Series F

Table of Contents

Understanding Series F Funding in Late-Stage Growth

In the dynamic world of venture capital, companies that have successfully navigated earlier rounds like Series A through E often reach a pivotal point where Series F Funding becomes essential. This advanced financing round represents mature-stage equity investments tailored for high-growth firms demonstrating proven revenue and market traction, typically following significant milestones in scaling operations. As defined by the SEC Glossary of Terms, Series F serves as a bridge in late-stage venture capital, enabling sustained expansion toward potential exits.

At Zaidwood Capital, we guide clients through these complex stages, where motivations for pursuing Series F include fueling international expansion, accelerating research and development, or supporting mergers and acquisitions. Typical capital raises range from $50 million to over $500 million, aligned with 2025-2026 trend data from the NVCA Yearbook showing increased deal volumes in mature sectors. Valuations shift from pure growth metrics to profitability-oriented assessments, addressing common misconceptions that equate this round solely with pre-IPO funding. Our expertise in capital formation, with an aggregate transaction volume of $24.4 billion across 300+ deals, positions us to facilitate investor matchmaking and due diligence. For instance, we recently assisted a tech firm in a $200 million Series F round to acquire a key competitor, streamlining their path to global dominance.

Key traits of Series F rounds include:

- Hybrid structures blending equity and debt for flexibility

- Involvement of institutional investors like private equity firms

- Emphasis on governance enhancements and liquidity options

This guide explores fundamentals, strategic considerations, and advanced advisory tactics, equipping founders with insights for successful late-stage preparation.

Core Fundamentals of Series F Funding

Series F funding represents a critical milestone in late-stage venture capital, where mature companies seek substantial capital to bridge toward pre-IPO funding or strategic acquisitions. At Zaidwood Capital, we observe that this round typically follows multiple prior financings, targeting high-growth US firms with established annual recurring revenue exceeding $50 million. For those exploring What is Series F Funding, it underscores a shift from aggressive expansion to sustainable profitability and exit readiness.

To qualify for Series F, companies must demonstrate robust operational maturity and financial discipline. Key requirements include audited financial statements to showcase transparent revenue streams and cost controls, strong corporate governance with independent boards, and comprehensive intellectual property protections to safeguard competitive advantages. We at Zaidwood emphasize the importance of scalable infrastructure, such as automated supply chains and global compliance frameworks, which signal to investors the firm’s ability to handle advanced capital infusions. Additionally, detailed financial modeling is essential, projecting cash flow positivity within 18-24 months to align with profitability focus. Regulatory compliance, as outlined in SEC guidelines for later-stage capital raises, ensures all equity issuances meet disclosure standards, mitigating legal risks in these mature equity rounds.

Capital raised in Series F rounds has trended upward, reflecting the escalating needs of scaling enterprises. According to the NVCA Yearbook, the median amount for US deals in 2025 reached approximately $142 million, with many high-profile cases surpassing $300 million to fuel international expansion or R&D acceleration. This marks a significant evolution from earlier stages, where valuations pivoted from 10-20x revenue multiples to more conservative 5-10x EBITDA metrics, prioritizing long-term viability over rapid growth. Investors in these rounds scrutinize exit strategies, such as IPO timelines or M&A synergies, demanding evidence of market leadership. For instance, a Silicon Valley-based SaaS provider we advised recently secured $180 million in Series F by highlighting its $120 million ARR and diversified revenue channels, illustrating how proven traction unlocks these advanced infusions.

