Technology Investment Banking Services

Table of Contents

Understanding Technology Investment Banking Services

In the fast-paced world of innovation, Technology Investment Banking Services play a pivotal role in guiding tech startups and scaling companies through complex financial landscapes. These specialized advisory offerings focus on mergers and acquisitions, capital raising, and due diligence tailored to the technology sector’s unique demands, such as rapid innovation cycles and scalable funding requirements. At Zaidwood Capital, we provide tech-focused financial advisory as a Technology Investment Bank to help firms navigate these challenges effectively.

We at Zaidwood Capital specialize in full-cycle M&A and capital advisory, delivering buy-side and sell-side mandates, equity and debt advisory, and comprehensive due diligence. Our expertise spans innovation sector financing, including connections to venture capital for early-stage growth and private equity for mature expansions. With over 24.4 billion USD in transaction volume and more than 300 completed deals, we have advised on tech transactions like AI startup acquisitions and SaaS platform mergers, ensuring clients access our network of over 4,000 institutional investors and more than 15 billion USD in deployable capital.

Investment banks vary by type, each suited to different client needs. Boutique firms like ours offer niche expertise, while bulge bracket banks handle massive global deals, and middle-market players focus on regional mid-sized transactions. The following table compares these firm types across key attributes:

| Firm Type | Boutique | Bulge Bracket | Middle Market |

|---|---|---|---|

| Personalization Level | High: Hands-on, tailored relationships | Medium: Standardized processes for large clients | Medium-High: Customized for mid-sized firms |

| Sector Expertise | Deep: Niche focus on tech and innovation | Broad: Across multiple industries | Specialized: Regional sectors with tech emphasis |

| Deal Size Focus | Mid to small: Flexible for startups | Large: Multi-billion deals for corporations | Mid-sized: $50M to $500M transactions |

| Speed of Execution | Fast: Agile decision-making | Slower: Bureaucratic layers | Moderate: Balanced efficiency |

This comparison highlights boutique advantages for technology firms, where high personalization and deep sector expertise enable faster execution in competitive markets, as seen in middle-market successes with tech deals. Unlike bulge bracket firms’ broad scope, boutiques like Zaidwood provide agile support for dynamic needs.

Upcoming sections will explore core principles of tech financing, capital raising options including venture capital pathways, and strategies for leveraging investor networks to drive growth.

Core Principles of Technology Investment Banking

At Zaidwood Capital, we specialize in Technology Investment Banking Services that empower innovative companies to navigate complex financial landscapes. These core principles form the bedrock of our approach, encompassing mergers and acquisitions, capital raising, and strategic advisory tailored to the fast-paced tech sector. Our full-cycle services ensure seamless support from ideation to execution, drawing on over 300 completed deals and access to more than $15 billion in deployable capital. By understanding these fundamentals, tech entrepreneurs can strategically position their firms for sustainable growth and market leadership.

Mergers and acquisitions represent a cornerstone of technology investment banking, enabling firms to consolidate strengths and accelerate expansion. We guide clients through valuation methods essential for tech assets, such as discounted cash flow (DCF) analysis, which projects future revenues from software subscriptions, and comparables, benchmarking against recent Tech Mergers And Acquisitions deals in similar sectors. Intellectual property valuation is particularly critical, assessing patents and algorithms that drive competitive edges. Initial due diligence involves reviewing financials, legal structures, and operational synergies to mitigate risks early. Our experience at Zaidwood demonstrates how these steps facilitate smooth transactions, as seen in deals involving SaaS platforms and AI innovators.

