Investment Banking

Table of Contents

Essentials of Investment Banking Advisory

In the dynamic world of Investment Banking Services, boutique firms like Zaidwood Capital play a pivotal role in guiding mid-market companies and institutional investors through complex financial landscapes. Investment Banking encompasses specialized advisory that drives strategic growth, particularly in the US, where mergers and acquisitions (M&A) activity continues to surge. At Zaidwood Capital, we focus on full-cycle M&A and capital advisory, leveraging our expertise to facilitate seamless transactions for clients including private equity firms, family offices, and companies with revenues exceeding $1 million.

Our core offerings include buy-side and sell-side M&A mandates, where we identify targets, conduct valuations, and negotiate deals to ensure alignment and value creation–essential steps in the M&A process as highlighted in industry analyses. We also provide capital formation through tailored equity funding strategies and debt advisory, structuring mezzanine and venture debt solutions to meet specific needs. With access to over 4,000 investors and $15 billion in deployable capital, we streamline transactions for efficient execution. Full-cycle due diligence covers financial, legal, and operational aspects, mitigating risks across our 300+ completed deals totaling $24.4 billion in volume. Led by Bryann Cabral, Rami Zeneldin, and Samuel Leung, our team delivers precision in every engagement.

This guide begins with these fundamentals, progressing to advanced strategies in M&A advisory and capital raising. Whether you’re navigating private equity opportunities or seeking growth capital, our insights empower informed decisions in a competitive market dominated by boutique firms, which now capture 30% of advisory fees according to recent trends.

Core Principles of Investment Banking

Investment banking serves as the vital intermediary in the financial world, connecting companies seeking capital with investors eager to deploy funds. At Zaidwood Capital, we specialize in these core functions, providing tailored advisory services that drive strategic growth for our clients in the US markets. Our approach focuses on mergers and acquisitions, capital formation, and comprehensive due diligence, ensuring seamless transactions backed by our extensive network.

To understand the fundamentals, investment banking encompasses a range of services designed to facilitate capital raising and complex transactions. What Is An Investment Bank acts as a bridge between issuers of securities and the investment community, handling everything from underwriting to advisory roles. As outlined in industry overviews, these institutions analyze valuations, structure deals, and manage regulatory compliance to support informed decision-making. For mid-market clients, boutique firms like ours offer distinct advantages over larger institutions, including more personalized attention and agile execution that aligns closely with specific business goals.

