What is Series D Funding

Table of Contents

Understanding Series D Funding

What is Series D Funding? It represents a pivotal late-stage venture capital round where high-growth companies raise substantial equity or debt after completing Series D following their Series C. This growth equity round enables mature startups to scale operations aggressively, penetrate new markets, and position for initial public offerings or strategic acquisitions. As companies evolve from early validation to robust expansion, Series D marks a shift toward larger stakes and sophisticated investor involvement.

Series D differs markedly from earlier rounds in scale, maturity, and strategic focus. Key distinctions include:

- Valuation and Capital Size: While Series A and B emphasize product-market fit with smaller sums, series D valuation often reaches hundreds of millions, typically $50-100 million, reflecting proven revenue streams.

- Investor Profile: Series D investors comprise institutional heavyweights like private equity firms and hedge funds, demanding board seats and liquidity timelines per SEC guidelines on later-stage capital.

- Triggers and Timeline: Pursued 4-7 years post-founding, after Series C scaling, when market expansion or acquisitions demand fuel–amid 2025’s dynamic regulatory landscape ensuring compliance with exemptions like Rule 506(b).

These rounds underscore investor protections and dilution considerations, as outlined in SEC resources, balancing growth with ownership integrity. For instance, a software company leveraged Series D to acquire competitors, boosting its market share by 40%.

We at Zaidwood Capital guide clients through these complexities, facilitating capital introductions to our network of over 4,000 investors and conducting full-cycle due diligence. This support streamlines preparation for IPOs or exits, aligning strategies with 2025 trends in late-stage financing.

Fundamentals of Series D Funding

What is Series D Funding? It represents a pivotal stage in the growth capital stages, where established companies secure substantial late-stage equity financing to fuel expansion beyond initial scaling. At Zaidwood Capital, we see companies leveraging Series D Funding to bridge the gap toward public markets or strategic acquisitions, building on prior rounds like Series C. This funding round typically occurs after a company has validated its product-market fit and seeks to accelerate momentum in competitive landscapes.

Series D funding emphasizes mature business models ready for global reach, often involving complex deal structures that demand expert guidance. According to the SaaSBoomi glossary, these stages mark transitions from early validation to sustained revenue growth, aligning with 2025 corporate strategies focused on resilience and innovation.

Companies pursue Series D after Series C to address advanced needs, such as international market entry or operational enhancements. Motivations include acquiring competitors to consolidate market share, investing in R&D for next-generation products, or preparing for an IPO by strengthening financials. We observe these rounds enabling firms to navigate regulatory hurdles, as outlined in SEC guidelines on raising later-stage capital, which stress compliance with exemptions like Rule 506(b) of Regulation D to avoid registration burdens.

In 2025, projections indicate heightened activity in tech and healthcare sectors, driven by AI integrations and telemedicine advancements. Key drivers also encompass talent acquisition in high-cost regions and supply chain fortifications amid geopolitical shifts.

The evolution from Series C to Series D reflects a shift in scale and sophistication. While Series C focuses on optimization, Series D targets exponential growth, often with higher valuations reflecting proven traction. This progression underscores the need for tailored advisory to mitigate risks like dilution for existing shareholders.

