What is Series C Funding

Table of Contents

Understanding Series C Funding

What is Series C Funding? It represents a pivotal late-stage venture capital round where established startups secure substantial capital to accelerate growth after proving their concepts in earlier stages.

Series C funding typically follows successful Series A and B rounds, targeting companies with proven revenue models and market traction. At this scaling investment round, startups often raise between $50 million and $100 million to pursue objectives like geographic expansion, product diversification, and team building. According to SEC resources on early-stage investors, venture capital funds play a key role here, with approximately 422,350 active angel investors in the U.S. contributing to the diversity of funding sources as companies mature. This stage emphasizes sustainable scaling over initial validation.

We at Zaidwood Capital support companies navigating Series C by leveraging our expertise in capital formation and connecting them to our network of over 4,000 institutional investors, facilitating access to more than $15 billion in deployable capital.

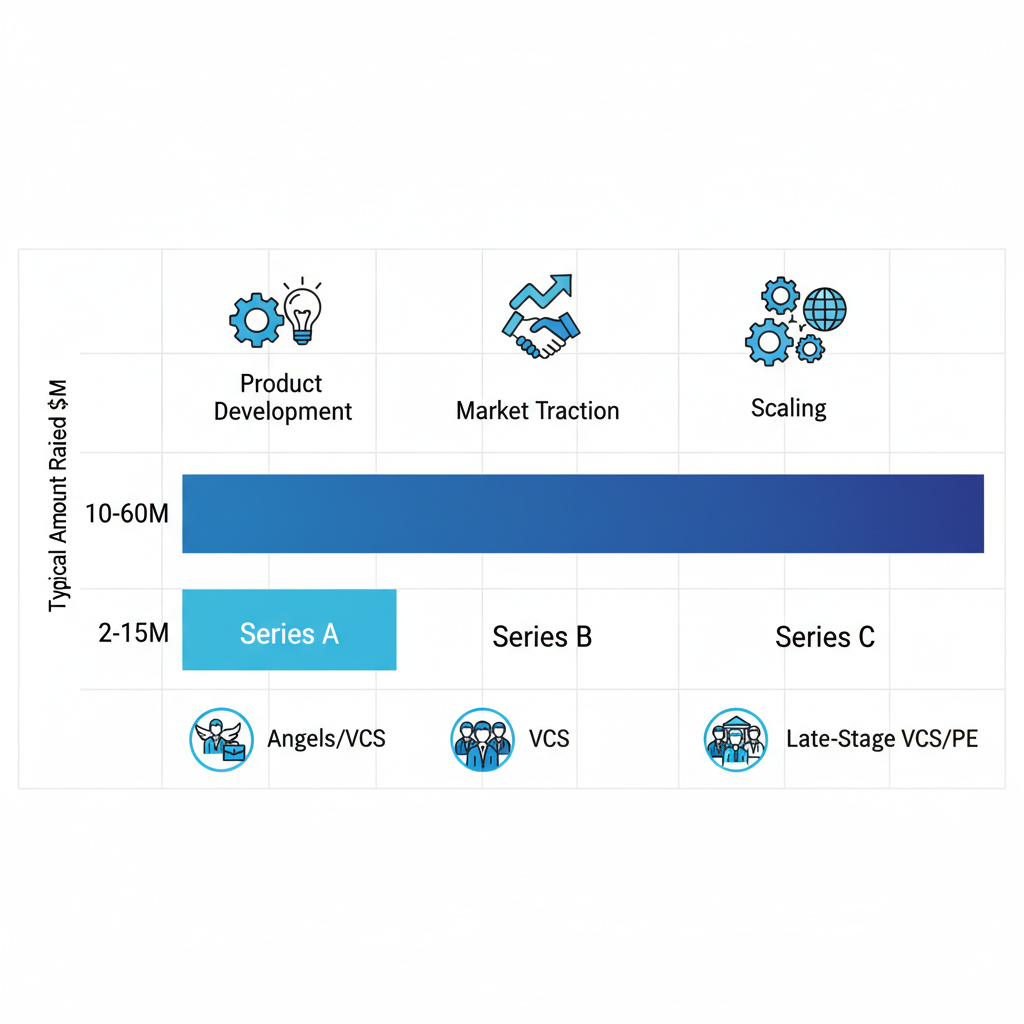

Funding stages evolve progressively, building on prior successes to address growing complexities. The differences between series a b c funding lie in their focus, from ideation to expansion.

| Funding Stage | Primary Focus | Typical Amount Raised | Investor Types |

|---|---|---|---|

| Series A | Product development | $2-15M | Angels/VCs |

| Series B | Market traction | $10-60M | VCs |

| Series C | Scaling | $50-100M+ | Late-stage VCs/PE |

Series C builds on the foundations of Series A and B by enabling mature companies to dominate markets, as seen in firms like Airbnb, which scaled globally post- Series C to achieve unicorn status. This progression highlights series c funding requirements, such as demonstrated profitability paths and robust governance, setting the stage for even larger rounds or exits.