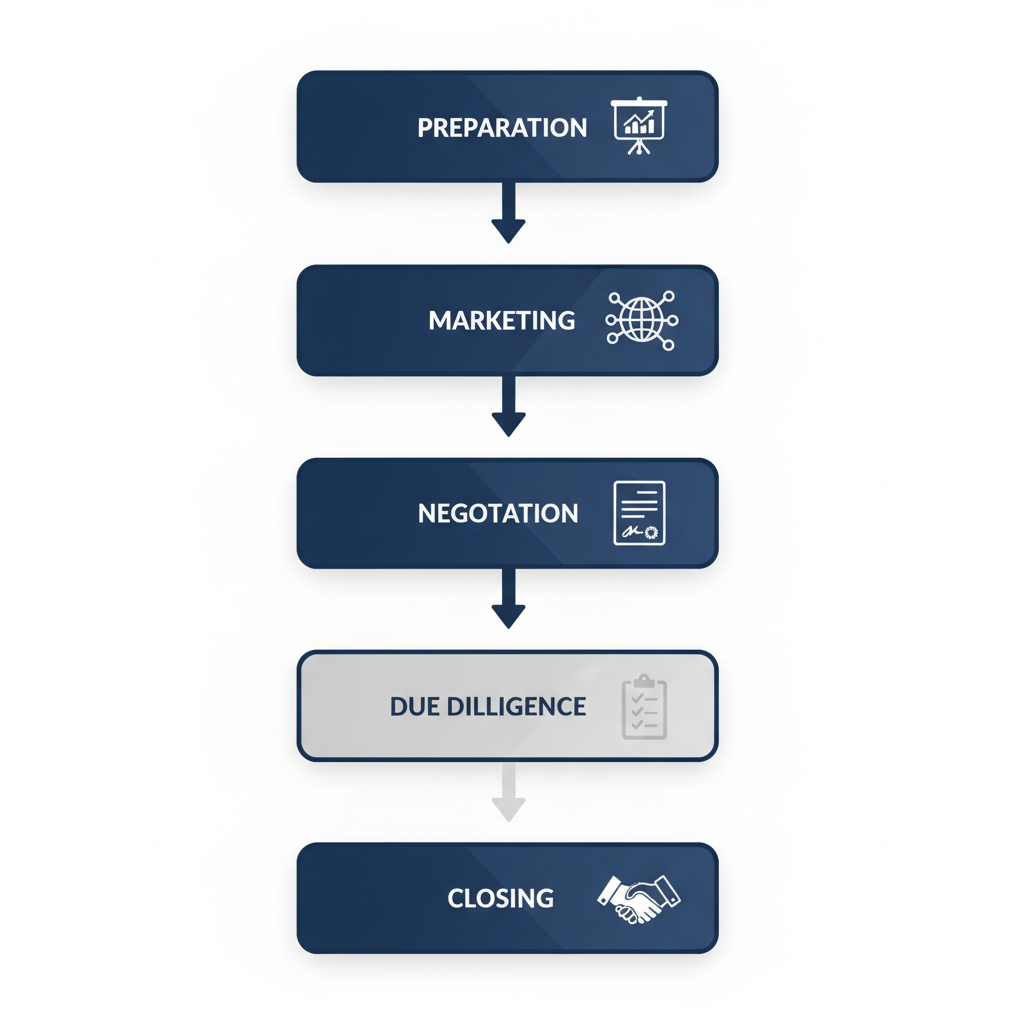

The mergers and acquisitions process forms a cornerstone of investment banking activities. This involves consolidating companies or assets through strategic deals, often requiring expert guidance to navigate complexities. Key steps include:

- Target identification and strategy development, where we assess potential opportunities based on client objectives.

- Valuation analysis, employing financial modeling to determine fair market value.

- Negotiation and deal structuring, aligning terms between buyers and sellers.

- Due diligence execution, verifying all aspects of the transaction.

- Closing and post-merger integration, ensuring smooth transitions.

These phases, as detailed in M&A essentials, typically span months and involve rigorous communication to mitigate risks. Our team at Zaidwood has guided over 300 deals, leveraging insights from US market trends to optimize outcomes for clients pursuing mergers and acquisitions.

Private equity represents another essential pillar, involving investments in private companies to foster growth and eventual exits. In this model, investors acquire ownership stakes, providing capital for expansion while actively influencing operations. We facilitate private equity placements by connecting clients to institutional investors, enabling equity infusions that support scaling efforts. This approach differs from public markets by emphasizing long-term value creation through operational enhancements and strategic repositioning.

Due diligence basics ensure transaction integrity by scrutinizing financial, legal, and operational elements. Checklists typically cover revenue verification, liability assessments, and compliance reviews. At Zaidwood, our full-cycle due diligence spans all phases, delivering thorough reports that inform decisions without overpromising results.

The following table provides an overview of key investment banking services, contrasting boutique firms like Zaidwood with traditional banks:

| Service Type | Boutique Firm (e.g., Zaidwood) | Traditional Bank |

|---|---|---|

| M&A Advisory (Buy/Sell-Side) | Tailored mandates with access to 4,000+ investors; full-cycle support | Broader but less personalized; higher fees for large deals |

| Capital Formation | Equity/debt structures; $15B deployable capital network | In-house funding but slower execution for mid-market |

| Due Diligence | Financial, legal, operational across all phases | Standardized processes; limited customization |

Boutique firms excel for mid-market clients by offering nimble, customized solutions that traditional banks often overlook due to their scale-focused operations.

At Zaidwood Capital, our integrated approach combines these services into a cohesive strategy, drawing from our $24.4 billion in aggregate transaction volume. We provide access to over 4,000 investors and $15 billion in deployable capital, as informed by investment banking fundamentals and M&A process data, to streamline client objectives efficiently.

Exploring M&A and Capital Strategies

In the dynamic world of Investment Banking, mergers and acquisitions represent pivotal opportunities for growth and value creation, particularly in the US mid-market. At Zaidwood Capital, we specialize in providing full-cycle advisory services that guide clients through these complex processes. Our expertise spans valuation techniques, debt and equity structures, and private equity dynamics, ensuring tailored strategies that align with evolving market trends. With over 300 completed deals and $24.4 billion in aggregate transaction volume, we leverage our network to facilitate seamless executions. This section explores these elements, highlighting how boutique firms like ours deliver specialized insights without the conflicts often seen in larger institutions.

