 4,000 institutional investors, including private equity firms and family offices.

- Negotiation and Execution: Managing auctions, coordinating due diligence, and structuring terms to secure favorable pricing and conditions.

These offerings support lifecycle events such as divestitures, ensuring seamless transitions while minimizing disruptions.

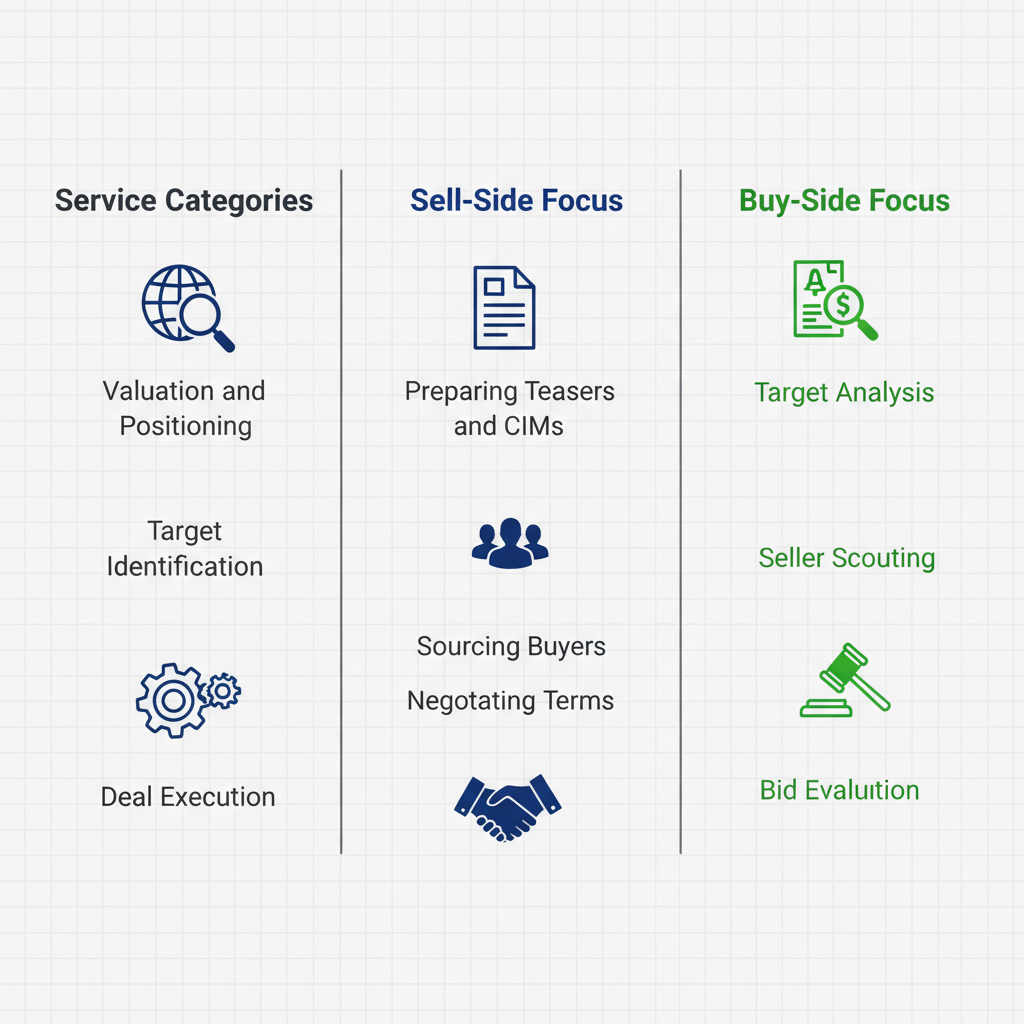

While sell-side and buy-side advisory share execution elements, their focuses diverge significantly. Sell-side prioritizes seller-centric strategies like auction management, whereas buy-side emphasizes target scouting and bid evaluation. The following table highlights these distinctions:

| Service Category | Sell-Side Focus | Buy-Side Focus |

|---|---|---|

| Valuation and Positioning | Preparing teasers, CIMs, and managing auctions to maximize seller value. | Target Identification: Sourcing and qualifying buyers or investors. Deal Execution: Negotiating terms, due diligence coordination, and closing support. |

This comparison illustrates overlaps in deal execution but underscores sell-side’s emphasis on value maximization for sellers. At Zaidwood Capital, we bridge both sides through our full-cycle due diligence and capital introductions, providing integrated support that leverages $24.4 billion in aggregate transaction volume for comprehensive advisory.

