Series E Funding

Table of Contents

Series E Funding Essentials

At Zaidwood Capital, we recognize Series E Funding as a transformative late-stage venture capital milestone for established companies poised for exponential expansion. This growth-stage investment round enables mature startups to scale operations, penetrate new markets, or gear up for strategic exits like initial public offerings. Unlike earlier funding stages focused on validation and product development, Series E emphasizes accelerating proven business models with substantial resources.

Series E funding typically involves raising $50 million or more from sophisticated Series E investors who prioritize companies with demonstrated revenue streams, market leadership, and scalable operations. This contrasts sharply with Series A through D rounds, which center on initial concept proving, team building, and market entry. For instance, a leading US tech firm like Airbnb utilized this advanced startup financing to fuel international growth post-pandemic recovery, highlighting how such capital sustains momentum toward unicorn status or beyond.

Securing this form of late stage venture capital demands meticulous preparation, including polished financial projections, comprehensive due diligence packages, and compelling strategic narratives. We at Zaidwood Capital excel in equity advisory and capital introductions, connecting founders to our vast network of over 4,000 institutional investors with access to more than $15 billion in deployable capital. Our expertise helps navigate these complexities, empowering clients to position effectively for successful outcomes without overpromising results.

Core Principles of Series E Funding

At Zaidwood Capital, we recognize Series E Funding as a pivotal milestone for mature startups poised for hyper-growth or strategic exits. This advanced growth financing stage supports companies with established revenue streams, often exceeding $50 million in annual recurring revenue, to scale operations, pursue acquisitions, or prepare for an initial public offering. Unlike earlier rounds, it emphasizes sustainable profitability paths over rapid user acquisition. For those wondering What is Series E Funding, it represents late stage venture capital where risk profiles diminish, and valuations soar based on proven metrics like EBITDA.

Series E differs markedly from prior funding rounds by shifting focus from foundational building to optimized expansion. In earlier stages, such as Series A, the emphasis lies on product-market fit, whereas Series E prioritizes pre-IPO refinements and bridge financing for liquidity events. We see reduced equity dilution here, as investors prioritize defensible market moats and robust management teams. According to industry insights from the Emory reference on startup funding stages, late-stage rounds like this involve higher scrutiny on financial health, contrasting with the growth experimentation of Series B or C. US market trends post-2020 show surging Series E activity, driven by resilient tech sectors, with companies like a SaaS firm in Austin raising $150 million to fuel global acquisitions.

