Steps To Sell A Business

Table of Contents

Navigating the Business Sale Process

Deciding to sell your business marks a pivotal moment, blending emotional fulfillment with financial strategy. As entrepreneurs reflect on years of dedication, understanding the Steps To Sell A Business becomes essential for a smooth transition. This selling your company process requires careful planning to maximize value while minimizing stress.

The journey begins with transaction preparation, where owners organize financial records and operations for scrutiny. Next comes accurate business valuation, using methods like the income or market approach, as recommended by the SBA. Marketing follows, confidentially attracting qualified buyers, leading to negotiations and due diligence to verify claims. Common challenges include timing the market and maintaining secrecy. The SBA notes that many sellers overlook professional advice, resulting in lower sale prices; one key insight is that a detailed sales agreement outlining assets and liabilities protects both parties and boosts success rates.

At Zaidwood Capital, we specialize in mergers and acquisitions advisory, connecting clients to over 4,000 investors for optimal outcomes. For first-time sellers, our expertise avoids pitfalls and accelerates the process — learn how to Sell Business. This guide explores understanding the sale, its benefits, the full process, and best practices to empower your decision.

Key Elements of Selling Your Business

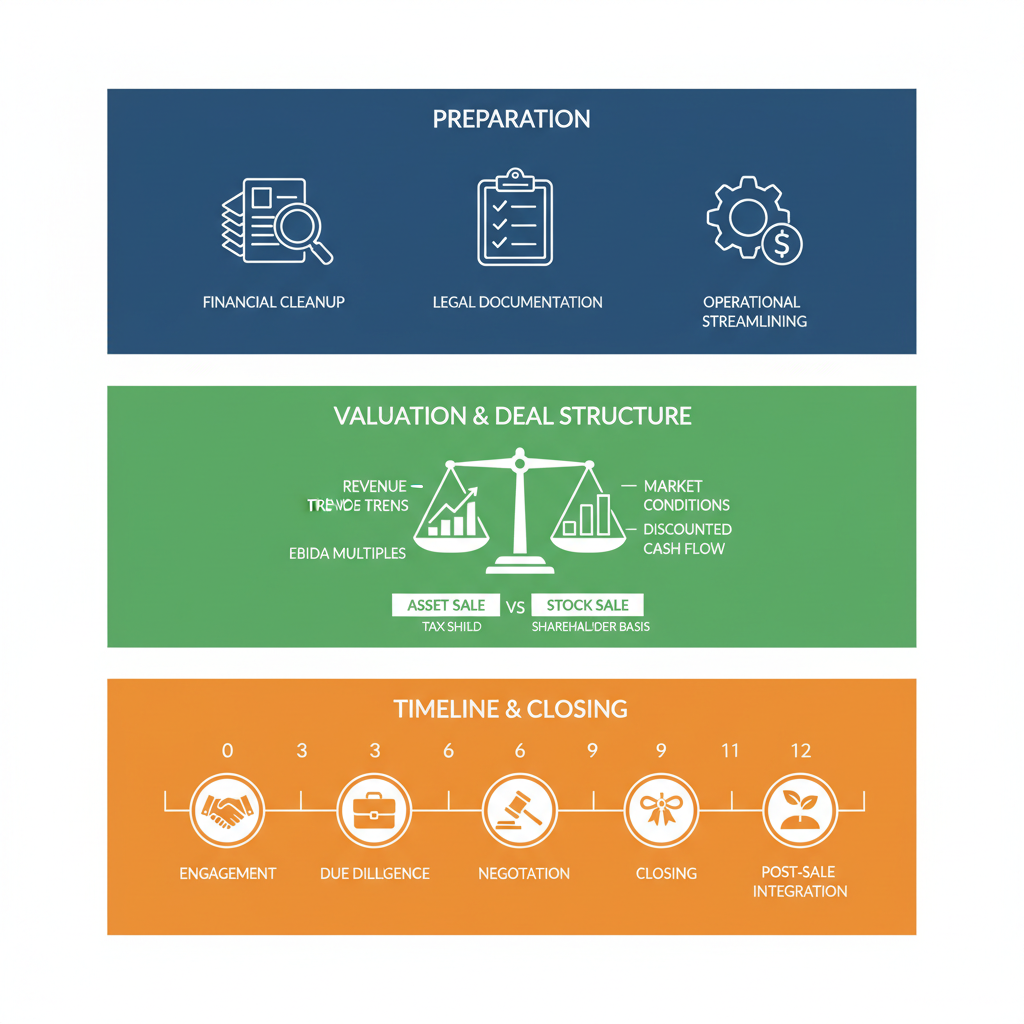

At Zaidwood Capital, we guide clients through the complexities of selling a business, ensuring a smooth transition that maximizes value. Understanding the key elements — preparation, valuation, and timelines — sets the foundation for a successful sale. Our experience with over 300 completed deals highlights how thorough groundwork leads to favorable outcomes. For those wondering How To Sell My Business, these components are essential starting points.

Key stages in preparing and selling your business effectively

Preparing Your Business for Sale

Preparing your business for sale involves a comprehensive initial assessment to enhance its appeal to potential buyers. This pre-sale readiness phase focuses on organizing operations and finances to present a turnkey opportunity.

Key steps include conducting a thorough financial cleanup, such as reconciling accounts and eliminating discrepancies to provide clear profitability metrics. We recommend streamlining operations by documenting processes and reducing dependencies on key personnel, which minimizes risks during transition. For instance, in one of our advisory engagements, organizing supplier contracts and inventory systems revealed hidden efficiencies that boosted buyer interest. Implementing early due diligence checks ensures all records are compliant and accessible.

Tips for success: Engage advisors early to identify blind spots, maintain meticulous record-keeping as advised by IRS guidelines for business sales, and focus on transferable assets. These actions not only attract serious buyers but also expedite the process, aligning with the broader Steps To Sell A Business.

Determining Business Value

Business valuation is the process of estimating your company’s worth based on financial, operational, and market factors. This company worth assessment provides a realistic price range, informing negotiations and expectations.

