What is Series E Funding

Table of Contents

Understanding Series E Funding

In the dynamic world of startup financing, Series E Funding represents a pivotal late-stage milestone where high-growth companies secure substantial capital to accelerate expansion. This round often follows Series D and signals a company’s transition toward maturity, with valuations soaring into the billions. For entrepreneurs navigating this path, understanding Series E funding equips them to make informed decisions about scaling operations and positioning for future liquidity events.

Series E funding typically involves equity or debt infusions, as outlined in the SEC’s glossary for small businesses, to fuel aggressive growth strategies like international expansion or strategic acquisitions. Startups reach this stage after progressing through seed funding for ideation, Series A for product development, Series B for market fit, Series C for scaling, and Series D for optimization. By Series E, companies have often achieved product-market validation, recurring revenue streams, and a robust customer base. Common capital needs exceed $50 million per round, drawn from institutional Series E investors seeking opportunities in late-stage venture financing. Founders pursue this financing to bridge gaps to profitability, fund mergers, or prepare for Series E funding to IPO, as seen in hypothetical cases like a tech firm expanding globally post-Series D to dominate its niche.

At Zaidwood Capital, we provide equity advisory services and capital introductions through our network of over 4,000 investors, helping clients navigate pre-IPO capital rounds without promising specific outcomes. Our expertise supports founders in evaluating funding options effectively.

This overview sets the foundation for exploring the core mechanics of Series E funding in the following sections, where we delve into strategies for success.

Core Concepts of Series E Funding

In the dynamic landscape of startup financing, Series E funding marks a pivotal phase for companies demonstrating hyper-growth and market dominance. This advanced venture capital stage bridges the gap between aggressive expansion and strategic maturity, often paving the way for Series E funding to IPO transitions. Our experience at Zaidwood Capital shows that understanding these core concepts empowers founders to navigate complex capital needs effectively.

Series E funding typically occurs after a company has exhausted earlier rounds and achieved substantial traction. It serves as late-stage equity financing, enabling sustained scaling for startups valued in the billions. Unlike initial rounds, Series E emphasizes optimizing operations for profitability and preparing for exit strategies, such as acquisitions or public listings. According to the SEC’s Capital Raising Building Blocks, this progression reflects a company’s evolution from validation to market leadership, with regulatory frameworks ensuring transparency in disclosures.

The capital infused in a Series E round far exceeds prior stages, reflecting the company’s proven revenue streams and expansion potential. On average, companies raise between $75 million and $300 million, though amounts can climb higher for sector leaders like tech or biotech firms. This influx supports ambitious initiatives, including international market entry or technology acquisitions. Valuation benchmarks at this juncture commonly reach 10-20x annual revenue multiples, as investors scrutinize unit economics and long-term sustainability. For instance, a SaaS company with $50 million in recurring revenue might command a $1 billion-plus valuation, drawing sophisticated backers seeking high returns.

At the Series E growth stage, startups shift focus from rapid user acquisition to achieving profitability paths and operational efficiency. Post-Series D, these firms often pursue mergers, global scaling, or infrastructure builds to fortify their competitive edge. This maturity phase demands rigorous financial modeling and risk assessment, aligning with growth-stage equity principles. Hypothetically, a fintech startup might leverage Series E funds to acquire a regional competitor, enhancing its user base while streamlining costs. Such moves underscore the round’s role in positioning companies for sustained dominance.