The following visual further illustrates these dynamics, underscoring investor shifts toward institutional players for high-growth phases. Understanding this evolution equips founders to prepare strategically.

Comparison of funding stages from Series A to C with investor insights

As we delve deeper into Series C mechanics, explore how tailored advisory can optimize your path forward.

Fundamentals of Series C Funding

What is Series C Funding? It represents a pivotal stage in a startup’s journey, providing growth-stage capital to companies that have validated their business models and achieved significant traction. At this late-round investment phase, Series C Funding enables proven enterprises to scale operations aggressively, often after securing earlier rounds like Series A and B. Unlike initial funding focused on ideation, this stage targets mature companies ready for expansion, such as entering new markets or enhancing product lines.

Typically occurring 2-5 years post-founding, Series C rounds align with businesses demonstrating strong revenue growth and market dominance. According to insights from the Innovation Maryland Fundraising Playbook, founders who have reached product-market fit face heightened investor scrutiny, emphasizing sustainable scaling over mere survival. Valuation at this juncture often exceeds $100 million, determined through revenue multiples commonly 5-10x annual recurring revenue or comparable exits in the sector. For instance, a SaaS company with $20 million in revenue might command a $200 million valuation based on industry benchmarks. Raise sizes generally start at $50 million, with equity dilution ranging from 10-20%, reflecting the company’s reduced need for capital intensity compared to earlier stages.