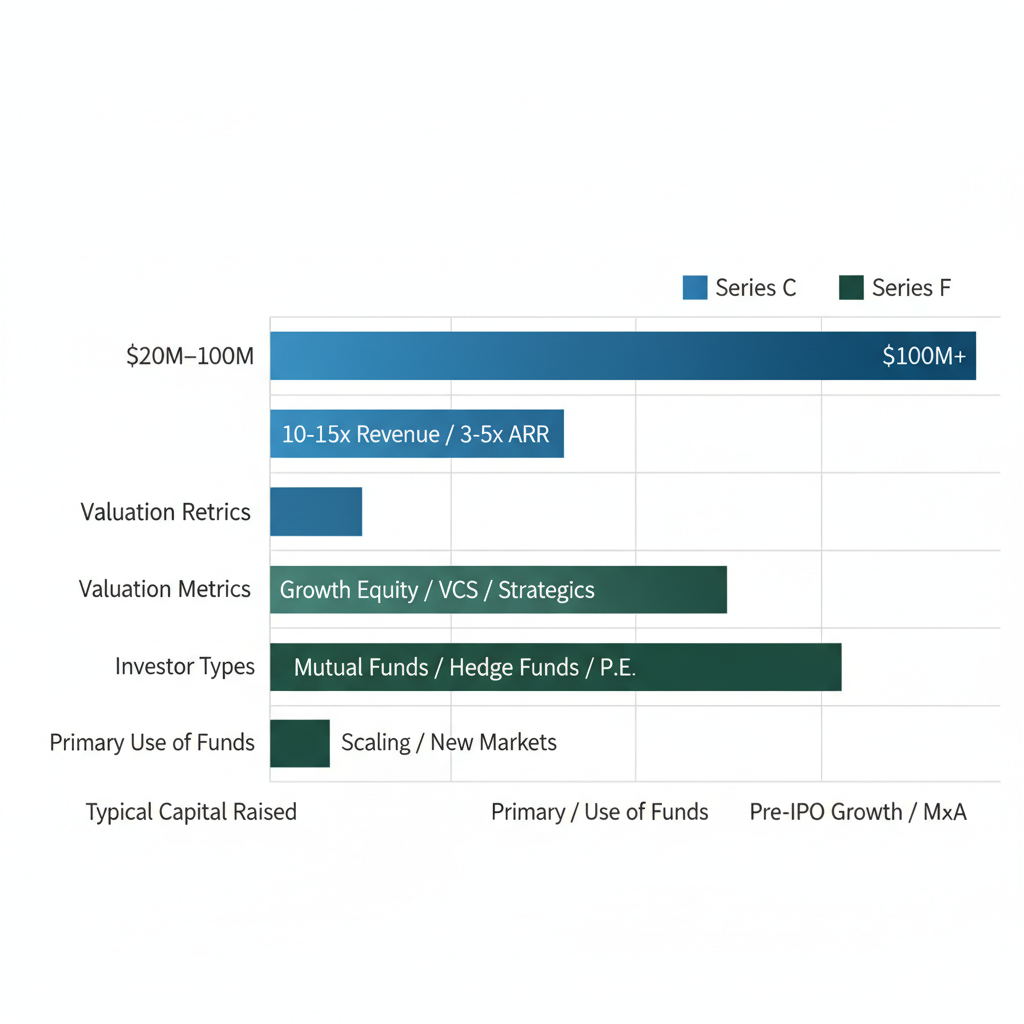

The progression of funding stages highlights the maturation trajectory in venture financing. As companies advance, capital demands intensify, and investor scrutiny sharpens on sustainable metrics rather than sheer scale.

Key differences in Series F versus earlier venture funding rounds

| Funding Stage | Typical Capital Raised | Valuation Metrics | Investor Types | Primary Use of Funds |

|---|---|---|---|---|

| Series C | $20M-$100M | Revenue multiples | Growth VCs | Product scaling |

| Series F | $100M+ | Profitability focus | Late-stage VCs, PE | Exit preparation, M&A |

This comparison, drawn from NVCA Yearbook data for 2025 trends, illustrates the shift toward maturity in Series F, where funds primarily prepare for liquidity events rather than foundational growth. Earlier rounds like Series C emphasize market penetration through product development, often backed by venture capitalists focused on upside potential. In contrast, Series F attracts private equity and late-stage specialists who prioritize governance and profitability, enabling firms to navigate complex exits with confidence. At Zaidwood, our network of over 4,000 institutional investors and $24.4 billion in aggregate transaction experience positions us to guide clients through these nuances, structuring deals that align with evolving investor criteria.

Understanding these fundamentals sets the stage for deeper exploration into valuation intricacies and strategic preparation in subsequent sections.

In-Depth Analysis of Series F Valuation and Structures

Series F funding represents a critical juncture for high-growth firms, where valuations pivot toward sustainable profitability and clear paths to exit. At Zaidwood Capital, we guide US-based companies through these late-stage complexities, leveraging our equity advisory expertise to optimize terms and connect clients to over $15 billion in deployable capital. This analysis explores valuation shifts, deal mechanics, and forward-looking trends, contrasting them with pre-IPO dynamics to equip founders for strategic decision-making.

