Series B

Table of Contents

Understanding Series B Funding in 2026

In the dynamic landscape of 2026, Series B funding represents a pivotal milestone for startups that have validated their product-market fit through earlier rounds. This growth-stage capital round enables companies to scale operations, expand market reach, and build robust teams. At Zaidwood Capital, we recognize the unique challenges of Series B Funding, where entrepreneurs seek substantial investments to fuel acceleration.

Unlike Series A, which focuses on proving viability and initial traction, series b funding shifts emphasis to rapid expansion and revenue generation. Startups typically raise between $20 million and $50 million, often over a 6- to 12-month timeline, as outlined in SEC guidelines for later-stage capital. Investors expect demonstrated metrics, such as consistent user growth and positive cash flow, while adhering to federal securities laws like Rule 506(b) of Regulation D for compliant offerings. Harvard Business School insights highlight that effective strategies, including pursuing large market opportunities and minimizing equity dilution, are essential for success in these scaling investment phases.

We at Zaidwood Capital bring over 20 years of expertise in capital formation, connecting clients to our network of more than 4,000 institutional investors and over $15 billion in deployable capital. With $24.4 billion in aggregate transaction volume, we assist in deal structuring and introductions, ensuring efficient rounds without guaranteed outcomes. For instance, we recently guided a SaaS startup through its series b valuation process, enabling geographic expansion post-funding.

This guide explores Series B fundamentals, valuation trends, market dynamics, and actionable strategies tailored for 2026, empowering you to navigate this critical phase with confidence.

Core Concepts of Series B Funding

Series B funding represents a critical expansion round financing stage for startups that have validated their product-market fit and achieved initial revenue traction. At this mid-stage venture capital juncture, companies shift from proving concepts to aggressively scaling operations across broader markets. We at Zaidwood Capital observe that understanding these core concepts equips entrepreneurs with the strategic foresight needed for 2026 growth trajectories.

What is Series B Funding? It follows the seed and What is Series B Funding rounds, where startups secure capital to build on early successes. Unlike Series A, which emphasizes prototype development and market validation through user testing and minimum viable products, Series B centers on revenue generation and operational scaling. For instance, a SaaS startup post-Series A might use B-round proceeds to hire sales teams and expand into new geographies, leveraging proven metrics like customer acquisition costs. According to SEC guidelines, venture capital at this stage involves preferred stock issuances that dilute founder equity while providing growth runway. The MassChallenge analysis highlights real-world examples, such as tech firms transitioning from $500K pilots in A rounds to multi-million revenue streams before pursuing B, underscoring the evolution from ideation to execution.

