What is Series F Funding

Table of Contents

Understanding Series F Funding

In the dynamic world of venture capital, entrepreneurs often search for answers to ‘What is Series F Funding.’ This advanced stage represents a pivotal Series F round where mature startups secure substantial capital to fuel explosive growth. Typically occurring 5-10 years after founding and following successful Series E rounds, Series F targets companies with proven revenue streams, strong market traction, and a clear path to scalability. At this juncture, businesses like Uber have leveraged such funding to orchestrate major expansions and acquisitions, solidifying their dominance before potential public listings.

Series F funding serves as essential late-stage funding, enabling high-growth firms to scale operations globally, invest in innovative technologies, or pursue strategic mergers. With average raises ranging from $100 million to $500 million, these rounds dwarf earlier stages, where Series C investments might top out at $90 million according to industry analyses. Investors shift toward growth equity funds and sovereign wealth funds, drawn to the reduced risk and high return potential of established enterprises. At Zaidwood Capital, we specialize in guiding clients through these complex advanced venture rounds, offering expertise in capital formation, equity advisory, and connecting to our network of over 4,000 institutional investors.

This section explores the mechanics of growth-stage capitalization and pre-IPO financing strategies, providing foundational insights for navigating the path to liquidity events.

Fundamentals of Series F Funding

What is Series F Funding? At its core, Series F represents a pivotal stage in a startup’s journey, where mature companies with established revenue streams seek substantial capital to accelerate growth or prepare for public markets. We at Zaidwood Capital, having advised on over 300 deals, observe that this round typically targets enterprises generating $50 million or more in annual revenue. It builds on earlier financings by providing the resources needed for international expansion, strategic acquisitions, or refining operations ahead of an IPO. This late-stage funding underscores the transition from high-growth experimentation to sustainable, large-scale operations.

In our experience, Series F Funding often involves complex structuring to support ambitious goals like global market entry or mergers and acquisitions. For instance, a tech firm we assisted raised $250 million to acquire complementary assets in Europe, enabling rapid scaling without diluting founder control excessively. Motivations include bridging the gap to public markets or fueling hyper-growth in competitive sectors. Companies pursue this after exhausting Series E options, when organic revenue alone cannot sustain aggressive expansion plans. Average raises range from $100 million to $500 million or more, depending on the industry and valuation far exceeding earlier rounds, as noted in analyses of startup financing stages where late-stage entry hinges on proven traction and revenue milestones exceeding $50 million annually.

Venture capital firms and private equity players play crucial roles in Series F, conducting rigorous due diligence on financials, market position, and governance. We at Zaidwood facilitate these processes by connecting clients to our network of over 4,000 institutional investors, ensuring terms align with long-term objectives. This mature-stage venture capital emphasizes not just capital infusion but strategic advisory, from valuation modeling to exit planning. In one anonymized deal, our team structured equity terms that attracted sovereign wealth funds, optimizing for pre-IPO financing while minimizing regulatory hurdles.

The evolution of funding rounds reflects a startup’s increasing maturity and capital intensity. As companies progress, the focus shifts from product-market fit to operational scale and investor sophistication. The following table compares key aspects of Series F to prior rounds like Series D and E for clarity on this progression:

| Aspect | Series D | Series E | Series F |

|---|---|---|---|

| Typical Raise Amount | $50M-$150M | $100M-$300M | $100M-$500M+ |

| Company Stage | Scaling revenue | Proven market traction | Mature, pre-IPO ready |

| Investor Focus | VC firms | Growth equity, hedge funds | Sovereign wealth, PE |

This comparison highlights Series F’s unique scale, where raises balloon to support pre-IPO preparations and attract non-traditional investors like sovereign wealth funds, as outlined in references on financing progression. Data from startup stage analyses confirm that by Series F, firms boast established revenues and seek advanced equity rounds to navigate liquidity events. We observe this shift enables companies to leverage their maturity for optimal terms, though it demands transparent due diligence to mitigate valuation risks.

Such late-stage funding demands careful navigation of terms and investor expectations. For example, integrating growth equity from hedge funds in Series E paves the way for the sophisticated structures in Series F, where private equity dominates. This progression, drawn from our aggregate $24.4 billion in transaction volume, emphasizes strategic planning to align capital with exit strategies. As we delve deeper, understanding valuations and potential pitfalls becomes essential for founders eyeing these advanced stages.