Valuation Dynamics in Series F Rounds

In Series F rounds, valuations evolve from aggressive growth metrics to mature indicators emphasizing profitability and exit potential. Traditional revenue multiples give way to 6-12x EBITDA assessments, reflecting investor focus on cash flow generation and scalability in US markets. Discounted cash flow (DCF) models project long-term value, incorporating assumptions like 3x year-over-year growth rates that late-stage venture capital firms prioritize for entry.

Comparable company analysis further refines these figures, benchmarking against peers in similar sectors with proven unit economics. For instance, a SaaS firm might command a premium if it demonstrates recurring revenue exceeding $100 million annually, adjusted for market conditions. We at Zaidwood employ tailored DCF frameworks to stress-test these valuations, ensuring alignment with investor criteria while highlighting upside from strategic acquisitions. This shift addresses key questions on how late-round valuations differ from earlier stages, prioritizing stability over explosive growth.

Such dynamics underscore the need for robust financial modeling, where exit-oriented financing becomes paramount. By integrating these methods, companies can negotiate stronger terms, bridging the gap to liquidity events.

Deal Structures and Investor Negotiations

Series F deals incorporate sophisticated terms to balance risk and reward, including 1x-2x liquidation preferences that protect lead investors during exits. Anti-dilution provisions, often weighted average, safeguard against down rounds, while governance clauses grant board observer rights to monitor progress. Drawing from SEC Private Funds guidelines, these structures rely on exemptions like Rule 506(c) for efficient capital raises without full registration.

Mezzanine hybrids blend equity with debt elements, providing flexible liquidity without immediate dilution. In negotiations, we at Zaidwood advocate for founder-friendly terms, such as carved-out preferences for prior rounds, leveraging our network to counter aggressive demands. Pro forma term sheets might include participation rights capped at 2x returns, ensuring alignment on milestones like revenue thresholds.

These elements evolve as companies mature, setting the stage for pre-IPO transitions. Effective negotiation hinges on due diligence, where our full-cycle services identify leverage points to secure optimal outcomes.

As firms advance, structural differences from pre-IPO funding become evident. The following table outlines key contrasts, based on SEC guidelines and NVCA data for 2025-2026:

| Aspect | Series F | Pre-IPO | Key Implications |

|---|---|---|---|

| Valuation Method | Revenue/EBITDA multiples | Full audits, comps | Emphasizes profitability vs. public scrutiny |

| Investor Rights | Preferences, board seats | ESOPs, lockups | Flexibility in private vs. regulatory focus |

| Liquidity Options | Mezzanine hybrids, partial sales | Secondary offerings, direct listings | Bridges to public markets with staged exits |

| Governance | Observer seats, veto rights | Full board compliance | Retains control pre-IPO while preparing for oversight |

| Reporting | Quarterly financials | SOX-compliant audits | Scales transparency without full burden |

This comparison highlights how Series F offers greater flexibility in investor protections compared to the rigid compliance of pre-IPO funding. At Zaidwood, we interpret these nuances to advise on bridging stages, structuring deals that minimize dilution while maximizing access to institutional capital. Our advisory role ensures seamless evolution, positioning clients for efficient liquidity solutions.

Trends Shaping Late-Stage Capital Through 2026

Late-stage venture capital through 2026 will feature hybrid debt-equity instruments, rising 30% per NVCA Yearbook projections, as investors seek balanced risk in volatile markets. Sustainable investing gains traction, with ESG clauses integrated into 40% of deals, prioritizing carbon-neutral operations alongside financial metrics. AI-driven due diligence accelerates evaluations, reducing timelines by 25% through predictive analytics on growth trajectories.

Investor criteria tighten to 3x YoY revenue growth and positive EBITDA, favoring firms with diversified revenue streams. Hybrid structures, including debt advisory services, enable non-dilutive funding for expansion, particularly in tech and biotech sectors. NVCA insights forecast increased focus on exit-oriented financing, with secondary markets facilitating partial liquidity for early stakeholders.

To illustrate shifting priorities, consider this mini-table on VC focuses:

| Focus Area | 2025 Emphasis | 2026 Projection |

|---|---|---|

| Deal Type | Pure equity rounds | 30% hybrid debt-equity |

| Due Diligence | Manual reviews | AI-enhanced automation |

| Investment Criteria | 2x growth, path to profitability | 3x growth, ESG integration |

These trends address queries on 2026 evolutions, emphasizing resilience in US markets. We at Zaidwood’s Velocity Matrix streamlines these processes, connecting clients to our 4,000+ investor network for faster execution. Applying these insights prepares firms for the Practical Preparation phase, where tailored strategies turn analysis into action.