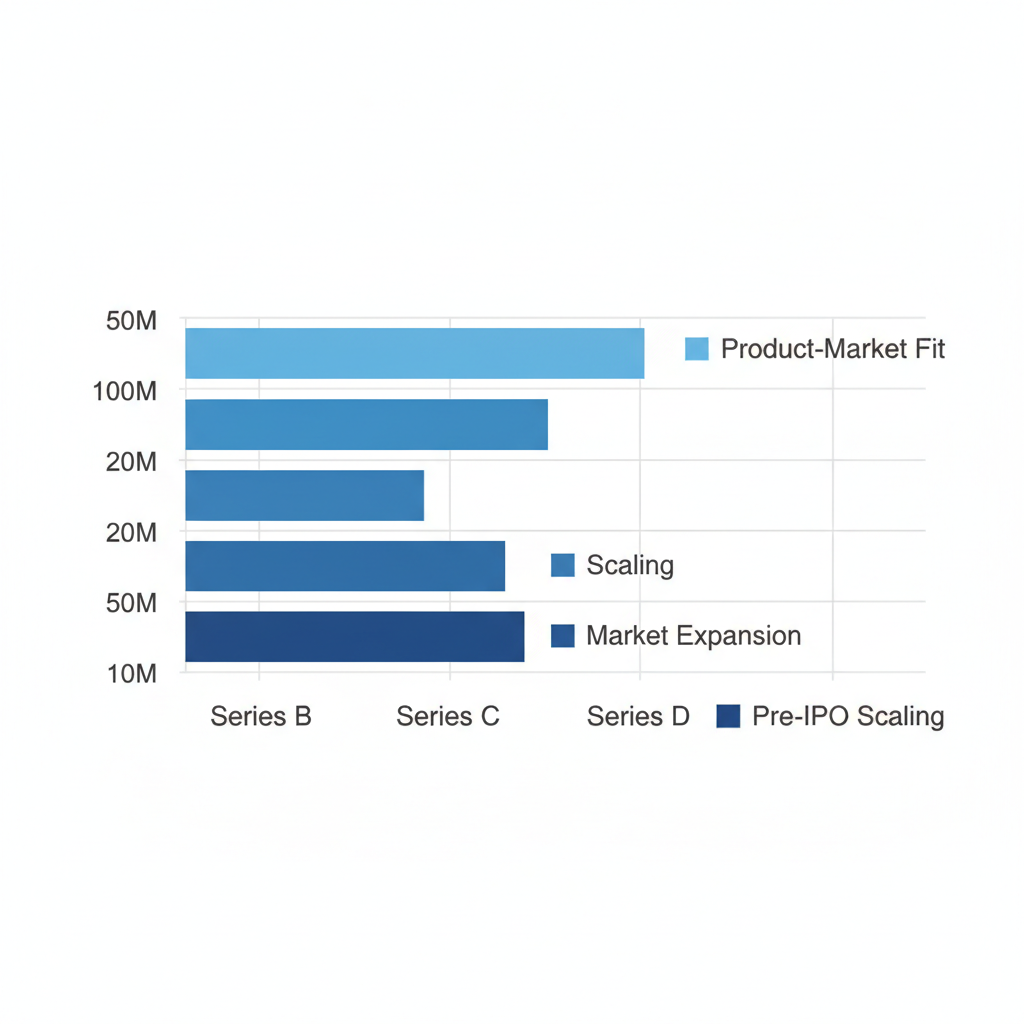

The evolution of funding rounds illustrates this progression clearly. Early stages prioritize product development and market fit, while later ones emphasize scalability and investor alignment.

| Aspect | Series B | Series C | Series D | Series E |

|---|---|---|---|---|

| Typical Amount Raised | $10M-$50M | $20M-$100M | $50M-$200M | $100M+ |

| Growth Stage Focus | Product-market fit | Scaling operations | Market expansion | Maturity and profitability |

| Investor Types | Early VCs | Growth VCs | Late-stage VCs, PE | PE firms, hedge funds, strategics |

| Valuation Metrics | 5-10x revenue | 8-15x revenue | 10-20x revenue | 10-20x revenue |

As data from SEC resources on capital raising stages indicate, each round introduces greater complexity and scrutiny, with Series E demanding robust governance and exit-ready structures. This table highlights how Series E stands out for its emphasis on pre-IPO scaling, where investor types evolve to include more institutional players like Series E investors focused on liquidity events.

Bar chart of funding evolution from Series B to E rounds

This visual underscores the exponential growth in capital demands, reinforcing the need for strategic planning in later rounds. Building on these insights, the advisory role becomes indispensable in securing such funding.

Investment advisors play a facilitative role in Series E processes, leveraging networks to connect founders with aligned Series E backers. At Zaidwood Capital, our full-cycle M&A and capital advisory services include introductions to over 4,000 institutional investors, drawing from $15 billion in deployable capital. As outlined in the FINRA Investment Advisers Guide, advisors must provide objective guidance without promising outcomes, focusing on due diligence and pitch optimization. We assist with crafting pro forma financials and strategic documentation to highlight value propositions, ensuring compliance with SEC reporting standards for going public readiness. In one hypothetical case, we supported a healthtech firm by arranging debt-equity hybrids, smoothing their path to profitability without direct transaction guarantees. This approach aligns with our commitment to streamlining transactions through precision catalysis, always emphasizing that investments involve risks and past performance does not guarantee future results. For more, consult legal and financial experts.

