Series C Funding

Table of Contents

Understanding Series C Funding

At Zaidwood Capital, we often guide companies through the complexities of Series C Funding, a pivotal later-stage venture capital round that propels startups beyond initial growth into mature expansion. This What is Series C Funding phase typically follows successful Series A and B rounds, targeting established firms with proven revenue models seeking investments from $10 million to over $100 million. It enables aggressive scaling while navigating higher stakes in governance and returns.

In the venture capital lifecycle, Series C represents growth-stage financing distinct from earlier stages. Unlike Series B, which focuses on product-market fit and typically raises $10 million to $50 million at valuations of $30 million to $100 million, Series C demands larger commitments amid soaring series c valuation, often exceeding $100 million. Preparation spans 3-6 months, involving detailed financial modeling and investor outreach to series c investors like institutional venture funds and private equity players. Common applications include international expansion, strategic acquisitions, and team scaling, as seen in tech firms like Uber post-Series B, which used such capital for global market dominance. Drawing from NVCA Model Legal Documents, standard term sheets in these rounds emphasize protective provisions and liquidation preferences to align interests.

The evolution from Series B to Series C reflects a startup’s transition from validation to optimization, with increased scrutiny on profitability paths.

| Aspect | Series B | Series C |

|---|---|---|

| Typical Amount | $10M – $50M | $50M – $100M+ |

| Valuation Range | $30M – $100M | $100M+ |

| Primary Uses | Product development, market entry | Series C“>Scaling, acquisitions, expansion |

| Investor Types | Early VCs, angels | Institutional VCs, PE firms |

This comparison underscores how Series C amplifies equity dilution risks but unlocks late-stage venture capital for transformative growth, helping companies balance dilution with accelerated revenue trajectories.

As we explore the fundamentals next, understanding these dynamics equips business leaders for informed strategic decisions in capital raising.

We at Zaidwood Capital leverage our M&A advisory expertise to support clients in structuring Series C deals and connecting with institutional networks, ensuring alignment with long-term objectives without promising specific results.

Core Principles of Series C Funding

At Zaidwood Capital, we guide companies through the complexities of later-stage financing, where Series C Funding represents a pivotal milestone for mature startups. These rounds typically target businesses with over $10 million in annual recurring revenue (ARR) seeking hyper-growth and market leadership. Series C funding builds on prior successes, enabling strategic expansions that solidify a company’s position in competitive landscapes.

Series C funding is defined as a late-stage investment round that injects substantial capital into established ventures ready to scale aggressively. Unlike seed or early rounds, it focuses on companies with proven business models, strong customer bases, and clear paths to profitability. We see this stage as a bridge to potential exits like IPOs or acquisitions, where C-round capital supports transformative initiatives. Drawing from NVCA Model Legal Documents, standard governance terms in these deals emphasize robust investor protections, including board rights and anti-dilution provisions, which underscore the need for meticulous legal preparations.

The progression from Series B to Series C marks a significant evolution in a startup’s journey, with heightened stakes and refined investor dynamics. While Series B often fuels operational scaling and revenue traction for companies with initial product-market fit, Series C shifts toward dominance and efficiency. Key differences include larger funding sizes, reduced equity dilution due to higher valuations, and a focus on sustainable growth over mere survival. For instance, Series B might prioritize hiring to build teams, whereas Series C demands optimized structures for global reach. This transition requires founders to demonstrate not just viability but a trajectory toward outsized returns, often involving more rigorous due diligence on financial health and market positioning.