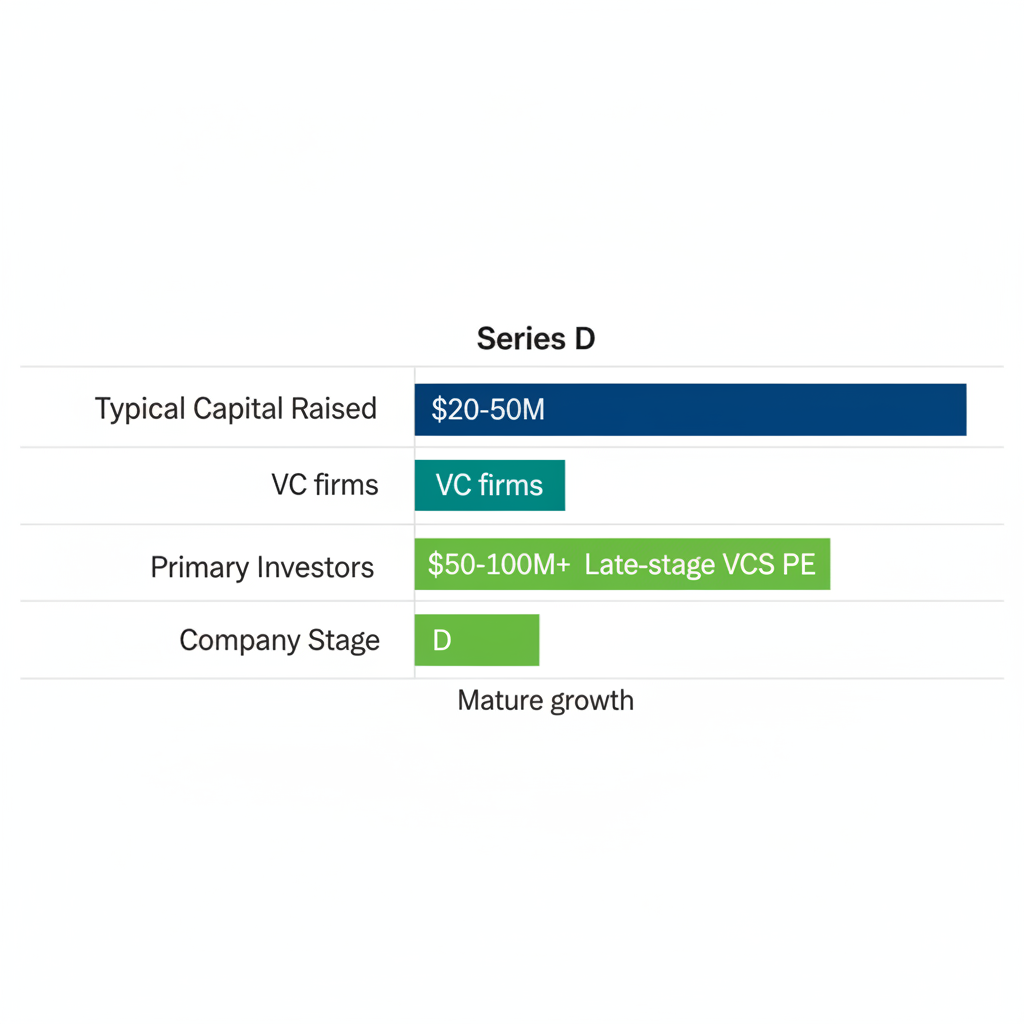

The following table compares key aspects of Series C and Series D funding rounds, highlighting differences in scale, investors, and purposes:

| Aspect | Series C | Series D |

|---|---|---|

| Typical Capital Raised | $20-50 million | $50-100 million+ |

| Primary Investors | VC firms, growth equity | Late-stage VCs, PE, hedge funds |

| Company Stage | Product-market fit validation | Mature growth with international expansion |

Data sourced from SEC guidelines on later-stage capital, with 2025 projections based on recent trends in tech and healthcare sectors. This comparison illustrates how Series D demands larger commitments from sophisticated backers, enabling companies to pursue ambitious objectives like pre-IPO scaling or strategic buys. For instance, a tech firm might use Series D proceeds for cross-border acquisitions, contrasting Series C’s domestic refinement.

Interpreting these differences, businesses at the Series D juncture face elevated expectations for returns, prompting closer scrutiny of terms like anti-dilution protections. We at Zaidwood Capital assist by structuring deals that balance growth ambitions with stakeholder alignment, drawing on our network to facilitate smooth executions.

Turning to investor dynamics, series D investors prioritize metrics like recurring revenue and EBITDA margins over early traction. These backers, including private equity firms and hedge funds, bring strategic value beyond capital, such as board expertise and exit pathways. The SEC resource notes that later-stage investors seek alignment with long-term liquidity events, evaluating not just financials but operational maturity.

At Zaidwood Capital, our role in series D valuation and placement leverages access to over 4,000 institutional investors, ensuring introductions to those specializing in late-stage opportunities. We provide full-cycle advisory, from pitch decks to due diligence, helping clients navigate 2025’s competitive landscape. This support is crucial for optimizing terms and accelerating timelines, as companies position for sustainable growth or market leadership.

Comparison of Series C and Series D funding fundamentals

In essence, Series D funding empowers mature enterprises to execute visionary strategies, with advisory firms like ours streamlining the process for optimal outcomes.