Exploring Series E Funding in Depth

Series E funding represents a critical late-stage investment phase where mature startups secure substantial capital to accelerate growth and prepare for major milestones like acquisitions or public listings. At Zaidwood Capital, we guide clients through these complex rounds by leveraging our extensive network of institutional investors. This section explores the investor landscape, fundraising motivations, and pathways to IPO, providing strategic insights for navigating Series E funding to IPO.

Investor Landscape for Series E

Series E investors typically include private equity firms, hedge funds, and sovereign wealth funds, shifting from the venture capitalists dominant in earlier stages. These institutional venture capital players prioritize established companies with proven revenue streams and significant market share. Evaluation criteria focus on revenue growth exceeding 50% year-over-year, scalable business models, and defensible competitive positions. For instance, a tech firm with $200 million in annual recurring revenue might attract a sovereign fund seeking long-term stability.

We at Zaidwood Capital connect clients to over 4,000 such investors, facilitating introductions that align with these stringent standards. Understanding this landscape helps companies tailor their pitches to emphasize maturity and return potential.

The evolution of investor profiles across funding rounds underscores a progression toward more conservative, high-capital commitments in later stages. The following table compares key aspects:

| Investor Type | Series A-B | Series C-D | Series E |

|---|---|---|---|

| Primary Focus | Early validation | Growth potential | Scalability and revenue |

| Typical Capital | $1M-$10M | $10M-$100M | $100M+ |

| Risk Appetite | High | Medium | Low |

This comparison, based on SEC and FINRA investor guidelines, highlights the institutional shift in Series E, where funds demand lower risk and higher certainty. To attract these equity advisory services can refine pitch materials, ensuring alignment with investor expectations for sustainable expansion.

Key takeaways include prioritizing metrics like customer retention rates above speculative innovation, positioning companies for successful capital raises.

Reasons and Strategies for Series E Raises

Companies pursue Series E funding primarily to fuel aggressive expansions, such as acquisitions that consolidate market position or ramp up research and development for product innovation. For example, a SaaS enterprise might raise to acquire a complementary platform, boosting its user base by 40%. Other motivations include international scaling or talent acquisition in competitive sectors like fintech, where late-stage investment bridges the gap to profitability.

Preparation strategies emphasize rigorous financial modeling to project post-funding valuations and robust due diligence packages that address potential red flags. Engaging advisory support early is crucial; we at Zaidwood Capital provide full-cycle guidance, from crafting pro forma financials to orchestrating investor roadshows. This includes stress-testing assumptions against market volatility and highlighting unique selling points like proprietary technology.

Effective tactics also involve building narrative momentum through milestones achieved in prior rounds, demonstrating a clear path to exit. Anonymized cases show firms that secured Series E investors by showcasing 3x revenue growth post-Series D often closed deals 20% above target valuations. Strategies should adapt to economic cycles, focusing on cost efficiencies to appeal to risk-averse funds.

In summary, proactive preparation transforms Series E raises into catalysts for transformative growth, with advisory expertise streamlining the process.

Transition Pathways from Series E to IPO

Post-Series E, the transition to IPO typically spans 1-3 years, involving intensive preparation to meet public market demands. Companies must first solidify governance structures, implement reliable internal controls, and define clear objectives like capital infusion for global expansion. Valuation impacts are profound; successful Series E rounds often boost pre-IPO multiples by 2-3x, but risks such as market volatility can erode gains if timing falters.

Key steps include assembling a team of underwriters, attorneys, and accountants to navigate SEC filings and compliance. We emphasize evaluating short-term cash needs to weather the process, which can extend 6-12 months amid economic shifts. Highlighted risks encompass increased stakeholder scrutiny and reporting burdens under the Securities Exchange Act.

The following table outlines essential preparation:

| Preparation Step | Description | Timeline |

|---|---|---|

| Assess Readiness | Evaluate financial health, governance, and market conditions per SEC guidelines | 3-6 months |

| Secure Advisors | Engage underwriters, legal, and accounting teams for IPO structuring | 1-3 months |

| File and Compliance | Prepare S-1 registration, implement reporting systems, and meet listing standards | 6-12 months |

| Market Roadshow | Communicate value proposition to investors, adjusting for demand | 1-2 months |

Drawing from SEC resources like “Ready to Go Public?”, this pathway underscores the need for committed leadership to manage uncertainties. In one anonymized scenario, a Series E-backed firm went public 18 months later, achieving a $2 billion valuation despite sector headwinds.