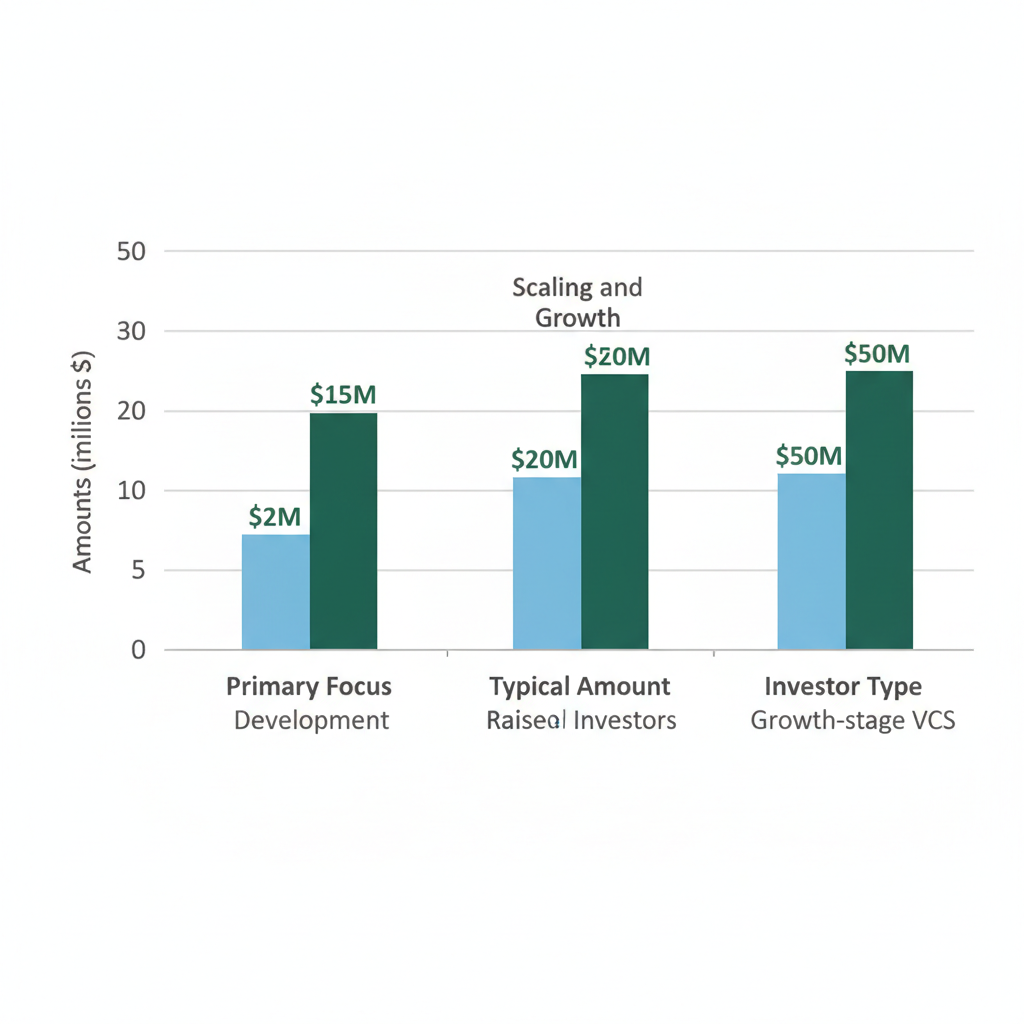

This progression from validation to expansion marks a pivotal shift in startup maturity. The following table illustrates key distinctions between Series A and Series B rounds, drawing from established funding strategies to clarify stage-specific priorities.

| Aspect | Series A | Series B |

|---|---|---|

| Primary Focus | Product development and market validation | Scaling operations and market expansion |

| Typical Amount Raised | $2M – $15M | $20M – $50M |

| Investor Type | Angel investors, early VCs | Growth-stage VCs, PE firms |

These differences highlight how Series B demands demonstrated traction, influencing investor due diligence and term sheets. Startups must prepare robust financial models to justify higher valuations, avoiding common pitfalls like over-optimistic projections that could extend timelines.

In series b funding rounds in the US, typical amounts range from $20M to $60M, varying by industry–software ventures often secure higher figures due to scalable models, while hardware firms cap around $40M for manufacturing ramps. Investor profiles evolve to growth-stage venture capital firms and private equity entities seeking 3-5x returns within 5 years. Series b valuation discussions typically hinge on metrics like ARR exceeding $1M, with multiples of 8-12x applied, per SEC-defined valuation principles that emphasize sustainable growth over speculative hype. We at Zaidwood facilitate connections to these investors through our network of over 4,000 institutions.

Securing Series B typically spans 6-12 months, from initial pitch to closing, involving iterative negotiations and legal reviews. In 2026, trends lean toward AI integration and sustainability mandates, with investors prioritizing ESG-compliant scalability–think climate-tech firms raising for green supply chains. This timeline underscores the need for proactive preparation, including pitch decks that align with evolving market demands.

As advisors in capital formation, we at Zaidwood streamline Series B pursuits by offering capital introductions and due diligence support, helping clients navigate these complexities efficiently. Our expertise in full-cycle advisory positions startups for successful expansions without the guesswork.

Visual comparison of Series A versus Series B funding characteristics

Building on these foundational elements, the intricacies of series b valuation and term structures warrant deeper exploration in subsequent discussions, ensuring entrepreneurs align funding strategies with long-term visions.

Exploring Series B Valuations and Influencing Factors

At Zaidwood Capital, our experience advising over 300 growth-stage companies has shown that understanding Series B valuations is crucial for startups scaling operations in competitive markets. These rounds typically occur after initial product-market fit, where investors scrutinize financial projections and growth potential to assign value. We emphasize rigorous due diligence to ensure fair assessments, helping clients navigate the intricacies of zaidwood capital advisory. This section breaks down calculation methods and key drivers shaping these valuations, drawing on established practices to inform strategic decision-making.

Valuation Calculation Methods in Series B Rounds

Determining a series b valuation requires blending quantitative models with market realities for growth-stage startups. One primary approach is the comparable transactions method, where valuations are benchmarked against recent deals in similar sectors. For instance, SaaS companies often see multiples of 5-10x annual recurring revenue, as noted in industry guides like the Quantic expert overview on funding rounds. This method adjusts for differences in growth rates and market positioning to arrive at a realistic figure.

Another key technique is the discounted cash flow (DCF) analysis, which projects future cash flows and discounts them to present value using a rate that reflects risk and opportunity costs. Tailored for mid-stage company worth, DCF incorporates assumptions about scaling expenses and exit timelines, often yielding valuations between $200 million and $500 million for promising US tech firms in 2026. The SEC’s guidance on raising later-stage capital underscores the need for fair assessments compliant with securities laws, such as evaluating dilution impacts under exemptions like Rule 506(b).

