M&a Due Diligence Services

Table of Contents

Understanding M&A Due Diligence Services

In the complex world of mergers and acquisitions, M&A Due Diligence Services play a pivotal role in safeguarding transactions. This comprehensive investigation process uncovers potential risks, validates business opportunities, and empowers informed decision-making for corporate clients and fund managers. By scrutinizing financial statements, legal compliance, and operational efficiencies, due diligence helps prevent costly surprises after the deal closes.

At Zaidwood Capital, we integrate merger and acquisition investigation processes seamlessly into the entire M&A lifecycle, from initial negotiations through to closing. Our full-cycle due diligence addresses key areas such as financial viability, legal liabilities, and operational synergies, mitigating threats that could derail a transaction. For instance, we emphasize antitrust considerations during pre-merger phases, drawing on guidance from the U.S. Federal Trade Commission. The FTC warns against sharing sensitive information like pricing strategies or future plans, which can lead to anticompetitive coordination and legal challenges. Our approach, backed by access to proprietary data and a network of over 4,000 investors, ensures thorough assessments. With an aggregate transaction volume of $24.4 billion, we deliver precise insights to streamline these protocols.

This guide explores the fundamentals of due diligence, deep dives into specialized methodologies, practical applications for buy-side and sell-side mandates, advanced strategies for complex deals, and answers to common questions.

Join us as we delve deeper into how zaidwood capital advisory can support your next transaction with strategic precision and expertise.

Fundamentals of M&A Due Diligence

At Zaidwood Capital, we specialize in M&A Due Diligence Services, providing clients with the foundational tools to navigate complex transactions. Due diligence forms the bedrock of any merger or acquisition, enabling thorough risk assessment and informed decision-making. This process involves scrutinizing a target’s operations, finances, and legal standing to uncover potential issues that could affect deal value. Drawing from our experience in over 300 completed deals, we guide clients through these essentials to ensure alignment with strategic goals.

The core stages of due diligence begin with assembling a multidisciplinary team, including financial analysts, legal experts, and operational specialists. We recommend starting with data room setup, where sellers organize critical documents for secure access. Preliminary reviews follow, focusing on high-level overviews to identify red flags early. This structured approach, as highlighted in American Bar Association guidelines, mitigates risks in law firm mergers, where 2023 saw increased activity but emphasized methodical evaluation for integration success. Financial audits verify historical statements and projections; legal compliance checks examine contracts and regulatory filings; operational assessments evaluate processes and supply chains. These interconnected steps reveal discrepancies, such as unsustainable revenue or hidden liabilities, directly impacting valuation.

Key components include financial, legal, and operational reviews, each addressing specific facets of acquisition investigation fundamentals. For instance, in a sample tech acquisition, we might scrutinize cash flow metrics to assess sustainability, aligning with ABA recommendations for evaluating accounts receivable turnover. Legal components draw on U.S. Department of Justice policies, which stress preventing fraud through rigorous contract validation–quoting the Criminal Division’s emphasis on transparent business practices to avoid criminal liabilities. Operational due diligence probes efficiency, ensuring cultural and technological compatibility to prevent post-merger disruptions.

The following table provides an overview of core due diligence areas, comparing their primary focus areas to highlight their distinct yet interconnected roles in M&A transactions.

| Due Diligence Area | Key Objectives | Typical Documents Reviewed | Common Risks Identified |

|---|---|---|---|

| Financial | Assess financial health and projections; Validate revenue streams and liabilities | Balance sheets, income statements, tax returns | Overstated assets, hidden debts |

| Legal | Ensure compliance and contract validity; Review litigation history | Contracts, IP filings, regulatory filings | Pending lawsuits, IP disputes |

| Operational | Evaluate day-to-day processes; Assess supply chain efficiency | Operational manuals, supplier agreements | Inefficiencies, key personnel risks |

Data sourced from American Bar Association guidelines on M&A due diligence. This comparison underscores how financial scrutiny complements legal safeguards, while operational insights ensure practical viability, forming a holistic merger risk assessment basics framework.

A comprehensive Due Diligence Checklist is essential for systematic coverage. Standard items include:

- Financial: Audit trial balances, debt schedules, and tax compliance records.

- Legal: Verify intellectual property ownership, ongoing litigations, and regulatory approvals.

- Operational: Map key processes, evaluate IT systems, and assess employee retention risks.

These elements, informed by Justice Department fraud prevention policies, help identify opportunities for efficiency gains, as seen in successful law firm integrations per ABA insights.