Valuation Techniques in Mergers and Acquisitions

Valuing a company for mergers and acquisitions requires rigorous methods to ensure fair pricing and informed negotiations. We commonly employ discounted cash flow (DCF) analysis, which projects future cash flows and discounts them to present value, accounting for risk and time value of money. This approach is ideal for US mid-market deals where growth projections vary widely. Complementing DCF, comparable company multiples assess value based on similar firms’ metrics like EV/EBITDA, providing a market-based benchmark. For instance, in a recent mid-market transaction, we used these techniques to value a technology firm at a 12x multiple, reflecting sector comparables and projected synergies.

These methods answer key questions like how to value a company for mergers and acquisitions, emphasizing intrinsic worth over superficial metrics. As noted in discussions on the rise of boutique m&a advisory firms, our focused approach avoids broad-bank conflicts, delivering precise valuations. In practice, we integrate acquisition strategies with client-specific data, supporting 2026 trends where US M&A volume is projected to reach $2.3 trillion, a 49% increase from prior years. Our team’s application of these tools has consistently enabled clients to negotiate optimal terms in competitive environments.

Debt and Equity Advisory Structures

Navigating debt and equity advisory demands a nuanced understanding of financing options tailored to mid-market needs. Mezzanine debt, a hybrid instrument, sits between senior debt and equity, offering flexibility through interest payments and warrants. We structure these for growth-oriented firms, minimizing dilution while providing capital for expansions. Asset-based lending, secured by receivables or inventory, suits cyclical businesses, whereas cash-flow financing relies on operational stability. On the equity side, growth equity investments fund minority stakes without ceding control, often tied to milestones for alignment.

Equity placements through our network of over 4,000 investors access $15 billion in deployable capital, streamlining liquidity solutions. Venture options, though distinct, emphasize early-stage innovation, differing from mature equity investments by higher risk profiles. In US contexts, we highlight how these structures support liquidity events, drawing from our 300 deals where equity advisory accelerated funding rounds. Boutique advisory evolution, as seen in firms like Lazard and Moelis, underscores our client-aligned model, capturing 30% of transaction fees amid market shifts.

Selecting the right structure hinges on factors like cost of capital, control preferences, and market conditions. For mid-market clients, we evaluate dilution risks against repayment pressures, ensuring alignment with strategic goals. The following table compares key debt and equity options we routinely advise on:

| Financing Type | Key Features | Pros for Mid-Market | Cons and Risks |

|---|---|---|---|

| Mezzanine Debt | Hybrid debt/equity; subordinated to senior debt; Interest + warrants; flexible terms | Lower dilution; Zaidwood structures for growth | Higher interest; repayment pressure |

| Growth Equity | Minority stakes for expansion | No control loss; milestone-based; Capital access via Zaidwood network | Valuation scrutiny; future dilution |

This comparison illustrates trade-offs in capital formation, where mezzanine debt preserves ownership but carries elevated costs, while growth equity enables scaling with shared upside. Regulatory contexts, including eased antitrust scrutiny and HSR Act timelines from 2025 trends, influence feasibility, as commercial banks and private credit funds bolster deal financing. At Zaidwood, we interpret these dynamics to recommend structures that mitigate risks, such as incorporating contingent value rights in equity deals for added protection.

Building on these options, our advisory extends to full-cycle due diligence, verifying financials and operational viability before commitment. This layered approach ensures robust equity investments, particularly as 2026 projections show global private equity volumes hitting $2 trillion, driven by complex transactions in tech and healthcare.

Debt vs. equity financing comparison for M&A strategies

Private Equity Deal Dynamics

Private equity deal dynamics in the US revolve around investment opportunities that balance control, returns, and risks. Structures typically include leveraged buyouts for majority stakes or growth capital for minorities, often with preferred returns and exit clauses. We differentiate private equity from venture capital by scale and stage: PE targets mature companies with stable cash flows, while VC funds high-growth startups, accepting higher volatility for equity upside.

Opportunities in 2026 abound, with megadeals like AI-driven partnerships signaling confidence, as OpenAI’s collaborations exemplify resource races. Our transaction insights from $24.4 billion in volume reveal risks such as regulatory hurdles and activism, yet pros like operational improvements yield 20-30% IRRs. For instance, in a recent US energy deal, we structured a PE investment with milestone gates, mitigating downside while capturing synergies.

Addressing private equity investment opportunities 2026, trends point to sovereign wealth funds’ activity and spin-offs, enhancing liquidity. Zaidwood’s network facilitates introductions to endowments and family offices, executing deals efficiently. Differences between private equity and venture capital lie in risk tolerance–PE emphasizes efficiency, VC innovation–guiding clients toward optimal paths. Our non-promotional guidance, rooted in 300 deals, equips stakeholders to navigate these dynamics, applying concepts to real scenarios for strategic advantage.

