Series D Funding

Table of Contents

Understanding Series D Funding

At Zaidwood Capital, we specialize in guiding companies through the complexities of advanced funding phases, including Series D funding. This late-stage venture capital round represents a pivotal moment for mature startups that have progressed beyond initial growth phases. Typically sought after achieving product-market fit and consistent revenue expansion, Series D funding enables businesses to scale operations aggressively, enter new markets, or prepare for an initial public offering (IPO).

Companies often pursue this stage two to five years post-Series C, once annual revenues surpass $50 million, signaling readiness for larger investments. Average capital raised in these growth equity rounds ranges from $50 million to $100 million, attracting Series D investors focused on proven scalability, robust management teams, and clear paths to profitability. Series D valuation becomes a critical factor here, as it reflects the company’s established market position and future potential. We at Zaidwood Capital leverage our expertise from over 300 completed deals and $24.4 billion in aggregate transaction volume to assist clients in structuring these rounds effectively.

Equity advisory firms like ours play a vital role by connecting companies to institutional networks and optimizing deal terms to meet investor expectations. For instance, in the tech and healthcare sectors, we help navigate due diligence and valuation negotiations, ensuring alignment with strategic goals. This positions firms for sustained growth without over-diluting ownership.

Building on this foundation, the following sections delve deeper into the fundamentals of Series D funding, exploring mechanics, risks, and success strategies to equip your business for this transformative phase.

Fundamentals of Series D Funding

Series D funding marks a pivotal phase in a company’s growth trajectory, serving as advanced growth capital to fuel large-scale expansion after achieving significant milestones in earlier rounds. This late-stage equity financing typically targets mature startups or established firms ready to dominate markets or prepare for exits like IPOs or acquisitions. At Zaidwood Capital, we have guided numerous clients through this transition, leveraging our $24.4 billion in aggregate transaction volume across over 300 deals. For a deeper understanding, explore What is Series D Funding.

Companies usually pursue Series D funding 5 to 10 years after founding, once they have validated their business model and scaled operations substantially. By this stage, revenue often reaches $50-100 million annually, with at least $50 million in annual recurring revenue (ARR) as a key benchmark for investor confidence. This level demonstrates sustainable growth and operational efficiency, distinguishing viable candidates from those still refining their strategies. For instance, in anonymized deals from our portfolio, we advised tech firms hitting these revenue thresholds to secure funds for international market entry or strategic acquisitions. Such capital injections, ranging from $50-200 million or more, enable aggressive scaling without diluting ownership excessively, though achieving the requisite Series D valuation requires meticulous financial modeling and performance metrics.

As startups progress through funding stages, each round builds upon the last, escalating in size, scrutiny, and strategic demands. Early rounds focus on ideation and product development, while later ones emphasize proven execution and long-term viability. This evolution reflects the maturation of the business, where initial seed capital gives way to substantial investments supporting global ambitions.