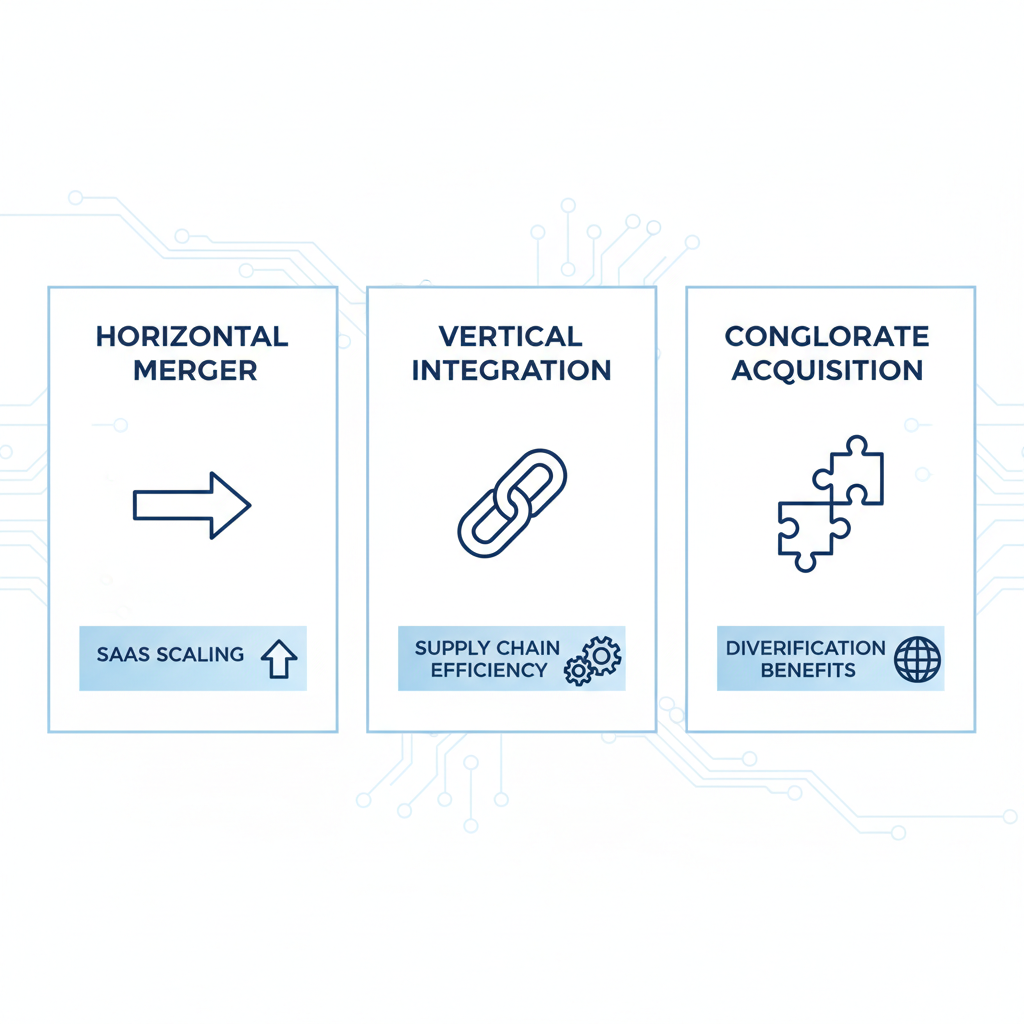

| M&A Type | Description | Suitability for Tech Startups | Examples |

|---|---|---|---|

| Horizontal Merger | Combining similar tech firms to expand market share. | High for scaling SaaS platforms. | Salesforce acquiring Slack. |

| Vertical Integration | Acquiring supply chain partners in tech ecosystem. | Ideal for hardware-software synergies. | Intel buying Mobileye. |

| Conglomerate Acquisition | Diversifying into unrelated tech verticals. | Suitable for portfolio diversification. Medium for emerging tech like AI. | Google acquiring Fitbit. |

This comparison, informed by established M&A frameworks, illustrates how horizontal mergers boost immediate scale while vertical integrations secure supply chains vital for hardware-dependent tech. Conglomerate approaches, though less common in pure tech, aid diversification amid market volatility. For startups, selecting the right type hinges on growth stage and risk tolerance, with our advisory ensuring alignment to maximize value creation without overextension.

Capital raising mechanisms further underpin these principles, offering diverse pathways for tech companies at various stages. Early-stage ventures often pursue venture capital to fuel product development and market entry, providing not just funds but strategic partnerships. As firms mature, private equity injections support scaling operations and international expansion. We at Zaidwood excel in structuring mezzanine and venture debt, blending equity-like flexibility with debt efficiency to minimize dilution. These options address common queries on funding paths, from seed rounds to growth equity, always emphasizing tech-specific metrics like user acquisition costs and recurring revenue.

Advisory roles in deal sourcing and negotiation complete the foundational toolkit, where we connect clients to our network of 4,000 institutional investors. Numbered steps in our process include: 1) Identifying targets via proprietary data; 2) Conducting preliminary valuations; 3) Negotiating terms with fairness opinions; and 4) Overseeing closing with full-cycle due diligence. This structured guidance demystifies innovation financing basics, much like guiding a startup through funding rounds as seasons of growth.