Core M&A due diligence areas: financial, legal, and operational overview

In practice, discrepancies uncovered can adjust deal terms by 10-20%, based on historical transaction data. At Zaidwood Capital, we integrate full-cycle support, from initial setup to final reporting, streamlining these fundamentals for seamless execution.

Building on these basics, our deep dive into advanced strategies explores tailored applications for diverse industries.

Deep Dive into M&A Due Diligence Components

At Zaidwood Capital, our M&A Due Diligence Services form the cornerstone of successful transactions, providing clients with a thorough examination of potential deals. These services encompass financial, legal, operational, commercial, and strategic elements, drawing from our full-cycle due diligence offerings, including Investment Bank Due Diligence, IT and human capital reviews. In our experience, integrating these components early can significantly influence deal outcomes, as evidenced by anonymized cases where overlooked details led to valuation adjustments.

Financial and Legal Aspects

Financial due diligence at Zaidwood begins with rigorous audits of historical financial statements and projections, ensuring accuracy in revenue recognition and expense forecasting. We scrutinize balance sheets for hidden liabilities and assess working capital adequacy, often revealing discrepancies that impact enterprise value. For instance, in a recent mid-market acquisition, our analysis uncovered overstated assets, leading to a 15% valuation reduction. Budgeting for this phase typically ranges from 1% to 10% of transaction value, as discussed in IMAA Institute forums, allowing flexibility for complex deals.

Legal compliance checks are equally critical, involving reviews of contracts, intellectual property rights, and regulatory adherence. We examine litigation risks, compliance with antitrust laws, and title issues on assets, identifying hurdles that could delay closing. In one cross-border deal, potential IP disputes surfaced during our review, prompting renegotiations that protected our client’s interests. These financial and legal validations not only mitigate risks but also inform precise valuation adjustments, ensuring alignment with regulatory frameworks.

While financial due diligence emphasizes quantitative precision, operational reviews focus on qualitative efficiencies, creating distinct yet complementary methodologies. This contrast highlights how financial analysis drives numerical adjustments, whereas operational insights shape process optimizations.

| Methodology | Financial Due Diligence | Operational Due Diligence |

|---|---|---|

| Data Analysis Focus | Historical financials and projections | Process mapping and efficiency audits |

| Key Tools | Financial modeling software | Workflow diagrams, site visits |

| Risk Output | Valuation adjustments | Integration challenges |

This table illustrates the methodological differences: financial due diligence relies on data-driven tools for fiscal accuracy, while operational approaches incorporate on-site evaluations for practical insights. Synergies arise when these are combined, as financial findings can validate operational efficiencies, enhancing overall deal viability. According to CFA Institute insights, such integrated approaches contribute to the winning ingredients in M&A by addressing both immediate risks and long-term value creation.

Operational and Commercial Reviews

Operational reviews at Zaidwood Capital delve into supply chain robustness, production efficiencies, and IT infrastructure, identifying bottlenecks that could erode post-merger value. We conduct site visits and process mappings to evaluate scalability, often recommending optimizations that streamline operations. In an anonymized manufacturing acquisition, our assessment revealed supply chain vulnerabilities, enabling our client to negotiate supplier diversifications and reduce downtime risks by 20%.

Commercial viability assessments analyze market positioning, customer concentrations, and competitive landscapes, ensuring sustained revenue streams. We review sales pipelines, pricing strategies, and brand equity, quantifying market share potential. For example, in a tech sector deal, commercial due diligence highlighted untapped synergies in customer bases, boosting projected synergies by 10%. These reviews interconnect with our full-cycle services, providing a holistic view that supports informed decision-making in dynamic markets.

Strategic Integration Considerations

Strategic due diligence informs post-merger synergy planning by assessing cultural fit, leadership alignment, and growth trajectories. At Zaidwood, we evaluate how acquired capabilities enhance our client’s portfolio, using risk-adjusted models to forecast integration timelines. The CFA Institute notes that 70% to 90% of M&A deals fail due to integration oversights, underscoring the need for holistic reviews that include technology and human capital.

| Component | Depth of Analysis | Key Insights from References |

|---|---|---|

| Financial/Legal | Audits and compliance checks | 1-10% budget allocation (IMAA) |

| Operational/Commercial | Efficiency and market audits | Process optimizations for value |

| Strategic | Synergy and risk modeling | 70-90% failure rate without depth (CFA) |

This component depth comparison reveals varying analytical layers, with strategic elements demanding forward-looking integration strategies. In our experience, these considerations enable risk-adjusted approaches that maximize shareholder value, aligning with comprehensive M&A advisory.