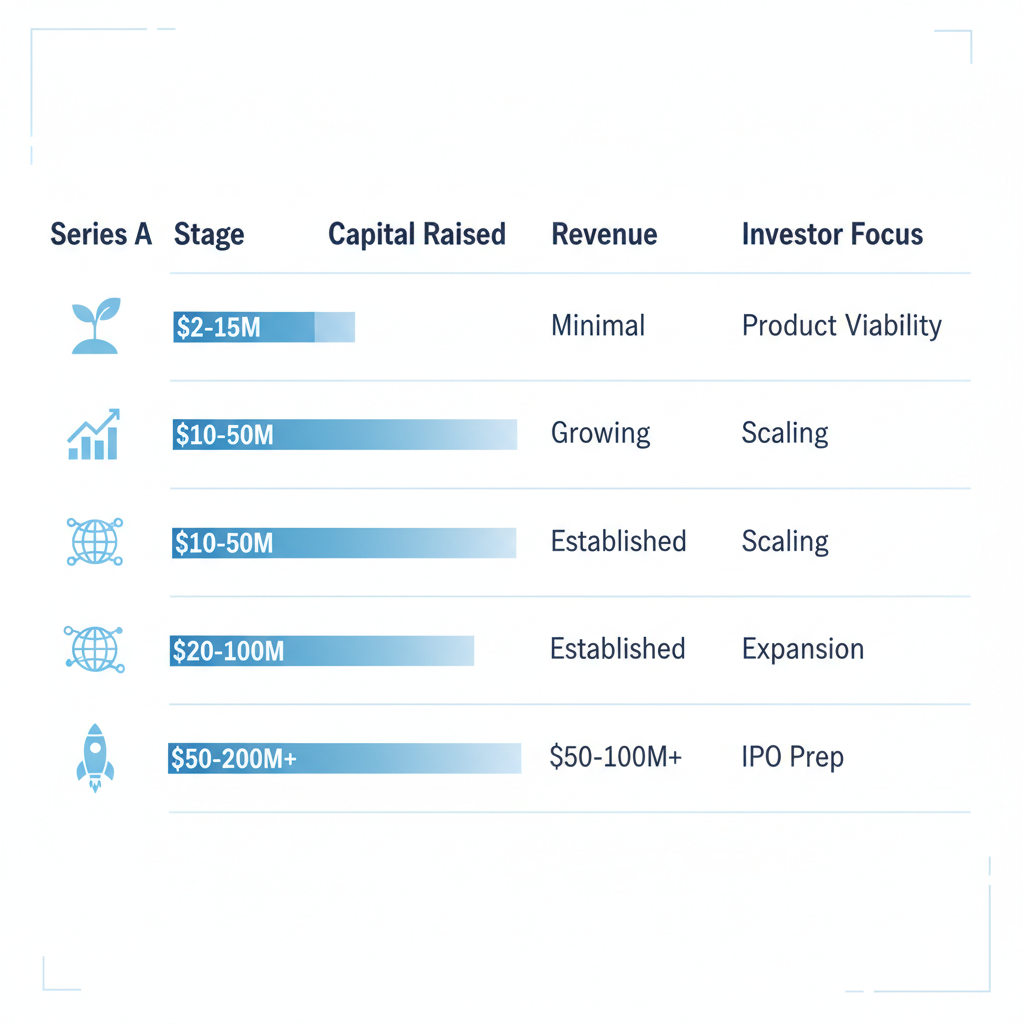

| Funding Stage | Typical Capital Raised | Revenue Requirement | Investor Focus |

|---|---|---|---|

| Series A | $2-15M | Minimal to none | Product viability and early validation |

| Series B | $10-50M | $10-50M | Growing traction and market expansion potential |

| Series C | $30-100M | $50M+ | Path to profitability, sustainability, and global reach |

| Series D | $50-200M+ | $50-100M+ | Proven scalability, expansion, and maturity for IPO or acquisition prep |

Series D demands higher thresholds because it bridges rapid growth with sustainable maturity, requiring evidence of repeatable revenue streams and defensible market positions. In our experience at Zaidwood, clients navigating this stage often face intensified due diligence, where lapses in financial robustness can derail deals. We recommend emphasizing scalable unit economics and clear exit pathways to meet these elevated expectations, as seen in our successful advisory on multi-hundred-million transactions.

This progression underscores the need for strategic preparation at each juncture. Building on the comparative insights above, companies must align their operations with investor priorities to unlock advanced growth capital effectively.

Comparison of funding stages from Series A through D

Series D investors prioritize several core expectations to mitigate risks in these high-stakes rounds:

- Robust Financials: Demonstrable $50 million+ ARR with strong margins and predictable cash flows to justify lofty valuations.

- Strategic Clarity: A defined roadmap for market dominance, including acquisition plans or geographic expansion.

- Proven Scalability: Track record of handling growth without proportional cost increases, validated through operational metrics.

- Exit Readiness: Preparation for liquidity events, with governance structures appealing to institutional backers.

- Team and Governance: Experienced leadership capable of steering through complex negotiations and regulatory landscapes.

We recommend early assessment of these areas to enhance appeal. At Zaidwood Capital, our equity advisory services streamline this process by crafting compelling pitch decks, pro forma financials, and strategic documentation tailored to Series D dynamics. With access to over 4,000 institutional investors and $15 billion in deployable capital, we facilitate introductions that accelerate funding timelines while ensuring alignment with client goals.