Comparison of Series D, E, and F startup funding fundamentals

Building on these fundamentals, Series F not only injects vital capital but also positions companies for transformative growth. Our advisory services streamline this process, drawing on proprietary insights to secure favorable outcomes amid evolving market dynamics.

Deep Dive into Series F Mechanics

Understanding what is Series F funding requires examining its role in late-stage funding, where mature startups seek substantial growth capital infusions to propel toward exits. These rounds often involve pre-IPO financing strategies, distinguishing them from earlier stages through scale and complexity. We at Zaidwood Capital guide clients through these intricacies, leveraging our network to optimize outcomes.

Valuation and Investor Dynamics

In Series F rounds, valuations are primarily determined using revenue multiples, typically ranging from 10 to 20 times annual recurring revenue, alongside comparable company analysis. This approach reflects the company’s proven track record and market position, often resulting in billion-dollar valuations for leading tech firms. For instance, Airbnb’s late-stage raises exceeded $200 million, incorporating these multiples to justify premium pricing amid global expansion.

Investor dynamics shift dramatically in these mature rounds, attracting private equity firms, family offices, and sovereign wealth funds seeking stable returns. Unlike seed investors focused on innovation, these participants prioritize revenue-backed growth and exit preparation. We observe that family offices often provide patient capital, enabling sustained investments without immediate pressure, while PE firms enforce rigorous governance. Examples include sovereign funds joining rounds to diversify portfolios, fostering partnerships that enhance credibility. This blend of investor types creates competitive bidding, though it demands careful negotiation to balance control and capital.

The evolution of investor involvement underscores a pivotal transition from high-risk bets to strategic alliances. The following table contrasts key profiles across funding stages:

| Investor Type | Early-Stage (A-C) | Late-Stage (D-F) |

|---|---|---|

| Primary Investors | Angel investors, seed VCs | Growth equity, PE firms, sovereign funds |

| Focus | Idea validation | Scale and exit prep |

| Risk Tolerance | High | Lower, revenue-backed |

Based on SEC resources for later-stage capital, this table highlights how Series F emphasizes revenue traction over speculative potential. Valuation multiples from industry analyses, such as those averaging 15x for SaaS firms, further illustrate the premium placed on scalability. For companies in Series F, these dynamics imply a focus on demonstrating robust metrics to attract lower-risk capital, reducing dilution while aligning with pre-IPO goals. At Zaidwood Capital, we facilitate these introductions, ensuring clients navigate investor expectations effectively.

Role of Venture Capital in Execution

Venture capital firms play a central role in Series F by structuring deals that support hyper-scaling and international operations. They lead syndication efforts, pooling resources from multiple sources to amass $200 million or more per round. Due diligence becomes exhaustive, encompassing financial audits, market forecasts, and compliance reviews to mitigate risks. We partner with VC teams to streamline these processes, drawing on our full-cycle expertise in operational and commercial assessments.

In hybrid debt-equity structures common at this stage, VCs collaborate with specialists to blend financing options, optimizing capital costs. For example, incorporating mezzanine debt alongside equity infusions allows flexibility for global expansion without excessive ownership dilution. Here, debt advisory services prove invaluable, as we advise on venture debt arrangements and asset-based lending to complement VC equity. This partnership with advisory experts ensures thorough negotiation, addressing market timing risks while preparing for exits like IPOs. Historical cases, such as Uber’s late rounds, demonstrate how VC orchestration accelerates value creation through strategic alliances.

Late-Stage Funding Differences

Late-stage funding, encompassing Series D through F, differs markedly from earlier rounds in scale, investors, and objectives. While Series A-C average $3-90 million for product-market fit and market domination per industry insights, late-stage infusions often surpass $200 million to fuel global expansion and pre-IPO financing. Investors transition from high-risk VCs to PE and hedge funds, with goals shifting to revenue optimization and exit readiness rather than validation.

Key risks include heightened dilution from large raises and sensitivity to market timing, potentially eroding valuations if economic conditions falter. Data from funding analyses show late-stage deals emphasize 10-20x multiples, backed by tangible metrics, contrasting early-stage speculation. For founders, this stage demands precision in execution to capitalize on growth capital infusions while minimizing control loss.