Practical Applications of M&A Due Diligence

At Zaidwood Capital, we apply mergers and acquisitions advisory principles to deliver M&A Due Diligence Services that bridge theoretical frameworks with tangible transaction outcomes. These services enable clients to navigate complex deals with precision, focusing on checklist implementation, timeline optimization, and risk management. By leveraging our expertise in full-cycle assessments, we help private equity firms and corporate entities execute seamless integrations while minimizing disruptions.

Implementing Checklists in Transactions

We initiate due diligence checklists during the early phases of a transaction, starting with preliminary financial reviews to establish baseline data. This step involves gathering historical financial statements, tax records, and revenue projections to identify immediate red flags. As the process advances to operational and legal reviews, teams scrutinize contracts, compliance status, and IT infrastructure, ensuring comprehensive coverage of key areas like intellectual property and employee agreements. Budgeting plays a critical role here; we allocate resources based on deal size and complexity, typically reserving 1-2% of transaction value for foundational diligence efforts.

Timelines vary according to scope and external factors, such as regulatory approvals or stakeholder availability. For standard engagements, we recommend phased milestones–preliminary (1-2 weeks), core analysis (3-6 weeks), and final synthesis (1 week)–to maintain momentum without compromising thoroughness. These structures allow for iterative feedback, adjusting priorities as new insights emerge.

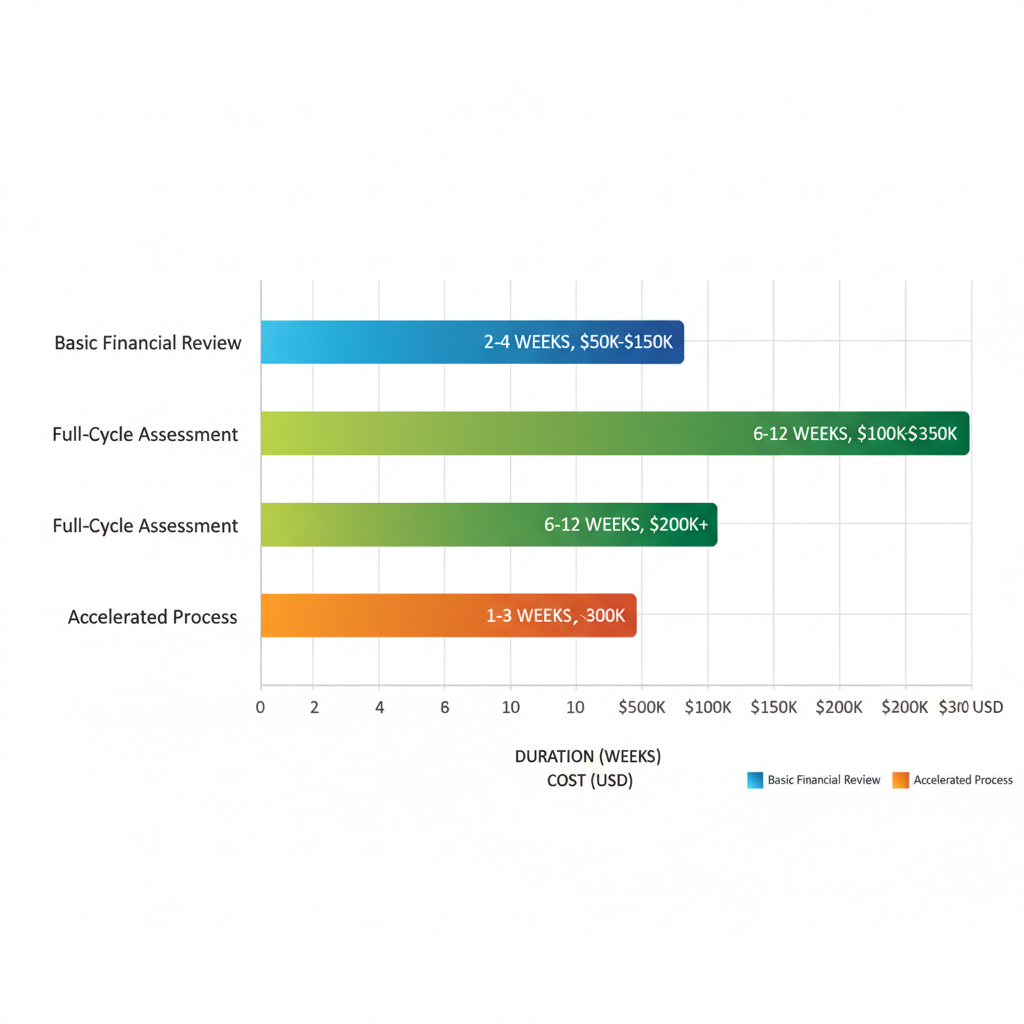

The following table outlines typical timelines and costs for various due diligence scopes, drawing from industry benchmarks like those discussed in IMAA forums:

| Scope | Typical Duration | Estimated Cost Range | Key Influences |

|---|---|---|---|

| Basic Financial Review | 2-4 weeks | $50K-$150K | Deal size, complexity |

| Full-Cycle Assessment | 6-12 weeks | $200K+ | Team size, international elements |

| Accelerated Process | 1-3 weeks | $100K-$300K | Urgency, focused areas |

In interpreting these figures, we advise clients to prioritize flexibility; for instance, larger deals with international components often require extended durations and higher budgets to address cross-border regulations. Optimizing costs involves streamlining document requests early and utilizing digital tools for data rooms, which can reduce expenses by up to 20% while accelerating reviews. This approach aligns with our capital introductions, connecting clients to specialized advisors for efficient execution.

M&A due diligence options: timelines and costs comparison

Visual aids like this chart reinforce the need for tailored planning, highlighting how scope directly impacts both time and investment. We have guided numerous transactions through these variables, ensuring alignments that support overall deal velocity.

Risk Mitigation Strategies

Once risks are identified through our checklists, we deploy targeted strategies to safeguard transaction value. For financial exposures, such as overstated assets, we recommend valuation adjustments via purchase price reductions or earn-outs tied to post-closing performance. Legal risks, particularly antitrust concerns outlined by the FTC, demand vigilant information controls during negotiations; we implement clean teams and confidentiality walls to prevent anticompetitive data sharing, as seen in cases where premature exchanges led to regulatory scrutiny.

Operational mismatches, including cultural or IT incompatibilities, require integration roadmaps developed in tandem with human capital assessments. Drawing from ABA insights on law firm mergers, we emphasize compatibility audits to forecast integration costs and timelines. In high-stakes scenarios, warranties and indemnities form the backbone of protection, with escrows holding 5-10% of deal value for potential claims.

To further illustrate, consider this table on key risk mitigation approaches, informed by FTC and ABA guidelines:

| Risk Type | Mitigation Technique | Expected Impact |

|---|---|---|

| Antitrust Exposure | Clean teams & data firewalls | Reduces coordination risks |

| Financial Overstatement | Earn-outs & price adjustments | Protects buyer valuation |

| Cultural Misalignment | Pre-merger audits & training | Enhances integration success |

These techniques not only address immediate threats but also foster long-term synergies, with our advisory services facilitating negotiations for balanced outcomes.

Case Studies and Best Practices

In one anonymized engagement, a mid-market acquisition uncovered supply chain vulnerabilities through our full-cycle diligence, leading to supplier diversification that preserved 15% of projected margins. Another deal involving a tech firm benefited from antitrust protocols, avoiding FTC delays and closing two weeks ahead of schedule.

- Prioritize Phased Checklists: Break diligence into modular stages for adaptability, as per ABA recommendations.

- Integrate Capital Networks: Leverage introductions to 4,000+ investors for third-party validations, enhancing credibility.

- Document Iteratively: Maintain audit trails to support warranties and dispute resolution.

- Monitor Post-Close Metrics: Track KPIs for 6-12 months to refine future strategies.

These practices, honed across our 300+ deals totaling $24.4B, underscore the value of structured diligence in driving successful mergers.

Advanced Topics in M&A Due Diligence

In the realm of M&A Due Diligence Services, advanced practices represent the next frontier for ensuring transaction resilience and value creation. At Zaidwood Capital, we elevate traditional processes through innovative approaches that address the complexities of modern deals. With global M&A activity surpassing $2 trillion in North America alone in 2024, as noted in PitchBook data, sophisticated acquisition audits have become essential to counter the 70% to 90% failure rate of such transactions.

Emerging technologies are transforming due diligence, particularly through AI and data analytics. We leverage generative AI to automate data processing, uncovering insights from vast datasets that manual reviews miss. For instance, predictive modeling identifies potential synergies or risks in operational flows, accelerating analysis from months to days. Our proprietary Velocity Matrix integrates machine learning to simulate deal outcomes, drawing on access to over $15 billion in deployable capital from our network of 4,000+ institutional investors. This tech-driven methodology not only enhances accuracy but also supports zaidwood capital services in delivering full-cycle due diligence tailored for high-stakes environments.