Deep Dive into Series D Funding

Series D funding represents a critical juncture for mature startups scaling toward global dominance, often involving substantial capital infusions to fuel expansion and market penetration. At this stage, companies typically demonstrate proven revenue streams and operational maturity, positioning them to attract sophisticated institutional backers.

Capital Expectations and Investor Types

Navigating Series D funding requires understanding the scale of capital involved, which often ranges from $50 million to over $200 million, enabling investments in international markets, acquisitions, and infrastructure. These rounds reflect elevated Series D valuations, driven by strong historical performance and projected growth trajectories. For instance, technology firms frequently command higher amounts due to their rapid scalability, while other sectors align with more conservative figures based on regulatory and market demands.

The variation in raise amounts across sectors underscores the need for tailored strategies. We at Zaidwood have observed these patterns in our advisory work, where sector-specific benchmarks guide client preparations for optimal outcomes.

| Sector | Typical Raise Amount | Key Drivers |

|---|---|---|

| Technology | $100M+ | Innovation and user growth |

| Healthcare | $75M-$150M | Regulatory approvals |

| Fintech | $80M-$120M | Compliance and adoption |

| Consumer | $50M-$100M | Market expansion |

This table highlights how capital expectations align with industry dynamics, informing companies on realistic targets. In our experience facilitating capital formations, aligning pitch materials with these benchmarks has helped clients secure funding efficiently without overvaluation risks.

Shifting to investor types, the landscape for Series D investors in the US features a mix of venture capital firms, private equity groups, hedge funds, and corporate investors, each bringing distinct perspectives and resources. Top players like Sequoia Capital and Andreessen Horowitz exemplify the caliber of participants, prioritizing companies with robust traction and clear paths to liquidity.

These investors evaluate opportunities through lenses of risk-adjusted returns and strategic fit, often collaborating in syndicates to share due diligence burdens.

| Investor Type | Typical Investment Size | Key Expectations | Role in Growth |

|---|---|---|---|

| Venture Capital Firms | $20-100M | Scalability metrics | High growth potential |

| Private Equity | $50-200M | Profitability path | Operational efficiency |

| Hedge Funds | $30-150M | Strong balance sheets | Risk mitigation |

| Corporate Investors | $10-50M | Strategic synergies | Partnerships |

The diversity among Series D investors allows companies to leverage varied expertise, from growth acceleration to strategic alliances. At Zaidwood, our network of over 4,000 institutional and private investors, with access to $15 billion in deployable capital, enables us to connect clients directly to these profiles, streamlining introductions and enhancing deal momentum through our capital introduction services.

Attracting Series D Investors

Securing interest from Series D investors demands a compelling narrative backed by tangible achievements, such as consistent revenue growth exceeding 100% year-over-year and expanding market share. Companies must showcase scalable business models through detailed metrics, including customer acquisition costs and lifetime value, to demonstrate sustainability at this advanced equity round stage.

Leveraging professional networks is equally vital; warm introductions via trusted advisors can bypass cold outreach and expedite evaluations. In one anonymized case, a tech client we advised tripled engagement rates by refining their pitch to highlight global expansion plans, drawing commitments from multiple funds.

We at Zaidwood facilitate these connections through our extensive investor rolodex, providing capital introductions that align client profiles with suitable Series D investors. Our full-cycle advisory ensures pitches emphasize growth levers, positioning companies for successful rounds while mitigating common pitfalls like undervaluation.

Investor Expectations in Depth

Series D investors scrutinize financial health rigorously, seeking evidence of positive cash flow trends and diversified revenue streams to confirm resilience against market volatility. Exit strategies form a core evaluation criterion, with preferences for IPOs or acquisitions offering 3-5x returns within 3-5 years, supported by comprehensive governance frameworks.

Beyond metrics, they assess team execution and competitive moats, often requiring board seats for oversight. Equity round assessments also probe intellectual property strength and regulatory compliance to safeguard investments.

Our team at Zaidwood supports clients in meeting these standards through strategic documentation and due diligence preparation, drawing on our $24.4 billion aggregate transaction volume to anticipate investor scrutiny and fortify applications effectively.