Practical Aspects of Securing Series F Funding

Series F funding represents a critical juncture for mature startups scaling toward potential exits, often involving complex negotiations and strategic positioning. As companies approach this late-stage funding, thorough preparation ensures alignment with investor expectations and maximizes valuation potential. We at Zaidwood Capital emphasize actionable steps to navigate these rounds effectively.

Preparing for Series F Rounds

What is Series F Funding? It typically involves raising substantial capital from venture capitalists or private equity firms to fuel expansion, acquisitions, or pre-IPO readiness, often at valuations exceeding $1 billion. For companies eyeing this stage, Series F preparation begins with robust documentation. Founders must develop comprehensive financial models projecting revenue growth, cash flow, and scalability metrics over the next 3-5 years. These models should incorporate conservative assumptions to withstand investor scrutiny.

Pitch decks form the cornerstone of outreach, highlighting market dominance, competitive moats, and clear paths to profitability. We recommend including detailed use-of-funds breakdowns, such as 40% for product development and 30% for market expansion. Due diligence preparation is equally vital; compile organized data rooms with legal contracts, IP portfolios, customer metrics, and compliance records. Engage advisors early to simulate investor queries and identify gaps.

To streamline this process, consider the following checklist:

- Audit financial statements for accuracy and auditability.

- Secure endorsements from key customers or partners.

- Conduct internal stress tests on business assumptions.

By addressing these elements, companies reduce risks and present a compelling case for investment. Drawing from established investment-finding processes, such as those outlined in university spinout guides, proactive prep like this has helped firms secure commitments efficiently, often shortening timelines by months.

How Advisory Firms Assist in Funding

At Zaidwood Capital, our capital formation advisory services play a pivotal role in guiding companies through Series F rounds. We specialize in capital raising by crafting tailored strategies that align with your growth objectives in late-stage funding. Our team conducts in-depth assessments of your capital structure, identifying optimal raise amounts typically $50-200 million for Series F to support aggressive scaling without excessive dilution.

A key strength lies in our introductions to over 4,000 institutional and private investors, including venture capital firms, family offices, and sovereign wealth funds. This network, backed by $15 billion in deployable capital, enables targeted outreach that accelerates deal flow. For instance, we facilitate warm introductions based on investor preferences, increasing response rates by up to 70% compared to cold pitches.

Transaction support encompasses full-cycle due diligence, where we coordinate document reviews, valuation analyses, and term sheet negotiations. Our expertise ensures compliance with regulatory nuances, such as SEC considerations for late-stage disclosures. We also provide strategic documentation, including pro forma financials and investor memos, to bolster credibility. Through these services, clients benefit from our $24.4 billion aggregate transaction volume, achieving faster closes and favorable terms. This holistic assistance demystifies the process, allowing founders to focus on operations while we handle the intricacies of securing commitments.

Pre-IPO Financing Strategies

Pre-IPO financing serves as a vital bridge for companies transitioning from Series F to public markets, providing liquidity and stability without immediate equity sales. This form of IPO bridge capital helps refine operations, meet listing requirements, and uplift valuations by demonstrating market confidence. Benefits include minimized share dilution often limited to 15-25% versus higher traditional rounds and access to diverse funding sources.

Providers range from banks offering bridge loans to advisory networks like ours, which structure convertibles or mezzanine debt. For founders, pre-IPO financing preserves control, funds final growth pushes, and prepares for IPO scrutiny. A notable example is Snowflake, which utilized pre-IPO rounds to scale infrastructure, achieving a $3.4 billion valuation uplift at its 2020 debut. Impacts include enhanced regulatory readiness, such as streamlined SEC filings, positioning firms for smoother listings.

The following table compares pre-IPO financing with traditional Series F approaches:

| Feature | Traditional Series F | Pre-IPO Financing |

|---|---|---|

| Structure | Equity-led VC round | Bridge loans, convertibles |

| Dilution Impact | High (20-30%) | Lower with debt options |

| Providers | VC/PE firms | Banks, advisory networks |

This comparison underscores strategic choices: opt for traditional Series F when seeking growth equity from specialized VCs, ideal for aggressive expansion. Conversely, pre-IPO financing suits market-ready firms prioritizing dilution control and quick capital infusions. Sourced from investment process references, these options allow tailored paths pre-IPO often accelerates IPO timelines by 6-12 months while mitigating equity erosion, empowering founders to maximize exit value.