The evolution from standard to advanced tools underscores this shift, as illustrated in the following comparison:

| Aspect | Standard Approach | Advanced Approach |

|---|---|---|

| Data Analysis | Manual review of documents | AI-driven analytics and predictive modeling |

| Risk Assessment | Qualitative checklists | Quantitative scenario simulations |

| Integration Planning | Basic synergy estimates | Full-cycle operational modeling |

This table highlights how advanced methods provide deeper foresight, informed by insights from CFA and ABA on evolving due diligence practices. Post-table, these enhancements yield measurable benefits: AI adoption can improve deal values by up to 20%, according to CFA analyses, while reducing integration timelines. In a recent anonymized $500 million cross-border acquisition, our quantitative simulations revealed hidden regulatory hurdles, averting potential delays and preserving value.

Complex risks in due diligence demand high-level merger risk modeling beyond basic checks. Advanced legal and regulatory challenges include navigating antitrust implications and international compliance, where we apply scenario-based assessments to forecast litigation exposure. Drawing from the U.S. Department of Justice’s Criminal Division Business Organizations Policy, we scrutinize fraud risks in corporate structures, identifying red flags like inadequate internal controls that could lead to enforcement actions. Human capital due diligence extends to talent retention modeling, evaluating key personnel incentives, while IT audits probe cybersecurity vulnerabilities using penetration testing frameworks. These layered analyses mitigate multifaceted threats, ensuring robust transaction frameworks.

Integration strategies form the capstone of advanced due diligence, focusing on seamless post-merger alignment. We conduct comprehensive human capital reviews to assess cultural fit and leadership continuity, employing surveys and predictive analytics to model retention rates. IT due diligence involves full-system audits, including data migration simulations to prevent disruptions. Fairness opinions and transaction advisory services provide independent valuations, often incorporating discounted cash flow models adjusted for synergies. Through our Deal Vault, clients access proprietary investor rolodexes for targeted capital introductions, facilitating $24.4 billion in aggregate transaction volume. These strategies, exemplified in a $1.2 billion private equity carve-out we advised, optimize operational synergies and drive long-term value realization.

Frequently Asked Questions on M&A Due Diligence

This section offers M&A Due Diligence Services insights through common merger queries and acquisition FAQ highlights, addressing key concerns from our experience at Zaidwood Capital.

- How much do M&A due diligence services cost?

Costs vary by transaction complexity and scope, but we recommend budgeting 1% to 10% of deal value, as discussed in IMAA forums. This covers financial, legal, and operational reviews to ensure comprehensive risk assessment without surprises.

- How long does the M&A due diligence process usually take?

The process typically spans 4-8 weeks, depending on data availability and deal size. We streamline timelines through our full-cycle approach, drawing on IMAA best practices for efficiency while maintaining thoroughness.

- Why is due diligence crucial for risk mitigation in M&A?

It identifies hidden liabilities and opportunities early, protecting transaction value. At Zaidwood Capital, we emphasize this step to safeguard client interests, aligning with strategies outlined in earlier sections.

- What does Zaidwood Capital’s involvement entail?

We provide end-to-end support, including financial audits, legal compliance checks, and operational evaluations. Our team coordinates with experts to deliver actionable insights tailored to your mandate.

- What are essential items on a due diligence checklist?

Core elements include reviewing financial statements, contracts, IP rights, and market positioning. We customize checklists to fit your needs, ensuring alignment with industry standards.

For personalized M&A advisory, contact us to discuss how we can assist your transaction.

Key Takeaways from M&A Due Diligence Services

M&A Due Diligence Services serve as essential transaction safeguards, mitigating risks and driving value in mergers and acquisitions where 70% to 90% of deals fail without thorough evaluation. As we’ve outlined, key components like financial, operational, and legal reviews, combined with advanced strategies such as AI-driven analytics, ensure informed decisions. Budgeting and timelines vary by deal complexity, but our structured approach accelerates insights while maintaining precision.

At the zaidwood capital firm, we deliver full-cycle due diligence capabilities, leveraging our network of over 4,000 investors and $24.4 billion in transaction volume to provide merger evaluation summaries tailored to your needs.

Contact us to explore how our expertise can safeguard your next transaction.