Ultimately, these transitions demand strategic foresight to mitigate risks and capitalize on Series E momentum toward public success.

Applying Series E Funding Practically

At Zaidwood Capital, we guide companies through the complexities of Series E funding, a critical stage where mature businesses seek substantial capital to accelerate growth, expand operations, or prepare for exits like acquisitions or public offerings. This strategic capital infusion often involves raising tens to hundreds of millions from institutional backers, enabling scaling while addressing liquidity needs. Our full-cycle advisory services, including equity and debt structuring, help navigate this process without any guarantees of outcomes.

Securing Series E Capital: Step-by-Step

Securing Series E capital requires meticulous planning and execution, as mature-stage financing demands proof of scalability and robust governance. We assist clients in preparing compelling narratives that highlight path to profitability and market dominance. The process begins with internal alignment on funding goals, followed by targeted outreach to venture capital firms and private equity players.

- Pitch Deck Creation: Develop a comprehensive pitch deck outlining business traction, financial projections, and use of funds. Emphasize metrics like revenue growth and customer acquisition to appeal to Series E investors.

- Investor Outreach: Leverage our network of over 4,000 institutional contacts to identify aligned Series E investors. We facilitate introductions, ensuring warm leads that understand late-stage risks and rewards.

- Term Sheet Negotiation: Review and negotiate terms, focusing on valuation, liquidation preferences, and governance rights. Our expertise in full-cycle M&A and capital advisory streamlines this to align with client objectives.

The following table outlines key preparation elements and their impacts, drawn from established benchmarks in exit strategies and liquidity planning.

| Preparation Element | Key Actions | Typical Outcome |

|---|---|---|

| Financial Modeling | Pro forma projections | Investor Confidence, Higher valuations |

| Due Diligence Readiness | Document organization | Faster Closing, Reduced Risks |

| Investor Pitching | Tailored presentations | Stronger Term Sheets, Committed Capital |

This preparation not only builds investor trust but also positions companies for smoother transitions, such as Series E funding to IPO. For instance, organizing financials in advance reduces scrutiny delays, allowing focus on strategic discussions. We recommend integrating debt advisory services early to explore hybrid structures that complement equity raises, enhancing overall capital efficiency.

Step-by-step guide to applying Series E funding practically

Building on these steps, clients often see accelerated timelines when combining equity pursuits with complementary financing options, ensuring resilience in competitive markets.

Valuation and Due Diligence in Series E

Valuation in Series E rounds hinges on sophisticated methods that reflect a company’s maturity and exit potential, such as preparing for IPO or strategic sales. We support assessments using discounted cash flow (DCF) analysis for long-term projections and comparable company multiples to benchmark against peers in similar sectors. These approaches help justify premiums based on revenue multiples, often 8-12x for high-growth firms, while accounting for market conditions.

Due diligence at this stage intensifies, covering financial audits, legal compliance, and operational reviews to mitigate risks highlighted in SEC guidelines on liquidity and exits. Companies must prepare audited statements, IP portfolios, and customer contracts, as investors scrutinize paths like Series E funding to IPO for regulatory hurdles.

A comparison of common valuation methods illustrates their application:

| Method | Key Inputs | Strengths in Series E |

|---|---|---|

| DCF Analysis | Future cash flows, discount rate | Captures growth potential |

| Comparables | Peer multiples, market data | Provides market context |

| Precedent Transactions | Past deal terms | Reflects real-world premiums |

This scrutiny ensures alignment with investor expectations, reducing valuation discounts. We facilitate full-cycle due diligence, coordinating with legal and financial experts to address findings promptly, though outcomes depend on individual circumstances.

Case Examples of Series E Success

Consider a hypothetical SaaS provider in the fintech space, seeking $150 million to fuel international expansion and AI integrations. Facing valuation pressures, the company engaged our services for pitch refinement and investor introductions. Post-Series E, they achieved a 20% uplift in enterprise contracts, paving the way for an IPO within 18 months and demonstrating effective Series E funding to IPO transitions.