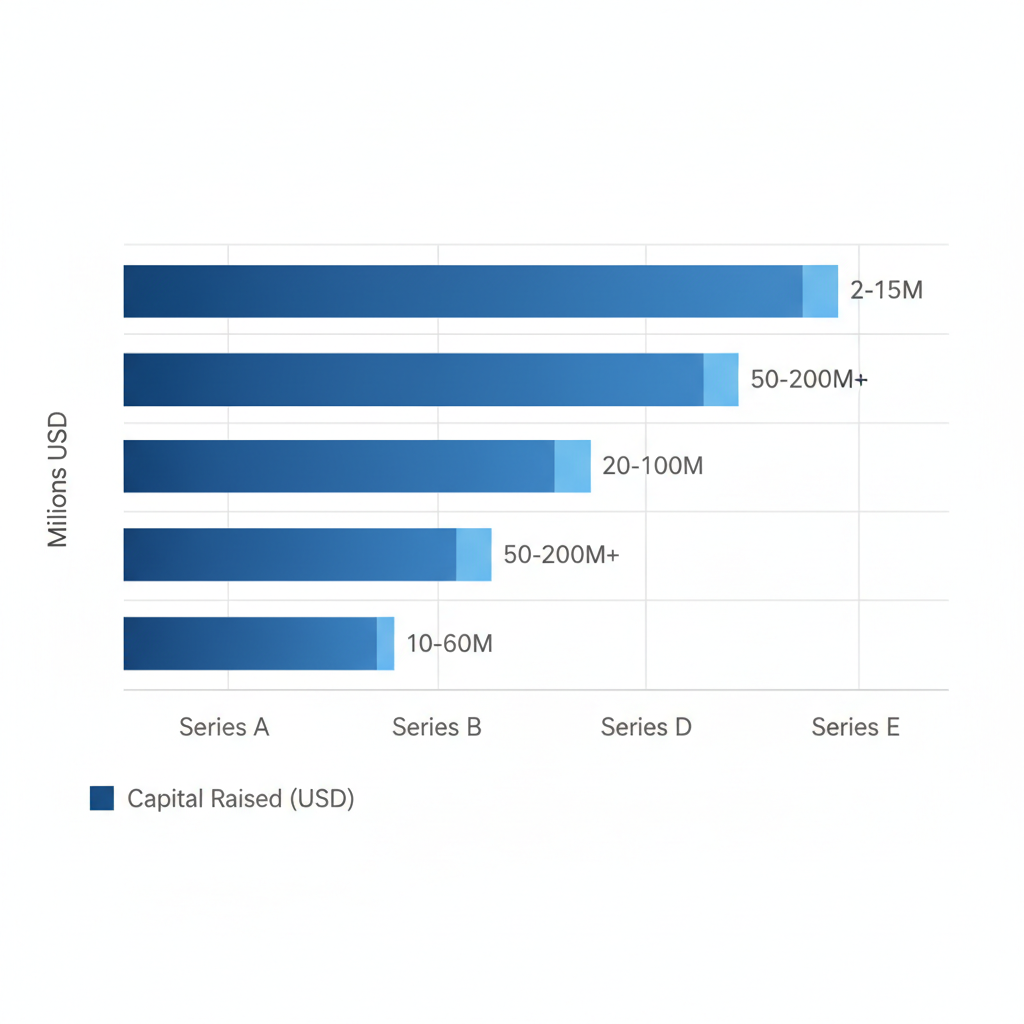

The following table illustrates these evolutions:

| Aspect | Series A | Series B | Series C | Series D | Series E |

|---|---|---|---|---|---|

| Primary Focus | Product development and market validation | Scaling operations and team growth | Expanding market share and revenue | International expansion and acquisitions | Pre-IPO optimization and late-stage growth |

| Typical Amount Raised | $2M – $15M | $10M – $60M | $20M – $100M | $50M – $200M+ | $100M+ (often $50M – $500M) |

| Investor Types | Angel investors, early VCs | Growth-stage VCs | Late-stage VCs, strategic corporates | PE firms, hedge funds | Sovereign wealth, family offices, late-stage VCs |

Comparison of capital raised across Series A to E funding stages

This comparison, drawn from industry averages and Emory’s stage definitions, highlights the progression toward mature-stage equity rounds, where Series E enables strategic pivots with less foundational risk.

Capital volumes in Series E vary significantly by sector, reflecting differing growth trajectories and regulatory landscapes. In tech, where scalability drives valuations, raises often exceed $100 million to support AI integrations or platform expansions. Healthcare firms, conversely, may secure $50 million to $200 million for clinical advancements amid longer validation periods. Founders must tailor pitches to these nuances, as we advise at Zaidwood, leveraging our network of over 4,000 institutional investors. Post-2020 data indicates average Series E raises between $75 million and $250 million in the US, with tech leading due to high multiples.

| Industry | Typical Series E Raise |

|---|---|

| Tech | $100M – $300M |

| Healthcare | $50M – $200M |

These figures underscore sector-specific opportunities; for instance, tech’s higher ceilings attract aggressive scaling, while healthcare emphasizes milestone-based funding. Implications for founders include aligning business models with investor appetites to maximize terms.

Series E investors seek companies with strong governance and exit-ready structures, often demanding board seats for oversight. We observe that these stakeholders, including sovereign wealth funds, prioritize paths to profitability over speculative upside. This late stage venture capital phase benefits scaling firms by providing non-dilutive growth capital, though it requires transparent metrics. Ultimately, it bridges to public markets or acquisitions, fortifying long-term value creation.

In-Depth Analysis of Series E Dynamics

From our experience at Zaidwood Capital, Series E funding represents a pivotal stage where companies transition from growth to maturity, attracting sophisticated investors focused on sustainable scaling. This section explores investor priorities, evolving market trends in late stage venture capital, and the inherent risks, providing actionable insights for founders navigating these complex dynamics.