M&A strategies visualization for technology investment banking

Our foundational principles lay the groundwork for deeper strategies in tech M&A advisory. As deals grow more intricate with AI and blockchain integrations, exploring advanced tactics becomes essential for sustained competitive advantage.

In-Depth Exploration of M&A and Capital Strategies

Due Diligence in Technology Deals

In the realm of technology investment banking services, due diligence forms the cornerstone of successful M&A transactions, particularly for tech firms where rapid innovation and regulatory complexities amplify risks. We at Zaidwood Capital emphasize a full-cycle process that spans preliminary assessments to confirmatory reviews, tailored to the unique challenges of software, fintech, and deep tech sectors. This involves scrutinizing codebases for vulnerabilities, validating intellectual property ownership, and evaluating scalability potential to ensure transactions withstand market volatility.

| Component | Focus Areas | Importance for Tech | Zaidwood Approach |

|---|---|---|---|

| Financial | Revenue models, burn rate | High due to valuation volatility | Integrated financial-legal review with full-cycle support from 300+ deals |

| Legal | IP patents, contracts | Critical for protecting innovations | Proprietary tools for IP assessment |

| Operational | Scalability, tech stack | Essential for compliance in SaaS and key for growth projections | Operational audits via partner networks |

This structured approach not only mitigates risks but also uncovers hidden value in tech assets. Drawing from FINRA guidelines on fintech diligence, we prioritize compliance in areas like cybersecurity and data privacy, where tech firms face heightened scrutiny. For instance, in a recent anonymized SaaS deal, our team identified contractual gaps that could have led to post-merger disputes, allowing the client to renegotiate terms proactively.

To optimize outcomes, conduct preliminary diligence early to inform valuation models, and engage cross-functional experts for confirmatory phases. This layered strategy ensures thorough coverage, reducing surprises in high-stakes tech transactions.

Investor Network Access and Introductions

Accessing robust investor networks is vital for tech companies seeking growth capital, and investment banks like ours facilitate seamless connections to expand opportunities. We leverage our extensive relationships to introduce clients to over 4,000 institutional players, including venture capital firms focused on innovative startups and established tech scalers.

This process begins with a tailored pitch deck review, followed by targeted introductions that align client profiles with investor mandates. For example, we recently connected a fintech startup to a venture capital fund specializing in RegTech, resulting in a strategic partnership that accelerated product development without diluting equity excessively.

Our tips for effective networking include preparing data room access in advance and following up with customized updates to maintain momentum. By bridging these gaps, we enable tech clients to tap into deployable capital efficiently, fostering sustainable expansion.

Structuring Complex Tech Financings

Structuring financings for scaling technology companies demands flexibility to balance growth needs with risk profiles, often blending debt and equity instruments. At Zaidwood Capital, our zaidwood capital advisory services excel in crafting mezzanine debt layers that provide bridge funding between equity rounds, alongside equity placements that support long-term value creation. These sector-specific capital strategies address the volatility of tech valuations while enabling rapid deployment of resources for R&D and market entry.

We guide clients through venture debt terms, such as warrants and interest rates typically ranging from 8-12%, which offer non-dilutive capital ideal for pre-revenue deep tech advisory scenarios. In private equity contexts, we structure growth equity infusions that include milestone-based tranches to align incentives. An anonymized example involved layering mezzanine facilities atop existing equity for a cloud computing firm, unlocking $50M in expansion capital while preserving founder control.

| Financing Type | Key Structure Elements | Pros for Tech Companies | Zaidwood Approach |

|---|---|---|---|

| Mezzanine Debt | Subordinated loans with equity kickers | Non-dilutive, flexible repayment | Customized terms integrated with $15B+ capital access |

| Venture Debt | Short-term loans tied to milestones | Quick funding without board seats | FINRA-compliant structuring for fintech scalability |

| Growth Equity | Minority stakes with governance rights | Patient capital for R&D-intensive growth | Placement via 4,000+ investor network |

| Liquidity Solutions | Secondary sales or buybacks | Founder exits with minimal disruption | Advisory on tax-efficient structures from 24.4B USD volume |

Interpreting these options, debt suits bootstrapped phases with lower immediate ownership loss, while equity thrives in high-growth trajectories demanding strategic input. Referencing FINRA’s emphasis on transparent disclosures in innovative financings, we ensure all structures comply with evolving regulations, mitigating compliance risks in AI and blockchain deals.