Practical Aspects of Series D Funding

Navigating Series D funding requires a strategic approach to valuation and investor engagement. At Zaidwood Capital, we guide clients through this advanced stage by leveraging our full-cycle equity advisory services to optimize outcomes. This section provides practical steps for preparation, highlighting how our expertise in capital formation and due diligence supports scalable growth.

Preparing for Series D Valuation

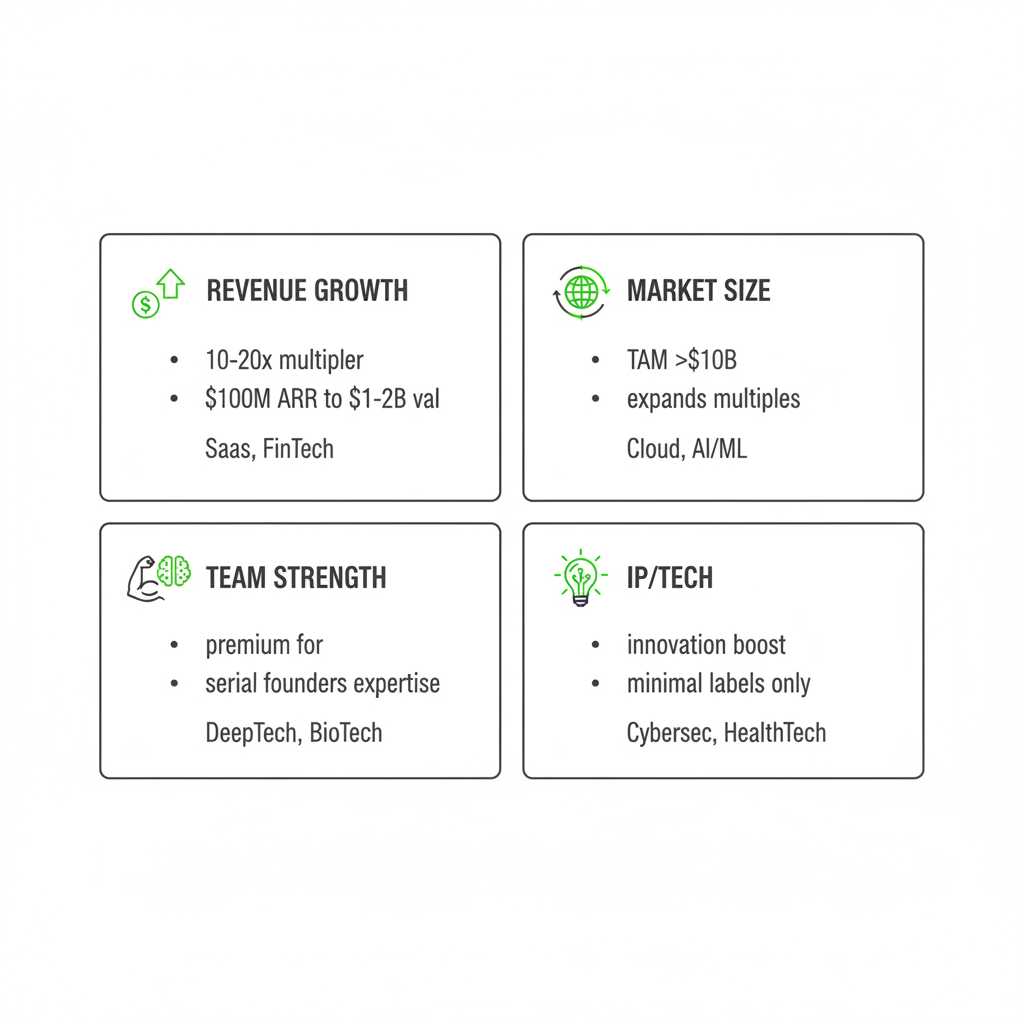

Preparing for Series D valuation involves a meticulous assessment of your company’s metrics and positioning. Key funding valuation drivers include revenue growth, market size, team strength, and intellectual property. For tech firms, valuations often apply multiples of 10-20x revenue, reflecting high scalability potential. Non-tech sectors may see adjusted multiples based on operational stability. We emphasize early financial modeling using pro forma statements to project realistic trajectories, drawing from our experience in over 300 completed deals.