Practical Steps for Securing Series F Investment

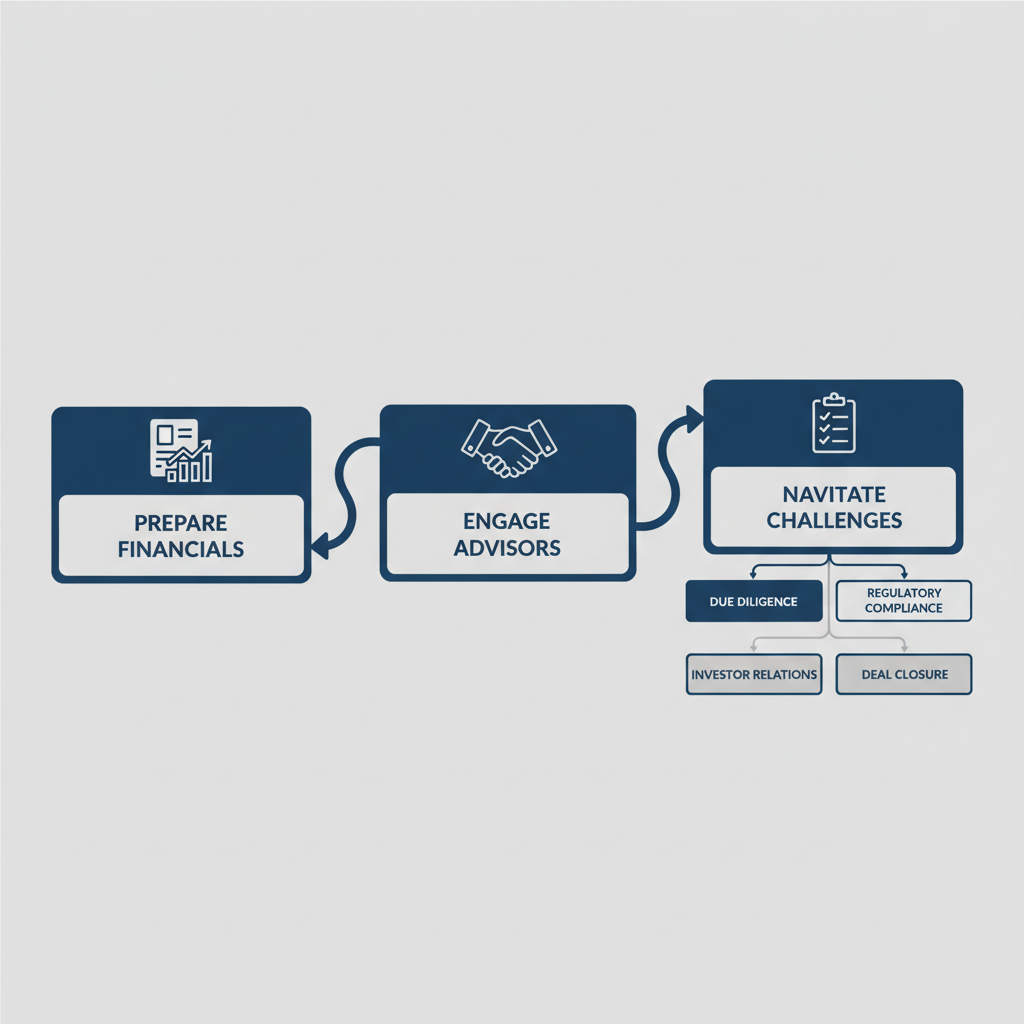

Securing Series F investment demands meticulous preparation, especially for US companies pursuing late-stage growth or pre-IPO paths. Our team at Zaidwood Capital specializes in capital formation advisory, helping clients streamline documentation and investor outreach to align with venture capital expectations. By focusing on robust financials, targeted engagement, and proactive challenge mitigation, businesses can position themselves effectively for substantial funding rounds. This approach draws on regulatory best practices to ensure compliance and strategic alignment.

Visual guide to securing Series F investment through key preparation steps.

These steps build on foundational insights, offering practical tactics that our advisors have refined through extensive experience in mergers and acquisitions and equity advisory.

Preparing Financials and Pitch Materials

Preparing for Series F requires comprehensive financial documentation that demonstrates scalability and risk management. Start by developing pro forma financials, which project future revenues, expenses, and cash flows under multiple scenarios, including base, optimistic, and conservative cases. Our strategic documentation services assist in creating these audited models, ensuring they incorporate market data and operational metrics for credibility. Reference SEC guidelines for raising later-stage capital, which emphasize clear assumptions and historical validation to avoid regulatory scrutiny.