Investor Expectations in Series E Rounds

Series E investors prioritize robust financial performance and strategic alignment, often seeking companies with 3x year-over-year growth, international market traction, and strong intellectual property portfolios. We have observed that these institutional late-round backers evaluate not just current revenue–typically exceeding $100 million annually–but also the path to profitability through scalable business models. For instance, in evaluating startups for Series E funding, they emphasize metrics like customer acquisition cost efficiency and recurring revenue streams, ensuring the company can withstand competitive pressures.

This shift in evaluation marks a departure from earlier growth equity phases, where innovation potential overshadowed immediate returns. As companies approach valuations often surpassing $1 billion, Series E investors demand evidence of operational excellence and market leadership. From our advisory perspective, understanding these criteria helps founders prepare compelling pitches that highlight long-term value creation.

The following table contrasts key differences between early-stage VCs and Series E investors, illustrating how priorities evolve at this mature stage:

| Criteria | Early-Stage VCs | Series E Investors |

|---|---|---|

| Valuation Focus | Potential and market size | Revenue multiples and path to profitability |

| Risk Tolerance | High (idea-stage bets) | Lower (proven models only) |

| Exit Horizon | 5-10 years | 1-3 years (IPO or acquisition) |

These distinctions underscore a more conservative approach in late-stage investments, where Series E investors focus on derisking opportunities through proven execution rather than speculative upside. This evolution influences how we structure advisory engagements to align client narratives with investor scrutiny.

Late Stage Venture Capital Trends

In the US, late stage venture capital has seen a resurgence post-2022, with rising dry powder exceeding $300 billion available for deployment, particularly in technology sectors like fintech and SaaS. We note a dominance of private equity firms, family offices, and corporate venture arms as typical participants, drawn to companies at $100 million-plus valuations seeking expansion capital. Recent trends highlight a preference for deals with global reach, influenced by economic recoveries and interest rate stabilizations that favor mature enterprises over speculative plays.

For example, anonymized US fintech firms have leveraged late stage venture capital to acquire international footprints, reflecting investor appetite for diversified revenue amid geopolitical shifts. Institutional late-round backers increasingly incorporate ESG factors, pushing for sustainable growth models. From our vantage, these dynamics signal a maturing ecosystem where late stage venture capital not only funds scaling but also bridges toward public markets or strategic acquisitions.

Risks and Challenges in Late-Stage Funding

Navigating Series E funding introduces significant risks, including founder dilution from high valuations that can cap future upside and complicate governance. Market downturns pose another challenge, as seen in 2023 when US late stage venture capital deals dipped by 20% due to inflation pressures, forcing companies to accept suboptimal terms. We advise clients on pitfalls like overreliance on growth narratives without profitability buffers, which can lead to stalled momentum or investor pullbacks.

To mitigate these, startups should diversify funding sources, such as exploring debt advisory services for mezzanine options that preserve equity. Valuation mismatches arise when hype outpaces fundamentals, risking down rounds that erode team morale. In our work with US-based enterprises, we emphasize rigorous due diligence to address regulatory hurdles and competitive threats in late stage venture capital.

Benefits like accelerated scaling and enhanced credibility come with preparation: building resilient financial models and fostering strong investor relationships. For instance, a Midwest SaaS company we supported used Series E to pivot toward AI integrations, offsetting risks through strategic partnerships. Ultimately, proactive risk management transforms challenges into opportunities for sustainable enterprise value.

Strategies for Securing Series E Funding

At Zaidwood Capital, we guide startups through the complexities of late-stage funding, emphasizing strategic preparation and execution. Series E funding represents a critical scaling investment preparation phase, where mature companies seek substantial capital to fuel growth, acquisitions, or pre-IPO positioning. Our experience with over 300 deals underscores the importance of meticulous planning to attract Series E investors focused on proven scalability and robust returns.

Preparing Your Startup for Series E

We recommend a structured approach to ensure financial and operational readiness for Series E funding. Begin by auditing financials to validate revenue streams and cash flow projections. Refine your business model to demonstrate sustainable scalability, incorporating metrics like customer acquisition costs and lifetime value. Build a comprehensive data room with historical financials, IP portfolios, and compliance records to facilitate due diligence.