Deep Dive into Series D Valuation and Investors

At Zaidwood Capital, we guide clients through the complexities of late-stage funding, where debt advisory services often complement equity raises to optimize capital structures. Series D rounds represent a pivotal stage for scaling startups, typically valued between $500 million and $2 billion in 2025, according to SaaSBoomi projections. This section analyzes valuation mechanics, investor profiles, and comparative trends to help founders and executives navigate these opportunities strategically.

Determining Series D Valuation Factors

Determining series D valuation begins with established methods like discounted cash flow (DCF) analysis, which projects future revenues and discounts them to present value, alongside comparable company analysis using market multiples. Our experience shows that revenue multiples dominate for tech and SaaS firms, with annual recurring revenue (ARR) often serving as the benchmark. For 2025, averages hover around 8-12x ARR for high-growth companies, reflecting investor confidence in scalability.

Several factors influence these valuations, including traction metrics such as user growth and profitability milestones. Strong team execution and intellectual property also play key roles, as they signal reduced risk. To illustrate, a SaaS platform achieving 50% year-over-year revenue growth might command a premium, while governance readiness for public markets adds further uplift.

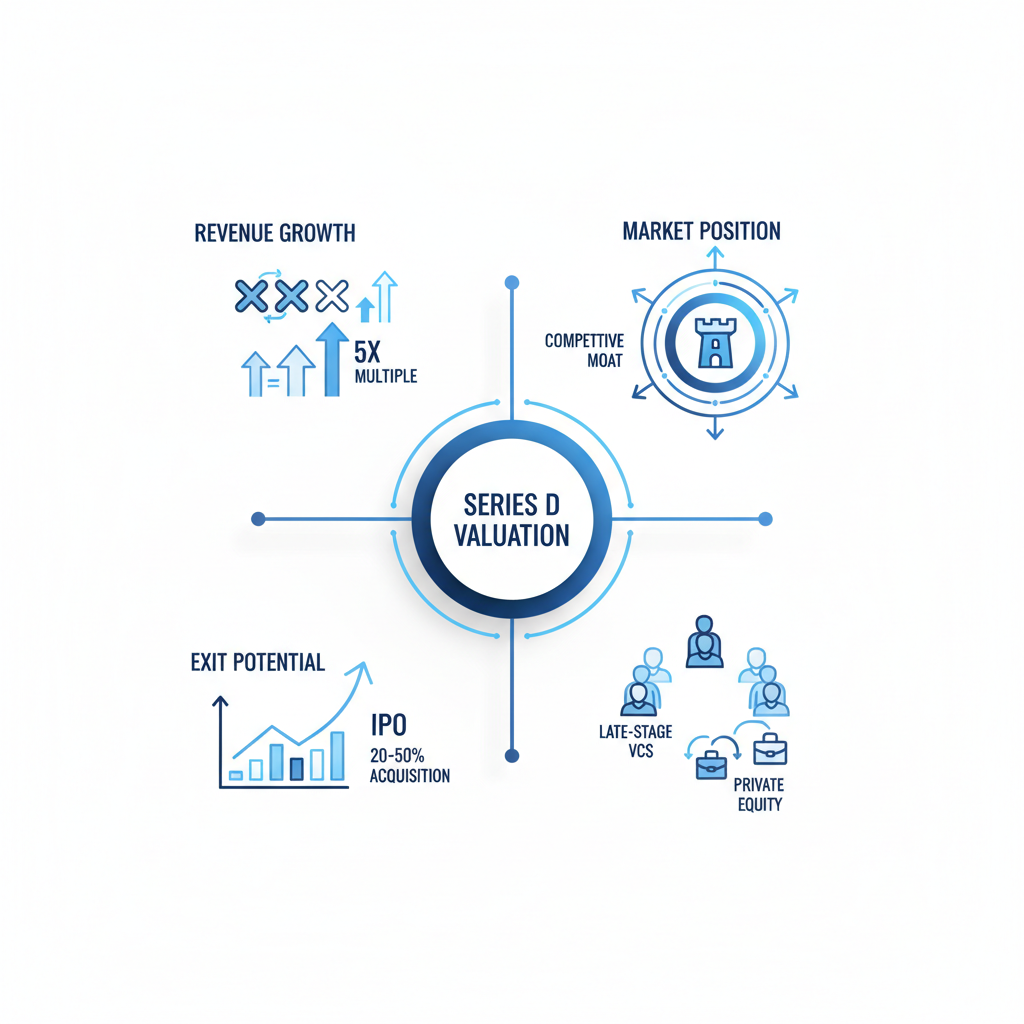

The following table outlines key factors influencing Series D valuation, drawing from private equity guides and 2025 SaaSBoomi data:

| Factor | Description | Impact on Valuation |

|---|---|---|

| Revenue Growth | Annual recurring revenue multiples | 3-5x for tech SaaS |

| Market Position | Competitive moats and IP | Premium for leaders |

| Exit Potential | IPO or acquisition readiness | Boosts by 20-50% |

These drivers highlight how revenue growth directly ties to multiples, while market leadership justifies higher premiums. For instance, companies with defensible IP see valuations 15-25% above peers, per Harvard Library insights on private equity structures. Exit readiness, such as audited financials, can accelerate rounds by demonstrating liquidity paths. In our advisory work, we emphasize balancing these elements to avoid overvaluation risks that deter investors.

Building on these factors, founders should benchmark against recent deals, like a fintech firm valued at $1.2 billion in early 2025 based on 10x ARR multiples. This approach ensures realistic expectations and positions startups for successful closes. Anonymized cases from our portfolio reveal that integrating debt options early enhances equity efficiency, supporting overall valuation uplift without diluting ownership excessively.

Series D valuation factors and late-stage investor profiles illustration

The infographic above visualizes how these interconnected elements shape late-stage metrics, aiding in strategic planning. As markets evolve, staying attuned to regulatory shifts, like those under the JOBS Act, further refines valuation accuracy.

Profiles of Key Series D Investors

Series D investors primarily include private equity firms, hedge funds, and late-stage venture capital entities, each bringing distinct criteria to the table. Private equity players focus on mature assets with proven cash flows, often seeking board seats for governance influence. Hedge funds, as noted in Harvard guides, target opportunities with medium-term liquidity, emphasizing portfolio diversification.

In the US, top series D investors prioritize scalability, with institutional investor criteria revolving around unit economics and exit timelines. Venture capital firms like those in Silicon Valley evaluate global expansion potential, while family offices assess alignment with long-term holdings. Our network of over 4,000 investors reveals that PE funds dominate 60% of 2025 rounds, per SaaSBoomi trends, valuing operational improvements.

Approaching these investors requires warm introductions via mutual connections or platforms like our investor rolodex. What do series D investors look for? Primarily, robust governance, 30%+ EBITDA margins, and clear paths to IPOs or acquisitions. For US-based opportunities, highlighting compliance with Dodd-Frank reporting builds trust. Strategies include tailored pitch decks showcasing traction data, followed by due diligence support from advisors like us.

Comparative Valuation Trends

Series D valuations typically exceed Series C by 2-3x, reflecting scaled operations and reduced risk. In 2025, Series C averages $150-500 million, driven by early traction, while Series D emphasizes maturity, reaching $800 million-$2 billion with multiples of 10-15x versus 6-10x.

Recent examples include a healthtech Series C at $300 million (8x ARR) scaling to $1.1 billion in Series D (12x), boosted by market expansion. Comparables from SaaSBoomi show AI firms gaining 40% uplift from C to D due to IP strength. These trends underscore the valuation leap as startups transition to profitability, informing strategic timing for raises.

Practical Strategies for Series D Preparation

As companies approach Series D funding, preparation becomes critical to securing substantial capital in competitive 2025 markets. We at Zaidwood Capital specialize in guiding clients through this phase, leveraging our full-cycle due diligence expertise and access to over 4,000 institutional investors. This section outlines key strategies for due diligence, deal structuring, and investor positioning to streamline your path to successful capital raises.

Due Diligence Best Practices

Preparing for Series D requires meticulous organization of financial, legal, and operational records to withstand intense investor scrutiny. We recommend starting with a comprehensive financial audit, including detailed modeling of revenue projections, cash flow statements, and historical performance metrics. This aligns with preparation checklists from industry resources like University Lab Partners, which emphasize documenting key assumptions and sensitivity analyses to demonstrate scalability.