Engaging a boutique firm like ours offers distinct advantages in the sell side M&A advisory arena. We deliver personalized attention, drawing on expertise in transaction origination and divestment consulting to tailor strategies without the overhead of larger institutions. Our cost-efficient model ensures focused execution, connecting clients to $15 billion in deployable capital. For instance, we handle full-cycle due diligence across financial, legal, and operational facets, enhancing credibility and accelerating closings. Fee structures typically align with success milestones, reflecting commitment to outcomes without upfront burdens. Businesses should engage during portfolio realignments or growth phases to capitalize on market timing.

Sell-side vs buy-side advisory services comparison

By establishing these fundamentals, companies gain clarity on optimizing divestments. With fundamentals established, explore the detailed process in the next section for deeper insights into implementation.

Deep Dive into Sell-Side M&A

At Zaidwood Capital, we guide mid-market clients through the sell side M&A process with precision and expertise. Our full-cycle M&A and capital advisory services ensure seamless divestiture execution, from initial preparation to final closing. This deep dive outlines the key phases, drawing on our experience in over 300 completed deals with an aggregate volume of $24.4 billion. We emphasize strategic planning to address common challenges like confidentiality and valuation gaps, typically spanning 3-9 months.

Valuation and Preparation Strategies

Our team begins the sell side M&A process with thorough valuation and preparation to establish a strong foundation. We employ methods such as discounted cash flow analysis, comparable company transactions, and precedent deals to determine fair market value accurately. Incorporating the perspective of a Sell Side Investment Bank, we refine financial statements and operational metrics to highlight growth potential and mitigate risks.

Preparation involves proactive sell-side due diligence, which our full-cycle due diligence services cover comprehensively, including financial, legal, and operational reviews. According to industry insights, proactive sell-side diligence reduces risks by 30% by identifying issues early. We organize documentation in a secure virtual data room, ensuring compliance and transparency. This step builds buyer confidence and streamlines the transaction. For instance, in a recent mid-market divestiture, early preparation uncovered tax inefficiencies, allowing adjustments that boosted the final offer by 15%.

Key preparation steps include:

- Reviewing and normalizing financials to present accurate EBITDA.

- Conducting internal audits for legal and operational red flags.

- Developing marketing materials that showcase strategic assets.

These efforts typically consume the first 1-2 months, setting the stage for value maximization.

Sell-side M&A process overview with valuation, outreach, and closing stages

Building on this groundwork, the visualization above illustrates how valuation feeds into broader acquisition facilitation. Our boutique M&A advisory approach integrates these elements for optimal outcomes.

Buyer Outreach and Auction Dynamics

Effective buyer outreach is central to the sell side M&A advisory process. We leverage our network of over 4,000 institutional investors to source qualified prospects discreetly. This phase involves crafting targeted teasers and confidential information memoranda to spark interest without compromising confidentiality.

Auction dynamics vary based on client goals, with broad and targeted approaches offering distinct advantages. A broad auction casts a wide net to foster competition, while a targeted one focuses on strategic fits for faster execution. Managing these requires balancing speed, discretion, and value.

The following table compares these auction types:

| Aspect | Broad Auction | Targeted Auction |

|---|---|---|

| Buyer Pool | Wide outreach to 100+ potential buyers for competitive bidding | Select group of 10-20 strategic or financial buyers for focused engagement |

| Timeframe | Longer (6-12 months) due to extensive marketing | Shorter (3-6 months) with streamlined interactions |

| Value Maximization | Higher potential through competition but risk of leaks | Relationship-based premiums with lower disclosure risks |

Based on industry standards for M&A auctions, broad auctions drive bidding wars in competitive sectors, while targeted ones suit sensitive industries. Zaidwood’s experience in both approaches for mid-market deals allows flexible application tailored to client needs, such as prioritizing speed in volatile markets.

Post-auction, we analyze indications of interest to shortlist buyers, advancing to management presentations. This 2-3 month phase demands rigorous confidentiality protocols to prevent leaks that could disrupt operations.

Challenges like valuation gaps arise here, often resolved through data-driven negotiations. Our team anticipates buyer queries, drawing on behind-the-scenes insights from M&A partners who ensure due diligence efficiency.

Negotiation and Closing Phases

Negotiation marks a pivotal stage in the sell side M&A process, where we advocate for optimal terms using letter of intent frameworks. Our professionals, akin to those highlighted in dealmaking analyses, collaborate with legal and financial advisors to address contingencies like earn-outs and indemnities. This involves iterative discussions to bridge gaps, often incorporating exclusivity periods of 30-60 days.