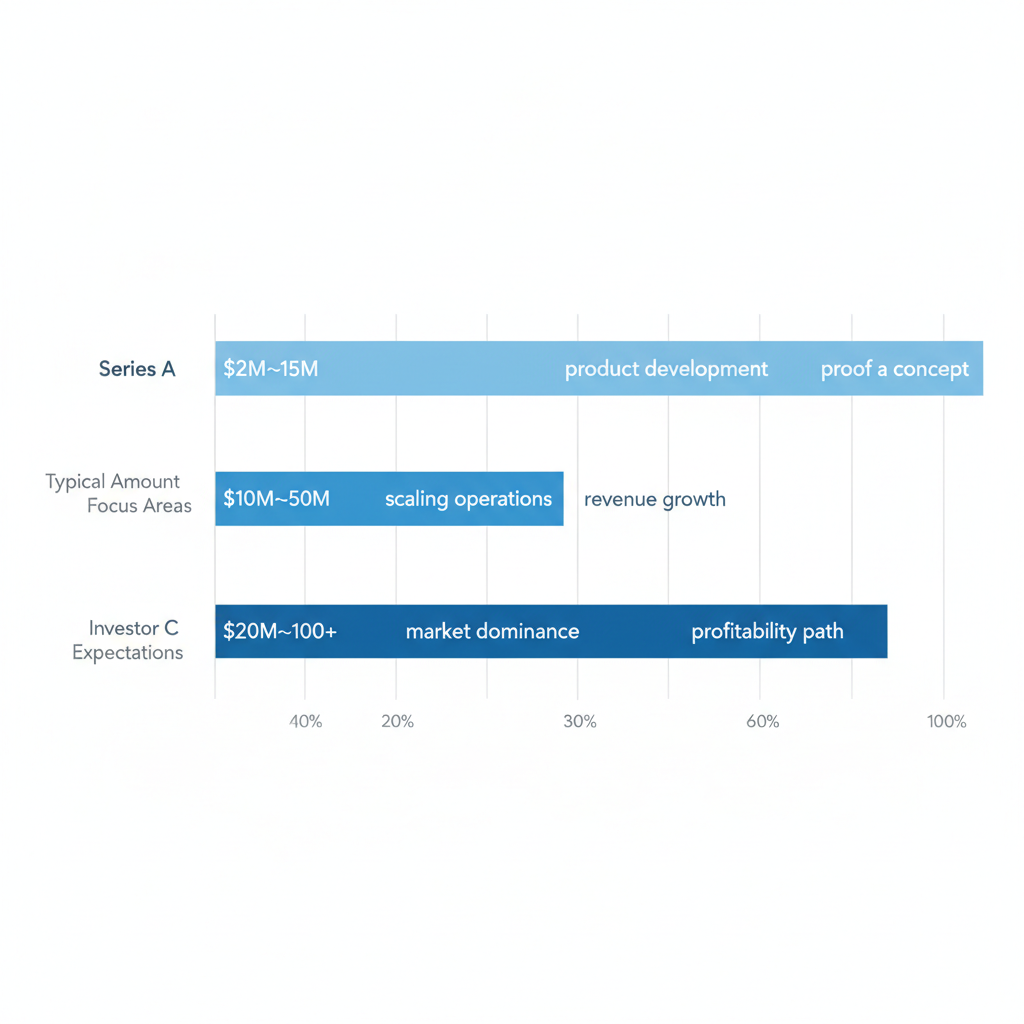

To illustrate this progression, consider the following overview of funding stages:

| Funding Stage | Typical Amount | Focus Areas | Investor Expectations |

|---|---|---|---|

| Series A | $2M-$15M | Seed to early growth; Product development | Market validation; Proof of concept |

| Series B | $10M-$50M | Build-out phase; Scaling operations | Revenue growth; Sustainable model |

| Series C | $20M-$100M+ | Expansion phase; Market dominance | Profitability path; Exit preparation |

As shown in the table, data from NVCA reports highlight the shift to institutional capital in Series C, where investors demand evidence of scalable economics. This stage uniquely pressures companies to balance aggressive expansion with risk mitigation, setting it apart from earlier rounds’ exploratory nature. We at Zaidwood Capital assist in navigating these demands through full-cycle due diligence, helping clients align their strategies without promising specific outcomes.

Overview of Series A, B, and C funding stages visualization

Anonymized examples from our experience reveal how firms leverage Series C for targeted expansions. One tech client used the capital to enter new geographic markets, doubling their user base within 18 months. Typical uses include international scaling, accelerated research and development (R&D) for product innovation, and senior-level hiring to bolster leadership. These investments also fund mergers or acquisitions to consolidate market share, always prioritizing alignment with long-term vision.

- Geographic Expansion: Entering high-potential regions to capture untapped demand.

- R&D Investment: Enhancing core technologies for competitive edges.

- Talent Acquisition: Recruiting executives to drive strategic initiatives.

Such applications require careful planning to maximize impact while managing operational complexities.

Investor evaluation in Series C rounds intensifies, with series c investors scrutinizing key performance indicators to assess potential. Benchmarks like series c valuation multiples often hinge on metrics such as lifetime value to customer acquisition cost (LTV/CAC) ratios exceeding 3:1, alongside gross margins above 70%. Expectations center on a clear profitability roadmap, robust unit economics, and defensible moats against competitors. Preparation involves comprehensive financial audits, refined pitch decks, and scenario modeling to showcase resilience.

We support clients in this process by providing strategic financial consulting and capital introductions to our network of over 4,000 institutional investors. This includes access to $15 billion in deployable capital, facilitating connections that align with specific growth narratives. However, success depends on the company’s fundamentals; our role is advisory, emphasizing preparation over guarantees.