In another scenario, a biotech firm raised $200 million from Series E investors to advance clinical trials, blending equity with mezzanine debt for balanced leverage. Our advisory streamlined due diligence, resolving IP queries swiftly and closing in under 90 days. This capital infusion enabled Phase III success, culminating in a strategic acquisition that delivered strong returns to stakeholders.

These anonymized examples underscore how tailored guidance from term negotiations to compliance can optimize mature-stage financing. While risks like market volatility persist, proactive preparation, informed by SEC exit strategies, enhances prospects without assured results. At Zaidwood, we emphasize regulatory adherence and strategic positioning to support such journeys.

Advanced Aspects of Series E Funding

At Zaidwood Capital, we guide clients through the complexities of investment transactions advisory, particularly in late-stage rounds like Series E funding. Companies pursue this stage not just for capital infusion but to fuel international expansion, acquisitions, or pre-IPO preparations, addressing challenges unmet by earlier rounds such as scaling operations amid regulatory scrutiny or market volatility.

Hybrid financing emerges as a sophisticated capital structure in Series E, blending equity and debt to optimize terms. Mezzanine and venture debt hybrids allow firms to layer interest-bearing loans atop equity infusions, minimizing immediate dilution while accessing growth capital. For instance, a hybrid might include convertible notes that evolve into equity upon milestones, balancing risk for Series E investors. According to SEC Investor Alerts on crowdfunding, these structures carry heightened risks like illiquidity and potential total loss, underscoring the need for robust disclosures. We emphasize evaluating cash flow sustainability in hybrids to avoid overburdening operations.

| Structure Type | Key Features | Pros | Cons |

|---|---|---|---|

| Equity | Ownership dilution | No repayment | Higher control loss |

| Debt (Mezzanine/Venture) | Interest payments | Retain equity | Cash flow burden |

Equity structures suit companies prioritizing flexibility without debt obligations, though they amplify founder dilution. Debt options, informed by SEC crowdfunding guidelines, preserve ownership but demand steady repayments, often hybridizing for tailored leverage. Post-table analysis reveals hybrids as ideal for deep tech firms navigating high R&D costs, where we highlight compliance to mitigate enforcement risks.

Regulatory considerations intensify at Series E, with SEC and FINRA oversight ensuring transparent disclosures for institutional funding mechanisms. Compliance involves audited financials and investor accreditation checks, as non-accredited participants face limits per SEC bulletins. Post-funding governance shifts include board expansions, integrating Series E investors with independent directors to enhance oversight and strategic alignment. Fairness opinions become critical, validating deal terms against market benchmarks to protect stakeholders during transitions like Series E funding to IPO.

Our advisory ties extend to these nuances, leveraging our network of over 4,000 investors and $24.4B in transaction volume. We provide full-cycle due diligence and strategic documentation, accessing our deal vault for deep tech opportunities. Through precision structuring, we streamline paths to liquidity events, ensuring clients achieve sustainable growth without compromising governance integrity.

Frequently Asked Questions on Series E

Series E funding represents a critical late-round financing stage for scaling companies. Below, we address common queries to guide your understanding.

What is the typical capital raised in Series E funding? Companies often secure $75 million or more, supporting global expansion and product maturation, as per SEC guidelines on funding rounds.

What criteria do Series E investors prioritize? Investors focus on strong growth metrics, proven revenue streams, and market dominance to mitigate risks in late-stage investments.

How does Series E funding to IPO preparation differ? It emphasizes rigorous financial audits and compliance, aligning with SEC definitions of equity offerings to build investor confidence.

What are the key risks in Series E funding? Primary concerns include equity dilution and market volatility, which can impact valuation as outlined in SEC investor protection resources.

How can advisors assist with Series E opportunities? We provide introductions to Series E investors and help structure deals, including deep tech investment deals, ensuring regulatory adherence per the SEC Glossary.

Navigating Series E Funding Successfully

Series E funding represents a pivotal stage for maturing startups, enabling substantial scaling through advanced growth capital often exceeding hundreds of millions. At this level, companies refine strategies with seasoned Series E investors focusing on proven models, expansion, and paths like Series E funding to IPO.

We at Zaidwood Capital support clients through expert equity advisory and full-cycle due diligence, facilitating introductions to our extensive network of institutional partners. Our capital formation services streamline access to deployable capital without any guarantees of outcomes.

As you consider next steps, we encourage exploring how our advisory can align with your funding goals. Book a call to discuss tailored strategies.