Valuation methods include asset-based approaches, which tally tangible and intangible assets minus liabilities, and market-based methods that compare to similar recent sales. Factors influencing worth encompass revenue trends, growth potential, and economic conditions; for example, stable cash flows can command premiums. According to IRS guidelines, distinguishing between asset sales and stock sales affects tax implications and final value — asset sales often yield higher proceeds but trigger more taxes. In our deals, we’ve seen valuations rise by incorporating intellectual property and customer contracts into the analysis.

Practical tips: Consult professionals for accurate appraisals, gather historical financials at least three years back, and consider synergies with buyers. This structured approach ensures your valuation reflects true market potential, avoiding underpricing.

Timeline Expectations

The timeline for selling a business typically spans 6 to 12 months, varying by company size, industry, and market dynamics. This duration accounts for preparation, marketing, negotiations, and closing.

Influencing variables include the complexity of due diligence, which can extend if legal or financial reviews uncover issues, and buyer financing availability. For smaller firms, we often achieve sales in under nine months by leveraging our network of over 4,000 investors. Larger transactions may stretch to a year due to regulatory approvals and detailed audits. Our full-cycle M&A advisory streamlines this by coordinating all phases efficiently.

To manage expectations: Set milestones early, such as completing valuation in the first month, and build flexibility for unforeseen delays. Regular advisor check-ins keep momentum, turning potential obstacles into opportunities for stronger deals.

Advantages of Expert Guidance in Business Sales

At Zaidwood Capital, we understand that selling a business is a pivotal moment requiring careful navigation. Engaging expert mergers and acquisitions advisory services transforms this complex journey into a strategic opportunity. Our team, with over 300 completed deals and access to a network of more than 4,000 institutional investors, helps clients achieve optimal outcomes. By leveraging our full-cycle expertise, sellers can focus on their core operations while we handle the intricacies of the transaction.

Maximizing Value Through Professional Advice

Professional advisors play a crucial role in enhancing the sale price and terms of a business. They conduct thorough business valuation assessments to accurately determine worth based on financials, market conditions, and growth potential, often uncovering hidden value that individual sellers might overlook. This leads to sale optimization strategies that attract premium offers.

We at Zaidwood Capital exemplify this through our tailored approach. Drawing from our aggregate transaction volume of $24.4 billion, we position businesses strategically to appeal to high-caliber buyers in our extensive investor network. For small businesses, this means accessing capital pools exceeding $15 billion, enabling competitive bidding that elevates pricing. Our services include crafting compelling pitch decks and pro forma financials that highlight synergies and future profitability, ensuring sellers negotiate from strength.