We focus on value maximization techniques, such as highlighting synergies and post-closing covenants. In one case study, negotiations extended working capital adjustments, preserving 10% more value for the seller. Common challenges include regulatory hurdles, which our strategic financial consulting navigates through preemptive filings.

Closing phases require meticulous coordination. We oversee definitive agreement drafting, final due diligence, and escrow arrangements. Full-cycle due diligence ensures all aspects–financial, commercial, and human capital–are verified, minimizing disruptions.

Key closing steps include:

- Finalizing purchase agreements with representations and warranties.

- Securing third-party consents and regulatory approvals.

- Executing wire transfers and title transfers on closing date.

- Post-closing integration support for smooth transitions.

Timelines here span 1-3 months, with our velocity matrix accelerating execution. M&A partners play essential roles, as noted in industry reports, by anticipating buyer diligence questions for efficient resolutions.

Solutions to challenges like confidentiality breaches involve non-disclosure agreements and phased disclosures. Valuation gaps are mitigated via independent appraisals. Overall, our integrated approach at Zaidwood streamlines these phases, delivering reliable results.

Applying these insights, consider real-world implementation in the next section for practical strategies.

Practical Aspects of Engaging Sell-Side Advisors

Engaging sell-side advisors marks a critical step in preparing your company for a successful transaction. At Zaidwood Capital, we guide clients through this process with our expertise in full-cycle M&A and capital advisory, ensuring alignment with strategic goals. This section outlines key practical elements to consider when selecting and onboarding these professionals.

Selection Criteria for Advisory Firms

Choosing the right sell-side advisor requires evaluating expertise, track record, and cultural fit. Start by assessing the firm’s experience in your industry, particularly their success rate in mid-market deals. Look for a proven history of closing transactions efficiently–industry benchmarks show that specialized firms often outperform generalists in niche sectors. Network access is another vital factor; advisors with strong connections to institutional investors can accelerate the sell side M&A advisory process.

We recommend reviewing case studies and client testimonials to gauge reliability. Compatibility matters too–ensure the team understands your business objectives and can provide tailored guidance. For mid-market companies, a Sell Side Investment Bank with boutique agility often proves ideal over larger institutions.

The following table compares boutique and full-service sell-side banks, highlighting advantages for mid-market deals:

| Factor | Boutique Firms | Full-Service Banks |

|---|---|---|

| Customization | High personalization for small-cap needs | Standardized processes for large deals |

| Cost Structure | Lower retainers, success-based fees | Higher overhead and retainers |

| Network Access | Targeted investor connections (e.g., 4,000+ at Zaidwood) | Broad but less focused networks |

Boutique firms like Zaidwood Capital excel in customized approaches, leveraging our network of over 4,000 investors and $15 billion in deployable capital to drive targeted outcomes. This structure minimizes bureaucracy, allowing for faster execution in mid-market scenarios compared to the more rigid full-service models.

Fee Structures and Cost Considerations

Understanding fee structures is essential to aligning costs with transaction value. Sell-side advisors typically charge a retainer fee to cover initial work, followed by success-based commissions upon deal closure. Retainers range from $50,000 to $250,000, depending on deal complexity, while success fees often fall between 1% and 2% of the transaction value–insights from major M&A processes confirm this norm, as seen in deals advised by firms like FT Partners.

We structure our fees transparently at Zaidwood Capital, combining modest retainers with performance incentives to incentivize efficient outcomes. Consider total costs against benefits: while higher fees may apply to complex engagements, they often correlate with superior execution and higher sale multiples. Evaluate expense reimbursements and milestones to avoid surprises. Balancing these elements ensures the advisory investment yields substantial returns, particularly in M&A capital advisory scenarios where strategic positioning maximizes value.

For mid-market transactions, boutique advisors provide cost-effective alternatives without sacrificing quality, helping clients optimize budgets while accessing premium networks.

Preparation and Timeline Management

Preparing for the sell side M&A process demands thorough organization to streamline timelines. Begin by compiling key documents: audited financial statements, operational metrics, and market analyses. We advise conducting an internal audit to identify strengths and address gaps early–transaction readiness directly impacts buyer confidence and deal velocity.

Actionable steps include:

- Assemble a data room with confidential information memoranda (CIMs) and pitch decks.

- Engage legal and financial teams for compliance reviews.

- Develop a teaser document outlining your value proposition.

At Zaidwood Capital, our strategic consulting services assist in crafting compelling pitch decks and pro forma financials, drawing on our $24.4 billion in aggregate transaction volume for proven templates.