Next, assess market positioning and competitive advantages. Conduct a thorough internal review to identify operational efficiencies and growth levers. For US startups, consider examples like a SaaS firm in Austin that bolstered its Series E readiness by integrating AI-driven analytics, resulting in a 40% valuation uplift.

To optimize, leverage checklists:

- Verify financial audits with third-party validation.

- Update cap tables and equity structures.

- Simulate stress tests for economic variables.

As outlined in Emory University’s resources on funding lifecycles, stage-specific readiness factors like governance maturity are essential. However, internal teams often face significant challenges in this process. Handling preparation in-house can be time-intensive, with potential gaps in sophisticated financial modeling that require deep expertise in late stage venture capital dynamics. Limited internal networks may slow investor outreach, straining resources during due diligence across financial, legal, and IT domains. This approach risks overlooked complexities in equity/debt hybrids, potentially delaying execution and reducing leverage in negotiations.

The following table compares self-preparation with advisor-supported methods:

| Strategy Area | Internal Team Handling | With Capital Advisors (e.g., Zaidwood) |

|---|---|---|

| Financial Modeling | Time-intensive, potential gaps in complexity | Expert pro formas, access to $15B+ capital networks |

| Investor Outreach | Limited network, slower connections | Introductions to 4,000+ institutions, faster execution |

| Due Diligence Support | Resource strain on team | Full-cycle diligence across financial/legal/IT |

By partnering with experienced advisors, startups achieve notable efficiency gains. Our full-cycle support streamlines processes, leveraging proprietary networks for accelerated timelines–often reducing preparation from months to weeks. This integration of equity advisory services ensures precise structuring, enhancing investor confidence without the burdens of internal overload.

Step-by-step guide to securing Series E funding for startups

Pitching Effectively to Series E Investors

Crafting a compelling pitch for Series E investors demands a blend of narrative storytelling and data-backed validation. Tailor your narrative to highlight scalability metrics, such as 3x year-over-year growth and market penetration strategies. Demonstrate traction through case studies, like a biotech startup in Boston that secured $150M by showcasing clinical trial outcomes and partnership pipelines.

Negotiation tactics include anchoring on valuation with comparable exits and emphasizing downside protections. Leverage advisors for warm introductions and rehearsal sessions to refine delivery.

Series E investors prioritize a balance between visionary narratives and empirical evidence. In late-round pitch optimization, they seek stories that humanize the journey while demanding rigorous data on unit economics and ROI projections. Preferences lean toward pitches that integrate both, avoiding overly speculative tales or dry spreadsheets.

| Pitch Element | Narratve Approach | Data-Driven Approach |

|---|---|---|

| Company Story | Emphasize founder vision and milestones | Back with timelines and key achievements |

| Market Opportunity | Paint expansive growth vision | Cite TAM/SAM data and penetration rates |

| Financial Projections | Highlight strategic pivots | Provide pro forma models and sensitivity analyses |

Synthesizing best practices, we advise hybrid pitches that weave narratives around data visuals, fostering trust and urgency among investors.

Documentation Essentials for Capital Raising

Essential documents form the backbone of Series E transactions, ensuring transparency and alignment. Start with a polished pitch deck outlining problem-solution fit, traction metrics, and use of funds. Develop a detailed business plan projecting five-year trajectories, including market analysis and risk mitigations.

Pro forma financials are crucial, modeling revenue, expenses, and exit scenarios with conservative assumptions. Include legal essentials like term sheets and NDAs, plus governance policies to signal maturity.

For illustration, a fintech in New York streamlined its raise by using advisor-vetted pro formas, accelerating closes. We integrate strategic documentation services to craft these, drawing on our $24.4B transaction volume for precision. Checklists aid compliance:

- Ensure all projections align with audited statements.

- Incorporate scenario analyses for volatility.

- Secure advisor reviews for investor-grade polish.

This preparation not only attracts capital but positions startups for advanced structuring in subsequent rounds.

Advanced Considerations in Series E Transactions

Navigating Series E funding demands a nuanced understanding of complex late-stage deals, where scaling companies face heightened scrutiny from institutional funding partnerships. At this juncture, founders must balance growth imperatives with valuation preservation and exit pathways. Our team at Zaidwood Capital guides clients through these intricacies, leveraging our expertise in full-cycle M&A and capital advisory to optimize outcomes without promising specific results.