The result is a maximized return, allowing owners to reinvest proceeds wisely and transition smoothly to new ventures.

Streamlining the Sale Process

Experienced advisors bring efficiency to the sale by managing timelines and reducing administrative burdens. They handle negotiations, document preparation, and buyer outreach, integrating key elements of the Steps To Sell A Business to accelerate the process without compromising quality.

Our team at Zaidwood Capital streamlines transactions using our Velocity Matrix, which combines digital marketing with capital markets know-how for faster execution. In over 300 deals, we have shortened typical sale cycles by coordinating due diligence early and maintaining confidentiality to prevent disruptions. For instance, we connect sellers directly to qualified buyers from our 4,000-plus investor base, bypassing lengthy marketing phases. This full-cycle support, including strategic documentation, ensures all parties align efficiently, adapting insights from resources like the SBA guide on successful business transitions to seller contexts.

Outcomes include quicker closings and preserved business momentum, freeing owners from prolonged uncertainty.

Risk Mitigation and Compliance

Advisors mitigate risks by identifying potential pitfalls early, such as undervaluation or legal oversights, and ensuring robust transaction safeguards. They oversee comprehensive due diligence to verify financial accuracy and compliance with regulations, drawing from SBA recommendations on evaluating licenses, permits, and environmental factors.

At Zaidwood Capital, our full-cycle due diligence covers financial, legal, operational, and commercial aspects, protecting clients in every mandate. With our expertise in mergers and acquisitions advisory, we have navigated complex deals totaling $24.4 billion, advising on zoning laws and valuation methods like capitalized earnings to avoid costly errors. Our investor network provides vetted opportunities, reducing exposure to unqualified buyers, while strategic positioning maintains confidentiality throughout.

This approach yields secure, compliant transactions that safeguard assets and reputation for long-term success.

The Step-by-Step Process of Selling a Business

Selling a business requires careful planning and execution, especially when following the Steps To Sell A Business effectively. At Zaidwood Capital, as a leading boutique capital advisory firm, we guide clients through this process with our full-cycle M&A expertise, ensuring compliance and value maximization. This section outlines the key phases, from initial assessment to final handover, to help owners navigate the complexities involved.

Step-by-step visualization of the business selling process

Valuation and Marketing Preparation

The first step involves determining your business’s worth through comprehensive business valuation methods. We assess value using industry multiples, such as 4-6 times EBITDA for mid-market firms, alongside financial projections that forecast revenue growth and cash flows over three to five years. This establishes a realistic asking price while considering asset allocation, including tangible and intangible elements like intellectual property.

To prepare for market, gather essential documents such as financial statements, operational metrics, and legal compliances. Engage professionals for a formal appraisal to avoid underpricing. Tips include benchmarking against recent comparable sales and adjusting for market conditions, like economic trends affecting your sector.

We integrate our strategic advisory to streamline this phase, leveraging our network for preliminary market feedback and refining your pitch materials. This positions the business attractively, reducing time to market while addressing potential buyer concerns proactively.

Finding Buyers and Negotiations

Once prepared, the next phase focuses on sourcing qualified buyers through targeted outreach. We develop confidential teasers and memorandums, distributed via our extensive investor network of over 4,000 institutions, to attract strategic acquirers, private equity firms, or family offices interested in your industry.

Negotiations begin with non-disclosure agreements (NDAs) for interested parties, followed by letters of intent (LOIs) outlining preliminary terms like purchase price and contingencies. Key tips include prioritizing buyers with proven financing and setting clear timelines for responses to maintain momentum. During deal negotiation phases, remain flexible on non-core terms while protecting critical assets.

Our team handles buyer vetting and LOI drafting, drawing on our experience in over 300 completed deals. We facilitate virtual data rooms for secure information sharing, accelerating interest and leading to competitive bids that enhance overall value.

Due Diligence and Closing

Due diligence follows the LOI, where buyers conduct thorough buyer verification of your operations, finances, and legal standing. This includes financial audits reviewing three years of statements, legal reviews for contracts and liabilities, and operational assessments of supply chains and IT systems. Expect this phase to last 60-90 days, requiring prompt responses to queries.