Next, conduct thorough legal reviews to ensure compliance with regulatory frameworks, such as intellectual property protections and contractual obligations. Operational due diligence involves assessing supply chain resilience, team capabilities, and IT infrastructure. Numbered steps can simplify this process:

- Assemble a cross-functional team to compile documentation in a centralized data room.

- Perform gap analyses to identify and address weaknesses, such as unresolved litigation or outdated compliance policies.

- Engage third-party auditors for validation, reducing red flags during investor reviews.

By prioritizing these elements, companies can present a robust profile that highlights growth potential. Our full-cycle due diligence services at Zaidwood integrate financial, legal, and operational assessments, ensuring readiness for Series D investors who demand transparency and foresight. This proactive approach not only accelerates the funding timeline but also strengthens overall business resilience.

In practice, startups often overlook human capital evaluations, yet evaluating leadership retention plans can significantly bolster credibility. We advise incorporating SWOT analyses tied to operational workflows to provide context for strategic decisions. With proper preparation, due diligence transitions from a hurdle to a competitive advantage, positioning your firm favorably in negotiations.

Deal Structuring Options

Series D financing demands flexible structures to balance dilution, control, and liquidity needs. Common options include pure equity for straightforward growth capital and hybrid instruments like convertible debt or mezzanine financing, which offer nuanced terms tailored to mature startups.

Equity rounds typically involve issuing new shares, influencing series D valuation through negotiated pre-money assessments. Mezzanine debt hybrids provide subordinated loans convertible to equity, bridging gaps in traditional funding while minimizing immediate ownership transfer. We structure these to comply with FINRA guidelines on capital formation, as outlined in Regulatory Notice 23-09, which stresses efficient processes without compromising investor protections–such as reasonable investigations for private placements.

Key considerations include interest rates for debt components (often 8-12% for mezzanine) and conversion triggers tied to milestones. Pros of hybrids include deferred dilution, while cons involve accrual costs that impact cash flow. Optimal terms might feature anti-dilution protections and liquidation preferences to safeguard founders.

The following table compares common Series D deal structures, drawing from FINRA notices on financing options and Zaidwood insights on 2025 hybrid trends:

| Structure | Pros | Cons | Best For |

|---|---|---|---|

| Pure Equity | No repayment obligation | High dilution | Rapid scaling needs |

| Convertible Debt | Faster closing | Interest accrual | Pre-IPO transitions |

Pure equity suits companies seeking aggressive expansion without debt burdens, though it accelerates ownership dilution. Convertible debt, conversely, enables quicker closes for bridge financing, ideal for startups eyeing IPOs, but requires managing accruing interest. We recommend hybrid models for most Series D scenarios, leveraging our equity advisory expertise to optimize terms and align with valuation goals.

Transitioning to these structures involves scenario modeling to forecast impacts on cap tables. Our strategic financial consulting ensures compliance and efficiency, helping clients navigate complexities like CAB rules for enhanced flexibility in capital raising.

Positioning for Investor Success

Effectively positioning for Series D involves crafting compelling narratives and leveraging networks to attract series D investors focused on proven scalability and exit potential.

Start with refined pitch decks that highlight traction metrics, market dominance, and defensible moats–addressing what series D investors look for, such as 10x return pathways and robust governance. We assist in developing these materials, incorporating pro forma financials and strategic documentation to showcase readiness.

Investor engagement strategies include targeted outreach via warm introductions and participation in exclusive forums. How to approach series D funding investors? Prioritize those with sector alignment, like venture capital firms and family offices in our network. Tactics encompass personalized teasers and follow-up diligence previews to build momentum.

The table below outlines key criteria against effective tactics:

| Investor Criteria | Positioning Tactics |

|---|---|

| Scalability Evidence | Data-driven growth projections |

| Exit Viability | Comparable transaction analyses |

| Team Strength | Highlighted leadership bios |

These tactics, informed by our capital introductions services, emphasize authenticity to foster trust. Accessing our exclusive deal vault provides proprietary insights and connections, streamlining outreach. By focusing on value alignment, companies can secure commitments efficiently, turning preparation into closed deals.