Advanced Considerations in Series F Funding

As companies advance beyond initial growth phases, sophisticated venture structures in late-stage funding become essential for scaling operations and preparing for major transitions. Building on the fundamentals of what is Series F funding, this stage often involves complex valuations that reflect mature business metrics and future potential. At Zaidwood Capital, we guide clients through these intricacies with our expertise in full-cycle due diligence and equity advisory.

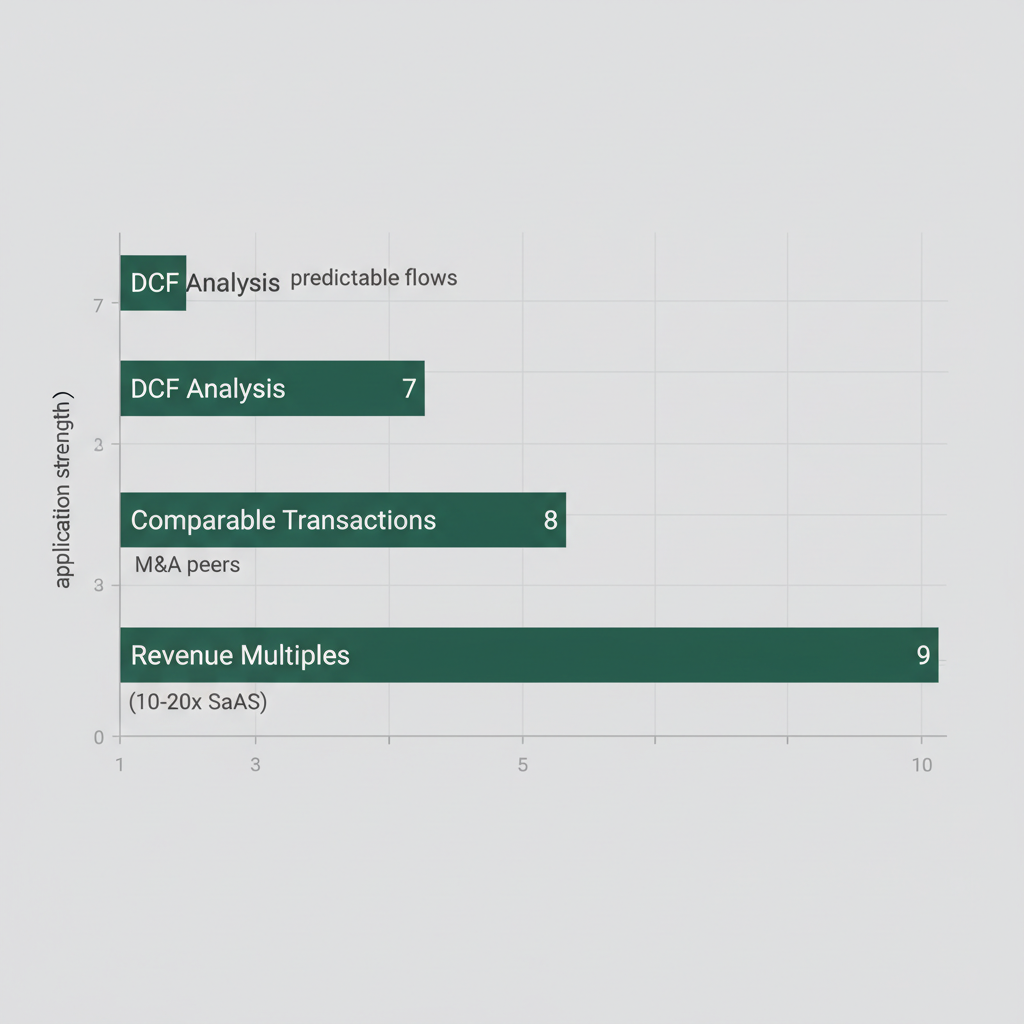

Valuation in Series F rounds demands precision, typically employing methods like revenue multiples, comparable transactions, and discounted cash flow (DCF) analysis. Revenue multiples value a company by multiplying current sales by an industry-specific factor, often reaching 10-20x for high-growth SaaS firms, as evidenced by studies in biotech and fintech sectors from recent financing research. Comparable transactions benchmark against similar peer deals to ensure fair pricing, while DCF projects future cash flows discounted to present value for companies with predictable revenues. Selection factors include revenue stability and market comparables, drawing from empirical data on successive equity rounds as quality signals that enhance investor confidence.