Prepare by organizing records meticulously and addressing red flags early, such as unresolved disputes. Tax considerations, per IRS guidelines on business sales, involve allocating proceeds between capital assets and goodwill to optimize capital gains treatment, potentially reducing liabilities through proper structuring.

We provide full-cycle due diligence support, coordinating with legal and financial experts to mitigate risks and expedite reviews. At closing, we oversee financing arrangements, document execution, and post-sale handover, ensuring a seamless transition while advising on seller roles during integration periods.

Proven Strategies for a Successful Business Sale

At Zaidwood Capital, we draw from our extensive experience in mergers and acquisitions to guide business owners through the complexities of selling their company. Our full-cycle M&A and capital advisory services emphasize meticulous preparation, proactive inquiry management, and expert involvement to maximize value and minimize risks. These strategies ensure a smooth transaction process, particularly for small companies navigating competitive markets.

Document Preparation and Checklists

Effective due diligence begins with thorough document preparation, a critical step in building buyer confidence. Sellers must organize financial statements, tax returns, contracts, and operational records well in advance. Drawing from SBA guidelines, this preparation involves compiling audited financials for the past three to five years, along with detailed asset inventories and employee agreements. Key practices include digitizing files for secure sharing and verifying accuracy to avoid delays.

For example, a manufacturing firm preparing its ledger revealed overlooked liabilities early, allowing corrections before buyer review. Similarly, service-based businesses often overlook intellectual property documentation, which can erode deal value if missing.

We at Zaidwood recommend creating a virtual data room with indexed folders, aligning with the Steps To Sell A Business by streamlining access. Our strategic documentation services help clients categorize materials efficiently, ensuring compliance without overpromising outcomes.

Handling Inquiries and Red Flags

Due diligence inquiries can uncover potential issues, requiring strategic responses to maintain momentum. Common red flags include financial inconsistencies, such as unreconciled accounts or hidden debts, as highlighted in SBA resources on business transitions. Sellers should anticipate questions on revenue sources and prepare mitigating evidence, like third-party audits, to address concerns promptly.

In one case, a tech startup faced scrutiny over customer churn rates; providing retention analytics turned a potential deal-breaker into a negotiation strength. Another frequent issue arises from incomplete operational records, where buyers question supply chain stability — resolving this with vendor contracts prevents escalation.

Our inquiry management tactics involve preemptive Q&A sessions with advisors. We advise sellers to document responses in a shared log, fostering transparency while protecting sensitive data, based on our experience closing over 300 deals.

Professional Valuation and Advisory

Engaging professionals for business valuation is essential for establishing a realistic sale price and attracting serious buyers. Factors influencing valuation include earnings multiples, asset values, and market comparables, with costs typically ranging from $5,000 to $50,000 depending on company size. SBA methods like the income approach provide a foundation, but tailored expert appraisals ensure accuracy for small companies.

Consider a retail operation valued at 4x EBITDA after factoring in inventory; without professional input, sellers risk underpricing. For family-owned firms, valuations also account for transfer taxes, avoiding surprises during negotiations.

We at Zaidwood Capital offer ma capital advisory services to connect clients with valuation specialists, leveraging our network of over 4,000 investors. This integration enhances credibility and supports informed decision-making in the sale process.

Final Considerations for Selling Your Business

Selling your business marks the culmination of careful planning and execution. As we have outlined throughout this guide, the Steps To Sell A Business involve thorough preparation, accurate business valuation, and rigorous due diligence to ensure a smooth transition. From initial strategy and financial assessments to negotiating terms and finalizing the deal, each phase contributes to maximizing value and minimizing risks. Accurate valuation establishes a fair market price, while comprehensive due diligence uncovers potential issues early, protecting both parties and facilitating successful sale completion strategies.

At Zaidwood Capital, we emphasize the role of experienced advisors in navigating these complexities. As a leading capital advisory firm, we leverage our extensive network of over 4,000 institutional investors and $24.4 billion in aggregate transaction volume to connect sellers with qualified buyers. Our full-cycle services, including mergers and acquisitions advisory and strategic documentation, provide the expertise needed for personalized guidance tailored to your goals.

Looking ahead, the sale opens doors to new opportunities, such as pursuing fresh ventures or enjoying well-earned retirement. We recommend consulting resources like the SBA guide for post-transaction planning, which offers practical tips for owners transitioning out of their businesses. With the right support, this chapter’s end becomes the start of an exciting next phase.