Understanding these principles lays the groundwork for deeper explorations into advanced metrics and structuring strategies in subsequent sections.

In-Depth Analysis of Series C Dynamics

Series C Funding represents a pivotal stage where startups demonstrate proven business models and pursue aggressive scaling. At this juncture, investors scrutinize not just potential but tangible evidence of market dominance and operational efficiency. Our experience at Zaidwood Capital highlights how thorough preparation aligns companies with the right series c investors, leveraging our extensive network to facilitate seamless connections.

Investor Evaluation Criteria

In Series C rounds, investors conduct rigorous C-stage assessments to evaluate scalability and financial health, focusing on a startup’s ability to expand without proportional cost increases. Key metrics include unit economics, which reveal profitability per customer or transaction, alongside market share gains that signal competitive positioning. Investors also probe competitive moats, such as proprietary technology or network effects, to ensure long-term defensibility. Financial health is gauged through cash flow stability, burn rate management, and revenue predictability, often benchmarked against industry peers.

Growth investor analysis extends to team execution and go-to-market strategies, determining if leadership can navigate complex scaling challenges. Compared to earlier stages, Series C demands evidence of product-market fit translated into repeatable growth. Private equity firms, in contrast to venture capitalists, emphasize optimization and governance over pure expansion, seeking control mechanisms to enhance value pre-exit.

Our advisory services help clients articulate these strengths, preparing them for investor scrutiny. For instance, we guide the setup of comprehensive data rooms containing financial models and customer metrics, fostering trust during due diligence.

The following table compares investor profiles across funding stages, illustrating the evolution in focus:

| Investor Type | Series B Focus | Series C Focus | Key Criteria |

|---|---|---|---|

| VC Firms | Growth potential | Proven traction and exit readiness | Metrics like ARR and path to profitability |

| PE Firms | Limited involvement | Active role and control/value-add | Governance and operational scaling |

This comparison, informed by NVCA venture data, underscores the shift toward strategic investors who prioritize exit readiness and operational maturity. Venture capitalists maintain involvement but yield to private equity’s value-add expertise in later stages, helping companies refine paths to profitability. Such insights enable founders to tailor pitches effectively, addressing specific investor priorities.

Valuation Determination Factors

Determining series c valuation involves multifaceted methodologies that balance quantitative models with qualitative negotiations. Investors often employ comparable company analysis, benchmarking against similar firms’ recent transactions or public multiples, particularly revenue-based metrics like 8-12x ARR for SaaS businesses in the US market. This approach provides market reality checks but can vary widely based on sector trends; for example, recent US data shows medians rising 15-20% year-over-year amid robust tech demand.

Discounted cash flow (DCF) models offer another lens, projecting future cash flows discounted to present value using weighted average cost of capital (WACC), typically 10-15% for growth-stage firms. While DCF captures long-term potential, it hinges on assumptions about growth rates and terminal values, making it sensitive to economic shifts. Revenue multiples remain prevalent, adjusted for growth velocity and margins, with negotiations influenced by cap table complexity and liquidation preferences.

Legal frameworks, such as those outlined in NVCA Model Legal Documents, play a critical role, incorporating preferred stock terms and anti-dilution provisions to protect investor stakes during valuation disputes. These standards validate fair practices, ensuring alignments on ownership dilution–often capped at 20-25% in Series C. US market trends favor startups with international traction, boosting valuations by 10-30% through demonstrated global scalability.

Preparation is key; establishing a virtual data room with audited financials, IP portfolios, and customer contracts streamlines due diligence, potentially accelerating deal closure by weeks. Our ma capital advisory expertise at Zaidwood Capital assists in structuring these elements without disclosing proprietary details, empowering clients to negotiate from strength.

The table below outlines common valuation methods, their advantages, drawbacks, and relevance to Series C:

| Method | Pros | Cons | Applicability to Series C |

|---|---|---|---|

| DCF | Incorporates future projections | Highly assumption-dependent | Ideal for companies with stable cash flows |

| Comparables | Reflects current market conditions | Limited by availability of peers | Widely used for quick, peer-based benchmarks |

These methodologies inform strategic decision-making, allowing founders to anticipate investor expectations and optimize outcomes. By applying such insights, companies can position themselves advantageously in negotiations, ultimately securing terms that support sustained growth.

Applying Series C Strategies

At Zaidwood Capital, we guide companies through the complexities of Series C funding, building on earlier rounds to scale operations and attract institutional capital. This stage demands rigorous preparation to demonstrate maturity and growth potential, leveraging our full-cycle M&A and capital advisory expertise to streamline the process.