Practical tips include modeling cash flow scenarios to select the optimal mix and negotiating covenants that preserve operational autonomy. This comprehensive structuring not only fuels innovation but also positions tech firms for future M&A liquidity events. By integrating financial modeling with investor insights, we streamline executions, as seen in deals where hybrid models reduced effective cost of capital by up to 20%. Our full-cycle support, from term sheet drafting to closing documentation, underscores our commitment to precision in complex tech financings.

Applying Investment Banking to Tech Growth

At Zaidwood Capital, we apply our expertise in technology investment banking services to help tech companies navigate critical growth phases. Our full-cycle M&A and capital advisory approach ensures clients secure the right partnerships and funding to scale effectively. Drawing from over 300 completed deals and access to more than $15 billion in deployable capital, we guide startups and established firms through complex financial landscapes.

Facilitating M&A for Startups

Technology investment banking services play a pivotal role in streamlining mergers for early-stage tech companies. We guide clients through essential steps, starting with target identification to pinpoint strategic fits that align with business objectives. This involves market analysis and due diligence to evaluate synergies in areas like software integration or market expansion.

Negotiation follows, where we structure deals to protect client interests, often incorporating earn-outs for performance-based payouts. For instance, a SaaS startup we advised acquired a complementary AI tool developer, boosting their product suite and revenue by 40% within a year. Documentation such as pro forma financials and strategic plans forms the backbone, ensuring compliance with US regulatory nuances like antitrust reviews.

Our startup acquisition support includes capital introductions to over 4,000 institutional investors, facilitating smoother transactions. This hands-on involvement minimizes risks and accelerates growth funding mechanisms for innovative ventures in the US market.

Venture Capital Fundraising Strategies

Securing zaidwood capital capital formation is crucial for technology companies pursuing rapid expansion. Venture capital funding works by providing equity investments to early-stage firms with high growth potential, often in exchange for ownership stakes and board influence. In the US, this process emphasizes scalable business models and strong intellectual property, as highlighted in industry resources on deal structuring.

Practical steps begin with pitch deck preparation, outlining market opportunity, traction metrics, and financial projections. We recommend including visuals on user growth and revenue forecasts to demonstrate viability. Next, practice verbal delivery to convey passion and address investor queries on risks and exit strategies.

| Pitch Element | Deck Pitch | Verbal Pitch |

|---|---|---|

| Preparation Time | 2-4 weeks for design and data | 1-2 weeks for scripting and rehearsal |

| Content Focus | Visual data, metrics, timelines | Storytelling, team dynamics, Q&A handling |

| Engagement Level | Static slides for review | Interactive discussion for rapport |

| Typical Outcome | Initial interest and follow-ups | Term sheet negotiations or passes |

This table illustrates how combining deck and verbal elements maximizes investor appeal, drawing from guidelines on venture capital forms and analysis. A checklist for success includes: 1) Tailor the deck to investor preferences; 2) Rehearse responses to due diligence questions; 3) Highlight US market traction with metrics like monthly active users.

For example, we assisted a fintech startup in pitching to US-based funds, resulting in $5 million in seed funding. How to pitch to venture capital investors in the US involves networking at events and leveraging warm introductions, ensuring alignment with fund theses on tech innovation. Our network streamlines this, connecting clients to venture capital opportunities without guarantees of outcomes.

This website is for informational purposes only and is not an offer, solicitation, recommendation, or commitment to transact. Not investment advice–consult your legal, tax, and financial advisors before making decisions.

Private Equity for Scaling Firms

Private equity investments in tech companies focus on mature firms ready for operational enhancements and exits. We provide advisory on valuation methods, such as discounted cash flow models, to maximize liquidity during buyouts or recapitalizations. Implementation involves structuring deals with covenants to align incentives, informed by academic insights on fund operations and regulatory frameworks like the Dodd-Frank Act.

Key steps include assessing scalability through due diligence on revenue streams and tech infrastructure. For scaling tech firms, private equity funding options emphasize leverage for acquisitions, differing from earlier-stage equity. Zaidwood’s role includes preparing fairness opinions and facilitating introductions to family offices and sovereign wealth funds.