Understanding these elements is crucial for establishing a defensible valuation baseline. The following table outlines key factors influencing Series D valuation across sectors:

| Factor | Impact on Valuation | Tech Example | Non-Tech Example |

|---|---|---|---|

| Revenue Growth | High multiplier (10-20x) | $100M ARR → $1-2B val (SaaS metrics) | Steady 30% YoY in manufacturing |

| Market Size | Expands multiples | TAM >$10B (Fintech expansion) | Global supply chain >$5B |

| Team Strength | Premium for expertise | Serial founders with exits | Proven ops leaders in energy |

This comparison illustrates how sector-specific examples can amplify valuation. For instance, strong revenue growth in tech can justify aggressive multiples, while non-tech relies on tangible assets. At Zaidwood, our Velocity Matrix integrates these factors to provide negotiation leverage, helping clients benchmark against peers and counter lowball offers effectively. We assist in structuring data rooms with audited financials to build investor confidence during discussions.

Negotiation tactics further enhance outcomes. We recommend scenario planning with our strategic documentation services, simulating investor pushback on multiples. Emphasize unique IP or market traction to defend your position, always backed by third-party validations. Our team facilitates introductions to institutional Series D investors, ensuring aligned terms that preserve equity control.

Infographic of key Series D valuation factors with examples and impacts

This visual underscores the interconnected nature of valuation drivers. By aligning preparation with these elements, startups can enter negotiations with robust arguments. Our advisory ensures comprehensive coverage, from initial modeling to final term sheet reviews, streamlining the process for faster closes.

Role of Equity Advisory in Funding

Equity advisory firms like Zaidwood play a pivotal role in Series D funding by managing complex due diligence and investor outreach. Our full-cycle services encompass financial audits, legal reviews, and operational assessments, mitigating risks that could derail deals. With access to over 4,000 institutional investors and $15B in deployable capital, we streamline introductions tailored to your growth narrative.

We handle investor attraction tactics through targeted roadshows and pitch decks, leveraging our aggregate 24.4B USD transaction volume for credibility. Benefits include accelerated timelines via our proprietary Velocity Matrix, which optimizes matching based on investor mandates. This external expertise often outperforms in-house efforts, providing specialized insights without diverting executive focus.

The table below compares in-house versus external advisory approaches:

| Aspect | In-House Handling | External Advisory (Zaidwood) |

|---|---|---|

| Due Diligence Scope | Limited to internal resources | Full-cycle across all disciplines |

| Investor Network | Relies on existing contacts | 4,000+ institutions, targeted intros |

| Negotiation Support | Basic term reviews | Velocity Matrix for leverage |

| Time Efficiency | Slower due to competing priorities | Accelerated via dedicated teams |

External partners like us deliver measurable advantages in efficiency and reach. For Series D investors, this structured support signals professionalism, increasing commitment rates. Our process includes customizing outreach to family offices and venture capital firms, ensuring alignment with your liquidity and growth goals.

Best Practices for Investor Readiness

Achieving investor readiness for Series D funding demands proactive steps to showcase scalability. Start with robust financial modeling, incorporating pro forma statements that highlight recurring revenue and unit economics. Conduct governance audits to address compliance gaps early, aligning with institutional expectations.

- Assemble a comprehensive data room with audited financials, IP documentation, and market analyses.

- Develop a compelling growth narrative via roadshows, emphasizing post-funding milestones.

- Engage early with Series D investors through warm introductions from advisors like Zaidwood.

- Simulate due diligence scenarios to refine responses and strengthen weak areas.

These practices, informed by our 300+ deals, help secure commitments efficiently. Tips include prioritizing metrics like customer acquisition costs and lifetime value to demonstrate sustainability. We integrate digital marketing with capital markets expertise for broader visibility, ensuring your readiness translates to favorable terms.