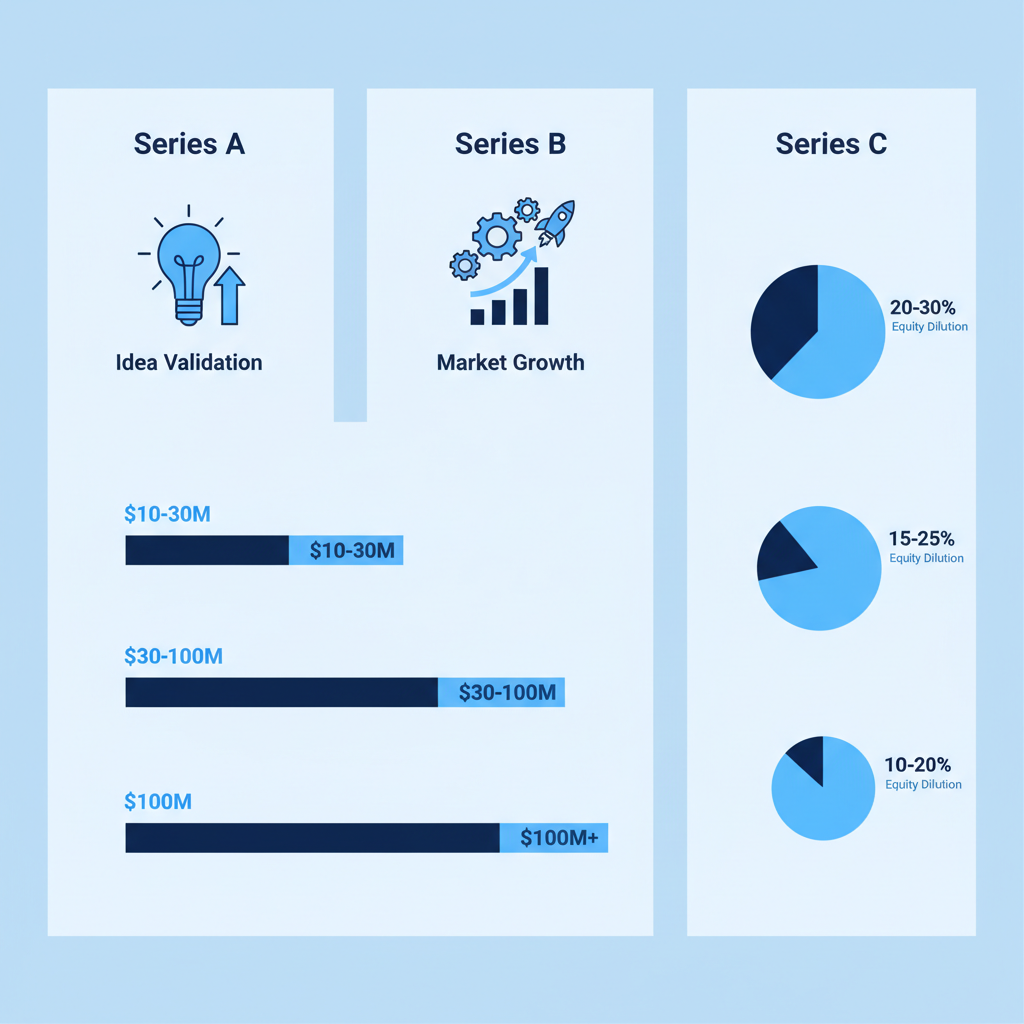

To illustrate the differences between series a b c funding, consider how each round builds on the last. The following table serves as a visual aid, drawing from SEC filings and industry standards to compare key aspects:

| Aspect | Series A | Series B | Series C |

|---|---|---|---|

| Focus | Idea validation | Market growth | Scaling operations |

| Valuation | $10-30M | $30-100M | $100M+ |

| Equity Dilution | 20-30% | 15-25% | 10-20% |

Data sourced from SEC and industry benchmarks for educational purposes. This comparison underscores Series C’s unique position, requiring greater maturity and proven metrics, such as consistent profitability paths, to attract institutional backers. As the Fundraising Playbook notes, successful Series C candidates often present robust financial projections and strategic roadmaps, distinguishing them from earlier rounds’ emphasis on potential.

Series C funding requirements further emphasize operational readiness, including detailed pitch decks, audited financials, and clear use-of-funds plans. Common applications involve international expansion, acquisitions, or R&D acceleration, all aimed at accelerating growth while mitigating risks. Investors at this level, including venture capital firms and private equity players, expect detailed due diligence and alignment with long-term exit strategies.

Series C funding essentials versus Series A and B rounds

At Zaidwood Capital, we provide tailored capital formation services to guide companies through these complexities. Our expertise in equity advisory and investor introductions helps navigate series c funding requirements, leveraging our network of over 4,000 institutional investors to secure optimal terms. We assist with crafting compelling documentation and structuring deals that minimize dilution while maximizing growth potential. This website is for informational purposes only and is not an offer, solicitation, recommendation, or commitment to transact. Not investment advice consult your legal, tax, and financial advisors before making decisions.

In-Depth Analysis of Series C Funding

At Zaidwood Capital, we guide companies through the complexities of advanced funding stages, where Series C represents a pivotal moment for scaling operations globally. What is Series C Funding often involves substantial capital infusions to fuel expansion beyond initial market validation. Our expertise in equity advisory helps startups navigate these waters, leveraging our network of over 4,000 institutional investors to secure optimal terms.

Investor Landscape and Equity Dynamics

Series C funding attracts a sophisticated investor base, shifting from early-stage venture capitalists to private equity firms, hedge funds, and global scaling partners. These investors prioritize proven traction and robust growth trajectories, often participating in investor syndication to spread risk while maximizing returns. For instance, private equity firms seek opportunities in mature startups with diversified revenue streams, as seen in recent trends where Series C rounds in Europe surged by 140% in operation numbers during Q1 2025, according to Fundacion Bankinter reports.

Equity dynamics in Series C typically involve dilution strategies that balance founder control with capital needs. Startups commonly relinquish 10-20% equity, a reduction from earlier rounds due to higher valuations averaging $100 million or more. This structure allows for aggressive expansion without excessive ownership loss. Valuation impacts are profound, as strong performance metrics like $10 million+ in annual recurring revenue (ARR) command premiums, enabling companies to retain more equity. At Zaidwood Capital, our capital formation services connect clients to these investors, facilitating deals that align with long-term strategic goals. An anonymized case involved a logistics firm raising $75 million at a $400 million valuation, preserving 85% founder equity through targeted syndication.

In addressing who invests in Series C funding and how to connect with them, our investor network streamlines introductions, ensuring alignment on equity terms and growth expectations. This approach not only secures funding but also builds lasting partnerships for future rounds.