Next, craft a compelling pitch deck highlighting market opportunity, competitive traction, and unit economics. Key elements include a 10-15 slide structure covering problem-solution fit, go-to-market strategy, and customer acquisition costs, tailored to late-stage investors. Complement this with a detailed business plan outlining milestones, cap table updates, and exit pathways. Zaidwood’s expertise in pitch decks and business plans integrates these components seamlessly, aligning them with pre-IPO funding objectives. For instance, we incorporate valuation drivers like recurring revenue streams and IP portfolio strength to showcase sustainable growth.

Use bullet-point checklists for efficiency:

- Audit historical financials for accuracy.

- Model three-year projections with sensitivity analysis.

- Design visuals for pitch decks emphasizing ROI potential.

This preparation not only bolsters investor confidence but also facilitates smoother due diligence, reducing timelines by up to 30% in our supported deals.

Engaging Advisors and Investors

Effective engagement begins with assembling a trusted advisory team experienced in late-stage venture capital. Our capital introduction strategies leverage Zaidwood’s network of over 4,000 institutional investors, facilitating warm introductions to family offices, endowments, and VC firms ideal for Series F scales. Outline outreach by prioritizing LP placements, where we match client profiles to investor mandates, focusing on sector alignment and deployment capacity exceeding $15B in deployable capital.

Due diligence processes demand transparency; prepare data rooms with financial audits, legal compliances, and operational KPIs upfront. SEC Glossary definitions guide accurate terminology, such as verifying ‘due diligence’ encompasses financial and commercial reviews. For pre-IPO funding supporting M&A, we integrate acquisition modeling into discussions, illustrating how bolt-on deals enhance enterprise value. Top investors for such rounds include those with track records in tech and healthcare, as seen in anonymized cases where our introductions led to $500M+ commitments.

Investor alignment efforts involve roadshows and teaser memos. Bullet steps include:

- Identify 20-30 targeted prospects via our rolodex.

- Schedule virtual meetings with pre-vetted NDAs.

- Follow up with customized term sheets.

This structured approach minimizes rejection rates and accelerates commitments.

Navigating Requirements and Common Challenges

Navigating VC criteria for Series F involves addressing stringent governance and scalability proofs. Prepare for metrics like 10x revenue growth potential and robust IP protections, while integrating M&A elements to demonstrate strategic acquisitions. Funding readiness tactics counter hurdles such as valuation gaps, often bridged by highlighting comparable transactions and discounted cash flow analyses.

Common challenges include regulatory delays and investor skepticism on burn rates. Overcome these by conducting mock due diligence internally and seeking fairness opinions. In one US-based example, our team resolved a $200M valuation dispute through refined projections, enabling a successful close. Pre-IPO funding ties bolster M&A by providing liquidity for targets, with Zaidwood’s full-cycle due diligence ensuring seamless integration.

Investor alignment efforts extend to exit planning, mitigating risks like market volatility. By anticipating these, companies enhance resilience in late-stage rounds.

The following table contrasts effective strategies with pitfalls, drawn from SEC and NVCA best practices for later-stage capital raising:

| Strategy Area | Best Practice | Common Pitfall | Advisory Mitigation |

|---|---|---|---|

| Financial Modeling | Audited pro formas with scenarios | Unaudited projections with overly optimistic assumptions | Zaidwood’s full-cycle diligence |

| Investor Outreach | Targeted intros via networks | Cold emails lacking warm connections | Access to 4,000+ investors |

| Pitch Deck Design | Data-driven slides with traction metrics | Overly verbose narratives without visuals | Customized documentation services |

| Due Diligence Prep | Comprehensive data rooms with audits | Incomplete operational disclosures | Strategic consulting for compliance |

Proactive planning via these best practices positions firms for success, while our advisory services provide tailored mitigations. For instance, Zaidwood’s deal vault offers access to representative transactions that inform realistic expectations. This empowers US companies to tackle sophisticated scenarios, transitioning to advanced tactics for optimal outcomes.

Note: This content is for informational purposes only and is not investment advice. Consult legal, tax, and financial advisors before proceeding. Past performance does not guarantee future results.