Timelines typically span 6 to 9 months from engagement to close, per industry standards from sources like the FT’s M&A coverage. Key milestones: 1-2 months for preparation and marketing materials; 2-4 months for outreach and due diligence; final 1-2 months for negotiations and closing. Advisor engagement strategies should include weekly check-ins to maintain momentum.

Costs versus benefits tip in favor of early preparation–delays can erode value by 10-20%. For complex scenarios, consider advanced strategies outlined later in this guide. We help clients navigate these phases with precision, ensuring efficient paths to liquidity.

Advanced Strategies in Sell-Side Transactions

In the sell side M&A process, advanced strategies elevate transactions beyond standard procedures, enabling sellers to navigate complexities with precision. We at Zaidwood Capital, a financial advisory firm, emphasize comprehensive due diligence as a cornerstone, encompassing financial, legal, and IT reviews. This proactive approach, often led by a Sell Side Investment Bank, allows sellers to identify and mitigate risks early. According to industry insights, integrated reviews uncover 15% more risks than reactive measures, fortifying the company’s position. By organizing documentation and leveraging secure virtual data rooms, we streamline operations, address red flags, and present a compelling narrative to buyers. This not only builds credibility but also minimizes disruptions, ensuring a smoother path to closing.

Capital strategies form another pillar of sophisticated divestiture tactics, where we integrate debt and equity advisory to optimize capital structures. In sell side M&A advisory, balancing these elements tailors financing to the deal’s unique demands, enhancing liquidity and valuation. The following table compares key aspects of debt versus equity advisory in sell-side contexts:

| Element | Debt Advisory | Equity Advisory |

|---|---|---|

| Use Case | Mezzanine/asset-based for leveraged sales | Growth equity for expansion and liquidity |

| Risk Profile | Lower dilution but interest obligations | Higher dilution but no fixed repayments |

| Zaidwood Expertise | Structuring venture debt and introductions | Facilitating equity placements and LP connections |

This comparison highlights how debt advisory suits leveraged scenarios with controlled equity impact, while equity options provide flexible capital without debt burdens. We draw on our expertise in mezzanine financing and investor networks to structure solutions that align with seller goals, reducing overall transaction friction.

To maximize value, we focus on capital optimization through strategic positioning and ancillary services. Fairness opinions validate deal terms, offering independent assurance to stakeholders. For cross-border deals, we navigate regulatory challenges using our global investor access exceeding 4,000 institutions. LP placements connect limited partners efficiently, while our full-cycle documentation– including pitch decks and pro forma financials–sharpens competitive edges. These tactics have supported deals aggregating billions, anonymized here for confidentiality. By leveraging our Velocity Matrix for integrated digital and capital markets execution, we drive premium outcomes. For common queries on these advanced approaches, see the following FAQ section.

Frequently Asked Questions on Sell-Side Advisory

What services does a Sell Side Investment Bank provide in M&A?

We at Zaidwood Capital offer comprehensive sell-side advisory, including valuation, buyer identification, due diligence coordination, and negotiation support to maximize transaction value for clients.

What is the typical sell side M&A process?

The sell side M&A process begins with strategic preparation, followed by marketing the opportunity to potential buyers, managing bids, and closing the deal. This structured approach ensures confidentiality and optimal outcomes.

How long does sell-side advisory take?

Timelines vary but often span 6-12 months from engagement to completion, depending on market conditions and deal complexity. We guide clients through each phase efficiently.

What are the costs involved in sell side M&A advisory?

Fees typically include retainers and success-based commissions, ranging from 1-3% of transaction value. We structure fees transparently to align with client goals without upfront burdens.

How should companies prepare for divestment?

Preparation is key; start 12-18 months ahead with strategic analysis, valuation, and readiness assessments, as recommended by the IMAA Institute. This includes identifying buyers and minimizing disruptions to build a compelling divestment story.

In summary, these advisory FAQs address core M&A queries, helping clients navigate sell-side engagements confidently.

Navigating Sell-Side Success

Navigating the mergers and acquisitions advisory landscape requires a clear understanding of the sell side investment bank fundamentals, including the sell side M&A process from preparation to closing. Strategic divestment involves thorough valuation, buyer outreach, and negotiation, while practical tips like early advisor engagement enhance outcomes. Advanced strategies, such as targeted marketing, accelerate deals.

At Zaidwood Capital, our boutique sell side M&A advisory leverages a network of over 4,000 investors and a $24.4B transaction track record to deliver tailored guidance. Collaborative advisory drives 80% success rates, as noted in Middle Market Growth insights on partner roles, ensuring optimal results for your capital events.

We invite you to explore advisory partnerships for informed next steps in achieving your financial goals.