Differences from Series B

Understanding the differences between series a b c funding reveals a clear evolution: Series B focuses on validating product-market fit and achieving initial traction, while Series C emphasizes hyper-scaling operations, international expansion, and infrastructure buildout. Series B rounds, typically $10-60 million, target growth validation with 15-25% equity ceded to VCs and angels. In contrast, Series C demands demonstrated scalability, with revenue benchmarks exceeding $10 million ARR to attract larger commitments.

| Criteria | Series B | Series C |

|---|---|---|

| Investor Types | VCs, Angels | PE, Hedge Funds, Global VCs |

| Amount Raised | $10-60M | $50-100M+ |

| Equity Given Up | 15-25% | 10-20% |

| Revenue Needed | $1-10M ARR | $10M+ ARR |

This comparison, informed by Financial Professionals’ insights on performance measurement, underscores how Series C shifts investor expectations toward sustainable profitability over mere growth. Implications are significant: higher stakes demand rigorous due diligence, but successful navigation can propel valuations 2-3x higher than Series B outcomes. For companies transitioning stages, these differences highlight the need for refined strategies, where Zaidwood Capital’s advisory ensures seamless progression from traction to dominance.

Documentation and Preparation Essentials

Meeting series c funding requirements starts with meticulous documentation, including pitch decks, pro forma financials, and comprehensive due diligence reports. Investors expect detailed growth metrics, such as customer acquisition costs and lifetime value projections, alongside audited financials to assess scalability. Revenue benchmarks like $10M+ ARR are non-negotiable, as highlighted in Fundacion Bankinter’s analysis of maturing investment trends.

Preparation involves outlining strategic roadmaps that demonstrate market leadership potential. Advisory firms like ours at Zaidwood Capital streamline these processes through full-cycle due diligence, integrating financial, operational, and commercial reviews. Our debt advisory services complement equity raises by structuring hybrid financing, reducing overall dilution.

| Document | Purpose | Zaidwood Support |

|---|---|---|

| Pitch Deck | Articulate vision and traction | Customized narratives with investor data |

| Pro Formas | Forecast revenues and scaling needs | Advanced modeling for accuracy |

| Due Diligence | Validate claims and mitigate risks | Full-cycle reviews with accountability metrics |

Drawing from Financial Professionals’ case studies, embedding performance reviews early enhances investor confidence, as one e-commerce client discovered when building FP&A functions pre-funding. What do investors expect from companies seeking Series C funding? Primarily, transparency and preparedness that our strategic documentation services provide, teasing practical applications in subsequent execution phases.

Practical Steps for Securing Series C Funding

Securing Series C funding marks a pivotal growth phase for startups, building on earlier rounds to scale operations and expand market presence. At Zaidwood Capital, we guide clients through this complex process, ensuring they meet key benchmarks and leverage our expertise in capital formation. This section outlines practical steps, from preparation to closing the deal, drawing on regulatory insights and proven fundraising strategies.

Preparing Your Company for Series C

To succeed in funding preparation, startups must demonstrate robust traction and scalability, addressing series c funding requirements head-on. First, evaluate revenue benchmarks: aim for at least $10 million in annual recurring revenue (ARR), supported by consistent growth rates of 100-200% year-over-year. According to SEC guidelines on early-stage financing, this level of maturity distinguishes later-stage rounds from initial ones. Second, assemble comprehensive documentation, including audited financial statements, detailed business plans, and pro forma projections that outline multi-year strategies.

Third, conduct internal due diligence to identify risks, such as operational inefficiencies or compliance gaps. We recommend engaging third-party auditors to validate financials, ensuring transparency that investors demand. Finally, refine your pitch deck to highlight unit economics, customer acquisition costs, and lifetime value metrics, aligning with series c funding requirements for data-driven narratives.

| Requirement | Series A/B | Series C |

|---|---|---|

| Revenue Benchmark | Pre-revenue to $5M | $10M+ ARR (full audits) |

| Documentation | Basic pitch | Detailed financials |

| Investor Engagement | Cold outreach | Network leverage (PE/hedge focus) |

Engaging Investors and Negotiating Terms

Effective investor outreach tactics begin with targeted networking, leveraging warm introductions over cold emails to access private equity and hedge funds typical at this stage. From the Fundraising Playbook insights, founders should prioritize building relationships through industry events and mutual connections, tailoring pitches to emphasize scalable growth and exit potential. Schedule one-on-one meetings with 20-30 qualified investors, presenting a clear value proposition backed by metrics like market share gains.

Once interest is secured, negotiation focuses on terms such as valuation, liquidation preferences, and board seats. Aim for a pre-money valuation of $100-500 million, supported by comparable transactions and fairness opinions. We advise using data rooms for secure document sharing, facilitating efficient reviews. Key steps include: 1) Reviewing term sheets for anti-dilution protections; 2) Engaging legal counsel early to avoid missteps; 3) Iterating on offers to balance control and capital infusion.