This deep dive sets the stage for practical implementations, where valuation and financing converge in actionable mandates.

Applying Investment Banking in Business Growth

At Zaidwood Capital, we apply investment banking principles to drive tangible business growth for our US clients through targeted mergers and acquisitions advisory and capital formation strategies. Our full-cycle approach integrates sell-side mandates, equity and debt advisory, and rigorous due diligence to streamline transactions and unlock value. By leveraging our network of over 4,000 institutional investors and $15 billion in deployable capital, we help small to mid-sized companies navigate complex capital advisory services landscapes effectively.

Sell-Side Mandates Step-by-Step

In sell-side mandates, we guide clients from initial preparation to deal closure, ensuring a structured path that maximizes value. This process begins with a comprehensive valuation analysis to establish a realistic sale price, followed by crafting teaser documents and pitch decks to attract potential buyers. At Zaidwood, we emphasize early integration of due diligence to identify and mitigate risks upfront, drawing on our expertise in financial modeling and market positioning.

Next, we conduct outreach to qualified buyers, often private equity firms or strategic acquirers, while managing confidential data rooms for secure information sharing. Negotiation phases involve term sheet development and fairness opinions to protect seller interests. Finally, we facilitate closing by coordinating legal and regulatory approvals, culminating in seamless handovers. For instance, in a recent deal involving a mid-market manufacturing firm, our step-by-step execution resulted in a 25% premium over initial valuations, highlighting the efficacy of our transaction advisory.

To illustrate the differences in advisory workflows, the following table contrasts sell-side and buy-side M&A processes:

| Phase | Sell-Side | Buy-Side |

|---|---|---|

| Preparation | Valuation, teaser creation; Zaidwood pitch decks | Target screening, initial outreach |

| Due Diligence | Seller data room setup | Buyer audits and verification |

| Closing | Negotiation, fairness opinions | Integration planning |

This comparison underscores our full-cycle support, where we handle both sides to provide continuity. Following the sell-side process, we incorporate insights from regulatory reviews, such as the Hart-Scott-Rodino Act’s waiting periods, to time closings efficiently and avoid delays from antitrust scrutiny. Our Zaidwood team has executed over 300 deals with an aggregate volume of $24.4 billion, demonstrating our ability to navigate these phases with precision and speed.

Building on these workflows, visual aids can clarify the sequential nature of sell-side engagements, aiding executives in planning their growth initiatives.

Step-by-step sell-side mandate process for business growth

Capital Formation Tactics

Raising capital is essential for scaling operations, and we at Zaidwood employ proven tactics to connect clients with private equity and other funding sources. Our strategies start with developing customized pitch decks and pro forma financials that highlight growth potential, tailored for institutional investors. We leverage our investor network to facilitate warm introductions, focusing on sectors like technology and manufacturing where demand for growth financing is high.

One key tactic involves structuring equity offerings, such as growth equity rounds, to align with investor risk profiles while preserving founder control. For mergers and acquisitions contexts, we advise on hybrid instruments like mezzanine debt to bridge funding gaps. A practical example from our portfolio includes securing $50 million in private equity for a SaaS company, where our capital introductions expedited the process from pitch to commitment in under 90 days.

Tips for success include maintaining transparent financial documentation and timing raises during favorable market cycles. We also utilize our deal vault for real-time investor updates, ensuring competitive bidding. Through these methods, we deliver growth financing that propels businesses forward without diluting value unnecessarily.

Due Diligence Procedures

Conducting thorough due diligence is a cornerstone of successful transactions, and we provide a hands-on checklist to cover financial, operational, and regulatory aspects. Our full-cycle due diligence services encompass financial reviews–verifying revenue streams, debt obligations, and cash flow projections–alongside legal audits for contracts and compliance. Operationally, we assess supply chain efficiencies and human capital structures to uncover synergies or red flags.

A practical checklist includes: (1) compiling historical financial statements and tax returns; (2) reviewing material agreements and IP portfolios; (3) performing site visits and employee interviews; (4) analyzing market positioning against competitors; and (5) evaluating IT systems for cybersecurity risks. Informed by FTC guidelines on premerger notifications, we ensure HSR Act compliance, including size-of-transaction thresholds and waiting period management to preempt regulatory hurdles.