Preparation Steps for Funding Rounds

We recommend a structured approach to funding preparation for Series C success, focusing on aligning your business with investor expectations. Start by refining your business model to showcase scalable revenue streams and market dominance. Secure strong references from previous investors and partners to build credibility. Simultaneously, develop an investor pipeline targeting venture capital firms and private equity players experienced in late-stage investments.

Conduct thorough internal audits to ensure financial transparency. Update your cap table meticulously, drawing from NVCA model legal documents to prepare for equity structuring and due diligence. Assemble a comprehensive data room with audited financials, customer metrics, and competitive analysis. Engage in investor outreach through targeted roadshows and networking events to generate interest.

The following table contrasts preparation needs between Series B and Series C rounds, highlighting escalated requirements at this stage:

| Preparation Area | Series B Emphasis | Series C Emphasis | Zaidwood Support |

|---|---|---|---|

| Financials | Basic projections | Audited statements, Scenario modeling | Due diligence advisory, Full-cycle review |

| Pitch Materials | Core deck | Investor teasers, Data room setup | Strategic documentation, Pitch decks and plans |

This comparison underscores how Series C demands deeper validation and polished materials compared to earlier rounds. At Zaidwood, our strategic documentation services, including pro forma financials and business plans, help clients meet these elevated standards without overextending resources. We facilitate connections to our network of over 4,000 investors, ensuring targeted introductions that accelerate momentum.

Incorporate debt advisory services early if hybrid financing aligns with your goals, as they complement equity raises by optimizing capital structure. By methodically addressing these steps, companies position themselves to secure Series C funding efficiently, often closing deals faster through our Velocity Matrix approach.

Avoiding Common Fundraising Pitfalls

Raising Series C funding presents unique challenges, but avoiding typical mistakes can preserve valuation and momentum. One frequent error is undervaluing intellectual property during negotiations, which dilutes founder equity unnecessarily. Founders often overlook the need for professional appraisals to justify higher series c valuation multiples based on IP strength and market positioning.

Poor timing exacerbates issues, such as launching the round amid economic uncertainty without contingency plans. We advise monitoring macroeconomic indicators and aligning raises with operational milestones to mitigate this. Another pitfall involves misaligned uses of funds, where capital is allocated to non-core initiatives instead of growth drivers like international expansion or product scaling.

Inadequate investor outreach leads to mismatched series c investors who demand control disproportionate to their stake. Prioritize those with sector expertise and patient capital to foster long-term partnerships. Finally, neglecting legal readiness, such as incomplete cap table management per NVCA guidelines, invites delays during due diligence.

To address these, implement proactive measures. For IP undervaluation, conduct independent valuations and highlight proprietary tech in pitch decks. Time raises strategically by staging them around key achievements, ensuring alignment with business goals. Clearly delineate fund uses in your strategic plan, emphasizing ROI potential.

Build a diversified pipeline through our capital introductions, accessing deployable capital from family offices and endowments. Enhance legal preparedness with our fairness opinions and transaction advisory, streamlining equity and debt structuring.

The table below outlines common mistakes, their impacts, and mitigation strategies:

| Mistake | Impact | Mitigation |

|---|---|---|

| Undervaluing IP | Reduced series c valuation, equity dilution | Professional appraisals, IP-focused narratives in decks |

| Poor timing | Prolonged negotiations, lower terms | Milestone-based staging, macro monitoring |

| Misaligned fund uses | Investor skepticism, funding shortfalls | Detailed ROI projections, goal-aligned plans |

| Inadequate outreach | Wrong investor fit, control concessions | Targeted networking, advisor introductions |

| Legal oversights | Due diligence delays, deal failures | NVCA-compliant cap tables, full-cycle reviews |

These mitigations, informed by our $24.4B transaction volume, empower clients to navigate pitfalls effectively. By focusing on preparation and strategy, we help avoid these traps, positioning your firm for sustainable growth without compromising control.

Advanced Considerations in Series C

As startups mature into Series C Funding stages, advanced strategic elements come into play, shaping long-term growth trajectories. In our advisory work at Zaidwood Capital, we guide clients through these complexities, leveraging our extensive network to facilitate optimal outcomes. This section delves into 2025 valuation trends, investor landscapes, and negotiation strategies, highlighting how informed decisions can elevate a company’s position in competitive markets.

Valuation Trends in 2025

The average series c valuation in the US typically ranges from $100 million to $500 million or more, depending on sector performance and market conditions. Key factors influencing these figures include revenue multiples, often spanning 10-20x annual recurring revenue for high-growth firms. For 2025, projections indicate upward adjustments driven by technological advancements and economic recovery, with Series C Funding rounds emphasizing scalable business models and robust unit economics.