Post-negotiation, finalize governance agreements and conduct closing due diligence. Drawing from SEC resources, ensure all offerings comply with securities regulations, such as exemptions for accredited investors. This structured approach minimizes risks and maximizes funding efficiency, setting the foundation for accelerated expansion.

| Investor Type | Series A/B Characteristics | Series C Focus |

|---|---|---|

| Angels/VCs | $1-15M deals, equity focus | Scaled PE/hedge, $20M+ |

| Involvement | Advisory roles | Strategic partnerships |

Leveraging Advisory Services

At Zaidwood Capital, we provide essential support throughout the Series C journey, from initial assessments to deal execution. Our M&A capital advisory expertise includes crafting pitch decks, business plans, and pro forma financials tailored to investor expectations. We assist with fairness opinions and transaction advisory, ensuring regulatory compliance as outlined in SEC guidelines.

Key benefits include access to our proprietary investor network, facilitating high-impact introductions that accelerate timelines. Unlike generic consultants, we offer full-cycle due diligence covering financial, legal, and operational aspects, mitigating risks in complex negotiations. Clients benefit from our $24.4 billion aggregate transaction volume, drawing on strategies from the Fundraising Playbook for pitch refinement and term sheet navigation.

We streamline the process with strategic financial consulting, helping define post-raise milestones like international expansion or acquisitions. This integrated approach empowers startups to secure optimal terms without over-dilution.

Advanced Strategies in Series C Funding

At Zaidwood Capital, we recognize that Series C funding represents a pivotal stage where companies shift from survival to dominance, focusing intensely on scaling operations compared to the product-market fit emphasis in earlier rounds like Series A and B. What is Series C Funding? It typically requires demonstrating robust revenue streams, often in the range of $50 million to $100 million annually, to attract investors seeking proven growth trajectories. These series c funding requirements underscore the need for advanced strategies that optimize capital deployment while mitigating expansion risks.

| Strategy | Focus | Risks |

|---|---|---|

| M&A Integration | Acquisitions for scale | Market entry challenges: Dilution control |

| Debt-Equity Mix | Hybrid financing | Interest rate exposure: Investor alignment |

Beyond M&A, hybrid capital structures offer flexibility by blending debt and equity, allowing firms to leverage non-dilutive financing for aggressive expansions. Post-raise governance becomes crucial, with enhanced financial planning and analysis (FP&A) functions driving accountability through metrics like variance analysis and cross-functional reviews. Risks such as equity dilution from over-reliance on acquisitions or integration failures can erode investor confidence if not managed proactively. Interest rate volatility in debt components further complicates alignment with long-term goals, necessitating robust forecasting to navigate economic shifts.

We at Zaidwood Capital bring our $24.4 billion in aggregate transaction experience to guide clients through these complexities, providing full-cycle due diligence, equity advisory, and strategic documentation. Our boutique M&A advisory services ensure seamless execution, connecting you to over 4,000 institutional investors for optimized outcomes in this high-stakes phase.

Frequently Asked Questions on Series C Funding

What is Series C Funding? Series C funding represents a mature stage where startups seek substantial capital to scale operations, expand markets, or pursue acquisitions. Typically involving venture capital firms and private equity, it follows successful Series A and B rounds, with amounts often exceeding $20 million. At Zaidwood Capital, we guide clients through this pivotal phase.

What are the key differences between Series A, B, and C funding? The differences between series a b c funding lie in maturity and goals: Series A focuses on product development and market fit ($2-15 million); Series B emphasizes growth and scaling ($10-50 million); Series C targets expansion, international reach, or exits ($50 million+). Recent trends show rising Series C activity, as seen in Spain’s 140% increase in such rounds in Q1 2025.

What are series c funding requirements? Series c funding requirements include proven revenue, strong market traction, and a scalable business model. Investors prioritize metrics like user growth and profitability paths, often requiring valuations over $100 million. We at Zaidwood assess these to connect you with our network of 4,000+ investors.

How can Zaidwood assist with Series C? Our full-cycle advisory streamlines Series C processes, from due diligence to capital introductions. With $24.4B in transaction volume, we help navigate this FAQ on scaling rounds efficiently.

Navigating Series C Funding with Expert Guidance

What is Series C Funding represents a pivotal stage for companies seeking substantial capital to scale operations beyond initial market validation. Following Series A and B, it enables expansion into new markets, product diversification, and team growth, typically attracting venture capital firms with proven revenue streams. These rounds bridge the gap toward profitability or exit strategies.

At Zaidwood Capital, we provide expert scaling support through our comprehensive capital formation services, guiding clients through complex funding landscapes. Explore how our advisory can optimize your path forward. Meeting series c funding requirements demands strategic preparation; with our insights, your venture positions for sustained growth and investor confidence.