In one Zaidwood-led transaction, our diligence uncovered a $2 million liability, enabling renegotiation terms that protected the buyer. We recommend engaging early with advisors to streamline this phase, reducing timelines by up to 40%. For small businesses entering private equity deals, this checklist not only mitigates risks but also enhances credibility with investors, fostering smoother mergers and acquisitions outcomes.

Advanced Topics in Advisory Services

As we at Zaidwood Capital delve deeper into advisory services, current trends in mergers and acquisitions in the US for 2026 reveal a dynamic landscape shaped by regulatory shifts and technological advancements. Projections indicate US M&A activity will reach $2.3 trillion, marking a 49% increase from 2024 levels, while global volumes could surge over 25%. Investment Banking plays a pivotal role in facilitating these megadeals, particularly in tech consolidations driven by AI integrations, such as partnerships between OpenAI and semiconductor leaders like NVIDIA. We anticipate heightened activity in healthcare and fintech, with private equity fueling larger, more complex transactions exceeding $2 trillion globally. Strategic financing in these areas demands sophisticated navigation of antitrust analyses and debt markets, where institutional deals thrive amid favorable consolidation environments.

Turning to private equity, advanced deal structures often involve control stakes in mature companies, emphasizing operational improvements to unlock value. These structures mitigate risks through leveraged buyouts and mezzanine financing, yet they carry challenges like market volatility and integration hurdles. Private equity investments typically exhibit a lower risk profile compared to early-stage ventures, focusing on established cash flows rather than unproven innovations. At Zaidwood, our expertise in m&a capital formation enables us to structure these deals efficiently, leveraging access to over $15 billion in deployable capital from our network of more than 4,000 institutional investors.

To illustrate key differences, consider the following comparison of private equity and venture capital structures, informed by our advisory experience:

| Aspect | Private Equity | Venture Capital |

|---|---|---|

| Investment Stage | Mature companies; control stakes | Early-stage; minority equity |

| Risk Profile | Lower; operational improvements | Higher; innovation focus |

| Zaidwood Role | Deal structuring, LP placements | Seed introductions |

This overview of risks underscores how private equity prioritizes stability, often through detailed operational enhancements, while venture capital embraces higher uncertainty for growth potential. Following such structures, we at Zaidwood facilitate seamless executions, drawing on advanced banking roles to align investor interests with strategic goals.

Enhancing full-cycle due diligence remains crucial for mitigating these risks in complex transactions. Our process integrates financial, legal, operational, commercial, IT, and human capital reviews, augmented by proprietary tools like the Velocity Matrix for accelerated insights. This approach not only identifies synergies but also supports fairness opinions, ensuring equitable outcomes. By streamlining transactions with precision, we empower clients to navigate 2026’s M&A complexities effectively, backed by our $24.4 billion in aggregate transaction volume.

Common Questions on Investment Banking Services

Investment Banking plays a pivotal role in guiding businesses through complex financial strategies at boutique firms like Zaidwood Capital. Below, we address common queries to clarify our services in mergers and acquisitions, capital formation, and more.

How much does investment banking cost for capital formation? Advisory fees typically structure as success-based percentages or retainers, varying by deal size and complexity. We tailor costs to align with client goals without upfront specifics.

What is the typical timeline for an M&A process? Under the Hart-Scott-Rodino Act, parties file notifications, observe a 30-day waiting period, and may face extensions for reviews. Our mergers acquisitions advisory streamlines this to expedite closings.

What role does due diligence play in investment banking transactions? Due diligence uncovers risks in financial, legal, and operational areas, ensuring informed decisions. For M&A, it supports regulatory compliance and mitigates liabilities throughout the process.

What are the benefits of Mergers and Acquisitions for small businesses? Mergers and Acquisitions enable growth, market expansion, and access to resources, helping small firms scale efficiently and compete effectively.

How does Private Equity benefit funding options? Private Equity provides growth capital and strategic support, ideal for businesses seeking expansion without public markets. We connect clients to institutional networks for tailored investments.

These insights highlight our commitment to transparent, efficient advisory, empowering informed choices in today’s financial landscape.

Navigating Your Path in Investment Banking

In summary, investment banking offers essential services in Mergers and Acquisitions and Private Equity, guiding businesses from fundamental strategies to advanced capital solutions. These processes enable strategic advisory for growth, navigating complex transactions with expertise.

At Zaidwood Capital, we leverage our extensive network and proven transaction experience to deliver full-cycle M&A and capital advisory. As boutique firms rise in the industry, providing transparent, client-aligned guidance, we empower informed decision-making.

Explore tailored solutions with us to seize opportunities in the US market.