Advanced Series D Investment Strategies

In our experience at Zaidwood Capital, advanced Series D investment strategies represent a pivotal evolution for mature startups seeking substantial growth capital. These tactics, tailored for 2025’s dynamic markets, go beyond traditional equity rounds by incorporating hybrid financing and collaborative models. They address the needs of sophisticated capital tactics, enabling companies to optimize their series D valuation while attracting institutional funding models. Drawing from private equity principles outlined in comprehensive guides, these approaches minimize dilution and enhance governance, ultimately appealing to series D investors with aligned interests.

Tactics breakdown begins with hybrid debt-equity structures, such as mezzanine financing and venture debt, which blend debt obligations with equity upside. Mezzanine options provide flexible capital without immediate full ownership transfer, reducing equity dilution for founders–a key advantage in late-stage rounds. Venture debt complements this by offering non-dilutive funding tied to revenue milestones, as highlighted in regulatory updates on capital formation. Co-investments, often syndicated with private equity firms, allow series D investors to pool resources, sharing due diligence costs and risks. This model fosters stronger alignment but requires careful management of partner dependencies.

The following table compares these advanced Series D strategies against traditional venture capital approaches:

| Strategy | Key Features | Risks | Returns Potential |

|---|---|---|---|

| Co-Investments | Syndicated with PE; Shared due diligence | Alignment dependency | Higher via scale |

| Hybrid Debt-Equity | Mezzanine structures; Lower dilution | Repayment pressure | Balanced upside |

As evidenced by Harvard private equity resources, co-investments scale returns through diversified expertise, while FINRA Notice 23-09 underscores the regulatory balance in hybrids, ensuring investor protections amid efficient capital raising. In practice, these structures mitigate repayment pressures via structured covenants, supporting sustained growth.

Governance enhancements further elevate Series D appeal. Implementing robust board compositions with independent directors and clear milestone reporting builds trust among institutional backers. We emphasize ESG integration and compliance frameworks, aligning with Dodd-Frank oversight to preempt regulatory hurdles. This proactive stance not only safeguards investments but also positions companies for smoother exits, drawing from venture capital’s emphasis on performance improvement.

Finally, integrating ma capital advisory services amplifies these strategies. Our full-cycle support, from structuring hybrids to facilitating co-investments, leverages a network of over 4,000 investors. This advisory layer ensures tailored due diligence and documentation, streamlining transactions for optimal series D valuation outcomes. By educating on these sophisticated tactics, we empower fund managers to navigate 2025 trends effectively.

Common Questions on Series D Funding

What is Series D Funding and how does it differ from Series C?

Series D funding supports mature startups scaling globally or acquiring competitors, raising $100M+ versus Series C’s $50M focus on expansion, per University Lab Partners’ insights on funding progression.

How much capital is typically raised in Series D?

Typically $100-500 million, enabling advanced growth like international markets or R&D acceleration, building on prior rounds’ foundations.

Who are the main series D investors?

Late-stage VCs, private equity firms, and sovereign funds; top US players include Sequoia and Andreessen Horowitz, seeking proven scalability.

Why pursue Series D in 2025?

To fuel acquisitions, tech upgrades, or pre-IPO preparations amid economic recovery, addressing funding stage queries for sustained leadership.

How can advisory assist with Series D?

We at Zaidwood provide boutique ma advisory expertise, connecting to 4,000+ investors and structuring deals for optimal outcomes.

What influences series D valuation?

Revenue growth, market dominance, and IP strength drive averages of $1B+, with factors like economic trends shaping 2025 multiples.

Recent examples of Series D success?

Companies like Stripe used it for global dominance; investor insights highlight strategic timing for high returns.

Key Insights on Series D Funding

Series D funding represents a pivotal late-stage strategy for scaling operations, often following successful growth rounds. Building on What is Series D Funding, it typically involves raising $50-100 million or more from venture capitalists and private equity firms, focusing on market expansion and pre-IPO preparation. Key differences include larger capital scales compared to earlier series, with series D investors demanding proven revenue and strategic alignment.

Valuation trends show series D valuation averaging $500 million to over $1 billion, reflecting reduced risk and high growth potential. Preparation is crucial: robust financials, compliance with SEC guidelines, and clear exit paths enhance success. At Zaidwood Capital, we guide clients through these complexities.

- Emphasize investor due diligence and term sheet negotiations.

- Prioritize scalable business models for liquidity events.

- Ensure regulatory adherence per SEC resources on later-stage capital.

Contact us at Zaidwood Capital for tailored advisory to navigate 2025 opportunities.