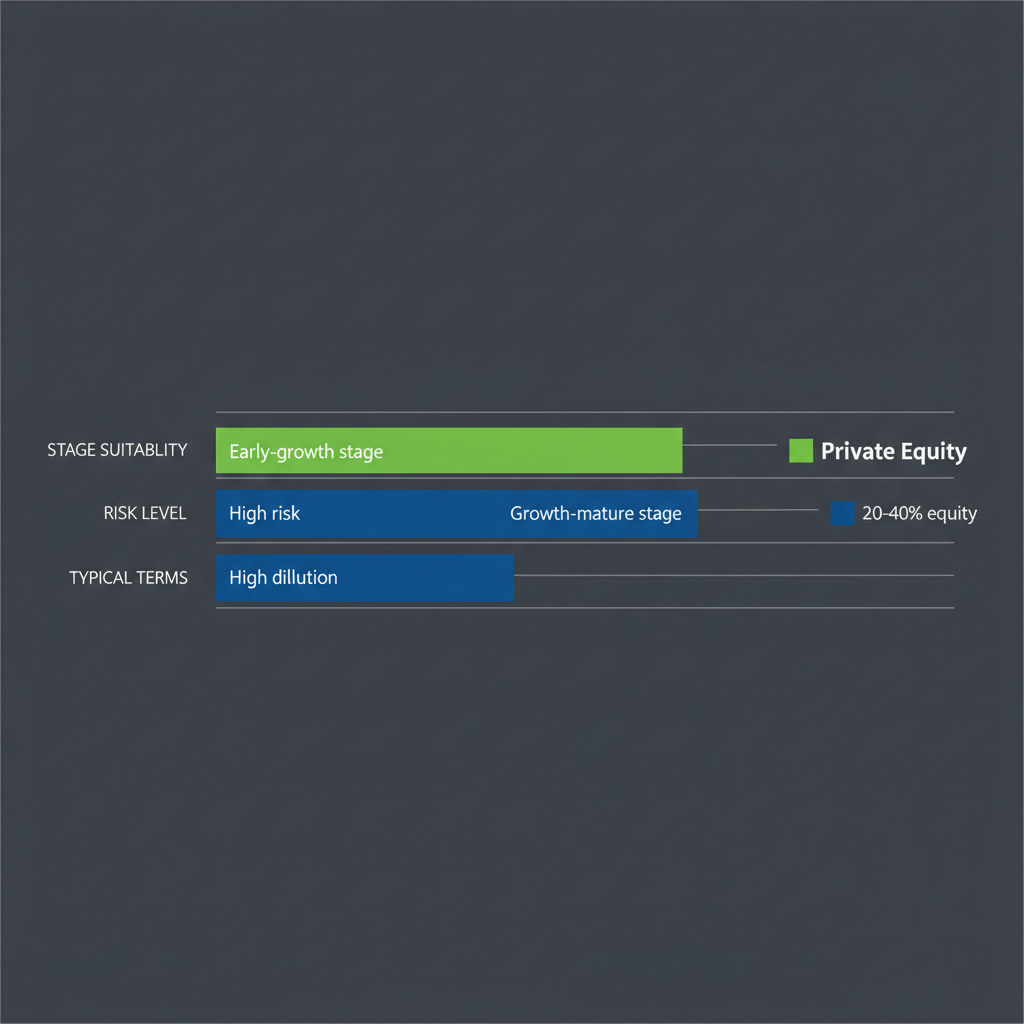

When choosing between funding sources, factors like company maturity and risk tolerance guide decisions. The following table compares venture capital and private equity:

| Option | Stage Suitability | Risk Level | Typical Terms |

|---|---|---|---|

| Venture Capital | Early to growth stage | High equity dilution | 5-10% equity, board seats |

| Private Equity | Later growth to maturity | Moderate leverage | 20-40% equity, covenants |

As shown, venture capital suits innovative startups with high dilution tolerance, while private equity fits established entities seeking structured growth, per Harvard guides on private equity trends. Supporting data from industry deals underscores these differences, with Zaidwood navigating clients through selection to optimize terms. For instance, we advised a cybersecurity firm on a $50 million private equity infusion for international expansion, enhancing value through strategic add-ons.

Comparison of VC and PE funding for tech growth stages and terms

Our precision catalyst approach ensures tailored liquidity solutions, balancing education on growth funding mechanisms with practical execution. Investments involve risk; past performance does not guarantee future results.

Building on these comparisons, tech leaders can leverage private equity for sustainable scaling, positioning for future IPOs or strategic sales in the evolving US landscape.

Advanced Strategies in Tech Investment Banking

In the evolving landscape of Technology Investment Banking Services, advanced strategies focus on navigating complex funding dynamics for tech firms. Emerging trends in venture capital highlight increased allocations to AI and fintech by 2026, with investors prioritizing scalable SaaS platforms featuring favorable terms like milestone-based funding. Private equity firms are specializing in technology M&A, targeting software and hardware sectors for mature exits. These developments demand sophisticated approaches to risk assessment and deal structuring.