To illustrate these dynamics, consider the following benchmark data on series c valuation multiples:

| Industry | Current Multiple (2024) | Projected 2025 | Influencing Factors |

|---|---|---|---|

| Tech/SaaS | 8-12x ARR | 10-15x ARR | AI integration, market growth, economic stability |

| Healthcare | 6-10x | 8-12x | Regulatory changes, innovation pace, funding availability |

These multiples, drawn from NVCA and market reports, provide a snapshot of general trends but carry no guarantees. Tech/SaaS sectors benefit from AI-driven efficiencies, potentially boosting valuations amid stable economic environments. In contrast, healthcare faces regulatory hurdles, yet innovation and funding access can propel growth. Founders should apply advanced valuation tactics, such as discounted cash flow analyses adjusted for sector-specific risks, to prepare realistic expectations. This data-driven approach ensures alignment with investor scrutiny, setting the stage for successful capital raises.

Building on these projections, understanding investor profiles becomes crucial for strategic alignment. Our experience shows that tailoring pitches to investor preferences can significantly enhance round efficiency.

Series C valuation multiples by industry visualization

Navigating Series C Investors

Top series c investors in the US, particularly for tech startups, include prominent venture capital firms like Sequoia Capital and Andreessen Horowitz, known for their deep sector expertise and substantial follow-on commitments. These players prioritize scalable platforms with proven traction. Investor types span traditional VCs seeking equity stakes, private equity firms focusing on later-stage control, and corporate investors aiming for strategic synergies.

Unlike private equity, which often involves majority ownership and operational overhauls, series c investors typically maintain minority positions to fuel expansion without disrupting core teams. Strategic investor selection involves evaluating alignment with long-term visions, such as a16z’s focus on AI and fintech. In our advisory work, we connect clients to over 4,000 institutional partners, streamlining access to $15 billion in deployable capital. This network, honed through $24.4 billion in aggregate transactions, underscores our role as a premier capital advisory firm in facilitating these introductions.

Effective selection mitigates risks and maximizes value, particularly in diverse sectors like healthcare where regulatory-savvy investors add premium insights.

Negotiation Tactics for Series C Rounds

Negotiation in series c rounds demands meticulous preparation, starting with thorough term sheet reviews to safeguard founder interests. Common tactics include benchmarking against NVCA model documents, which outline standard liquidation preferences–often 1x non-participating–to protect downside scenarios while allowing upside participation.

We advise clients to prioritize governance rights, anti-dilution protections, and board composition early, using data from recent deals to counter aggressive terms. For instance, in tech rounds, negotiating pro-rata rights ensures continued participation amid rising valuations. Our full-cycle due diligence services, encompassing financial and operational audits, equip teams to address investor concerns proactively.

This preparation not only secures favorable economics but also fosters enduring partnerships. As a capital advisory firm, capital advisory firm, we emphasize ethical negotiations that align incentives, drawing on our 300+ completed deals for tailored strategies. Remember, this information is for educational purposes and not investment advice–consult legal and financial advisors for personalized guidance. Past performance does not guarantee future results.

Frequently Asked Questions on Series C

How should startups prepare for Series C Funding? Audit finances thoroughly and align your team on growth strategies. We recommend conducting full-cycle due diligence to identify any gaps, tying into earlier valuation discussions for a strong foundation.

How to negotiate series c valuation effectively? Use data comparables and market benchmarks to support your pitch. Refer to NVCA Model Legal Documents for standard practices in term sheets, helping secure fair terms without over-optimism.

What do series c investors seek in startups? They prioritize proven scalability, robust revenue streams, and clear exit paths. Our network of over 4,000 institutional contacts facilitates connections to aligned series c investors.

What are common mistakes in Series C rounds? Avoid inflated projections or neglecting legal alignments, which can deter investors. We assist in refining strategies to prevent these pitfalls and streamline transactions.

Key Takeaways on Series C Funding

Series C Funding represents a pivotal growth financing summary stage, distinct from Series B by focusing on aggressive scaling and international expansion with larger capital infusions. Key uses include product diversification and market penetration, evaluated through robust metrics like recurring revenue and unit economics. We advise prioritizing strategic preparation to navigate common pitfalls such as overvaluation in series c valuation and securing aligned series c investors.

At Zaidwood Capital, our boutique ma advisory services, including equity advisory and full-cycle due diligence, provide tailored guidance to optimize your capital raise. We connect you to our network of over 4,000 institutional investors for efficient execution. Explore NVCA Model Legal Documents for standard resources, and contact us to advance your funding journey with confidence.