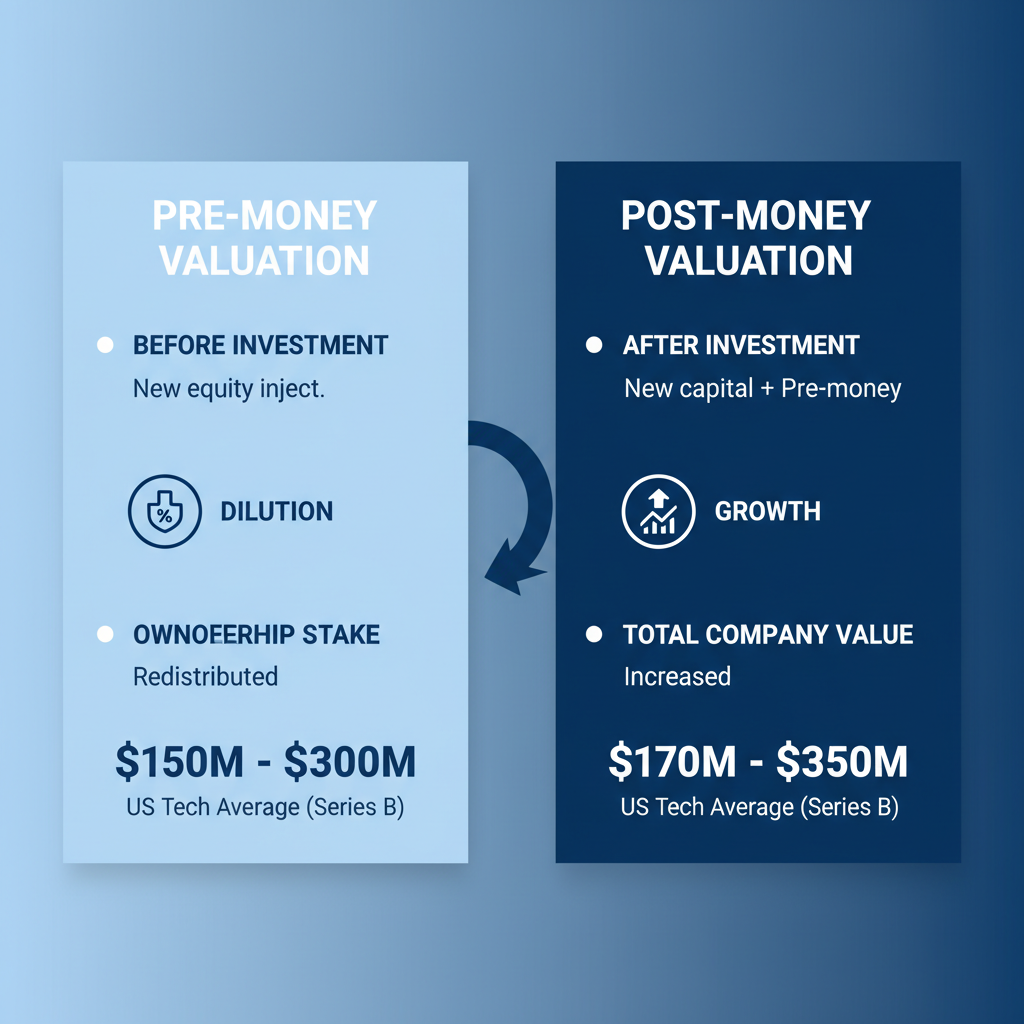

| Concept | Pre-Money | Post-Money |

|---|---|---|

| Definition | Valuation before new investment | Valuation after investment infusion |

| Impact on Ownership | Higher dilution if overvalued | Reflects total company value post-round |

| 2026 Average (US Tech Startups) | $150M – $300M | $170M – $350M (approx.) |

This comparison highlights how pre-money sets the baseline for equity allocation, while post-money encompasses the full round’s effect on ownership stakes. For example, a $200 million pre-money valuation with $50 million raised results in a $250 million post-money figure, diluting founders by about 20%. Accurate application prevents disputes and aligns with SEC recommendations for transparent term sheets. In our advisory practice, clarifying these distinctions has streamlined negotiations, ensuring clients retain strategic control amid valuation pressures.

Pre-Money vs. Post-Money Valuation Comparison in Series B

Key Factors Driving 2026 Series B Valuations

As series b funding evolves in 2026, several interconnected elements will dictate valuation premiums for US startups. Revenue metrics stand out, with consistent growth signaling scalability; investors prioritize traction like month-over-month increases exceeding 20% for tech ventures. Market trends, including post-2022 corrections, have tempered exuberance, leading to more conservative multiples amid economic uncertainties–yet sectors like AI and clean tech may command 15-20% uplifts due to demand surges.