Key trends include:

– Surging AI investments, projected to capture 40% of VC dollars, driven by generative models and data infrastructure needs.

– Fintech innovations in blockchain and embedded finance, emphasizing regulatory-compliant scalability.

– Advanced tech financing through hybrid instruments, blending equity with structured debt for growth-stage companies.

Transitioning to funding differences, private equity and venture capital diverge significantly in risk profiles, terms, and exit mechanisms, particularly for tech scalability. Private equity often involves higher leverage and operational oversight, suiting established tech entities, while venture capital supports early-stage innovation with flexible governance. Understanding these nuances aids in selecting optimal paths for emerging sector investments.

| Aspect | Private Equity | Venture Capital | Tech Implications |

|---|---|---|---|

| Exit Timeline | 3-7 years. | 2-5 years. | Faster for high-growth tech. |

| Control Level | Majority stakes, operational input. | Minority, advisory roles. | Preserves founder autonomy in startups. |

| Exit Strategy | Preferred for mature SaaS exits. | Ideal for AI venture flips. | Tailors to scalability stage. |

As noted in the CFA Institute’s guide on PE exits, strategic buyers must scrutinize adjusted metrics like EBITDA to uncover hidden risks, such as deferred capex or sale-leaseback obligations, which are more prevalent in PE structures. For tech firms, this implies VC’s quicker timelines enable rapid pivots in volatile markets, whereas PE’s longer horizons support sustained hardware integrations. Based on our 24.4B USD aggregate transaction volume, these distinctions influence deal success rates by up to 25% in software sectors.

To further illustrate, consider covenants: VC agreements typically feature anti-dilution protections and liquidation preferences, fostering innovation without stringent financial hurdles. In contrast, PE covenants enforce debt service coverage ratios and capex restrictions, ensuring stability in mature operations. Drawing from our expertise in advanced structures, Zaidwood’s zaidwood debt advisory services integrate mezzanine and venture debt to bridge these gaps, optimizing exits for AI and SaaS clients. Our network of over 4,000 investors facilitates tailored introductions, enhancing liquidity solutions for high-growth tech mandates.

| Aspect | Venture Capital Terms | Private Equity Covenants |

|---|---|---|

| Financial Hurdles | Liquidation preferences, conversion rights. | Debt covenants, EBITDA multiples. |

| Flexibility | High for pivots. | Moderate, operational controls. |

This comparative framework empowers tech leaders to align financing with strategic goals, mitigating risks while maximizing value in dynamic markets.

Common Questions on Technology Investment Banking

Technology Investment Banking Services often raise questions about financing tech ventures. Here are key tech funding FAQs addressed through sector-specific Q&A.

What are the best venture capital firms for tech startups?

Leading US venture capital firms prioritize scalable models in AI and fintech, offering strategic guidance without direct competition comparisons.

How does venture capital funding work for technology companies?

We often advise that venture capital funding involves pitching ideas, securing seed rounds, and scaling through series A to C, with equity exchanged for capital.

What are typical venture capital terms for SaaS startups?

SaaS startups face terms like 20-30% equity dilution per round, milestone-based tranches, and liquidation preferences to align investor-startup interests.

How does private equity differ from venture capital in tech?

Private equity focuses on mature tech firms for growth capital or buyouts, unlike venture capital’s early-stage risk-taking for high-potential startups.

What role does private equity play in tech exits?

Private equity advisory services facilitate exits via mergers or IPOs, providing zaidwood capital m and a services for due diligence and valuation.

How to pitch tech ideas to investors in the US?

Craft concise decks highlighting traction, market size, and AI/fintech trends; we recommend tailoring to US investor preferences for quick, data-driven decisions.

Navigating Tech Investment Opportunities

In the realm of Technology Investment Banking Services, Zaidwood Capital excels as a boutique advisory firm, delivering full-cycle M&A support, capital raising through venture capital and private equity channels, and meticulous due diligence for tech enterprises. Our extensive network of over 4,000 institutional investors, backed by more than $15 billion in deployable capital, empowers clients with unparalleled access and expertise to navigate complex deals efficiently.

Applying these insights equips you with tech advisory essentials for strategic decision-making. At Zaidwood, we invite you to explore our services for personalized guidance, fostering informed paths forward without any commitments. This guide reinforces the foundational knowledge needed to thrive in dynamic tech investment landscapes.