Advanced Considerations in Series F and Beyond

As companies progress to Series F and beyond, the funding landscape evolves into sophisticated capital strategies that blend equity, debt, and exit planning. In the US late-stage market, investors scrutinize not just growth but sustainable profitability and global scalability. We at Zaidwood Capital guide clients through these complexities with our full-cycle advisory in equity and debt, drawing on over 300 completed deals to optimize outcomes without absolute guarantees.

Late-stage venture capital firms prioritize rigorous criteria to ensure viable paths forward. Top VCs, per the NVCA Yearbook’s 2025 medians, demand at least 4x returns potential, focusing on revenue trajectories that demonstrate consistent expansion. For Series F rounds, path to profitability becomes paramount, often requiring 3x year-over-year growth alongside robust unit economics. Global scalability assessments evaluate market penetration strategies, favoring companies with diversified revenue streams and international footholds. These thresholds help filter investments poised for outsized impact.

The following table provides a brief comparison of key criteria from top US VCs for Series F investments, informed by NVCA-sourced thresholds for 2026 and illustrating our facilitation in real deals.

| Criteria | Typical Threshold | Examples from Deals | Advisory Role |

|---|---|---|---|

| Revenue Growth | 3x YoY minimum | SaaS unicorn case | Structuring support |

| Exit Path | Clear IPO/M&A timeline | Tech acquisition | Investor matchmaking |

This overview highlights how criteria align with strategic milestones. We enhance these processes by providing tailored structuring support and matchmaking, ensuring clients meet investor expectations while navigating nuances like valuation adjustments.

Hybrid financing options, such as mezzanine and venture debt, offer flexible alternatives to pure equity raises. These instruments bridge gaps in mature investment tactics, providing non-dilutive capital for scaling operations or acquisitions. Negotiation tactics include securing covenants that protect equity stakes, leveraging interest rate caps, and aligning repayment with cash flow milestones. According to NVCA insights, hybrids accounted for 15% of late-stage deals in 2025, enabling faster growth without excessive dilution. We structure these arrangements to balance risk and reward, often integrating them with equity components for comprehensive funding solutions.

Pre-IPO funding rounds distinguish themselves through enhanced liquidity provisions and regulatory preparations. Unlike earlier stages, these infusions prioritize secondary sales and structured exits, with average amounts reaching $200 million in 2025 US benchmarks. Successful 2026 examples include tech firms blending funding with M&A paths, achieving 20% liquidity for early stakeholders. We deliver fairness opinions and transaction advisory to validate terms, facilitating seamless transitions to public markets or strategic buyers. Our equity advisory services ensure informed negotiations, underscoring our commitment to educational guidance in these high-stakes environments.

Frequently Asked Questions on Series F Funding

At Zaidwood Capital, we often field questions about advanced funding stages. Here are key insights on Series F.

What is Series F funding? Series F represents a late-stage venture capital round for mature companies scaling globally, post-Series E, often before or alongside pre-IPO preparations. It funds expansion, per SEC definitions of equity stages.

How does Series F differ from pre-IPO funding? Series F focuses on growth equity for valuation boosts, while pre-IPO funding targets final liquidity and compliance readiness, bridging to public markets with stricter regulatory scrutiny.

What are typical amounts and timelines for Series F? Rounds average $100-500 million, spanning 6-12 months. Valuations hit billions, with due diligence emphasizing market dominance and revenue scalability.

What advisory roles support Series F raises? Advisors facilitate investor connections and structure deals. Our capital formation advisory helps clients navigate these complex late-stage venture capital processes efficiently.

What requirements apply to Series F funding? Companies need proven revenue over $100 million, strong governance, and audited financials, aligning with SEC guidelines for advanced rounds to attract institutional backers.

Leveraging Series F for Strategic Growth

In summary, Series F funding represents a pivotal stage in late-stage venture capital, where companies secure substantial capital infusions often exceeding $100 million to fuel hyper-scaling and pre-IPO funding preparations. Evolving valuations and deal structures demand rigorous due diligence and strategic positioning, as highlighted by recent trends in growth financing. Preparation steps, from financial modeling to investor outreach, are essential for navigating this complex landscape.

At Zaidwood Capital, we emphasize the critical role of expert advisory in optimizing these processes, ensuring alignment with market dynamics and stakeholder expectations. Our tailored strategies help clients maximize outcomes in this high-stakes environment.

Looking ahead through 2026, the US venture market shows promising growth, per the NVCA Yearbook, offering ample opportunities for innovative enterprises to thrive.