Advanced Series D Strategies

At Zaidwood Capital, we guide tech startups through the intricacies of Series D funding, where valuations reach sophisticated levels driven by proven scalability and market dominance. High-stage valuation metrics for these rounds often apply multiples of 15-25x annual recurring revenue (ARR), reflecting the maturity and predictability of revenue streams. For instance, in our portfolio of over 300 completed deals totaling $24.4 billion in transaction volume, we’ve seen Series D valuation benchmarks push toward the upper end for AI and SaaS leaders, projecting average round sizes exceeding $500 million by 2026 amid sustained tech growth trends. However, these figures carry risks; market volatility can compress multiples, underscoring the need for robust financial modeling to avoid overvaluation pitfalls.

Preparation for late-round negotiations demands meticulous strategy, particularly when engaging Series D investors who prioritize governance and exit alignment. We emphasize thorough term sheet analysis, focusing on liquidation preferences, anti-dilution provisions, and board composition to safeguard founder equity. Advanced tactics include structuring hybrid debt-equity instruments, blending venture debt with equity to optimize capital efficiency without excessive dilution. Our advisory services equip clients to navigate these complexities, drawing on proprietary insights to counter aggressive terms from institutional backers. Founders must remain vigilant, as missteps in negotiations can erode long-term control–always consult legal experts to mitigate exposure.

Series D rounds mark a pivotal evolution from earlier funding stages, with heightened scrutiny and strategic foresight replacing the growth-focused optimism of Series A-C. Valuation approaches shift dramatically, incorporating maturity premiums and operational depth over basic traction metrics.

The following table illustrates key differences in valuation dynamics:

| Aspect | Series A-C Average | Series D Focus | Implications |

|---|---|---|---|

| Multiples | 5-10x revenue | 10-20x+ | Maturity premium demands proven scale |

| Due Diligence | Basic financials | Full-cycle | Operational deep dives ensure viability |

| Exit Horizon | Long-term | Near-term IPO | Accelerated timelines heighten pressure |

This progression reflects the transition to enterprise-grade investments, where investors assess full-cycle sustainability rather than mere potential. At Zaidwood, our full-cycle due diligence processes prepare clients for these rigors, including fairness opinions that validate complex structures and strategic LP placements to secure optimal terms. By leveraging our network of over 4,000 institutional investors, we streamline access to deployable capital exceeding $15 billion, ensuring seamless execution while addressing inherent risks in high-stakes transactions.

FAQ on Series D Funding

Addressing common investor queries on Series D funding can help companies prepare for late-stage growth. Below, we answer key questions based on our experience at Zaidwood Capital.

What is the average Series D valuation in 2026?For tech companies, Series D valuations typically range from $1-5 billion, reflecting strong scaling and market dominance. We guide clients to benchmark these figures through comprehensive advisory.

Who are the top Series D investors in the US?Prominent Series D investors include firms like Benchmark, Sequoia Capital, and Andreessen Horowitz. Our network connects you to over 4,000 institutional players for optimal matches.

What do Series D investors expect from companies?They seek proven revenue growth, scalable models, and clear exit paths. At Zaidwood, we structure capital raises to highlight these strengths, enhancing attractiveness.

How does advisory support aid Series D preparation?Our full-cycle due diligence and strategic documentation ensure robust pitches. This streamlines transactions and maximizes valuation outcomes for your funding round.

What revenue milestones attract Series D funding?Investors favor companies with $50M+ annual recurring revenue and 3x year-over-year growth. We assist in financial modeling to meet these thresholds effectively.

Navigating Series D Success

Series D funding represents a pivotal growth funding summary for mature startups, typically requiring $50-100 million in capital at revenue benchmarks of $50-100 million annually. Key Series D investors include late-stage venture capital firms and private equity players, focusing on Series D valuation factors like revenue growth, market expansion, and scalable operations. An investor strategy overview emphasizes rigorous due diligence and strategic alignment to mitigate risks.

At Zaidwood Capital, our equity advisory expertise streamlines these complexities. With over 300 completed deals and access to $15 billion in deployable capital through our network of 4,000+ institutional investors, we provide tailored guidance for Series D success.

We invite you to consult Zaidwood for your capital raising needs and accelerate your growth trajectory.