Capital advisors play a pivotal role in securing Series E funding by providing access to expansive networks, crafting meticulous documentation, and spearheading negotiations. We connect clients to over 4,000 Series E investors, drawing from our $24.4 billion aggregate transaction volume. Through our transaction advisory services, we streamline processes using the Velocity Matrix for accelerated deal velocity and the Deal Vault for secure investor rolodex access. For instance, our strategic financial consulting ensures pitch decks and pro forma financials align with late-stage expectations, fostering trust and efficiency in these high-stakes engagements.

In structuring late stage venture capital rounds, companies often weigh pure equity against hybrid debt-equity options like mezzanine debt. Hybrid structures have gained traction in recent years, allowing firms to minimize dilution while accessing flexible capital for expansion. This approach appeals to private equity and debt funds seeking balanced risk profiles, particularly for US-based enterprises preparing for IPOs or acquisitions. As seen in an anonymized case, a US technology firm utilized a hybrid model to raise $200 million, preserving founder equity through interest-bearing instruments alongside equity components. Such strategies enhance scalability, addressing relevant queries on investor influence in exit preparation.

| Factor | Pure Equity | Hybrid Debt-Equity |

|---|---|---|

| Dilution Impact | High founder dilution | Lower equity give-up, interest payments |

| Investor Appeal | Growth-focused VCs | PE/debt funds for balanced risk |

| Exit Flexibility | Standard | Repayment options pre-exit |

Selecting between pure equity and hybrids depends on factors like cash flow stability, growth trajectory, and risk tolerance. Pure equity suits aggressive scaling with VC backing, while hybrids offer repayment flexibility for mature operations. Our debt advisory integrates these options seamlessly.

Advanced due diligence in Series E transactions evolves across financial, operational, and IT domains, building on earlier funding stages. We conduct full-cycle reviews, including:

- Financial audits verifying revenue sustainability.

- Operational assessments of supply chain resilience.

- IT evaluations for cybersecurity and scalability.

This comprehensive approach mitigates risks, empowering clients to advance confidently toward liquidity events.

Common Questions on Series E Funding

At Zaidwood Capital, we address advanced funding FAQs to clarify late-stage query resolutions for entrepreneurs navigating deal vault investments.

How does late stage venture capital differ from early stage funding?

Late stage venture capital focuses on scaling mature companies with proven revenue, unlike early stage funding that supports initial product development and market entry. This recap highlights our guide’s emphasis on growth metrics over ideation.

What criteria do Series E investors prioritize?

Series E investors seek robust scalability, strong governance, and clear exit paths, often from private equity firms valuing operational maturity. We advise aligning with these to attract committed capital.

How should companies prepare for Series E Funding?

Preparation involves detailed financial audits, strategic roadmaps, and team enhancements to demonstrate valuation uplift. Our capital formation services streamline this process for optimal readiness.

What benefits do advisors provide in Series E rounds?

Advisors offer negotiation expertise, investor connections, and due diligence support, mitigating risks in complex deals. We enhance outcomes through our institutional network.

What trends and risks shape Series E Funding?

Trends include AI integration and sustainability focus, with risks like market volatility and regulatory hurdles. Staying informed ensures resilient strategies.

What challenges arise in pitching to Series E investors?

Challenges involve proving sustained growth amid competition; effective strategies emphasize data-driven narratives. We help craft compelling pitches for success.

How does an IPO influence Series E decisions?

An impending IPO accelerates Series E by bridging to public markets, attracting investors seeking liquidity. This ties into our advisory on exit planning.

Navigating Series E Success

Series E Funding represents the pinnacle of late stage venture capital, enabling companies to scale globally after proving market dominance. Key preparation includes comprehensive documentation and governance alignment to appeal to Series E investors focused on sustainable growth and exit readiness. Strategic networks facilitate essential connections, bridging innovators with capital deployers.

At Zaidwood Capital, we leverage our extensive investor rolodex and full-cycle advisory to craft strategic late-stage partnerships. Our services streamline capital formation, ensuring US-based firms navigate this complex phase with precision and velocity.

We at Zaidwood invite you to book a call and explore tailored guidance for your growth funding culmination.