The competitive landscape further influences outcomes, where a defensible moat through proprietary technology or network effects can elevate worth. Team expertise plays a pivotal role; seasoned executives with exit histories often justify higher valuations by mitigating execution risks. Macro factors, such as interest rate fluctuations and regulatory shifts outlined in SEC resources, add layers– for instance, tighter compliance may pressure valuations but reward prepared firms.

At Zaidwood, we’ve observed in over 300 deals how balanced factor analysis drives optimal terms. An anonymized SaaS case saw valuation rise from $180 million to $250 million by emphasizing user retention data and market timing, without guaranteeing specific results.

| Factor | High Impact Example | Low Impact Scenario |

|---|---|---|

| Revenue | 5x YoY growth in SaaS ARR to $20M | Stagnant metrics below $5M with high churn |

| Market Trends | AI boom yielding 8x multiples in hot sectors | Economic downturn capping at 4x amid corrections |

| Team | Founders with prior IPO success attracting top VCs | Inexperienced leadership raising scalability doubts |

Practical Strategies for Series B Capital Raising

Raising Series B capital marks a pivotal stage for startups transitioning from early validation to scalable growth. At Zaidwood Capital, we have guided numerous ventures through this phase, leveraging our full-cycle due diligence and capital introductions to connect founders with institutional investors. This section outlines practical strategies to position your startup effectively for 2026 funding rounds, emphasizing preparation, process navigation, and advisory support drawn from our $24.4B aggregate transaction volume experience.

Preparing Your Startup for Series B Investors

Startups typically seek Series B financing after achieving post-Series A milestones, such as consistent revenue growth and product-market fit. We recommend evaluating readiness when annual recurring revenue (ARR) approaches $1M, signaling potential for market expansion. Key preparation steps include refining financial models to project scalability and developing a compelling pitch deck that articulates your vision.

| Criteria | Series B Specifics | General VC |

|---|---|---|

| Revenue Threshold | $1M+ ARR | Any viable traction |

| Scalability Proof | Market expansion plans | Idea potential |

| Team Experience | Proven execution | Vision alignment |

Navigating the Series B Funding Process

The series b funding process unfolds over 6-9 months, demanding strategic timing for 2026 efficiency. Begin with targeted investor outreach, leveraging networks from prior rounds. We recommend starting in Q1 to align with fiscal year-end cycles, allowing ample time for iterations.

| Stage | Duration | Key Actions |

|---|---|---|

| Preparation | 1-2 months | Financial modeling, deck development |

| Pitching | 2-3 months | Roadshows, initial meetings |

| Closing | 2-3 months | DD completion, term sheets, execution |

Advanced Topics in Series B Financing

As startups advance into Series B stages, sophisticated financing configurations emerge to fuel scaling while preserving founder control. At Zaidwood, we guide clients through these advanced round configurations, leveraging our expertise in equity and debt advisory to optimize outcomes without overpromising results.

| Option | Debt Financing | Equity Financing |

|---|---|---|

| Risk Profile | Lower equity dilution but repayment obligation | Ownership dilution, no repayment |

| Suitability for Series B | Mezzanine for growth without full equity | Standard for scaling capital |

| Zaidwood Support | Debt advisory services | Equity advisory and introductions |

Frequently Asked Questions on Series B

What differentiates Series B from Series A funding? Series A focuses on product development and initial market fit, while Series B emphasizes scaling operations, expanding market share, and achieving revenue growth. Typical shifts include larger investments and more rigorous due diligence.

What are typical amounts for series b funding in 2026? Amounts range from $20-50 million, depending on sector and traction. Tech startups often secure higher figures to fuel rapid expansion amid competitive landscapes.

How do investors determine series b valuation? Valuations, averaging $100-200 million, hinge on revenue multiples, growth metrics, and market potential. Investors assess scalable business models and defensible moats for sustainable returns.

What do investors look for in Series B startups? Drawing from Harvard Business School strategies, they prioritize strong teams with founder-market fit, large addressable markets, and product-market validation. Clear go-to-market plans and competitive tension build investor confidence.

How can advisory services benefit Series B rounds? Our expertise streamlines processes, optimizes structures, and introduces capital networks. For hybrid needs, we offer debt advisory services to complement equity, enhancing overall funding efficiency without dilution risks.

Key Takeaways for Series B Success

Series B funding marks a critical growth phase, building on initial traction with investments averaging $30-60 million at valuations of $100-200 million. Success hinges on demonstrating scalable revenue, product-market fit, and efficient processes while navigating dilution and investor alignment. For 2026, expect heightened focus on AI-driven efficiencies and sustainable expansions as key scaling milestones.

At Zaidwood Capital, we empower founders with tailored capital formation strategies, ensuring compliance with SEC guidelines like Rule 506(b). Our network connects you to deployable capital exceeding $15 billion. We invite you to explore our advisory services for seamless series b valuation optimization and beyond–no commitments required.