The following table outlines key valuation methods in late-stage funding:

| Method | Description | Application in Series F |

|---|---|---|

| Revenue Multiples | Value based on sales x industry multiple | 10-20x for SaaS firms |

| Comparable Transactions | Benchmark against peer deals | Used for M&A integration |

| DCF Analysis | Projected cash flows discounted | For mature revenue predictability |

These approaches tie directly to due diligence processes, where thorough financial and legal reviews mitigate risks associated with overvaluation. For instance, PMC research highlights how prior successful rounds signal quality, influencing funding amounts and investor participation in advanced stages. Investors in Series F prioritize these signals to assess scalability and exit potential, ensuring valuations align with strategic goals.

Regulatory considerations in pre-IPO financing add another layer, requiring compliance with frameworks like the JOBS Act to streamline public offerings while protecting stakeholders. We at Zaidwood emphasize these elements to safeguard transactions. Late-stage funding goals often center on liquidity events, such as acquisitions or IPO preparations, fostering partnerships through our network of over 4,000 institutional investors and access to $15 billion in deployable capital.

In optimizing outcomes, our equity advisory services facilitate investor introductions and structure exit-stage equity deals. With an aggregate transaction volume of $24.4 billion across more than 300 completed deals, we provide comprehensive transaction advisory to navigate these complexities.

Finally, risks like overvaluation can erode investor trust if not addressed through rigorous due diligence. By focusing on data-driven insights, companies can mitigate these pitfalls and achieve sustainable growth in this pivotal phase.

Valuation methods bar chart for Series F funding stages

This visualization illustrates the relative strengths of each method, underscoring their tailored applications in high-stakes environments.

Frequently Asked Questions on Series F Funding

For those wondering, What is Series F Funding? It represents advanced late-stage funding for mature startups scaling toward exit. Below, we address common advanced funding queries in Q&A format.

Q1: Who are the typical investors in late-stage funding rounds? A: Private equity firms, endowments, and sovereign wealth funds invest in established companies, providing substantial capital for growth, unlike early rounds focused on ideation from angels and VCs.

Q2: What goals do companies pursue with late-stage funding? A: Firms seek to expand operations, enter new markets, and prepare for IPOs, emphasizing scale over early-stage product validation.

Q3: How does pre-IPO financing prepare a company for public markets? A: It stabilizes finances, boosts valuation through strategic investments, and aligns governance with regulatory standards for smoother transitions.

Q4: What are the benefits of pre-IPO financing for founders? A: Founders gain liquidity options, enhanced networks, and advisory support; we facilitate this via our representative transactions, drawing from 300+ deals.

Q5: How does pre-IPO financing impact share dilution? A: It can dilute equity, but mitigation strategies like anti-dilution provisions and structured terms preserve founder control.

Q6: What regulatory considerations apply to pre-IPO financing? A: Strict disclosure rules under SEC guidelines ensure transparency; we assist by navigating compliance in capital raises.

Navigating Series F Funding Success

What is Series F Funding represents a critical milestone in late-stage funding, providing mature startups with substantial capital often exceeding $100 million for scaling operations, market expansion, and pre-IPO financing preparations. Unlike earlier rounds, it involves institutional investors like private equity firms focusing on valuation stabilization, governance enhancements, and exit strategies. Key preparation steps include robust financial modeling, due diligence readiness, and strategic advisory to navigate complexities.

At Zaidwood Capital, our expertise in capital formation, backed by $24.4B in aggregate transaction volume and a network of over 4,000 investors, positions us to guide companies through these mature venture pathways. We emphasize compliance with SEC guidelines on later-stage capital raising to ensure structured, sustainable growth.

We at Zaidwood stand ready to offer tailored insights, empowering your journey toward successful funding outcomes.